1. Overview of the Industrial Robot Industry

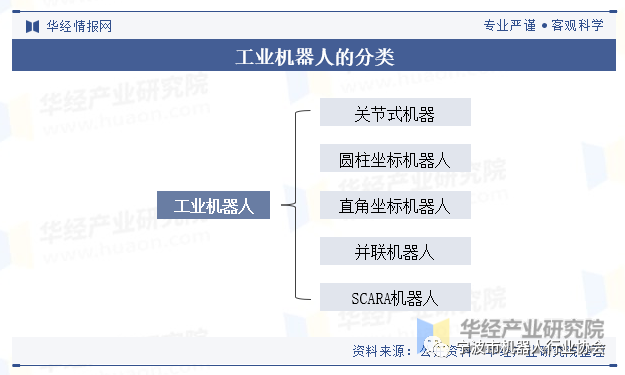

Industrial robots are automated, reprogrammable, multifunctional machines capable of performing various tasks in industrial settings, including material handling, workpiece manipulation, or tool operation. They can be categorized based on their motion coordinates into articulated robots, cylindrical coordinate robots, Cartesian robots, parallel robots, and SCARA (Selective Compliance Assembly Robot Arm) robots.

2. Background of the Industrial Robot Industry Development

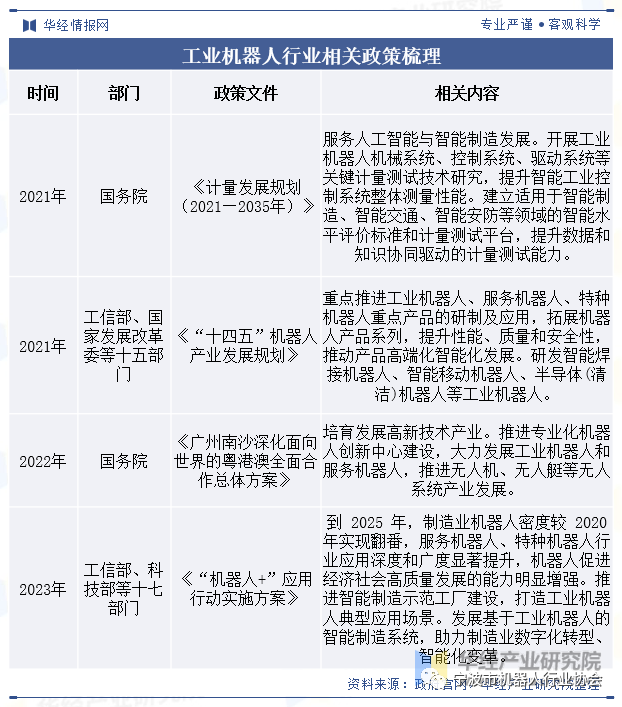

1. Policy

In recent years, the government has continuously improved industrial policies for developing intelligent manufacturing, accelerating the smart transformation of traditional manufacturing, and encouraging industrial enterprises to move towards intelligence. The “Robot+” application action implementation plan states: “By 2025, the density of robots in manufacturing will double compared to 2020, and the depth and breadth of applications for service robots and special robots will significantly increase, focusing on ten key application areas, breaking through more than 100 innovative application technologies and solutions for robots, and promoting over 200 typical application scenarios with high technical levels, innovative application models, and significant application results, providing comprehensive support for the development of the robot industry.”

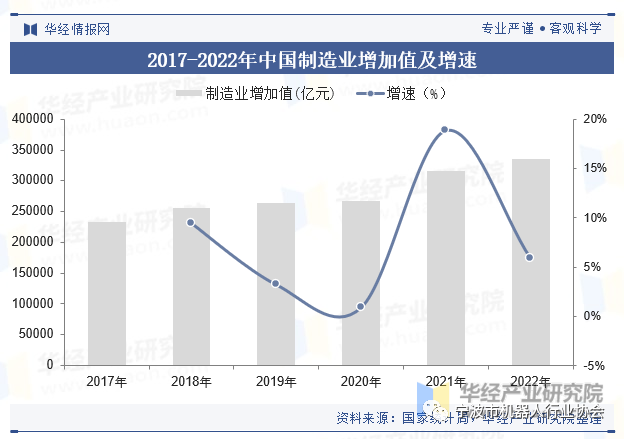

2. Economy

The replacement of manual labor with robots is an important trend in the future of manufacturing, with industrial robots becoming representatives of intelligent equipment in smart manufacturing. Data shows that in 2022, the added value of China’s manufacturing industry reached 33.5 trillion yuan, maintaining its position as the world’s largest manufacturing country.

3. Industrial Robot Industry Chain

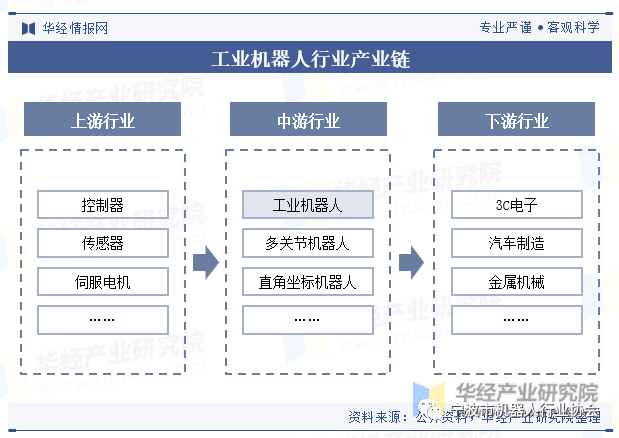

1. Industry Chain

From the perspective of the industry chain, the upstream mainly provides core components required for the production of industrial robots, including but not limited to controllers, sensors, and servo motors; the midstream involves the manufacturing of industrial robots; and the downstream application fields include 3C electronics, automotive manufacturing, and metal machinery.

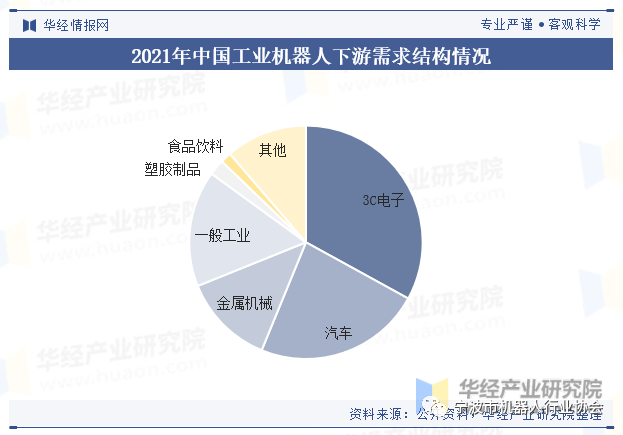

2. Downstream Analysis

Industrial robots are general-purpose equipment, and the downstream application fields are quite broad, with market demand closely related to capital expenditure in manufacturing. In 2021, China’s industrial robots were mainly applied in the 3C electronics and automotive sectors, accounting for 33% and 23%, respectively.

Related report: The “2023-2029 Deep Analysis and Investment Potential Forecast Report of the Chinese Industrial Robot Industry” published by Huajing Industry Research Institute.

4. Current Status of the Industrial Robot Industry

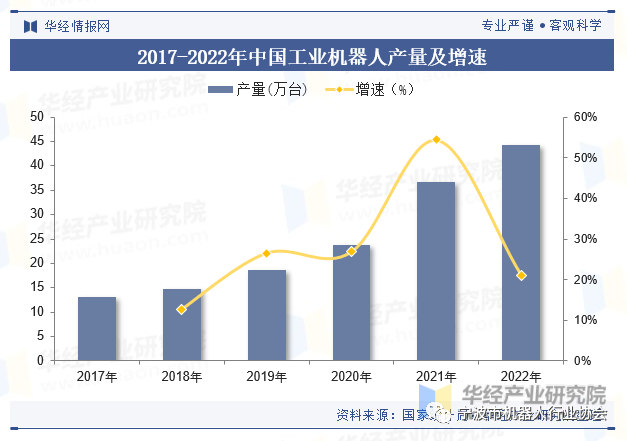

1. Production Volume

The high demand for industrial robots driven by the booming new energy vehicle and photovoltaic industries has become the main engine for the development of China’s industrial robot industry. The production volume of industrial robots in China continues to expand, maintaining a high level, with a production volume of 443,100 units in 2022, a year-on-year increase of 21.04%.

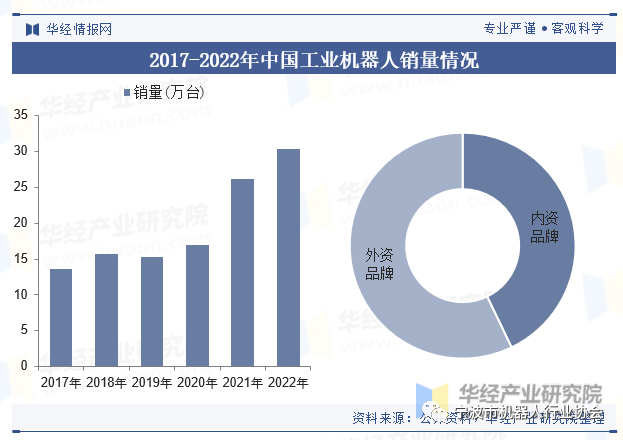

2. Sales Volume

Data shows that in 2022, the sales volume of industrial robots in China was 303,000 units, a year-on-year increase of 16%. As the world’s largest consumer of industrial robots, China remains the largest market for industrial robots globally, with a domestic production rate of about 40% in 2022, primarily concentrated in the low-end market.

5. Competitive Landscape of the Industrial Robot Industry

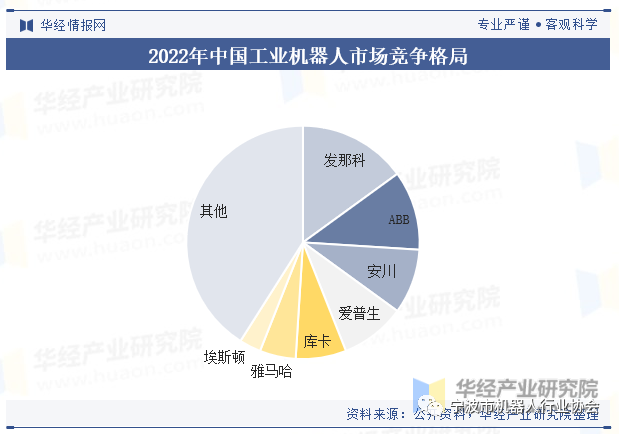

1. Competitive Landscape

In 2022, the four major families of industrial robots (ABB, Fanuc, KUKA, and Yaskawa) held about 40% of the market share in China’s industrial robot market. Although foreign brands still dominate the market, the market share of domestic brands is increasing year by year as domestic robots improve performance and expand application fields, significantly accelerating the process of domestic substitution.

2. Key Enterprises

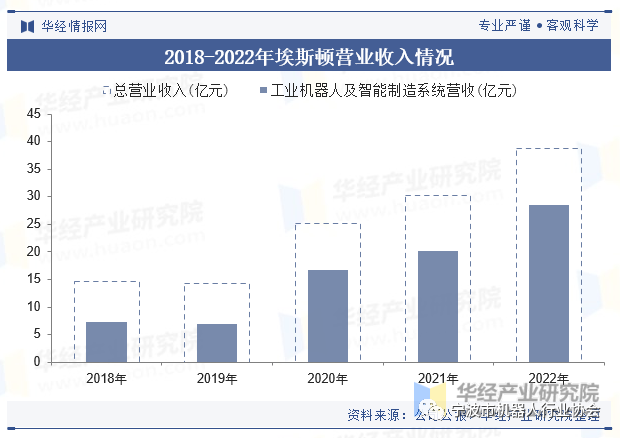

Nanjing Estun Automation Co., Ltd. currently has 64 industrial robot products, including six-axis general-purpose robots, four-axis palletizing robots, SCARA robots, and industry-specific customized robots, with payloads ranging from 3kg to 600kg. It is currently one of the most influential companies in China’s motion control field and a leading domestic industrial robot enterprise with highly autonomous core technologies and components. In 2022, Estun’s total revenue was 3.881 billion yuan, of which industrial robots and intelligent manufacturing systems generated revenue of 2.855 billion yuan, with a gross profit margin of 33.37%.

6. Development Trends of the Industrial Robot Industry

The application of industrial robots in China is still relatively short, and the density of industrial robots is far lower than that of countries like the US and Japan. The domestic robot market is primarily occupied by imported robots. In the long run, despite the late start of domestic robots, the government will continue to implement protective policies for robot localization, build domestic robot brands, gradually overcome technical barriers, and enable industrial robot companies to possess core competitiveness for independent development. Automation technologies such as industrial robots are increasing the skill requirements for labor in manufacturing, and the shortage of skilled talent is a significant challenge facing the industry’s development. With the continuous integration of new-generation information technology, biotechnology, new energy technology, new materials technology, and robotics technology, the functions and performance of robots will be greatly enhanced, further promoting the application and development of industrial robots.

Data source: Huajing Industry Research Institute