“Introduction“:

Line Control Braking: The Technological High Ground of Autonomous Driving Execution Layers

1.1 Advanced Autonomous Driving Regulations Gradually Take Effect, Accelerating the Penetration of Line Control Braking

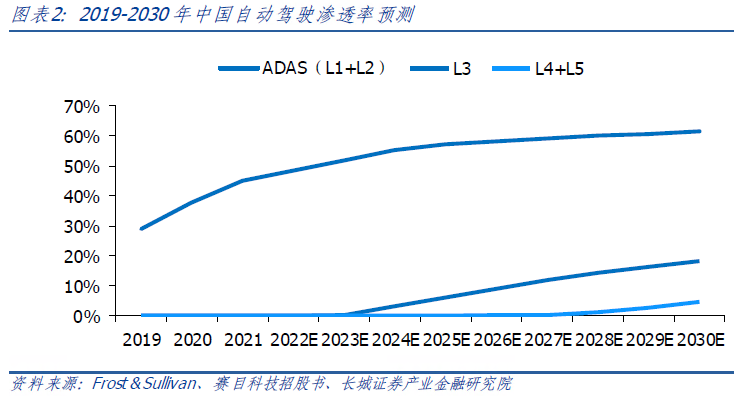

L3 legislation is accelerating, hastening the rollout of advanced autonomous driving. In 2017, the State Council released the “New Generation Artificial Intelligence Development Plan”, clearly stating the need to accelerate the research and application of autonomous driving technology, subsequently continuing to advance autonomous driving legislation and related policy-making. On June 30, 2022, Shenzhen issued the “Regulations on the Management of Intelligent Connected Vehicles in the Shenzhen Special Economic Zone”, which is the first regulation in China to standardize the management of intelligent connected vehicles, comprehensively stipulating L3+ level autonomous driving road testing and demonstration applications, access and registration, and usage management.

Line control braking systems are the core of autonomous driving technology. The core technologies for autonomous driving control are longitudinal and lateral control technologies (both involve braking control). Autonomous vehicles can collect information about their surroundings through sensors and manipulate the vehicle’s movement through line control after calculating the planned path according to algorithms. Functions like ACC/AEB/LKA/AP in L2 and HWP/TJP in L3 need to be implemented on the IBS (line control braking) system, and the hardware and control strategies of the line control braking system are the core technologies of the autonomous driving execution layer.

Line control braking systems have advantages such as high precision, fast response, and support for energy recovery. In traditional mechanical braking, the master cylinder, booster, control system, and brake pedal cannot be decoupled, making energy recovery difficult, and the long piping can lead to braking delays. Compared to traditional braking, line control braking has the following advantages: 1) Line control braking adds electronic control circuits and high-precision sensing devices, reducing brake response time; 2) Line control braking can convert braking energy into electrical energy, achieving energy recovery (increasing range by 10%-30%); 3) Line control braking can be configured with multiple redundancy mechanisms to enhance safety performance, better adapting to L3+ level autonomous driving solutions.

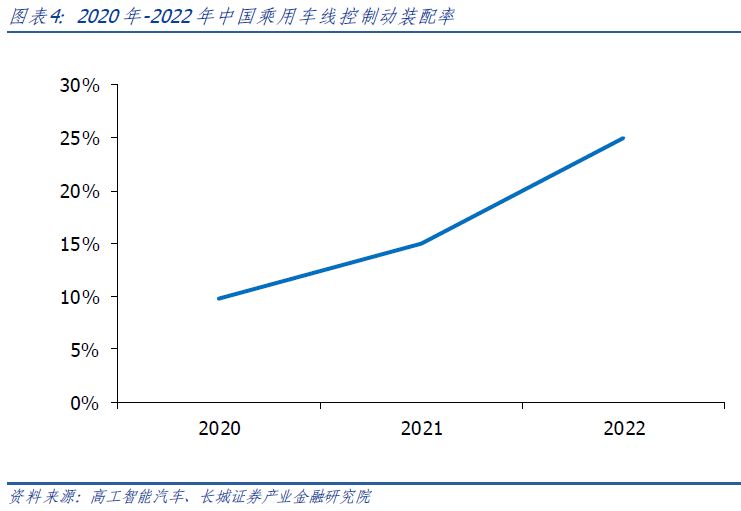

The electrification and intelligence of vehicles are driving the increase in line control braking installation rates. With the push of vehicle electrification and intelligence, the installation rate of line control braking has achieved rapid growth, reaching 25% in 2022 for passenger vehicles in China (only 9.8% for the entire year of 2020). Currently, the main models equipped are still mid-to-high-end models, but the price space is gradually opening up. According to data from Gaogong Intelligent Automotive, the average delivery prices for One-Box/Two-Box standard equipped models in 2022 were 310,000/250,000 (a year-on-year decrease of about 70,000/40,000). With the rapid increase in the penetration rate of electric intelligent vehicles, line control braking, as a key technology in the autonomous driving execution layer, is expected to further open up its supporting space.

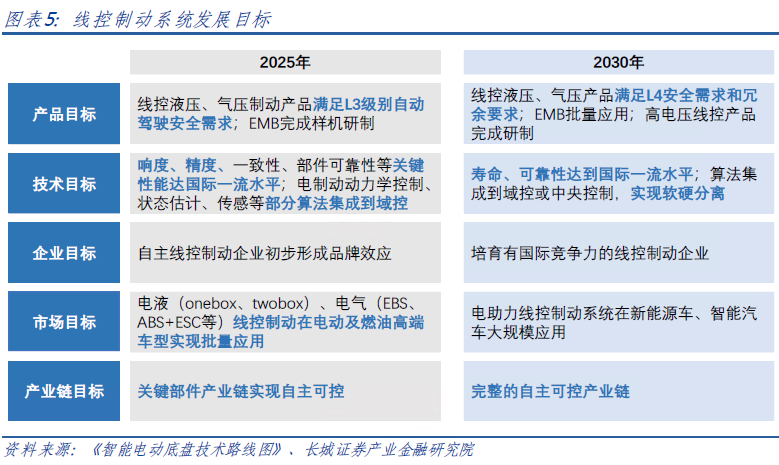

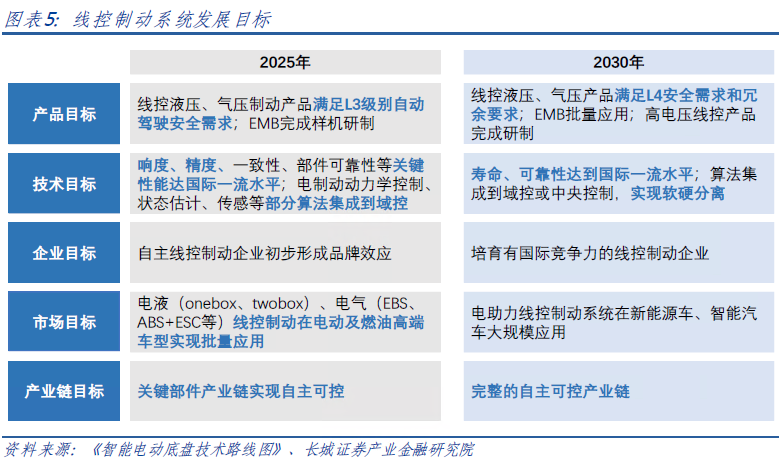

The development path of line control braking is clear, with plans to achieve mass application by 2025. According to the “Intelligent Chassis Technology Roadmap” released by the China Society of Automotive Engineers: By 2025, line-controlled hydraulic and pneumatic braking products will be able to meet the requirements for L3 level autonomous driving, and EMB will complete prototype development and be equipped on commercial vehicles. By 2030, line-controlled hydraulic and pneumatic braking products will meet the safety and redundancy requirements for L4 level, achieving large-scale installation applications, and EMB will complete mass application.

1.2 Technological Trends: In the Medium Term, the One-Box EHB Will Become Mainstream

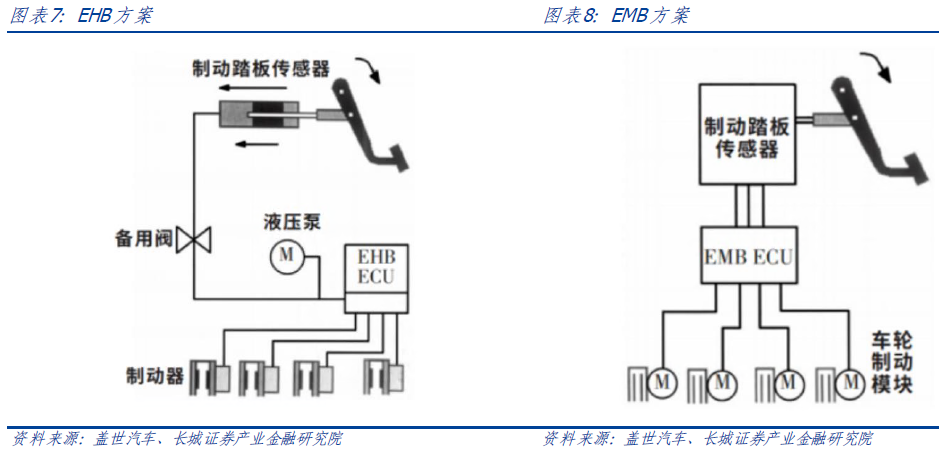

EHB is the current main form of line control braking, while EMB has not yet achieved mass production. Line control braking is divided into two technical modes: EHB (line-controlled hydraulic braking system) and EMB (electromechanical braking system). 1) EHB replaces the vacuum booster with an electronic booster but still retains hydraulic pipelines and brake fluid. When the pedal is pressed, the sensor transmits signals to the ECU, which drives the hydraulic pump for braking through the motor; 2) EMB integrates the motor directly into the brake caliper, generating braking force and achieving complete electric control of braking (eliminating hydraulic pipelines and brake fluid). Currently, the line control braking products on the market are basically EHB mode (about 97%), while EMB is still in the research and development stage.

Currently, Two-Box dominates EHB, while One-Box is expected to become mainstream. EHB is divided into two schemes based on integration level: Two-Box and One-Box. 1) In the Two-Box scheme, ESC and electronic boosters are independent modules, providing mutual backup redundancy; 2) In the One-Box scheme, ESC and electronic boosters are integrated into one module, requiring additional backup redundancy systems to meet the needs of autonomous driving. The One-Box scheme has advantages such as high integration, low cost, and high energy recovery efficiency, gradually becoming the mainstream solution for line control braking, with its share increasing from 20.5% in 2021 to 34.6% in the first five months of 2022.

1.3 Current Landscape: Foreign Capital Dominates Chassis Braking Components, While Local Manufacturers Gradually Increase Their Volume

Currently, the chassis component market in China is dominated by foreign capital (joint ventures). In terms of basic mechanical braking, domestic manufacturers have achieved breakthroughs in market share, but in core electronic control areas like ESC, EPB, and line control braking, international component giants such as Bosch, Continental, and ZF still hold the vast majority (over 80%), with few local suppliers capable of achieving mass supply.

The degree of domestic substitution in the braking field is relatively high. Braking products are one of the earliest market segments for domestic manufacturers to penetrate in the chassis field, with disc brakes being the main form. According to data from Gaogong Intelligent Automotive, in 2022, the market share of front/rear disc brakes for passenger vehicles in China was nearly 100%/90%. From the perspective of manufacturer share, Continental, Hitachi Astemo, and ZF together occupy about 50% of the market share, with domestic manufacturers like Fudi Technology, Asia-Pacific Co., Berteli, and Libang Heixin holding market shares of 6.9%, 6.7%, 5.3%, and 3.2%, respectively, totaling 22% market share.

Foreign capital occupies the main share of the electronic control market, while the competitiveness of domestic EPB is beginning to show. 1) The domestic matching rate of EPB has improved. In 2022, the pre-installation rate of EPB in Chinese passenger vehicles exceeded 80%, with domestic manufacturers narrowing the gap with foreign manufacturers. The market shares of Fudi Technology, Berteli, and Asia-Pacific Co. were 9.6%, 9.4%, and 1.5%, respectively, totaling 20% market share (an increase of about 4 percentage points compared to 2021); 2) There are very few domestic manufacturers supplying ESC. In 2021, the pre-installation rate of ESC in Chinese passenger vehicles was 91.6%, with Bosch, Continental, Aisin, NISSIN, and Hitachi Astemo occupying over 90% of the market share. Only a few domestic manufacturers like Jingxi Heavy Industry, Berteli, and Asia-Pacific Co. have achieved mass production, resulting in a strong foreign capital presence in the ESC market.

The current line control braking market is monopolized by Bosch, while Berteli shows significant volume among domestic manufacturers. Currently, the global line control braking market is dominated by three major manufacturers: Bosch, Continental, and ZF. Among them, Bosch has the highest configuration rate of iBooster+ESP. In the Chinese market, Bosch is the absolute leader in the line control braking market, and in recent years, Berteli, Asia-Pacific Co., and Wan’an Technology have begun research and development and mass production of line control braking products, with Berteli showing significant volume in 2022 and holding a leading market share.

Domestic manufacturers are accelerating the launch of One-Box products, with many expected to achieve mass production in 2023. Among the listed companies, Berteli (One-Box) and Asia-Pacific Co. (Two-Box) have achieved mass production of line control braking. Berteli is the first domestic company to achieve mass production of One-Box, while Asia-Pacific Co.’s One-Box is expected to be mass-produced in the second half of 2023, and Wan’an Technology (through its joint venture company Handewan’an) is expected to mass-produce commercial vehicle EMB in 2024.

2.1 Gradual Overcoming of Technical Barriers to Build a Competitive Foundation—Adhering to the Electric Control Braking Vertical Development Path

Core electronic control products are key precursor technologies, with domestic major players achieving full coverage. Line control braking requires manufacturers to have mass production experience of core electronic control products.

2.1.1 ESC: The Central Hub of Vehicle Dynamics Control, Essential for Line Control Braking

ESC (Electronic Stability Control) is the current central hub of vehicle dynamics control. ESC is an upgrade based on ABS (Anti-lock Braking System), combined with TCS (Traction Control System) and AYC (Yaw Moment Control System). ESC can monitor the vehicle’s operating status in real-time and adjust braking force and engine torque as needed to change the vehicle’s yaw moment, ensuring lateral stability during driving, enhancing safety, comfort, and handling.

The One-Box scheme integrates ESC, requiring suppliers to have ESC development capabilities. ABS/TCS/ESC are all active safety control systems related to braking, especially ESC, which has a significant technical barrier. Currently, only a few domestic manufacturers, including Jingxi Heavy Industry, Berteli, Asia-Pacific Co., and Yuanfeng Electric Control, have mass production experience of ESC. From the perspective of braking product layout, manufacturers typically have layouts in ABS/ESC before developing One-Box products (such as Berteli), while manufacturers that have not completed ESC development often enter the line control field through the Two-Box scheme (such as Tongyu Technology).

2.1.2 EPB: Line Control Applications in Parking Braking, Providing Failure Protection for Line Control Braking

EPB (Electronic Parking Brake) is the application of line control technology in parking systems, capable of implementing functions like AP in autonomous driving. EPB uses electric signal transmission to achieve electronic control of parking brakes, resulting in faster response times. In functions like ACC/AP/AEB in L2, EPB plays a role in requesting and releasing parking.

Integrated EPB can link with core safety systems like ABS/ESC. EPB can be divided into independent ECU type and integrated ECU type based on whether it has a separate EPB ECU. Integrated EPB combines the EPB and ESC systems into one controller, reducing the complexity of ECU costs and wiring layout, and making EPB hardware more modular (capable of integrating ABS, ESC, ACC, etc.), thus enhancing vehicle safety. Due to technical requirements, integrated EPB requires companies to have ESC production capabilities.

EPB can serve as a backup system for line control braking, meeting electronic redundancy requirements. In L3+ level autonomous driving, One-Box must have electronic redundancy and cannot solely rely on mechanical redundancy. The Bosch IPB+RBU scheme and Continental MK C1+HBE scheme can achieve dual redundancy, supporting L3/L4 level autonomous driving. Domestic manufacturers have redundancy schemes that either use dedicated redundancy modules (mostly based on ESC modifications) or combine EPB redundancy. Among them, Berteli has full-stack support capabilities for ABS/ESC/EPB, and its EPB can serve as electronic redundancy for line control braking, with braking force at industry-leading levels. In 2022, Berteli completed the development of the WCBS2.0 prototype with braking redundancy functionality (with braking force greater than 0.8g after main system failure), expected to be mass-produced in 2024.

2.2 Clear Organic Development Path Ensures Development Prospects—Chassis Braking as the Foundation, Moving Towards Autonomous Driving

Based on advantages in execution control layers, braking manufacturers are entering the perception layer to layout ADAS. From the perspective of international manufacturers’ ADAS layout, products from Bosch, Continental, etc., cover sensors, control strategies, and actuators, providing a complete ADAS system service. Domestic line control braking manufacturers have overcome technical challenges in ABS/ESC and are starting to enter the perception layer to layout ADAS systems, such as Berteli developing ADAS based on front-view camera systems (mass production in 2022), Asia-Pacific Co. providing multifunctional cameras, millimeter-wave radars, and platform-based ADAS functional software, and Wan’an Technology developing ADAS systems like AEB/ACC/LKA based on millimeter-wave radar.

Domestic passenger vehicles show a high acceptance of domestic ADAS solutions, and the development prospects of line control braking to ADAS are promising. In terms of ADAS solutions, local manufacturers have advantages in cooperation and localization compared to foreign capital. Data from January to April 2022 shows that in the L2+ level supplier market for domestic brand passenger vehicles, Bosch ranked first (with a share of 24.8%), and among the top 15 suppliers, local suppliers occupy more than half of the seats, with the concentration of the ADAS market far lower than that of the chassis braking market. Overall, braking suppliers, based on core execution layer technology accumulation, are expected to develop along the path of line control braking → line control chassis (integrating steering and air suspension capabilities) → autonomous driving solutions (fusion of perception, decision-making, and execution), with the market space expected to grow significantly (about tenfold).

3.1 Restructuring of Supplier Relationships—Local Manufacturers Open Collaboration, Customized Solutions

3.1.1 Software and Hardware Accelerate Decoupling: Local Manufacturers Provide “White Box Supporting”, Meeting Flexibility in OEM Design

In the era of “software-defined vehicles”, OEMs will deeply control “software + algorithms”. In the past, automotive components emphasized software-hardware integration (software updates were almost synchronized with mechanical hardware replacements). With the development of intelligence, the software iteration cycle has shortened, and the decoupling of software and hardware has become a future trend. OEMs typically have two options: either develop software and algorithms in-house or seek software iteration solutions from software companies.

Centralized architectures accelerate the landing of line control chassis, with local Tier 1 offering higher flexibility in “white box supporting”. 1) Trend: A major trend in the chassis field is the integration of line control chassis into DCU (Domain Control Unit) controllers, where OEMs develop software (including collaboration with software companies) and chassis component suppliers provide actuators. 2) Current Status: Currently, OEMs are committed to mastering architectural design + achieving key functional software development in-house, while Tier 1 is responsible for providing underlying software and hardware. Compared to international Tier 1, local manufacturers have higher cooperation levels with OEMs and can achieve white box supporting to meet OEM design flexibility.

Multiple OEMs are starting self-research + co-research models for line control chassis. Unlike the traditional automotive era where Tier 1 held strong bargaining power, in the era of intelligence, OEMs are strengthening their control over key systems. Among domestic car manufacturers, BYD has taken the lead in completing the self-research of line control braking systems BSC (One-Box) through its subsidiary Fudi Technology; Great Wall Motors is conducting self-research on line control braking through its subsidiary Jinggong Chassis, with EMB products expected to achieve mass production in 2023; Changan Automobile released the “Chenzhi Technology” brand in 2023 to layout intelligent line control chassis; Geely Automobile has established a joint venture with Berteli to co-develop intelligent chassis line control braking products.

3.1.2 New Domestic Forces Entering the Market: Local Manufacturers Develop & Service Efficiency is High, Adapting to Rapid Iteration Cycles of Vehicle Models

In the traditional automotive era, international Tier 1 giants held monopolistic technology and had absolute bargaining power in the automotive industry chain, often requiring OEMs to align their vehicle development cycles with those of international Tier 1 giants. With the entry of new forces in vehicle manufacturing, the iteration cycle of new energy and intelligent connected technology has rapidly shortened, and OEMs’ demands for speed and quality in product development and optimization have increased.

Local Tier 1 can adapt to the iteration rhythm of OEM vehicle models. Since 2018, the replacement cycle of domestic brand models has significantly shortened (from 5-6 years to 2-3 years), and new energy vehicle manufacturers typically launch new products at a pace of about 1-2 models per year. Compared to the development cycles of various braking manufacturers, local manufacturers generally control their cycles within 1-2 years, aligning with the iteration rhythm of OEM vehicle models.

3.2 The “Chip Shortage” Crisis Accelerates Domestic Substitution—Short-Term Supply Demand → Long-Term Supply Chain Stability Demand

Chips are the core raw materials for line control braking. Line control braking consists of ECU, motors, body, and solenoid valves. In terms of cost share, for ESC, the ECU accounts for a significant portion of the cost (about 45%). Due to the higher control precision requirements in line control braking, the performance requirements for control chips are elevated, and it is expected that the ECU in line control braking will account for 50-55%, with chips accounting for about 40%. Currently, line control braking ECUs are mainly supplied by foreign automotive chip manufacturers such as ST, Infineon, and NXP.

The chip shortage crisis is driving OEMs to achieve supply chain autonomy, with brake manufacturers actively promoting domestic substitution solutions. Since 2021, the international automotive chip shortage has put pressure on vehicle production. For example, Bosch experienced a time when the order fulfillment rate for automotive chips was less than 20%, leading to delivery limitations for line control braking products. The chip shortage crisis has provided domestic companies with a window for accelerated substitution, with domestic vehicle brands gradually forming a supply chain system dominated by local suppliers. Currently, domestic brake manufacturers’ ABS/ESC/EPB have basically launched fully domestic chip substitution solutions, and line control braking has achieved complete domestic substitution for auxiliary chips, with key components like solenoid valves also being self-researched and manufactured, bringing dual advantages of cost and production controllability to local manufacturers.

4.1 Berteli: Domestic One-Box Line Control Braking Leader, Line Control Chassis + Intelligent Driving Open Up Growth Space

Domestic line control braking leader, the synergy effect of line control chassis is promising. The company has formed a product layout covering traditional braking + electric control braking + steering + lightweight. In the braking field, it covers a full range of products including brakes, ABS, ESC, EPB, and line control braking. In 2022, Berteli held a market share of 9.4% in the pre-installation market of EPB for passenger vehicles in China, leading among domestic manufacturers, and the company was the first domestic manufacturer to achieve mass production of One-Box. In 2022, the company acquired Zhejiang Wanda and initiated the research and development of line control steering, which will create a good synergy between Wanda’s steering system and the company’s braking system, promoting the company’s long-term goal of line control chassis.

Comprehensive layout of intelligent driving, Berteli’s execution layer technology + ADAS mass production form a synergy. 1) In the field of line control chassis, the company has completed the development of WCBS 2.0 (with braking redundancy) prototype in 2022, expected to be mass-produced in the first half of 2024. EMB (electromechanical braking system) is expected to complete A-round prototype development in 2023, and the company is conducting R&D work on DP-EPS, R-EPS steering systems, and line control steering systems to further improve the layout of line control chassis; 2) In the field of intelligent driving, the company began independently developing ADAS technology based on front-view camera systems in the fourth quarter of 2019, achieving mass production in the first half of 2022, with currently 18 projects under research.

During the Shanghai Auto Show in April, the company showcased its L2+ high-precision positioning solution for the first time, using the high-precision positioning camera AFC 2.0, which can not only achieve L2 level HWA/TJA functions but also integrate millimeter-wave radar signals and automatic parking visual signals to realize NOA and other L2+ functions.

4.2 Asia-Pacific Co.: Leading Basic Braking, Welcoming a Dual Inflection Point of Line Control Braking + Performance

Asia-Pacific Co. is a leader in basic braking systems for vehicles, accelerating into line control braking, ADAS, and other intelligent tracks. The company’s products cover basic braking, chassis electric control, line control chassis, and wheel hub motors. The company was the first in China to independently develop and produce automotive hydraulic ABS and, based on this, developed and produced ESC, EPB, eb-Booster, line control braking, and other automotive electric control products, with customers including mainstream automakers such as Changan, Geely, and Great Wall. The company has achieved industrialization of 77GHz millimeter-wave radar, vision systems, and ADAS systems based on the foundation of chassis braking. In terms of wheel hub motors and line control chassis, the company has the development capabilities for multiple integrated wheel hub motor products.

4.3 Wan’an Technology: Comprehensive Layout of Line Control Braking for Commercial and Passenger Vehicles, EMB First Application on Vehicles

The chassis products cover both commercial and passenger fields, being the first to develop line control braking for commercial vehicles. Wan’an Technology’s products cover chassis control systems, primarily pneumatic braking (for commercial vehicles), hydraulic braking (for passenger vehicles), and suspension systems. In recent years, the company’s business has expanded from basic braking products to electric control and intelligent driving products, also venturing into chassis lightweighting and wireless charging products. The subsidiary Handewan’an is engaged in the research and development of line control braking for commercial vehicles, while the joint venture company Tongyu Technology is focused on developing electric control products and line control braking for passenger vehicles. (Source: Great Wall Securities)