The industry has observed that Bosch is recommending the distributed implementation of domain controllers, which marks a strategic shift in the global automotive multinational OEM vehicle development and launch. This article mainly discusses the differentiation of domain control under the overall vehicle strategy, starting with the core point of distributed implementation of domain controllers—automotive modularization.

Starting with Automotive Modularization

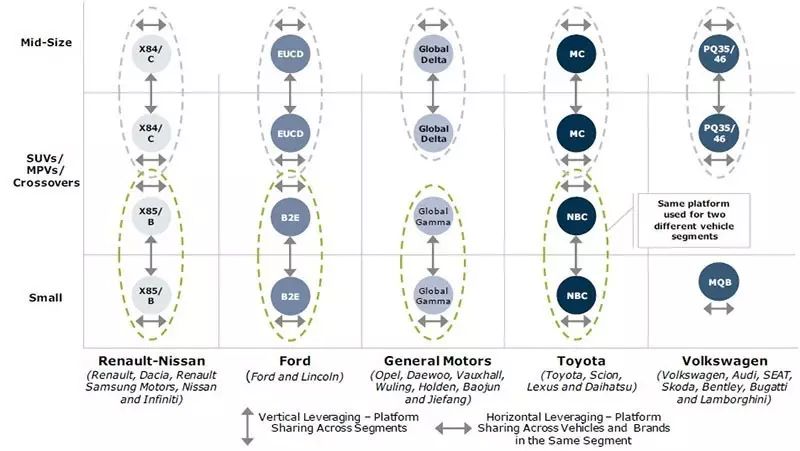

Overview of the original automotive platform: Previously, vehicles were built based on individual segments according to their platforms.

Figure 1: Platform Overview

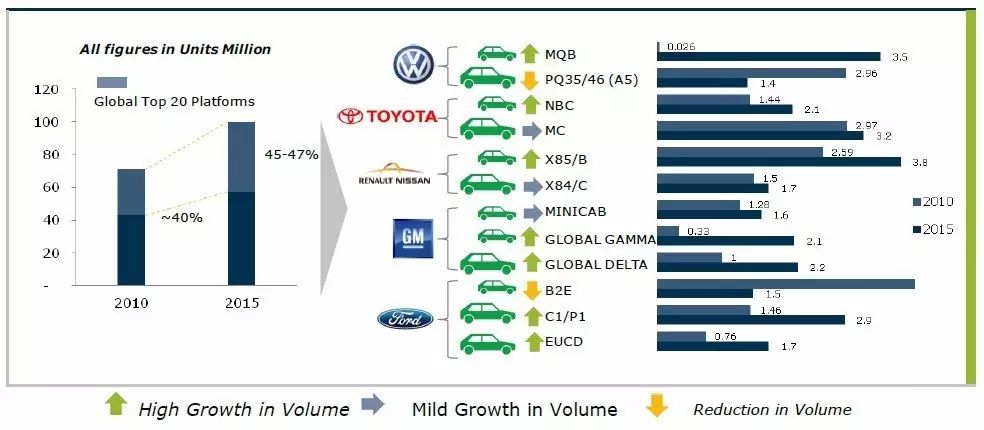

Sales are actually concentrating around platforms, with larger automotive model platforms having a strong competitive advantage.

Figure 2: 2012 Platform Sales

In fact, looking at the current situation, automotive manufacturers are facing many issues, such as rapidly changing market demands in China, where the original planning, design, engineering, and manufacturing are somewhat lagging behind and need to change. In fact, several years ago, the automotive industry began moving in this direction, using modularization to achieve strategic objectives.

The goals of automotive modularization are:

-

To shorten product development time and bring products to market quickly.

-

To reduce product quality risks by minimizing the number of modules.

-

To enhance production line flexibility to quickly respond to market changes.

-

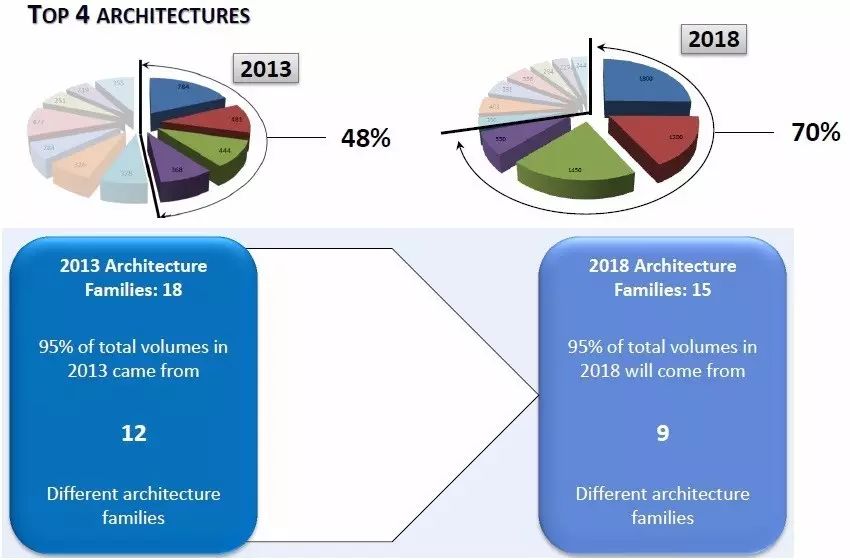

To achieve model development concentration by integrating original platforms, thus reducing overall investment (in molds, production, etc.).

-

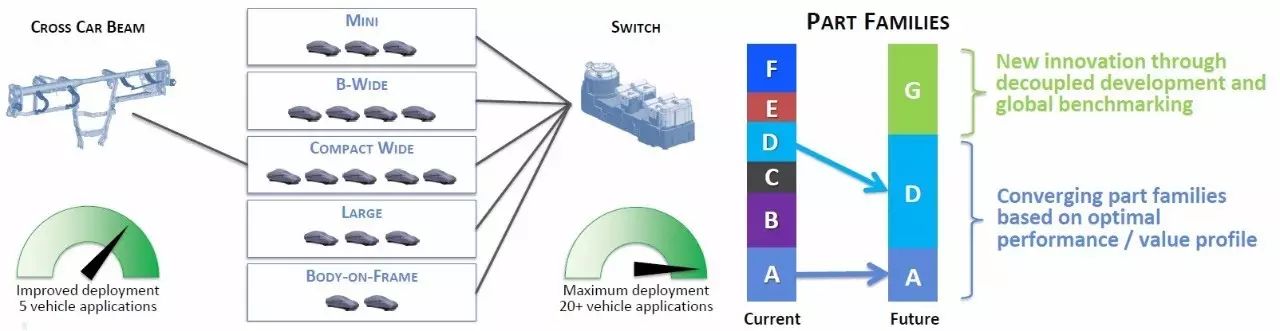

To reduce development and component costs by achieving commonality across models and segments.

-

To outsource non-core components, focusing on core value, and reducing management costs.

Taking Chrysler as an example, from a certain perspective, they use fewer people to produce core standardized components to supply different vehicle models.

Figure 3: Chrysler Planning

Figure 4: Component Merging and Classification to Reduce Differentiation

The inherent double-edged sword issue lies in:

-

The defects and recall risks caused by generalization will increase.

-

A significant amount of resources must be invested when making product design changes.

-

Automotive companies have strict requirements for component suppliers: 1) Supply capacity must be highly flexible. 2) Supply regions should cover multiple areas with strong logistics support. 3) Product costs must be reduced.

Another major issue is how to control the functions and variability within the vehicle. After conducting extensive classification management of structural and mechanical functional components, the ECU components of automotive electronics bear a significant portion of the differentiation.

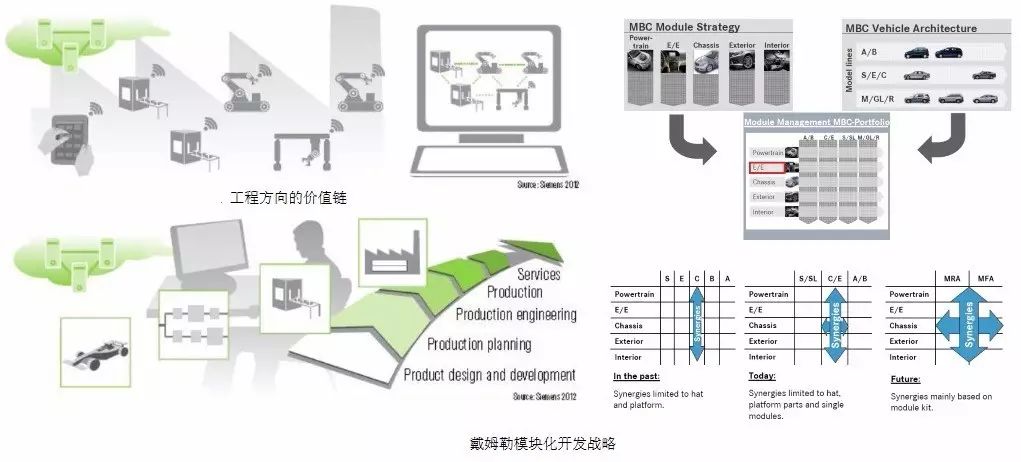

Figure 5: Industry 4.0 and Daimler’s Modular Strategy

Future Automotive Electronic Business Models Under Foreign OEM Systems

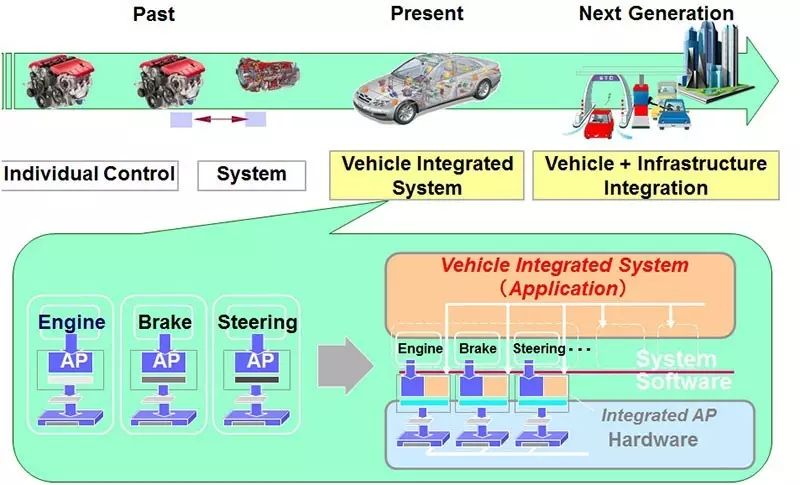

From the perspective of automotive electronic engineering development, it is essential to integrate the modularization needs of vehicle manufacturers into the front-end concepts, shifting the design process from single, closed development to the integration of multiple platforms and diverse requirements. Let’s take a look at the following diagram; the future will be an integrated system.

Figure 6: Evolution of Automotive Systems

Past EE (Electrical Electronics) Development:

1) Structured integration of automotive electronic systems based on individual vehicle series or platforms. 2) Under this value system, individual component suppliers follow a single line of cost and value optimization.

Current EE Development:

1) Platforms that are somewhat structurally similar are entering synchronized integration. 2) Procurement and optimization of components are approached from the perspective of two platforms.

Future:

For front-wheel drive and rear-wheel drive platforms, electronic components may have a basic configuration that can be modified.

Impacts:

-

From a project perspective, the demand for individual projects is several times higher than before, while the number of projects decreases to single digits.

-

A mature strategic supplier partnership system leads to increased costs for individual R&D due to concentrated project development expenses.

-

The complexity of demand suddenly increases, leading to engineering challenges in meeting design complexity.

-

More experimental data processes need to be integrated, requiring greater amounts of simulation to meet rapid development and complexity requirements.

It should also be noted that the expansion of the industry by Continental and ZF is also adapting to future needs. In the new model, without sufficient strength, business will fail. The original business model has already changed quietly; those who keep up will survive, while those who do not will be consumed.

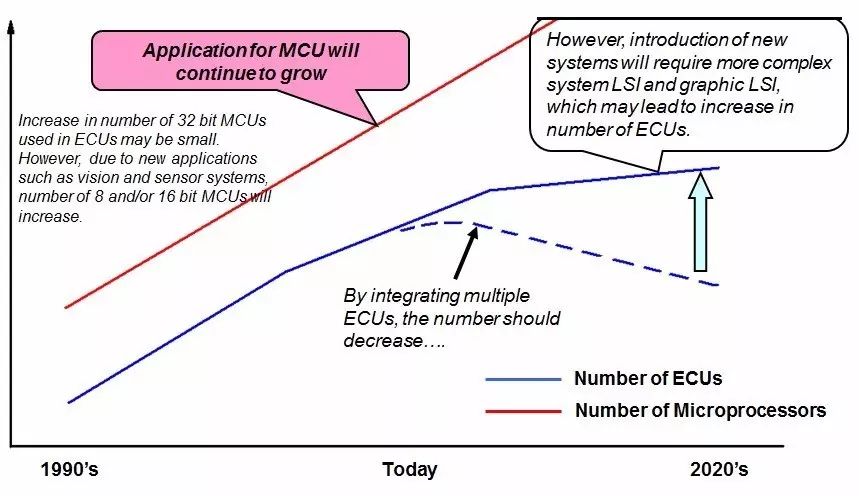

International OEMs will simply be divided into two types: those with domain control capabilities and those without. From the perspective of microcontrollers, what gets absorbed is what is eliminated for domain control; we do not need so many ECUs, just a system-level and simple solution.

Figure 7: Development of Automotive MCU

Automotive Electronic Business Under Local Independent Brand Enterprises

OEMs need to change; from the perspective of EE electronic architecture, this is a step-by-step process. Currently, most OEM vehicle models are at the gateway stage, meaning they have not yet attempted to integrate the original vehicle models into a cohesive stage. Due to supplier issues, some functions have already begun to integrate, but from an architectural standpoint, this is more passive.

The basic requirement is that the automotive electronic architecture and electronic products must align with vehicle development, moving quickly to meet consumer demands faster than joint venture manufacturers.

Thus, the issues of domain control domestically are:

-

Suppliers are uncontrollable: Integrating functions increases the capability threshold for suppliers, further leaning towards stronger Tier 1 suppliers, which actually complicates matters for themselves.

-

Large suppliers do not customize long-term strategies: Large Tier 1 suppliers tend to bring generic products, with very few modifications to the architecture and functionality defined for local independent OEMs.

-

Expensive development costs: After accounting for development fees and product costs, there are only disadvantages; what was once a replication is now fully self-developed.

-

Unequal returns and investments: Due to the practice of vehicle platformization and modularization, especially with global simultaneous launches and developments, this kind of domain control tier evolution incurs costs.

Basic conclusion: It has been impossible to push from the start; by 2020, stagnation occurred, and this concept of domain control simply does not work in the domestic market.

Regarding the Development Path of Automotive Electronics

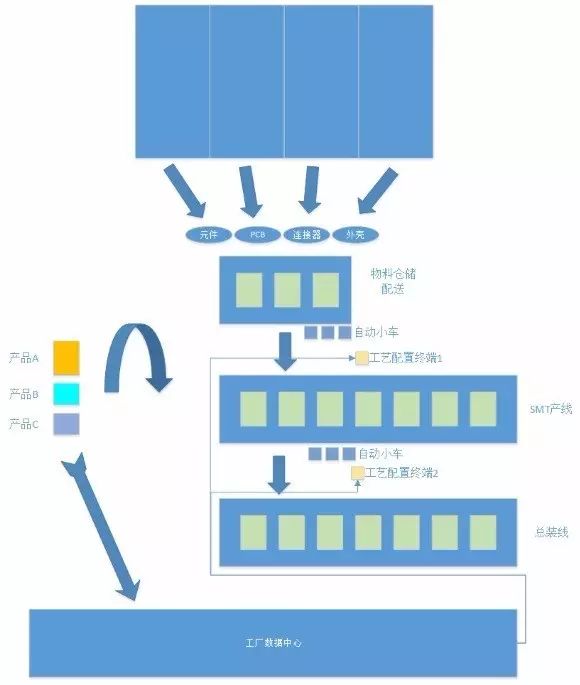

Particularly concerning the global automotive electronics system, it is indeed moving towards the concepts of production outsourcing or flexible production. After properly developing automotive electronic ECU sensors, system integration occurs at the assembly stage, with the basic plan being to serve several customers with one product. The future direction of automotive electronics is through reconstruction and customization.

△Figure 8: Future Vision

Future Vision

-

More different production lines are interconnected.

-

By changing the communication modes of each process station, large data generated during internal production can be exchanged at any time.

-

Building an application model for the entire factory that allows for the arbitrary change of individual product suppliers and production processes according to customer requirements, switching between multiple customers and products.

-

All of this requires flexible use of a 3S system, including external sensors, device software, and complete factory solution services.

-

Achieving customized production that was previously deemed impossible from a cost perspective.

Implementation Methods

-

Automated vehicle systems

-

Robotic systems

-

Process data collection & configuration

-

Minimal process workers

-

Company-level IT engineers, process engineers

Summary of This Article

1) Some differentiation is due to differing national conditions and strategies; in the future, more effort should be spent on cycles and on different differentiated technological paths.

2) Following others blindly leads to failure. A deep understanding of others and real needs is necessary; sometimes others do things because they are carrying a heavy burden.

References:

1) Figures 1 and 2 are from “Platform Strategy will Shape Future of OEMs Flexibility to Drive Growth”

2) Figures 3 and 4 are from “FCA Global Architectures and Standardization”

3) The left half of Figure 5 is an illustration of Industry 4.0, and the right half is from “The future of mobility Dr. Nicola zur Nieden External Affairs and Public Policy – Automotive Issues”

4) Figures 6 & 7 are from “Introduction to Automotive Embedded Systems”

5) Figure 8 is my own drawing

Author Introduction:An engineer in the automotive industry, having entered the field in early 2008, primarily working on automotive electronics, transitioning from new energy vehicles to future ADAS. Automotive electronics are the core and variable of future vehicles; automotive electronic professionals must seek a path for local solutions, collaborating with local automotive brands and industries to find a way forward.

Alibaba’s Wang Jian: How the First Internet Car was Made

The Three Musketeers of Autonomous Driving: The Era of Partnerships