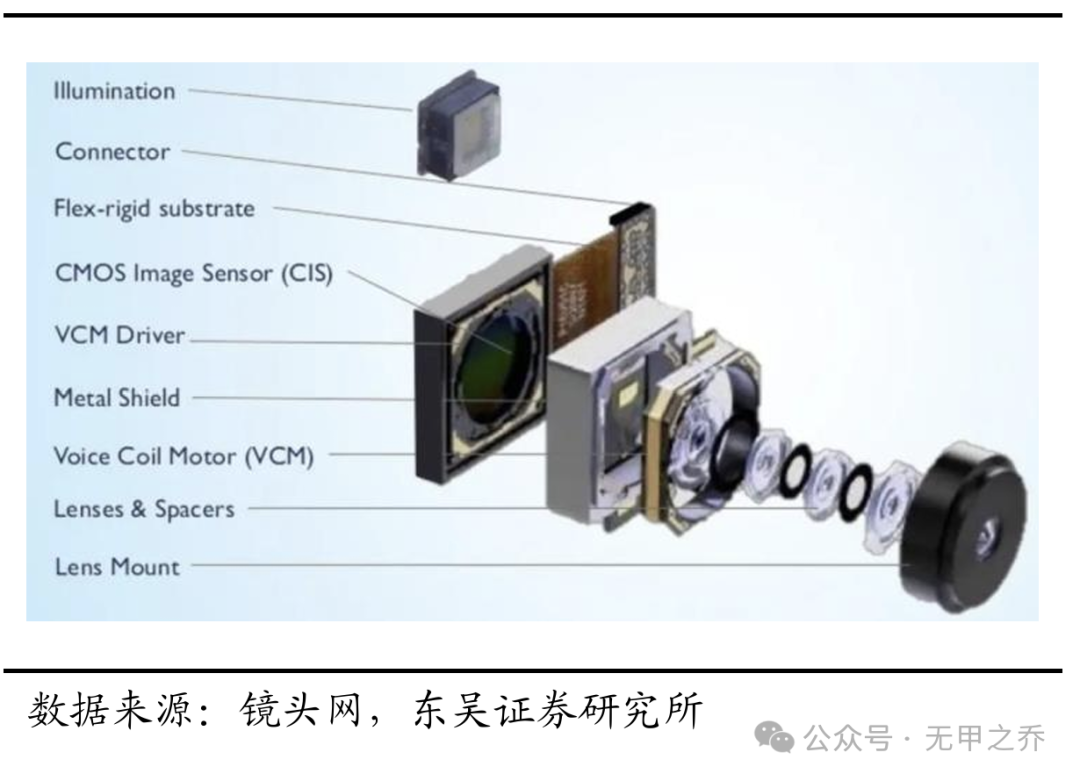

1. What is the core product CIS of Weir Shares? CIS, short for Cmos Image Sensor, is the core component of camera modules, accounting for 30-50% of the total cost of the camera module. Its role in the camera module is to convert optical signals into electrical signals, transforming photons into electrons. As a core component supplier for camera modules, Weir Shares’ subsidiary Omnivision has fully benefited from the recovery in smartphone shipments and the wave of intelligentization in new energy vehicles in recent years. In 2024, Weir Shares predicts a net profit between 3.15-3.35 billion, an increase of 467%-503% year-on-year. The OV50K product, primarily used in smartphone camera modules, features 50 million pixels and achieves a dynamic range of 140db through LOFIC technology. It is produced by SMIC, with lower prices and faster delivery compared to Sony’s competing products. It has already entered the supply chain for the rear main camera of Huawei’s P70 and is expected to increase its market share in domestic smartphone camera modules.

As a core component supplier for camera modules, Weir Shares’ subsidiary Omnivision has fully benefited from the recovery in smartphone shipments and the wave of intelligentization in new energy vehicles in recent years. In 2024, Weir Shares predicts a net profit between 3.15-3.35 billion, an increase of 467%-503% year-on-year. The OV50K product, primarily used in smartphone camera modules, features 50 million pixels and achieves a dynamic range of 140db through LOFIC technology. It is produced by SMIC, with lower prices and faster delivery compared to Sony’s competing products. It has already entered the supply chain for the rear main camera of Huawei’s P70 and is expected to increase its market share in domestic smartphone camera modules. Source: IT Home The OX08D10 product, mainly used in vehicle cameras, serves as the main camera CIS for BYD’s “God’s Eye” system, offering lower costs and utilizing LED suppression technology to accurately identify traffic lights while driving at high speeds; with an ultra-wide dynamic range of 140db, it effectively captures details in extremely bright and dark environments. With the rapid implementation of intelligent driving expected in 2025, its shipment volume is anticipated to continue increasing.

Source: IT Home The OX08D10 product, mainly used in vehicle cameras, serves as the main camera CIS for BYD’s “God’s Eye” system, offering lower costs and utilizing LED suppression technology to accurately identify traffic lights while driving at high speeds; with an ultra-wide dynamic range of 140db, it effectively captures details in extremely bright and dark environments. With the rapid implementation of intelligent driving expected in 2025, its shipment volume is anticipated to continue increasing. Source: Omnivision official website2. How is the company’s performance composed?

Source: Omnivision official website2. How is the company’s performance composed? Source: Weir Shares 2024 performance forecast In 2024, according to the company’s performance forecast, the net profit attributable to the parent company is expected to be between 3.15-3.35 billion, an increase of 467-503% year-on-year.

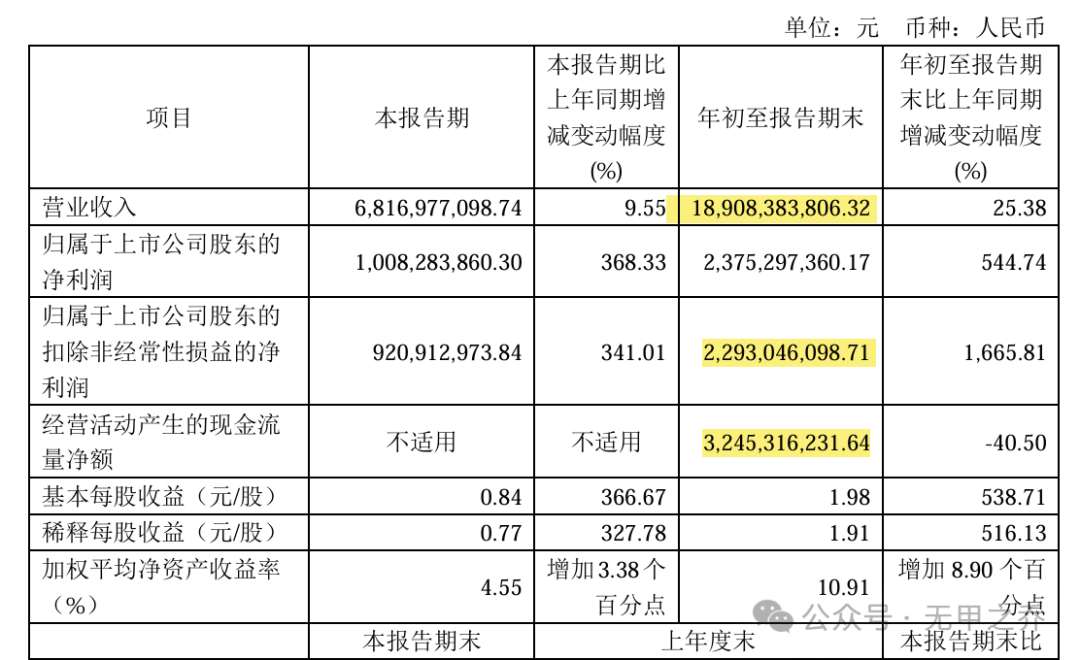

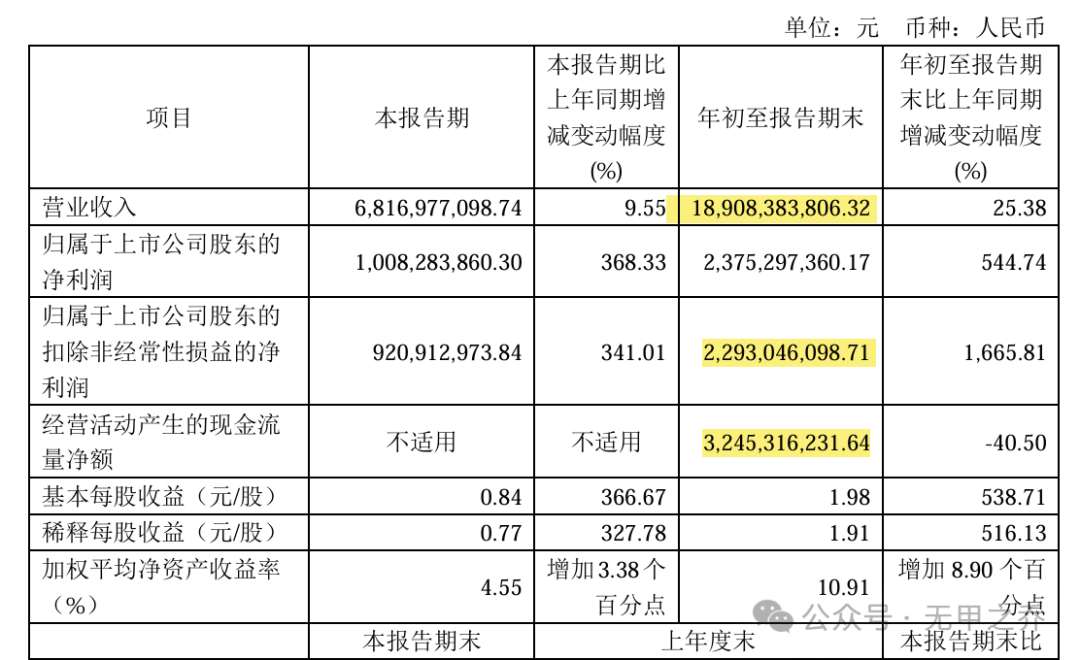

Source: Weir Shares 2024 performance forecast In 2024, according to the company’s performance forecast, the net profit attributable to the parent company is expected to be between 3.15-3.35 billion, an increase of 467-503% year-on-year. Source: Weir Shares 2024 Q3 report In the first three quarters of 2024, total revenue reached 18.9 billion, a year-on-year increase of 25.4%, with a net profit of 2.293 billion after deducting non-recurring gains and losses, an increase of 1665% compared to the same period last year. Comment: The predicted significant increase in net profit attributable to the parent company in 2024, with a slight increase in revenue, indicates a substantial improvement in Weir Shares’ profitability.

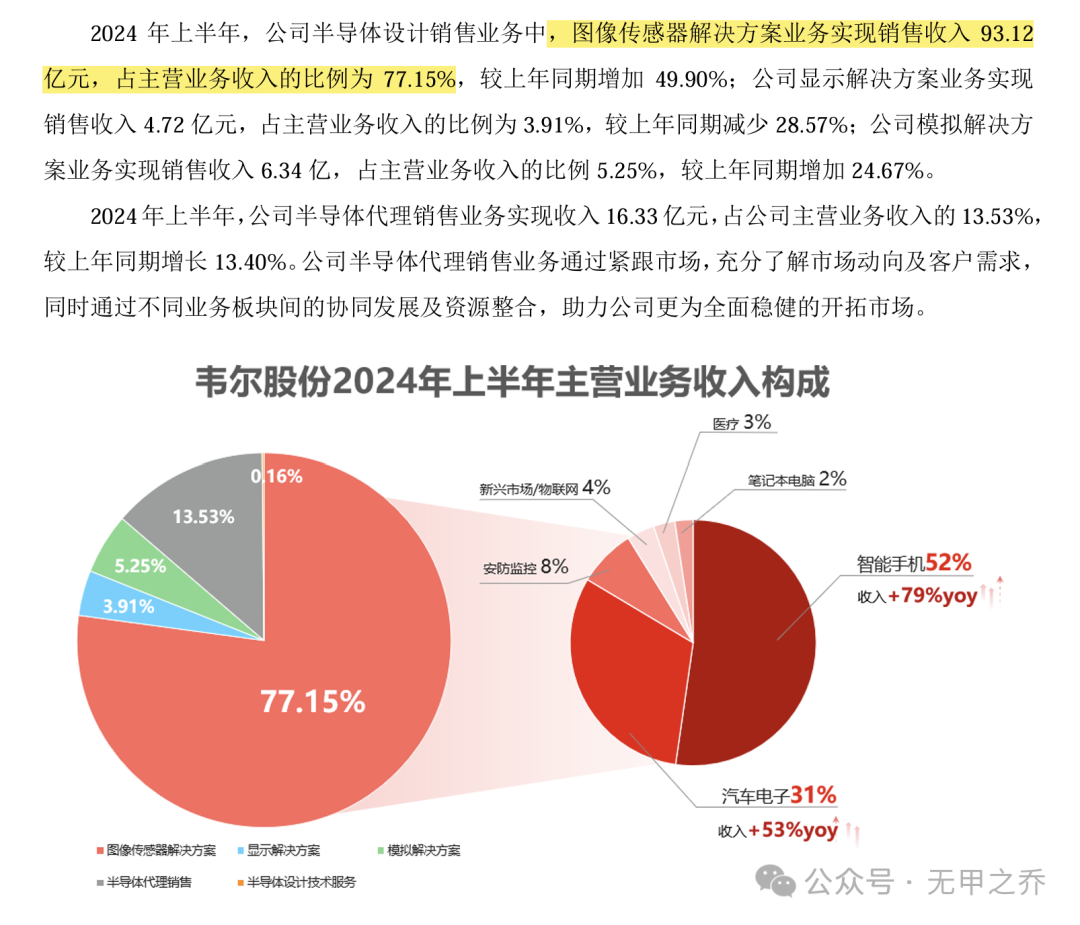

Source: Weir Shares 2024 Q3 report In the first three quarters of 2024, total revenue reached 18.9 billion, a year-on-year increase of 25.4%, with a net profit of 2.293 billion after deducting non-recurring gains and losses, an increase of 1665% compared to the same period last year. Comment: The predicted significant increase in net profit attributable to the parent company in 2024, with a slight increase in revenue, indicates a substantial improvement in Weir Shares’ profitability. Source: Weir Shares 2024 semi-annual report As of Q2 2024, Weir Shares’ revenue reached 12.09 billion, a year-on-year increase of 36%, with revenue from image sensor solutions at 9.312 billion, accounting for 77.15%, an increase of 49% compared to last year. Among the revenue from image sensor solutions, smartphones accounted for 52%, with a year-on-year growth of 79%, while automotive electronics accounted for 31%, with a year-on-year growth of 53%. Comment: Weir Shares experienced growth in both revenue and profit last year, primarily driven by the revenue growth of its subsidiary Omnivision in CIS chips. Future efforts in smartphone camera modules and intelligent automotive camera modules are expected to further enhance revenue and profit.3. Future performance development outlook 3.1 Competitive landscape of Weir Shares’ smartphone camera modules

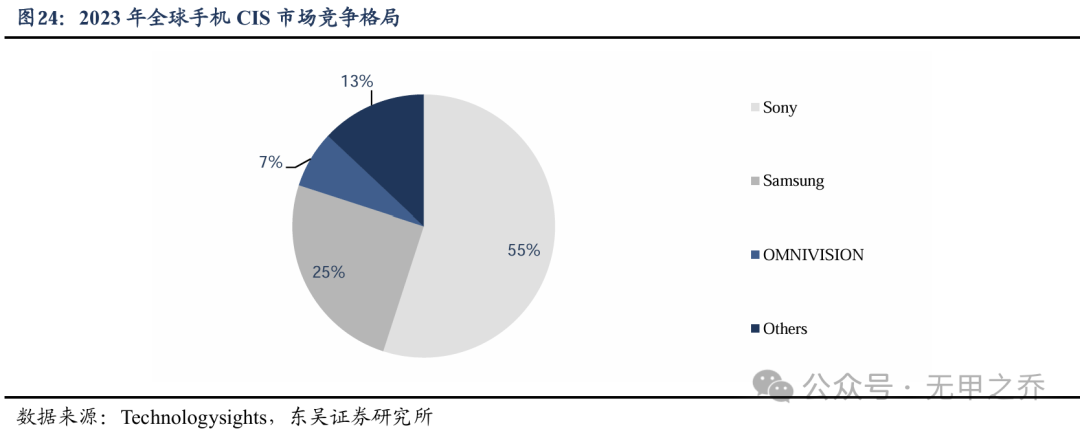

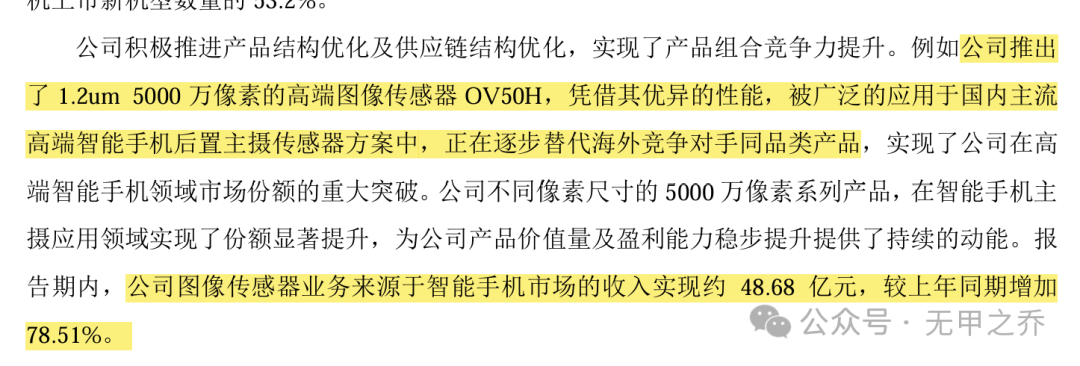

Source: Weir Shares 2024 semi-annual report As of Q2 2024, Weir Shares’ revenue reached 12.09 billion, a year-on-year increase of 36%, with revenue from image sensor solutions at 9.312 billion, accounting for 77.15%, an increase of 49% compared to last year. Among the revenue from image sensor solutions, smartphones accounted for 52%, with a year-on-year growth of 79%, while automotive electronics accounted for 31%, with a year-on-year growth of 53%. Comment: Weir Shares experienced growth in both revenue and profit last year, primarily driven by the revenue growth of its subsidiary Omnivision in CIS chips. Future efforts in smartphone camera modules and intelligent automotive camera modules are expected to further enhance revenue and profit.3. Future performance development outlook 3.1 Competitive landscape of Weir Shares’ smartphone camera modules In 2023, Sony dominates the global smartphone CIS market with a share of about 55%, primarily supplying Apple; Samsung holds about 25%, mainly supplying its own products; Omnivision, as a subsidiary of Weir Shares, mainly supplies domestic brands like Xiaomi, Oppo, and Huawei, with domestic smartphones accounting for about 59% of the overall smartphone market share, indicating a broad space for Weir’s products to replace imports. In the high-end flagship camera CIS chips, Sony’s main products are IMX989 and IMX888, while Samsung’s main products are ISOCELL GN2 and ISOCELL HP3, which are the main competitors of Omnivision’s OV50K. Omnivision’s OV50K is produced by SMIC, offering significant advantages in delivery time and cost compared to Sony. Years ago, Omnivision was pushed out of Apple’s supply chain by more advanced Sony camera solutions, and there are hopes for Omnivision to rise again with the support of domestic smartphone manufacturers.

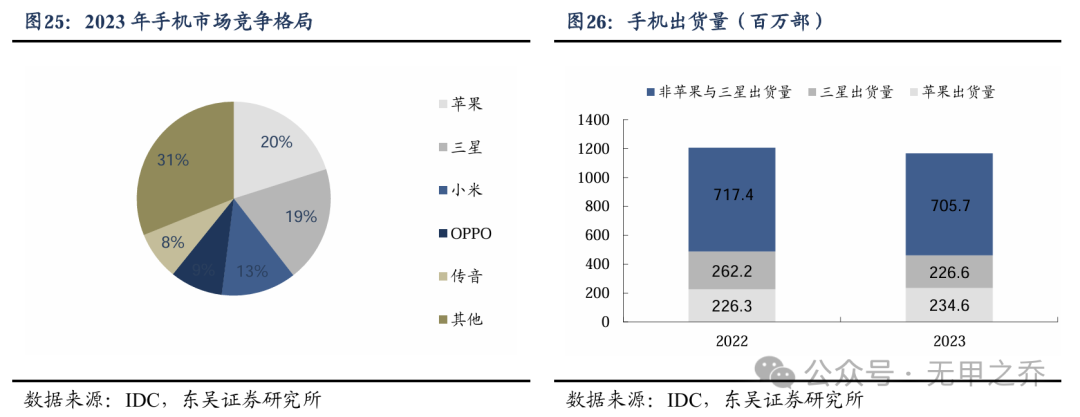

In 2023, Sony dominates the global smartphone CIS market with a share of about 55%, primarily supplying Apple; Samsung holds about 25%, mainly supplying its own products; Omnivision, as a subsidiary of Weir Shares, mainly supplies domestic brands like Xiaomi, Oppo, and Huawei, with domestic smartphones accounting for about 59% of the overall smartphone market share, indicating a broad space for Weir’s products to replace imports. In the high-end flagship camera CIS chips, Sony’s main products are IMX989 and IMX888, while Samsung’s main products are ISOCELL GN2 and ISOCELL HP3, which are the main competitors of Omnivision’s OV50K. Omnivision’s OV50K is produced by SMIC, offering significant advantages in delivery time and cost compared to Sony. Years ago, Omnivision was pushed out of Apple’s supply chain by more advanced Sony camera solutions, and there are hopes for Omnivision to rise again with the support of domestic smartphone manufacturers. Source: Weir Shares 2024 semi-annual report In the global smartphone market in 2023, Apple accounts for about 20%, Samsung for about 19%. Sony and Apple are closely tied, while Samsung’s camera CIS chips mainly supply its own products, making it difficult for Weir’s products to penetrate. However, in the domestic replacement market for brands like Xiaomi, Oppo, and Transsion, Weir’s products are expected to gradually expand market share with superior performance, fast delivery cycles, and more attractive pricing.

Source: Weir Shares 2024 semi-annual report In the global smartphone market in 2023, Apple accounts for about 20%, Samsung for about 19%. Sony and Apple are closely tied, while Samsung’s camera CIS chips mainly supply its own products, making it difficult for Weir’s products to penetrate. However, in the domestic replacement market for brands like Xiaomi, Oppo, and Transsion, Weir’s products are expected to gradually expand market share with superior performance, fast delivery cycles, and more attractive pricing. Source: Dongwu Securities – “Weir Shares: Domestic Leader…” 3.2 Competitive landscape of Weir Shares’ vehicle camera modules According to data from the China Association of Automobile Manufacturers, in 2024, the sales of new energy vehicles in China are expected to reach 12.866 million, with a penetration rate of 40.9%, of which L2-level vehicles account for about 55% (approximately 7.07 million units). In January-February 2025, retail sales of new energy vehicles reached 1.43 million, a year-on-year increase of 35%. BYD has taken the lead in launching intelligent driving systems in its affordable models like the Seal and Qin L, with a strategy of “more features without increasing prices” that has prompted major automakers to equip their models with intelligent driving systems for 2025.

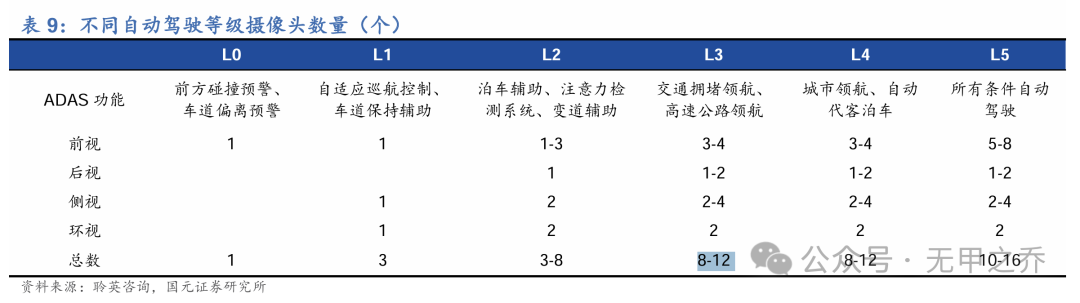

Source: Dongwu Securities – “Weir Shares: Domestic Leader…” 3.2 Competitive landscape of Weir Shares’ vehicle camera modules According to data from the China Association of Automobile Manufacturers, in 2024, the sales of new energy vehicles in China are expected to reach 12.866 million, with a penetration rate of 40.9%, of which L2-level vehicles account for about 55% (approximately 7.07 million units). In January-February 2025, retail sales of new energy vehicles reached 1.43 million, a year-on-year increase of 35%. BYD has taken the lead in launching intelligent driving systems in its affordable models like the Seal and Qin L, with a strategy of “more features without increasing prices” that has prompted major automakers to equip their models with intelligent driving systems for 2025. Assuming that future intelligent driving vehicles will achieve high-speed navigation capabilities, some L2-level assisted driving systems (with 3-8 cameras) will upgrade to (8-12 cameras), resulting in an approximate 80% increase in the number of cameras per vehicle. Weir Shares’ vehicle camera CIS chips are currently in a leading global position, with a clear competitive landscape: Weir’s subsidiary Omnivision and ON Semiconductor are the two main competitors, essentially dividing the market.

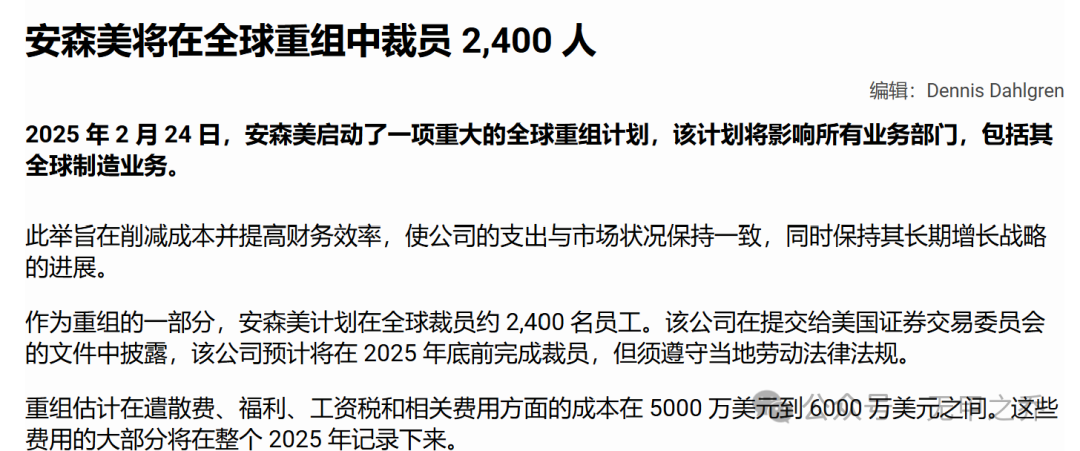

Assuming that future intelligent driving vehicles will achieve high-speed navigation capabilities, some L2-level assisted driving systems (with 3-8 cameras) will upgrade to (8-12 cameras), resulting in an approximate 80% increase in the number of cameras per vehicle. Weir Shares’ vehicle camera CIS chips are currently in a leading global position, with a clear competitive landscape: Weir’s subsidiary Omnivision and ON Semiconductor are the two main competitors, essentially dividing the market. Source: evertiq In the context of fierce competition in vehicle camera CIS, Weir Shares’ performance is rapidly rising, while the former leader ON Semiconductor is laying off employees to cut costs. Therefore, there is strong confidence in the rapid growth of Weir Shares’ vehicle CIS chip performance in the coming years.4. Appropriate price assessment 4.1 Analysis from future profit expectations Based on consensus expectations from Wind, considering that semiconductor companies experience high profit growth during performance surges, a PEG analysis is employed. Specifically, this involves using the profit expectations for 2025 and the net profit growth rate for 2026 to estimate a relatively reasonable allocation value and overheated value.

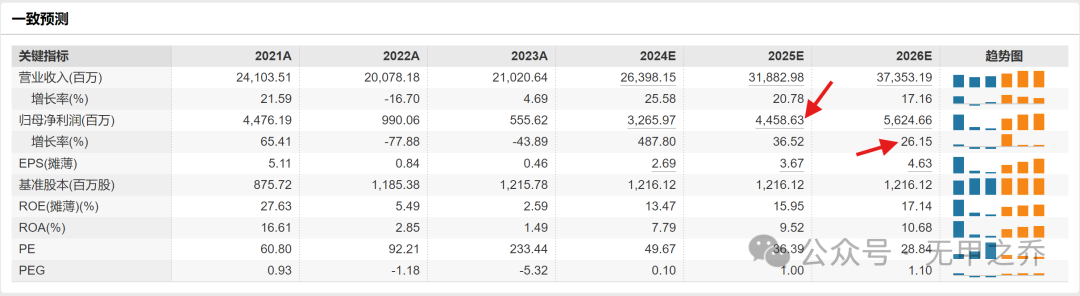

Source: evertiq In the context of fierce competition in vehicle camera CIS, Weir Shares’ performance is rapidly rising, while the former leader ON Semiconductor is laying off employees to cut costs. Therefore, there is strong confidence in the rapid growth of Weir Shares’ vehicle CIS chip performance in the coming years.4. Appropriate price assessment 4.1 Analysis from future profit expectations Based on consensus expectations from Wind, considering that semiconductor companies experience high profit growth during performance surges, a PEG analysis is employed. Specifically, this involves using the profit expectations for 2025 and the net profit growth rate for 2026 to estimate a relatively reasonable allocation value and overheated value. Source: Wind Financial Terminal Using PEG to estimate a reasonable market value, approximately 4.4 billion in predicted profits for 2025 multiplied by a profit growth rate of 26 times for 2026 (due to high profit growth, a certain premium can be applied, but also because of significant performance fluctuations, this premium is deducted), the estimated reasonable market value is 114.4 billion, with a reasonable allocation value of 90% or 103 billion, and an overheated value of 1.5 times or 171.6 billion. Based on the current market value, the current price appears to be expensive. 4.2 Analysis from inventory cycle As a cyclical industry, Weir Shares and other semiconductor companies exhibit clear “cyclical” characteristics. Generally, during periods of explosive market demand, it is challenging for companies to replenish inventory instantly, leading to a market reaction reflected in stock price surges. However, when companies respond and replenish inventory on a large scale, it often results in market oversupply, causing stock prices to decline:

Source: Wind Financial Terminal Using PEG to estimate a reasonable market value, approximately 4.4 billion in predicted profits for 2025 multiplied by a profit growth rate of 26 times for 2026 (due to high profit growth, a certain premium can be applied, but also because of significant performance fluctuations, this premium is deducted), the estimated reasonable market value is 114.4 billion, with a reasonable allocation value of 90% or 103 billion, and an overheated value of 1.5 times or 171.6 billion. Based on the current market value, the current price appears to be expensive. 4.2 Analysis from inventory cycle As a cyclical industry, Weir Shares and other semiconductor companies exhibit clear “cyclical” characteristics. Generally, during periods of explosive market demand, it is challenging for companies to replenish inventory instantly, leading to a market reaction reflected in stock price surges. However, when companies respond and replenish inventory on a large scale, it often results in market oversupply, causing stock prices to decline:

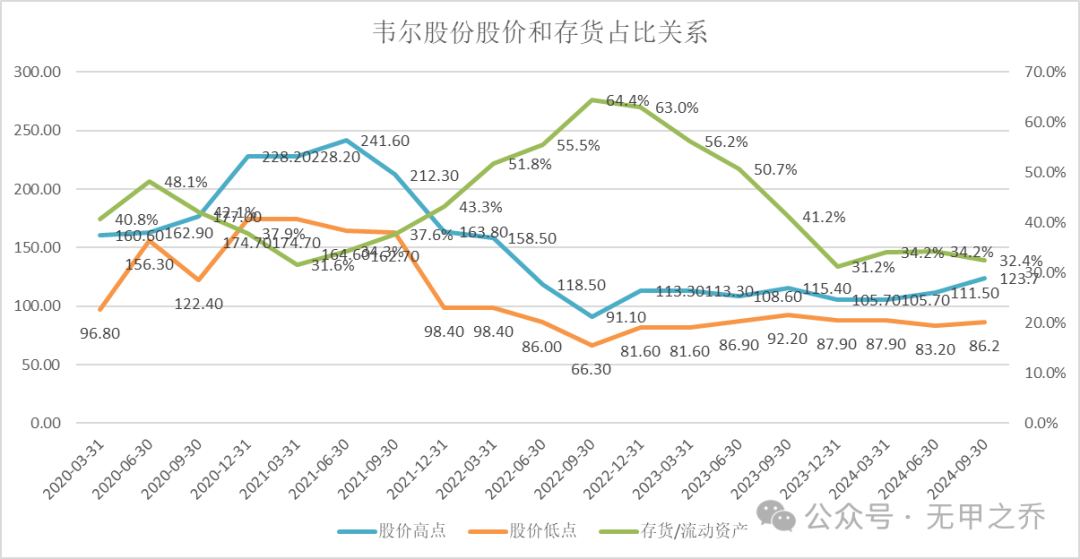

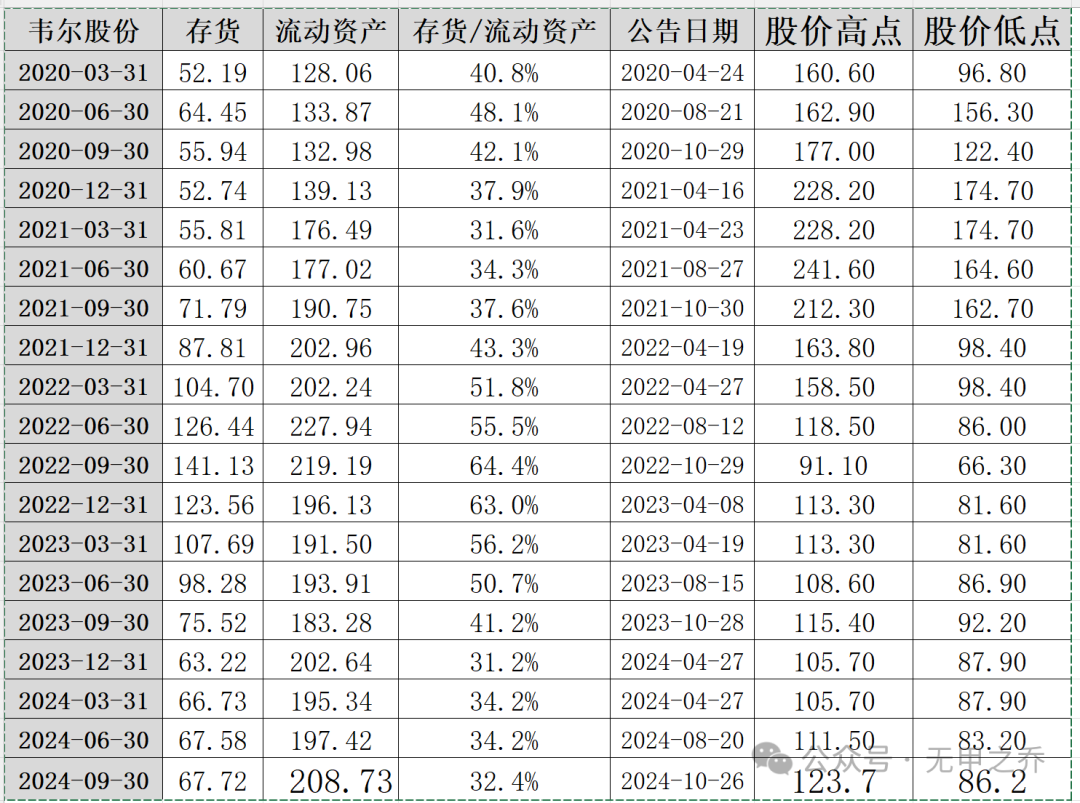

Data Source: Wind Financial Terminal Analyzing the price attention range of Weir Shares around 30 days before and after the quarterly report announcements from 2020 to 2024, the highest and lowest prices were extracted, and the proportion of inventory to current assets was analyzed: In the first phase from March 2020 to March 2021, the proportion of inventory to current assets rose from 40% to 48% before subsequently falling to 31.6%, while Weir Shares’ stock price showed an upward trend, with the highest price rising from 160 to 228 yuan. In the second phase from March 2021 to September 2022, the proportion of inventory to current assets rose from 31.6% to 64.4%, while Weir Shares’ stock price fell from 228 to 91 yuan. In the third phase from September 2022 to September 2024, the proportion of inventory to current assets fell from 64.4% to 34.2%, while the highest stock price rose from 91.1 to 123.7 yuan. Therefore, over the past five years, the relative proportion of inventory and the subsequent stock price trends of Weir Shares have generally exhibited a negative correlation. Looking ahead, Weir Shares may continue to actively replenish inventory and increase the supply of CIS chips in the current market environment, leading to relatively significant downward pressure on stock prices in the future.Summary: The current overall price of Weir Shares has reflected future market expectations, indicating that it is relatively expensive at this time. Considering the future path of inventory replenishment and capacity expansion, stock price pressure is expected to be significant.5. Important Notice This article is for research reference only and does not constitute specific investment advice, nor is it related to my affiliated company. Please take note.

Data Source: Wind Financial Terminal Analyzing the price attention range of Weir Shares around 30 days before and after the quarterly report announcements from 2020 to 2024, the highest and lowest prices were extracted, and the proportion of inventory to current assets was analyzed: In the first phase from March 2020 to March 2021, the proportion of inventory to current assets rose from 40% to 48% before subsequently falling to 31.6%, while Weir Shares’ stock price showed an upward trend, with the highest price rising from 160 to 228 yuan. In the second phase from March 2021 to September 2022, the proportion of inventory to current assets rose from 31.6% to 64.4%, while Weir Shares’ stock price fell from 228 to 91 yuan. In the third phase from September 2022 to September 2024, the proportion of inventory to current assets fell from 64.4% to 34.2%, while the highest stock price rose from 91.1 to 123.7 yuan. Therefore, over the past five years, the relative proportion of inventory and the subsequent stock price trends of Weir Shares have generally exhibited a negative correlation. Looking ahead, Weir Shares may continue to actively replenish inventory and increase the supply of CIS chips in the current market environment, leading to relatively significant downward pressure on stock prices in the future.Summary: The current overall price of Weir Shares has reflected future market expectations, indicating that it is relatively expensive at this time. Considering the future path of inventory replenishment and capacity expansion, stock price pressure is expected to be significant.5. Important Notice This article is for research reference only and does not constitute specific investment advice, nor is it related to my affiliated company. Please take note.