In the past few years as an insurance broker, I have often been asked: “How’s it going lately? How long can one work in the insurance brokerage industry? Does the poor economy have any impact?”

Actually, my answer has always been the same: a truly good profession is not about chasing trends, but about being able to firmly root oneself amidst the waves.

Just like fishermen know best, the bigger the waves, the fatter the fish—the more turbulent the risks, the more valuable the insurance broker becomes.

1. Why is insurance brokerage considered a “counter-cyclical” profession?

Every industry has its cycles. Ten years ago, real estate and education were golden paths, but now they face transformation;

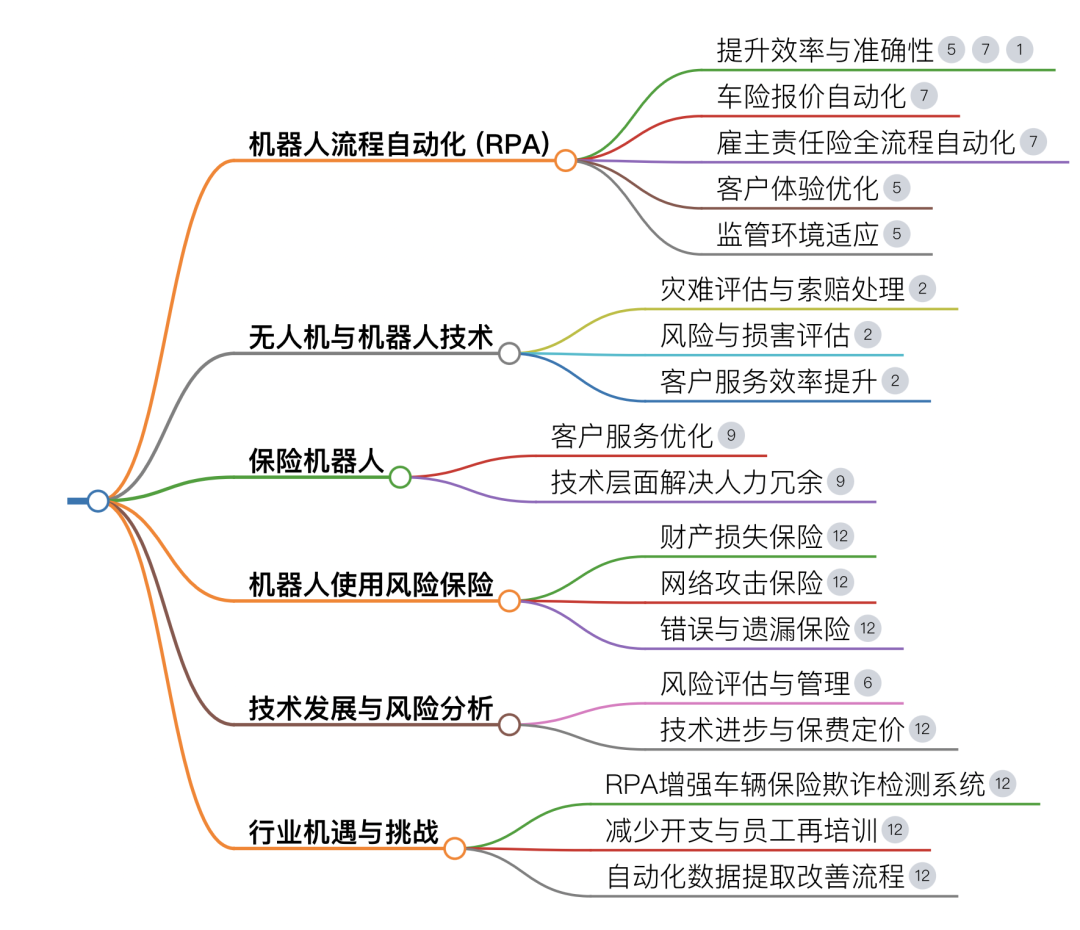

and this year, the hottest sectors are low-altitude economy, AI, and robotics—who can guarantee that they won’t become saturated in ten years?

But regardless of how industries change,risks always exist; they just take on different forms.

In the past, selling houses meant worrying about unfinished projects; now, building drones means worrying about them crashing into people; previously, factory owners feared fires, while today, AI companies are most concerned about data breaches. Risks do not disappear; they only shift.

Last year, a friend’s company faced a situation where a product injured a worker during testing, and the compensation nearly caused the company to collapse.

When a drone goes out of control and damages goods, when a smart warehousing system malfunctions and causes a fire, when an autonomous driving algorithm fails and leads to an accident… these losses, often amounting to millions, are simply unsustainable for a startup’s cash flow.The essence of insurance is to use certain small costs to lock in uncertain large risks.

2. True entrepreneurs never gamble on luck

Some say: “Entrepreneurship is a gamble; you might just succeed.”

This statement is only half true.

Those who dare to take risks are warriors, but those who understand how to avoid risks are the true winners.

This year, the low-altitude economy is booming, and some are developing logistics drones, most concerned with: “If the machine falls and injures someone, how much will the insurance cover?” Others are working on AI medical imaging, focusing on data breach contingency plans.

Every time I think of my days as a product manager—where I used to write requirement documents, now I have to write risk planning proposals.

The commonality is that one must delve into the client’s business logic, understand every business link, to identify risk gaps.

3. The more professional, the more freedom

This industry has a paradox:it seems to help others manage risks, yet it actually provides the greatest professional freedom for itself.

There is no need to chase hot industries because every new path has new demands. Last year it was battery insurance for new energy vehicles, this year it is liability clauses for low-altitude flying vehicles, and next year it may involve understanding the ethical risks of brain-computer interfaces.

Thus, this is an infinite game, a state of continuous evolution, which makes professional life increasingly counter-cyclical.

Just like an experienced traditional Chinese medicine practitioner becomes more valuable with age, the industry knowledge accumulated by insurance brokers will eventually form a protective moat.

More importantly, the underlying logic of this profession is progressive:

As the digital economy develops, personalized risks become harder to cover with standardized products;

As the wave of entrepreneurship surges, small and medium enterprises have an increasing demand for customized protection.

And insurance brokers are the best connectors between these two ends.

4. Choose a “long-term way of living”

Some ask me: “Is it too late to enter the industry now?” My answer is hidden in two sentences:

First, there is no sunset industry, only sunset thinking.Second, all professional value is the true skill that is honed over time.

The profession of insurance brokerage may not lead to overnight wealth, but it offers us a “long-term way of living”—no need to worry about industry cycles, no fear of technological replacement, as long as we adhere to one core principle:always think one step ahead of the client regarding risks and prepare an alternative route.

After every insurance purchase, clients say: “After buying insurance, I finally dare to innovate.” This reassures me:the bigger the waves, the more we need someone to uphold the bottom line; the faster the times, the more worthwhile it is to do the difficult yet correct thing.

So, if you ask me where the future of insurance brokers lies?

My answer is:in every emerging industry’s risk list, in every entrepreneur’s sense of security, and even in our courage to continuously break cognitive boundaries.

After all, the best way to combat uncertainty is to become certainty itself.

We welcome more excellent partners to join us, to enter the future path.

Further reading:

As a family member of an entrepreneur, you need to secure their millions as soon as possible

The dilemma of dual-income families: who takes leave when the child is sick?

What to do about global tax increases in the US? Use “insurance” to hedge

Going overseas is popular, but what if the money doesn’t come back?—A must-read for overseas business

What is the “get out of jail free card” for corporate executives? What is director and officer liability insurance?

About MeRisk architect, focusing oninternet practitioners, entrepreneurs, and startuprisk management;

WeChat:iamren, please add a note withthe title of this article