In 1978, my family lived in a side room of a mud-brick thatched house, while my grandfather lived in the main house where a small radio, scientifically known as a reed horn, was mounted on the wall. Every morning and evening, it broadcasted announcements from the local brigade, news from the provincial radio station, and traditional operas.

Caption: The small horn used since the 1960s

Caption: The small horn used since the 1960s

After the reform and opening up, in just over forty years, a vast array of domestic consumer electronics products gradually made their way into our lives: black-and-white televisions, tape recorders, color televisions, personal computers, feature phones, MP3 players, smartphones, electric vehicles…

From humble beginnings, great heights have been achieved. We are fortunate to share the pulse and fate of this great era. Here, I would like to share six stories from the development of modern electronic manufacturing in China over the past 40 years and the transformation process of moving upstream in the supply chain.

1. Black-and-White Television: From Manual Soldering to Automated Soldering

In the movie “Hi, Mom,” in 1981, a worker named Li Huanying from the Victory Chemical Plant in Yicheng, Hubei, purchased the first television set produced by the factory.

The packaging of the movie shows that the black-and-white transistor television was produced by Hefei Radio Factory No. 2.

Hefei Radio Factory No. 2 was a small factory that relocated from Shanghai in the 1950s. In 1974, the first domestic transistor television was born. Although the technology was not yet mature and most televisions on the market were still tube-based, the factory saw a great opportunity and decided to leapfrog into the “transistor television” project, establishing a “television group” and introducing and replicating the “4D4” model black-and-white transistor 9-inch television from Shanghai Radio Factory No. 4, naming it “Huangshan Brand,” which was referred to as “Xinghai Brand” in the movie.

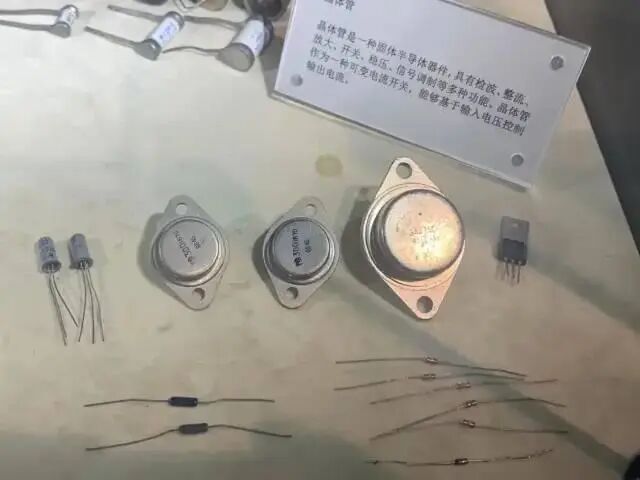

Chief Engineer Zhang Xi wrote a memoir detailing the traditional through-hole soldering technology, which involved several main steps: drilling holes in the circuit board, through-hole assembly, soldering, and inspection. The components had long “legs”.

Caption: Domestic transistors in the Shanghai Radio Museum

Caption: Domestic transistors in the Shanghai Radio Museum

The production process of televisions relied on “process control” for quality assurance. Zhang Xi contacted a distant relative working in the process department of Shanghai Radio Factory No. 18 (Feiyue Brand Television). Through this family connection, he managed to bring back the “television production process documents”.

Caption: The production line of Huangshan black-and-white televisions at Hefei Radio Factory No. 2 in 1984

Caption: The production line of Huangshan black-and-white televisions at Hefei Radio Factory No. 2 in 1984

In 1981, the factory secured a quota from Beijing for 50,000 sets of Japanese Sharp 12-inch black-and-white television parts, thus introducing Japanese automated soldering technology, along with necessary equipment such as television signal generators, quality testing instruments, and wave soldering machines, establishing a modern assembly line that significantly improved production efficiency. The television in “Hi, Mom” corresponds to products from this period, selling for 450 yuan and requiring a ticket for purchase.

Due to the need to purchase Japanese parts with precious foreign exchange, which had to be allocated by Beijing, the quota was limited. In 1982, Hefei Radio Factory No. 2 reverted to using domestic components to manufacture black-and-white televisions. However, this return to domestic production represented a significant technological regression—expensive imported wave soldering machines were left unused, and workers had to revert to manual soldering. After all, adopting automated soldering is a systematic project that cannot rely solely on the workshop’s efforts without the cooperation of the technical department. Therefore, the process department worked alongside the production workshop to conduct experiments, and after achieving success, ultimately promoted the reform of wave soldering technology, leading all workshops in the factory to abandon manual soldering. It is worth noting that through-hole components still required manual labor.

In the 1980s, radio enthusiasts would order radio kits and television kits through magazines like “Radio” and then manually solder and debug them at home, without needing tickets or waiting in line, eliminating middlemen. My middle school classmate Yang Yongqiang told me that his family spent over 300 yuan to have their physics teacher Li Ruilin solder one such “handcrafted” product. My schoolmate and founder of Gekewei, Zhao Lixin, recalled that his family assembled Songhe brand bicycles (with parts provided by the Sanxian factory Xianghua Machinery Factory), earning 30 yuan per bike, as supplies from Shanghai’s Phoenix and Yongjiu were very tight and required tickets.

In 1991, my family acquired a Shanghai-produced Kaige brand 14-inch black-and-white television, which was replaced by a Konka color television in 2001.

2. The Introduction of Surface Mount Technology in Color Television High-Frequency Tuners

1. Mechanical Tuners Using Manual Soldering

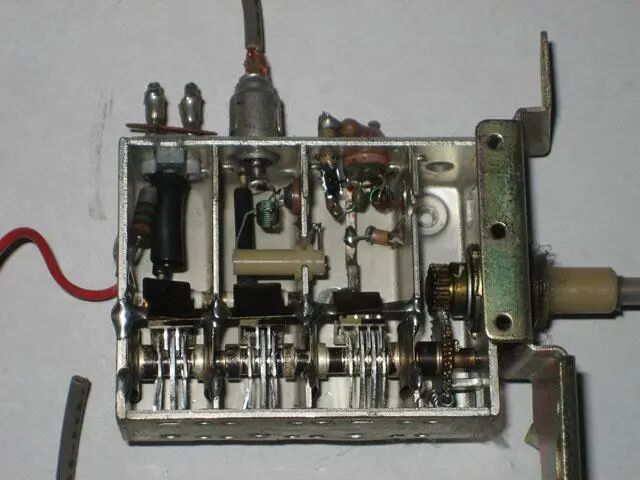

Traditional black-and-white televisions used mechanical tuners, which featured a large knob on the television set, later evolving to two large knobs.

I found a production case of mechanical tuners online. In the last century, Qingdao Electronic Components Factory No. 1 was the only manufacturer of television tuners in Shandong Province. It started as follows: In 1975, Qingdao Electronic Components Factory No. 1 was tasked with trial production of a VHF mechanical tuner designed by a national joint effort, and that year they developed a sample, which was finalized as the KP12-2 model. Subsequently, they manufactured molds and conducted trial production, starting small-scale production in August 1977, producing 500 units that year. In 1980, the factory was tasked with trial production of a UHF mechanical tuner. They referenced the Japanese P24 tuner and produced 9 prototypes in June 1981, finalizing it as the TJ2-2 model and began large-scale production.

Caption: Old-style mechanical tuner for televisions

Caption: Old-style mechanical tuner for televisions

2. The Assembly of Color Televisions Became Very Popular

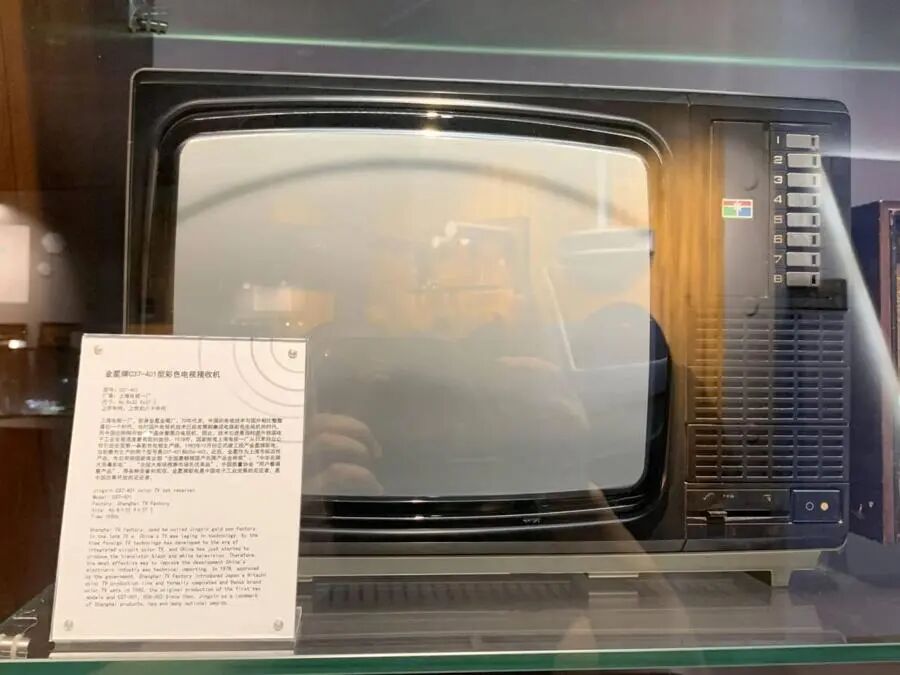

On December 26, 1970, China’s first color television was born at the Tianjin Radio Factory, but key components like the color television picture tube still needed to be imported, making mass production impossible. At this time, the West had already begun to widely adopt integrated circuits in color televisions, leaving us a whole generation behind.

After Nixon’s visit to China in 1972, RCA from the United States almost successfully collaborated with the mainland on color televisions, but the project was later shelved. In the 1980s, over 100 color television production lines of various sizes were introduced nationwide, mainly from Japan. Many military electronics companies faced a severe task of “military to civilian” conversion, seeking orders from the market, and the quickest way to achieve this was to obtain import permits to assemble imported complete sets of parts for televisions, which could then be sold in the domestic market, yielding quick economic benefits. In 1986, Ni Runfeng from Changhong Machinery Factory, against the odds, introduced the latest generation of color television production lines from Japan’s Matsushita, laying the foundation for Changhong to become a future color television giant.

Caption: In 1978, Shanghai introduced Japanese production lines, and in 1982, Jin Xing color televisions began mass production

Caption: In 1978, Shanghai introduced Japanese production lines, and in 1982, Jin Xing color televisions began mass production

During the Spring Festival of 1983, China Central Television officially launched the “Spring Festival Gala.” Since then, watching the Spring Festival Gala on New Year’s Eve has become a fixed program in every household. The production of televisions began to explode.

The aforementioned Hefei Radio Factory No. 2 introduced a Japanese JVC color television production line in 1984, purchasing JVC parts for production, and the following year upgraded to a more advanced Sanyo production line. In 1986, the factory and Nanjing 714 (Panda) Factory introduced the more advanced “SABA” color television from Germany’s Thomson, but during the investigation, it was found that the production automation level of Thomson televisions was high, all using automatic insertion, while China at that time still relied on manual insertion, which was prone to errors.

By 1987, China’s television production had reached 19.34 million units, surpassing Japan to become the world’s largest television producer, with a social ownership exceeding 100 million units.

It is worth mentioning that although the factory declined, the white goods manufacturing industry in Hefei continues to this day and has successfully moved upstream in the supply chain. The television power supply giant Shenzhen Hanjia has established a large factory in Hefei. In 2008, the first sixth-generation liquid crystal display production line in China was established in Hefei, and BOE finally succeeded.

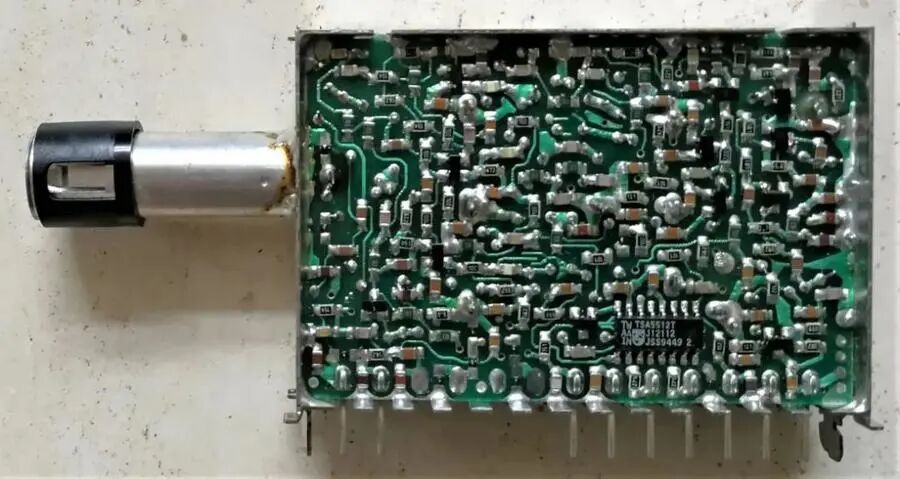

3. Electronic Tuners Used in Color Televisions

The electronic tuner used in color televisions is an important component in the television receiving terminal, commonly known as the “high-frequency head,” which completes the processes of receiving amplification, gating, frequency conversion, and demodulation of images and sound. Any distortion or distortion in this process can degrade the quality of the received image and sound.

In the 1970s, Philips launched the first surface-mounted integrated circuit, a button-shaped micro-device that later evolved into small form factor integrated circuits, with lead distribution on both sides of the device in a gull-wing shape. Due to the absence of leads or the short leads of surface-mounted devices, they improved the high-frequency performance of electronic products, thus being applied in the widely used electronic tuners of color televisions. Below is a Philips tuner that uses many SMD components, but also has through-hole soldered components.

Caption: Philips television tuner UV916E/IEC-long

Caption: Philips television tuner UV916E/IEC-long

Starting in 1985, domestic color television tuner factories began to import SMT automatic placement machine production line equipment in bulk, starting mass production of small electronic products represented by television tuners. Over the five years starting in 1985, approximately 100 SMT automatic placement machines were imported, forming a production capacity of nearly ten million television tuners, effectively meeting the explosive demand of the domestic market.

To adapt to the rapidly developing domestic color television production needs, the aforementioned mechanical tuner specialist Qingdao Electronic Components Factory No. 1 signed a contract with Japan’s Matsushita in December 1984 to introduce production technology and equipment for B-type electronic tuners for color televisions, officially starting production in June 1986, with an output of 183,900 units that year. This product reached the advanced level of the 1980s internationally, adopting planar resonance technology in circuit design, thus achieving the miniaturization of electronic tuners. After introducing the production line, the factory’s technical staff actively carried out localization efforts, reducing the cost of each tuner from $8 to $4.3, improving the company’s economic efficiency and contributing to the production of quality products for several color television manufacturers and expanding exports.

With such tuners, controlling the television via remote control became possible. In the mid-1980s, I first heard about remote controls when a boy from a nearby family went on a business trip to Japan and brought back a Japanese original color television that could change channels from under the covers. By the late 1980s, Huang Hongsheng founded Skyworth, and chip magnates Huang Xueliang and Zhu Changhua joined Shenzhen Santek Laser, all working on developing remote controls for color televisions.

It is worth mentioning that Qingdao’s home appliance industry is a pillar industry, with Hisense’s black electronics and Haier’s white electronics being the “dual strong” players, performing well in overseas markets. Hisense televisions and TCL televisions (including the American brand RCA and the German brand Thomson) are now produced in Mexico and sold to North America, competing with Japanese and Korean brands like Sony, Samsung, and LG.

Caption: BESTBUY supermarket in North America during the “Black Friday” promotion featuring various brands of televisions

Caption: BESTBUY supermarket in North America during the “Black Friday” promotion featuring various brands of televisions

3. The Rise of OEM—Huawei, ZTE, and Xiaomi

1. The Emergence of Electronic Manufacturing Services (EMS) After the Oil Crisis of the 1970s

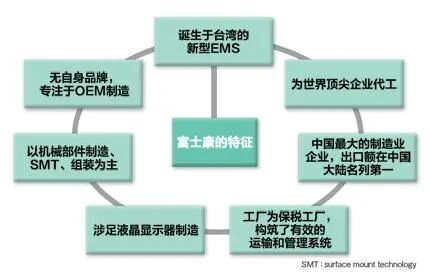

Electronic Manufacturing Services (EMS), also known as ECM (Electronic Contract Manufacturing), is a term translated into Chinese as professional electronic OEM services. Foxconn, which everyone knows, is a representative EMS company.

EMS companies mainly have two businesses: one is highly automated PCBA production lines, commonly referred to as “soldering circuit boards,” where the workforce mainly consists of engineers and skilled technicians, predominantly male; the other is labor-intensive complete machine assembly and testing lines, commonly referred to as “assembly,” where the workforce mainly consists of dexterous young women. At that time, electronic factories were colloquially referred to as “daughter countries,” where male workers had to rely on connections to get in, and once inside, they had no worries about finding partners, and no bride price was required!

Caption: In 2008, a Foxconn “iPhone girl” tests the phone’s camera function

Caption: In 2008, a Foxconn “iPhone girl” tests the phone’s camera function

In 1961, the EMS industry was initially established by SCI Systems in Alabama, USA (merged with New Media in 2001). The establishment of Solectron in the 1970s marked the beginning of the EMS industry model.

In the 1970s, two oil crises erupted, causing global oil prices to rise from $1.2 per barrel in early 1970 to nearly $40 per barrel by the end of 1979, with a cumulative increase of 30 times over the decade, leading to widespread inflation worldwide. Against this backdrop, labor-intensive industries significantly shifted from developed countries, leading to the emergence of the “Four Asian Tigers” (Hong Kong, Singapore, Taiwan, and South Korea) and the “Four Asian Tigers” (Indonesia, Thailand, Malaysia, and the Philippines). The EMS business rapidly developed and established factories in developing countries to significantly reduce costs. After China’s reform and opening up, especially after the 1997 Southeast Asian financial crisis, many EMS manufacturers came to mainland China to set up factories for reasons such as cost maintenance, availability of raw materials, and manufacturing speed.

In 2022, the top 20 EMS companies globally included Foxconn, Pegatron, Wistron, Jabil, Flex, BYD, Universal Scientific Industrial, New Media, New Kinpo, Ten-Hong, Belletron, Shenzhen Technology, Wantai, Baidian, Zheneng, FABRINET, SIIX, Sumitomo, IMI, and Guanghong. There are also some Hong Kong-funded EMS industries, such as VTech, which have significant production capacity in mainland China.

Newly established large EMS companies in mainland China include BYD, Shenzhen Technology, Guanghong Technology, Zhuoyue Technology, and Luxshare, providing complete electronic manufacturing services such as process R&D, procurement management, production control, and warehousing logistics for numerous domestic and foreign clients, mainly serving the rising industries of smartphones (consumer electronics), industrial control (industrial electronics), and automotive electronics.

Growing up near Yuyuan Road in Shanghai, Guanghong Technology’s Tang Jianxing provided insightful analysis of this industry in 2017: Among the top 100 EMS companies globally, the top ten were predominantly American-funded in the early days, including Flex, Solectron, Jabil, and New Media, many of which are still around today. Of course, in the mid-term, over a decade ago, it was evident that some Taiwanese-funded enterprises entered this industry and grew significantly.

However, a notable characteristic is that now many large companies have moved their factories to China for two main reasons: one is the effect of industrial chain integration, and the second is that only China can provide so many efficient and skilled workers to complete such an industry. Therefore, in recent years, local companies in China, including ourselves, have gradually mastered some core technologies in electronic manufacturing. It can be said that in terms of quality and technology, we are not inferior to the aforementioned multinational companies, but the only difference is that we are not yet large enough. Thus, we hope to leverage the capital market to rapidly expand our scale and compete with these large international EMS companies.

2. Huawei’s Early Collaboration with Outsourcing Factories

In the 1980s, Huawei and ZTE started with small program-controlled switches, which were essentially specialized computers, using the Zilog Z80 8-bit microcontroller as the core control unit.

In September 1991, Huawei rented the third floor of an industrial building in Haoyue Village, Bao’an District, Shenzhen, dividing the floor into four sections: single board, power supply, general testing, and preparation, with a warehouse and kitchen also on the same floor. Dozens of beds were lined up against the wall, and when there weren’t enough beds, foam boards were used with mattresses on top. More than fifty Huawei employees began their arduous entrepreneurial journey, initially replicating and manually drawing circuit boards.

Caption: An old photo of the Xicheng Industrial Zone (now demolished)

Caption: An old photo of the Xicheng Industrial Zone (now demolished)

The circuit boards were outsourced to external factories for soldering (Note: single-layer boards with through-hole soldering). At that time, there were no automatic testing devices, and thousands of solder joints were visually inspected one by one by quality department employees using magnifying glasses to check for cold soldering, missed soldering, or solder bridges. The first batch of BH-03 units was packaged and shipped out on December 2, 1991.

By October 1997, my Huawei employee number was already 8148, with thousands of employees and an annual output value of several billion. I worked at the Xixiang factory for nearly a year, mainly involved in FQC (final inspection). The circuit boards were produced in specialized outsourcing factories, and some products had already adopted 16-layer boards and SMT processes. The Xixiang factory assembled complete machines and conducted testing. If a circuit board had a fault, it needed to be modified or repaired, and the board would be taken to the soldering section for repairs.

In 1999, the production center in Bantian was put into operation, collaborating with Germany’s FhG on factory layout and automation design, establishing six SMT production lines. By this time, I was already in the marketing department, occasionally taking clients for visits. Everyone wore anti-static clothing and shoe covers, and the placement machines were running quickly, looking very advanced, and no one thought of it as a “shell company” anymore.

Process expert Owen Chen Zhiguang introduced that the world EMS giant Flex had provided global OEM services for Huawei’s communication base stations using its production bases spread across continents, eliminating the lengthy sea transport process (air freight was too expensive, making the cost of tofu equivalent to meat prices), allowing base stations to reach their destinations quickly for installation, which greatly aided Huawei’s internationalization. I was one of the first to go to overseas base stations and found this point quite credible.

3. ZTE’s Early Collaboration with Outsourcing Factories, Later Building Its Own Production Lines, Becoming the “Huangpu Military Academy” of the Mobile Phone Industry

The book “ZTE Communications” records the process in 2003 when ZTE’s mobile phone division purchased automatic placement machines to build two SMT production lines. It mentions that the mainboards for ZTE’s mobile phones and those of Huawei and Konka’s small PHS phones were designed by Kyocera and manufactured by EMS company Solectron.

It was precisely because ZTE’s mobile phones had design and manufacturing capabilities during the first wave of mobile phone trends that today the three major ODM (Original Design Manufacturer) companies are all from ZTE’s entrepreneurial lineage, and they are all located in Shanghai (the first and second research institutes of ZTE), namely Huaqin (Qiu Wensheng is ZTE’s mobile phone R&D employee No. 007), Wingtech (Zhang Xuezheng), and Longqi (Dr. Du Junhong).

Although Samsung has moved its production to Vietnam, it has also entrusted many phones to Huaqin Technology, known as the “King of Thousand Yuan Phones,” for design and manufacturing.

4. Xiaomi’s Entry Also Involved Collaboration with EMS

Xiaomi entered the electronics field relatively late. In the book “Unstoppable,” the process of Xiaomi’s early search for EMS factories is described.

“(In 2011, Xiaomi) was slowly reaching cooperation agreements with suppliers, but there was no progress on who would be the OEM factory for Xiaomi phones. Zhou Guangping’s team listed the top EMS factories in the world, including Foxconn, and went around to talk, but all ended in failure. In fact, the more top-tier companies are, the more cautious they are about collaborating with new brands. Their production capacity is sufficient, and they are only willing to allocate resources to long-term cooperative old customers.”

“After everyone reviewed the list, it was found that only the last OEM factory had not completely rejected Xiaomi, which was the Nanjing-based Inventec. If this subsidiary of Inventec also refused to cooperate with Xiaomi, it would be a fatal blow to the entrepreneurs. Moreover, if the OEM factory could not be negotiated, what use would the suppliers be?”

“On the morning of February 2011, Zhang Feng, sitting in the office of the general manager of Inventec in Nanjing, was waiting for a person named Liu De to visit. Liu De came from a company whose name he had never heard of—Xiaomi.”

“Inventec was Xiaomi’s only hope, and Xiaomi was also Inventec’s hope for the future. Xiaomi was willing to pay for the initial R&D costs, and Zhang Feng also offered Xiaomi a very generous price. This was an important moment for Xiaomi, marking the first handshake between the software world and the hardware world.”

Currently, Guanghong Technology is providing OEM services for Xiaomi phones in China, Vietnam, and India.

5. OPPO and VIVO Emerge in Dongguan, Along with Huawei, and the Decline of Gionee

Since the era of “processing with supplied materials,” Dongguan’s electronics industry has been very developed, with a saying: “Traffic jams in Dongguan mean global shortages.”

Established in 1995, Nokia’s Dongguan factory was once the largest mobile phone factory in the world, with products sold both domestically and exported.

In May 2004, Duan Yongping founded Dongguan BBK, and the first new model, Lingrui LR007, was launched. At that time, BBK did not have its own license and used the license of Tian Shida. Also borrowing Tian Shida’s license was Gionee, founded by Liu Lirong, who also came from Subor. OPPO and VIVO, which originated from BBK, have always built their own production lines in Dongguan. Notably, in recent years, OV has also been pursuing the OEM route.

Gionee was established in Dongguan in 2002, initially assisting the Tian Shida brand. After obtaining a mobile phone production license in 2005, Gionee began producing branded mobile phones. Gionee’s marketing was very effective, and its distribution outlets were once very numerous. On November 26, 2017, Gionee held a “Gionee Full Screen – Super Launch Conference” on Shenzhen Satellite TV, with Liu Lirong full of confidence. That day, I happened to pass by, completely unaware that this was Gionee’s last glory, as just over a month later, it encountered problems.

Some industries from Shenzhen moved to Dongguan, with Huawei’s mobile phones being the most famous, having both in-house production and extensive outsourcing.

After Honor’s independence, its headquarters is located in Futian, Shenzhen, and all production is done through professional OEM methods.

4. From PC to iPod and iPhone, Foxconn Becomes the Largest OEM in Mainland China

Foxconn has grown in mainland China alongside the “world’s factory” for nearly forty years. This is akin to “Kang Shifu” instant noodles, which are not very large in Taiwan but rapidly expanded after coming to the mainland.

In 1974, Terry Gou founded Hon Hai Precision Industry Co., Ltd. in Taiwan, producing knobs for black-and-white televisions. Considering that the quality of molds directly affects product quality, in 1977, after finally accumulating the first bit of capital, Gou went to Japan to purchase mold equipment and built his own mold factory. However, the rapid rise of color televisions made knobs unnecessary, forcing Hon Hai to seek new directions.

Gou keenly judged that personal computers would experience explosive growth, eventually entering the homes of ordinary people. The key leap for Foxconn was due to personal computers, so let’s extend the timeline to recall history.

1. Foxconn Becomes a Top Player in PC Connectors and Cases

In 1983, Hon Hai developed computer connectors using new equipment imported from Japan, beginning to establish business relationships with computer manufacturers. This was also the first year Hon Hai officially entered the PC field.

By 1985, Terry Gou personally traveled to the United States to develop clients. He targeted major international PC manufacturers like Dell, Compaq, and Intel. To save on airfare during his time in the U.S., Gou rented a car and directly hired an American as a marketing manager, solving the roles of driver, translator, and sales all at once, traveling across the U.S. He would eat a hamburger when hungry and stay in the cheapest $12 motels. Over a few years, he traveled to over thirty states in the U.S., securing numerous orders for PC connectors.

Foxconn became Hon Hai’s first self-owned brand, a name that combines the auspicious beast fox (Fox) with connector.

Established in 1988, the Foxconn Shenzhen factory had only over 100 employees, making connectors and was a small factory. It was during the “population dividend” explosion period, primarily consisting of dexterous young female workers. At that time, it was difficult for male workers to find jobs, and the hiring practice in Shenzhen was that ten female workers could bring in one male worker.

In the first year of operation, the conditions in the electronic factory were very harsh, with dormitories frequently experiencing power and water outages.

Caption: In 1988, Foxconn invested in its first base in mainland China—Shenzhen Ocean Factory

Caption: In 1988, Foxconn invested in its first base in mainland China—Shenzhen Ocean Factory

Caption: Manually inserting connectors into circuit boards

Caption: Manually inserting connectors into circuit boards

The early Ocean Factory was a crucial period for Terry Gou’s transformation at Foxconn, so he personally took charge, not only managing staff but also teaching employees how to operate. He often worked alongside employees on the production line, solving problems together, and would stay on the assembly line for three days and nights if needed to meet deadlines.

On June 18, 1991, Hon Hai was listed in Taiwan. With capital in hand, it began purchasing land to build new factories in Shenzhen, Huangtian, and Kunshan.

The second breakthrough in the PC field was in cases.

In 1995, Terry Gou focused on many manufacturers’ overlooked computer cases, starting to “snatch business.” During this process, Foxconn’s years of accumulated foundational technical strength played a significant role, such as mold technology. At that time, the world’s largest computer manufacturer, Compaq, was always using LG to manufacture cases, but LG could never commit to completing orders on time. Gou “seized the opportunity” and negotiated with Compaq, stating that Foxconn could deliver faster and at a lower price. Within ten days, the first batch of goods was delivered, all qualified, and within six months, the first order was completed.

After mastering case production, Foxconn also began assembling complete machines for Compaq.

2. Foxconn’s Key Move: Circuit Board Assembly (PCBA)

If Foxconn had only done this, it would still be a successful structural component supplier, but Gou was not satisfied with that; he aimed to produce key components and build SMT production lines for circuit board assembly (PCBA) to achieve higher profits and become an EMS company like Flex and Solectron.

Foxconn needed to invest heavily in building numerous SMT production lines in mainland China, starting with modern high-standard factories!

Foxconn needed to invest heavily in building numerous SMT production lines in mainland China, starting with modern high-standard factories!

On February 2, 1996, Foxconn completed land procedures and officially began construction of a new factory in Longhua, which was put into operation on June 6, 1996, just four months later. Early on, to avoid blind investments, Foxconn adopted a model of securing orders before building factories, starting construction only after receiving a batch of computer orders. Normally, it takes two to three years for a factory to go from construction to production, but with orders in hand, the speed of factory construction was particularly fast.

It is said that when selecting the site in Longhua, standing on the overgrown wasteland, Terry Gou, with the spirit of Genghis Khan, pointed and said to local government officials, “I want all the visible land.” The completion of the Longhua Park marked a new starting point for Foxconn, “This is no longer a tent, but a home without a sense of wandering.” Gou expressed his feelings in an interview with the Shenzhen Special Zone Daily.

Across the Meiguan Expressway is Longgang’s Bantian, which also became a hot spot, with Huawei moving over from Nanshan District and the once-popular Shenzhou Computer settling in. The Meiguan Expressway opened a connection between Huawei and Foxconn. From this perspective, Foxconn and Huawei are separated by the Meiguan Expressway, mutually achieving success. Foxconn’s east gate connects to the expressway, heading east, hence the name “Chaoyang Gate.”

Mingrui Ideal’s Ji Yunqing recalled that around 2000, to improve inspection speed and quality, Foxconn, Huawei, ZTE, and other companies spared no expense to purchase Japanese Omron VT-WIN2 AOI automatic optical inspection equipment to replace manual visual inspections, with each unit costing as much as $300,000, to check the quality of each solder joint. After widespread adoption of this equipment and the entry of domestic products into the competition, the price of conventional equipment is now around 200,000 to 300,000 yuan per unit.

Caption: Example of a complete SMT automated production line

Caption: Example of a complete SMT automated production line

A complete SMT production line includes solder paste printing (leftmost), placement (left 3, 4, 5), reflow oven (longest equipment), and AOI automatic visual inspection (left 2, 6, 9) among other equipment.

By around 2000, Hon Hai was among the top 33 enterprises in Taiwan, while major electronic companies like Inventec and Delta were ahead of Foxconn.

After 2000, Foxconn had mastered the production processes for computer system integration, connectors, cases, and key components, gaining the ability to produce complete computers.

A significant milestone occurred in 2001 when Intel chose Foxconn to produce its Intel-branded motherboards instead of Asus! In 2001, Hon Hai’s revenue reached NT$174.8 billion, surpassing TSMC to become Taiwan’s largest private enterprise.

By 2003, Foxconn had become the largest professional OEM manufacturer (EMS) of desktop computers globally.

By 2003, Foxconn had become the largest professional OEM manufacturer (EMS) of desktop computers globally.

3. Breakthrough in Personal Portable Electronics, from iPod to iPhone

In the spring of 2003, on an ordinary weekday afternoon at Apple’s headquarters in Silicon Valley, Terry Gou stopped Tony Fadell, the inventor of the iPod, and presented a sample, saying, “This is our music player, and it’s better than yours,” successfully taking Apple from Inventec in Taiwan. In 2007, the first iPhone was born.

In 2005, Foxconn surpassed the then-leading Flex to become the world’s largest EMS manufacturer. Since then, Foxconn has consistently held the top position. As of 2019, Foxconn had over 1,800 SMT (Surface Mount Technology) production lines!

5. From Tape Recorder OEM to Mobile Phones, Guanghong Becomes a Global EMS Top 20

1. Shenzhen Special Zone Started from Consumer Electronics

The Shekou Industrial Zone was established in March 1979, predating the establishment of the Shenzhen Special Zone, and is referred to as “the special zone within the special zone.” Great Wall Development was established in 1985 in Shenzhen’s Shekou Industrial Zone, a subsidiary of the state-owned China Electronics, starting by OEMing magnetic heads and hard drives for Seagate. Great Wall Development was listed in 1994 and has since been renamed Shenzhen Technology, entering the top 20 of the global EMS industry.

Caption: In 1958, Sanyo Electric launched a series of products in Hong Kong, including radios

Caption: In 1958, Sanyo Electric launched a series of products in Hong Kong, including radios

In the early 1980s, the Shenzhen Urban Planning Committee decided to plan an industrial area focused on electronics and processing in what is now Huaqiangbei—Shangbu Industrial Zone. Subsequently, various electronic-related manufacturing industries emerged, such as the China Electronics system (Aihua Electronics and Jinghua Electronics, which had ties to Sony, producing tape recorders), Huachang system (Huachang Sanyo, etc.), and Saige system (Saige Hitachi, established in 1989 to produce color television picture tubes). At that time, Japanese tape recorders and WALKMAN were very popular!

Caption: Huachang Sanyo’s large billboard

Caption: Huachang Sanyo’s large billboard

2. The Rise of the EMS Industry in Mainland China

When I came to Shenzhen in 1997, I attended training organized by the municipal government to obtain a Shenzhen household registration. The instructor mentioned that BYD’s success in making nickel-hydrogen batteries was due to using cheap labor to replace expensive Japanese automated production lines. No one expected that today BYD and the automation level of Chinese production lines would be so high. BYD’s fuel vehicle F3, launched in December 2005, sold very well and became a legendary car. BYD continued to expand, and under its vertically integrated strategic deployment, it established an EMS manufacturing department, officially founded in November 2006.

In 2007, when BYD first started its OEM business, there were some conflicts with Foxconn. As a result, Foxconn once barred BYD cars from entering its factory, which became a humorous anecdote.

Now, let’s talk about the story of Guanghong Technology (ranked among the top 20 EMS companies globally). I specifically visited their headquarters in Huizhou to gain a deeper understanding of their growth process.

3. Guanghong Technology OEMs Circuit Boards for Japanese Electronics Factories

Tang Jianxing grew up near Yuyuan Road in Shanghai and worked as a salesperson at the Shanghai Commercial Bureau from March 1975 to August 1982, having many intersections with radios. In 1975, he began working with radios and tape recorders, becoming very familiar with the Red Light and Haiyan brand radios and Shanghai brand tape recorders. In 1978, he assembled his first electronic tube tape recorder, and in 1980, he owned his first cassette recorder (with four speakers). Due to his father being in Hong Kong, he applied for residency in Hong Kong in 1982. Due to his interest in radio, he did not want to follow his family’s arrangements and entered the Japanese company Sanyo Electric in Hong Kong, which mainly produced cassette recorders. At the end of that year, he was dispatched to the newly established Shekou Sanyo. He was a “Hong Kong worker,” earning a salary equivalent to dozens of times that of mainland workers. In 1984, the Huachang Sanyo joint venture was established, and he served as the production department director of the tape recorder factory, later promoted to senior manager in charge of production. The standardized management operation model of the Japanese company greatly influenced him, and he worked there until the end of 1997.

Caption: In 1986, Tang Jianxing during the Sanyo period (third from the left in the back row)

Caption: In 1986, Tang Jianxing during the Sanyo period (third from the left in the back row)

In the late 1990s, with the rise of electronic products like VCDs and DVDs, the once-proud tape recorder industry began to decline. The entire industry was struggling, and at that time, Huachang Sanyo had to lay off workers. In December 1997, Tang Jianxing, in his forties and in his prime, left Sanyo and joined Guanghong Technology in January of the following year. He invested his savings along with the compensation he received from leaving Sanyo into the still unprofitable Guanghong Technology, acquiring a certain share and taking charge of the company’s actual operations.

Caption: Guanghong employees in 1998

Caption: Guanghong employees in 1998

Founded in 1995 in a farmer’s factory in Huizhou’s Daya Bay, Guanghong Technology initially helped a department of Sanyo that produced optical disc drives to make PCBs for laser heads.

The SMT (Surface Mount Technology) equipment introduced by Guanghong in the 1990s was considered very advanced technology, but the heavily purchased equipment often sat idle. Tang Jianxing utilized the relationships he had built over many years in the industry to find various clients, producing tape recorders, audio equipment, and televisions. Initially, sometimes due to insufficient technology, the products produced were substandard, and clients would not return for a second order. It took a long time to turn orders into reality, so sometimes to serve a client well and secure an order, he had to run back and forth dozens of times.

Tang Jianxing took on an order from Kodak for disposable cameras to process the circuit boards on them. Upon receiving the order, he found it to be very complex, requiring not only surface mounting and through-hole components but also a process called bonding, which the company had never done before. Tang Jianxing had to seek help everywhere, borrowing two machines from a friend to fulfill the order. He managed to stabilize the client temporarily, but they made it clear that the next time they came, they needed to see the actual production. This put Tang Jianxing in a difficult position again, and he had to find friends to help. Eventually, a friend volunteered to invest in bonding equipment and place it in Guanghong’s factory, allowing the company to take on this order.

From 1998 to 2002, the PCBA industry, primarily based on SMT technology, grew rapidly, with many Japanese companies in the industry. Thanks to his years of experience at Sanyo, Tang Jianxing was familiar with Japanese clients and established a strict quality system. Despite the strict certifications, Japanese companies like Sony, Panasonic, and Aihua gradually became clients of Guanghong Technology.

4. The Mutual Success of Domestic Brand Phones and Mainland EMS

During the mobile phone boom in the early 21st century, the industry was thriving, and as long as a phone could be produced, it could be sold. Some brands, in their rush to capture the market, insisted on shipping products even if there were potential issues with PCB soldering, as long as the screws were properly fastened. After using the phones for a while, they were prone to faults, and some domestic brands suddenly fell out of favor.

At a dinner organized by an industry association, Tang Jianxing met a gentleman involved in mobile phone manufacturing. When exchanging business cards, the other party praised, “I know Guanghong; the boards are well made!” However, there was no business relationship at that time, and this unexpected compliment surprised Tang Jianxing. After further communication, he discovered that many of the boards Guanghong produced were indirectly supplied to the other party through mobile phone design companies. “I found that no matter which supplier I sourced from, the boards produced by Guanghong were the best,” the other party praised.

In 2003, the company officially entered the mobile communication system equipment industry, producing transceivers for ZTE’s base stations. Starting in 2004, the company began collaborating with domestic mobile phone companies like TCL and Lenovo. In 2007, Guanghong passed Huawei’s audit and became a supplier.

Guanghong Technology has grown alongside Chinese mobile phone brands, becoming a client of major domestic smartphone companies and leading ODM companies, such as Huawei, Xiaomi, OPPO, VIVO, Honor, Huaqin, Wingtech, and Longqi. Guanghong has transitioned from “manufacturing” to “intelligent manufacturing,” also introducing many domestic automation devices, with AOI (Automatic Optical Inspection) equipment being a typical example that requires rapid response to demand.

Starting in 2015, Guanghong Technology established a factory in Jiaxing, adjacent to Shanghai, entering the industrial control (such as micro-inverters) and automotive electronics sectors, where quality requirements are even higher.

As domestic brands expand overseas, Guanghong is also going “out,” establishing factories in Vietnam, Bangladesh, and India, with over 100 SMT placement lines and mobile phone assembly lines.

6. From GSM Phones, China Moves Upstream in the Chip Industry

This year, many are worried about the transfer of some smartphone production capacity. However, it should also be noted that China’s electronics industry has successfully moved upstream in the supply chain and made significant achievements in chips and automation equipment.

Chips can be roughly divided into three areas: wafer manufacturing, chip design, and chip packaging and testing. After the establishment of the Sci-Tech Innovation Board in 2018, mainland China has achieved explosive growth in these areas.

From a strong perspective in chip design, the sales revenue of China’s integrated circuit design industry was approximately 534.57 billion yuan in 2022, a year-on-year increase of 16.5%. From the most basic wafer manufacturing perspective, according to a report by Knometa Research, by the end of 2021, global IC wafer capacity reached the equivalent of 21.6 million 200mm (8-inch) wafers per month, with mainland China’s wafer factories having a processing capacity of about 3.5 million wafers, accounting for 16% of the total. By 2024, this share is expected to reach nearly 19%, and most of the new wafer factories being built in China are owned by mainland entities.

The first leap, GSM changed the entire world, and “China Chip” thus took a big step forward.

Personal consumer electronics are massive and serve as the core driving force behind the rapid development of chips. If China had not seized the great opportunity of the consumer electronics revolution, the chip industry would have had little chance to grow.

1. The driving force behind Japan’s transistor development was pocket radios.

In 1957, Sony launched the TR-63, elevating radios from being a household item to a personal item. From transistors to integrated circuits, Japan embarked on the fast track of chip development. Today, Japan’s strength lies in the full range of wafer manufacturing equipment (including lithography machines from Nikon and Canon) and materials (such as photoresists and many other materials).

2. The driving force behind the rapid development of chips in Silicon Valley and Taiwan, China, was personal computers.

In 1977, the home computer Apple II became a hit, and in 1981, IBM launched the PC, leading to the rapid global development of compatible machines, with Taiwan becoming an important manufacturing base. Today, the shining AI leader Jensen Huang of NVIDIA started by embedding graphics cards in PCs for gaming.

3. China’s chip industry successfully started with the mass production of self-designed GSM phones.

The first wave of mobile phones in China relied heavily on advertising. Starting in 1998, domestic GSM phone brands began to develop, peaking in 2005. Li Wen’s endorsement of the Waveguide brand was notable. I had the opportunity to meet Mr. Xu Lihua, the founder of Waveguide, who told me that Waveguide was founded in Shenzhen and later moved to Ningbo, and has now successfully transformed into a professional OEM enterprise.

The second wave of mobile phones was the cost-effective counterfeit feature phones, which minimized all unnecessary expenses. In 2006, counterfeit phones exploded, and the fervor continued until 2010. Shenzhen’s “Transsion,” filled with counterfeit spirit, originated from Ningbo’s Waveguide and has made it to today. At the same time, the development of operator channels allowed companies like “Zhonghua Cool Union” to grow, a term first proposed by Fu Jun.

In 2004, Huawei insisted on pursuing the GSM path, seizing the opportunity to expand its network in major cities like Manila, finding a breakthrough for domestic GSM base stations. Huawei and ZTE built networks globally, connecting countless remote areas, and affordable domestic GSM phones became popular worldwide, starting at just $7 each.

In this process, domestic chips experienced significant growth. Companies like MediaTek in Shenzhen, Spreadtrum in Shanghai, Gekewei in Shanghai, Aiwai Electronics in Shanghai, RDA (Ruidi Technology), and Goodix Technology have all made significant strides in the chip field.

4. The smartphone and mobile internet again changed the entire world, leading to the growth of “China Chip”.

In 2007, the first iPhone was produced at Foxconn’s Longhua factory in Shenzhen, supporting only GSM.

Because the “crazy” craftsmanship of the all-touch smartphone that Steve Jobs eagerly anticipated was successfully achieved in collaboration with the mainland supply chain, it can be said that the smartphone industry revolution is essentially a fruitful collaboration between the U.S. and China.

At the same time, Japan’s advantages in electronic assembly disappeared. Japan, as a superpower in consumer electronics, had always maintained a closed market for mobile phones, and even Nokia, at its peak, could not penetrate it. However, Japan opened up during the smartphone era. In 2008, Japan’s SoftBank introduced the iPhone 3G, and by 2012, Apple’s market share in Japan continued to rank first. It is worth mentioning that Japan remains strong in chips, devices, equipment, and materials, having shifted to the upstream of the supply chain.

“Made in China” has since taken over from “Made in Japan,” achieving excellent quality. Domestic smartphones can be submerged in water and still work, and they can be dropped without breaking. My eighty-year-old father bought a low-end smartphone for just a few hundred yuan in 2015, which lasted over four years without breaking.

With each new phone release, innovations are closely related to complete machine manufacturing, such as dual SIM dual standby, high volume, ultra-thin, full screen (under-screen fingerprint), multi-camera + optical zoom, beauty features (AI), foldable screens, integrated satellite communication (the most challenging antenna), and three-proofing (light dust-proof, shock-proof, and waterproof functions).

The Chinese chip industry has taken another leap forward in smartphones, with the recently popular Huawei MATE60 phone’s main chip, Kirin 9000S, being a typical representative, with computing and storage capabilities considered large chips. The best performance is seen in small chips: touch and fingerprint sensors, display drivers, audio, image sensors, RF, power management, and more.

5. China, the “World Factory,” is at the Forefront of the Fourth Industrial Revolution

China has demonstrated tremendous industrial chain integration capabilities, transitioning from “manufacturing” to “intelligent manufacturing,” with the Fourth Industrial Revolution integrating cutting-edge technologies such as big data, artificial intelligence, the Internet of Things, and robotics. With changes in population structure, the “demographic dividend” is indeed declining, but the “talent dividend,” infrastructure, and industrial chain advantages continue to strengthen.

China remains the world’s largest manufacturing center for smartphones, with the highest efficiency and yield, and Samsung has entrusted some of its phone production to domestic ODMs (like Huaqin).

Process expert Wan Bin once told me that China has always been the center of electronic assembly and module manufacturing technology in the world, and the core capabilities and resources of companies like Foxconn still lie in China. Various equipment, tools, and materials surrounding electronic product assembly are increasingly produced and manufactured in China. The challenges faced during the welding of flexible boards in Apple’s TWS earphones were successfully tackled in Shenzhen.

The domestic intelligent equipment industry has experienced explosive growth. When I visited Mingrui Ideal, I saw products being shipped continuously to both domestic and international markets!

Industry 4.0 serves various industries; for example, the export value of textile machinery has jumped to first in the world, reaching $5.537 billion in 2022. I remember interning in Wuxi back in 1993, where I was welding circuit boards for textile production lines.

6. The Chinese Land Continues to Nurture and Popularize New Things, with DJI Drones as a Typical Example

I lived in Yuehai Men Village, where DJI Technology defined consumer-grade aerial photography drones, marking a significant milestone in human history and sparking a drone industry revolution! Drones have become a beloved commodity for the general public worldwide.

Caption: DJI (Da Jiang Technology) in Costco supermarket in North America

Caption: DJI (Da Jiang Technology) in Costco supermarket in North America

China’s large population and love for life have led to the rapid explosion of short video businesses, making it less bothersome to squeeze into subways and stand in line.

Old electronic products are also continuously popularized due to Chinese strength. Smart toilets, which have a long history in Japan and cost thousands of yuan, have entered Chinese households in recent years, now starting at just a few hundred yuan.

7. Electric Vehicles, Like Large Appliances, Again Drive the Development of “China Chip”

Electric vehicles have a long history, but due to low energy density and insufficiently robust power grids, they have always been suppressed by fuel vehicles, only persisting in public transport (both rail and non-rail).

In 2008, BYD received investment from Warren Buffett, marking the beginning of Sino-U.S. cooperation. In 2020, Tesla’s super factory in Shanghai Lingang began operations, allowing Musk to completely shake off the stigma of “bankruptcy” and see his wealth soar. The explosion of electric vehicles in China is inseparable from excellent infrastructure, including a high-standard highway network covering rural areas, long-distance transmission lines, and numerous fast-charging stations. Musk must have felt this deeply, as he lamented on social media that the construction of the fall prevention net under the Golden Gate Bridge cost $400 million and took six years to complete.

In recent years, there has been a severe shortage of automotive chips, providing a once-in-a-lifetime opportunity for domestic chips to be “validated in vehicles,” and once validated, they can be produced in volume.

After more than 40 years of rapid progress, there will always be adjustments, but we will always move forward.

Original article by Jiefang Daily · Shangguan News, reproduction without permission is strictly prohibited

Author:Dai Hui

WeChat Editor: Taini

Proofreader: Nano

◢ You Might Also Like↓↓

Old problems cannot be ignored! The “Ding Ding” car on Nanjing East Road pedestrian street in Shanghai has been in operation for over 20 years and needs an upgrade.

Even outside the venue for three hours! Jay Chou’s concert in Shanghai: Fans outside watch the live broadcast to feel the atmosphere.

Worse than “getting COVID”! No effective drugs available! Some have already been infected, and deterioration may threaten life…

Interference in rescue! Trending first for false information! The topic of “4-year-old girl’s rescue halted due to external reasons” has led to Sina Shanghai being interviewed.

For more exciting content, please download theShangguan News APP

“Share, like, and watch, all in one go↓