However, people can’t help but wonder, has China transformed from a major machine tool country to a strong machine tool country from 2009 to 2020?

In 2008, the top ten machine tool producers in the world were: Germany’s Trumpf, Japan’s Yamazaki Mazak, Germany’s Gildemeister, Japan’s Okuma, Japan’s Amada, the USA’s MAG, Japan’s Mori Seiki, China’s Shenyang Machine Tool, Japan’s Jtekt, and China’s Dalian Machine Tool. Among the top ten, there were two from Germany, five from Japan, one from the USA, and two from China.

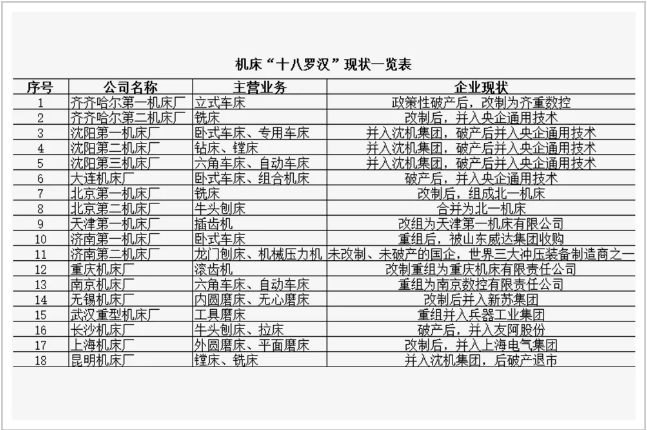

Thirteen years later, in the top ten machine tool companies, Germany and Japan still dominate, while two mainland Chinese machine tool companies have been replaced by Taiwanese companies. What’s even more lamentable is that the four major pillar enterprises in China’s machine tool industry—Shenyang Machine Tool, Dalian Machine Tool, Qin Chuan Machine Tool, and Kunming Machine Tool—are heading towards a dead end. Shenyang Machine Tool and Dalian Machine Tool have both declared bankruptcy, and Kunming Machine Tool has also been delisted, leaving only Qin Chuan struggling to hold on, drifting further away from the world’s top ten…

Why, today, when both output value and consumption are the highest in the world, does China’s machine tool industry still remain “large but not strong”?

The machine tool industry is of great significance. For high-tech industries, machine tools are the epitome of modern process technology; without advanced processing technology, there is no core competitiveness in modern manufacturing. For the country, the machine tool industry is a crucial national asset, and without high-end machine tools with independent innovation, there is no qualification to become a world-class strong country.

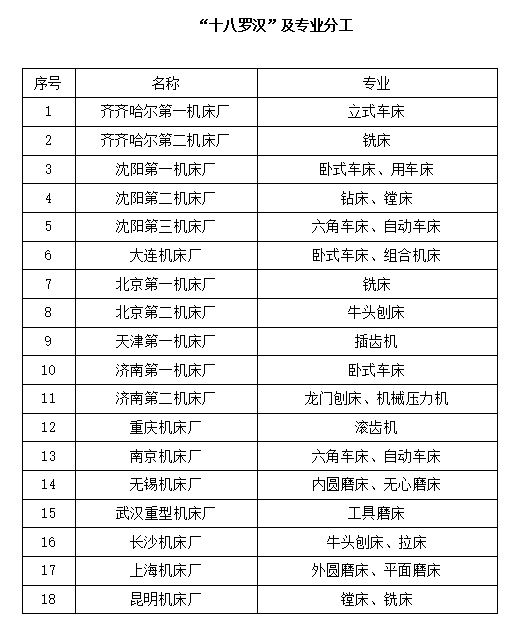

China’s machine tool industry did not start late. After the establishment of the new China in 1949, under the suggestion of Soviet experts, during the first five-year plan, the country transformed some machine repair plants and built some new enterprises, among which 18 enterprises were designated as key backbone enterprises for machine tool production, known in the industry as the “Eighteen Arhats.” They represented the highest level of China’s equipment manufacturing industry and even the entire industrial development at that time, creating countless firsts in the machine tool industry: the first lathe in new China (Shenyang No.1 Machine Tool), the first horizontal milling and boring machine (Shenyang No.2 Machine Tool), the first CNC gantry milling machine (Qing No.2 Machine Tool), and the first three-coordinate CNC gantry mobile milling machine (Beijing No.1 Machine Tool)… all were the masterpieces of the “Eighteen Arhats.”

In the autumn of 1958, when Kim Il-sung, chairman of the Workers’ Party of Korea, visited Tsinghua University with Premier Zhou Enlai, the waiting teachers and students warmly welcomed this foreign guest: not with flowers or applause, but by intently operating a complex machine tool, processing something.

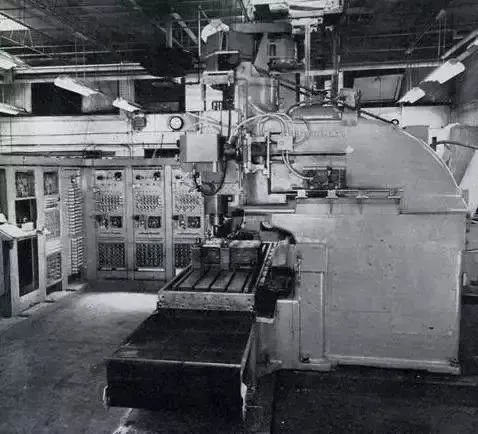

Before long, a steel plate engraved with the words “Long Live Kim Il-sung” was handed to Kim Il-sung, who immediately took it with great interest, touched it, and asked questions. Subsequently, another plate inscribed with “Long Live Chairman Mao” was handed to Premier Zhou Enlai. Chairman Kim Il-sung praised this advanced technology and immediately wrote a commemorative note. The device that completed the engraving was China’s first CNC machine tool, the X53K1, jointly developed by Tsinghua University and Beijing First Machine Tool Factory.

Caption: China’s first CNC machine tool X53K1 in 1958

At that time, industrialized countries that mastered the cutting-edge technology of “CNC” adopted a policy of absolute blockade against China. Without prototype machines and available technical materials for reference, an average age of only 24 years among researchers, including professors, engineering technicians, workers, and students, relied solely on a single “for reference only” data card and a schematic diagram, overcoming one challenge after another in just nine months, successfully developing a CNC system to control the machine tool’s workbench and transverse saddle as well as the feed motion of the vertical milling head, achieving three-coordinate linkage.

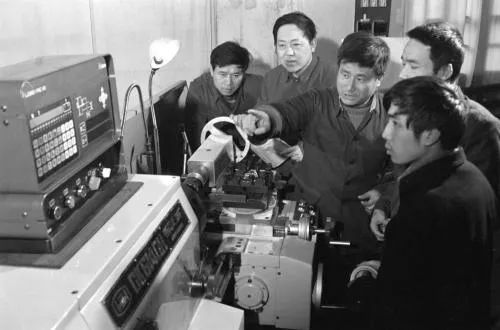

Caption: Team members who designed China’s first CNC machine tool

This is undeniably a miracle. It is worth noting that it took the USA four years to successfully develop a CNC machine tool, the UK two and a half years, while Japan had not fully mastered the technology and was still exploring.

After that, in the 1980s, Beijing University of Technology successfully developed China’s first industrial control single-board computer, and by the early 1990s, China was still closely chasing the pace of developed countries in Europe and the USA. Taking five-axis machine tools as an example, Germany only began producing five-axis machining centers in 1987 and commercializing them, while Shenyang Machine Tool Factory also launched a “table-to-table” five-axis four-linkage machining center at the 1991 Beijing Machine Tool Exhibition.

In terms of control systems, Tsinghua University had already conducted relevant research, and Beijing University of Technology was also developing the 8080 single-board computer, while the West still relied on Philips and Bosch systems, with Siemens yet to emerge.

It can be said that at that time, the gap between China and industrialized countries in the machine tool field was only about five years. However, starting from the mid-1990s, the gap between China’s machine tool industry and developed countries gradually widened.

Here, we must mention one of the biggest events of the twentieth century—the disintegration of the Soviet Union.

On December 25, 1991, the Soviet Union announced its dissolution, completely disappearing from the world stage, leading to an imbalance in the global military industrial market, which indirectly resulted in changes in the world machine tool industry.

Why? Machine tools are the foundation of manufacturing, and manufacturing is the cornerstone of military industry. The sudden change in the military market demand led to a lack of procurement for high-end machine tools used in military production. In 1994, the three largest machine tool manufacturers in Germany—Deckel, Maho, and Gildemeister—began to experience losses and bankruptcies. Before this, Deckel was a well-known lathe brand, Maho was a well-known milling machine brand, and Gildemeister produced both lathes and milling machines. To save themselves from the crisis, Gildemeister integrated Deckel and Maho to form the DMG machine tool group. The “bundling” of the three manufacturers brought technological advantages and scale advantages, and driven by marketization, DMG quickly transformed technology into new productivity, rapidly expanding in the global market.

When significant changes occur in market demand, adjustments on the supply side can present opportunities and challenges for enterprises. If demand changes drastically, the industry may even undergo reconstruction.

At this time, far away in East Asia, China had just ended its planned economic system.

In 1992, the 14th National Congress of the Communist Party of China clearly stated that “the goal of China’s economic system reform is to establish a socialist market economic system to further liberate and develop productive forces.” After the Third Plenary Session of the 11th Central Committee of the Communist Party of China, China established the policy for the reform of state-owned enterprises, emphasizing expanding enterprises’ autonomy as the main form, adjusting the production management authority and benefit distribution relationship between the state and enterprises, and establishing various forms of economic responsibility systems within enterprises.

By 1990, China’s machine tool industry had 8 comprehensive research institutes, 37 specialized research institutes, and enterprise design departments, forming a research and development system for the machine tool industry. Amid the wave of reform of state-owned enterprises, the eighteen state-owned backbone enterprises established at the beginning of the founding of the country either underwent reform or restructuring, and “seven institutes and one institute” also transformed into enterprises, each seeking survival. The original machine tool research and development system was shattered.

To promote market-oriented development, in 1998, the Ministry of Machinery Industry, which had over 4,600 personnel managing over 900 enterprises, was also dissolved.

After the economic system reform, to produce more market-competitive products, some Chinese enterprises did not hesitate to spend heavily to import CNC technology from Japan, Germany, and the USA to narrow the gap with developed countries.

For instance, Ji Yi Machine Tool first cooperated with Japan’s Yamazaki Mazak, pioneering international cooperation in the machine tool industry. Afterwards, Shenyang Machine Tool and Germany’s Scharmann, Qing Yi Machine Tool and Germany’s Witzig & Abegg, etc., also cooperated… Learning advanced technology from abroad allowed the “Eighteen Arhats” to gain a temporary boost.

This introduction is actually a double-edged sword. While some enterprises gained technology, the original machine tool system was impacted, and the evolution of independent innovation capabilities was distorted to a certain extent, raising concerns for sustainable development in the future.

In 2001, China joined the World Trade Organization (WTO), and the manufacturing industry boomed, leading to a surge in demand for machine tools. As the “leader” of China’s machine tool industry, Shenyang Machine Tool seized an unprecedented good time, advancing rapidly: in 2004, it merged with Yunji and Kunji, monopolizing the lathe and boring machine market; in 2005, it acquired Germany’s Heller, striving to master high-end CNC technology.

In 2008, Shenyang Machine Tool and Dalian Machine Tool ranked 8th and 10th respectively in the world machine tool enterprise output value ranking. Ji Er Machine Tool became one of the “three major CNC stamping equipment manufacturers in the world,” allowing China’s large automotive stamping production line to enter the manufacturing workshops of Ford in the USA, Nissan in North America, and Peugeot Citroën in France. Notably, in the global machine tool ranking in 2012, Shenyang Machine Tool claimed the top spot with sales of 18 billion yuan.

“Although on the surface, China’s machine tool industry experienced a ‘golden decade’ after 2001, with total industry output value soaring tenfold, most enterprises pursued quantity and scale at the expense of technological research, and the original apprenticeship system was lost. Workers became contract workers, excessively pursuing economic benefits, and the spirit of craftsmanship was lost. More regrettably, the previously intact industrial research system collapsed due to the reform, leaving only the aerospace and military industrial research systems relatively intact. This has led to an increasing gap between China’s machine tools and those of advanced countries, which used to be a five-year gap but has now widened to 15 years.”

—Dan Xilin

However, as the Chinese market bids farewell to explosive growth and returns to a state of limited incremental growth with intense global competition, various shortcomings in the machine tool industry have once again been exposed. Once rapidly developing leading enterprises have quickly become the fastest declining examples and have collectively entered the “farewell performance” era in recent years.

Data shows that in 2019, 15.1% of China’s large-scale machine tool enterprises reported losses; in the first half of 2020, this number further expanded to 24.1%. China’s once “four kings” of machine tools—number one (Shenyang Machine Tool), number two (Dalian Machine Tool)—have declared bankruptcy and restructured, while number three (Qin Chuan Machine Tool) is also facing severe losses.

Moreover, from the perspective of the entire industry, the localization rate of high-end CNC machine tools in China is less than 10%, with over 90% relying on imports. China’s machine tools are completely suppressed by foreign enterprises in high-end fields. The self-sufficiency rate for five-axis and above processing centers is less than 10%, with the self-sufficiency rate for gantry processing centers and vertical processing centers even less than 1%, with most materials, tools, and cooling liquids relying on imports.

The emergence of such results in China’s machine tool industry can be attributed to several reasons:

1. Lack of Core Technology

In 1996, Shenyang Machine Tool spent over 100 million yuan to introduce CNC technology from the USA’s Bridgeport, but the foreign side only sent a source code data package without disclosing the core technology principles and usage principles, resulting in the developed CNC machine tool being a waste product; in 1999, Dalian Guangyang imported Japanese machine tools, but the Japanese side imposed a series of “unfair terms”: the installation location and usage had to be restricted, and unauthorized movement of the machine tool would result in it being automatically locked, rendering it scrap; in 2005, Shenyang Machine Tool bought Germany’s Heller, thinking it had acquired the technology. However, German laws stipulated that “local knowledge cannot be transferred abroad,” and technology for machine tools with five axes and above was embargoed against China. In 2007, Shenyang Machine Tool planned to spend 60 million euros to buy a set of CNC system source codes, but experts estimated it would take five years to interpret, another five years for industrialization, and the technology would be outdated by then.

In fact, due to political and technological security considerations, the German Federal Office for Economic Affairs and Export Control has always imposed strict restrictions on machine tool exports.

On one hand, they strictly limit the precision of exported machine tools. For example, from 2013 to 2014, German machine tools with positioning precision of less than 5 microns and repeat positioning precision of less than 2 microns could not be exported to China; on the other hand, they impose strict limitations on the usage of exported machine tools, implementing the “three no principles.” Germany prohibits high-precision machine tools from being sold to military enterprises, educational institutions, and machine tool factories in China.

Japan’s Ministry of International Trade and Industry (MITI) has similar policies, and Japanese companies also have corresponding protective measures. For instance, before selling Japanese machine tools, they would send personnel to visit Chinese purchasing enterprises to conduct on-site inspections of workshops, take photos, upload GPS location of the workshop, and determine the future working position and environment of the machine tool. If the machine tool deviates from the preset working position in the future, it would malfunction and be unable to operate normally. If the purchasing party needs to move the machine tool to a new workshop, they would need to apply to Japan again and obtain on-site confirmation from the Japanese personnel to unlock it before processing in the new workshop.

2. Suppression by Foreign Enterprises

Anything that China cannot manufacture independently is sold at a high price or banned by foreign brands; anything that China achieves independently is immediately met with aggressive low-price dumping by foreign enterprises, causing Chinese enterprises’ huge R&D expenses to go to waste. As a result, Chinese enterprises find themselves in a dilemma of “high-end fear, mid-end weakness, and low-end imitation.”

In high-end fields, Chinese machine tool enterprises dare not even touch some high-end industry demands. For example, in recent bidding processes for mainframe manufacturers, there are a large number of strict acceptance indicators for production programs and CPK, CMK (CPK, Complex Process Capability index, is an indicator used by modern enterprises to represent process capability. CMK, Machine Capability Index, refers to the critical machine capability index, which mainly evaluates the ability of production equipment to meet requirements and stability), leading mainland manufacturers to withdraw. The enterprises participating in the bidding for production line machine tools are almost all German, Japanese, or Swiss companies, with only occasional Taiwanese and Korean companies, but very few from mainland China.

In the mid-range sector, Japanese machine tools firmly occupy China’s mid-range market with their reliable and durable performance and relatively inexpensive prices. For instance, in the case of horizontal machining centers, Japanese companies like Mori Seiki, Yamazaki Mazak, and Okuma occupy over 80% of China’s market. In the production lines of domestic automobile brands like Geely and Great Wall, the market has been dominated by German and Japanese machine tools for over a decade.

In the low-end sector, on one side, there are numerous small and medium-sized private machine tool enterprises clustered in places like Tengzhou (the small and medium-sized machine tool capital of China) and Yuhuan (the economic CNC lathe capital of China), engaged in low-end chaos. On the other side, there are large enterprises attempting to break the foreign monopoly. After investing heavily in R&D, they fail to generate profits, falling into the predicament of “the more they innovate, the more they go bankrupt.” For example, during the rapid development years of Shenyang Machine Tool, although sales surged, profits were minimal. Data shows that Shenyang Machine Tool sells a machine tool for 350,000 yuan, but purchasing the CNC system from Germany’s Siemens or Japan’s Fanuc costs 280,000 yuan, and when adding maintenance and upgrade costs, Shenyang Machine Tool basically has no profit. It can be said that in the low-end sector, China’s machine tool industry is overall in a stage of “still on the road to automation, with intelligence just beginning,” mainly based on imitation, with low technical content and extremely low technical thresholds, leading to fierce price wars.

3. Violating Industrial Rules

The machine tool industry is characterized by high technical thresholds, high specialization, and long-term accumulation. Germany has a complete industrial system, and its apprenticeship and dual education systems provide a steady stream of high-quality “new blood” for manufacturing. At the same time, German enterprises are rigorous and pragmatic, focusing on becoming strong in “narrow fields.” On this basis, Germany has produced over 1,300 single-item champion enterprises, providing a “fertile soil” for the development of Germany’s high-end machine tool industry.

Japanese enterprises value intergenerational and technical inheritance, avoiding unfamiliar fields and striving for perfection. Under this cultural dominance, Japan currently has a high number of long-lasting enterprises, with 3,900 existing long-lasting companies. Many well-known machine tool enterprises have survived for over a century, passing through several generations, such as Yamazaki Mazak (established in 1919), Fanuc (established in 1956), Mori Seiki (established in 1951), and Komatsu (established in 1945).

In contrast, China’s machine tool enterprises tend to pursue “expansion and quick success” as soon as they achieve certain results, leading Shenyang Machine Tool and Dalian Machine Tool into dire straits.

For instance, Shenyang Machine Tool invested over 1 billion yuan to create the world’s first intelligent and interconnected CNC system—i5—and launched the i5 CNC machine tool after its release. The then chairman of Shenyang Machine Tool Group, Guan Xiyou, even proposed to shape i5 into the “Apple” of the machine tool industry, aiming to revolutionize the business model of the machine tool industry. However, it was ultimately proven to be a step too far: by early 2016, i5 had received 10,000 super orders, but that year Shenyang Machine Tool suffered a loss of 1.4 billion yuan.

The reasons for the huge losses concentrated on two points: on one hand, to quickly capture the market, Shenyang Machine Tool adopted a rental strategy instead of sales, resulting in financial losses; on the other hand, Shenyang Machine Tool also engaged in long-term short-term debt for R&D and expansion. In just 2017, Shenyang Machine Tool implemented 9.251 billion yuan in debt-to-equity swaps, yet still struggled with cash flow depletion and debt crises.

Meanwhile, Dalian Machine Tool, which completed its mixed-ownership reform, not only touted “making machine tools like making cars” but also rushed into rapid expansion, leading to significant financial and financing issues, ultimately resulting in a debt hole of hundreds of billions.

4. Weak Industrial Foundation

China’s industrial foundation is unstable and lacks nutrients. Since the late 1990s, China has lost a complete machine tool industry research and development system, severely restricting the development of China’s machine tool industry. In the upstream design and manufacturing, China’s foundations in materials, components, and experience are weak, making it difficult to support comprehensive independence in the high-end machine tool field; in the downstream application, without imported materials, high-end machine tools in China are as useless as “scrap metal.”

Taking materials as an example, China’s basic materials have significant gaps in homogeneity and cutting performance compared to foreign countries. Not only do high-end tools rely on imports, but many high-end materials in downstream applications are also heavily dependent on imports. A certain factory in Beijing once spent heavily to purchase Swiss machine tools, but when testing with domestic materials (bar materials, tolerance h7 level), after three months of attempts, they could not pass the tests no matter what. After contacting the manufacturer, they tested with Swiss materials, and everything worked fine.

In this situation of “internal worries and external troubles,” China’s machine tool industry has been rapidly left behind by Europe, the USA, and Japan, struggling to catch up.

Currently, developed countries are fully leading in the machine tool industry, while we still face obvious shortcomings in many basic common areas. According to data from China’s Machine Tool Tool Association, the technical gaps between China’s machine tools and foreign ones mainly manifest in the following six aspects: processing precision; reliability; internal electrical, pneumatic, and control systems; processing speed; aesthetics; and intelligence.

1. Processing Precision

Machine tools are complex electromechanical information systems, and during the processing, they are influenced by static mechanics, dynamics, vibrations, and heat. Taking internal thermal influences as an example, it includes dozens or even hundreds of influencing factors such as heat generated by the motor’s rotation cutting magnetic lines, friction heat generated by screw guideway movement, and heat generated during the cutting process, which can cause thermal deformation of parts and changes in tool and material properties, ultimately reflected in processing errors.

Europe has already established corresponding physical models in this regard, capable of simulating and analyzing the sources of processing errors through high-precision simulation methods and compensating for them to improve processing precision. However, currently, Chinese enterprises do not even have effective research on the heat source of motor rotation cutting magnetic lines.

2. Reliability

Germany’s DMG has a strict quality control system for its repair rates. Several years ago, DMG’s allowable annual repair rate had dropped to 1.8 times per (thousand machines*year), which is at least an order of magnitude lower than China’s current repair rate.

3. Electrical, Pneumatic, and Control Systems

An effective and complete control system is a prerequisite for machine tools to achieve high processing precision and intelligence, while a complete and reasonable sensor system is the core hardware foundation of the control system.

German, Swiss, Japanese, and American machine tool enterprises have accumulated a wealth of know-how during their long development process, understanding the required number, types, precision, and installation locations of sensors. For instance, taking DMG’s current market five-axis milling machining center DMC 80 FD duo BLOCK as an example, a single machine is equipped with over 60 sensors, including temperature, force, vibration, lubrication flow, and cooling liquid temperature in critical locations. Through these sensors, necessary machine tool and processing information can be accurately collected, allowing timely online corrections and compensations through appropriate control methods.

4. Processing Speed

China’s slow processing speed can partly be attributed to the lack of machine tool design capabilities. Currently, there are many small and medium-sized factories in China, where the equipment used is still simple machine tools from Shenyang Machine Tool Factory like CA6150. In some well-known single-item champion companies, many of the machine tools used are still outdated CNC machines from the 1990s, leading to low production efficiency. Reports indicate that by 2019, machine tool enterprises in Taiwan had completely eliminated manual machines, while one-third of Shenyang Machine Tool’s production lines still produce manual machines priced at only 50,000 yuan, lacking full CNC capability, which prevents them from focusing on cutting-edge technologies, gradually being surpassed by machine tool enterprises in Taiwan and South Korea.

In contrast, European machine tool manufacturers can target their designs and improvements based on application scenarios. For instance, the Swiss company Tonors has developed numerous machining centers specifically for slender bar materials and high-precision small parts in watches. Their machines for producing automotive engine fuel injectors can automatically load and unload, processing a single injector in just a few seconds, achieving an annual processing volume of millions of parts while ensuring high precision and production efficiency.

5. Aesthetics

In the past, machine tool designs were all square and rectangular. Over thirty years ago, cars were also designed that way. However, starting in 2000, machine manufacturers like Germany’s DMG began inviting designers from Italy’s Ferrari to design the machines’ aesthetics, emphasizing streamlined shapes and considering ergonomic applications, no longer being “clunky and heavy.” Although Chinese machine tools have seen improvements in aesthetics, including color design, they have yet to achieve streamlined designs.

6. Intelligence

Some practitioners in China’s machine tool industry still have a shallow understanding of machine tool intelligence. A senior expert in the machine tool industry publicly stated in an interview that the intelligence of their machine tools is simply reflected in being able to control the machine’s operation via mobile phone. This notion of equating intelligence to “remote control” is insufficient to guide breakthroughs in machine tool intelligence in China, such as achieving “self-learning, self-adapting, self-diagnosing,” and even “self-deciding.”

Currently, European machine tool enterprises are far ahead of us in terms of intelligence. For example, DMG’s Celos can significantly optimize human-machine interaction, modularizing machine functions into app-like features, allowing users to perform programming operations more easily and quickly on the panel. Additionally, Celos has achieved high-precision simulation of the processing process, allowing operators to first visualize the processing process through modeling simulations after receiving processing instruction segments.

Other aspects of machine tool intelligence require a complete sensor system as a foundation, combined with big data and artificial intelligence to achieve automatic optimization of processing processes, parameters, paths, and speed curves, providing early warnings for potential conflicts and correcting for internal and external disturbance factors to ensure precision. However, both big data and artificial intelligence applications in the machine tool field require a substantial amount of experiential data. For example, regarding intelligent optimization of tools, we can monitor their torque in real-time through sensors and detect damage through torque monitoring. However, to further predict tool lifespan and provide early warnings for wear, a large amount of torque curve data before tool wear is needed as a basis, and this research has been underway in Europe for a long time, yielding significant results.

The essence of intelligence lies in the digitization and editability of knowledge and experience. Without a data foundation, the stability and high precision of machine tools cannot be achieved, and intelligent control is merely empty talk.

The machine tool industry is given far more importance in Europe than in China, at least reflected in the levels of attention from high-level officials, the industry, and society.

High-level attention is not only reflected in the usual funding for research institutions and sponsorship for enterprise R&D the German Chancellor or President almost always attends the European Machine Tool Exhibition (EMO) held in Hanover, Germany.

From an industry perspective, taking the scale and professionalism of the European Machine Tool Exhibition as an example, the exhibition held at the Hanover Exhibition Center in Germany has 27 venues, occupying 496,000 square meters of indoor venue space, nearly four times that of China’s International Machine Tool Exhibition (CIMT). At the same time, the ticket price of several dozen euros also limits the audience to professionals, increasing the caliber of attendees. Moreover, each year, they propose corresponding themes to highlight the development focus of the machine tool industry.

Caption: German Chancellor Angela Merkel attending the Hanover Industrial Exhibition in 2010

On the social education level, Germany has a complete and sound multi-tiered education system, with apprenticeship systems, dual systems, and universities providing talent support for various positions in the industrial field. Factory workers enjoy generous compensation (in 2020, German mechanical engineering graduates earned even more than those in IT, economics, and finance), and there is a high level of recognition for workers and engineers from practitioners, students, parents, and friends.

However, the common feature of the healthy development of foreign machine tool industries is a mature market environment.

From an industrial ecosystem perspective, Germany has a large automotive industry because automotive production requires machine tools that can be produced on a large scale. Therefore, many machine tool manufacturers in Germany focus on products more suitable for mass production, while Switzerland is known for its watch and precision manufacturing, leading Swiss machine tool manufacturers to primarily produce high-precision machine tools.

In contrast, the entrepreneurs of China’s state-owned machine tool enterprises are mostly appointed by the administration, and enterprise development is often guided by the completion of political tasks.

“The domestic machine tool market in China is like an Olympic arena; essentially, it is a fierce global competition. If we want to go abroad, we must first achieve leadership in the domestic market.”

Dan Xilin has provided the suggestion of “three transformations and one innovation”:

1. Marketization

We must vigorously cultivate entrepreneurs and operate according to market rules. Enterprises must first become economic entities, focusing on cutting-edge technologies and solving “bottleneck” issues, with everything centered on economic benefits. Only by ensuring good product quality and solving real problems for users can enterprises generate profits. At the same time, they must stabilize their workforce to ensure continuity.

2. Internationalization

We need to select the best athletes from around the world to form a football team to achieve first-class results. Internationalized enterprises require international talent. We should not only import a large number of talents from France, Germany, and Japan, but also research what the German, Japanese, and Vietnamese markets need, and consider whether we can provide good after-sales service for products sold in foreign markets and whether we have the confidence to compete with foreign enterprises.

3. Legalization

We lag far behind in terms of respecting talent and knowledge; we must operate according to market rules and national standards. We need to emphasize intellectual property rights and fair competition.

4. Only through differentiation and innovation can we win the market.

The future development directions for the machine tool industry are “aiming for intelligent production” and “improving single machine standards.”

“Aiming for intelligent production” means that machine tools will have communication functions, enabling real-time interconnection between machine tools, other production equipment, and management centers. “Improving single machine standards” focuses on “higher, faster, and stronger.” The development of machine tools has always revolved around improving the three core indicators of precision, speed, and performance, ultimately meeting the processing needs of new materials and new industries while achieving cost reduction and efficiency improvement. Therefore, additive manufacturing, the composite of single machine functions, and specialization are all future innovation focuses.

In summary, local machine tool enterprises must keep a close eye on first-class international enterprises, utilize top international talents, and let professionals handle professional matters. Regardless of whether they are state-owned, private, or foreign enterprises, they must adhere to market rules.

to obtain resources more directly!