By | Dazhuang Lv

Reported by AI-Drive

AI-Drive notes: As a leading global semiconductor supplier, Renesas Electronics has recently shifted from a low profile to confidently attacking the autonomous driving market.

This Japanese giant’s roadmap hides its major weapon, the yet-to-be-released next-generation R-CAR SoC, which is designed for deep learning and is expected to be deployed in Level 4 autonomous vehicles starting in 2020.

“The new SoC will officially launch samples in 2019, with a computing performance of 50 trillion operations per second (5 TOPS) and a power consumption of only 1 watt.” said Ryuji Omura, Executive Vice President of Renesas, who now leads the company’s vehicle solutions business.

If Omura’s claims hold true, Renesas’s R-CAR SoC will set a new benchmark in the chip industry, with deep learning energy efficiency exceeding that of competitors like the EyeQ5 SoC (Intel/Mobileye) by more than double. The latter achieves 24 TOPS but consumes 10 watts.

Unlike the fierce competition between NVIDIA and Intel, Renesas has remained tight-lipped about its autonomous driving projects.

For a long time, people believed that the R-CAR SoC was designed for in-vehicle infotainment or active safety systems. Therefore, when it announced its intention to leverage this SoC in the autonomous driving market, it caused quite a stir.

Previously, Renesas’s silence on autonomous driving led analysts to believe that the Japanese giant had adopted a more conservative roadmap, focusing primarily on the ADAS market rather than targeting the uncertain autonomous driving market.

At that time, many industry insiders speculated that Renesas was hesitant to confront the top-tier players like NVIDIA and Intel directly, instead viewing Texas Instruments and NXP as its main competitors (as these companies primarily generate revenue from lower-level safety systems).

However, everyone was mistaken. With the development of the new generation R-Car SoC, Omura believes that Renesas is fully capable of competing on equal footing in the autonomous vehicle SoC market.

Renesas has maintained a low profile all along to wait for the right moment, and now by introducing the R-Car SoC, it has positioned itself to overshadow the higher power-consuming products from NVIDIA and Intel, demonstrating superior strategy.

Latest Product Lineup

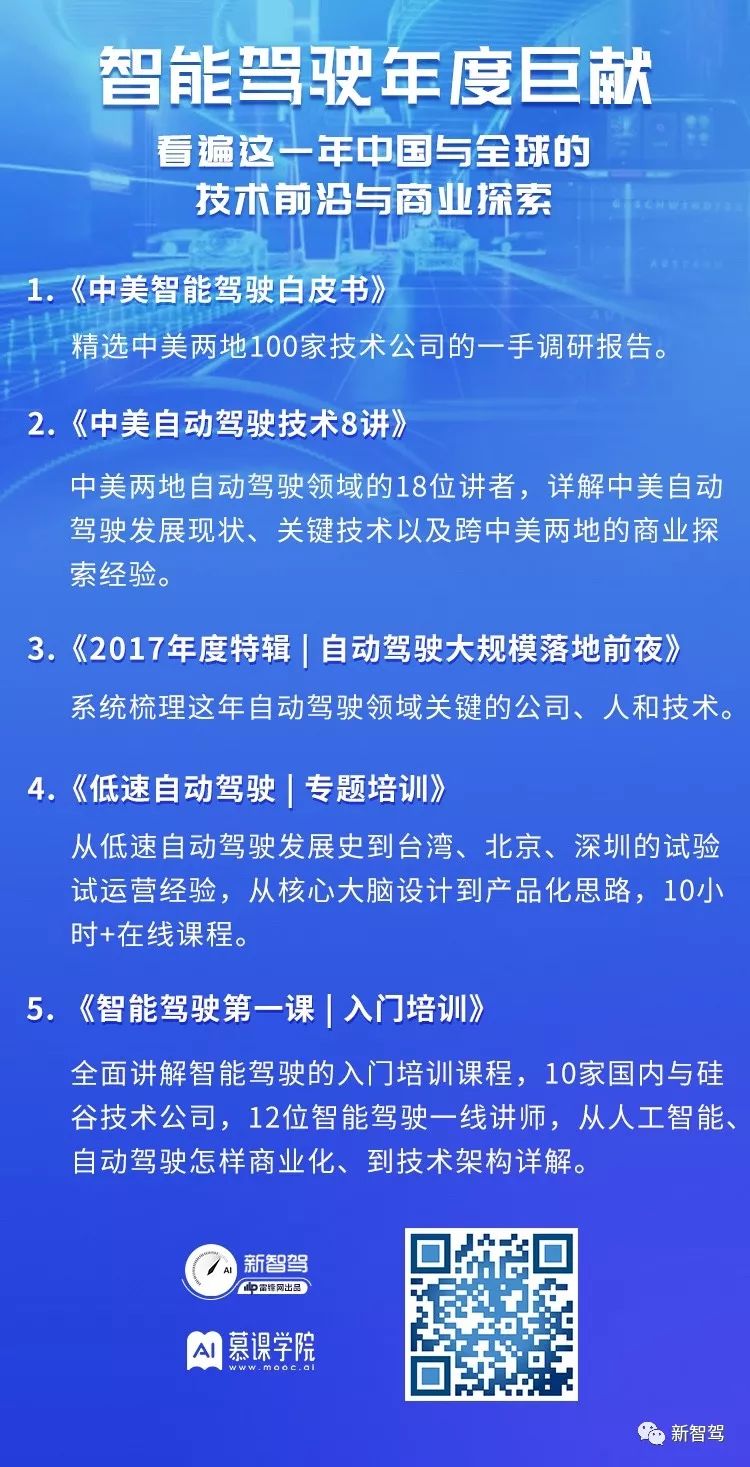

Renesas believes that relying solely on a general-purpose GPU to handle vehicle computing tasks will inevitably encounter performance and power consumption obstacles, while the R-Car autonomous driving platform takes a different approach,integrating multiple cores based on different tasks to enhance internal bus throughput.

Currently, Renesas has two SoCs on the market: R-Car H3 and R-Car V3M.

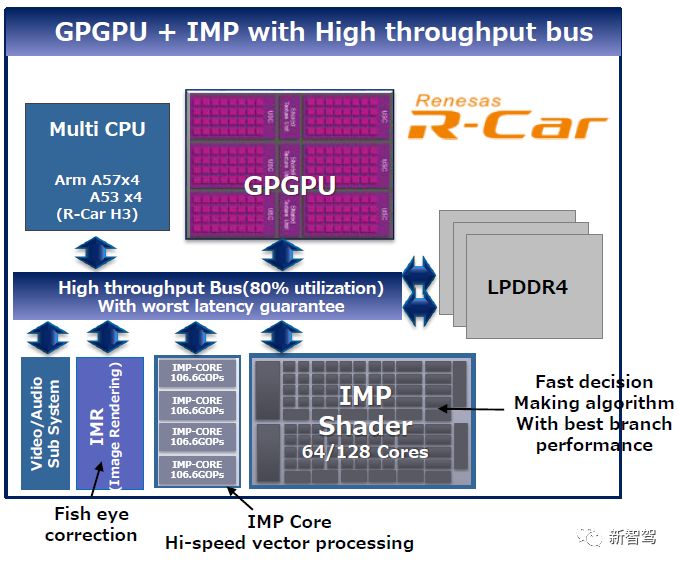

The R-Car H3 is a vehicle computing platform developed for the autonomous driving market. Renesas points out that this SoC has cognitive computing capabilities, allowing it to process the vast amounts of information collected by sensors in real-time and accurately, making it ideal for driving safety support systems.

With this SoC, automotive manufacturers can directly run applications that require complex calculations, such as obstacle detection, driver state recognition, hazard prediction, and hazard avoidance. Additionally, the R-Car H3 can also be used in in-vehicle infotainment systems.

The R-Car V3M is a high-performance image recognition SoC, primarily used in front-facing cameras, providing support for surround systems or LiDAR. Moreover, it has a built-in image signal processor that offers low-power hardware acceleration for visual processing.

A detailed analysis reveals that the R-Car V3M consists of two ARM Cortex-A53 CPUs, a dual-core ARM Cortex-R7, and IMP-X5+ (Renesas’s recognition engine). Of course, it also includes dedicated hardware to enhance computational vision and deep learning algorithms.

When asked about the prospects of the R-Car V3M being applied in LiDAR, Omura mentioned LeddarTech, a solid-state LiDAR company that has become a partner of Renesas. LeddarTech chose the R-Car V3M primarily to help process the massive data and high sampling rates generated by the LeddarCore IC (designed specifically for solid-state LiDAR).

* R-Car V3M has also become a key component in LiDAR

At the beginning of last month at CES, Renesas also showcased a fully autonomous driving test vehicle, which is a modified Lincoln equipped with six R-Car V3M chips and two sets of R-Car H3 (one for redundancy).

* Renesas’s autonomous driving vehicle at CES

The Road to Autonomous Driving

Undoubtedly, NVIDIA is currently the most powerful driver in the autonomous driving industry, with its chips widely adopted by various tech companies and automotive manufacturers. However, Omura stated,Renesas hopes to catch NVIDIA off guard by timely entering the market with mass production models.

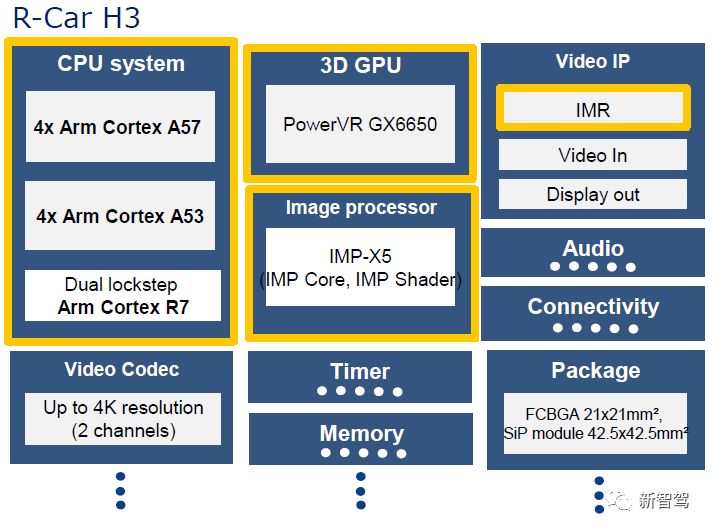

As a cognitive source for autonomous vehicles, AI is crucial. However, Omura emphasized: “AI alone cannot drive a vehicle. Without key solutions such as cloud services, sensors, and vehicle control, autonomous vehicles cannot be realized.”

* Renesas has over 200 partners worldwide

Currently, Renesas has ambitious plans, expanding the R-Car platform to seize dual design opportunities in the ADAS and autonomous driving markets.

For Renesas, autonomous driving and ADAS are not two markets requiring different platforms. “They are on the same platform, and we aim to meet the demands of both markets simultaneously,” Omura said.

However, achieving this goal is not easy. Besides the deep learning R-Car SoC set to launch next year, what other products can Renesas showcase to prove its strength in the fiercely competitive autonomous driving market against the dual giants NVIDIA and Intel?

1. Equipping vehicles with more MCUs (Microcontroller Units) and SoCs

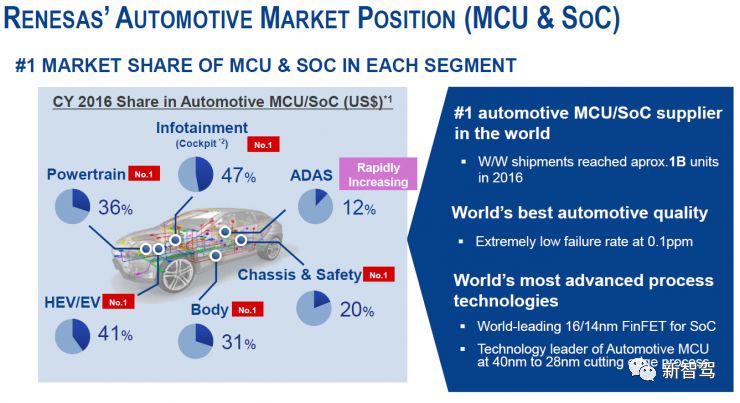

First, Renesas believes its greatest advantage lies in the ubiquitous MCUs and SoCs within vehicle architectures.

“We understand cars,” said Katsuhiko Itagaki, Senior Engineer of Renesas’s Automotive Solutions Business. Renesas’s product line encompasses visual chips, cognitive processors, and ECUs for braking, steering, and acceleration, covering almost everything.

* Renesas’s position in the automotive market

2. New vehicle structural divisions

With the advent of electrification and autonomous driving trends, the entire vehicle system is undergoing significant changes. “We clearly know how to transform the various blocks within vehicle structures,” Itagaki said.

Given that 80% of the new vehicle structure is determined by electronic components, “Renesas is in a favorable position because we know how to draw lines between different functions and identify the non-negotiable red lines between functionalities.”

3. Open architecture and new ecosystem

Renesas has been advocating open architecture. What Omura refers to as “open” means collaborating with over 200 partners on the R-Car platform. “Our ecosystem is quite large. Our customers, whether OEMs or tier-one suppliers, also have the freedom to choose their specific partners,” Omura emphasized. “We do not play the ‘black box’ game (referring to Mobileye).”

Renesas’s partners in autonomous driving include TTTech, NXP, Hella Aglaia, the University of Waterloo, and Neusoft.

Okumura pointed out that Renesas has established a long-term partnership with TTTech, which is utilizing R-Car H3 SoCs and RH850/P1H-C MCU platforms to provide customers with a “Highly Automated Driving Platform (HADP).”

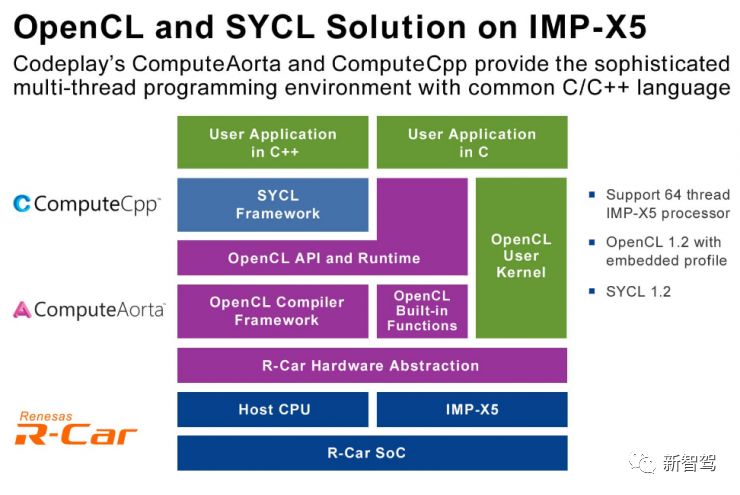

In terms of software running on R-Car chips, Renesas is also quite open.

Currently, it is collaborating with Codeplay Software, a company specializing in high-performance compilation tools and software optimization for multi-core processing. This partnership aims to attract developers who are currently writing CUDA for NVIDIA SoCs to the R-Car platform, utilizing Codeplay’s OpenCL open standard software framework.

This framework initially appeared as a proof of concept on the R-Car H3 but is now being used on the R-Car V3M and other R-Car SoCs (targeting both ADAS and autonomous driving).

* OpenCL and SYCL solutions on IMP-X5

Renesas’s ecosystem has formed a vast network, encompassing a wide range of partners from mapping companies to cybersecurity firms.

For example, Usher, a high-precision mapping company based in Detroit, is a partner of Renesas, generating high-precision maps by combining remote sensing technology with its own geospatial and machine learning technologies. It is easy to imagine that Usher’s software can accurately depict road details, aiding autonomous vehicles in making intelligent control decisions.

Fortinet, based in Sunnyvale, California, is also a partner of Renesas, providing IT architecture security technology. Fortinet has integrated its FortiOS security operating system into Renesas’s R-Car H3 SoC to ensure the security of vehicle network domains, cloud infrastructure services, and applications, safeguarding autonomous vehicles.

4. ASIL-D ECU

Renesas also claims that its ASIL-D safety ECU is at least two generations ahead of its strongest competitor, Infineon.“Our latest safety ECU is already in sampling, utilizing 16nm FinFET process technology,” Omura explained.

“For us, safety is Renesas’s key strength.” He emphasized that besides understanding what it takes to meet ASIL-D requirements, Renesas has been striving to find the best solutions for system robustness. “The goal of Renesas’s R&D team is to adopt a system-level safety solution,” Omura stated.

Automotive Business as Renesas’s Pillar

A year ago, a report from Semicast Research indicated that Renesas was the world’s third-largest automotive chip supplier in 2016, following NXP and Infineon. However, Renesas is no longer a typical Japanese semiconductor company.

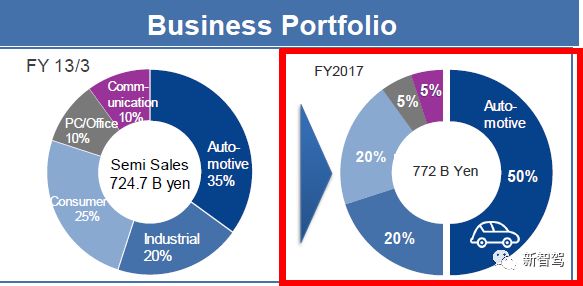

After several years of rapid restructuring, Renesas has once again “rebuilt its image,” with revenue increasing from 744 billion yen in the 2012 fiscal year to 772 billion yen last year. Although the growth seems modest, the gross profit margin has risen from 31% to 46%.

During this period, Renesas streamlined its operations, directly cutting 40% of its workforce, bringing the number of employees down to around 20,000. Meanwhile, Renesas completed the acquisition of Intersil in 2016.

* Today, 50% of Renesas’s revenue comes from the automotive business

Currently, half of Renesas’s revenue comes from the automotive industry, with its MCU business almost entirely focused on the automotive market. Crucially, 70% of Renesas’s automotive business comes from outside Japan.

At present, Renesas’s teams are spread across Europe, the United States, and Japan. Its U.S. team has absorbed many core members from Magna (a tier-one supplier focused on ADAS and autonomous driving system design), while the European team is responsible for developing autonomous vehicle architectures. 【End】

Follow us on Sina Weibo, NetEase, Toutiao, TianTian Quick Report, UC Headlines, Sohu, and Yidian Zixun

Recommended Reading:

Renesas Launches Autonomous Driving Platform, Ambitiously Competing with Mobileye

Explore the cutting-edge technology and business explorations in the field of intelligent driving in China and globally over the past year. Scan the QR code below or click “Read Original” for more information.