Author: Liu Yuwei

EET Electronic Engineering Magazine Original

As the Internet of Things (IoT) becomes the third wave of development in the global information industry after computers and the internet, the boundaries between people and things, and between things and things, are continuously being extended. The concept of connecting everything has greatly changed people’s existing living environments and habits.

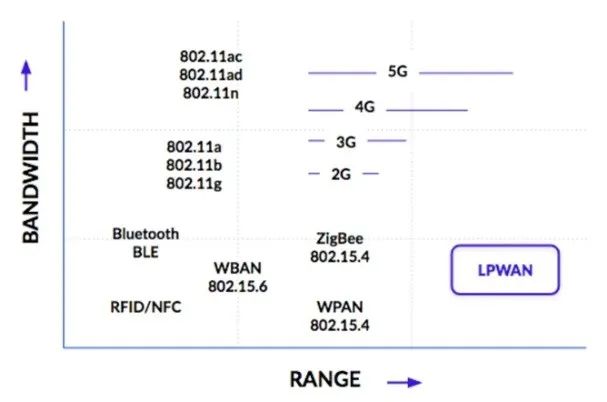

Before the advent of Low Power Wide Area Networks (LPWAN), IoT scenarios such as smart homes and industrial IoT typically used short-range communication technologies like Wi-Fi, Bluetooth, and Zigbee; however, for larger areas and long-distance connections, they relied on operators’ networks such as 2G, 3G, and 4G. However, if we categorize these wireless communication technologies based on power consumption and transmission distance, we find that there is still a lack of technologies that can simultaneously meet the characteristics of “low power consumption” and “long distance”. The emergence of LPWAN technologies just fills this gap.

What Is LPWAN?

To transmit information wirelessly over long distances, it is necessary to increase the signal power or reduce the signal bandwidth. LPWAN, or Low-Power Wide-Area Network, is a type of wireless communication network that is long-range, low-power, and low-bandwidth. Most LPWAN technologies can achieve network coverage of several kilometers or even tens of kilometers, addressing challenges in the IoT industry such as high terminal power consumption, massive terminal connections, insufficient wide-area coverage capability, and high costs, making it suitable for large-scale deployment.

LPWAN does not refer to a specific technology but rather a combination of various low-power, wide-area network technologies, which generally have the following characteristics:

● Low power consumption: Battery life can last up to 10 years

● Long distance: Wide coverage, up to several tens of kilometers, typically exceeding 2 kilometers in urban environments

● Low data rate: Occupies little bandwidth, transmits small amounts of data, and has low communication frequency

● Insensitive to transmission delay: Does not have high real-time requirements for data transmission

● Low cost: Due to large-scale deployment, the cost is low

The above characteristics are the main differences between LPWAN and other wireless network protocols such as Bluetooth, RFID, cellular M2M, and ZigBee.

Different Technical Factions of LPWAN

With the explosive growth of IoT demand, the competition among IoT technology standards has intensified, and the competition among technical factions in LPWAN is particularly fierce.

LPWAN can be divided into two categories: one category includes technologies such as LoRa and SigFox that operate in unlicensed spectrum, also known as non-cellular LPWAN; the other category includes EC-GSM, LTE Cat.1/0/M1 (eMTC), NB-IoT, and other technologies promoted by 3GPP based on licensed spectrum, also known as cellular LPWAN. Among the many LPWAN technologies, NB-IoT, eMTC, and LoRa are currently the most used and the most controversial, often compared with each other, but in fact, they differ in technical positioning and application fields.

Licensed Spectrum

In licensed spectrum IoT technologies, the classification by network rate is as follows: high-speed can be carried by Cat 4 and above and 5G, low-speed can be carried by NB-IoT, and medium-speed can be carried by Cat 1 or eMTC.

eMTC is a response from 3GPP to the strong interest in LPWAN solutions, supporting standard LTE connections while retaining resources; NB-IoT was born to challenge Sigfox and the LoRa Alliance, and it operates outside the LTE architecture, unlike eMTC. Cat.1 has recently become popular, and both it and eMTC can carry voice and medium-speed market after the 3G shutdown, positioned between high-speed connectivity (5G and 4G LTE) and low-speed (2G GPRS and NB-IoT).

Currently, NB-IoT is primarily promoted domestically; this narrowband IoT based on cellular technology supports software updates to existing cellular infrastructure, such as upgrading existing LTE and GSM base stations. By reusing existing 2G or 3G spectrum, it can quickly achieve domestic and international coverage and deployment.

eMTC is an IoT technology based on LTE evolution, referred to as Low-Cost MTC in R12 and LTE enhanced MTC in R13. Its main features are higher transmission rates, lower latency, support for handover, and VoLTE voice communication, applicable in scenarios that require high mobility and transmission rates such as voice calls.

Compared to eMTC, NB-IoT provides a 20dB gain improvement, equivalent to a 100-fold increase in coverage area capability, and has better building penetration capabilities, giving it potential advantages in smart city applications. NB-IoT focuses on small data volume and low-speed applications, with very low device power consumption, especially with the use of DRX (Discontinuous Reception) technology, allowing terminals to operate only when needed.

On the other hand, due to its narrowband IoT and low-speed characteristics, NB-IoT can take on part of the 2G market but struggles to handle 2G/3G voice calls, medium-speed, and mobile connection demands, making eMTC/Cat.1 more suitable for this field. In terms of cost, NB-IoT simplifies RF hardware, protocols, and reduces baseband complexity, lowering overall component costs, while chip solutions using eMTC/Cat.1 are usually more expensive.

Unlicensed Spectrum

LPWAN technologies using unlicensed frequency bands include Sigfox, LoRa, Weightless, etc. Due to the use of publicly available unlicensed frequency bands, the entry barrier is low, and the construction is simple, leading to a faster commercialization process.

LoRa

LoRa is a wireless digital communication modulation technology at the physical layer, known as Chirp Modulation, and its main feature is operating in the free frequency band below 1GHz, extending the communication distance by 3-5 times compared to traditional wireless RF communication at the same power consumption, achieving distances of 1-20km.

LoRa terminals can be powered by batteries or other energy harvesting methods, with battery life lasting 3-10 years. At the same time, the low data rate of 0.3-50kbps also extends battery life and increases network capacity, achieving a balance of low power consumption and long distance.

LoRa signals also have strong penetration through buildings, with application scenarios including low-power, low-cost sensors in smart agriculture; battery-powered device tracking and status monitoring in industrial automation; and logistics tracking or positioning, where LoRa communication is more stable than NB-IoT during high-speed movement.

SigFox

Although SigFox also uses unlicensed spectrum, it has a strong ecosystem among foreign operators, with successful promotion in Europe and its own base stations in nearly 60 countries/regions worldwide.

SigFox operates in the ISM bands of 868MHz and 902MHz, consuming very little bandwidth or power. Therefore, it is suitable for systems that only need to send small amounts of infrequent data bursts, such as parking sensors, water meters, and smart trash bins. Its downside is that when data is sent back to the sensor/device (downlink capacity), it is severely limited, and there can also be signal interference issues.

Both LoRa and Sigfox feature long-distance and low-power characteristics, extending battery life and enabling large-scale information transmission, and both utilize unlicensed Sub-1GHz ISM bands without additional authorization costs. Both LoRa and Sigfox have daily transmission limits, making them suitable for fields without real-time communication needs.

Ingenu

Ingenu (formerly known as On-Ramp Wireless) has developed a bidirectional solution based on years of research, implementing a proprietary direct-sequence spread spectrum technology known as RPMA (Random Phase Multiple Access). RPMA is designed to provide high-capacity, secure, and wide-ranging interconnectivity in the 2.4GHz band.

In the US, a single RPMA access point can cover an area of 176 square meters, which is much larger than the standards of Sigfox and LoRa. It has minimal overhead, low latency, and broadcasting capabilities, allowing it to send commands to a large number of devices simultaneously. However, hardware, software, and other functionalities are limited to what the company provides, and it requires building its own public and private networks dedicated to machine-to-machine communication.

Symphony Link

Link Labs is a member of the LoRa Alliance, so it uses LoRa chips. However, Link Labs does not use LoRaWAN but builds a proprietary MAC layer (software) on top of a chip called Symphony Link from Semtech.

Compared to LoRaWAN, Symphony Link adds some important connectivity features, including guaranteed message reception, wireless firmware upgrades, removal of duty cycle limitations, repeater functionality, and dynamic range.

Weightless SIG

Weightless SIG (Special Interest Group) was established in 2008, with the mission of standardizing LPWAN technologies. Weightless SIG is the only true open standard that can operate in unlicensed Sub-1GHz spectrum. There are three versions of Weightless available for different purposes:

Weightless-W: Utilizes white space (unused local spectrum in licensed frequency bands)

Weightless-N: An unlicensed narrowband protocol born from NWave technology

Weightless-P: A bidirectional protocol derived from M2COMM Platanus technology

Among these, Weightless-N and Weightless-P are more popular because Weightless-W has a shorter battery life.

Nwave’s Weightless-N is functionally very similar to SigFox but boasts a better MAC layer implementation. It claims to use “advanced demodulation technology” that allows its network to coexist with other radio technologies without generating additional noise. Like SigFox, it is best suited for sensor-based networks, temperature readings, tank level monitoring, smart metering, and other similar applications.

Weightless-P standard uses FDMA + TDMA modulation in a 12.5 kHz narrowband (greater than SigFox but less than LoRa). It also features adaptive data rates similar to Symphony Link (200 bps to 100 kbps). With very high sensitivity, it is -134 dBm at 625 bps, supporting PSK and GMSK modulation. For dedicated networks, more complex use cases, and situations where controlling uplink and downlink data is crucial, Weightless-P makes sense. The development kit for Weightless-P has just begun to hit the market.

Deployment Status of Different Faction LPWAN Technologies

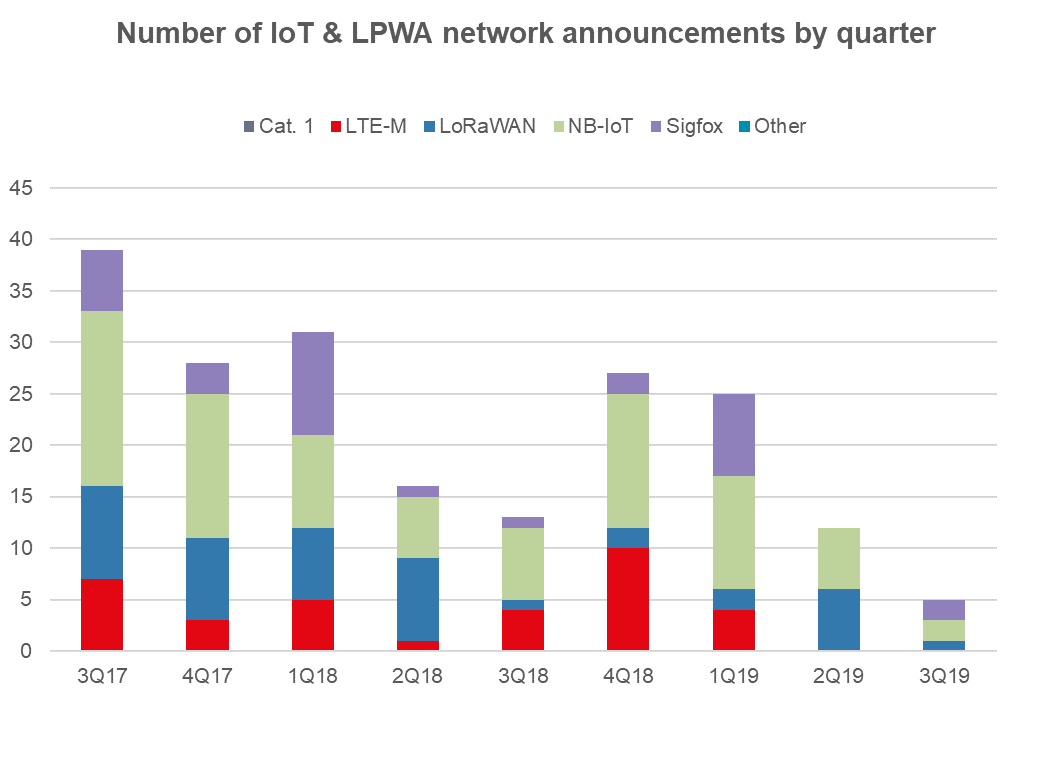

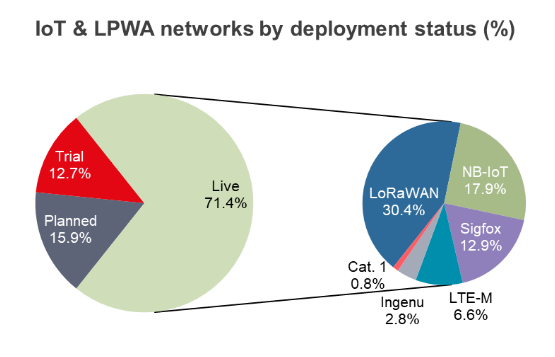

According to the IoT and LPWAN deployment tracking report released by research firm Ovum in Q4 2019, the total number of announced LPWAN deployments globally, including licensed and unlicensed spectrum, has reached 501.

LoRa, which operates in the unlicensed spectrum, remains the most adopted technology in the existing networks, dominating commercial deployments with nearly one-third of the market share (about 30.3%). However, NB-IoT has gradually caught up, ranking second with 89 commercial networks as of the end of Q3 2019.

LoRa, which operates in the unlicensed spectrum, remains the most adopted technology in the existing networks, dominating commercial deployments with nearly one-third of the market share (about 30.3%). However, NB-IoT has gradually caught up, ranking second with 89 commercial networks as of the end of Q3 2019.

Although there has been growth in licensed spectrum LPWAN deployments, LoRa is expected to maintain its leading position. LoRa chipset provider Semtech stated in a briefing at the end of last year that there are now 14 national public LoRa networks in 10 countries worldwide, with over 50,000 global LoRa technology developers. The technology has over 100 million terminal nodes (including private networks) and is supported by 120 service providers worldwide.

In terms of licensed spectrum technology, many CSPs are now adopting a dual-technology strategy, providing both NB-IoT and LTE-M networks. However, in terms of network deployment, NB-IoT still far outpaces LTE-M, with three times as many commercial network deployments as LTE-M. The lower module costs make NB-IoT (or actually using 2G or 3G cellular networks) a more attractive solution.

In terms of licensed spectrum technology, many CSPs are now adopting a dual-technology strategy, providing both NB-IoT and LTE-M networks. However, in terms of network deployment, NB-IoT still far outpaces LTE-M, with three times as many commercial network deployments as LTE-M. The lower module costs make NB-IoT (or actually using 2G or 3G cellular networks) a more attractive solution.

IoT roaming for NB-IoT or LTE-M has significant advantages for applications like asset tracking, as asset tracking may require network connectivity across multiple countries/regions, but the roaming issues of licensed spectrum LPWAN have restricted market development. Lack of roaming means that deploying licensed spectrum LPWAN IoT terminal devices in multiple countries/regions requires signing multiple contracts with different operators and potentially dealing with various management systems. However, this situation has been changing in recent years.

Who Will Win in China?

In China, the competition among various LPWAN technologies can be simply viewed as a contest between licensed spectrum (represented by NB-IoT) and unlicensed spectrum (represented by LoRa). Although both parties claim to serve different markets with no competition, they are both striving for dominance in the emerging IoT field where communication standards have yet to be determined.

On December 13, 2017, the Radio Management Bureau of the Ministry of Industry and Information Technology released the “Technical Requirements for Low-Power Short-Distance Radio Transmission Equipment (Draft for Comments)”, while China completed the comprehensive submission of candidate technology solutions for IMT-2020 (5G), with NB-IoT technology officially included in the candidate technology collection for 5G.

LoRa, which does not have authorized frequency bands in China, coupled with the announcement by the Ministry of Industry and Information Technology in November 2019, further regulating the management of low-power short-distance radio transmission equipment, has led many to interpret that LoRa will be completely replaced by NB-IoT in China. In response, chip manufacturer Semtech specifically issued a statement interpreting this announcement, indicating that LoRa meets all the requirements of the Ministry of Industry and Information Technology’s announcement No. 52. (For detailed interpretation, please refer to the article “About LoRa and the Ministry of Industry and Information Technology’s Document No. 52, This Article Answers All Questions” https://www.eet-china.com/news/202007311648.html)

In terms of chip research and supply, Semtech (International) AG is a Swiss company headquartered in Rapperswil, Switzerland. The manufacturing, assembly, and distribution of LoRa chips are conducted in Asia. Additionally, Semtech has licensed certain manufacturing rights of its LoRa technology to semiconductor companies in Europe and Asia.

There are no restrictions on NB-IoT chips, and anyone can produce them, with major contributions from companies such as Huawei HiSilicon, Unisoc, and MediaTek. With the backing of the national IoT strategy, since the standard was established in 2017, operators have successively issued subsidy policies for NB-IoT modules. In early April this year, China Telecom announced the results of its centralized procurement project for NB-IoT IoT modules for 2020, with an average winning price of 14.5 yuan, the lowest being 13.47 yuan and the highest 14.8 yuan. In July, some module manufacturers even quoted prices as low as 9.9 yuan.

The rapidly growing market size of the network is the main reason for the decline in NB-IoT module prices. When operator subsidies stimulate more players to enter, the supply side increases, leading to a drop in upstream chip prices, which in turn brings down downstream prices. This is favorable for the popularization of NB-IoT and accelerating the transition of 2G users. However, if end users insist on lowering prices, some manufacturers in the supply chain may not make a profit, leading to a scenario where “before the unlicensed spectrum competition heats up, the NB-IoT camp first engages in a price war to eliminate some teammates”.

Compared to eMTC and NB-IoT, Cat.1 has greater opportunities domestically, as Cat.1 belongs to the 4G network branch, allowing operators to complete network deployment using existing 4G base stations without additional investment. In contrast, eMTC requires infrastructure construction, while operators are currently investing more resources in 5G construction, making it difficult to allocate extra funds for eMTC.

In terms of network coverage, speed, and latency, Cat.1 has advantages over NB-IoT and 2G; compared to eMTC modules, it has the advantages of low cost and low power consumption while maintaining the same millisecond-level transmission latency, making it the best technology to fill the gap left by the shutdown of 2G/3G.

As the suitability of NB-IoT becomes narrower and it struggles to replace the entire 2G/3G network market, the three major operators have also begun deploying Cat.1 networks, even somewhat diminishing the status of NB-IoT. This is also related to operators not yet finding a good business model for NB-IoT; their profit models need further exploration, and vertical industry users need to work with operators to explore business cooperation and charging models.

Complementarity and Coexistence

From an evolutionary perspective, the trend of IoT access technologies is increasingly evident in the direction of low power and wide coverage. Although some say that with the popularization of 5G, its low latency, low power consumption, and high data transmission rate characteristics are expected to shake the entire LPWAN landscape, it is said that 3GPP is also considering allowing 5G technology to operate in unlicensed bands (especially 3.5 GHz, 5 GHz, and 60 GHz), which would have a significant impact on unlicensed LPWAN. However, I believe that the high costs and inflexible deployment of 5G, determined by operator networks, especially for users who wish to ensure that data remains local and secure, will still adopt self-organizing network methods within small areas.

Various LPWAN technologies each have their characteristics and mature markets. Taking NB-IoT and LoRa as examples, both share common LPWAN technology characteristics such as low power consumption, wide coverage, and low cost. NB-IoT offers greater bandwidth and reliability, suitable for large-scale coverage, while LoRa has lower power consumption, simpler deployment, and lower costs, making it more flexible in meeting diverse application needs.

No IoT technology is perfect; there are only the most suitable choices for their applications. Even the three major operators will choose hybrid networking based on practical situations. From a technical and application perspective, although licensed and unlicensed LPWAN technologies may compete in certain fields in the future, they will primarily complement and coexist with each other, rather than replace one another.

↓↓ Scan to get a free development board↓↓

Core Technical Advantages

This solution uses Realtek’s RTL8753BAU-VL as the Bluetooth Dongle responsible for forwarding gaming audio from the phone, with the low-power dual-transmission RTL8753BFE serving as the receiving headset for gaming audio, achieving an end-to-end gaming mode latency of less than 65ms.

↓↓ Click to read the original text for more free development boards