ADAS, as a type of active safety technology that is not exactly new, has received widespread attention in recent years, and many new cars are equipped with this product. But you might not know that in the ADAS market, there is one company that occupies 90% of the market share with just a few products, and even the globally popular Tesla uses its system, with a market value of up to $8.545 billion. It is akin to the position of BAT in China, and that is Mobileye from Israel.

Let’s take a look at what makes this company so powerful.

Mobileye Background

Before introducing Mobileye, I think it is necessary to introduce ADAS:

ADAS (Advanced Driver Assistance Systems) is one of the intelligent automotive technologies that manufacturers have actively developed in recent years, and it is a technological progression towards achieving the realm of fully autonomous vehicles in the future. The main function of ADAS is not to control the car, but to provide drivers with information on the vehicle’s operational conditions and changes in the external environment for analysis, and to preemptively warn of potential dangers, allowing drivers to take measures in advance to avoid traffic accidents.

Mobileye is a company that provides such products.

Mobileye was founded in 1999 by Professor Amnon Shashua and Ziv Aviram from the Hebrew University of Jerusalem, Israel. From the moment of its establishment, Mobileye set its mission to develop and promote a vision system to assist drivers in ensuring passenger safety and reducing traffic accidents. It has a research and development center in Israel and branches in the United States, Cyprus, China, Germany, and Japan.

One of the founders of Mobileye, Professor Amnon Shashua, is an international authority on computer artificial intelligence, specializing in the development of computer vision, which is how computers understand useful information from images.

Professor Amnon Shashua

Want to know how advanced the company’s technology is? We can prove it with facts: since going public in July 2014, Mobileye has achieved an almost 100% success rate when competing for tenders for intelligent vehicle safety devices from major automotive manufacturers.

Although Mobileye was established in 1999, it wasn’t until 2007 that models equipped with Mobileye products were launched. It took them eight years from research and development to formal commercialization. By October 2013, Mobileye sold its one millionth product. From October 2013 to this January, they sold 9 million products, accumulating a total sales of 10 million units, with original equipment manufacturer (OEM) products accounting for 80% and aftermarket products 20%.

Currently, Mobileye has more than 500 employees globally, with three to four hundred in research and development.

The Power of Mobileye

How powerful is Mobileye? First, let’s look at some data. According to information from the company’s website: automotive brands including Audi, BMW, Citroën, Ford, General Motors, Honda, Hyundai, Jaguar, Land Rover, Nissan, Opel, Renault, Toyota, and Volvo all have partnerships with Mobileye. Mobileye has numerous advantages, such as the historical data of computer image annotations, the accumulation of algorithms, and even the development of its own chips. Of course, the chips have historical background. These experiences are not something that other companies can surpass in a short time.

Currently, Mobileye’s main product is a camera-based advanced driver assistance system (ADAS), which includes: Front Collision Warning (FCW), Forward Vehicle Distance Monitoring and Warning System (HMW), Lane Departure Warning System (LDW), Pedestrian Detection and Collision Prevention System (PCW), and Intelligent High Beam Control System (IHC), among others.

The company’s lane departure warning system uses a monocular graphical processor to determine the lane markings on the road and measure the vehicle’s position relative to the markings. Its features include the ability to detect various types of lane markings (solid, dashed, box-shaped, and cat-eye). In the absence of lane markings, the system uses the road boundary to determine position. The system fits three road model parameters: lateral distance, slope, and curvature to enhance warning reliability. The system can also operate in rain and at night.

Before discussing Mobileye’s products and technologies in detail, we need to talk about how ADAS works:

ADAS consists of up to nine systems, including blind spot detection systems, supported parking assist systems, rear collision warning systems, lane departure warning systems, collision mitigation braking systems, adaptive lighting systems, night vision systems, active distance control cruise systems, collision prevention systems, and even more functions. Each system mainly includes three programs:

(1) Information collection, where different systems collect information about the vehicle’s working state and parameter changes through different types of vehicle sensors, including millimeter-wave radar, ultrasonic radar, infrared radar, laser radar, CCD/CMOS image sensors, and wheel speed sensors, and continuously convert the changing mechanical motion into electrical parameters (voltage, resistance, and current). For example, the lane departure warning system uses CMOS image sensors, while the night vision system uses infrared sensors, adaptive cruise control typically uses radar, and parking assist systems use ultrasonic sensors;

(2) Electronic Control Unit (ECU), which analyzes and processes the information collected by the sensors and then outputs control signals to the controlled devices;

(3) Actuators, which execute actions based on the signals output by the ECU.

Machine vision technology has developed rapidly in recent years, and most businesses attempt to enhance the ability of devices to detect objects by improving camera vision or increasing radar. However, Mobileye takes a different approach by using a single camera with attached sensors and proprietary algorithms to perform object detection tasks on a single hardware platform. This significantly simplifies the installation process and greatly reduces costs, making it favored by major automakers.

In simple terms, Mobileye has met all the requirements of automotive safety driving systems with just one camera. In terms of ensuring the safety of drivers and pedestrians, Mobileye has six key technologies:

Front Collision Warning (FCW): The FCW system operates when activated, effective at vehicle speeds between 0-200 km/h, and issues a warning within 2.7 seconds before a collision with a vehicle ahead.

Pedestrian Collision Warning (PCW): The PCW operates at speeds between 1 km/h and 50 km/h, issuing a warning when a potential collision with a pedestrian ahead is detected.

Lane Departure Warning (LDW): The LDW is activated at speeds above 55 km/h, issuing a warning when the driver unintentionally departs from the lane. If the turn signal is used during lane changes, no warning is issued.

Vehicle Distance Monitoring Warning (HMW): The HMW measures the distance to the vehicle ahead in seconds. If approaching the set distance, a danger warning is issued.

Urban Forward Collision Warning (UFCW): When the distance to an object is less than 1.6 to 2.0 meters (which can be adjusted by the driver), the system issues a warning for an imminent danger; UFCW operates at speeds between 1-30 km/h.

Intelligent High Beam Control (IHC): On dark roads, when no vehicles are nearby, the system can control the vehicle’s front lights, automatically switching from low beam to high beam.

Since the installation of Mobileye’s collision warning system, the driving skills of drivers for the Coca-Cola European Group’s delivery vehicles have significantly improved. An American transport company verified and compared the impact of installing the Mobileye system on traffic accident costs. The results showed that the accident rate for vehicles without the system was 1.4 times higher than for those equipped with it for every 100 miles (160 km) driven.

Mobileye’s unique technology has quickly captured over 70% of the global automotive safety driving system market.

Exclusive Benefits from the Smart Car Concept

Mobileye’s technology has had a huge impact on the entire automotive industry. Since 2007, the EyeQ chip for driver assistance systems has been installed in vehicles, and by 2012, the global deployment scale of the EyeQ chip surpassed one million units. Currently, 3.3 million vehicles worldwide are equipped with EyeQ chips.

The cycle required for automotive manufacturers to integrate such driver assistance systems into a specific model is very long, requiring 1-2 years for initial communication, assessment, integration development, production line inclusion, and formal production line upgrades to mass production. Once a model is put into production, the production cycle lasts for five years. By 2016, it is expected that 237 models will adopt Mobileye’s technology, all of which have gone through these previous stages. Any competitor wishing to challenge Mobileye must also undergo a similarly long adaptation cycle. Such a long adaptation period constitutes the first barrier; meanwhile, the models already included in development plans provide high predictability for Mobileye’s revenue in the coming years.

Through cooperation with most automotive manufacturers over the past decade, Mobileye has accumulated millions of miles of driving scenarios across 43 countries under different environments, climates, and road conditions. It is based on this data that Mobileye has developed its leading core algorithms. Any competing company wishing to achieve similar accuracy must also accumulate a comparable amount of data. This presents a huge challenge for newcomers; moreover, in this process, Mobileye has already been developing the next innovative applications based on a larger volume of data.

By the end of 2014, 18 automotive brands with 160 models were using Mobileye’s driver assistance systems, and by 2016, the number of automotive brands using Mobileye systems was expected to increase to 20 with approximately 237 models. Currently, Mobileye’s OEM partners include BMW, Volvo, Ford, General Motors, Honda, and Tesla. Through cooperation with these industry giants, Mobileye’s sales grew by over 120% for two consecutive years in 2012 and 2013.

Leading Technological Advantages

Mobileye consists mainly of three parts: camera components (including cameras, speakers, and main control chips), EyeWatch (display), and OBD interface box. Mobileye’s camera is the most powerful part of the entire system design. They use specially customized EyeQ visual processing chips, along with over a decade of program accumulation, achieving very comprehensive assisted driving functions with just a single camera.

Balancing Algorithm and Hardware

The algorithm and hardware are the core of the ADAS system and also constitute Mobileye’s core competitiveness, which can be discussed in the following points:

First, it is crucial to effectively recognize key target objects in real-time from captured images. Various oddities may appear on the road, such as a plastic bag on the ground, which does not affect driving but can be difficult for machines to distinguish between a plastic bag and a stone. This directly determines what kind of decisions the machine will make.

Second, calculating the Time To Collision (TTC) accurately is a standard that greatly affects user experience. If the warning is issued too early, users may feel it is unnecessary; if too late, it will not serve its preventive purpose. Currently, Mobileye’s aftermarket products set the TTC at 2.7 seconds, which users have rated as “just right.”

However, to make an accurate TTC estimate, it is necessary to obtain accurate absolute speed and relative speed concerning other vehicles, while also considering comprehensive factors such as road curvature, slope, and trajectory.

Third, there is a difference between “vehicle distance monitoring” and “preventing front collisions”. Currently, many ADAS products confuse the two. For example, if both you and the vehicle ahead are traveling at 100 km/h but the distance is only 10 meters, the front collision prevention will not issue an alert, while the distance monitoring will. This is the most significant difference between the two.

Mobileye believes that since it is onboard hardware, it must consider power consumption, size, and cost. In 1999, when Mobileye’s product was still in the laboratory stage, the entire system was about the size of a server, with high power consumption that could not meet automotive needs. Therefore, they had to develop their own chips, but the downside was that the initial costs were very high.

Additionally, it is essential to continuously integrate new functions on the same platform to provide the best cost-performance solutions. Over more than a decade, Mobileye has continually updated and iterated product functions, leading to increasingly demanding hardware performance. Their EyeQ series chips have already undergone three generations, with the third generation’s performance improved by 48 times over the first generation. They are currently developing a three-camera solution, but in the experimental stage, it can only run algorithms using three EyeQ3 chips. The EyeQ4 chip they are developing can process data from three cameras simultaneously.

Lastly, the angle of the lens, effective recognition distance, and resolution are mutually contradictory. For example, the ADAS system requires good longitudinal visibility, low pixel count, and high sensitivity for the camera. Su Shuping also specifically mentioned that ADAS conflicts with dashcams because dashcams require a wide angle and much higher pixel counts (even if only 2 million pixels).

Finally, there are the most basic requirements for hardware reliability and robustness. As an OEM product, it must also meet the strict technical and quality requirements of the main engine manufacturers.

Mobileye’s FCW (Forward Collision Warning) algorithm recognition accuracy has now reached 99.99%. For the ADAS industry, this is a height that is difficult for other products to reach, as even a difference between 99.9% and 99.99% is a significant concept.

Having entered the ADAS industry early, Mobileye has collaborated with over 20 OEMs, covering 237 models. For ADAS teams that have only started in the past two to three years, many choose to avoid direct competition with Mobileye and instead opt to enter a specific niche or lower-end market, which is also a wise approach.

Introducing the EyeQ Visual Processing Chip

The EyeQ visual processing chip was jointly developed by Mobileye and STMicroelectronics (one of the world’s largest semiconductor companies). In 2015, Mobileye released the fourth generation ADAS visual processor EyeQ4, with related products expected to be applied to new models starting in 2018.

It is worth mentioning the S-CAM series cameras produced by TRW that use EyeQ processors. TRW, the automotive group (TRW Automotive Holdings Corp.), is a leading global supplier of automotive safety systems and one of the world’s top ten automotive parts suppliers.

The S-Cam2 series has already earned TRW significant business share, while the S-CAM 3 (using EyeQ 3) has six times the processing power of the second generation. The S-CAM 3 was first showcased at the 2013 Frankfurt Motor Show, offering a broader vertical and horizontal field of view (from the previous generation’s horizontal 42°, vertical 27° to horizontal 52°, vertical 39°) and improved imaging clarity (from 752×480 to 1280×960). In October 2014, TRW released the latest generation of onboard camera systems, the S-Cam4 series, with the new generation of single-lens cameras expected to be produced in 2018.

Last year, the company released the latest fourth-generation system chip EyeQ4. With over 15 years of expertise in designing and developing specialized chips for computer vision, the EyeQ4 chip features 14 computing cores, ten of which are custom vector accelerators, significantly enhancing visual processing and data interpretation performance.

EyeQ4

The EyeQ4 series products have already attracted the attention of a globally renowned European automotive manufacturer, with related products expected to be applied to new models starting in 2018. The EyeQ4 chip is an essential component of scalable camera systems and will not only be featured in collision avoidance systems for monocular image processing to meet the requirements of European New Car Assessment Program (NCAP), National Highway Traffic Safety Administration (NHTSA), and regulations in other regions, but will also be used in tri-focal camera structures to fulfill some high-end customer demands, such as semi-autonomous driving functions. The EyeQ4 chip can seamlessly integrate with radar sensors and laser scanning beams, providing users with a more advanced service experience.

Mobileye representatives revealed that this new product could provide strong support for future autonomous driving, as they believe that building autonomous driving systems centered around cameras is a very practical solution, since cameras can provide the richest information resources at the lowest cost.

To make advanced features for autonomous vehicles affordable for the general public, it requires the basic processor unit to process images from multiple cameras simultaneously and accurately extract the most critical data from each camera, such as the positions of various surrounding objects and lane information. The first-generation chip product EyeQ1 began development in 2004, and now the fourth generation EyeQ4 chip has been developed, allowing Mobileye to accumulate a wealth of advanced knowledge and valuable experience in computer vision processing, effectively optimizing chip architecture to consume only 2 to 3 watts of energy while completing intensive computational processing.

In addition to hardware, Mobileye also has two significant advantages that leave competitors like Bosch and Continental far behind. First, Mobileye has retained verification data from past product sales in its database, with mileage exceeding 7 million kilometers.

Second, the database not only has a vast scale but also contains precise data from global OEMs.

These factors place Mobileye at the top of the ADAS hierarchy.

How Domestic ADAS Can Break Through

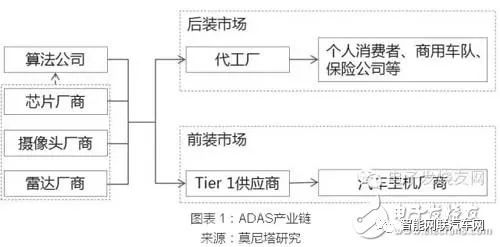

According to a report by Monita, a research and business information company under Caixin Think Tank:

The breakthrough for domestic ADAS localization lies in a few algorithm companies.

Monocular ADAS cameras can be domestically produced, but with low added value; chips are mostly supplied by foreign manufacturers, and domestic chip manufacturers still have relatively weak design and manufacturing capabilities. A few algorithm companies that focus on ADAS system development have longer algorithm accumulation compared to Tier 1 and complete vehicle manufacturers, making them the most likely to achieve ADAS localization.

At the same time, ADAS and traditional vehicle-mounted visual products have different software technology and hardware requirements, making it not easy for traditional vehicle electronics companies to enter the ADAS market. Among those claiming to have algorithms for driving assistance, some can only produce dashcams, 360° panoramic parking products, etc., and are not true ADAS. The technical foundation of ADAS is computer vision, which vehicle-mounted camera products do not require. We estimate that domestic teams starting from scratch will need at least 3 to 4 years to complete the initial technical accumulation.

On the other hand, the requirements for cameras in dashcams and monocular visual ADAS are contradictory, hence dashcams with ADAS functions usually can only serve as recording devices. Unless such companies recruit key teams, it is difficult to directly enter the ADAS field.

Chart 2: Screenshot of Smart Dashcam Video (Jilu Ke), Camera is Wide Angle

Source: Baidu, Monita Research

Chart 3: Screenshot of ADAS Road Test Video (Mobileye), Camera is Not Wide Angle

Source: Mobileye, Monita Research

There are only a few algorithm companies in China that possess independent technology. Among the companies claiming to be able to do ADAS, after excluding those that only produce “smart” dashcams, 360° surround view products, reversing cameras, etc., there are fewer than 15 remaining. If we delve into algorithm levels, there may be even fewer.

Chart 4: Major Domestic ADAS Algorithm Companies

Source: Monita Research

Additionally, Monita Research believes that the gap between domestic algorithm companies and Mobileye in basic ADAS functions is not significant.

As an industry benchmark, Mobileye’s vehicle and lane line recognition rates can reach 99.99%. Among the domestic algorithm companies that have provided data, the leading team has a vehicle recognition rate of 99%, which is lower than that of Mobileye, but its lane line recognition rate has surpassed Mobileye, reaching 99.999%. Other teams’ recognition rates are also around 95%.

Chart 5: Mobileye is Still Leading in Vehicle and Lane Recognition Rates, But the Leading Domestic Team is Close Behind

Source: Internet, Monita Research

However, recognition rates can only serve as qualitative comparisons, and algorithm differences cannot be judged by a single metric. There are three reasons for this:

1) Currently, there is no authoritative third-party testing agency, and the data provided by different teams is not obtained under the same testing conditions.

2) The actual performance may be compromised in adverse environments (rain, snow, night), and different algorithms may have varying degrees of discount in such conditions.

3) Whether for lane line recognition or vehicle detection, recognition rates are not a comprehensive metric; pursuing a single metric to the extreme may diminish its practical value, and factors such as false positive rates and response times should also be considered.

They also believe that the localization of ADAS may progress faster than expected.

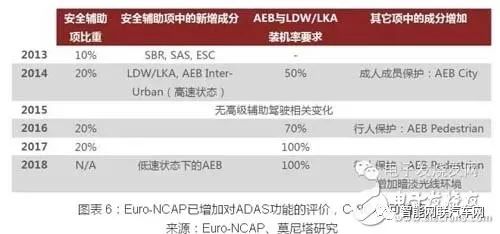

In terms of policy, the new version of C-NCAP in China has determined that AEB will be included in evaluations, which will be announced in mid-2017 and come into effect in mid-2018. Therefore, automotive manufacturers’ procurement of ADAS systems may start to increase in the coming one to two years.

In terms of price, Mobileye can provide chips capable of AEB and LDW functions for only $200, which will not be a barrier to promotion.

In terms of technology, domestic teams can achieve basic ADAS functions meeting OEM requirements within 1-2 years. Domestic startups, after two to three years of technical accumulation, are now gradually reaching the stage of demonstrating demos to manufacturers.

Chart 6: Euro-NCAP has Increased Evaluation of ADAS Functions, C-NCAP Can Learn from This

Source: Euro-NCAP, Monita Research

In their view, the development progress of the front and aftermarket markets may not differ significantly in the next two years.

Entering the front market early is beneficial for algorithm companies to continuously provide automotive manufacturers with products that upgrade functions, accelerating the speed of product transition from demo to mass production, increasing recognition in the aftermarket, and helping algorithm companies develop aftermarket products for similar models based on their front systems, enhancing product segmentation. The main obstacles lie in algorithm technology and mass production experience.

Chart 7: Mobileye Front Products (Ford Explorer Using Processor)

Source: Internet, Monita Research

The aftermarket market is larger in scale, with many potential segments, and algorithm companies can also obtain cash flow from the aftermarket. However, more products and consumer education are needed to open up the market. Currently, the maturity of domestic aftermarket ADAS products is low, mainly reflected in the few products on the market and low segmentation. At the same time, consumers generally have little understanding of ADAS or have misconceptions (thinking it is just a high-end version of a dashcam), so launching aftermarket ADAS requires further consumer education.

Chart 8: Aftermarket Products (Top – Mobileye 560, Bottom – Driver Guardian A1)

Source: Internet, Monita Research

Considering the driving forces and obstacles for market development, there is no single path with the least resistance. The development progress of the front and aftermarket markets may not differ significantly in the next two years. Although algorithm companies appear to be rushing into the front market, based on recent communications with these algorithm companies, they are also aware of the importance of the aftermarket. From the necessity and development obstacles of the two markets, startup companies may pursue both paths if conditions such as funding allow.

The difference may lie in the fact that the requirements of the front market are relatively clear, with automotive manufacturers having explicit technical qualification requirements, while the aftermarket lacks actual trial products, and there is little understanding of consumer psychology, making the temperament of the consumer electronics market less predictable than that of automotive manufacturers.

Monita estimates that by 2020, the sales revenue of front monocular ADAS may reach 6.9 billion yuan, and the total sales revenue of the front market from 2016 to 2020 may reach 16.7 billion yuan, while the total sales revenue of the aftermarket may reach 40.1 billion yuan. In the total sales revenue of 56.8 billion yuan from the front and aftermarket markets over five years, chip costs account for about 6%, and camera costs about 14%. The remaining 45.4 billion yuan will be divided among algorithm companies, Tier 1, and other hardware suppliers, with the profit distribution ratio between algorithm companies and Tier 1 determined by mutual negotiation.