Click the “blue words” above to follow us!

A gyroscope is an angular motion detection device, alongside an accelerometer as one of the two core components of an inertial navigation system. After several generations of effort by “gyroscope experts”, China has developed its gyroscope technology from scratch, gradually breaking through foreign technological blockades, and now possesses strong independent R&D capabilities, providing key technological support for the development of aerospace, aviation, maritime affairs, weaponry, and high-end industrial manufacturing.

01

What is a Gyroscope

1. Core Component of Inertial Navigation Systems

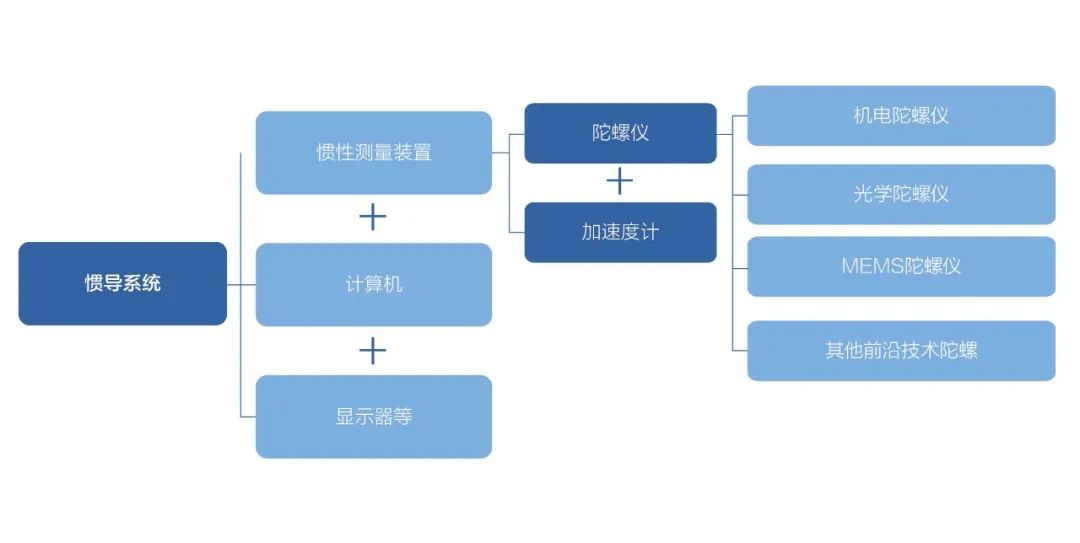

Inertial navigation is a self-contained navigation positioning technology that does not rely on external navigation information. Its basic working principle is to calculate the position information of the carrier by measuring linear acceleration and angular velocity, thereby achieving positioning and navigation. Because it does not radiate energy externally and does not rely on external information, it can operate independently without interacting with the outside world. This gives inertial navigation advantages over satellite navigation, such as independence from external information, good concealment, strong radiation resistance, and all-weather capability, and it is usually used in conjunction with satellite navigation. The gyroscope, as one of the two core components in the inertial navigation system, is used to measure the carrier’s sensitive angular velocity and angular deviation. Typically, each inertial measurement unit (IMU) contains three sets of gyroscopes, corresponding to measurements of angular motion data in three degrees of freedom, used for superimposing calculations of initial speed and position to determine the direction and rate of motion of an object in space, ultimately achieving navigation functionality.

2. Generations of Gyroscopes

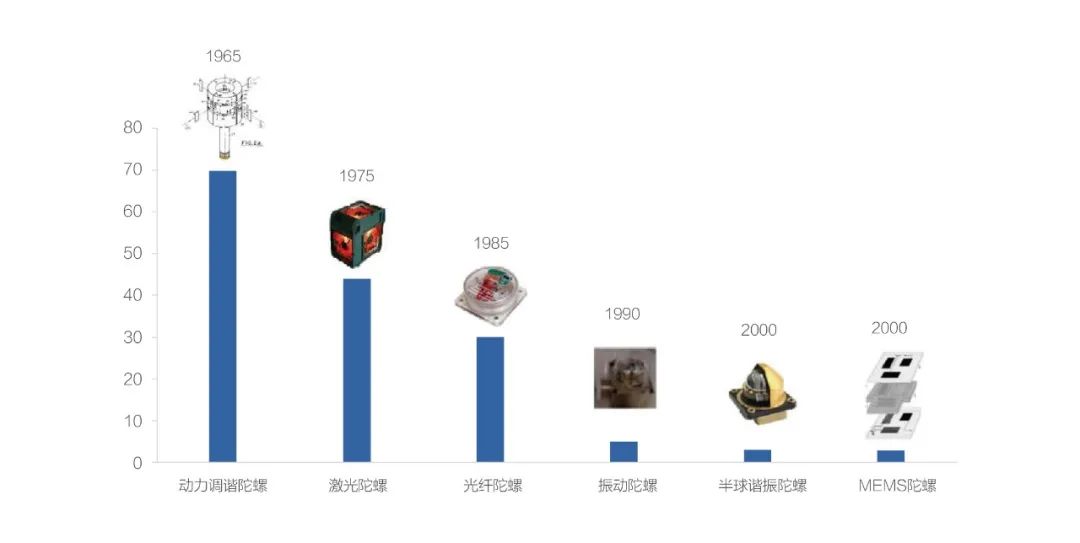

Traditionally, gyroscopes follow Newton’s classical mechanics. With the development of laser technology and microelectronics, various gyroscopes have been developed based on different measurement principles with varying measurement accuracies. Gyroscopes can be broadly divided into four generations based on their measurement principles and invention order.

The first generation, based on Newton’s classical mechanics, includes electromechanical gyroscopes that use the gyroscopic torque generated by rotor rotation or carrier vibration to measure angular motion. Typical representatives include liquid floating gyroscopes, electrostatic gyroscopes, and dynamically tuned gyroscopes.

The second generation consists of optical gyroscopes based on the Sagnac effect, primarily including laser gyroscopes and fiber optic gyroscopes. Laser gyroscopes measure rotational angular velocity using the difference in optical path length of laser beams, with two beams of light traveling clockwise and counterclockwise in a closed light path interfering with each other. By detecting the movement of interference fringes, the rotational angular velocity can be measured. Fiber optic gyroscopes calculate the angular velocity of an object by detecting the phase difference between two laser beams that rotate in opposite directions in a fiber optic loop.

|

(Ring) Laser Gyroscope |

Fiber Optic Gyroscope |

|

|

|

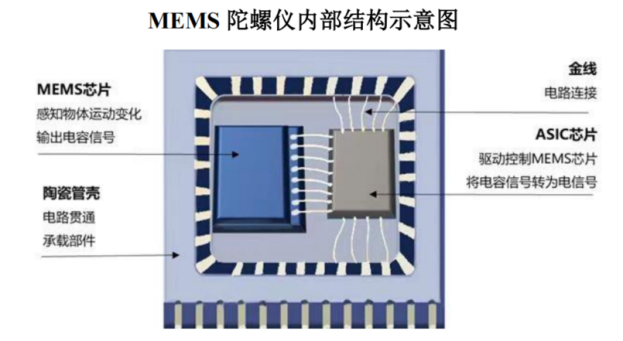

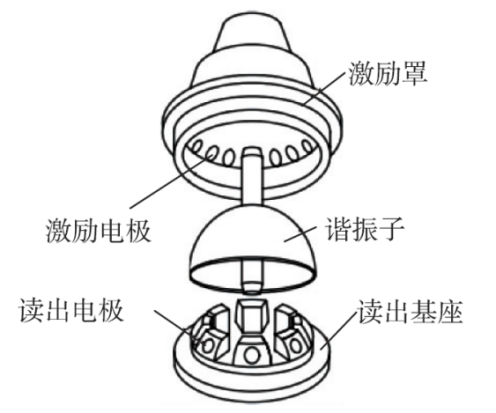

The third generation includes vibrating gyroscopes based on the Coriolis effect and micro-nano technology, mainly comprising hemispherical resonant gyroscopes and MEMS gyroscopes. MEMS gyroscopes, also known as silicon micro-gyroscopes, integrate mechanical devices and electronic circuits on a tiny silicon chip using micro-nano technology, detecting angular velocity through the Coriolis acceleration effect on vibrating mechanical components. The working principle of the hemispherical resonant gyroscope is based on the Coriolis effect generated when a vibrating resonator rotates around its axis of symmetry, causing the resonator to vibrate slightly under electrostatic excitation, which in turn generates precession effects, with the overall rotational angle signal obtained through electrode detection and mathematical demodulation.

|

MEMS Gyroscope |

Hemispherical Resonant Gyroscope |

|

|

|

The fourth generation is based on micro-electromechanical and quantum technology. Typical representatives include nuclear magnetic resonance gyroscopes and atomic interferometric gyroscopes. Their goal is to achieve high precision, high reliability, miniaturization, and wider application fields for navigation systems, and they are still in the early research stage.

02

Applications of Gyroscopes

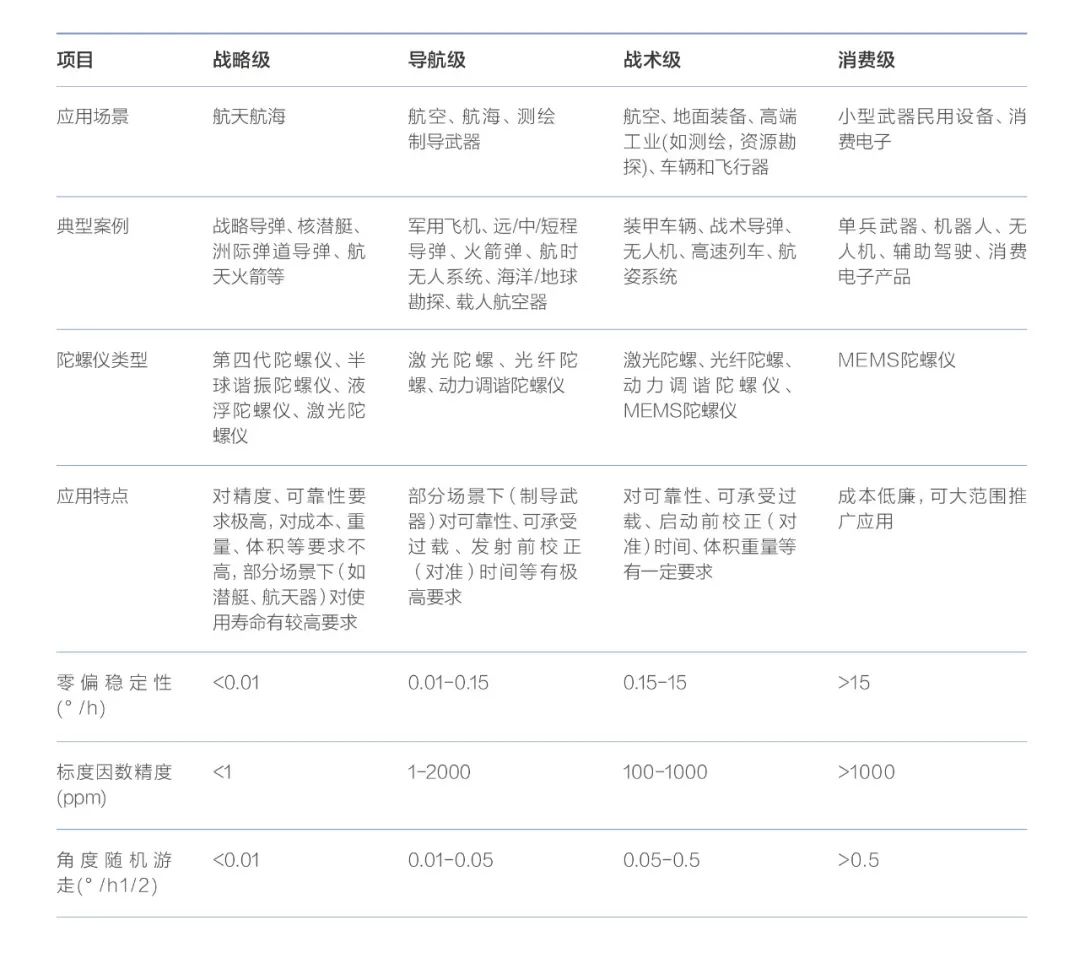

The main accuracy indicators for gyroscopes include systematic drift rate (system error, which can be compensated by software), random drift rate (random error), and zero bias stability. The smaller the values, the higher the accuracy level, among which zero bias stability is the most critical indicator, used to measure the degree of dispersion of the gyroscope output value around its mean when the input angular velocity is zero during a working cycle. Based on different zero bias stability, gyroscopes can be categorized into consumer-grade, tactical-grade, navigation-grade, and strategic-grade, with progressively higher accuracy requirements. Currently, the gyroscopes widely used in the market mainly include fiber optic gyroscopes, laser gyroscopes, and MEMS gyroscopes, where optical gyroscopes are mainly suitable for strategic, navigation, and strategic-grade applications, while MEMS gyroscopes are mainly suitable for consumer and tactical-grade applications.

The first generation electromechanical gyroscopes are characterized by high precision but large volume, complex system structure, high cost, and short lifespan. Liquid floating gyroscopes and electrostatic gyroscopes were replaced by optical gyroscopes in the 1980s and are currently used only in a few high-precision military applications; dynamically tuned gyroscopes have a relatively simple structure, moderate precision, and lower cost, and are still used in the field of miniaturized guided weapons.

The second generation optical gyroscope technology is mature, with high precision and strong reliability. With product iterations, optical gyroscopes and their systems have covered tactical-grade, navigation-grade, and strategic-grade applications, being used in large quantities across multiple fields including land, sea, air, and space, but due to their high cost and large volume, they are somewhat limited in consumer-grade applications. Laser gyroscopes have higher precision and cost, long working life, and good environmental adaptability, but they exhibit lock-in phenomena (insensitivity to angular velocity signals below a certain threshold) and are larger in size and weight, making them more suitable for navigation-grade applications; compared to laser gyroscopes, fiber optic gyroscopes do not require precision machining of optical cavities, have lower precision and cost, do not exhibit lock-in phenomena, but are more susceptible to thermal expansion and contraction caused by temperature changes and tension changes when coiled, resulting in poorer environmental adaptability, making them more suitable for tactical-grade applications.

The third generation MEMS gyroscopes are characterized by small size, light weight, strong environmental adaptability, low cost, and ease of mass production, and have been extensively applied in automotive and consumer electronics. With further performance improvements, MEMS gyroscope applications have also expanded to industrial and aerospace fields. The hemispherical resonant gyroscope is a high-precision gyroscope among Coriolis vibrating gyroscopes, gradually being applied in aerospace, aviation, and maritime fields, but due to structural and manufacturing technology limitations, there are very few companies capable of large-scale production on the market.

The fourth generation gyroscopes are still in the research stage, with theoretical precision levels being very high, suitable for strategic-grade applications.

03

Gyroscope Industry Analysis

1. Industry Chain Analysis

The upstream of optical gyroscopes mainly includes suppliers of electronic components, optical devices, structural parts, and processing equipment. Among them, the core upstream for fiber optic gyroscopes is optical devices (fiber optic rings and Y-waveguide phase modulators) suppliers; the core upstream for laser gyroscopes includes laser, main control circuit board, testing, and processing equipment suppliers; the upstream of MEMS gyroscopes mainly includes suppliers of MEMS wafers, ASIC wafers, semiconductor equipment, and packaging services; the core upstream for hemispherical resonant gyroscopes mainly includes suppliers of quartz resonators, ultra-low expansion alloys, and other metal materials, as well as precision processing equipment suppliers. As of now, a mature supply system has not yet formed domestically.

The midstream mainly consists of various gyroscope manufacturers, with European and American manufacturers holding a leading technological position. In terms of domestic manufacturers, there are many mid-low precision fiber optic gyroscope and MEMS gyroscope manufacturers; laser gyroscopes are mainly concentrated in state-owned military units, with few private enterprises; there are currently no mass production manufacturers for hemispherical resonant gyroscopes, with most still in the R&D stage.

The downstream primarily consists of inertial module, system development, and integrators, specifically divided into military inertial systems and civilian inertial systems. Military inertial systems are mainly occupied by domestic military background system integrators, with a low degree of marketization, including the aviation field (military aircraft), precision guidance field (missiles, precision-guided bombs, and underwater guided weapons), aerospace, maritime, and land equipment, with major integrators including AVIC 618 Institute, Aerospace 9th Academy’s Aerospace Electronics, Engineering Navigation, Weapon Control Institute, and Aerospace 7th and 4th Academies, etc.; civilian inertial systems are mainly concentrated in high-end industrial and consumer electronics, specifically including drones (providing precise speed, position, attitude information), intelligent driving (outputting vehicle motion parameters at high frequency at any moment), oil exploration (oil inclination instruments), mobile communication—dynamic communication (automatically controlling antennas to accurately point to satellites while vehicles are in motion), and high-speed rail (track inspection vehicles). Considering cost and accuracy requirements, the civilian market mainly consists of fiber optic and MEMS inertial integrators.

2. Market Scale

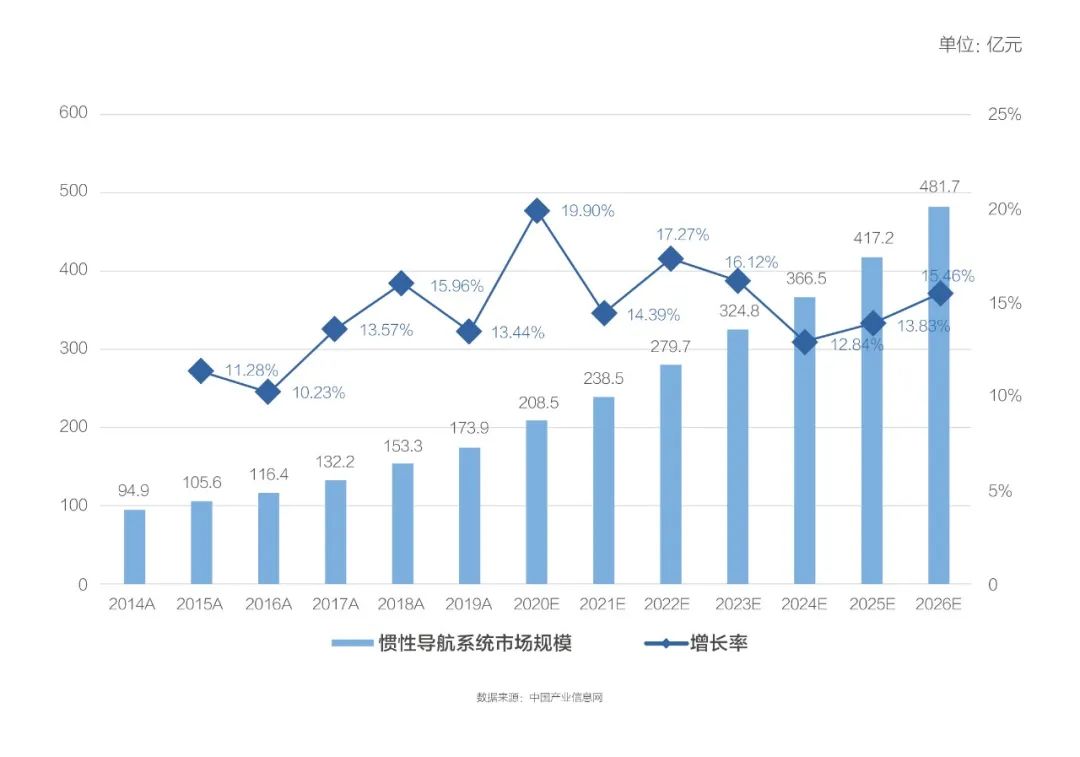

In 2022, the global inertial navigation system market size grew from $11.166 billion in 2016 to $19.588 billion, with an expected market expansion to $25.7 billion by 2026. In 2022, the US inertial navigation system market accounted for 27.74% of the global market, the EU market accounted for 22.42%, and China accounted for 20.09%. China’s inertial navigation systems are mainly applied in military fields, with a 74.1% share in the military sector in 2023, but there is a gradually expanding trend in the civilian sector. The following chart shows the statistics and forecasts of China’s inertial navigation market size from 2014 to 2026:

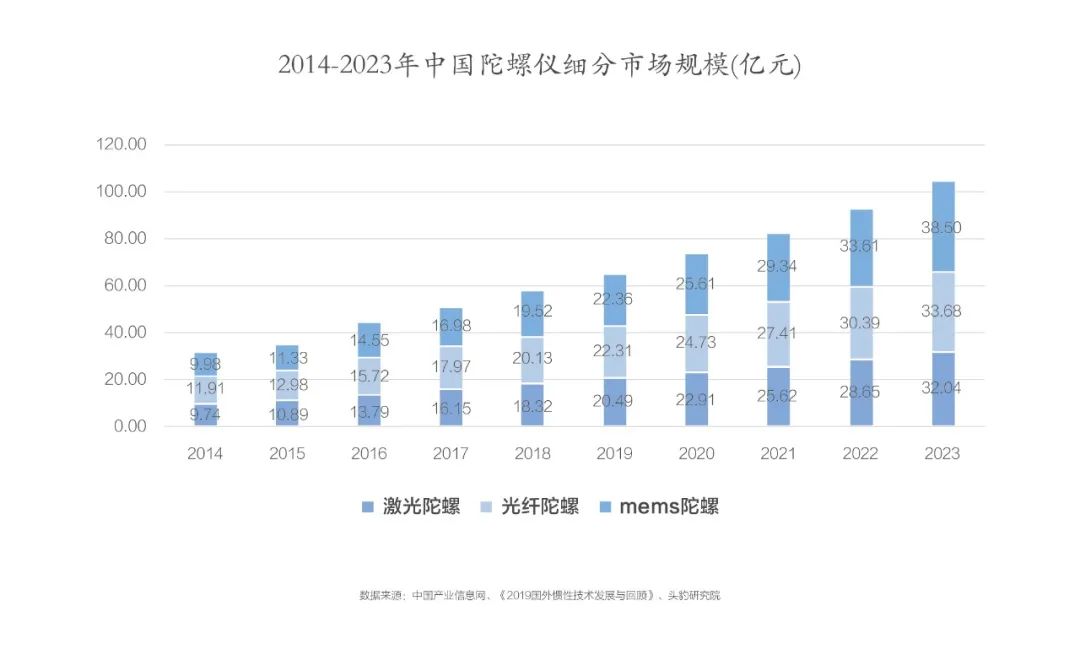

Against the backdrop of stable growth in national defense spending, driven by the rapid development of the low-altitude economy, intelligent driving, and high-end industry in civilian sectors, the demand for gyroscopes in both military and civilian markets is steadily increasing, especially for miniaturized, low-cost, medium-high precision gyroscopes. In 2023, the market size for laser inertial navigation systems in China reached 9.619 billion yuan, fiber optic inertial navigation systems reached 10.105 billion yuan, and MEMS and other systems reached 11.55 billion yuan. The price of gyroscopes accounts for about 30%-40% of the price of inertial navigation systems, calculated at 33%, the following statistics show the segmented market size of domestic gyroscopes from 2014 to 2023:

3. Competitive Landscape

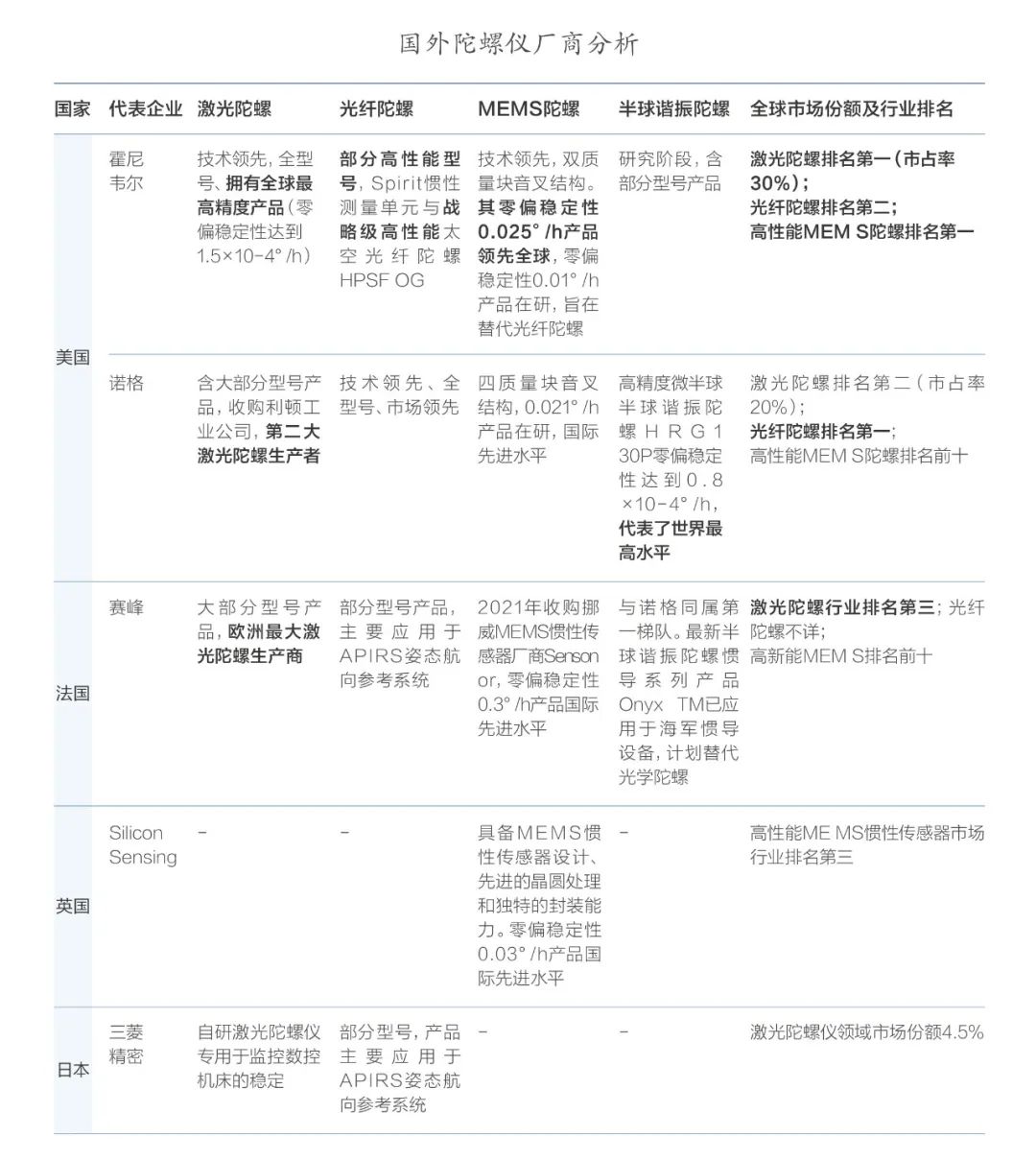

(1) Foreign Competitor Analysis

The US, France, and the UK have been researching inertial technologies such as gyroscopes for over a century, dating back to the 1850s when French scientist Foucault successfully developed the world’s first Foucault gyroscope. In the 1950s, the US Draper Laboratory developed the first liquid floating gyroscope that met inertial-grade requirements, representing the most advanced gyroscope development technology currently. Major manufacturers include Honeywell (US), Northrop Grumman (US), and Safran (France), along with companies like Analog Devices (US) and Silicon Sensing (UK-Japan joint venture).

Japan developed high-precision fiber optic gyroscopes in the 1980s (NEC Corporation) and quickly began commercial production with assistance from the US and UK, representing the second tier of current gyroscope development technology alongside Russia and Germany, with major companies including Silicon Sensing (UK-Japan joint venture), Mitsubishi Precision (Japan), and Polyus (Russia).

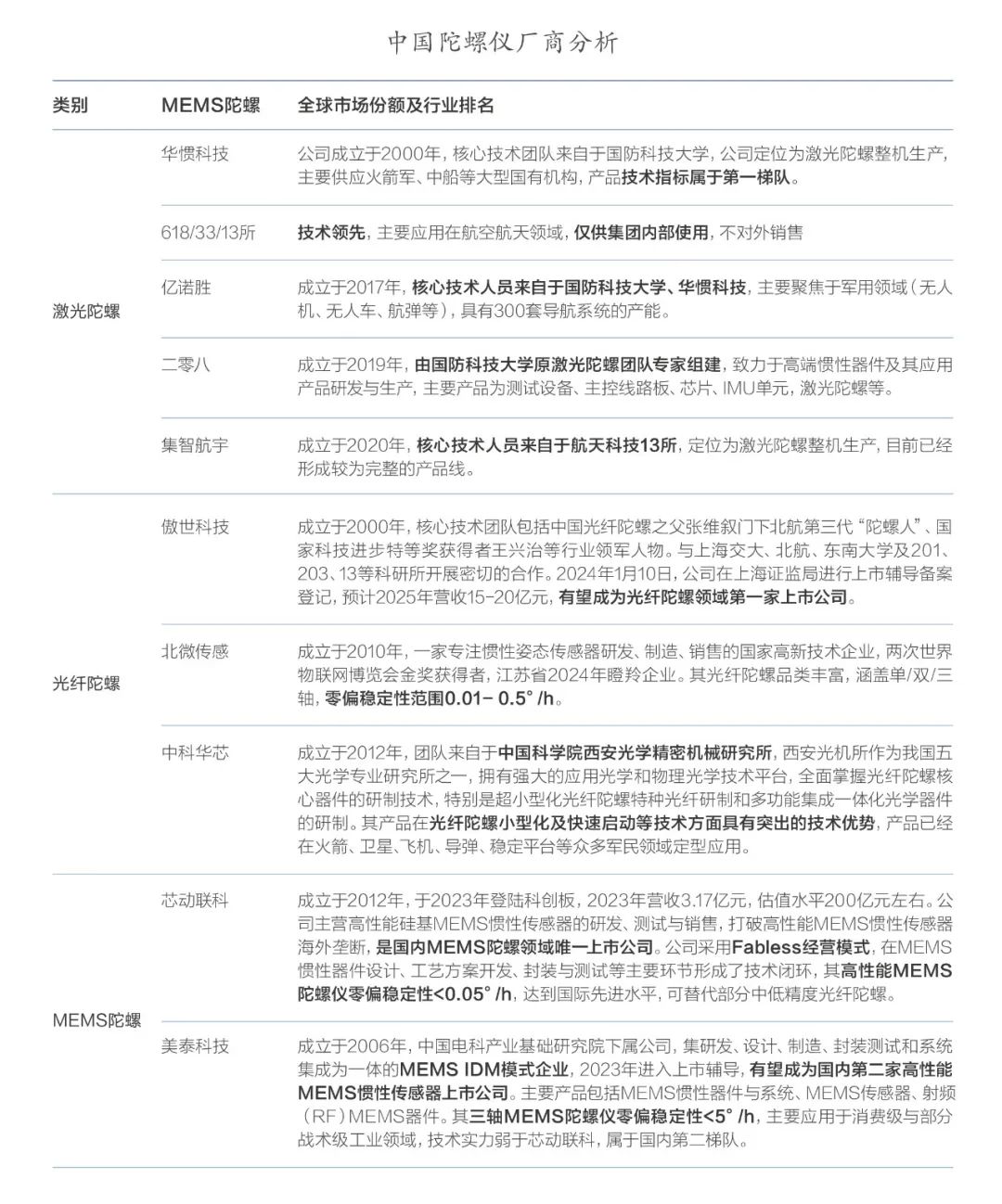

(2) Domestic Competitor Analysis

In the 1980s, Professor Zhang Weixu from Beijing University of Aeronautics and Astronautics was the first to conduct research on fiber optic gyroscopes; in 1994, Professor Gao Bolong from the National University of Defense Technology developed China’s first laser gyroscope, making China the fourth country to independently develop laser gyroscopes and marking the beginning of the industrialization of optical gyroscopes. The domestic gyroscope research started relatively late and has been restricted by technical blockades and export controls from European and American countries. After the efforts of three generations of “gyroscope experts”, the domestic gyroscope development technology has risen to the third tier.

The technology for domestic laser gyroscopes comes from Russia and the National University of Defense Technology, primarily developed and produced by state-owned enterprises, including AVIC 618 Institute, Aerospace Science and Industry Corporation 33rd Institute, Aerospace Science and Technology Corporation 13th Institute, and Huaguan Technology (National University of Defense Technology), etc. Except for Huaguan Technology, which is state-controlled, most are for internal use only, with the main models being 50/70/90/120/150 models. Private enterprises are mainly derived from personnel with backgrounds in state-owned enterprises or the National University of Defense Technology, including 208, Innosense, and Jizhi Aerospace. Few private enterprises currently have mass production capabilities, producing mainly 30/50/70 models, capable of selling to the military market and partially replacing civilian fiber optic gyroscopes.

Domestic mid-low precision fiber optic gyroscope technology has matured, and the market is relatively saturated. However, there is still a significant gap in (ultra) high-precision fiber optic gyroscope technology compared to foreign countries. Institutions involved in related technology research include Beihang University, Beijing Institute of Technology, Aerospace Group 33rd Institute, Shanghai 803rd Institute, and the National University of Defense Technology; in addition to research institutions, large inertial system integrators and specialized gyroscope manufacturers are also actively cooperating in product R&D, with major inertial system companies including Times Optical, AVIC Jierui, StarNet Yuda, and Engineering Navigation, while core fiber optic gyroscope manufacturers include Shanghai Aoshi Technology, Beimi Sensing, and Zhongke Huaxin.

Domestic manufacturers have rapidly developed high-performance MEMS gyroscopes based on semiconductor industry accumulation, gradually narrowing the gap with overseas manufacturers. Major manufacturers include Xindong Lian Technology and Meitai Technology, among which some high-performance products have reached international advanced levels and can achieve tactical-grade applications.

Domestic hemispherical resonant gyroscope technology is significantly behind that of foreign countries, with the 26th Research Institute of China Electronics Technology Group developing the first batch of prototypes in 2002. Other research institutions include Aerospace 803rd Institute, China Shipbuilding Industry Corporation 707th Institute, and the National University of Defense Technology. Except for a few research institutions capable of small batch production, there are almost no private enterprises with mass production capabilities, with most still in early R&D stages, including Jingxie Technology, Zhongke Hangxin, and 208 Technology.

The self-research capabilities of gyroscopes in other countries are limited, with countries like South Korea, India, Brazil, and Switzerland having certain research capabilities but still having a significant gap compared to domestic capabilities.

04

Investment Recommendations

The inertial navigation industry is a high-tech and strategic emerging industry that integrates new-generation information technology with high-end equipment manufacturing. The core inertial sensor manufacturing technology is one of the important core general technologies in the defense industry, with extensive applications in both military and civilian fields. Although there have been rapid advancements in domestic gyroscope manufacturing technology in recent years, companies like Honeywell, Northrop Grumman, and Safran firmly dominate the global market, leading the world in the research of high-performance gyroscopes and advanced gyroscopes, with a pressing need for domestic alternatives across various types of gyroscopes. With the stimulation of emerging downstream industries such as low-altitude economy, intelligent driving, and industrial IoT, the civilian market for gyroscopes is expected to experience rapid growth. Attention should be paid to the following four aspects:

(1) The trend of domestic substitution, focusing on existing gyroscopes, especially the substitution of high-performance gyroscopes for foreign products, with typical representative manufacturers being Xindong Lian Technology.

(2) The trend of high precision, (micro) miniaturization, and low-cost gyroscopes, mainly focusing on small laser gyroscopes like the 30 models for commercialization, achieving replacement for some mid-low precision fiber optic gyroscopes; attention should also be paid to the industrialization of high-performance miniaturized MEMS gyroscopes and their applications in tactical and navigation grades; and the industrialization of high-precision fiber optic gyroscopes, which have cost advantages over laser gyroscopes.

(3) The industrialization of hemispherical resonant gyroscopes and the research progress of fourth-generation nuclear magnetic resonance gyroscopes and atomic interferometric gyroscopes based on quantum technology. Hemispherical resonant gyroscopes have been deployed overseas and are considered by leading manufacturers to be the next-generation gyroscope technology with the potential to replace optical gyroscopes, with some domestic manufacturers already conducting R&D. The fourth-generation gyroscopes mainly focus on the research progress of leading foreign manufacturers and Beijing University of Aeronautics and Astronautics.

(4) Different types of gyroscopes have significantly different requirements for materials, design capabilities, processing and manufacturing, detection, and processing equipment. Domestic gyroscope technology mainly comes from various universities and research institutions. For investment targets, focus on the background of the team, distribution of core R&D capabilities, and supply chain conditions.

Internal Data Free Exchange

Previous Reviews

SiChuang Research | Low Altitude Economy and eVTOL: The Future of Urban Air Traffic

SiChuang Research | The Rise of Embodied Intelligence: A New Era of Autonomous Behavior in Robotics

SiChuang Research | The Development Trend of Magnetic Suspension Technology Industrialization

SiChuang Research | Quantum Technology Creates the “Future Engine” of New Quality Productivity

SiChuang Research | FPGA Welcomes Development “Chip” Opportunities

SiChuang Research | Sodium-Ion Batteries Enter the Fast Track of Industrialization

SiChuang Research | Drones Creating New Tracks in the Low Altitude Economy