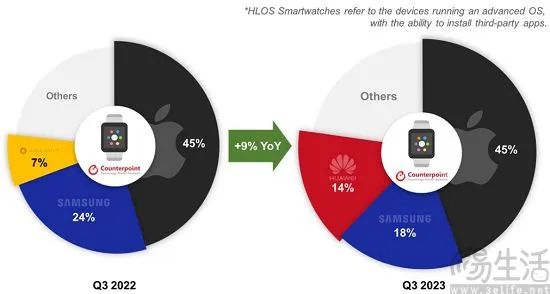

According to recent data released by research firm Counterpoint Research, global shipments of “HLOS” (high-level OS) smartwatches increased by 9% year-on-year in the third quarter of 2023. After experiencing a slowdown earlier this year, the smartwatch market regained growth momentum in the second quarter of 2023 and continued this trend into the third quarter.

Apple held a 45% market share, maintaining its position as the leader, while Samsung ranked second with an 18% market share. Apple achieved a historic high in shipments during this quarter, with a year-on-year increase of 7%, significantly driven by the second-generation Apple Watch SE. Analysts pointed out that the growth of fully smart watches in the domestic market has also contributed to the performance of these products in the global market.

The so-called HLOS smartwatches are essentially “fully smart watches,” which run on watchOS or are based on Wear OS, allowing users to freely install third-party applications. This rich functionality is one of the most significant features of these products. In contrast, basic smartwatches use a more “lightweight” operating system, which may come pre-installed with some applications, but due to the inability to install third-party applications, their usage scenarios are somewhat limited, leading many consumers to jokingly refer to them as “large fitness bands.”

In fact, fully smart watches have already become the mainstream in this market. For instance, the smartwatches from Apple and Samsung are not positioned for entry-level users. Particularly for Apple, its shipments account for nearly half of the market share. Even the lowest-priced Apple Watch SE is undoubtedly a fully smart watch. This market situation indicates that most users no longer consider price as the key factor in choosing a smartwatch; instead, they prioritize functionality and differentiation when making their purchasing decisions.

Counterpoint analysts noted that the smartwatch market has achieved year-on-year growth in the high-end segment for two consecutive quarters, particularly evident in the Chinese market.

The trend of high-end smartphones is already very evident, with average prices continuously rising. This is because more comprehensive functionalities can only be achieved with higher hardware configurations. This principle also applies to smartwatches. For example, after upgrading to the S9 SiP chip, the Apple Watch Ultra 2 and Apple Watch Series 9 have improved computing power and can now recognize subtle control gestures like “double-finger tapping” thanks to higher precision sensors.

While high-end smartwatches dominate the market, major manufacturers are also focusing on providing differentiated experiences and addressing user pain points. Notably, fully smart watches no longer highlight health and fitness monitoring as their main selling points. Instead, they are adding more features based on changes in users’ daily usage scenarios. For example, in response to the need for interaction with smart cars, some fully smart watches have partnered with relevant manufacturers to introduce features such as NFC car keys, seamless unlocking, and wrist-based vehicle control. Although the coverage of such features is still quite limited, these differentiated functionalities are clearly key to attracting users.

In fact, the product differentiation brought about by functionality may still be at a relatively “elementary” level. Currently, some fully smart watches are starting to improve user experience from the ground up. For instance, the Xiaomi Watch S3, equipped with HyperOS, focuses more on applications related to smart home integration. It is evident that HyperOS and information related to Xiaomi’s automotive products could potentially make it an important component of Xiaomi’s automotive ecosystem. Meanwhile, the vivo Watch 3, which uses BlueOS, currently focuses on interface and interaction optimization, but its emphasis is on AI large model empowerment, capable of breaking application and device boundaries to facilitate information flow and data sharing.

However, the rise and growth of fully smart watches do not mean that non-fully smart watches aimed at the entry-level market will quickly disappear. Still, their growth has undeniably slowed. According to previous data released by Counterpoint, the shipment volume of non-fully smart watches in the Indian market experienced rapid growth again in the third quarter of 2023, with Fire Boltt achieving the highest single-quarter shipment volume in history. Together with Noise and boAt, they have reached 35% of the global total shipment volume, maintaining growth for three consecutive quarters. However, analysts pointed out that despite these impressive results, the growth of non-fully smart watches in emerging markets has significantly slowed compared to before.

It is worth noting that the slowdown in the growth of non-fully smart watches does not indicate that the market is about to enter a downturn. Instead, it is a sign that this segment is entering the second half of the race, which may further encourage consumers to invest more budget in choosing feature-rich fully smart watch products. Since non-fully smart watches cannot install third-party applications, they may claim to be “smart,” but their actual usage scenarios are somewhat limited. For example, they cannot be used completely independently of smartphones, and various monitoring data still rely on mobile apps. Therefore, from a functional perspective, it is reasonable to regard them as “large fitness bands.”

For users, when budgets are limited, these relatively simple non-fully smart watches still hold certain appeal. Therefore, the current market trend towards stability actually indicates that it has reached a saturation point. In this context, the high homogeneity of user experiences with non-fully smart watches, combined with limited usage scenarios, will inevitably compel consumers to invest more budget in purchasing fully smart watches. It should also be noted that for consumer electronics, the products at the top of the “pyramid” are always the ones driving overall industry progress.

Currently, fully smart watches attract users by incorporating higher-spec sensors and more powerful chips, offering a richer set of features. As non-fully smart watches stabilize, fully smart watches are likely to benefit from this, indicating that competition in this market may become even more exciting in the future.

【Images in this article are sourced from the internet】Recommended Reading:

A versatile notebook priced at 5199 opens a path to becoming a “king”.

Shocking! Will e-commerce platforms really not lose money like this?

November Android phone performance ranking: Red Magic 9 Pro+ scores 218W to take first place.

October Android phone performance ranking: Snapdragon 8 Gen 3 enters the list for the first time with an average score close to 200W.