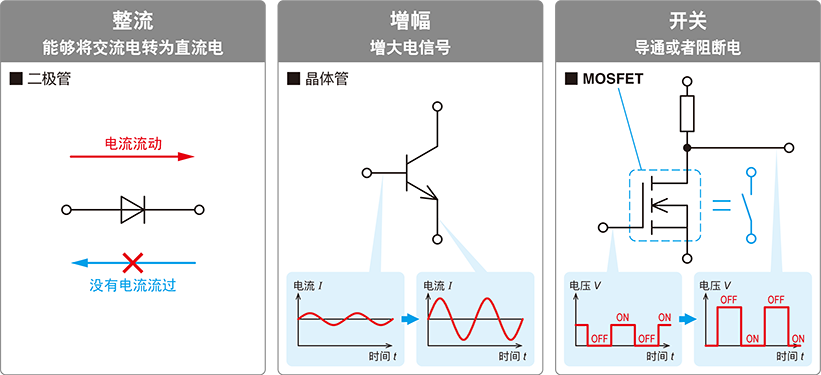

Power semiconductors are the core of energy conversion and circuit control in electronic devices, primarily serving functions such as power conversion, power amplification, power switching, circuit protection, inversion (DC to AC), and rectification (AC to DC). With the national push for energy substitution and energy-saving renovations, there is an urgent need for high-quality and high-efficiency electrical energy. Currently, most of the world’s electrical energy is processed through power semiconductors, and this proportion is expected to further increase.

Source: Fujitsu

Since the birth of power semiconductors, over seventy years of research and application have led to technological innovations in various aspects, including substrate iteration, structural design optimization, advanced packaging forms, and the application of large-size wafers. The main direction of evolution has been towards higher power density, smaller size, and lower power consumption and loss. The structural design is continuously improved to adapt to the needs of more application scenarios. According to Yole data, power semiconductor devices undergo product iteration every twenty years. Compared to other semiconductors, the iteration cycle is relatively slow, and each generation of chips has a longer lifecycle.

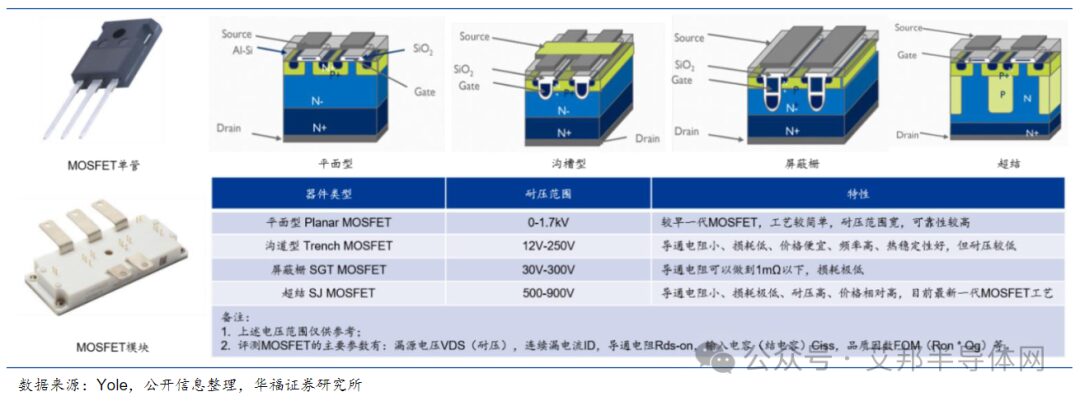

As of today, power semiconductors have a solid domestic industrial chain foundation and relatively mature technology. Low-to-mid-end domestic power semiconductor products have formed a scale and localization, shifting from dependence on imports to self-sufficiency. In the mid-to-high-end fields, such as SGT MOSFETs, SJ MOSFETs, IGBTs, and compound semiconductors, domestic manufacturers are still following the technology development routes of overseas manufacturers due to late starts, high design thresholds, relatively complex processes, and a lack of verification opportunities.

1. Market Size Analysis

The market size of power semiconductors accounts for 8%-10% of the global semiconductor industry, with a stable structural proportion. Since power semiconductor devices are used in almost all electronic manufacturing industries, including computers, network communications, consumer electronics, automotive electronics, and industrial electronics, the rapid development of emerging application areas such as new energy vehicles/charging piles, data centers, wind and solar power generation, energy storage, intelligent equipment manufacturing, robotics, and 5G communications has also driven the growth of the power device market. Therefore, the industry experiences weak cyclical fluctuations, and the global power semiconductor market size is steadily increasing.

According to Omida’s data and forecasts, the global power semiconductor market size will reach 50.3 billion USD in 2023, and it is expected to grow to 52.2 billion USD in 2024, reaching 59.6 billion USD by 2027, with the power IC market accounting for 54.8%, power discrete devices for 30.1%, and power modules for 15.1%.

As the world’s largest consumer of power semiconductors, China accounts for about one-third of the global market, expected to reach 20.6 billion USD in 2024, which is about 39% of the global market, indicating a promising future market development.

2. Product Category Analysis

Power semiconductors can be divided into power discrete devices, power ICs (Integrated Circuits), and power modules. Power discrete devices are the core components for processing electrical energy (power) and act as a bridge between weak current control and strong current operation, mainly consisting of diodes, thyristors, and transistors. Power ICs are products of the integration of power electronic devices technology with microelectronics technology, integrating power devices and their drive circuits, protection circuits, and interface circuits into one or several chips, including AC-AC transformers, AC-DC rectifiers, DC-AC inverters, and DC-DC voltage regulators. Power modules are packaged modules formed by combining power devices according to specific functions.

Among power discrete devices, MOSFETs, IGBTs, and SiC MOSFETs represent a strong demand for power devices, with the market size as follows:

➤MOSFET

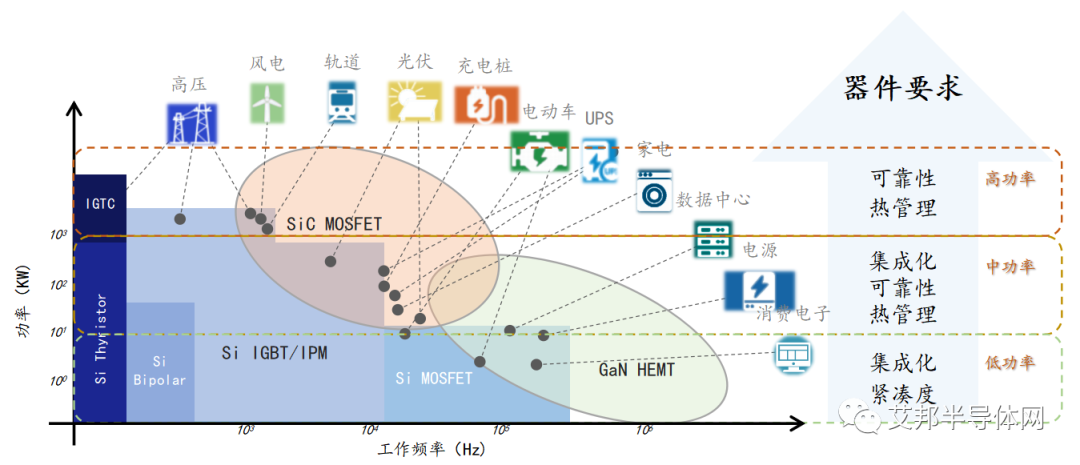

MOSFETs have advantages such as fast switching speed, high input impedance, low on-resistance, ease of driving, and good thermal stability, making them suitable for low current and low voltage conditions, as well as for large current switching circuits and high-frequency circuits, with a wide range of application scenarios.

Data source: Yole, public information compilation, Huafu Securities Research Institute

As MOSFET technology and processes continue to mature, costs will gradually decrease. Mid-to-high-end products will also gradually penetrate into the mid-to-low-end market. For example, Trench MOSFETs will move from mid-range to mid-low range, replacing part of the low-end market of planar MOSFETs. SGT MOSFETs will partially replace Trench MOSFETs in low-voltage applications, moving from mid-to-high-end to mid-range. SGT MOSFETs, SJ MOSFETs, and silicon carbide MOSFETs are likely to be the three main products of MOSFETs in the future. Since the advent of MOSFETs in the 1970s, the technology has evolved from planar MOSFETs to Trench MOSFETs, then to SGT MOSFETs and SJ MOSFETs, and now to the hot third-generation wide bandgap MOSFETs (silicon carbide, gallium nitride). The technological iteration direction of power MOSFETs mainly revolves around process, design (structural changes), process optimization, and material changes to achieve high performance—high frequency, high power, and low loss.

According to WSTS statistics, the global MOSFET market size in 2023 is 14.3 billion USD, and it is expected to grow to 16 billion USD by 2026; the Chinese MOSFET market size in 2023 is about 5.1 billion USD, accounting for 36% of the global market. It is expected that the Chinese MOSFET market size will grow to 5.76 billion USD by 2026, with a growth rate higher than the global market growth rate. The proportion of high-voltage MOSFET products has increased from 29% in 2020 to 36%, with a compound annual growth rate of 8.1%.

➤IGBT

IGBTs are core components of energy conversion and transmission, capable of continuous operation at higher voltages, featuring high input impedance, low conduction voltage drop, small drive power, and lower saturation voltage, resulting in greater power gain. They are widely used in conversion systems with DC voltages of 600V and above.

Data source: Infineon, public information compilation, Huafu Securities Research Institute

According to WSTS data, the global IGBT market size reached 9 billion USD in 2023, and it is expected to reach 12.1 billion USD by 2026. China is the largest consumer market for IGBTs globally, with a market size of 3.2 billion USD in 2023, and it is expected to reach 4.2 billion USD by 2026.

➤Third Generation Semiconductors

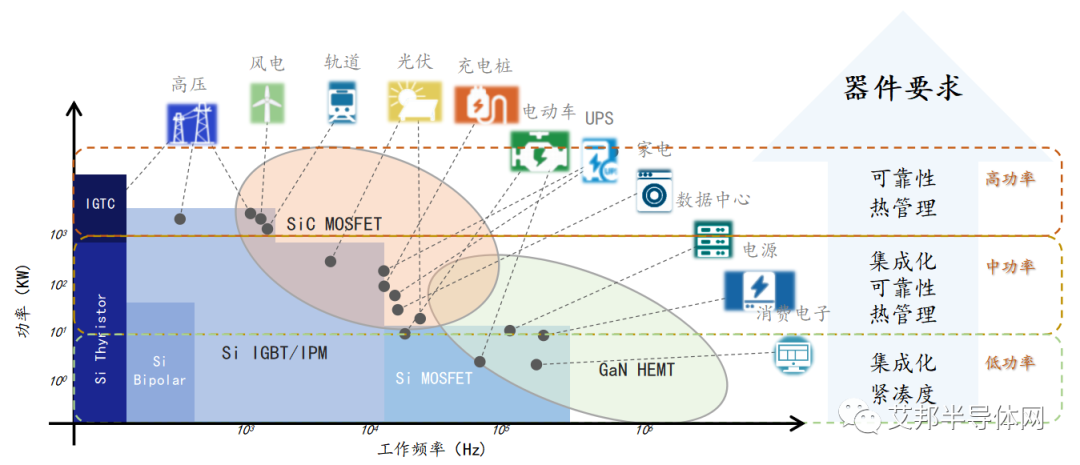

Silicon carbide (SiC) devices have advantages such as high voltage resistance, large current capacity, high temperature resistance, high frequency, high power, and low loss. Gallium nitride (GaN) devices feature high electron mobility, wide bandwidth, high breakdown field strength, and high-temperature resistance.

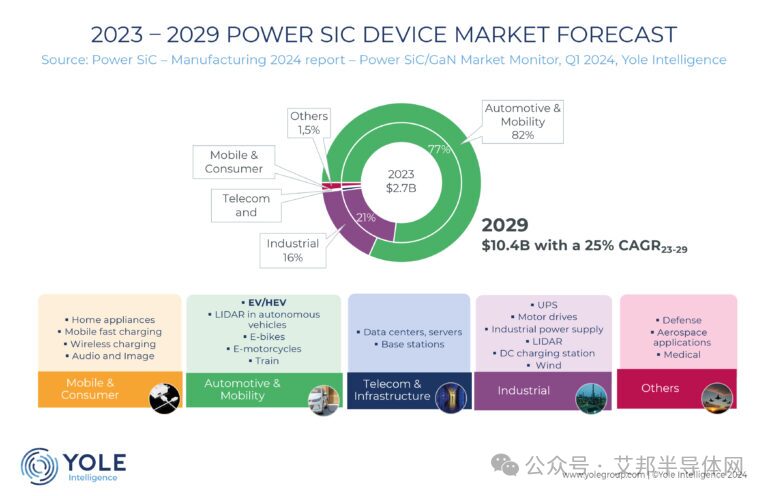

Currently, SiC has advantages over GaN in high power and high-temperature applications, and SiC power devices are rapidly developing in the new energy vehicle industry, with rapid market growth. According to Yole data, driven by strong demand in automotive applications, especially from the increasing demand for pure electric vehicle (EV) main inverters (which occupy over 70% of the market share), the entire SiC market is showing rapid growth. At the same time, the applications of SiC in industrial control and new energy fields are also growing faster than market expectations. The global market size of SiC devices is approximately 2.7 billion USD in 2023 and is expected to exceed 10 billion USD by 2029, with a compound annual growth rate of 25% from 2023 to 2029.

Figure: 2023-2029 SiC Power Device Market Forecast Source: Yole

According to Yole data, the gallium nitride power semiconductor device market will grow from 126 million USD in 2021 to 2 billion USD in 2027, with a compound annual growth rate of 59%.

3. Application Field Analysis

The market size of power semiconductors accounts for 8%-10% of the global semiconductor industry, with a stable structural proportion. Since power semiconductor devices are used in almost all electronic manufacturing industries, including computers, network communications, consumer electronics, automotive electronics, and industrial electronics, the rapid development of emerging application areas such as new energy vehicles/charging piles, data centers, wind and solar power generation, energy storage, intelligent equipment manufacturing, robotics, and 5G communications has also driven the growth of the power device market. Therefore, the industry experiences weak cyclical fluctuations, and the global power semiconductor market size is steadily increasing.

According to Omida’s data and forecasts, the global power semiconductor market size will reach 50.3 billion USD in 2023, and it is expected to grow to 52.2 billion USD in 2024, reaching 59.6 billion USD by 2027, with the power IC market accounting for 54.8%, power discrete devices for 30.1%, and power modules for 15.1%.

As the world’s largest consumer of power semiconductors, China accounts for about one-third of the global market, expected to reach 20.6 billion USD in 2024, which is about 39% of the global market, indicating a promising future market development.

With the rapid development of new energy vehicles and charging piles, photovoltaics and energy storage, AI servers and data centers, drones, 5G, the Internet of Things, and artificial intelligence, new application scenarios and demands have emerged for the power semiconductor industry. The steady development of pillar industries such as industrial automation and consumer electronics will inevitably increase the demand for high-performance power devices, which are core components of end products.

➤New Energy Vehicles and Charging Piles

The new energy vehicle industry is an important pillar of China’s national economic development, and accelerating innovation and development in new energy vehicles is a key direction for the automotive industry. With the continuation of tax exemptions for new energy vehicle purchases, optimization of driving environments, and local policies limiting vehicle registrations, the advantages of new energy vehicles are gradually becoming apparent. At the same time, under the trend of the new four modernizations (electrification, intelligence, connectivity, and sharing), the automotive industry is entering a period of unprecedented change, ushering in significant growth for new energy vehicles, with increasing penetration rates and rising demand for chips. From basic power system control to autonomous driving technology, advanced driver assistance systems, and automotive entertainment systems, there is a significant reliance on electronic chips.

Source: Founder Microelectronics

As the core component for achieving energy conversion, the per vehicle usage of power devices in new energy vehicles is about 2 to 3 times that of traditional fuel vehicles. According to data from the China Association of Automobile Manufacturers, the number of automotive chips required for traditional fuel vehicles is 600 to 700, while electric vehicles require 800 to 1,000 chips, with power semiconductor chips being essential components for new energy vehicles.

Power semiconductor devices are widely used in components such as electric motor drive systems, power management systems, and air conditioning systems in new energy vehicles, with MOSFETs and IGBTs dominating the market. According to IHS data, the global market size for power devices in new energy vehicle power systems is expected to grow from 2 billion USD in 2022 to 3.9 billion USD by 2026. The per vehicle value of power devices in China is expected to rise from 400 USD per vehicle in 2021 to 460 USD per vehicle in 2023.

In the charging pile sector, fast charging piles require the use of high-power devices due to their high charging power and efficiency. IHS data indicates that in 2023, China added 731,000 public charging piles, with an annual growth rate of 50.2%, bringing the total number of public charging piles to 2.033 million; by the end of 2023, the total number of charging piles reached 5.211 million, with a year-on-year growth rate of 99.3%. It is expected that by 2025, the number of charging piles will reach 12 million, and the market size for power semiconductors in charging piles is expected to reach 3.3 billion USD.

The new energy vehicle and charging pile industries are gradually becoming one of the largest application markets for power semiconductors, and this growth is expected to continue, providing substantial incremental demand for high-performance and high-efficiency power semiconductor devices. The demand for IGBTs and SiC in the new energy vehicle sector is expected to remain strong.

➤Data Centers

Data centers are vital infrastructure in modern information society, responsible for information storage, computation, and processing. In recent years, the construction of data centers has rapidly progressed, and under the drive of emerging technologies such as 5G, big data, artificial intelligence, and the Internet of Things, data traffic has surged, leading to higher requirements for computing performance and energy efficiency. Efficient and reliable power management solutions have become key elements in data center construction.

Source: Infineon

In the construction of data centers, power semiconductors play an important role, including power management chips, power converters, inverters, etc. As the scale of data centers continues to expand and performance requirements increase, the demand for power semiconductors is also steadily rising. According to IDC data, the global data center market size reached 280 billion USD in 2023, and it is expected to reach 380 billion USD by 2026, with a compound annual growth rate of 10.4%.

➤Wind, Solar, Storage, Hydrogen, and Other New Energy Generation Industries

Photovoltaic power generation, as an important component of clean energy, plays a vital role in the global energy transition. With continuous advancements in photovoltaic technology, the cost of photovoltaic power generation has gradually decreased, and the installed capacity of photovoltaic systems has rapidly increased. Energy storage systems, as important supporting facilities for photovoltaic power generation, play a key role in achieving efficient utilization of photovoltaic electricity.

Source: Infineon

In photovoltaic and hydrogen energy, as well as energy storage systems, power semiconductor devices are widely used in inverters, variable frequency drives, and charge/discharge controllers. Inverters, as the core devices of photovoltaic systems, have their performance directly impacting the efficiency and stability of the entire system. According to IRENA data, the global installed capacity of photovoltaic systems reached 1,000 GW in 2023, and is expected to reach 1,500 GW by 2026, with a compound annual growth rate of 14.9%.

According to data from the National Energy Administration, China’s newly added photovoltaic grid-connected capacity reached 216.88 GW in 2023, a year-on-year increase of 148%. By the end of 2023, China’s cumulative grid-connected capacity reached 6,089 GW, and it is expected to continue to grow rapidly in 2024.

According to data released by the National Energy Administration at a press conference, China’s newly added installed capacity of new energy storage is about 22.6 GW in 2023, an increase of 261% compared to last year; the newly added wind power grid-connected installed capacity in 2023 is 75.9 GW, with a year-on-year increase of 102%. According to the Global Wind Energy Council’s (GWEC) “2023 Global Wind Energy Report,” the newly added global wind power installed capacity in 2023 was 118 GW, a year-on-year increase of 36%. It also states that over the next five years, the global newly added grid-connected capacity for wind power is expected to reach 680 GW, with an average annual new installed capacity of 136 GW, achieving a compound growth rate of 15%.

4. Current Development Status of IGBTs and SiC

➤IGBT: Insulated Gate Bipolar Transistors (IGBTs) play an important role in energy conversion and transmission. In recent years, IGBTs have been widely used in electric vehicles, rail transit, and renewable energy fields. China has made significant progress in the IGBT field, with the performance of domestic IGBT devices gradually approaching international leading levels. At the same time, domestic companies have increased their R&D investment in IGBT technology, and further breakthroughs and comprehensive industrialization are expected in the future.

➤SiC: Silicon carbide (SiC), as a third-generation semiconductor material, has excellent high-temperature, high-frequency, and high-voltage performance, and is widely used in electric vehicles, photovoltaic power generation, and wind power generation. In recent years, the demand for SiC devices has grown rapidly, with major global semiconductor companies increasing their R&D investment in SiC technology. Significant progress has also been made in domestic SiC, with several companies already capable of producing SiC devices and gradually occupying a certain market share.

The power semiconductor device industry is a key industry encouraged and supported by the country. To promote the development of power electronics technology and industry, and to build a resource-saving and environmentally friendly society, the government has formulated a series of policies and regulations to guide, encourage, support, and promote the development of the domestic power semiconductor industry, enhancing local technological competitiveness. The power semiconductor industry has risen to a national strategic height. With the in-depth advancement of national policies such as “smart manufacturing” and “new infrastructure,” as well as the implementation of the carbon peak and carbon neutrality strategies, IGBTs and SiC power semiconductors are expected to enter a fast track under the protection of policies, as they are core components for achieving autonomous control of electrification systems and energy conservation and environmental protection.

In recent years, the domestic power semiconductor market has become increasingly competitive. Why is the market outlook for power semiconductors generally optimistic?

This can be attributed to the characteristics of power semiconductors.

Objectively speaking, power semiconductors are specialty process products that are not size-dependent and do not pursue extreme linewidths in processing. They do not have to follow Moore’s Law but need to focus on the iteration and upgrading of structures, packaging technologies, and basic materials.

➤In terms of investment, power semiconductors are essential components of power electronic devices, with the global market size consistently maintaining between 8% and 10% of the semiconductor industry, experiencing weak cyclical fluctuations. Additionally, the verification cycle for power semiconductors is relatively short, with a clear business model that can quickly increase production capacity and achieve business growth.

➤In terms of demand, the application fields of power semiconductors have expanded from consumer electronics and industrial control to automotive electronics, new energy, rail transit, smart grids, and variable frequency appliances. The industry market size is steadily increasing.

Especially against the backdrop of the global pandemic, people’s production and lifestyle have undergone tremendous changes, with remote work, video conferencing, online classrooms, and online entertainment giving rise to the demand for products and technologies such as cloud power and 5G base station power.

At the same time, under the dual carbon goals, the rapid development of electric vehicles and new energy photovoltaics, along with the increasing penetration rate of electric vehicles, expanding demands in intelligent fields, and the promotion of products like new energy photovoltaics, the power semiconductor business is expected to enter a long period of rapid growth.

Therefore, in recent years, semiconductor products, including power semiconductors, have seen price increases and supply shortages, remaining in a state of long-term scarcity. Meanwhile, in the increasingly complex international environment, localizing the supply chain has also provided development opportunities for domestic power semiconductor companies.

➤In terms of materials, third-generation semiconductor technologies such as SiC and GaN are maturing.

Compared to traditional semiconductor materials, third-generation semiconductor materials can operate at higher temperatures, stronger voltages, and faster switching frequencies. For example, SiC has advantages such as high critical magnetic field, high electron saturation velocity, and high thermal conductivity. Power semiconductor devices made from SiC can be applied in high-frequency and high-temperature scenarios, significantly reducing switching losses compared to traditional silicon devices.

In summary, China has always been the largest procurement market for power semiconductors, accounting for nearly 40% of global demand. However, there is a significant gap between production and consumption of devices. In this long-dominated market by Europe, America, and Japan, domestic manufacturers are rapidly catching up in design, production, and capacity. With the combined efforts of government, capital, and technology, the domestic replacement of power semiconductors is inevitable. The future of mainland power semiconductors is promising.

(Source: International Precision Ceramics and IGBT Exhibition, itbank. This article is produced by Qingdao West Coast International Investment Promotion Center, reprinted for sharing and learning purposes, not for commercial use. If there is any infringement, please contact us for removal.)

Recommended Reading

Learn and Implement the Spirit of the 20th National Congress, Effectively Attract Investment, and Promote Chinese-style Modernization

Tangdao Bay Innovation Center Launched, Inspur Group Helps New District Build a New Engine for Software Information Industry

“Chip-Screen Interaction, Building an Ecosystem” 2024 Chip-Screen Night Held at Qingdao Beer City