The HomePod, priced at $349, targets music lovers at home. It features an A8 chip, an array of 7 tweeters, 6 microphones, and an upward-facing woofer.

1. Apple’s Entry into the Smart Speaker Market Will Generate Market Attention

After much anticipation, the HomePod, which Apple initially planned to announce for release at the end of 2017, finally launched on February 9, 2018. Apple’s entry is expected to stir up new waves in the market.

A significant reason for this is that Apple has a large base of loyal fans who are eager to try new products, and this group is surrounded by other Apple-related products, which will likely provide positive feedback on the smart speaker experience.

For Apple, they typically do not invest in product development unless there is a lucrative market opportunity. Although Apple is not a pioneer in product development, their products often create a buzz upon release, such as the dual-camera system in smartphones, leading the market to believe that Apple has the ability to set trends. This trend will likely encourage more manufacturers to enter the market.

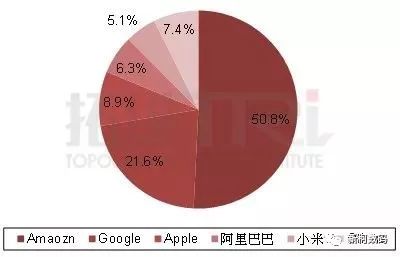

In 2018, the smart speaker market is no longer dominated solely by Amazon and Google. With Apple’s entry, the market is expected to attract more consumer attention. Additionally, companies like Xiaomi and Alibaba have also launched related products, further driving overall market growth.

Estimates for the market share rankings of various smart speaker products in 2018 show that Amazon’s Echo series still leads with a market share of 50.8%, followed by Google’s Home series at 21.6%, and Apple’s HomePod is expected to reach a market share of 8.9%. Furthermore, Alibaba and Xiaomi’s smart speaker products are projected to have market shares of 6.3% and 5.1%, respectively.

2. Three Major Flaws of Apple HomePod Prevent Its Market Share from Exceeding 10% in 2018

Despite having a large base of loyal fans, the HomePod has three major flaws: product positioning gap, ecosystem not open enough, and functions similar to those of smartphones, which will hinder its market share from surpassing 10% in 2018.

In terms of product positioning, Apple markets the HomePod as a home musician, claiming to have the best sound quality among similar products. However, current consumers view smart speakers as a bridge for communication between people and appliances, rather than solely for music enjoyment. Clearly, the HomePod’s product positioning does not align with market perception.

Since consumers perceive smart speakers as a bridge, there must be a sufficient number of products that can connect with smart speakers, indicating that establishing an ecosystem is crucial. However, Apple’s stringent approval process for manufacturers entering the ecosystem has resulted in very few products passing the HomeKit MFi certification, leading to slow development in the smart home sector.

Lastly, the smart home functionalities of the HomePod are similar to those of smartphones. Even without purchasing a HomePod, consumers can use their Apple phones for voice control or app management. When there is a substitutive effect between the two, the HomePod becomes non-essential.

Overall, the HomePod has not met market expectations in terms of positioning and application. As a latecomer, it still requires time to refine this product. Until the ecosystem is complete, the market will continue to be dominated by Amazon.