This article is reproduced from the WeChat public account:New Materials Online

Drone

Introduction: Drones, known as “aerial robots,” are unmanned aircraft manipulated by radio remote control devices and self-equipped program control devices, including unmanned helicopters, fixed-wing aircraft, multi-rotor aircraft, unmanned airships, and unmanned gliders. Drones can be divided into military, civilian, and consumer categories based on different usage fields.

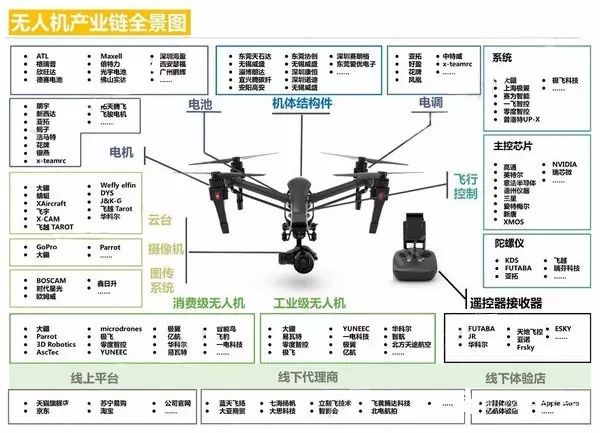

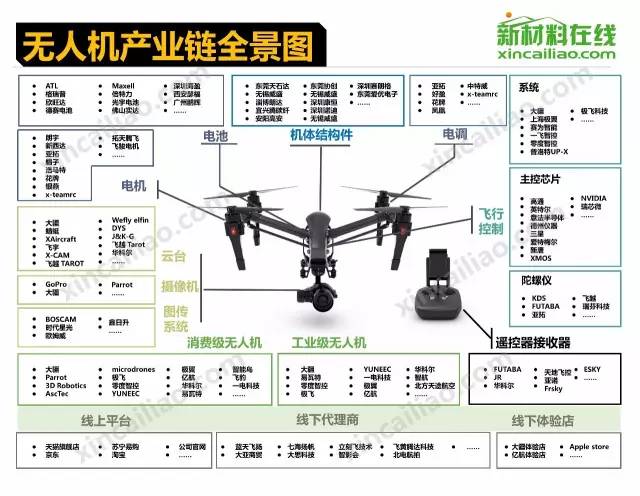

The drone industry chain can be divided into R&D, production, sales, and services, including product R&D testing, flight control system development, production of key components such as engines, payload manufacturing, drone assembly, drone sales, drone operation training, operational service businesses, and integrated application services.

The main participants in the drone industry chain include two categories: one is manufacturers like DJI and GoPro; the other is upstream manufacturers providing hardware and software for drones, including chips, flight control, batteries, sensors, GPS, gyroscopes, power systems, data systems, video transmission systems, electronic components, drone training, etc.

1. Comprehensive Overview of the Drone Industry Chain

Moreover, in terms of hardware, the chip is the core component that directly determines the drone’s control performance, communication capability, and image processing ability. Drones are not as mysterious and distant as we imagine; they have chips, intermediate manufacturers, and peripheral industries, similar to other well-known consumer electronics.

Major drone main control chip manufacturers include: Qualcomm, Intel, STMicroelectronics, TI, Samsung, Atmel, Nuvoton, XMOS, NVIDIA, Rockchip RK3288, etc.

2. Eight Major Drone Control Chips

1. STMicroelectronics STM32 Series

The STM32 series includes multiple product series such as STM32F0/F1/F2/F3/F4/F7/L0/L1/L4, among which the STM32F4 series is widely used in drones. Based on the ARM Cortex-M4, the STM32F4 series MCU uses STMicroelectronics’ NVM process and ART accelerator, achieving processing performance of 225 DMIPS/608 CoreMark at a working frequency of up to 180 MHz while executing from flash memory, which is the highest benchmark score achieved by all Cortex-M core-based microcontroller products to date.

2. Qualcomm Snapdragon Flight Platform

Snapdragon Flight is a highly optimized 58x40mm development board designed specifically for consumer drones and robotic applications.

Snapdragon Flight includes a Snapdragon 801 SoC (composed of four cores with a frequency of 2.26GHz), supporting GPS, 4K video recording, robust connectivity, and advanced drone software and development tools, dual-channel Wi-Fi, and Bluetooth modules, supporting real-time flight control systems, equipped with global navigation satellite system receivers, supporting 4K video processing, and quick charging technology, all integrated on a business card-sized mainboard. It brings cutting-edge mobile technology to create a new level of consumer drones. These functional components form an asynchronous computing platform that supports the development of advanced drone functions such as obstacle avoidance and video stabilization.

3. Intel Atom Processor

In the field of unmanned aerial vehicles, the Yuneec Typhoon H, equipped with depth sensing technology, features collision avoidance, convenient takeoff, a 4K camera, 360-degree gimbal, and a built-in display screen in the remote controller.

Using a quad-core Intel Atom processor PCI-express custom card to process real-time information regarding distance and sensors, as well as how to avoid close-range obstacles. From the hardware aspect, it supports Intel’s RealSense computing 3D camera; from the software aspect, it is Intel’s “RealSense” computing SDK.

4. Samsung Artik Chip

Samsung’s Artik chip has three models, among which the main one used in drones is Artik5, which measures 29x25mm, equipped with a 1GHz ARM dual-core processor (Mali400MP2 GPU), paired with 512MB LPDDR3 memory and 4GB eMMC flash. It supports Wi-Fi, low-power Bluetooth, and 802.11b/g/n. Additionally, this chip can decode formats such as H.264 for 720p-30fps video and provides TrustZone.

5. Texas Instruments OMAP P3630

Texas Instruments’ OMAP3630 once shone in the single-core smartphone field, but as multi-core became mainstream and TI gradually withdrew from consumer electronics, the OMAP3630’s battlefield has shifted to emerging markets like drones.

6. Atmel Mega2560 Chip

Atmel’s AVR processor chips are widely used in drones abroad, but in China, STMicroelectronics occupies a large part of the market.

7. XMOS XCORE Multicore Microcontroller

Multi-rotor aircraft require four to six brushless motors to drive the drone’s rotors. The motor driver controller is used to control the drone’s speed and direction. In principle, each motor requires an 8-bit MCU for control, but there are also solutions where one MCU controls multiple BLDC motors.

8. Nuvoton MINI51 Series

Mini51 is a Cortex-M0 32-bit microcontroller series characterized by a wide voltage operating range of 2.5V to 5.5V and a working temperature of -40℃ to 105℃, built-in 22.1184MHz high-precision RC crystal oscillator (±1% accuracy, 25℃ 5V), and built-in Data-Flash, undervoltage detection, rich peripherals, integration of various serial transmission interfaces, high anti-interference capability (8kV ESD/4kV EFT), support for online system updates (ISP), online circuit updates (ICP), and online application updates (IAP), available in TSSOP20, QFN33 (4mm*4mm and 5mm*5mm), and LQFP48 packages.

3. Major Domestic Drone Manufacturers

① DJI Innovations

A global leader in flight imaging systems, specializing in everything from drone flight control systems to overall aerial photography solutions, from multi-axis gimbals to HD video transmission. Its products are widely used in aerial photography, film, agriculture, real estate, news, firefighting, rescue, energy, remote sensing mapping, wildlife protection, and more. Representative works: DJI Phantom 3 4K, DJI Inspire 1 Pro.

② ZeroTech Robotics

Founded by Shenzhen Rapoo Technology and Beijing ZeroTech, the company focuses on the R&D and manufacturing of small intelligent drones, being a pioneer and leader in the global intelligent aircraft field. Currently, it has a leading product system in intelligent drones, multi-axis gimbals, and HD video transmission. Representative work: Explorer 2nd generation.

③ EHang Electronic Technology

In the field of model aircraft and flying vehicles, independently developed communication video transmission hardware and mobile navigation control systems. Representative: EHang 184.

④ XAG Technology

Dedicated to the R&D and manufacturing of civilian drones and flight control systems, it is a leader in the drone industry and a leading commercial drone R&D enterprise in China. It has made significant breakthroughs in commercial drones and agricultural drones. Representative work: XMission “Extreme Hero” (all-weather drone).

⑤ JIUYING Electronic Technology

Its control systems have revolutionized the balance, stability, and maneuverability of single-rotor remote-controlled helicopters, opening a new chapter in single-rotor model helicopters. “JIUYING Technology” has created brands like “NINE-EAGLES,” “SOLOPRO,” and “MOLA,” with products mainly sold to over 150 countries and regions including North America, South America, Japan, and the European Union. Representative work: MOLA X1 drone.

⑥ FLYPRO Aerospace Technology

Innovative technology company specializing in drone design and R&D, FLYPRO has an international drone product R&D team, leading innovative drone design and R&D capabilities, and advanced flight control systems, visual positioning systems, and obstacle avoidance technologies. Representative work: FLYPRO X-Eagle drone.

⑦ AEE Technology

A global leader in multi-rotor drone systems, pioneering integrated multi-rotor drone systems.

⑧ AIT Technology

Receivers, transmitters, aircraft models, coaxial dual-rotor helicopters, simulation aircraft models, micro mechanical gyroscopes, etc.

⑨ Dagu Technology

Dagu Technology integrates cutting-edge technologies and resources in the IT wireless communication transmission field, collaborating with military manufacturers to establish a high-tech joint-stock company with rich customer resources and market, aiming to provide various access methods for customers in the wireless communication transmission field.

4. Surge in Sales, Decrease in Investment

Since 2015, the drone market has experienced explosive growth. The past two years have undoubtedly been the fastest growth years for drones; data shows that the rise of the drone industry has attracted a large amount of capital to support its rapid development. However, the drone industry is becoming increasingly saturated; although the growth trend continues, how long it can last remains uncertain. The capital market has begun to tighten its investment in drones, and whether the decline in investment amounts is a precursor to the cooling of the drone industry remains to be seen. In the face of fierce competition today, what will the drone industry look like after the sand settles?

Growth in the US Market – Open Growth

Recently, according to foreign media reports, the market research company The NPD Group published a report stating that from April 2015 to April 2016, US drone sales increased by 224%, approaching $200 million.

According to The NPD Group report, in November and December 2015, drone sales grew more than doubled month-on-month, especially during the Christmas sales season in 2015, drone sales increased by 445% compared to the same period in 2014. According to FAA data, since the open registration, nearly 500,000 drone users have registered with the FAA, and this number continues to grow.

Growth in the Chinese Market – Geometric Growth Trend

As a leading country in drones (in terms of consumer drone technology and market share), the drone market in China is also showing a geometric growth trend. Currently, 99% of consumer drones are exported from Shenzhen. According to Shenzhen Customs statistics, in 2015, the total export value of drones from Shenzhen reached 2.7 billion yuan (approximately $412 million), which is 9.2 times that of the same period in 2014. In just the first half of 2015 (up to May), the export volume of consumer drones from Shenzhen reached approximately 160,000 units, with a value of 750 million yuan, an increase of 69 times in shipment volume and 55 times in value compared to the same period in 2014. However, the first and second quarters of each year are usually the off-season for drone sales, making these year-on-year comparisons less significant. Nevertheless, overall, the growth is rapid. There are currently no sales data for domestic drones in 2016, but based on the current market situation, the heat of drones has not decreased, and sales should still be on the rise.

Drone Audience Structure – 90% of Players Over 31 Years Old

As an emerging technology, it is generally perceived that the main age group of drone users should be between 20 to 30 years old. However, according to another report from market research firm Skylogic, young people are not the main force among drone players, with 90% of players being over 31 years old.

According to the report, the so-called millennial players aged 16-31 only account for 9.3% of the entire drone market share, while players aged 32-51 account for the highest proportion at 45.6%. Notably, the player group over 52 years old is also substantial, reaching 45%. This data is quite indicative, as the difficulty of operating drones, their prices, and practicality may all contribute to attracting older users.

Purchase Channels – Most Choose Professional Dealers and E-commerce

Skylogic’s report also provides relevant data on drone purchase channels. The report shows that drone buyers generally do not purchase drones from large retailers (such as Best Buy, Target, etc.); most people choose to buy directly from drone manufacturers or professional dealers.

From the report, it can be seen that e-commerce channels such as Amazon and eBay also play a significant role in the overall sales volume of drones, which is somewhat similar to domestic drone sales channels. However, the difference is that the main distribution channels in China are concentrated in e-commerce. Besides well-known drone manufacturers like DJI establishing their own distribution channels, most small manufacturers choose platforms like Taobao and JD.com as their primary sales methods.

Market Share – Chinese Companies are Rising

Skylogic’s report also provides statistics on the sales of various brands in the North American drone market, showing that among the top three companies in the North American drone market, two are from China. The Chinese drone star company DJI has captured 50% of the market share, leading the pack, while the second-ranked company, 3D Robotics, which recently faced difficulties, holds 7% market share. The third-ranked drone manufacturer is also from China – Yuneec, with a market share of 4%.

In the past, whether in consumer electronics or emerging technologies, the trend was led by the US, with China following suit, resulting in a large number of “knock-off” industries. While “Made in China” has become popular worldwide, “Created in China” has yet to produce anything noteworthy. However, in recent years, China’s innovative forces have quietly risen, breaking the US’s dominant position in the technology sector in the field of consumer drones.

Investment Situation – 33% Decline in Q1 2016

The rapid growth of the global drone market has also attracted a lot of capital investment. In 2015, there were 74 investment transactions in the drone industry, raising $454 million, with investment amounts increasing by 301% compared to 2014. However, starting this year, the capital market’s investment in the drone market has been declining. According to CB Insights data, in the first quarter of 2016, there were 21 investment financing events in the drone field, maintaining over 20 transactions for three consecutive quarters. Although the transaction volume remained stable compared to the previous quarter, the investment amount dropped to $91 million, reflecting a 33% decline compared to the previous quarter. However, the current investment amount is still 32% higher than the same period last year. In the first quarter’s investment transactions, only two exceeded $20 million, while there were seven in the previous quarter.

5. Future Predictions for Drone Development

1. According to PwC estimates, by 2020, the global drone market value will increase from the current $2 billion to $127 billion. PwC believes that drones can be used not only for defense, delivery, and aerial photography but also for verifying trade claims, increasing agricultural yields, and creating special effects for Hollywood blockbusters.

2. According to the latest estimates from the Federal Aviation Administration (FAA), by 2020, there will be 7 million civilian and commercial drones sold in the US, compared to only 2.5 million today. During this period, the sales of small hobbyist drones will increase from 1.9 million to 4.3 million, while commercial drone sales will rise from 600,000 to 2.7 million.

3. IDC predicts that by 2019, drone sales in China will reach 3 million, despite only having 390,000 in sales this year. This is good news for the world’s largest drone manufacturer, Shenzhen DJI.

5. After the last round of financing in May last year, DJI’s valuation reached $8 billion. Although DJI has not disclosed its 2015 revenue, it is estimated that sales will double to $1 billion this year.

6. Apple is one of DJI’s biggest supporters. The DJI Phantom 4 drone will be prominently featured in Apple retail stores, a spot typically reserved for Apple’s own products. This drone will be available in over 400 Apple retail stores. GoPro had planned to release its first drone during this holiday season to offset the decline in demand for action cameras, but this news is evidently a blow to GoPro.

7. According to crowdfunding platform AngelList, $1.9 billion in venture capital will be injected into emerging companies related to drones. The average valuation of these companies is $5.3 million, with the three most watched companies being trade logistics company Skycatch, drone cloud mapping and analytics company DroneDeploy, and intelligent drone manufacturer Matternet.

Conclusion: Drones, like traditional aerospace manufacturing industry chains, have long chains that involve numerous industries, from airborne weapon systems, composite materials for airframes, flight control, launch and recovery devices, to the complete drone and its applications. The above not only provides various enterprises within the industry chain but also offers purchasing channels, giving you a profound understanding of the drone industry chain and the current market situation.

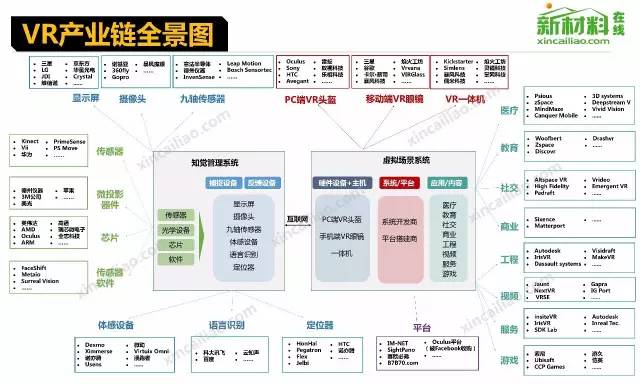

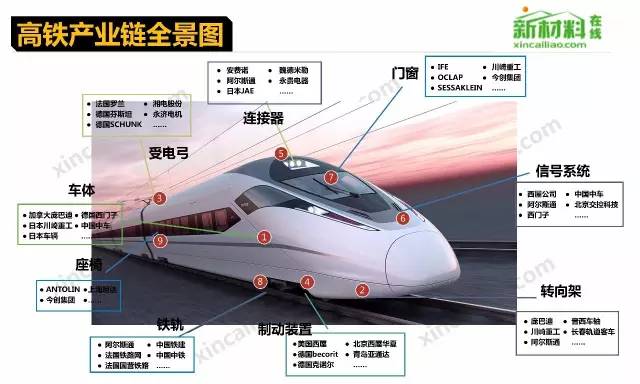

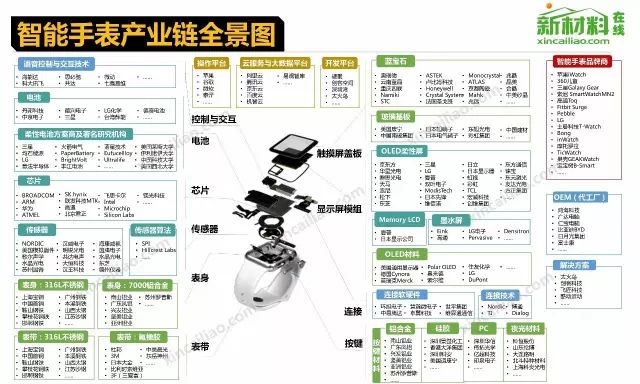

A comprehensive summary of the current most popular 18 major industry chains, presented in panoramic views with 18 images, is essential for industry chain research. The content covers:

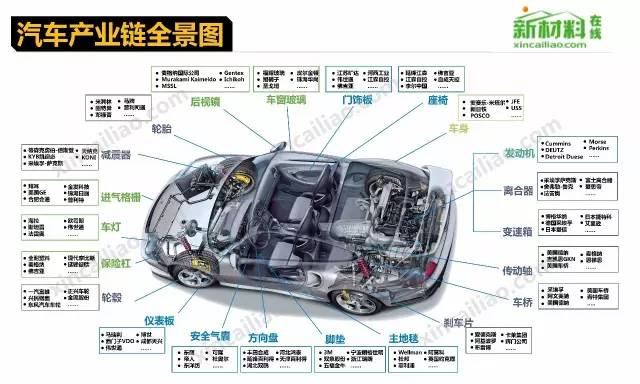

1. Global Automotive Industry Chain

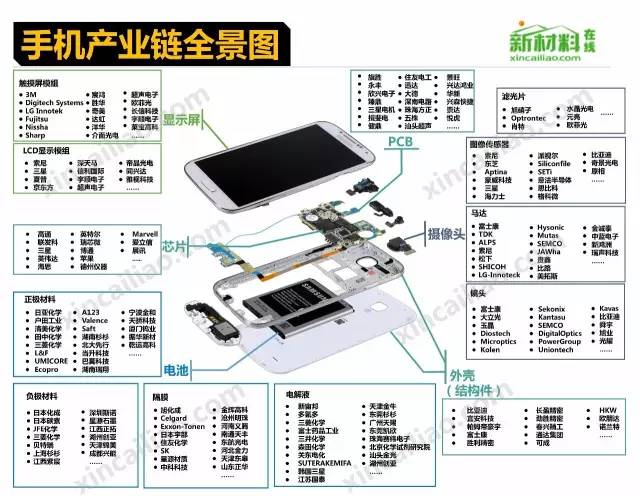

2. Global Mobile Phone Industry Chain

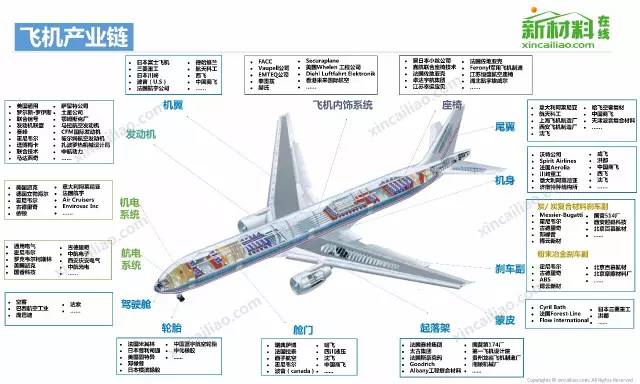

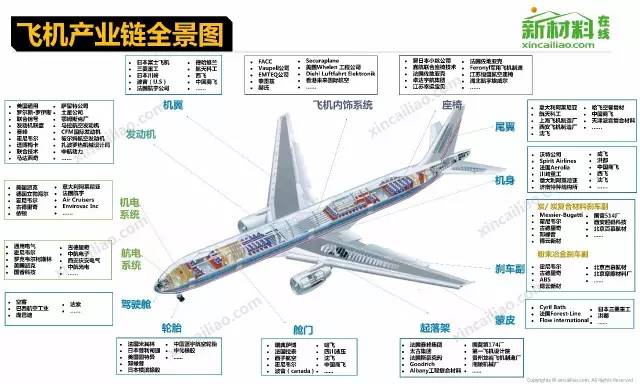

3. Aircraft Industry Chain

4. VR Industry Chain

5. New Energy Vehicle Industry Chain

6. Drone Industry Chain

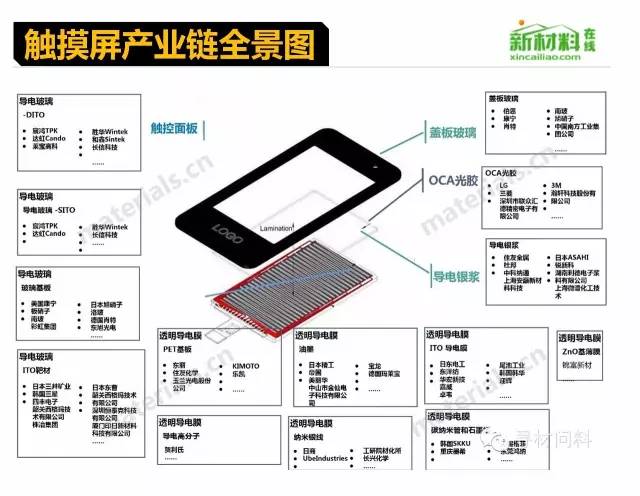

7. Touch Screen Industry Chain

8. Smartwatch Industry Chain

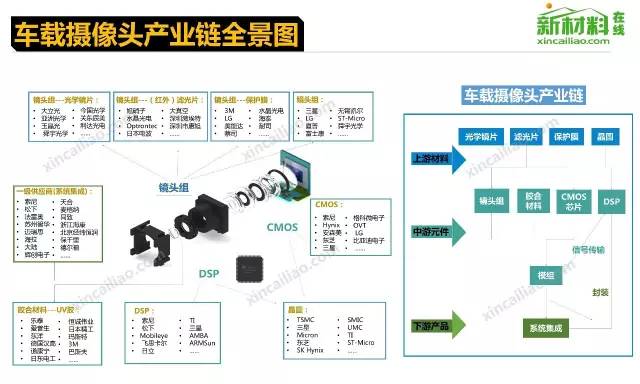

9. Dash Cam Industry Chain

10. High-speed Rail Industry Chain

11. Home Furnishing Industry Chain

12. Building Materials Industry Chain

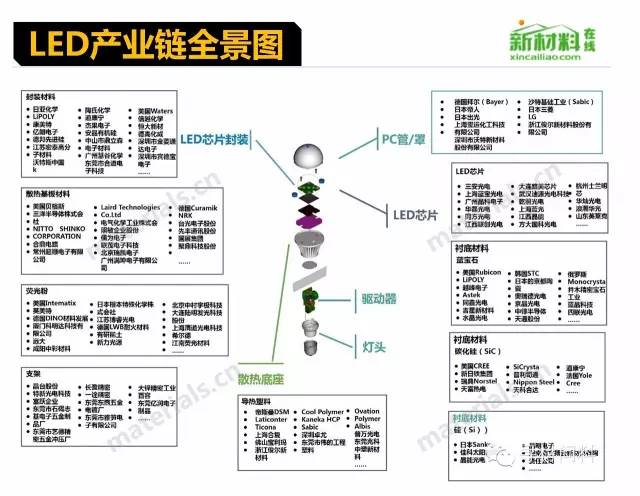

13. LED Industry Chain

14. Battery Industry Chain

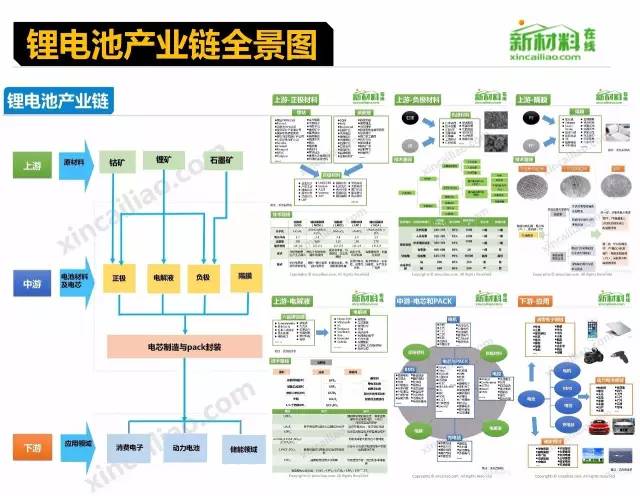

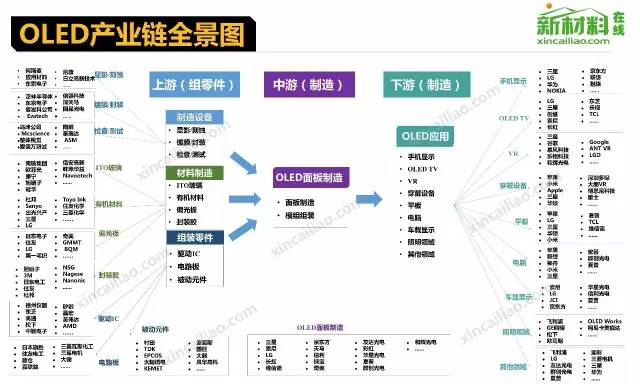

15. OLED Industry Chain

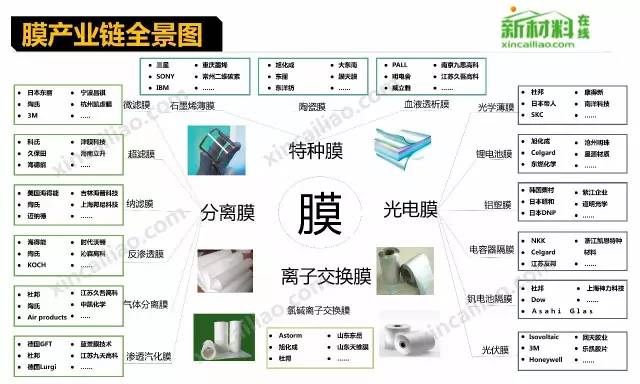

16. Film Industry Chain

17. Lithium Battery Industry Chain

18. Complete Robot Industry Chain….

Special Recommendations

# Year-round Learning: Basic Series Topics on Aviation Materials

-

Aircraft Leasing and Return Knowledge WeChat Study Class -

Civil Aviation Aircraft Electronic Book Collection -

Aviation Maintenance Thematic Lecture Audio Selection Listening -

“Personal Aviation Maintenance Compilation” Subscription to the Aviation Maintenance Compilation Reader -

“Guidelines for Aviation Maintenance Base Construction Technology”