Source: ittbank

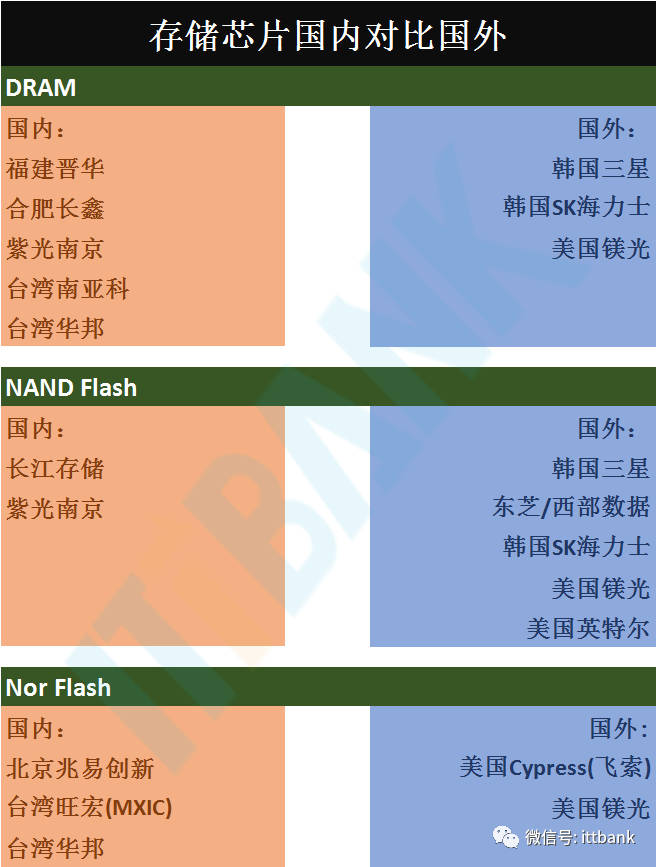

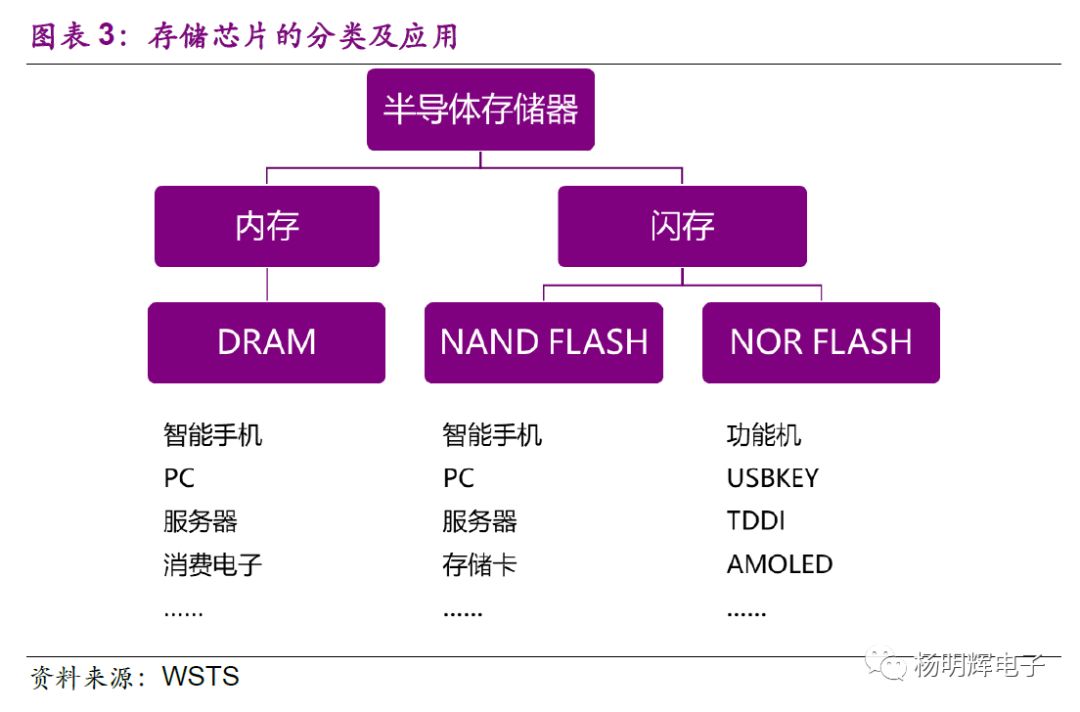

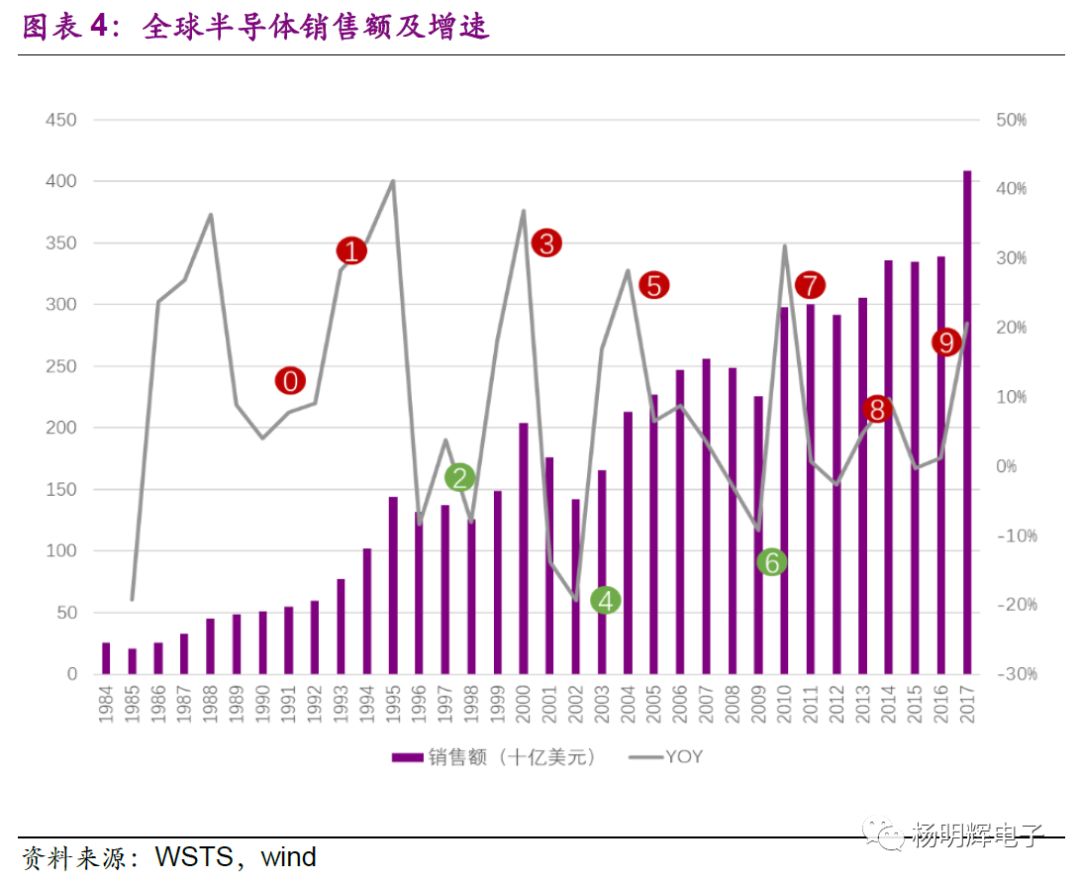

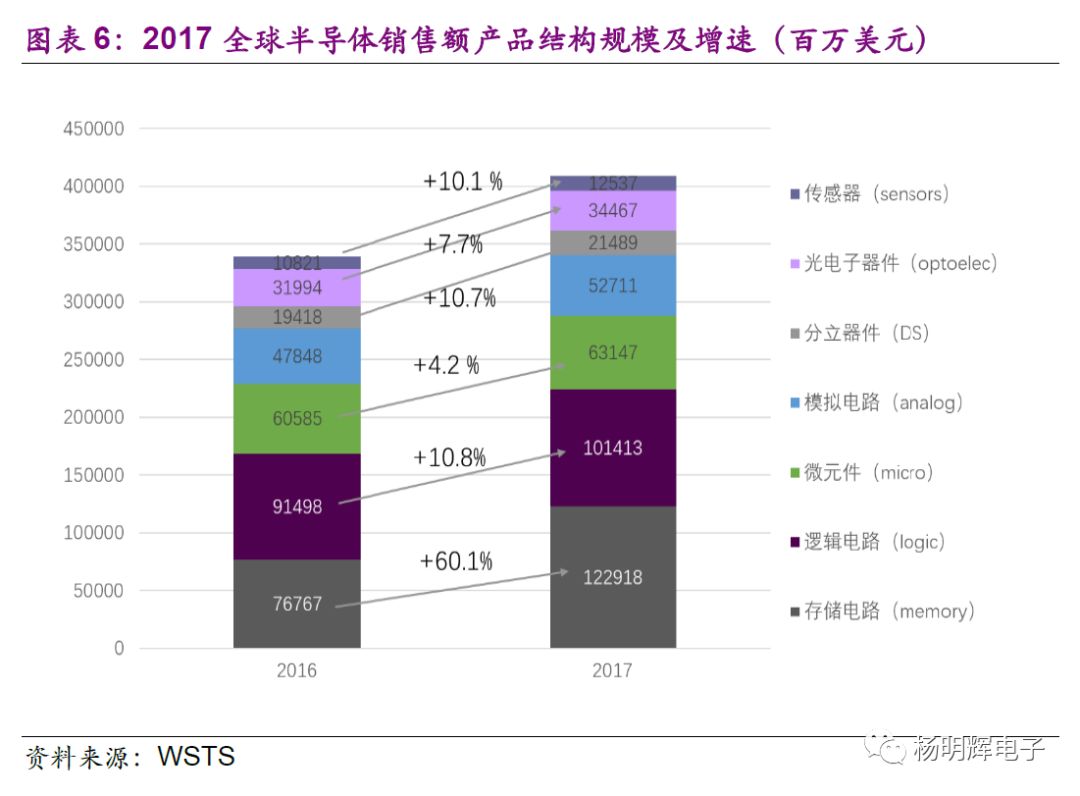

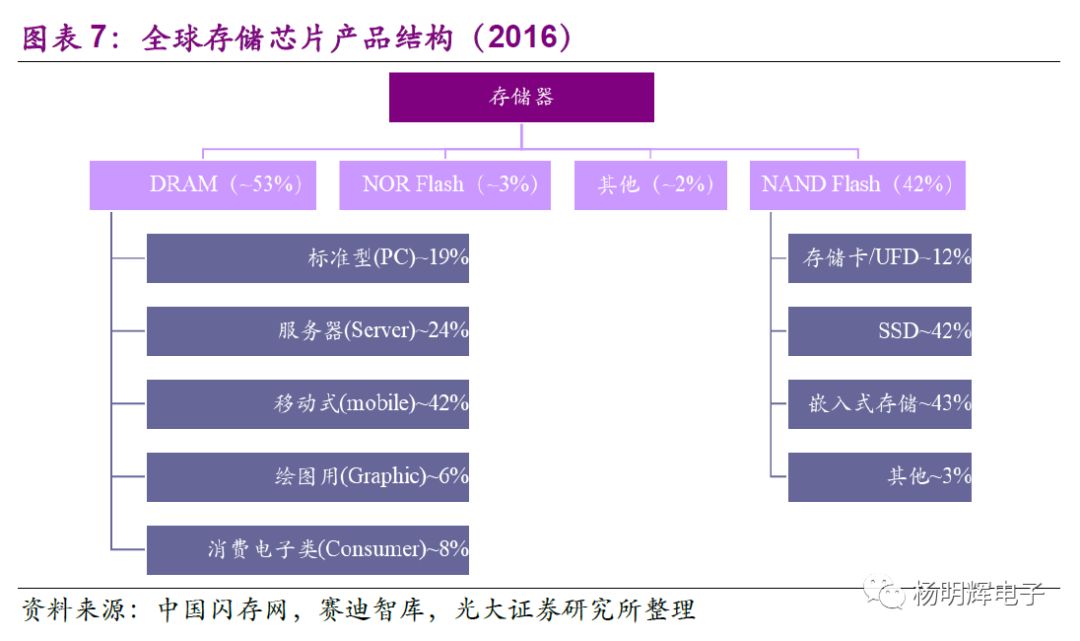

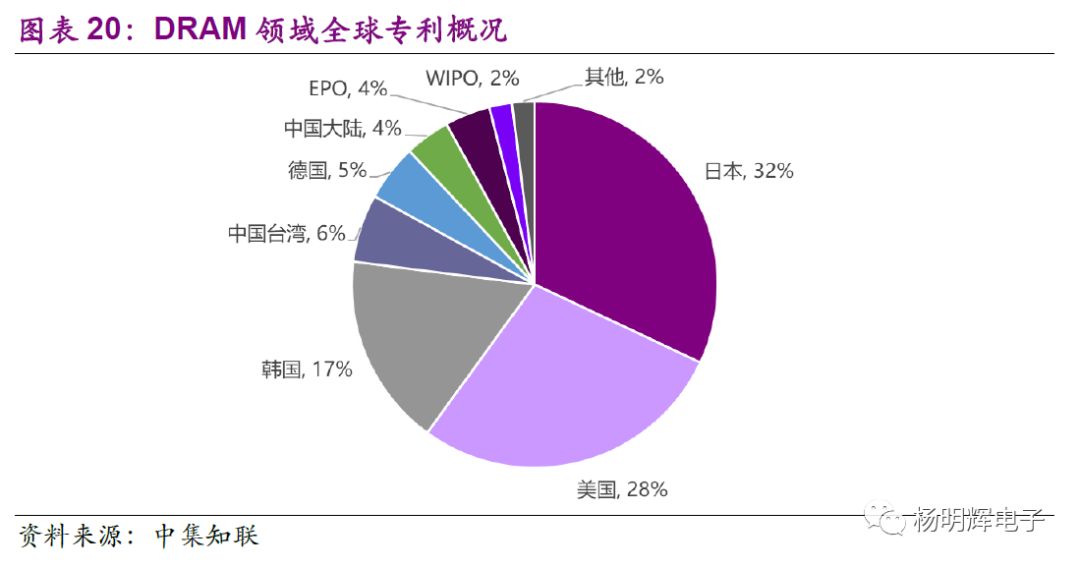

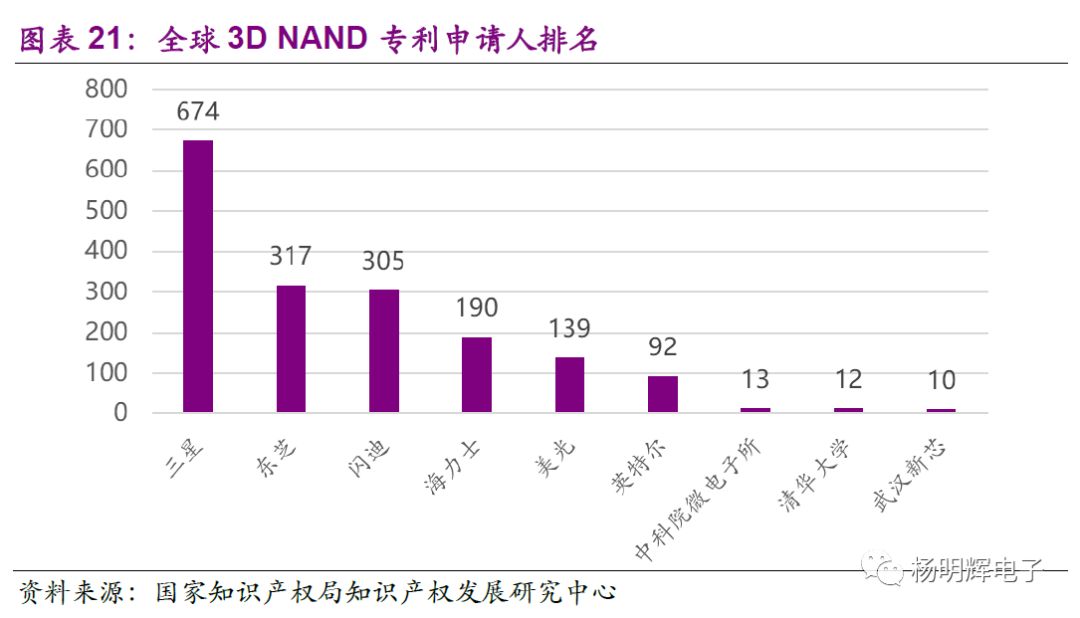

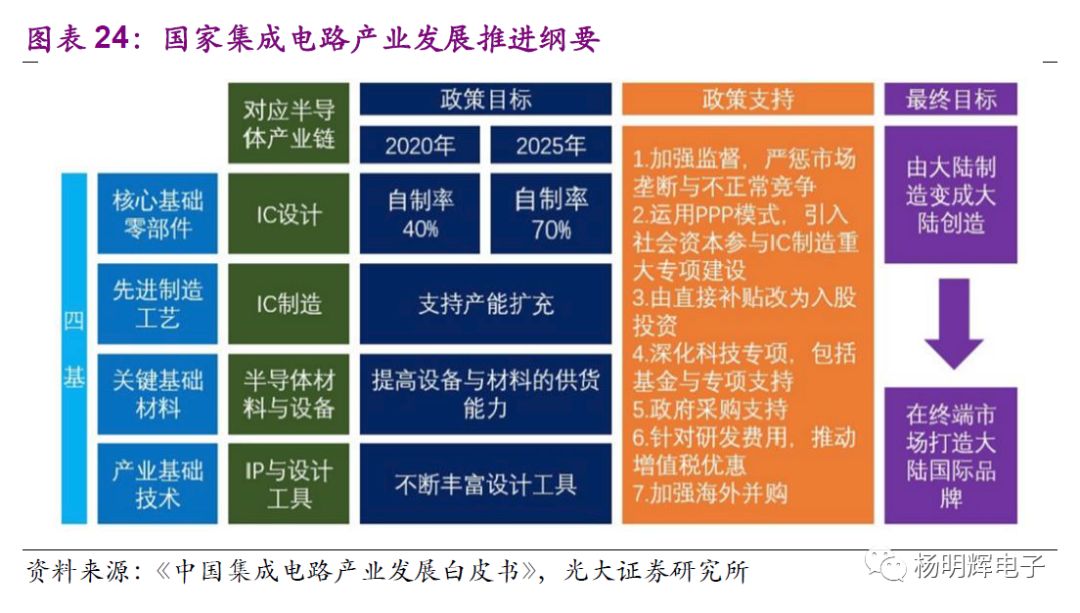

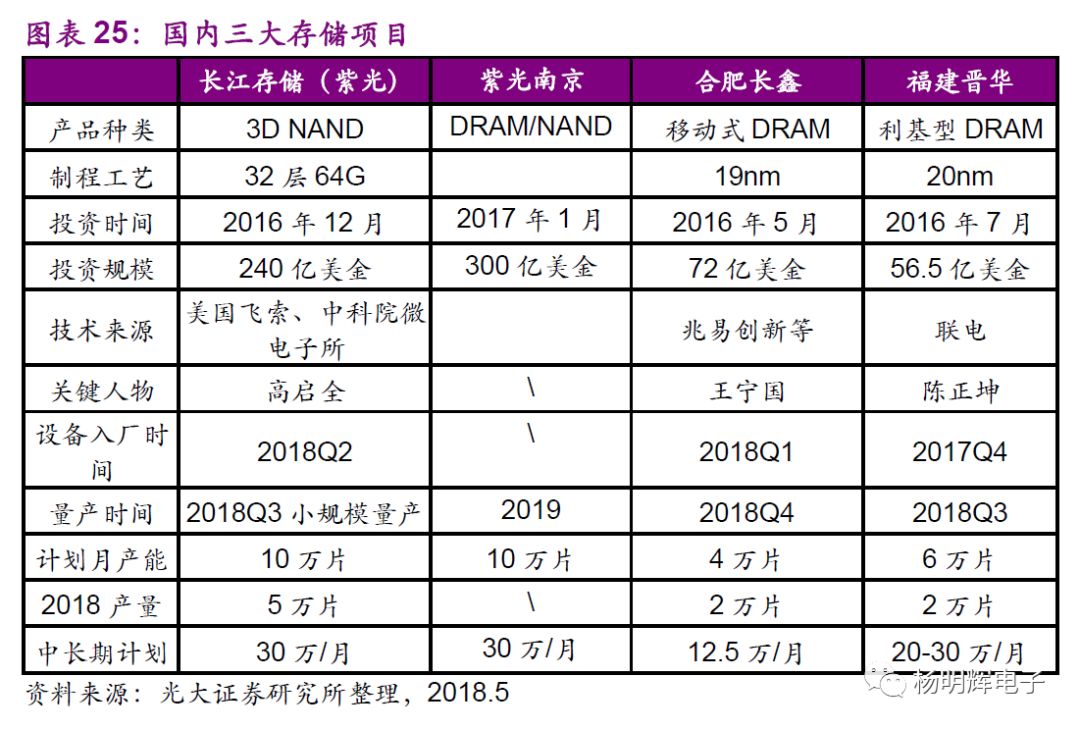

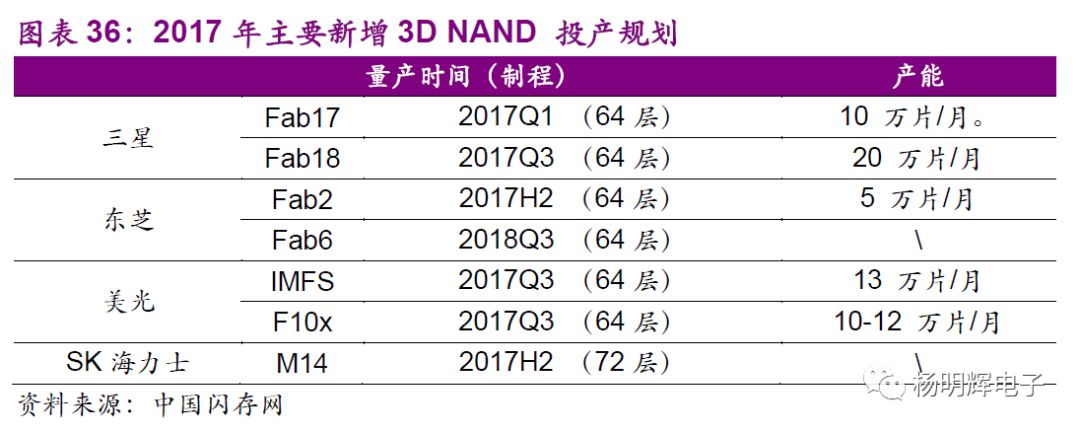

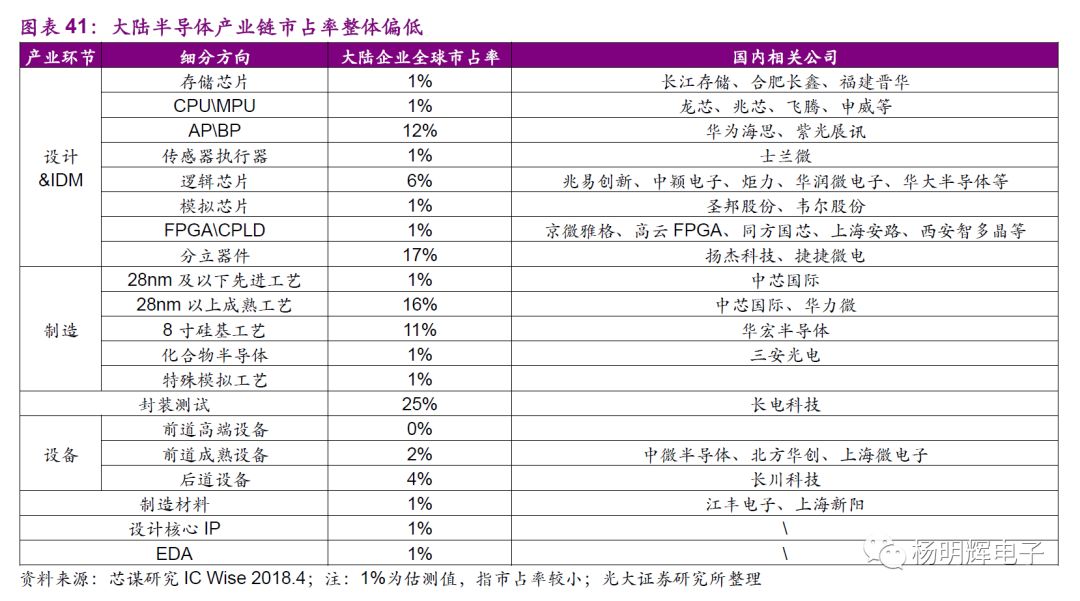

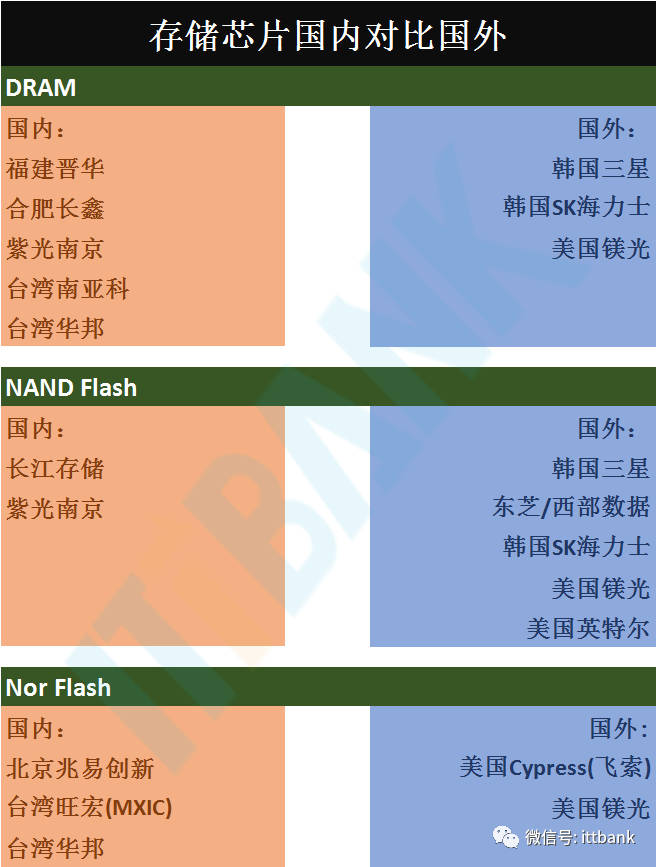

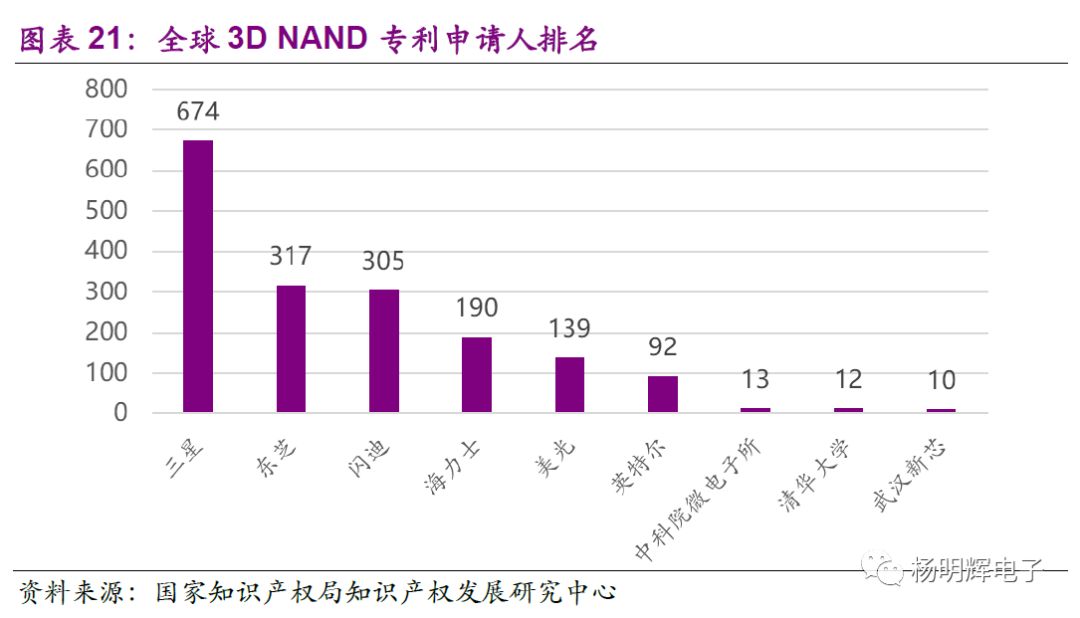

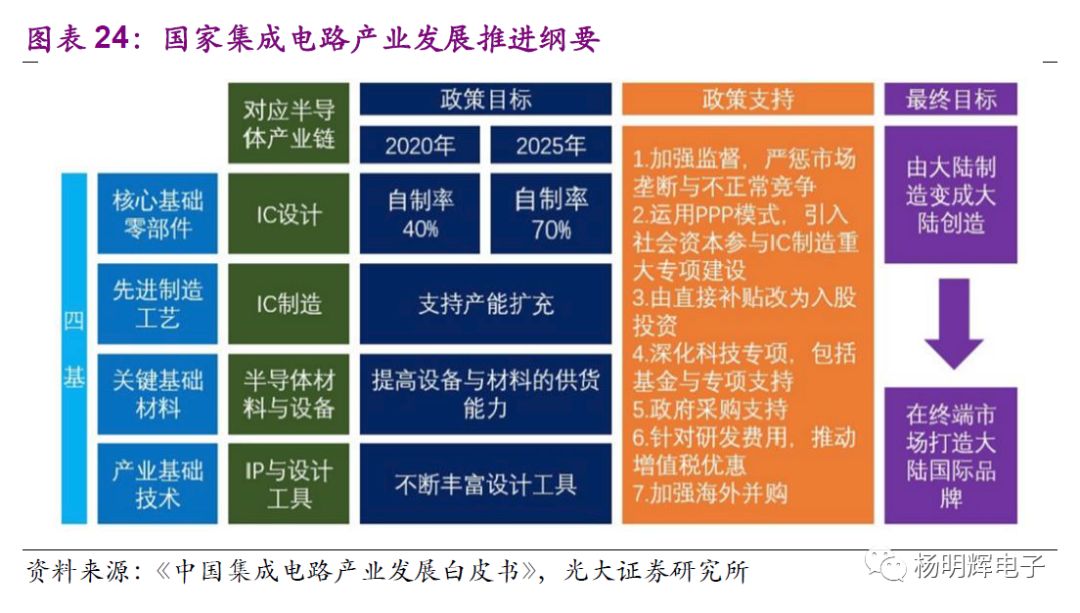

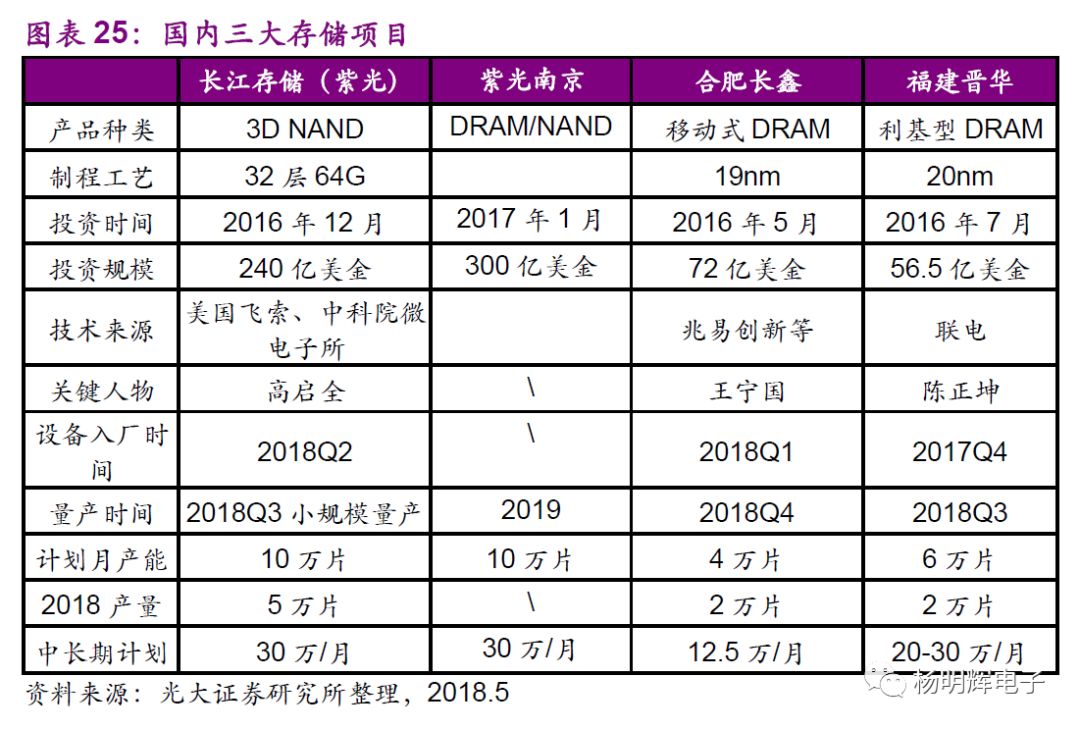

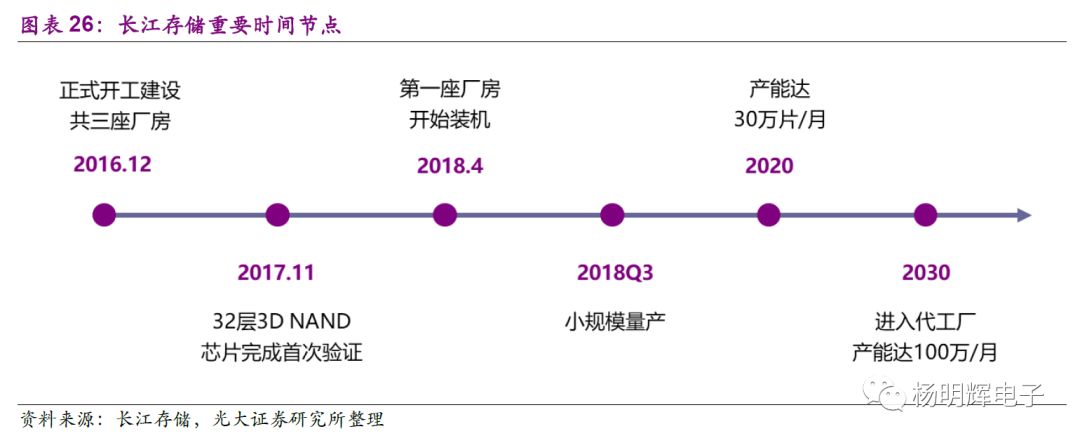

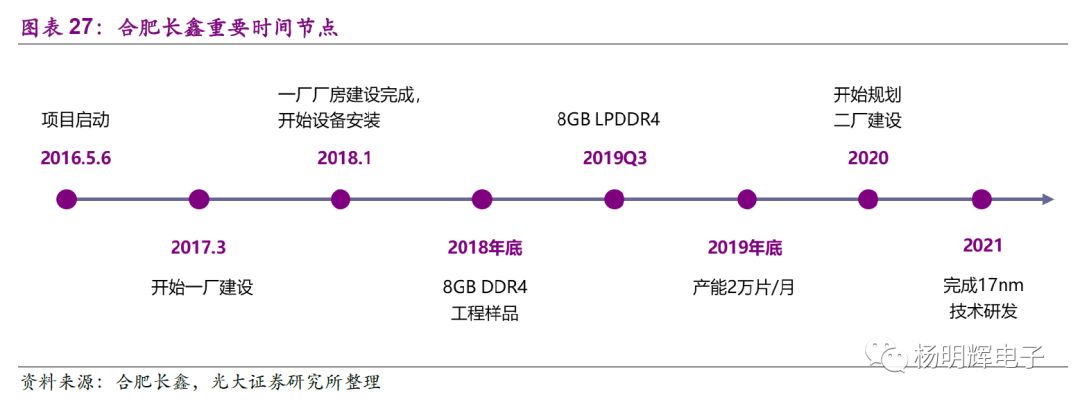

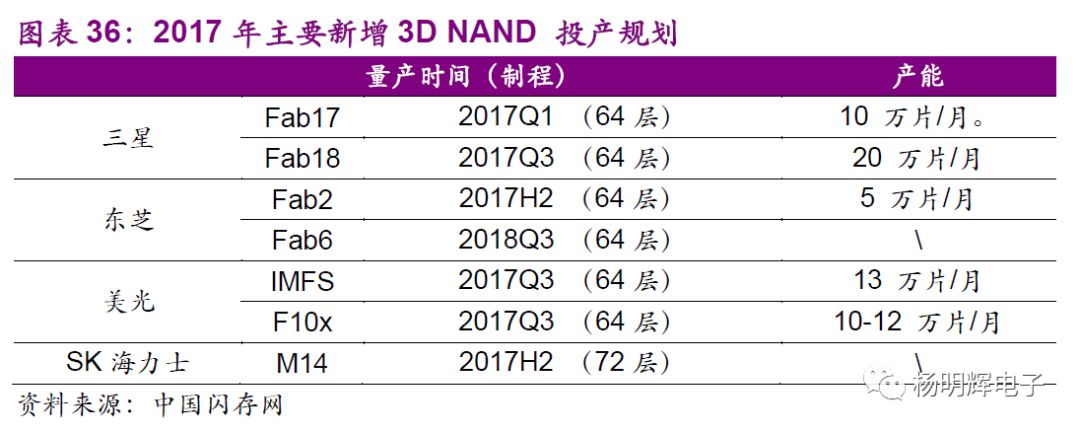

Why Is Our Country Developing Storage Chips?

The following content is sourced from:Everbright Securities Electronic Research Team

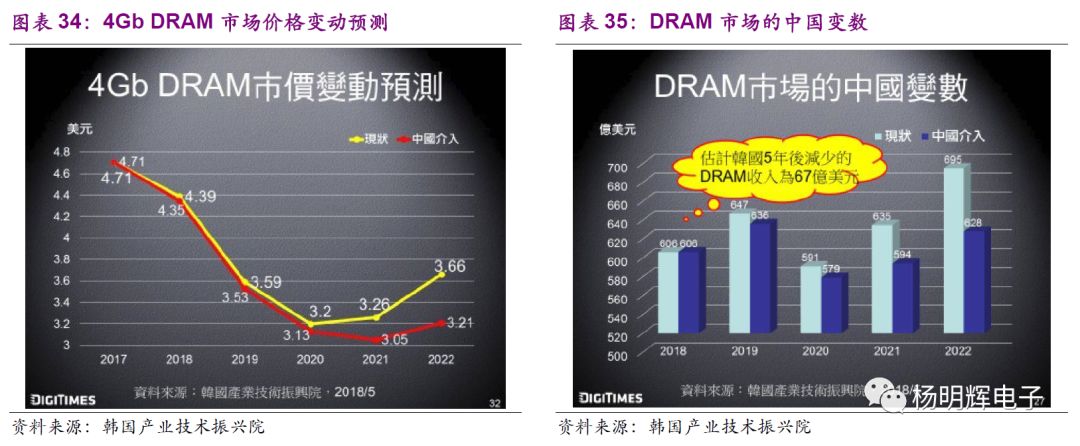

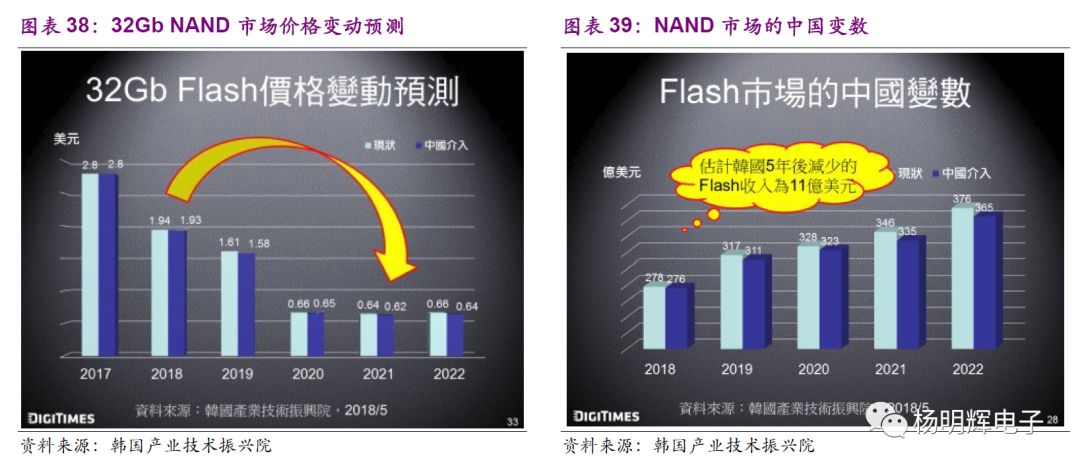

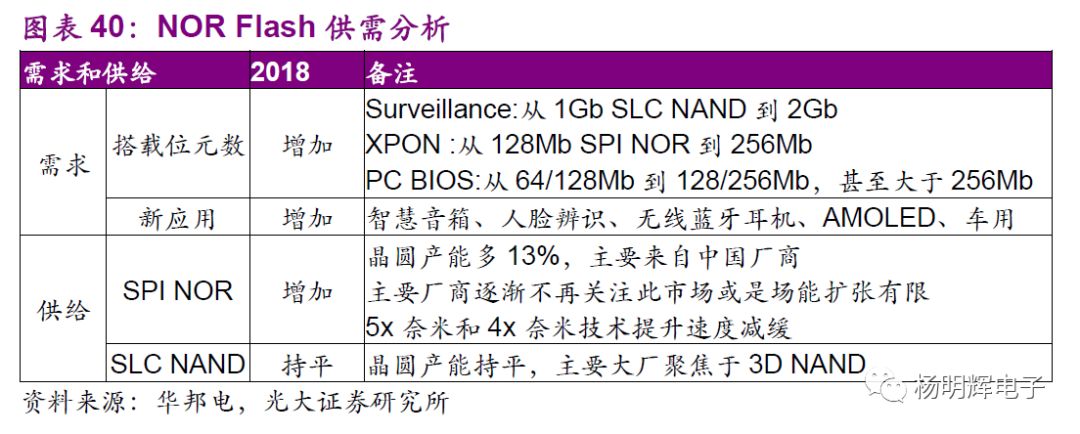

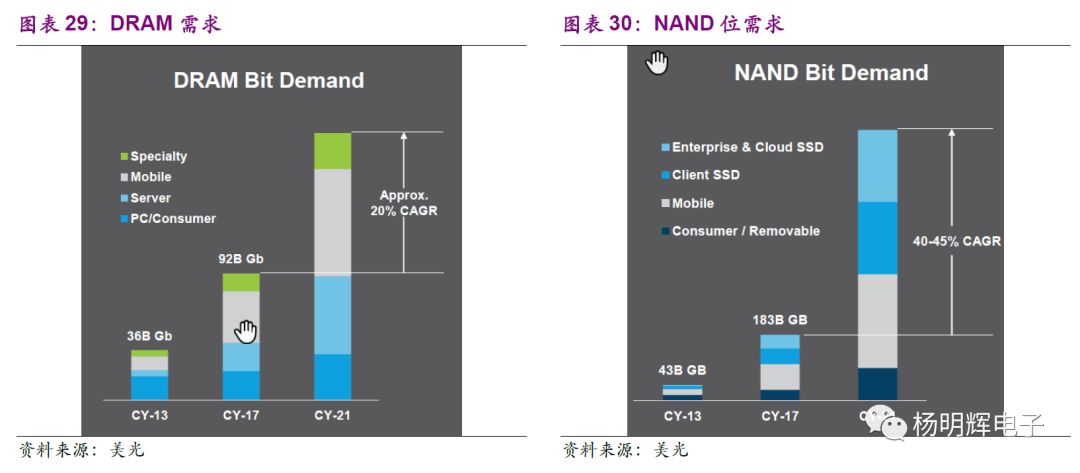

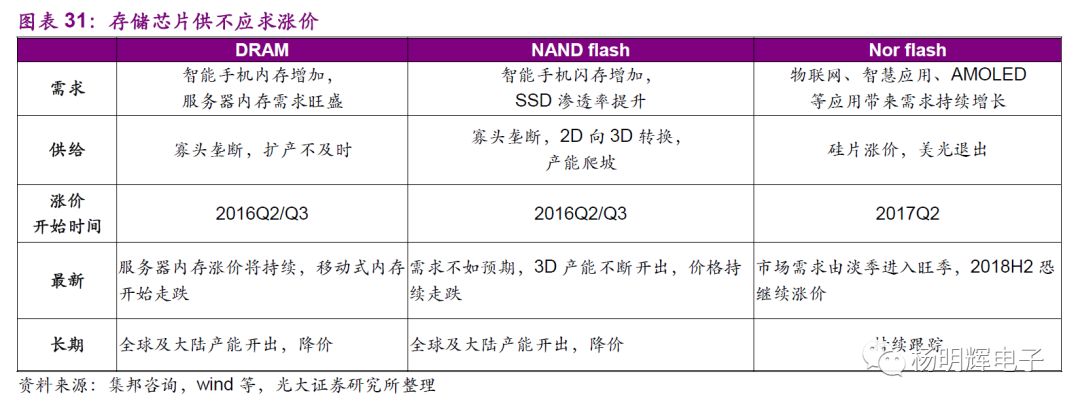

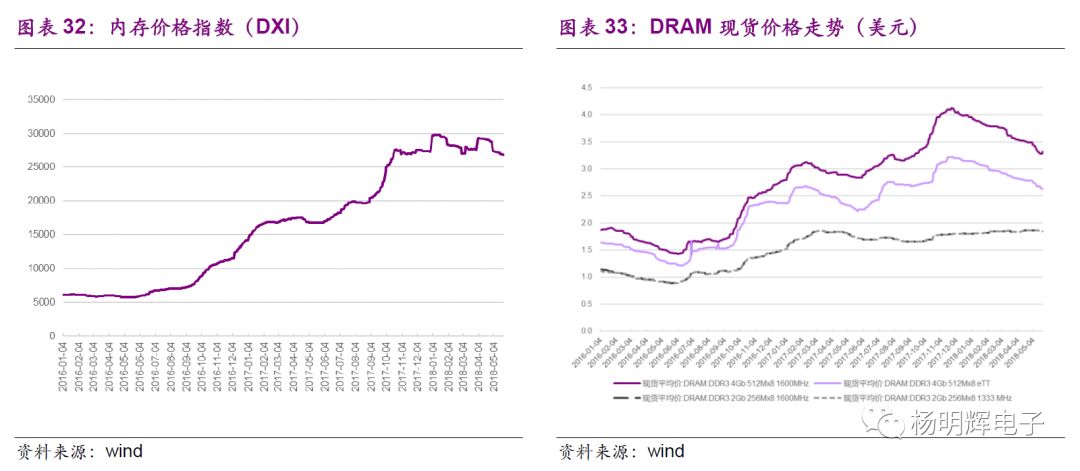

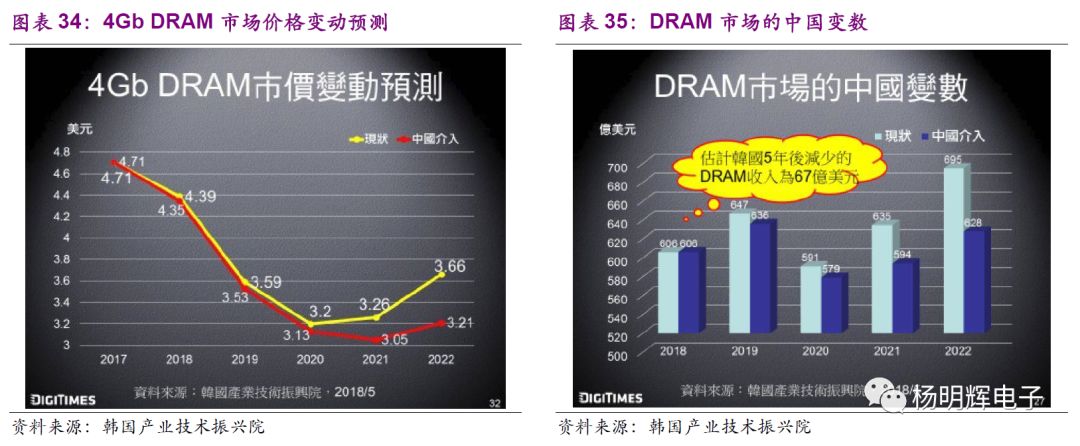

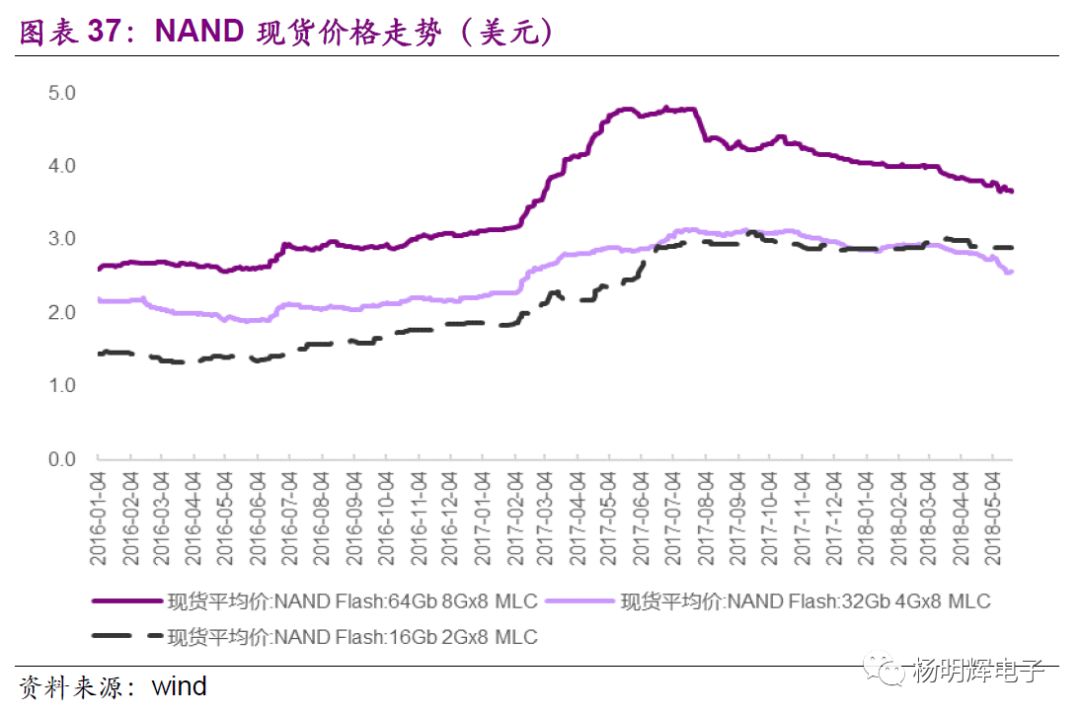

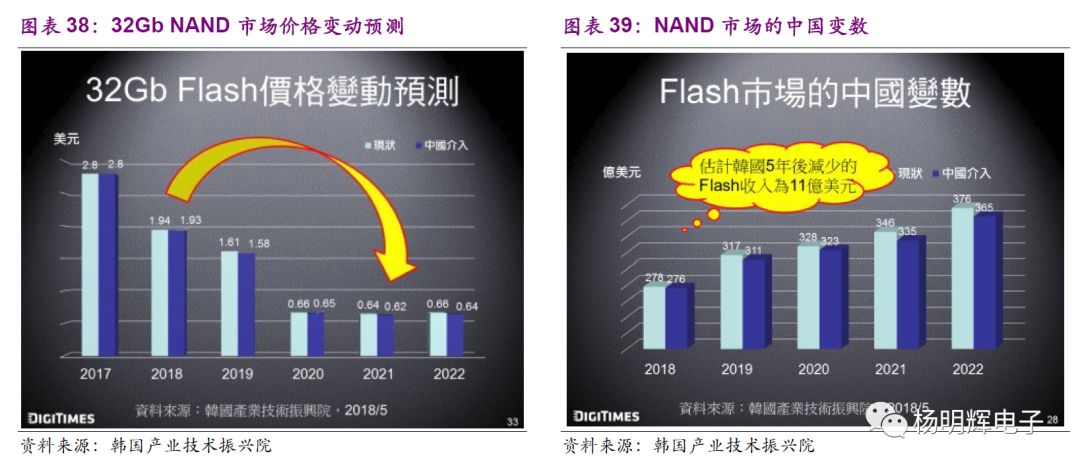

What Impact Will the Development of Storage Chips in Mainland China Have?

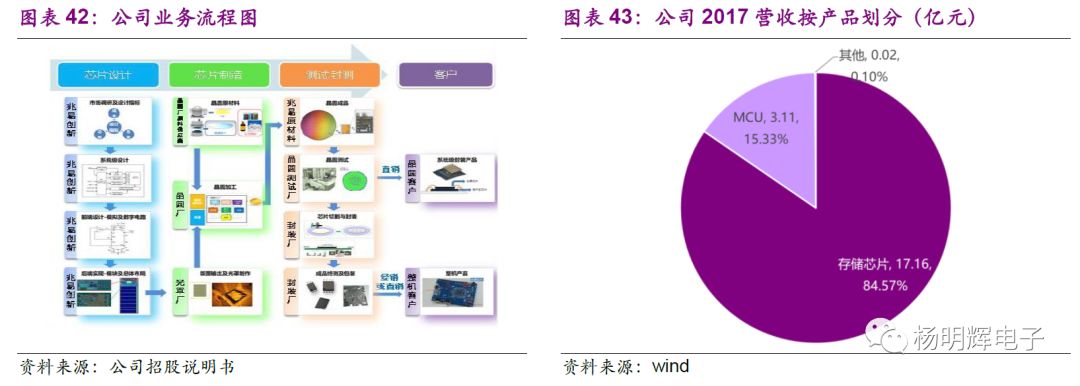

Investment Recommendations

Source: ittbank

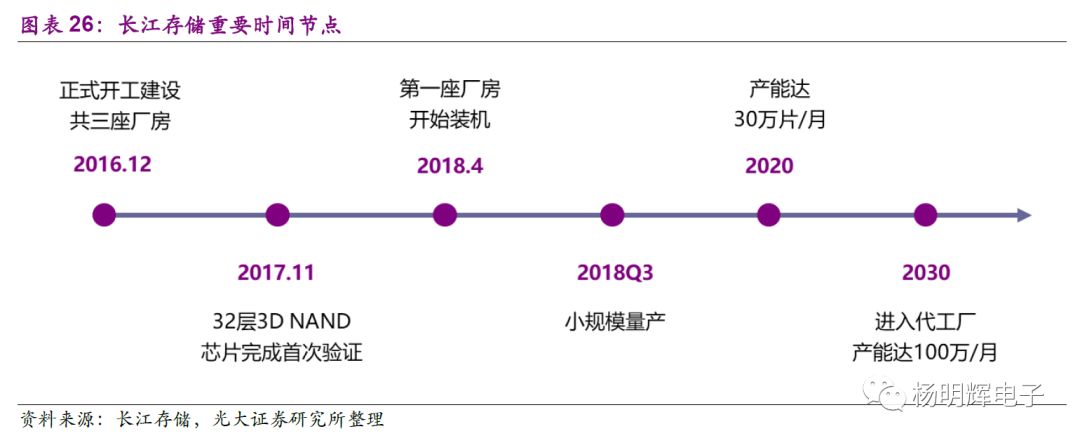

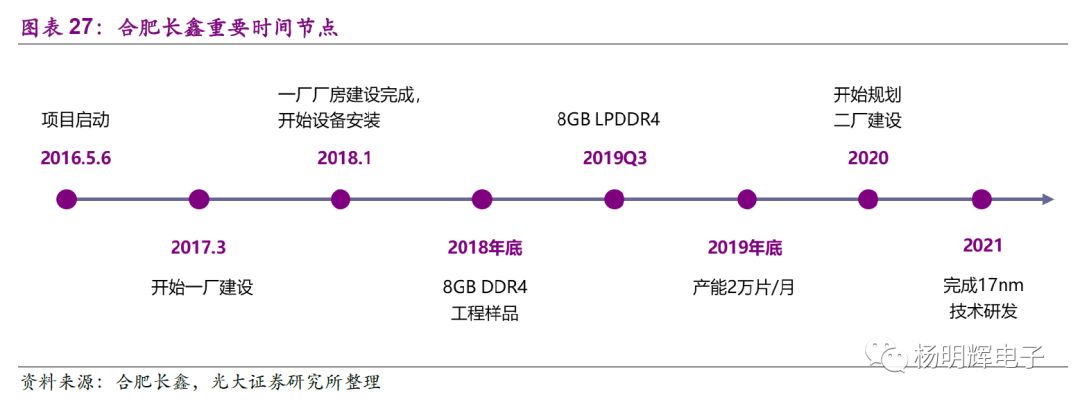

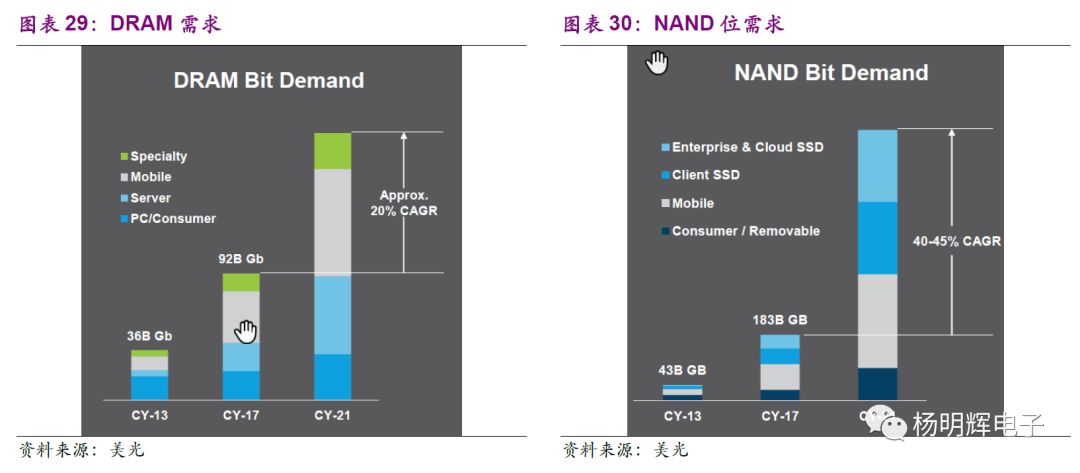

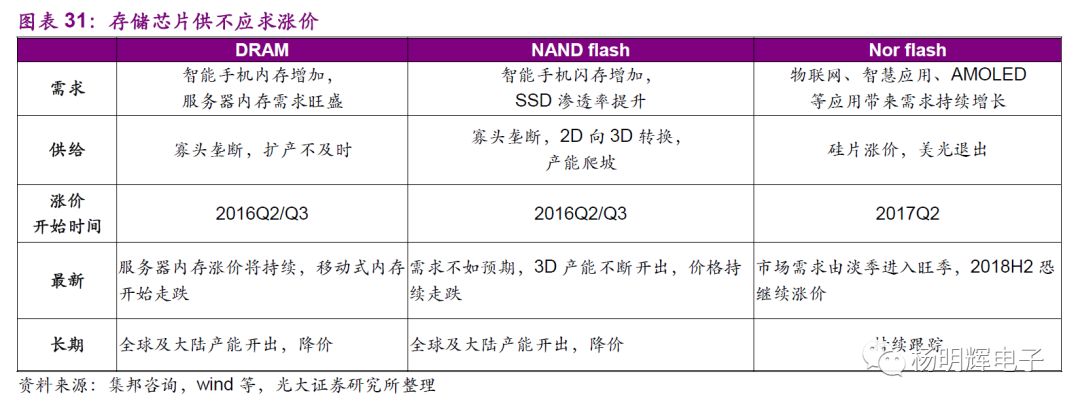

What Impact Will the Development of Storage Chips in Mainland China Have?

Investment Recommendations