Recommendation: GSAuto Alliance | Three Electric Technology Expert Committee Initially, it is only for personnel involved in the research, management, and manufacturing of three electric systems in new energy vehicles from OEMs, Tier 1 companies, universities and research institutions. Currently, we have recruited over 490 people, mainly distributed across more than 50 OEMs, 50+ Tier 1s, universities, and research institutions in the three electric R&D management positions.If you are willing to share, please contact the editor via WeChat (GSAuto0001) or email ([email protected]).

-

“Chip Manufacturing: Semiconductor Processes and Equipment” focuses on introducing semiconductor manufacturing equipment, selecting representative equipment for explanation from a practical perspective. To deepen readers’ understanding of the various equipment’s uses, it adopts an approach that explains the semiconductor manufacturing process while describing the manufacturing equipment used in each process and its structure and principles, aiming to provide readers with a systematic understanding of the entire semiconductor manufacturing system.

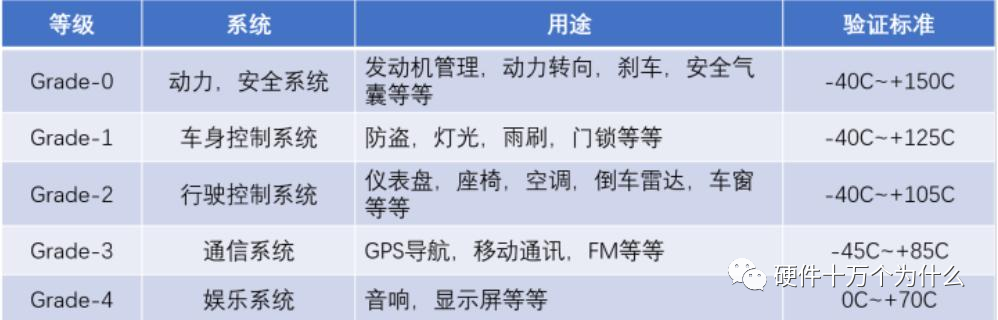

Automotive Chip Levels

According to the automotive electronic standards set by the United States, automotive chips are divided into five levels, with a lower number indicating a higher level.

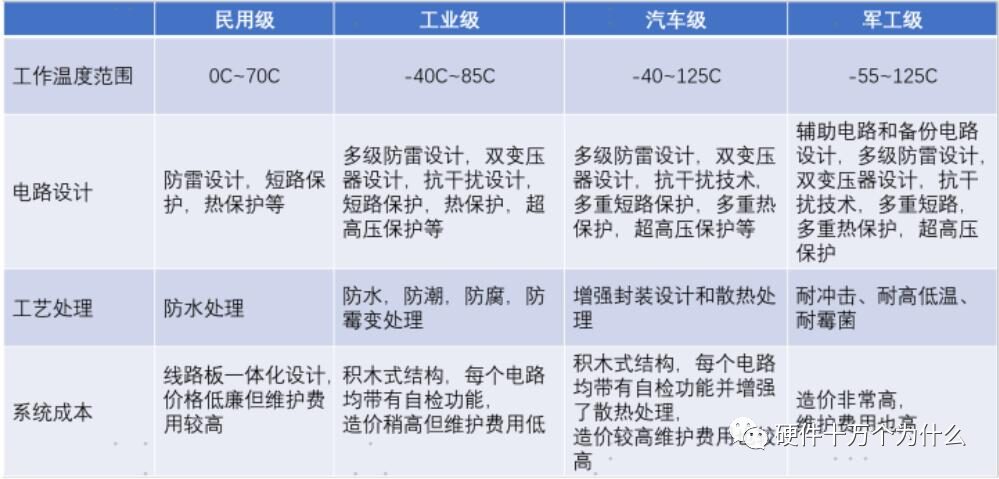

Difference Between Automotive Grade Chips and Industrial Grade Chips

Automotive Grade Chip Lifecycle

10~15 years

Difference Between Automotive Grade Chips and Consumer Grade Chips

Consumer-grade chips have a replacement lifecycle of 2~3 years. Automotive grade chips have lower requirements for processing technology but higher quality requirements.

Requirements for Chip Companies Entering the Automotive Industry

Chip companies entering the automotive industry need to pass a series of standard tests such as the American Automotive Electronics Council AEC (Automotive Electronics Council) and also pass the ISO/TS 16949 quality verification.

Automotive grade chips need to go through a certification process that includes reliability standards AEC-Q100, quality management standards ISO/TS 16949, and functional safety standards ISO26262, etc.

Ranking of Automotive Grade Chip IC Companies

In 2020, Infineon climbed to the top after acquiring Cypress.

Automotive main control chip market size (in 100 million USD)

Main control chip giants have strong AI computing advantages, while functional chip manufacturers have rich experience in the automotive industry chain. Mergers, acquisitions, and alliances frequently occur between these two camps.

As of now, NVIDIA has cooperated with over 370 global automotive manufacturers and Tier 1 suppliers; Intel acquired Mobileye to enter the automotive industry; Qualcomm once intended to acquire NXP, etc.

Detailed explanation of automotive main control + functional chips, and a detailed description of the automotive chip industry pattern.

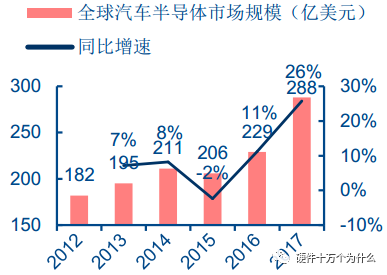

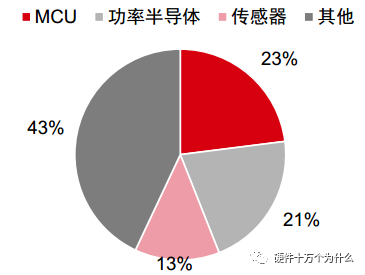

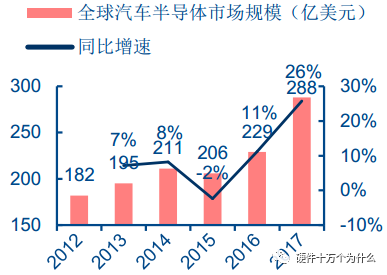

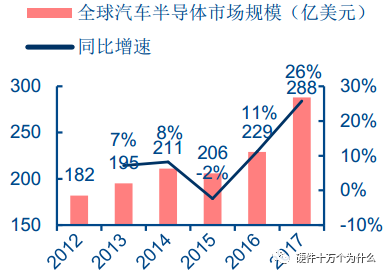

Intelligent driving involves human-machine interaction, visual processing, intelligent decision-making, etc., with AI algorithms and chips at the core. With the acceleration of automotive electrification, automotive semiconductors are growing rapidly. In 2017, the global market size reached 28.8 billion USD (+26%), far exceeding the growth rate of vehicle sales (+3%). The highest proportion is functional chips MCU (6.6 billion USD, accounting for 23%), followed by power semiconductors (21%), sensors (13%), etc.

Automotive semiconductors can be classified into functional chips MCU (Microcontroller Unit), power semiconductors (IGBT, MOSFET, etc.), sensors, and others. According to Strategy Analytics, in traditional fuel vehicles, the value of MCU accounts for the highest proportion at 23%; in pure electric vehicles, MCU accounts for the second highest proportion after power semiconductors at 11%. DIGITIMES predicts that the market size of functional chips MCU is expected to steadily increase from 6.6 billion USD in 2017 to 7.2 billion USD in 2020.

▲ Global automotive sales (in ten thousand units)

▲ Global automotive semiconductor market size (in 100 million USD)

▲ Fuel vehicle semiconductors classified by type

▲ Pure electric vehicle semiconductors classified by type

▲ Automotive functional chip market size (in 100 million USD)

Traditional automotive functional chips are only suitable for specific functions such as engine control and battery management, which cannot meet the high data volume calculations related to intelligent driving.

In recent years, as the penetration rate of intelligent driving increases, global chip giants have rushed into the automotive industry, launching main control chips with AI computing capabilities. The market size of main control chips is expected to grow rapidly, with IHS predicting it could reach 4 billion USD by 2020.

▲ Automotive chips: Main control chips & functional chips

▲ Automotive main control chip market size (in 100 million USD)

Main control chip giants have strong AI computing advantages, while functional chip manufacturers have rich experience in the automotive industry chain. Mergers, acquisitions, and alliances frequently occur between these two camps.

As of now, NVIDIA has cooperated with over 370 global automotive manufacturers and Tier 1 suppliers; Intel acquired Mobileye to enter the automotive industry; Qualcomm once intended to acquire NXP, etc.

▲ Automotive chip market pattern

Main control chips: Computing power continues to grow

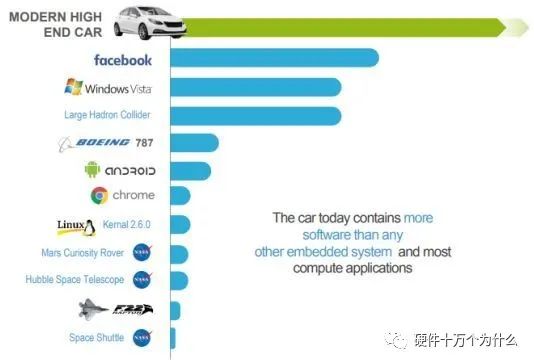

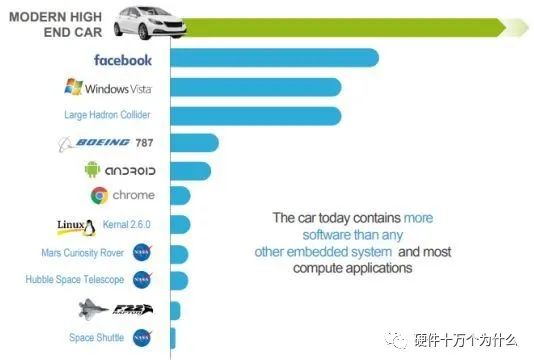

Intelligent driving involves human-machine interaction, visual processing, intelligent decision-making, etc., with AI algorithms and chips at the core. According to NXP statistics, currently a high-end car has over 100 million lines of code, far exceeding that of airplanes, mobile phones, and internet software, and in the future, with the penetration and level of autonomous driving increasing, the number of code lines in cars will show exponential growth.

The computing volume of autonomous driving software has reached the level of 10 TOPS (Tera Operations Per Second). Traditional automotive MCUs’ computing power is difficult to meet the computing requirements of autonomous driving vehicles, leading to the entry of AI chips such as GPUs, FPGAs, and ASICs into the automotive market.

▲ Cars now carry over 100 million lines of code

▲ The number of code lines in cars is increasing exponentially

▲ Typical automotive MCU computing power

▲ NVIDIA GPU SoC computing power

Global leaders in autonomous driving include Google, Baidu, Tesla, Audi, etc. From the SoC chip architecture of these manufacturers’ autonomous driving main control modules, we can glimpse the development direction of automotive chips.

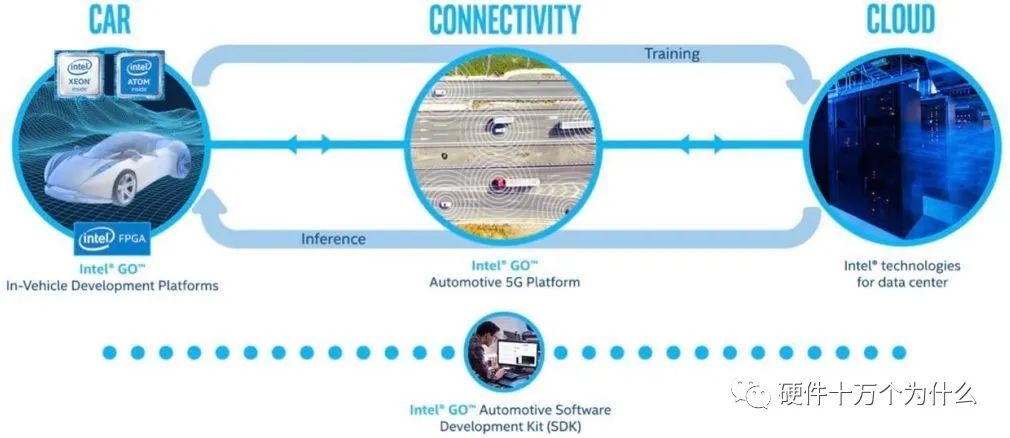

Google Waymo: Uses Intel CPU + Altera FPGA scheme, with Infineon MCU as communication interface. Google Waymo’s computing platform uses Intel Xeon 12-core CPU, paired with Altera’s Arria series FPGA, and uses Infineon’s Aurix series MCU as the communication interface for CAN or FlexRay networks.

▲ Google Waymo’s computing platform architecture

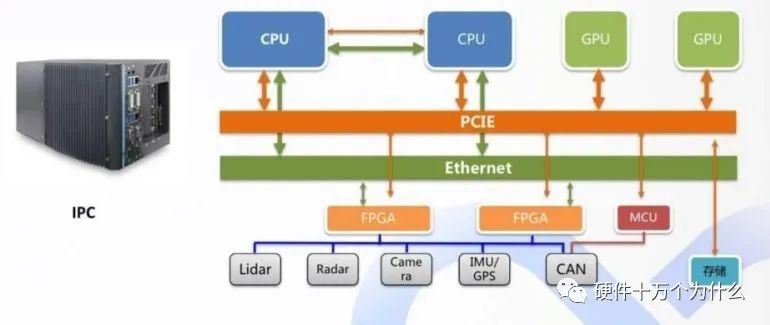

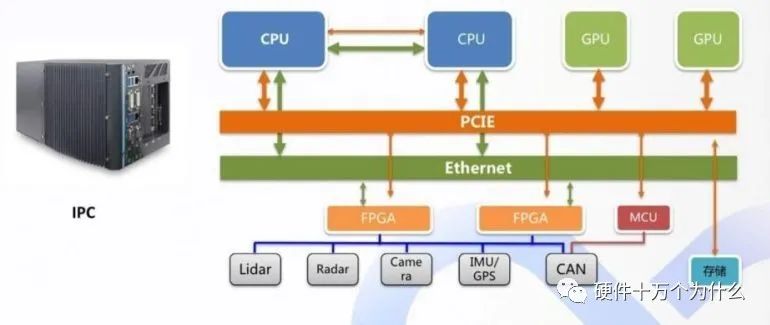

Baidu Apollo: NXP/Infineon/Renesas MCU + Xilinx FPGA/NVIDIA GPU. Baidu’s autonomous driving prototype uses an IPC (Industrial PC) solution, but the size and power consumption of the IPC are difficult to meet mass production requirements, so Baidu has also launched an embedded solution for domain controllers suitable for mass production. The raw data from various sensors is connected to the Sensor Box, where data fusion is completed, and the fused data is transmitted to the computing platform for autonomous driving algorithm processing.

Baidu’s autonomous driving dedicated computing platform ACU (Apollo Computing Unit) defines three series products: MLOC (high precision positioning, MCU), MLOP (high precision positioning + environment perception, MCU + FPGA), MLOP2 (high precision positioning + environment perception + decision-making planning, MCU + GPU).

▲ Baidu Apollo’s IPC computing platform architecture

▲ Baidu Apollo’s domain controller computing platform architecture

Tesla: From Mobileye ASIC to NVIDIA GPU. In 2014, Tesla released Autopilot 1.0, equipped with 1 front camera, 1 rear reversing camera (not participating in assisted driving), 1 front radar, and 12 ultrasonic sensors, with the vision chip using Mobileye EyeQ3 and the main control chip using NVIDIA Tegra 3.

At the end of 2016, Tesla released Autopilot 2.0, equipped with 3 front cameras (different perspectives: wide-angle, telephoto, medium), 4 side cameras (left front, right front, left rear, right rear), 1 rear camera, 1 front radar (enhanced version), and 12 ultrasonic sensors (detection distance doubled), with the main control chip using NVIDIA Drive PX 2, processing speed 40 times that of Autopilot 1.0.

▲ Mobileye EyeQ3 chip architecture

▲ NVIDIA Drive PX2 chip architecture

Audi: Mobileye ASIC, NVIDIA GPU + Altera FPGA + Infineon MCU multi-chip integrated solution. The new Audi A8 has publicly unveiled its zFAS controller solution. zFAS has four high-performance processors: 1) Mobileye’s EyeQ3 is responsible for processing visual information, including traffic sign recognition, pedestrian recognition, collision alerts, lane line detection, etc.; 2) NVIDIA’s Tegra K1 SoC is responsible for 360° surround imaging; 3) Altera’s Cyclone5 FPGA is responsible for sensor fusion, map fusion, parking assistance, etc.; 4) Infineon’s Aurix series MCU is used for traffic congestion control, assisted driving, etc.

▲ Audi A8’s computing platform architecture

In the automotive main control chip field, GPUs will continue to maintain their mainstream status as general automotive main control chips, while FPGAs will serve as effective supplements, and ASICs will become the ultimate direction.

Currently, AI and intelligent driving algorithms are not yet finalized, and GPUs, as general accelerators, are expected to maintain their mainstream status in automotive main control chips for a considerable time; FPGAs, as hardware accelerators, are expected to serve as effective supplements; if all or part of the intelligent driving algorithms can be solidified in the future, ASICs will become the optimal cost-performance ultimate choice.

▲ Automotive main control chip trend chart

1. NVIDIA: GPU monopoly advantage, from intelligent cockpit to autonomous driving

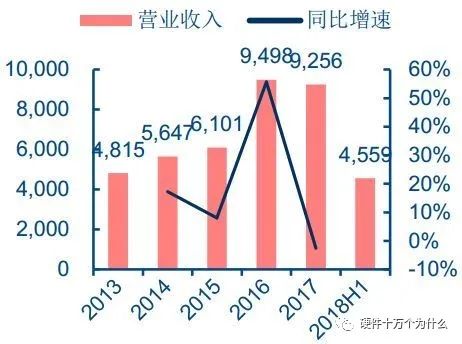

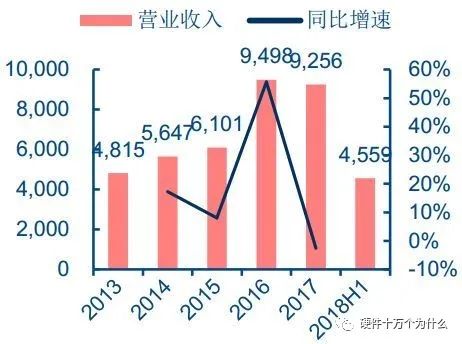

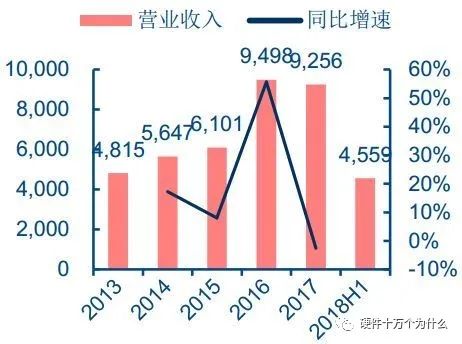

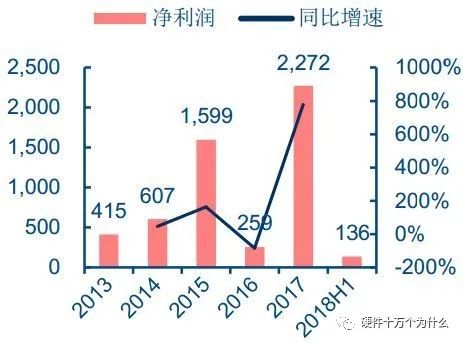

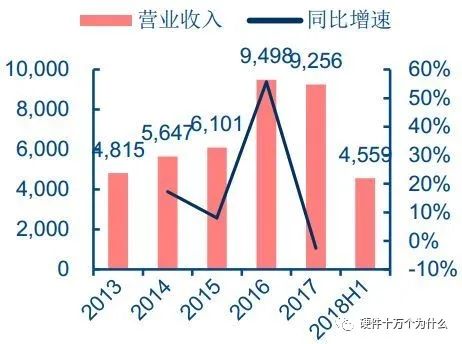

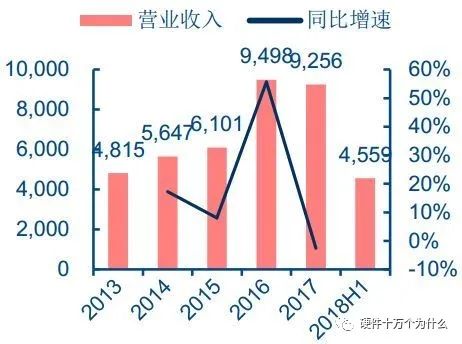

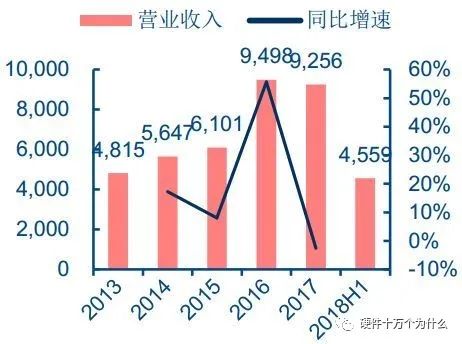

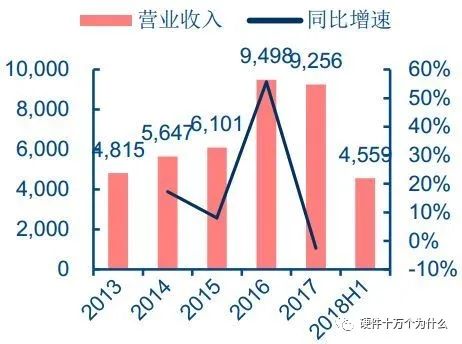

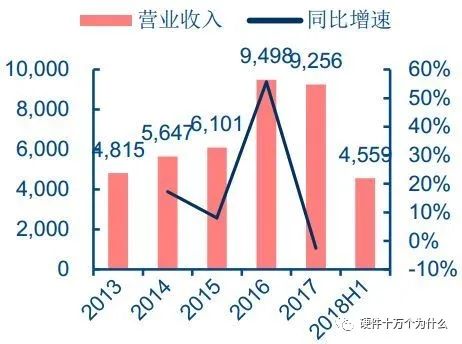

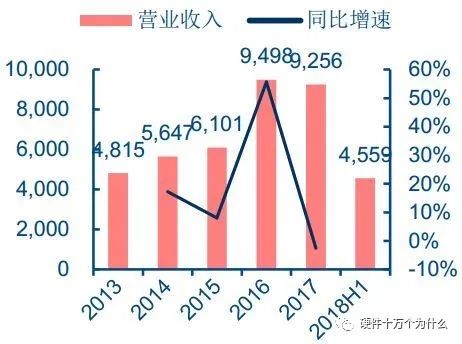

NVIDIA’s revenue and net profit are rapidly growing, with automotive as a long-term driver. NVIDIA is the leader in the GPU field, maintaining over 70% market share for many years. In the 2018 fiscal year (corresponding to the 2017 calendar year), NVIDIA’s revenue was 9.71 billion USD, a year-on-year increase of 40.6%; net profit was 3.05 billion USD, a year-on-year increase of 82.9%.

▲ Global discrete GPU market share (2009-2017)

▲ NVIDIA revenue (in million USD)

▲ NVIDIA net profit (in million USD)

NVIDIA’s digital cockpit computer Drive CX: Utilizes advanced 3D navigation, high-resolution digital instrument clusters, natural language processing, and image processing to achieve driving assistance functions. The core of Drive CX is based on the Maxwell architecture Tegra X1 SoC, and there are also configurations for the Tegra K1 SoC.

The main functions of DRIVE CX include: 1) Natural language processing, completing address queries, calling contacts, etc.; 2) 3D navigation and infotainment, providing high-resolution, high-frame-rate graphics display for numerous applications; 3) Full digital instrument cluster, providing rich graphics display through the instrument cluster or head-up display (HUD); 4) Surround vision, improving the image rendering of fisheye lenses and reducing ghosting effects using complex motion recovery structure technology and advanced stitching technology, and rendering a virtual car in high-fidelity models to achieve realistic surround vision effects; 5) Docking with Android Auto, allowing drivers with Android smartphones or iPhones to easily access their mobile devices and interact with applications such as maps, searches, and music.

▲ NVIDIA digital cockpit computer Drive CX

NVIDIA’s autonomous driving vehicle platform Drive PX: Combines deep learning, sensor fusion, and surround vision, aiming to change the driving experience. The main functions of Drive PX include: 1) Sensor fusion, capable of fusing data from 12 cameras, lidar, millimeter-wave radar, and ultrasonic sensors; 2) Computer vision and deep neural networks, suitable for running DNN (Deep Neural Network) models, enabling intelligent detection and tracking; 3) End-to-end high-definition mapping, capable of quickly creating and continuously updating high-definition maps; 4) Software development toolkit DriveWorks, containing reference applications, tools, and library modules.

▲ NVIDIA autonomous driving vehicle development platform Drive PX

2. Intel: Actively merging and acquiring, entering the autonomous driving dedicated chip market

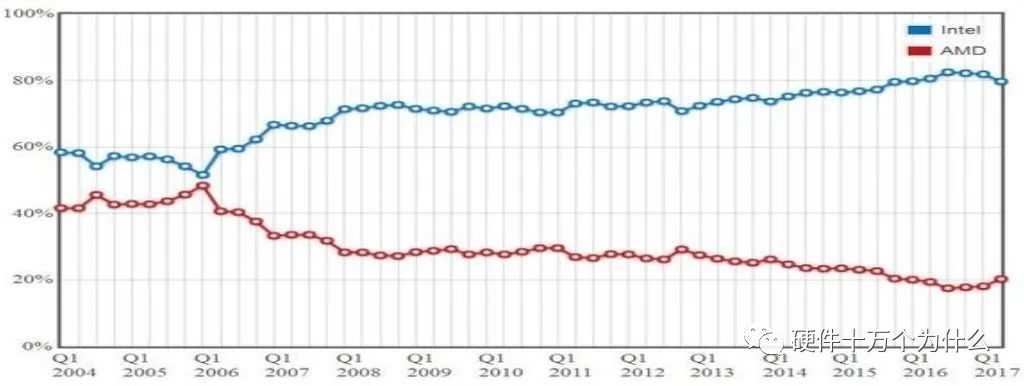

Intel’s traditional business growth is sluggish, and it is entering the automotive field to create new growth points. Intel was once the world’s largest semiconductor chip manufacturer.

According to PassMark statistics, Intel held an 80% market share in the global CPU industry in Q1 2017. In recent years, with the rise of smartphones and the decline of the personal computer market, the growth rate of the company’s main chip business revenue has significantly declined, and its operating revenue has been surpassed by Samsung Electronics. The company once attempted to produce mobile processors but ultimately failed and had to disband the department responsible for that business.

In recent years, Intel has been actively laying out autonomous driving, IoT, AI, VR, and other emerging fields through a large number of acquisitions to create new growth points, striving to transform from a traditional chip manufacturer to a multi-solution provider.

▲ Global CPU market share (2004-2017)

▲ Intel revenue (in million USD)

▲ Intel net profit (in million USD)

Intel’s acquisition of Mobileye: Global leader in visual ADAS. Mobileye is one of the global leaders in the visual ADAS market, holding an 80% share of the ADAS market, with a wealth of visual ADAS products. Mobileye’s proprietary software algorithms and EyeQ chips can analyze visual information in detail and predict possible collisions with other vehicles, pedestrians, bicycles, or other obstacles, and can also detect road markings, traffic signs, and traffic lights.

As of the end of 2017, Mobileye’s products had been used in 313 models from 27 automotive manufacturers, with a shipment volume of 8.7 million units that year. In March 2017, Intel acquired Mobileye for 15.3 billion USD to create the Intel fleet. The fleet will include various automotive brands and models to showcase its versatility and adaptability. Level 4 vehicles will be deployed for testing in the United States, Israel, and Europe.

▲ Mobileye EyeQ5 will assist cars in achieving L4-L5 level autonomous driving

▲ Intel’s “Vehicle to Cloud” system solution

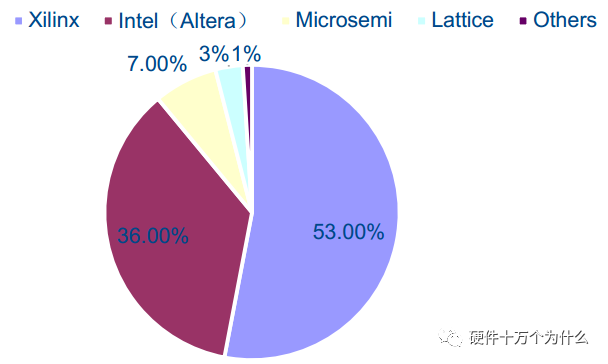

Intel’s acquisition of Altera: Autonomous driving FPGA chips are already in mass production. Currently, the global FPGA market is mainly divided between Xilinx and Altera, holding nearly 90% of the market share, with a total of over 6,000 patents.

Altera’s FPGA products have four major series: the top-tier Stratix series (nearly 10,000 USD), the cost and performance-balanced Arria series (2,000~5,000 USD), the inexpensive Cyclone series (10~20 USD), and the MAX series CPLD. Intel announced the completion of its acquisition of Altera in 2015, helping to accelerate the growth of its data center and IoT business.

▲ FPGA market share distribution in 2016

3. Qualcomm: Leveraging communication advantages, from infotainment to V2X

Qualcomm’s traditional business revenue has declined, actively laying out in emerging industries. Qualcomm is the leader in global smartphone SoCs.

In the automotive field, Qualcomm’s solutions include: 1) In-vehicle information systems, cellular network solutions optimized for automotive; 2) Driving data platforms, intelligently collecting and analyzing data from different automotive sensors, enabling precise positioning, monitoring and learning driving patterns, perceiving the surrounding environment, and accurately sharing information with external platforms; 3) Infotainment, providing 3D navigation, online media playback, and parking assistance support, as well as voice, face, and terminal recognition features; 4) Wireless charging for electric vehicles, launching Qualcomm Halo WEVC wireless charging solutions.

▲ Global smartphone SoC market share (2016-2017)

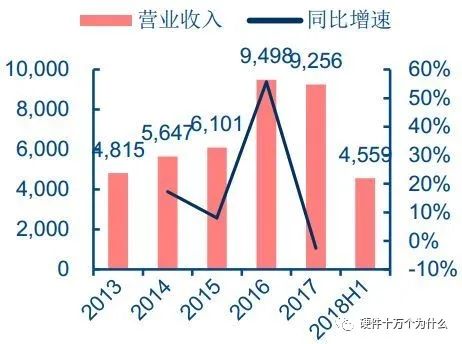

▲ Qualcomm revenue (in million USD)

▲ Qualcomm net profit (in million USD)

▲ Qualcomm’s layout in emerging industries

Qualcomm launched an in-vehicle infotainment system solution. The Snapdragon automotive platform infotainment system is now divided into minimalist (Select), high-end (High), and premium (Premium) solutions.

The minimalist solution can support 3 displays, including the infotainment system, instrument cluster, and head-up display (HUD); the high-end level can support up to 4 displays, with separate screens for the front passenger or rear seat entertainment, while also supporting top-tier audio, low-latency wireless transmission of high-definition video, surround processing, and deep learning and computer vision processing to identify nearby obstacles and pedestrians; the top-tier solution can support up to 6 displays, including instrument cluster, infotainment system, HUD, front passenger, and rear seat (two different screens).

At the 2017 CES, the Maserati showcased hardware equipped with a customized Snapdragon automotive solution, including Snapdragon automotive processors, Gobi 3G/4G LTE modems, Wi-Fi, and Bluetooth modules. Another vehicle on display, the Chrysler Portal, installed Panasonic’s in-vehicle entertainment concept system, which will be based on the latest version of Android Auto and Qualcomm’s Snapdragon chips.

▲ Snapdragon 602A automotive processor

Qualcomm launched a vehicle-to-everything chipset that supports LTE and DSRC vehicle-to-everything solutions. The Snapdragon X5 LTE supports LTE V2X, with speeds up to category 4, a downlink rate of 150 Mbps, and an uplink speed of 50 Mbps. The Snapdragon X12 LTE supports speeds of up to category 10, with a downlink rate of up to 60 MHz 3x CA (450 Mbps) and a 40 MHz 2x CA (100 Mbps) uplink rate.

The Snapdragon X16 LTE modem supports peak download speeds of up to 1 Gbps, helping to meet the connectivity needs and use cases of next-generation intelligent connected vehicles, including high-definition map updates, real-time traffic and road condition information, software upgrades, Wi-Fi hotspots, and multimedia streaming.

In addition, Qualcomm launched the world’s first commercial solution for cellular vehicle-to-everything (C-V2X) based on the 3rd Generation Partnership Project (3GPP) version 14 specification in September 2017, the Qualcomm 9150 C-V2X chipset. This chipset includes an application processor running the Intelligent Transportation System (ITS) V2X stack and a hardware security module (HSM), which is expected to be released in the second half of 2018 and to achieve mass production and supply to automakers by 2019. C-V2X supports both DSRC and LTE communications, providing vehicles with surrounding environmental information and information in non-line-of-sight (NLOS) scenarios.

Functional chips: The technology is relatively mature, and the pattern is stable with some changes

The functional chip market is relatively mature, and the pattern is relatively stable. According to Strategy Analytics, in 2016, the global automotive MCU installation volume exceeded 2.5 billion, with an average of 25-30 MCUs installed per vehicle. The top 5 global automotive MCU markets in 2016 were NXP (14%), Infineon (11%), Renesas (10%), STMicroelectronics (8%), and Texas Instruments (7%).

Compared to consumer chips and general industrial chips, automotive chips operate in harsher environments: temperature ranges can be as wide as -40~155℃, high vibration, dust, electromagnetic interference, etc. Due to safety issues, automotive chips have higher reliability and safety requirements, with a general design life of 15 years or 200,000 kilometers. “Automotive grade” chips need to undergo a rigorous certification process, including reliability standards AEC-Q100, quality management standards ISO/TS 16949, functional safety standards ISO26262, etc.

A chip generally takes 2-3 years to complete automotive certification and enter the supply chain of automotive manufacturers; once entered, it generally has a supply cycle of 5-10 years. High safety and high reliability standards, long supply cycles, and long-term cooperative relationships with upstream and downstream component manufacturers and automotive manufacturers are the main reasons for the stability of the current automotive chip pattern.

▲ Automotive grade chips vs consumer and industrial grade chips

▲ Overview of major automotive MCU companies globally

▲ Typical automotive MCU computing power

▲ 2016 Global Automotive MCU Market Share

The functional chip market pattern also has variables: 1) Traditional functional chip manufacturers actively expand into main control chips while maintaining their existing shares, such as NXP Bluebox, Infineon Aurix, Renesas R-Car, etc.; 2) Functional chip manufacturers are integrating advantages through mergers and acquisitions, such as NXP acquiring Freescale, Infineon intending to acquire STMicroelectronics, etc.; 3) Semiconductor giants also hope to acquire functional chip manufacturers to obtain in-vehicle technology and channel experience, such as Intel acquiring Mobileye, Qualcomm once intended to acquire NXP, etc.

NXP: Provides complete automotive semiconductor solutions, with the Bluebox platform supporting L4 autonomous driving.

Automotive electronics layout: NXP’s automotive semiconductor products cover MCU and MPU, in-vehicle networking, media and audio processing, intelligent power drivers, energy and power management, sensors, system basis chips, driver assistance transceivers, automotive safety, etc.

Autonomous driving platform: NXP BlueBox is an autonomous driving development platform that integrates the S32V234 automotive vision and sensor fusion processor, S2084A embedded computing processor, and S32R27 radar microcontroller. BlueBox can complete multi-sensor fusion (millimeter wave radar, vision, lidar, V2X), supporting L4 autonomous driving, with a power consumption of less than 40W and computing power of 90,000 DMIPS (Dhrystone Million Instructions executed Per Second).

Vision chip: The S32V234 vision processor has a CPU (4 ARM Cortex A53 and 1 M4), 3D GPU (Vivante GC3000), and vision acceleration unit (2 APEX-2 vision accelerators), supporting 4 cameras. It can be used for front-view cameras, rear-view cameras, surround systems, sensor fusion systems, etc., capable of real-time 3D modeling, with a computing power of 50 GFLOPs. Meanwhile, the S32V234 chip has reserved interfaces for supporting millimeter wave radar, lidar, and ultrasonic, enabling multi-sensor data fusion, and can support ISO26262 ASIL-C standard.

Radar chip: The S32R27 radar processor adopts two e200z7 32-bit CPUs and two 32-bit lock-step mode e200z4, capable of supporting adaptive cruise control, intelligent headlight control, lane departure warning, and blind spot detection functions.

▲ NXP revenue (in million USD)

▲ NXP net profit (in million USD)

▲ NXP Bluebox autonomous driving development platform

Infineon: Covers integrated circuits and power semiconductors, vision and radar chips supporting ADAS functions.

Automotive electronics layout: Infineon’s automotive semiconductor products cover body semiconductors, automotive safety, chassis assembly, powertrains, hybrid and electric vehicles, active antennas, etc.

Autonomous driving platform: Infineon has launched the Aurix autonomous driving domain controller, which can complete sensor signal fusion (radar, cameras, ultrasonic, and lidar), compute the best driving strategy, and trigger actuators in the vehicle, supporting enhanced ADAS functions such as traffic assistance, autonomous obstacle avoidance, etc.

Vision chip: Capable of achieving ADAS functions such as lane departure warning, forward collision warning, traffic sign recognition, and pedestrian recognition.

Radar chip: 1) 77GHz long-range radar system, using SiGe (silicon-germanium) technology to ensure high-frequency functionality and durability, can be used for collision avoidance systems; 2) 24GHz short-range radar system, also using SiGe (silicon-germanium) technology, can be used for blind spot monitoring systems.

In-vehicle 3D camera chip: Infineon has launched the Real3 series of 3D image sensor chips, using time-of-flight (ToF) cameras to measure the 3D environment, capable of recognizing driver behavior and transmitting this information to ADAS, and can enhance HMI experience such as gesture recognition.

▲ Infineon revenue (in million euros)

▲ Infineon net profit (in million euros)

▲ Infineon Aurix autonomous driving controller architecture diagram

Renesas: Multi-category in-vehicle MCUs and SoCs, R-Car platform supports L4 autonomous driving.

Automotive electronics layout: Renesas’ automotive semiconductor products cover system-on-chip (SoC), power management, battery management, power devices, communication devices, video, and display, etc.

Autonomous driving platform: Renesas has launched the R-Car autonomous driving SoC, using ARM CPUs and PowerVR GPUs, with an expandable hardware platform covering entry-level (R-Car E series), mid-level (R-Car M series), and high-end (R-Car H series), supporting various open-source software (Android, QNX, Linux, Windows, Genivi, etc.). In addition, there are external camera chips (R-Car V series), in-vehicle camera chips (R-Car T series), intelligent cockpit chips (R-Car D series), and V2X chips (R-Car W series), etc.

▲ Renesas revenue (in 100 million yen)

▲ Renesas net profit (in 100 million yen)

▲ Renesas R-Car hardware and software platform

STMicroelectronics: A semiconductor manufacturer led by safety, covering vision, radar, and V2X products.

Automotive electronics layout: STMicroelectronics’ automotive semiconductor products cover advanced driver assistance systems (ADAS), body comfort systems, chassis and safety systems, new energy vehicles, entertainment systems, mobile services, power systems, communication, and networking, etc.

Vision chip: Can be used for signal processing of front, rear, side, and in-vehicle cameras. In addition, STMicroelectronics collaborates with Mobileye to develop the EyeQ series chips, responsible for chip manufacturing technology, dedicated memory, high-speed interface circuits, and system packaging design, as well as overall safety architecture design.

Radar chip: 1) 77GHz long-range radar system, STRADA770 single-chip transceiver, can cover 76-81GHz, suitable for adaptive cruise control (ACC), automatic emergency braking (AEB), forward collision warning (FCW), lane change assistance (LCA), pedestrian detection (PD), etc.; 2) 24GHz short-range radar system, STRADA431 chip, includes one transmitter and three receivers, suitable for blind spot detection (BSD), lane change assistance (LCA), parking assistance (PA), reverse side detection (RCTA), collision mitigation braking (CMB), etc.

V2X chip: Based on DSRC, STMicroelectronics and Israeli V2X manufacturer Autotalks began collaborating to develop V2X chipsets in 2014. The V2X solutions showcased at CES 2018 integrated STMicroelectronics’ Telemaco3 in-vehicle information service platform and Autotalks’ CRATON2 chipset.

▲ STMicroelectronics revenue (in million USD)

▲ STMicroelectronics net profit (in million USD)

▲ STMicroelectronics ADAS system

Texas Instruments: Provides open ADAS SoC solutions.

Automotive electronics layout: Texas Instruments’ automotive semiconductor products cover advanced driver assistance systems (ADAS), infotainment systems and instrument clusters, body electronic devices and lighting, HEV/EV and power systems, etc.

Autonomous driving platform: Texas Instruments’ main ADAS products are the TDAx series, including TDA2x, TDA3x, and TDA2Eco SoCs, based on heterogeneous hardware and a universal software architecture, providing scalable open ADAS solutions. TDA2x was released in October 2013, mainly targeting the mid to mid-high-end market, equipped with 2 ARM Cortex-A15 cores, 4 Cortex-M4 cores, 2 TI fixed-point C66x DSP cores, 4 EVE vision accelerator cores, and Imagination SGX544 GPU, mainly used for front camera information processing, including lane warning, collision detection, adaptive cruise control, and automatic parking systems, etc.

TDA3x was released in October 2014, mainly targeting the mid to mid-low-end market, reducing the configuration to include dual-core A15 and SGX544 GPU, mainly applied in rear cameras, 2D or 2.5D surround views, etc., supporting various ADAS algorithms such as lane line assistance, adaptive cruise control, traffic sign recognition, pedestrian and object detection, forward collision warning, and rear collision warning.

Sensor chips: Including camera chips (front, rear, side, surround), radar chips (long-range, short-range, multi-mode), scanning lidar chips, ultrasonic chips, and sensor fusion chips, etc.

▲ Texas Instruments revenue (in million USD)

▲ Texas Instruments net profit (in million USD)

▲ Texas Instruments TDAx product comparison

Summary

Cars have evolved from “function machines” to “smart machines”, from “automotive electronics” to “autonomous driving”. The strategy is optimistic about automotive chips as the core components in the intelligent driving industry chain.

Globally, major companies laying out the automotive chip industry include: NVIDIA, Intel, Qualcomm, etc.; potential merger and acquisition targets include: Infineon, etc. Domestic companies are expected to gradually penetrate from products with lower safety level requirements, such as in-vehicle entertainment systems, to front-mounted systems, from domestic OEMs to joint venture automakers.

*********************************

1. The views in this article are for sharing and communication only and do not represent the position of this public account;

2. Article source: Hardware Ten Thousand Whys, reprint must note 【Smart Enjoy New Power】

Selected Previous Issues

Welcome to join the professional technical discussion community:

▼ClickRead the original textJoin the Three Electric Expert Committee Knowledge Planet