1. Semiconductor Market Size

The downstream applications of semiconductors are extensive and closely related to economic development. Semiconductors refer to materials that have electrical conductivity between conductors and insulators at room temperature. Their resistivity increases with temperature, making them suitable for manufacturing integrated circuits and semiconductor devices. The downstream applications of semiconductors are widespread, encompassing various industries such as smartphones, PCs, automotive electronics, medical technology, communication technology, artificial intelligence, the Internet of Things, industrial electronics, and military.

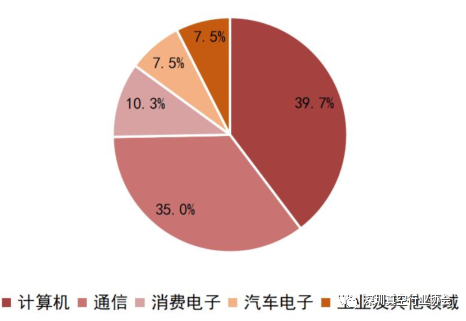

From the perspective of downstream demand structure, computers (mainly PCs and servers) and communication products (mainly smartphones) constitute the primary sources of global semiconductor demand, accounting for nearly three-quarters combined. According to IC Insights data, in 2020, the sales revenue in the computer field accounted for 39.7% of the semiconductor downstream, while the communication field accounted for 35.0%, followed by consumer electronics and automotive electronics, which accounted for 10.3% and 7.5%, respectively.

Chart 1: Downstream Sales Structure of the Semiconductor Industry

Data Source: IC Insights, Dongguan Securities Research Institute

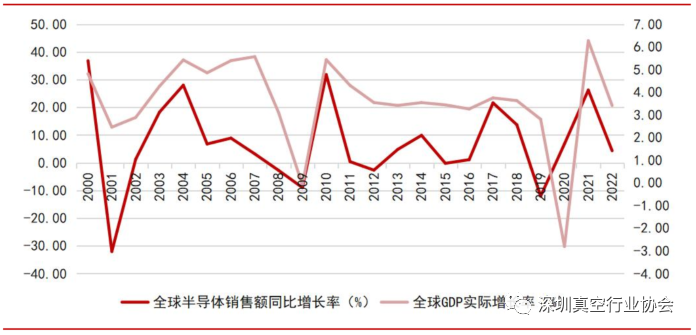

In the era of electronic information, the sales of semiconductors are increasingly linked to global economic growth, playing an important role in economic development. In this era, semiconductors play an increasingly important role in economic development, with sales closely correlated with global economic growth. According to data from WSTS and the International Monetary Fund, from 1987 to 1999, the correlation coefficient between global semiconductor sales growth rate and GDP growth rate was 0.13, while from 2000 to 2022, this coefficient increased to 0.46, indicating a significant enhancement in correlation. As the silicon content in downstream PCs, servers, smartphones, and new energy vehicles continues to rise, it is expected that the correlation between semiconductor sales and economic development levels will continue to increase in the future.

Chart 2: Year-on-Year Growth Rate of Global Semiconductor Sales and Actual GDP Growth Rate from 2000 to 2022

Data Source: WSTS, International Monetary Fund, Dongguan Securities Research Institute

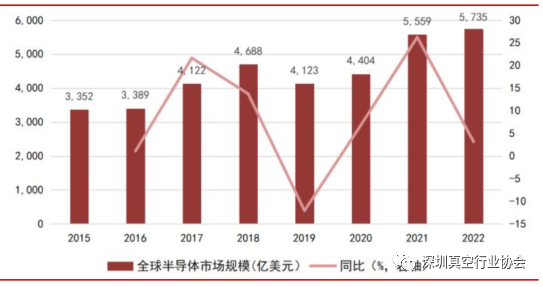

Review of Industry Sales Scale: Innovation in the Downstream Drives Industry Development, with Industry Scale Growing Amid Fluctuations. We have reviewed the sales situation of semiconductors over the years and found that the market scale is mainly determined by downstream innovation. The sales situation of downstream terminals and the release of enterprise capacity jointly determine cyclical fluctuations, showing a characteristic of growth amid fluctuations. From 2015 to 2022, global semiconductor sales grew from $335.2 billion to $573.5 billion, with a compound annual growth rate of 7.97%, higher than the global GDP growth rate during the same period.

2015-2018: Smartphones were still in a rapid penetration period, driven by strong demand for consumer electronics such as smartphones and TWS, the global semiconductor market flourished, growing from $335.2 billion to $468.8 billion, with a compound annual growth rate of 11.83% from 2015 to 2018;

2019: The market for smart terminals represented by smartphones declined, leading to a downward cycle in the global semiconductor market, exacerbated by intensified international trade frictions. The global semiconductor industry market size was $412.3 billion, down 12.05% year-on-year;

2020-2022: With the continuous expansion of 5G terminal scale, increasing demand for data centers, and the gradual expansion of intelligent scenarios such as AIoT and continuous penetration of automotive electronics, coupled with increased demand for remote work and home entertainment during the pandemic, the global semiconductor industry scale increased. The global semiconductor market size in 2020, 2021, and 2022 was $440.4 billion, $555.9 billion, and $573.5 billion, respectively, with year-on-year growth rates of 6.82%, 26.83%, and 3.17%.

Chart 3: Global Semiconductor Market Size from 2015 to 2022

Data Source: WSTS, Dongguan Securities Research Institute

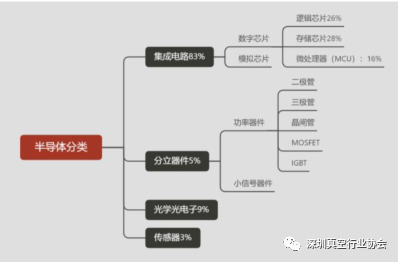

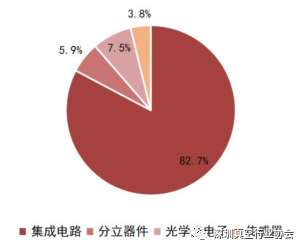

Classification of the Semiconductor Industry. According to the World Semiconductor Trade Statistics (WSTS), semiconductor products are divided into four categories: integrated circuits, discrete devices, optoelectronic devices, and sensors. Among them, integrated circuits account for more than 80% of the industry scale, with subfields including logic chips, memory chips, microprocessors, and analog chips, widely used in 5G communication, computers, consumer electronics, network communication, automotive electronics, and the Internet of Things, making them the core components of most electronic devices.

According to WSTS data, in 2022, the global market sizes for integrated circuits, discrete devices, optical optoelectronics, and sensors were $479.988 billion, $34.098 billion, $43.777 billion, and $22.262 billion, respectively, accounting for 82.7%, 5.9%, 7.5%, and 3.8% of the global semiconductor industry. Among the aforementioned semiconductor product distributions, integrated circuits are the most technically challenging and fastest-growing sub-products, making them the most important component of the semiconductor industry.

Chart 4: Classification of Semiconductors

Data Source: WSTS, Dongguan Securities Research Institute

Chart 5: Sales Proportion of Semiconductor Subcategories (2022)

Data Source: WSTS, Dongguan Securities Research Institute

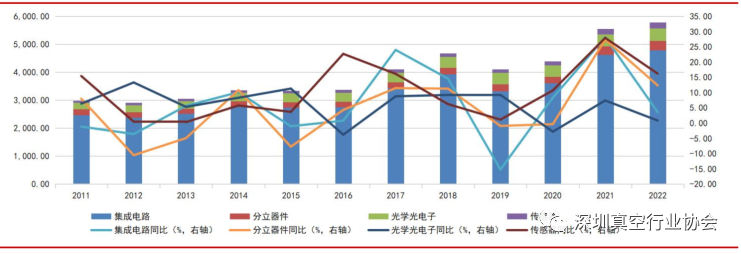

Chart 6: Market Size Changes of Semiconductor Subcategories from 2011 to 2022

Data Source: WSTS, Dongguan Securities Research Institute

Integrated Circuits: Integrated circuits (IC) are a type of microelectronic device or component that uses a certain process to interconnect the required transistors, resistors, capacitors, and inductors in a circuit on a small piece or several small pieces of semiconductor chips or medium substrates, then packaged in a housing, forming a microstructure with the desired circuit function, also known as a chip.

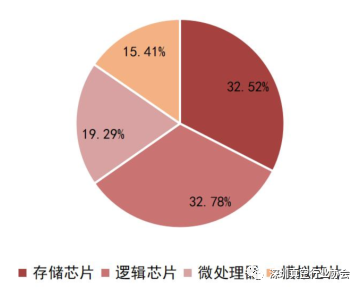

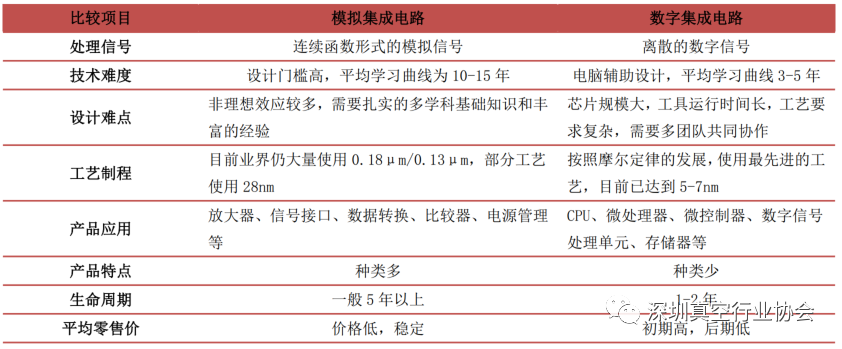

According to the type of signal processed, integrated circuits can be divided into digital chips and analog chips. Integrated circuits can be classified into two main categories based on the type of signal processed: digital integrated circuits and analog integrated circuits. Digital integrated circuits are used to perform arithmetic and logic operations on discrete digital signals, including logic chips, memory chips, and microprocessors, which are digital logic circuits or systems made by integrating components and wiring on the same semiconductor chip; analog integrated circuits mainly refer to integrated circuits that process analog signals composed of capacitors, resistors, transistors, etc. According to WSTS data, in 2020, logic chips, memory chips, microprocessors, and analog chips accounted for 32.78%, 32.52%, 19.29%, and 15.41% of the integrated circuit market size, respectively.

Chart 7: Composition of Global Integrated Circuit Products in 2020

Data Source: WSTS, Dongguan Securities Research Institute

Chart 8: Comparison of Analog and Digital Integrated Circuits

Discrete Devices: Refers to semiconductor devices that have fixed single characteristics and functions, which cannot be further subdivided in function, such as diodes, transistors, thyristors, and power semiconductor devices (such as LDMOS, IGBT), etc. They do not integrate any other electronic components internally, only possessing simple voltage and current conversion or control functions without the circuit’s system function. Compared to integrated circuits, discrete devices are larger in size, but they have advantages in ultra-high power and semiconductor lighting applications.

2. Semiconductor Industry Structure

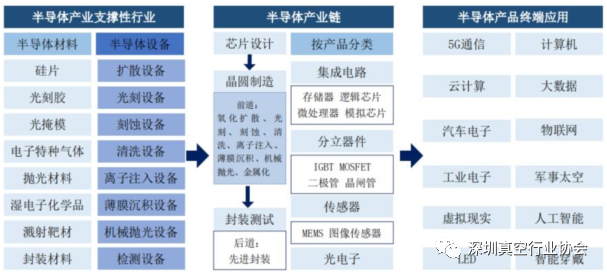

Semiconductor Industry Chain Situation. From the perspective of the production process, semiconductor production is mainly divided into three major processes: design, manufacturing, and packaging/testing, requiring upstream semiconductor equipment and materials as support. The downstream applications represented by integrated circuits are extensive, and demand growth driven by downstream innovation is the core driving force for the rapid development of the semiconductor industry.

Chart 15: Semiconductor Industry Chain

Data Source: Shengmei Shanghai Prospectus, Dongguan Securities Research Institute

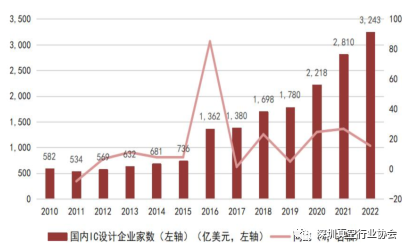

Integrated Circuit Design: Refers to designing the required circuit diagram according to established functional requirements, with the final output being a mask layout. The development of China’s integrated circuit design industry started at a low point, but relying on huge market demand and favorable industrial policy environment, it has become a new force in the global integrated circuit design industry. From the perspective of industry scale, the sales scale of integrated circuit design in mainland China grew from 38.3 billion yuan in 2010 to 451.9 billion yuan in 2021, with a compound annual growth rate of about 25.15%; the gradual improvement of the domestic industrial chain also provides wafer manufacturing support for domestic startup chip design companies. With the support of industry funds and policies, as well as the return of overseas talent, the number of chip design companies in China has rapidly increased. According to data from the China Semiconductor Industry Association, since 2010, the number of chip design companies in China has significantly increased from 582 in 2010 to 3,243 in 2022, with an average compound growth rate of about 15.39% from 2010 to 2022.

Chart 16: Growth of China’s Chip Design Enterprises from 2010 to 2022

Data Source: China Semiconductor Industry Association, Dongguan Securities Research Institute

Chart 17: Sales Revenue and Year-on-Year Growth Rate of China’s Integrated Circuit Design Industry

Data Source: China Semiconductor Industry Association, Dongguan Securities Research Institute

Integrated Circuit Manufacturing: Integrated circuit manufacturing refers to the process of transferring the designed circuit diagram onto substrates such as silicon wafers, i.e., fabricating the required transistors, diodes, resistors, and capacitors on a small piece of silicon, glass, or ceramic substrate using a specific process, interconnecting them appropriately, and then packaging them in a housing, significantly reducing the size of the entire circuit and the number of lead wires and solder points.

From the process perspective, integrated circuit manufacturing is generally divided into front-end (FEOL) and back-end (BEOL) processes. The front-end process generally refers to the manufacturing process of devices such as transistors, mainly including isolation, gate structure, source-drain, contact hole formation, etc. The back-end process mainly refers to forming interconnects that transmit electrical signals to various devices on the chip, mainly including dielectric deposition between interconnects, metal wiring formation, and contact pad preparation.

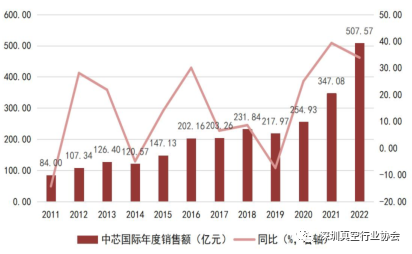

In recent years, benefiting from the rise of domestic foundries such as SMIC and Hua Hong Semiconductor, as well as leading foundries like TSMC setting up factories in mainland China, the market scale of China’s integrated circuit manufacturing industry has achieved rapid growth. According to data from the China Semiconductor Industry Association, from 2010 to 2021, the market scale of integrated circuit manufacturing in mainland China grew from 40.9 billion yuan to 317.63 billion yuan, with a compound annual growth rate of 20.48%; among them, SMIC’s annual revenue grew from 8.4 billion yuan to 50.757 billion yuan, with a compound annual growth rate of 17.77% from 2011 to 2022.

Chart 18: Sales Revenue and Year-on-Year Growth Rate of Integrated Circuit Manufacturing in Mainland China

Data Source: China Semiconductor Industry Association, Dongguan Securities Research Institute

Chart 19: Annual Revenue and Year-on-Year Growth Rate of SMIC from 2011 to 2022

Data Source: SMIC Financial Report, Dongguan Securities Research Institute

Industry Competitive Landscape: TSMC Dominates, SMIC and Hua Hong Semiconductor Rapidly Rise. Integrated circuit manufacturing requires thousands of steps, and the close coordination and error control between each link require extensive experience accumulation. Any error in one step can significantly reduce chip yield, leading to extremely high technical barriers. In addition to technology, semiconductor manufacturing also has extremely high capital requirements, with capital expenditures for building a wafer fab reaching billions or even tens of billions of dollars. The extremely high technical and capital barriers result in a very high industry concentration. Currently, the industry presents a competitive landscape dominated by TSMC, which maintains a dual lead in process technology and market share. According to Trendforce data, in Q4 2022, TSMC achieved revenue of $19.962 billion, with a market share of 58.5%, an increase of 2.4 percentage points year-on-year, far ahead of other foundries; domestically, the mainland semiconductor manufacturing industry is represented by SMIC and Hua Hong Semiconductor, which have continuously improved their process technology and expanded production scale in recent years, achieving rapid growth. In the fourth quarter of 2022, SMIC and Hua Hong Semiconductor achieved revenues of $1.621 billion and $882 million, ranking fifth and sixth globally, respectively.

Chart 20: Revenue Ranking of the Top Ten Global Foundries in Q4 2022

Data Source: Trendforce, Dongguan Securities Research Institute

Note: Li Jidian includes foundry revenue; Huahong Group includes Huahong Hongli and Shanghai Huahong

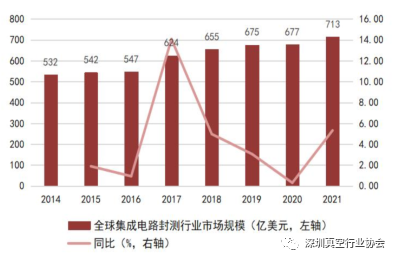

Integrated Circuit Packaging and Testing: Benefiting from industrial transfer, China’s IC packaging and testing industry growth rate exceeds the global average. The packaging and testing industry is located downstream of the semiconductor manufacturing process and requires significant investment in equipment and personnel, being a capital-intensive and labor-intensive industry. Compared to other fields of integrated circuits, the threshold for packaging and testing is relatively low, making it the most mature field in China’s semiconductor industry chain, where domestic substitution is easiest to achieve. Over the past decade, due to semiconductor industry transfer, labor cost advantages, tax incentives, and other factors, global integrated circuit packaging and testing capacity has gradually shifted to the Asia-Pacific region. China’s IC packaging and testing industry started early, leveraging labor cost advantages and a broad downstream market to undertake a large number of packaging and testing order transfers, thus developing rapidly, with market scale steadily increasing in recent years. In recent years, the global integrated circuit packaging and testing industry has entered a period of steady development, with a compound annual growth rate of 4.27% from 2014 to 2021. In China, benefiting from the booming development of downstream applications such as smartphones, the growth rate of the packaging and testing industry has outpaced the global average. According to data from the China Semiconductor Industry Association, the annual sales revenue of China’s integrated circuit packaging and testing industry increased from $125.6 billion in 2014 to $276.3 billion in 2021, with a compound growth rate of about 11.92%, far exceeding the global average during the same period. With the continuous development of downstream applications and the advancement of advanced packaging processes, the domestic packaging and testing industry has broad growth space.

Chart 21: Global Integrated Circuit Packaging and Testing Industry Market Size and Year-on-Year Growth Rate from 2014 to 2021

Data Source: Yole, Dongguan Securities Research Institute

Chart 22: Sales Revenue and Year-on-Year Growth Rate of China’s Integrated Circuit Packaging and Testing Industry from 2014 to 2021

Data Source: China Semiconductor Industry Association, Dongguan Securities Research Institute

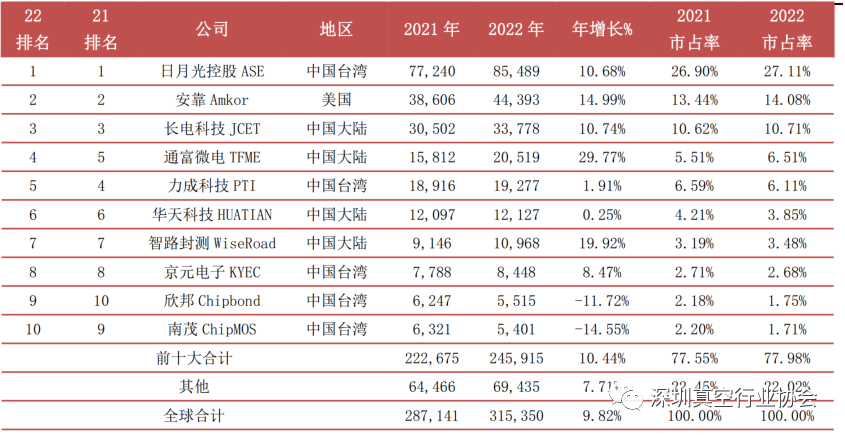

The packaging and testing segment is the most competitive segment in China’s integrated circuit field, with four companies entering the global top ten in revenue. Currently, the overall domestic self-sufficiency rate in the integrated circuit field is relatively low, especially in semiconductor equipment, materials, and wafer manufacturing, with a significant gap compared to international leading levels. However, packaging and testing are the most internationally competitive segments in China’s integrated circuit field. In recent years, several domestic packaging and testing leading enterprises, represented by JCET, have made significant strides in advanced packaging through independent research and development and mergers and acquisitions, now possessing strong market competitiveness and capable of participating in international market competition. According to data from the Chip Thought Research Institute, in 2022, four companies from mainland China entered the global top ten packaging and testing companies, namely JCET, Tongfu Microelectronics, Huatian Technology, and Zhilv Testing, with annual revenues ranking third, fourth, sixth, and seventh globally, respectively.

Chart 23: Estimated Ranking of the Top Ten Global Packaging and Testing Companies in 2022

Data Source: Chip Thought Research Institute (January 2023), Dongguan Securities Research Institute

Note: The revenue of Zhilv Testing includes UTAC and Sun Moon Semiconductor

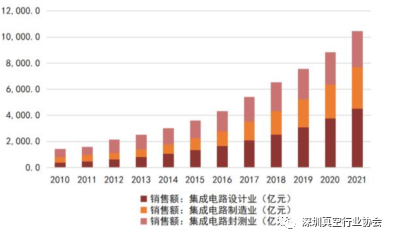

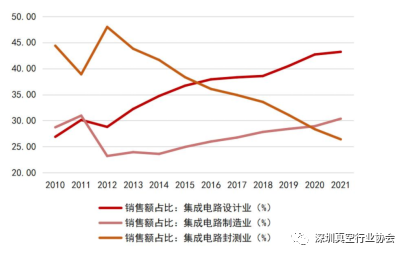

China’s integrated circuit market continues to grow, and the industry structure is continuously optimized. According to data from the China Semiconductor Industry Association, from 2010 to 2021, China’s integrated circuit sales grew from 142.4 billion yuan to 1,045.83 billion yuan, with a compound annual growth rate of 19.87%. After experiencing global industrial transfer and multiple mergers and acquisitions, the integrated circuit packaging and testing industry has become the most globally competitive subfield of semiconductors in China. Before 2016, its sales revenue ranked first among the three major links; in recent years, domestic IC design companies represented by Huawei HiSilicon have risen rapidly, leading to a rapid increase in the sales share of the IC design industry, with sales exceeding the packaging and testing industry in 2016 to rank first; the rise of domestic foundries such as SMIC and Hua Hong Semiconductor has also driven the growth of China’s integrated circuit manufacturing market scale, surpassing IC packaging and testing in 2020 to rank second. The increasing proportion of higher value-added integrated circuit design and manufacturing indicates that China’s IC industry structure is gradually optimizing, evolving from a model dominated by packaging and testing to a complete integrated circuit industry chain with equal emphasis on IC design, manufacturing, and packaging/testing.

Chart 24: Sales Revenue of Each Link in China’s Integrated Circuit Industry

Data Source: China Semiconductor Industry Association, Dongguan Securities Research Institute

Chart 25: Proportion of Sales Revenue of Each Link in China’s Integrated Circuit Industry

Data Source: China Semiconductor Industry Association, Dongguan Securities Research Institute

—— Recommended Reading ——

免

责

声

明

This promotional copy’s data and graphic information are for reference only; accurate information is subject to formal approval documents or signed agreements. We respect creativity and value sharing. The information shared is for reference only; if there are discrepancies or errors, please contact us for modification or deletion; the platform does not bear any legal responsibility for any direct or indirect losses caused by users’ use or inability to use the information transmitted by this public account platform. Some images and videos are sourced from the internet; if there is any infringement, please contact us for deletion. Within the limits permitted by law, Shenzhen Vacuum Technology Industry Association reserves the final interpretation.