In the global semiconductor industry landscape, the rise of NXP Semiconductors can be considered a classic case. From Philips’ laboratory technology reserves to its status as an invisible champion in automotive electronics and the Internet of Things, its 70-year development history is not only a chronicle of technological innovation but also reflects the challenges and opportunities in the autonomous development process of China’s semiconductor industry.

If you have questions about sensor technology or domestic substitution, feel free to message for discussion.

1. Technological Origins and Strategic Transformation: Three Leapfrogs from Laboratory to Global Giant

1. Technological Accumulation during the Philips Era (1953-2006)

Foundation of Technology:

In 1955, Motorola launched the first commercial high-power transistor for car radios, the germanium transistor, marking a milestone in the European semiconductor industry.

In 1974, Motorola launched its first 8-bit microprocessor, the MC6800, quickly capturing the calculator and electronic watch markets.

Enlightenment of Chip Radio:

In 1983, the TDA7000 FM radio receiver from Philips Semiconductors became the first complete chip radio, recognized by IEEE® as one of the “25 Microchips that Changed the World”.

Organizational Independence:

In 2006, Philips spun off its semiconductor business into an independent company, NXP, with an initial valuation of approximately 8 billion euros and revenue of 6.3 billion dollars that year, of which automotive electronics accounted for 34%.

2. Mergers and Acquisitions Period (2006-2015): Building a Technological Moat

Key Acquisitions:

Acquisition of Freescale’s Wireless Business in 2006: Acquired RF front-end technology and cellular communication patents, enhancing mobile device chip capabilities;

Full Acquisition of Freescale in 2015: The transaction amount was 11.8 billion dollars, and after integration, the global market share of MCUs (Microcontrollers) surged to 28%, with automotive chip revenue exceeding 5 billion dollars, becoming the fourth largest semiconductor company in the world and the largest automotive supplier.

Technological Synergy:

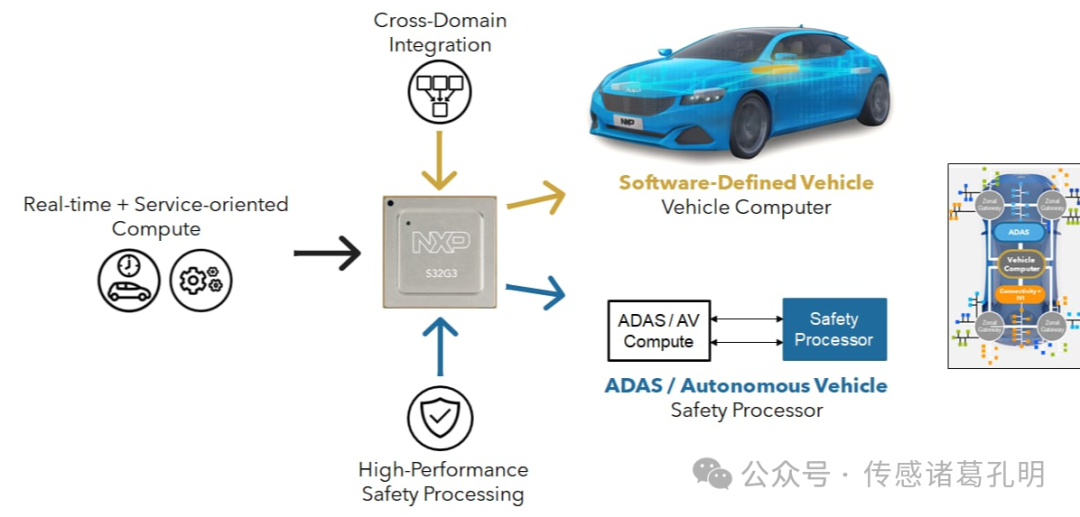

After the merger, NXP combined Freescale’s Power Architecture processors with its own CAN bus technology to launch the S32 automotive computing platform, supporting autonomous driving and vehicle networking applications.

3. Transformation to Intelligence and Security (2016-Present)

Shift in Technological Focus:

Automotive Processor Platform: In 2017, the S32 series was launched, integrating multi-core Arm Cortex architecture, supporting ASIL-D functional safety level, with a 5-fold increase in computing power compared to the previous generation;

Security Chip Technology: In 2021, the EdgeLock security solution was released, certified by Common Criteria EAL6+, capable of executing 3000 encryption operations per second.

Financial and R&D Investment:

In 2023, revenue reached 13.276 billion dollars (approximately 95.64 billion yuan), with R&D investment accounting for 18.5%, automotive electronics contributing 52%, and industrial and IoT accounting for 28%.

2. Core Technology System: Breakthroughs in Four Pillar Areas

1. Automotive Electronics: The Hardware Foundation of Intelligent Driving

Millimeter-Wave Radar Technology:

MR3003 Transceiver Chipset: Supports 77GHz frequency band and 4D point cloud imaging, with an angular resolution of 0.1°, detection distance of 300 meters, applied in XPeng G9’s automatic lane change system;

S32R45 Processor: Integrates 8 DSP cores and 2 Arm Cortex-A53, with a computing power of 6000 DMIPS, capable of processing 12 radar signals in parallel.

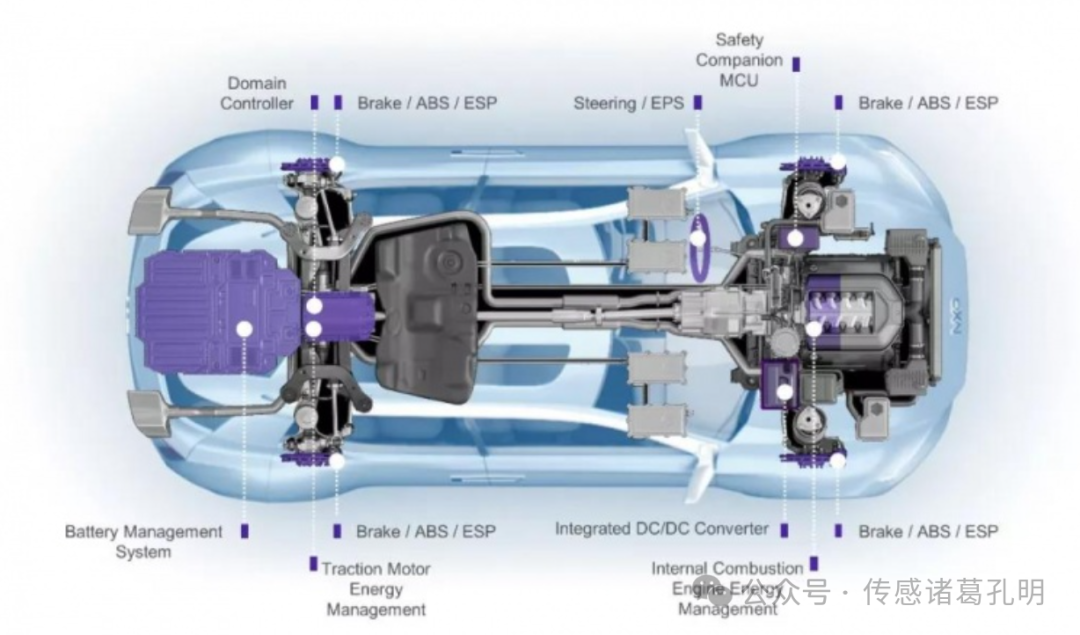

In-Vehicle Network Architecture:

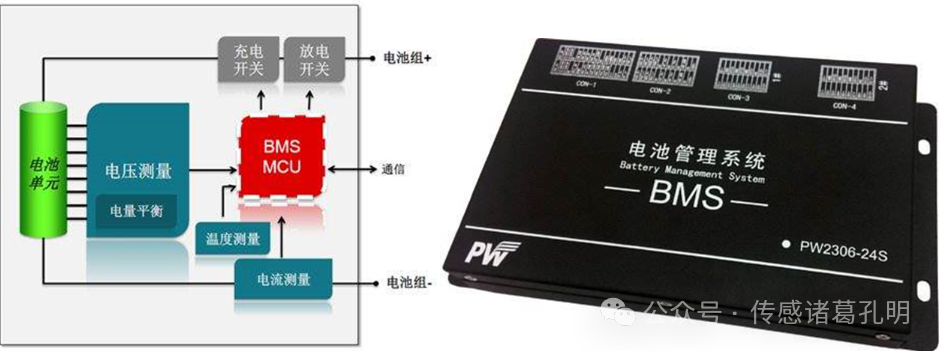

CAN FD Bus Controller TJA1463: Transmission rate of 5Mbps (8 times that of traditional CAN), with a delay of less than 50ns, used for real-time monitoring of NIO ET7 battery management system.

Battery Management System (BMS):

MC33771 battery monitoring chip supports 14-channel voltage detection, with an accuracy of ±2mV, capable of monitoring up to 168 battery cells, applied in CATL power battery packs.

2. Security Chips: Trust Anchor in the IoT Era

Near Field Communication (NFC) Technology:

PN5180 Reader Chip: Compatible with ISO 14443 Type A/B and FeliCa protocols, recognition distance of 10cm, recognition speed of 0.2 seconds, integrated into Huawei’s “One Touch Transfer” function;

EdgeLock SE050 Security Element: Built-in CC EAL6+ certified hardware encryption engine, supporting ECC-256 and RSA-3072 algorithms, applied in Alipay facial payment terminals.

Automotive Security Gateway:

S32G automotive processor integrates HSM (Hardware Security Module), supporting Secure Boot and OTA encrypted upgrades, deployed in BYD DiLink 5.0 intelligent cockpit platform.

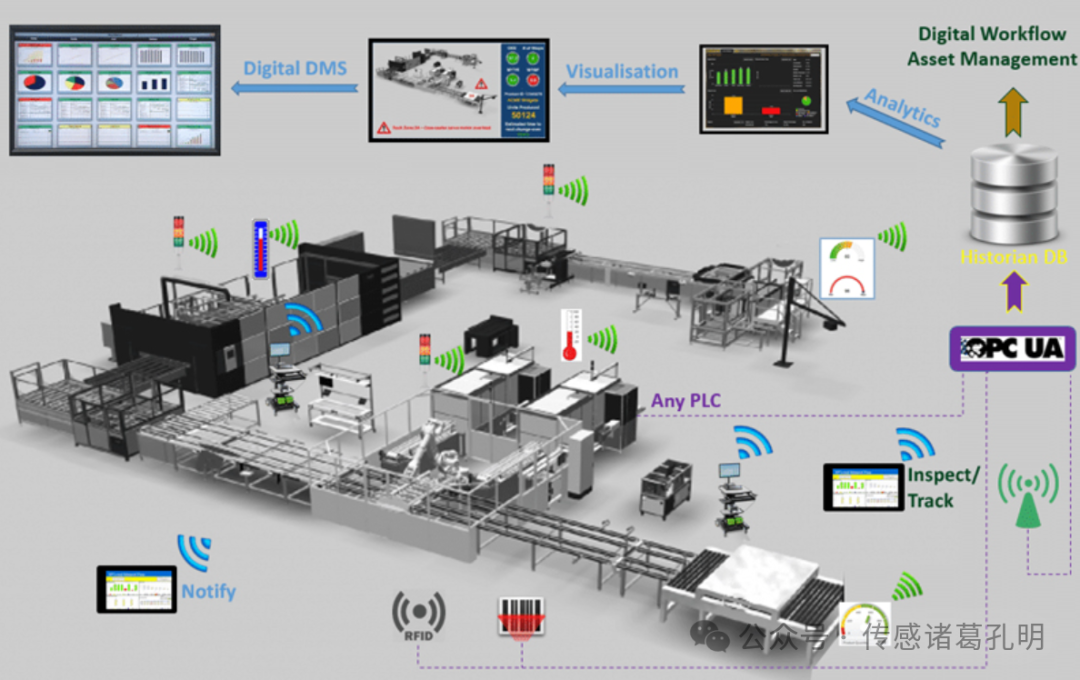

3. Industrial IoT: Innovations in Edge Intelligence and Connectivity Technology

Cross-Industry Processor i.MX RT Series:

RT1170 Dual-Core Processor: 1GHz Cortex-M7 and 400MHz Cortex-M4 work together, supporting 2D graphics acceleration and dual Gigabit Ethernet, used in Inovance’s industrial human-machine interface (HMI);

EdgeVerse Development Platform: Provides AI model compression toolchain, capable of compressing ResNet-50 model to below 1MB, with inference latency of less than 10ms.

Ultra-High Frequency RFID Technology:

UCODE DNA tag chip complies with EPC Gen2v2 standard, with a storage capacity of 8KB, supporting 128-bit AES encryption, applied in SF Express logistics package tracking system, with a reading distance of up to 15 meters.

4. Power Semiconductors: Efficiency Innovators in the Energy Revolution

Gallium Nitride (GaN) Devices:

GAN039-650NBS: 650V/30A GaN power transistor, switching frequency of 5MHz, efficiency of 98%, used in Xiaomi’s 120W fast charging device;

TFLEX Power Module: Integrates drive and protection circuits, power density of 100W/in³, efficiency improvement of 3%, applied in Sungrow’s string photovoltaic inverters.

Silicon Carbide (SiC) Technology Reserves:

Collaborated with STMicroelectronics to develop 1200V SiC MOSFET, with a conduction resistance of less than 15mΩ, targeting the market for electric vehicle main drive inverters.

3. Market Strategy: Vertical Deepening and Ecosystem Building

1. Automotive Market: Full-Stack Technology Binding and Regional Layout

Deep Customer Binding:

Signed a 10-year supply agreement with BMW and Volkswagen, covering S32G gateway processors, radar chips, and in-vehicle network controllers;

In 2023, received orders for Tesla’s FSD chip foundry, using TSMC’s 16nm FinFET process, with a single chip integrating 12 billion transistors.

Localization Strategy in China:

The Tianjin factory focuses on advanced packaging technology, with an annual production capacity of over 2 billion units; the Suzhou R&D center develops automotive-grade chips that meet GB/T 32960 standards;

In 2024, established a joint venture “Xinchip Technology” with Horizon Robotics to develop an autonomous driving domain controller based on the Journey 5 chip.

2. Industrial and Consumer Electronics: Scenario-Based Solutions

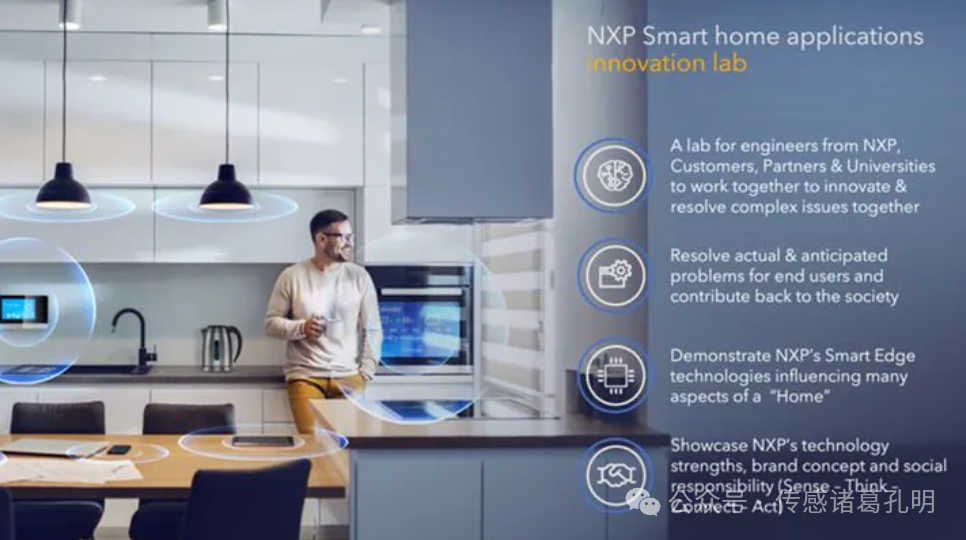

Smart Home Ecosystem:

Provided Haier with Zigbee 3.0 chip JN5189, supporting Matter protocol, reducing device pairing time from 15 seconds to 3 seconds;

Xiaomi’s smart lock uses the A71CH security chip, supporting SPAKE2+ encryption protocol, requiring over 100 years of computing power to brute-force crack.

Mobile Payment Infrastructure:

UnionPay POS machines are equipped with PN80T series NFC controllers, with transaction processing time <200ms, processing over 100 million transactions daily;

80% of global electronic passports use SmartMX series chips, supporting national secret algorithm SM4 and ISO 14443 standard.

3. Technical Standards and Developer Ecosystem

Industry Standard Leadership:

Deeply involved in the development of AutoSAR Classic/Adaptive platforms, defining automotive software architecture; leading the formulation of NFC Forum technical standards.

Developer Toolchain:Launched MCUXpresso IDE, integrating over 2000 third-party software libraries, supporting one-click code generation and debugging, reducing development cycles by 30%.

Industry-Academia Collaboration:

Established a joint laboratory for automotive-grade chips with Tsinghua University, developing functional safety verification methodologies; collaborated with the Institute of Microelectronics of the Chinese Academy of Sciences to develop RISC-V architecture automotive-grade MCUs.

4. Insights on Domestic Production: Technological Breakthroughs and Ecosystem Solutions

The Chinese automotive chip industry faces real challenges: the localization rate of automotive-grade MCUs is less than 5%, and 100% of 77GHz millimeter-wave radar chips rely on imports. NXP’s growth path provides the following breakthrough directions:

1. Technological Challenges: Breakthroughs in Functional Safety and Reliability

Automotive Certification System:

Establish testing laboratories that meet AEC-Q100 (Grade 0) standards, covering temperature cycles from -40℃ to 150℃ and 1500 hours of high-temperature aging tests.

Architectural Innovation:

Develop autonomous MCU cores based on RISC-V, supporting ASIL-D functional safety level, integrating Lockstep Core and ECC memory verification.

2. Industry Chain Collaboration: A Closed Loop from Design to Manufacturing

IDM Model Exploration:

Collaborate with SMIC and Hua Hong Semiconductor to establish dedicated production lines for automotive-grade chips, promoting mass production of 40nm eFlash technology;

Application-Driven Development:

Formed joint laboratories with BYD and NIO to develop BMS chips and motor controllers, achieving “chip-vehicle” collaborative verification.

3. Policy and Capital Support: Building an Industry Moat

Tax Incentives:

Enterprises investing over 100 million yuan in automotive-grade chip R&D are eligible for a 50% additional deduction, with special subsidies covering AEC-Q100 certification costs;

Standard Formulation:

Promote the inclusion of C-V2X communication protocols and autonomous millimeter-wave radar frequency bands (such as 76-81GHz) into national standards, breaking the technological monopoly of Europe and the United States.

5. Conclusion

NXP’s 70-year development history reveals a truth: the competitiveness of the semiconductor industry stems from dual breakthroughs in technological depth and ecosystem collaboration. If China’s chip industry aims to transition from “substitutor” to “definer,” it must simultaneously focus on functional safety design, industry chain autonomy, and standard discourse power. This path is destined to be long, but every technological breakthrough will add a cornerstone to the global rise of Chinese manufacturing.