1. Semiconductor Equipment Industry

Concept and Classification

(1) Concept of Semiconductor Equipment

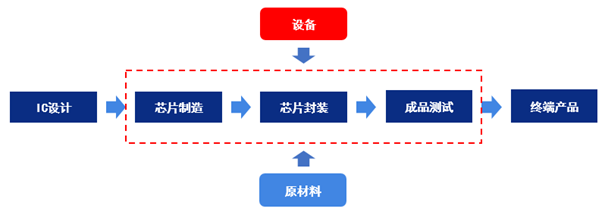

Semiconductor equipment, in a narrow sense, refers to the equipment used in the chip manufacturing and packaging processes. Broadly, it also includes the machinery needed to produce semiconductor raw materials, which is a crucial supporting link in the semiconductor industry supply chain. The semiconductor equipment discussed in this article is within the narrow scope.

(2) Classification of Semiconductor Equipment

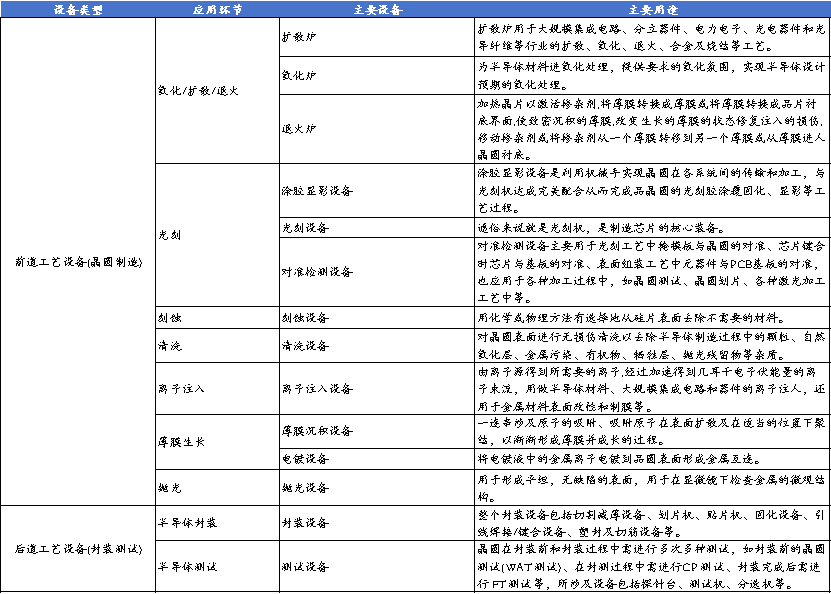

Throughout the chip manufacturing and packaging process, there are thousands of processing steps. Semiconductor equipment is divided into two major categories based on application: front-end process equipment (wafer manufacturing) and back-end process equipment (packaging and testing). Further subdivision can yield hundreds of different types of machines, including: photolithography machines, etching machines, thin film deposition equipment, ion implanters, testers, sorters, probe stations, etc.

2. China’s Semiconductor Equipment Industry

Market Status Analysis

(1) Market Status Analysis of the Semiconductor Equipment Industry

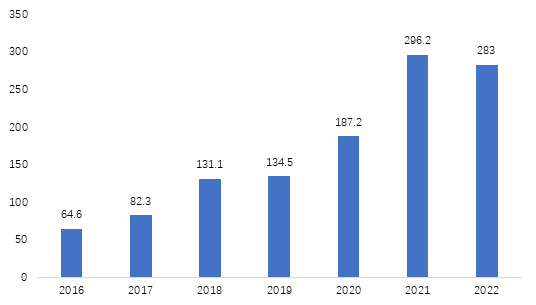

According to SEMI data, from 2016 to 2021, the semiconductor equipment market size in mainland China showed a year-on-year growth trend, with fluctuating growth rates. In 2021, the market size of semiconductor equipment in mainland China reached $29.62 billion, a year-on-year increase of 44%. Although investment in equipment in mainland China slowed down in 2022, decreasing by 5% compared to 2021, it still secured the title of the world’s largest semiconductor equipment market for three consecutive years with a total amount of $28.3 billion.

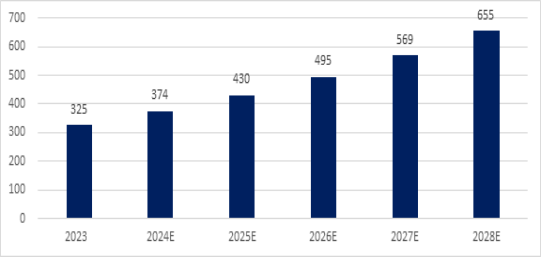

(2) Market Size Forecast of the Semiconductor Equipment Industry

Combining the global semiconductor equipment development trends, domestic substitution of semiconductor equipment, and the strong downstream demand, it is conservatively estimated that the semiconductor equipment industry in China will continue to maintain high-speed growth in the coming years, with a compound growth rate of around 15% from 2023 to 2028. By 2028, the market size of China’s semiconductor equipment is expected to reach $65.5 billion.

3. Structure of China’s Semiconductor Equipment Industry and Competitive Landscape

Analysis of Competitors

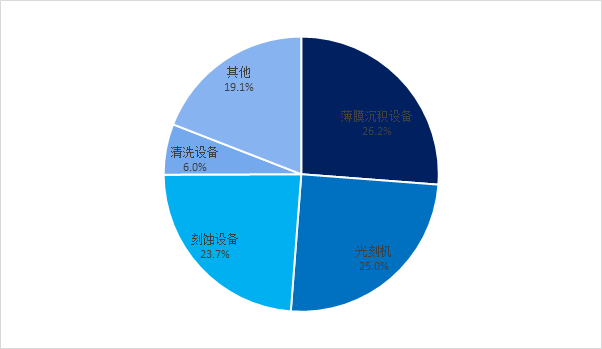

(1) Analysis of the Structure of the Semiconductor Equipment Industry in China

In 2022, the market shares of thin film deposition equipment, photolithography machines, and etching equipment in the semiconductor equipment industry were roughly equal, accounting for over 60% of the market share. Among them, thin film deposition equipment had the highest proportion, reaching 26.2%; followed by photolithography machines at 25%; and etching equipment closely following at 23.7%.

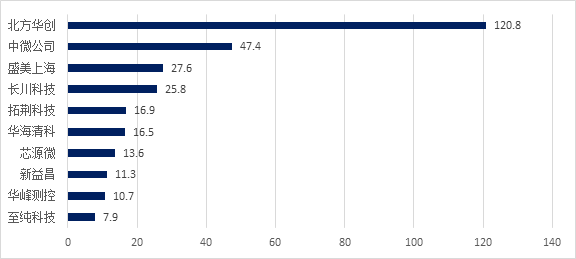

(2) Analysis of the Competitive Landscape of Semiconductor Equipment Companies in China

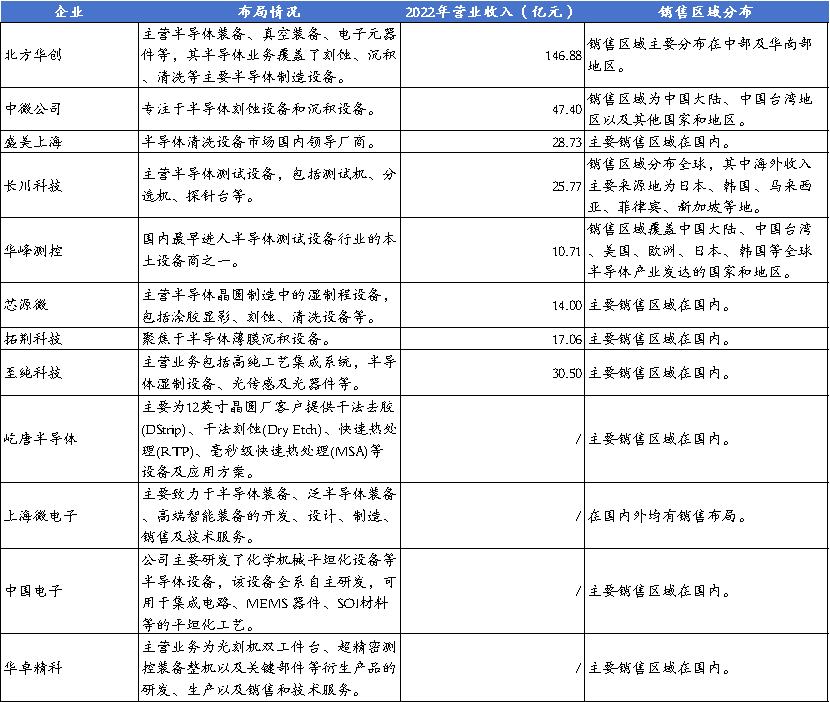

According to CINNOResearch statistics, the top 10 semiconductor equipment companies listed in mainland China in 2022 had the same lineup as the top 10 in 2021, with no new entrants. Specifically, Northern Huachuang, as the leading domestic semiconductor equipment manufacturer, achieved a semiconductor revenue of 12.08 billion yuan in 2022, maintaining the first position. Zhongwei Company ranked second, Shengmei Shanghai ranked third, and Changchuan Technology ranked fourth, consistent with their rankings in 2021. In 2022, the newly listed Tuojing Technology jumped from ninth place in 2021 to fifth place with a revenue of 1.69 billion yuan, while Huahai Qingke, also listed in 2022, advanced from eighth to sixth place with a revenue of 1.65 billion yuan, both companies achieving year-on-year revenue growth of over 100%.

(3) Representative Companies in the Semiconductor Equipment Industry

In recent years, China’s semiconductor industry has rapidly developed under the support of national policies and the demand driven by applications in smart devices. The important supporting industries, such as semiconductor equipment materials, have also gained attention. With the support of the national major project “Manufacturing Equipment and Complete Process for Large-Scale Integrated Circuits”, China’s semiconductor equipment has achieved domestic substitution in several processes and entered the stage of industrialization and mass production, giving rise to a number of excellent semiconductor equipment manufacturers. In addition to listed companies, non-listed companies such as Yitang Semiconductor, China Electronics Technology Group, and Shanghai Microelectronics are also the backbone of semiconductor equipment manufacturers in mainland China.