Sensors, as cutting-edge technology in modern science, are considered one of the three pillars of modern information technology and are recognized as a high-tech industry with great development potential both domestically and internationally. Sensor technology is directly related to the development of China’s automation industry. Experts believe that “if sensor technology is strong, then the automation industry is strong,” which shows the importance of sensor technology to the automation industry and even to the entire national industrial construction.

The marine field also cannot lack sensor technology; it is the foundation of marine instruments and equipment, and its various performance aspects are key to measuring the quality of instruments and equipment, as well as ensuring the quality of survey data. Various data correction schemes have emerged, but in long-term observations, the stability, drift, and accuracy of sensors remain the most important indicators. Marine sensors are widely used in marine monitoring, detection, and observation, providing measurements and data on various marine environmental factors, such as temperature, salinity, conductivity, depth, water color, sediment, and pressure. This data is not only essential for marine scientific research but also serves as an indispensable data source in the field of marine resource development.

Currently, the global sensor market is mainly dominated by a few leading companies from the United States, Japan, and Germany. Together, the United States, Japan, Germany, and China account for 72% of the global sensor market share, with China holding about 11%. Compared to over 20,000 types of products produced worldwide, China can only produce about one-third of that, and the overall technological content is relatively low, which is a state that urgently needs to change.

Industry insiders believe that although China’s sensor market is developing rapidly, local sensor technology still lags significantly behind the world level. This gap manifests in two ways: on one hand, there is a lag in the ability of sensors to perceive information; on the other hand, there is a technological lag in the intelligence and networking capabilities of sensors themselves. Due to the lack of sufficient large-scale applications, domestic sensors are not only low in technology but also high in price, making it difficult to compete in the market.

Sensor technology has undergone years of development, which can generally be divided into three generations: the first generation is structural sensors, which use changes in structural parameters to sense and convert signals; the second generation is solid-state sensors developed in the 1970s, which are made up of solid components such as semiconductors, dielectrics, and magnetic materials, utilizing certain properties of materials to produce thermocouple sensors, Hall sensors, and light-sensitive sensors; the third generation is the newly developed intelligent sensors, which are products of the combination of microcomputer technology and detection technology, giving sensors a certain level of artificial intelligence.

Currently, there are about 6,000 types of sensor products in China, while there are more than 20,000 abroad, which far from meets the domestic market demand. The import ratio of mid-to-high-end sensors reaches 80%, and the import ratio of sensor chips is as high as 90%, resulting in a huge gap in domestic production. High-tech products such as digitalization, intelligence, and miniaturization are in serious shortage, and high-end products required for national major equipment mainly rely on imports.

Sensors are a high-tech industry that has been “choked” in China, with over 90% of sensor chips needing to rely on imports, which is even higher than the dependence of the integrated circuit industry on foreign sources. For sensors and intelligent instruments required for national security and major engineering projects, foreign countries often impose restrictions on China. Foreign-funded enterprises occupy the vast majority of the high-end market share in China and will continue to dominate the high-end market for a long time to come. This trend is unlikely to change fundamentally in the short term. There is no doubt that there is a huge gap between China’s sensor industry and the world’s advanced level, so where is the gap in China’s sensor industry? Where is China’s sensor “neck” stuck? We have listed the following six aspects for industry professionals to consider.

In recent years, domestic sensors have made significant progress, and some sensor products are not inferior to those of major foreign brands in key performance parameters. However, the problem with domestic sensors lies not in the parameters but in the reliability, consistency, and stability of the products, which is the reason many large projects are hesitant to use domestic sensors.

Currently, domestic devices mainly occupy the mid-to-low-end market, and low reliability is one of the main reasons affecting the widespread application of domestic devices. It is difficult to enter the mid-to-high-end market. At the same time, the high-end market is monopolized by foreign companies, and the core manufacturing equipment for high-end sensors mainly relies on imports. Domestic manufacturers, which are “small and scattered,” find it challenging to update equipment and processes based on their own accumulation, and although they have a number of independently developed processes and products, their main performance indicators still lag 1-2 orders of magnitude behind foreign counterparts, with lifespan lagging by 2-3 orders of magnitude.

This requires sensor manufacturers to not only focus on design but also implement process control in production, from cutting equipment to batch testing equipment. By introducing automation and mechanization, uncertainties caused by manual operations can be eliminated, ensuring the reliability and consistency of the products.

There are many companies in China that make sensors, but very few are involved in sensor chip design, which is the area where the gap between China’s sensor industry and advanced foreign levels is the largest. The R&D investment for a mainstream intelligent sensor chip is around 1 billion RMB, requiring a research team of dozens of people and an accumulation of 6-8 years, with a production scale of tens of millions (or even hundreds of millions) of units necessary for profitability. Moreover, the risk of failure in sensor chip research is high, and generally, small and medium-sized domestic companies cannot bear such high costs and risks. Even if successful, it is often difficult to achieve a profitable scale of shipments.

Domestic companies are mainly concentrated in the mid-to-lower reaches of the industry chain, with few having independent chip design capabilities. The localization rate of intelligent sensor chips is less than 10%, and core technology is severely lagging behind developed countries. In 2020, among the top thirty MEMS sensor manufacturers globally, only GoerTek (ranked 6th) and AAC Technologies (ranked 19th) made it onto the list. Their sensor chips are mostly purchased externally, and they need to strengthen their own design capabilities for sensor chips. In addition, there is a serious lack of standards in the design, production, and testing of domestic intelligent sensors, with ineffective connections between upstream and downstream of the industry chain.

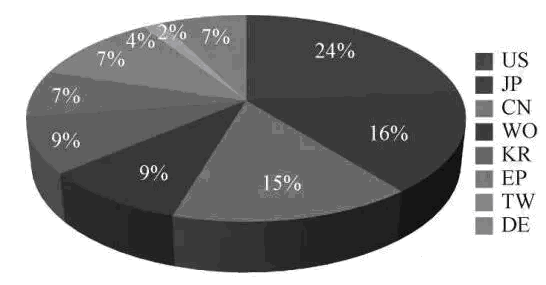

In recent years, looking at the number of MEMS patents in major countries globally, China ranks third with 15% of the application volume, behind only the United States and Japan. This indicates that domestic universities and research institutes have decent capabilities in tracking high technology and developing high-value-added products. However, a common problem is that while the number of sensor patent applications is large, the results are mostly in the form of samples, far from industrialization, lacking the ability and mechanism to convert scientific and technological achievements into marketable products.

Proportion of MEMS Patent Applications by Major Countries/Regions

A large number of sensor achievements remain sealed in the form of samples or patent documents within universities and research institutes, failing to reach enterprises for practical production. Domestic sensor manufacturing enterprises lack effective connections with downstream applications. On one hand, communication channels established among academia, research, and application are not smooth, with a lack of intermediary organizations; on the other hand, some achievements lack industrialization value and are considered worthless patents.

Sensor design software is expensive, and the design process is complex and requires consideration of many factors. Currently, there is no mature and user-friendly sensor design software with independent intellectual property rights in China. Foreign sensor EDA design software such as Conventor, IntelliSuite, COMSOL, and ANSYS dominates the entire Chinese market.

EDA stands for Electronic Design Automation and is central to the development of electronic design and manufacturing technology. EDA technology uses computers as tools, employing hardware description languages to scientifically and effectively integrate databases, computational mathematics, graph theory, graphics, topology logic, and optimization theory, forming a new technology specifically for electronic systems. The emergence of EDA technology not only better guarantees simulation, debugging, and error correction at all levels of electronic engineering design, providing strong technical support for its development, but also plays an increasingly important role in various fields such as electronics, communications, chemicals, aerospace, and biology, significantly reducing the workload of relevant practitioners.

EDA simulation is at the source of MEMS sensor product design; without corresponding EDA software, we cannot design a MEMS sensor at all.

In the 1960s and 1970s, most integrated circuits were completed manually because the actual number of tubes was not large, and the front end could manually complete function calculations. The back-end layout would transfer the tubes and connections from the circuit diagram to geometric shapes using a pen, drawing tape diagrams, etc. Since the number of tubes was small and the circuit lines were simple, it was not easy to make mistakes. However, when the number of lines reached hundreds or thousands, the circuit diagram became complex, and humans were no longer suitable for this work. The efficiency of manual work would become very low, and the error rate would greatly increase. The increase in error rate would also lead to a sharp rise in costs, thus more efficient and lower-cost EDA technology came to the historical stage and was widely used in integrated circuit design.

Recently, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) officially prohibited China from using advanced EDA software modules, attempting to stifle the development of China’s advanced semiconductor industry for the next ten years, ringing alarm bells for our industry. This is also a microcosm of the current weakness of China’s industrial software industry, not only in the sensor industry but also in industrial design, chip design, and other fields where foreign EDA software is predominantly used. Local companies have low penetration in the software segment supporting sensors and are monopolized by foreign IDM companies such as Bosch and Analog Devices, with technology still lagging behind international standards. However, in the sensor chip and solution segments, small to medium-sized technology-oriented enterprises are accelerating their penetration in emerging application scenarios.

China’s sensor industry faces serious reliance on imports, with domestic sensor companies primarily imitating similar foreign products. Many companies directly import foreign sensor chips for packaging and processing, leading to severe product homogeneity and a lack of independent R&D products. This is due in part to the instability of domestic sensors and a lack of innovation in sensor products, but also due to a lack of determination among domestic technology companies to explore domestic alternatives, which leads to a passive approach of simply following foreign technology giants in product R&D.

Currently, most domestic intelligent sensor manufacturers are emerging startups, primarily following and imitating, and their technology and product performance still struggle to gain the trust of large application developers such as mobile phones and automobiles, making it difficult to enter the mid-to-high-end ranks. Price is a key influencing factor; due to the maturity of the international market, foreign mainstream manufacturers have already driven prices very low, while domestic manufacturers lack technological advantages, making it difficult to compete in the market.

Domestic sensor companies are generally small, leading to a relatively single product line; the variety and series of products are only about 30%-40% of those abroad, resulting in poor standardization and series production. Therefore, in the low-end market, there is a phenomenon of “involution”—repetitive production and vicious competition, ultimately harming the orderly competition in the market.

Products that are more difficult to manufacture in the sensor series often rely on imports, and only about 3% of sensor manufacturers in China have a relatively complete range of products. Due to the low penetration of domestic companies in the software algorithm segment supporting products, they are monopolized by foreign IDM companies such as Bosch and Analog Devices, limiting their ability to provide comprehensive system solutions and thus restricting their ability to capture value in the industry chain.

Overall, China’s sensor companies are relatively small in scale, with the vast majority being small and medium-sized enterprises. According to data disclosed in the “Blue Book on the Development of Sensors in China,” among the more than 1,600 existing sensor companies in China, less than 200 have an output value exceeding 100 million RMB, accounting for about 13% of the total. Even among listed companies in the Chinese sensor industry, most are concentrated below a market value of 10 billion RMB, with significant gaps in market value space, resulting in an incomplete and immature sensor industry chain in China.

Hanwei Technology is a leading domestic gas sensor manufacturer. According to its 2021 semi-annual report, the revenue from sensor business was 126 million RMB, and the total revenue was 1.1 billion RMB, with the sensor business accounting for only 11.5%. Silan Microelectronics is a leading domestic power semiconductor company, with total revenue of 3.3 billion RMB in the first half of 2021, and MEMS sensor revenue of 140 million RMB, accounting for only 4.24%. Although the share is low, these market shares rank high in the sensor industry.

From a global perspective, the sensor industry has a large number of types, is dispersed, and has small market sizes for unique categories, which is one of the biggest weaknesses of the sensor industry. The weakness of China’s sensor industry further amplifies this issue.

End

This article is reprinted from: Industrial Headlines

Follow the Industrial Video Account for more information

For more inquiries, please consult customer service Xiao Ye

Feeling tired? Click “Looking” to support us!