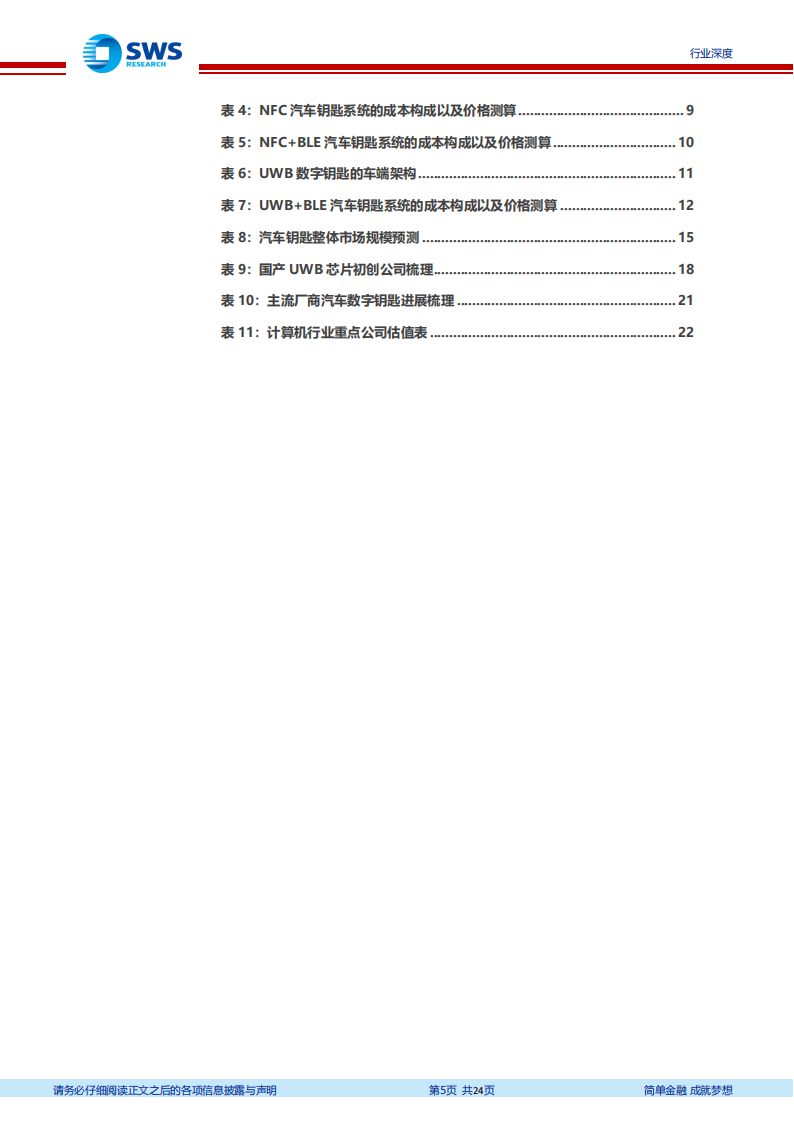

Car keys have gone through four stages: mechanical keys, remote keys, PEPS, and digital keys, with digital keys further divided into three technical routes: BLE, NFC, and UWB. Due to the superior safety, positioning accuracy, and range of UWB compared to BLE and NFC, it has become the optimal technology for automotive digital keys. PEPS refers to the passive entry/passive start system, which is realized through RFID technology. The typical operating distance for PEPS is about 1.5 meters, requiring the owner to carry a smart physical key and touch the capacitive sensor on the door handle to unlock it. A digital key refers to placing a physical key into a smartphone to become a “virtual key,” primarily realized through BLE (Bluetooth Low Energy), NFC (Near Field Communication), and UWB (Ultra-Wideband). The maximum operating ranges for BLE, NFC, and UWB are 10 meters, 2 centimeters, and 30 meters, respectively, while the positioning accuracies for BLE and UWB are at the meter and centimeter levels, respectively. Both BLE and NFC are vulnerable to relay attacks, while UWB is not.

Driven by the completion of the “CCC standard + the increase in smartphone UWB penetration (currently about 16% penetration rate),” 2022 marked the first year for UWB keys to enter the market, with numerous Tier 1 suppliers starting to secure contracts. In July 2021, the CCC alliance released the automotive digital key version 3.0 specification, clarifying that the third-generation digital key is based on UWB/BLE (Bluetooth) + NFC interconnected solutions. Since then, UWB digital keys have garnered significant attention from automakers, actively promoting the technology’s implementation. Since 2019, Apple has equipped all its models with UWB starting from the iPhone 11, while Samsung and Xiaomi introduced UWB in their models in 2020 and 2021, respectively. Due to these factors, BMW’s iX M60 and iX xDrive40, as well as NIO’s ET7/ET5, began to launch UWB keys in 2022. Additionally, automakers such as Tesla, Volkswagen, Ford, Audi, Hyundai, and Great Wall have started to lay out plans for UWB technology; Tier 1 suppliers such as Continental, HELLA, ASE, SWS, and Huayang have successively secured UWB key projects.

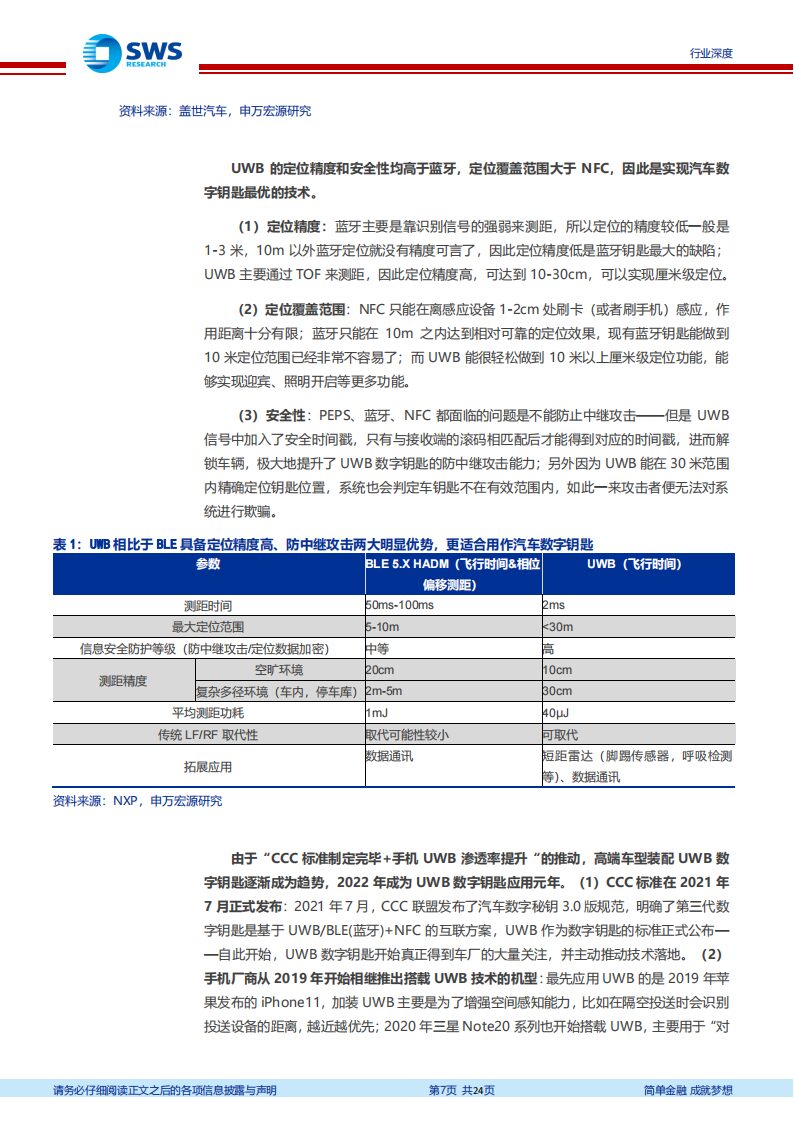

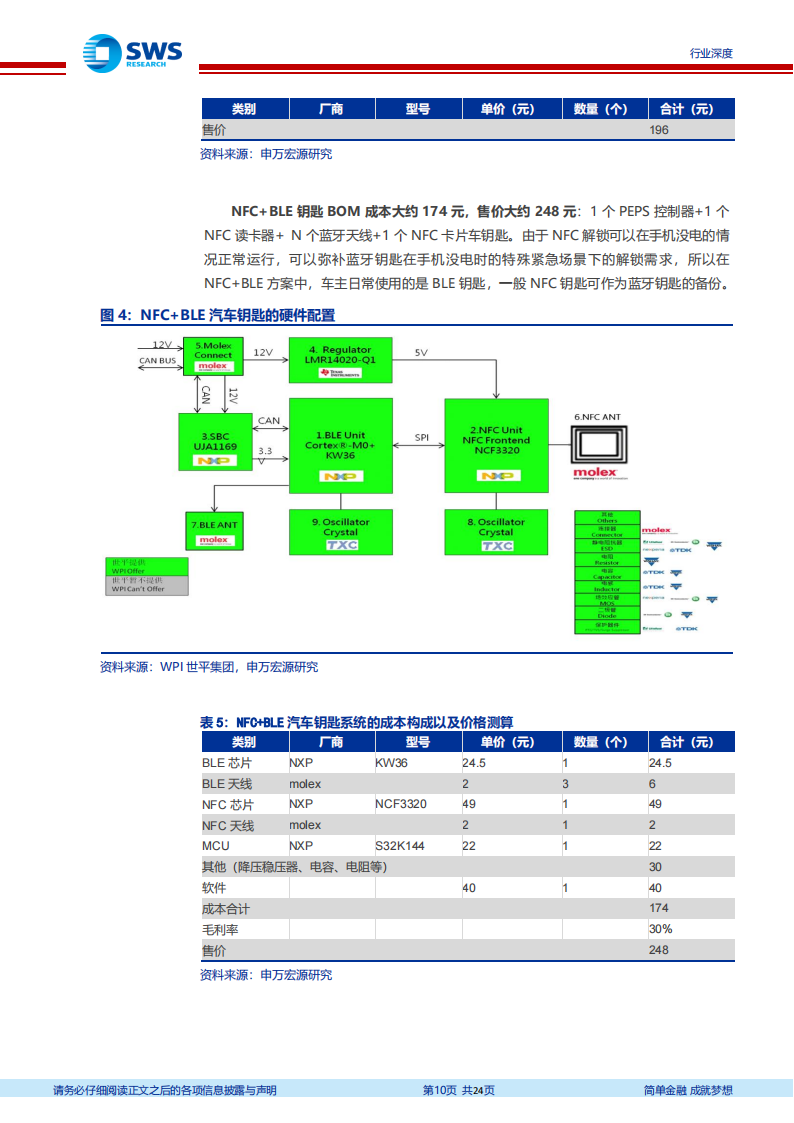

It is estimated that the prices for PEPS/Single BLE/Single NFC/NFC+BLE/UWB+BLE key systems are 250 yuan / 175 yuan / 196 yuan / 248 yuan / 659 yuan, respectively. (1) Hardware: PEPS requires installation of one PEPS controller + four low-frequency antennas (two inside and two outside the vehicle) + one smart key; BLE keys require one PEPS controller + N Bluetooth antennas; NFC keys require one PEPS controller + two NFC card readers + one NFC card key; UWB key systems consist of one PEPS controller + N UWB anchors. (2) Software: This includes vehicle-side software components, mobile apps, and the automaker’s cloud-based digital key management platform, with the vehicle-side software components being the most crucial. The positioning algorithm and information security software capabilities are the core of the core; UWB has also expanded applications in three areas: kick radar, in-vehicle living detection, and AVP, aiming to enhance cost-effectiveness and reduce overall system costs.

The market share of automotive digital key hardware and software suppliers varies. In terms of hardware Tier 1 shares: Continental, KOSTAL, and Pektron ranked as the top three in China’s automotive digital key hardware market in 2021. In terms of software solution providers, Yingji, Pektron, and Jiede rank as the top three in software market share, collectively accounting for 42.89%.

We expect the penetration rate of digital keys to increase from 14% (2021) to 70% (2025), gradually replacing PEPS, with the market size increasing from 500 million to 4.9 billion; the penetration rate of NFC+BLE will increase from 4% to 40%, and UWB+BLE from 0 to 20%, becoming the most mainstream digital key solutions, corresponding to market sizes of 1.9 billion and 2.6 billion, respectively. Although 64% of digital key solutions in 2021 were single BLE solutions, NFC+BLE offers better cost-performance and can handle special scenarios such as power outages; UWB+BLE is mainly constrained by its higher price and lower smartphone UWB adoption rate, but its safety, positioning accuracy, and range are significantly better than NFC and BLE. We believe that from 2022 to 2025, UWB will gradually become standard equipment in vehicles priced above 250,000 yuan—thus we think these two solutions will become mainstream.

Related targets: (1) Upstream: Focus on automotive-grade BLE chips (TaiLing Micro), NFC chips (Goodix Technology), UWB chips (no A-share UWB chip companies, but pay attention to companies involved in UWB modules and antenna segments such as XW Communication). The global market sizes for these three automotive-grade chips in 2025 are projected to be 154 million, 252 million, and 300 million dollars, respectively, with corresponding antenna market sizes of about 100 million dollars (XW Communication, ShuoBeide). (2) Midstream: Due to the higher degree of customization for digital keys compared to PEPS and the lack of foreign Tier 1 service advantages + weaker enthusiasm than domestic manufacturers, there are increasing opportunities for domestic replacements. Attention should be paid to companies like Jingwei Hengrun, Desay SV, Huayang Group, and Qianfang Technology (Lianlu) that already have designated projects.

Welcome to all angel round and Series A companies in the entire automotive industry chain (including the electrification industry chain) to join the group (Friendly connections with 700 automotive investment institutions including top-tier organizations; some quality projects will be selected for thematic roadshows to existing institutions);There is a communication group for leaders of sci-tech innovation companies, and dozens of groups for the automotive industry, including complete vehicles, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, and vehicle networking. Please scan the administrator’s WeChat to join (Please indicate your company name)