What are semiconductors? Materials with conductivity between conductors and insulators at room temperature? Does this explanation resonate with everyone? Will it spark interest among people from different industries? This article will provide a multidimensional explanation of the semiconductor industry, transforming it from merely a material recognized by physicists and chemists to the core hardware foundation of the electronic information industry, which includes integrated circuits, optoelectronic devices, discrete devices, and sensors. Moreover, it will also analyze the semiconductor industry chain from an academic perspective, detailing the upstream semiconductor industry represented by integrated circuits, the midstream electronic components and modules industry, and the downstream assembly and terminal application industry. The article aims to dissect semiconductors from as many angles as possible, helping more readers find points of interest in semiconductors from their familiar perspectives.

1. Understanding Semiconductors from the Physical and Chemical Material Perspective

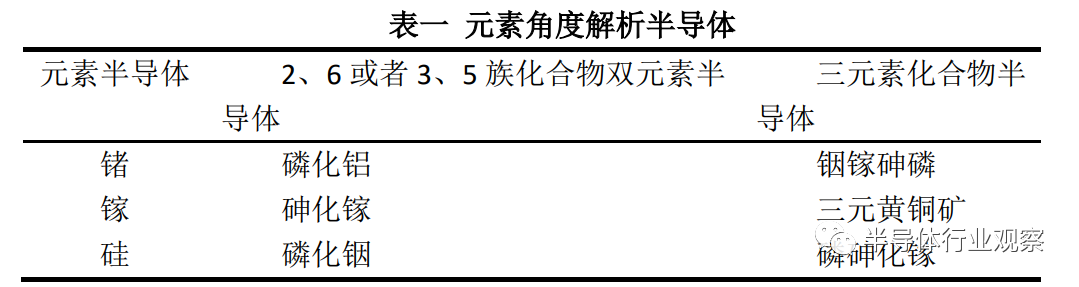

Semiconductors are materials with conductivity between conductors and insulators at room temperature. Semiconductors are generally classified into two categories: elemental semiconductors and compound semiconductors, which are derived from elements in group 4 of the periodic table and groups 2 and 6, respectively. Semiconductors can also be classified based on the number of constituent elements into binary compound semiconductors and ternary compound semiconductors.

(1) Elemental Semiconductors

Elemental semiconductors are composed of a single element. Examples include boron, germanium, silicon, gray tin, antimony, selenium, tellurium, etc. Among these, germanium, silicon, and tin have been researched earlier, and their preparation processes are relatively mature. The position of these elemental semiconductors in the periodic table indicates the relationship between the properties of semiconductor materials and their atomic structure, especially the atomic structure, as they all reside in group A of the periodic table. Elements with semiconductor properties, such as silicon, germanium, boron, selenium, tellurium, carbon, and iodine, are composed of these materials.

Their conductivity lies between that of conductors and insulators, with a typical resistivity range of 10-7 to 10-3. The main preparation methods include the Czochralski method, zone melting method, or epitaxy. The most commonly used materials in industry are silicon, germanium, and selenium, which are used to make various transistors, rectifiers, integrated circuits, solar cells, etc. Other materials like boron, carbon (diamond, graphite), tellurium, iodine, and red phosphorus, gray arsenic, gray antimony, gray lead, and sulfur are also semiconductors but have yet to find applications.

(2) Binary Compound Semiconductors from Groups II-VI or III-V

Binary compound semiconductors from groups II-VI or III-V refer to compounds formed by two specific atomic ratios, possessing defined band gap widths and band structures. This includes crystalline inorganic compounds (like III-V and II-VI compound semiconductors) and their solid solutions, amorphous inorganic compounds (like glass semiconductors), organic compounds (like organic semiconductors), and oxide semiconductors. The term compound semiconductors usually refers to crystalline inorganic compound semiconductors.

The main binary compound semiconductors include: gallium arsenide, indium phosphide, cadmium sulfide, bismuth telluride, copper oxide, etc. The Bridgman method (a method for growing single crystals from the melt), liquid encapsulation Czochralski method, and vertical gradient freeze method are commonly used to prepare compound semiconductor single crystals, while epitaxy and chemical vapor deposition methods are used to prepare their thin films and ultra-thin layer microstructured compound materials. They are used to make optoelectronic devices, high-speed microelectronic devices, and microwave devices.

(3) Ternary Compound Semiconductors

Ternary compound semiconductor materials refer to compounds formed by three specified atomic ratios, possessing defined band gap widths and band structures. Broadly speaking, ternary compound semiconductors with ideal Eg values can be divided into two categories. The first category is commonly referred to as “pseudo-binary” compound semiconductors, which are formed by mixing two binary compounds, such as the GaxIn1-xAs series of ternary compound semiconductors made from the alloy of GaAs and InAs (where 0≤x≤1, x represents the molar fraction of GaAs). The semiconductor structures grown in this manner are disordered, and the alloying elements do not form regular crystals. The second category consists of true ternary compound crystals. For example, AIP can be considered as Si atoms in Si crystals being replaced by Al and P atoms. Similarly, the ternary compound CuGaS2 can be viewed as ZnS being replaced by the binary system, namely ZnS + ZnS → CuGaS2.

In a broad sense, ternary compound semiconductors with ideal Eg values can be divided into two categories. The first is the so-called “pseudo-binary” compound semiconductors, which are formed by mixing two binary compounds, such as the GaxIn1-xAs series of ternary compound semiconductors made from the alloy of GaAs and InAs (where 0≤x≤1, x represents the molar fraction of GaAs). The semiconductor structures grown in this manner are disordered, and the alloying elements do not form regular crystals. The second category consists of true ternary compound crystals. For example, AIP can be considered as Si atoms in Si crystals being replaced by Al and P atoms. Similarly, the ternary compound CuGaS2 can be viewed as ZnS being replaced by the binary system, namely ZnS + ZnS → CuGaS2.

(4) In Summary

Elemental semiconductors are the earliest discovered and applied semiconductors, which opened the door for human use of semiconductors. On the other hand, binary and ternary compound semiconductors are the developments in the semiconductor industry. The differences between binary and ternary semiconductors are noteworthy: the primary differences in physical properties between ternary compound semiconductors and the two binary compounds that compose them, AC and BC, include the following aspects:

(1) Volume Change: In the structure of ternary compounds, the volume of the unit cell is not equal to the sum of the unit cell volumes of the two binary compounds. Generally, the volume change involves alterations in the cubic lattice constant (a) and changes in the ratio c/a.

(2) Chemical Electronegativity: Due to the interaction and exchange of binding energies between A-C and B-C in the composite structure, the electronegativity of ternary compound semiconductors is entirely different from that of any of their binary compound components.

(3) Structural Changes: The composite structure of the two materials manifests as the mutual influence of binding forces, meaning they may combine in an optimal manner without adhering to original binding rules.

(4) p-d Orbital Hybridization: Using chalcopyrite as an example, there is a clear phenomenon of Zn (or Ga) obtaining binding energy and energy gaps from the active 3d orbitals of Cu in the composite structure system.

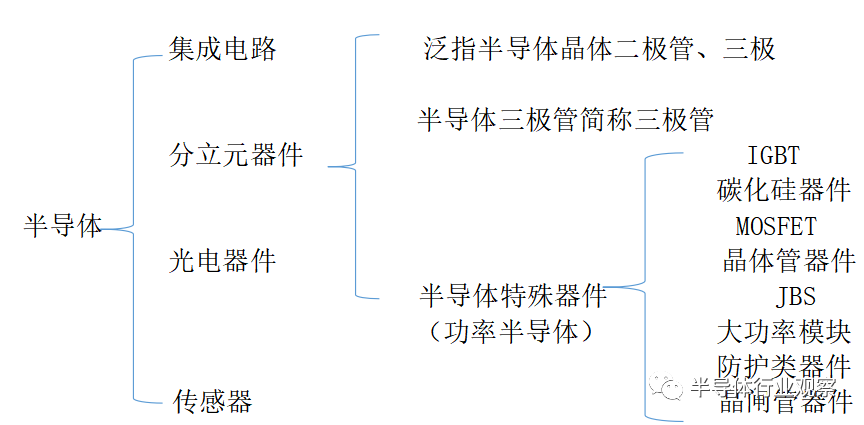

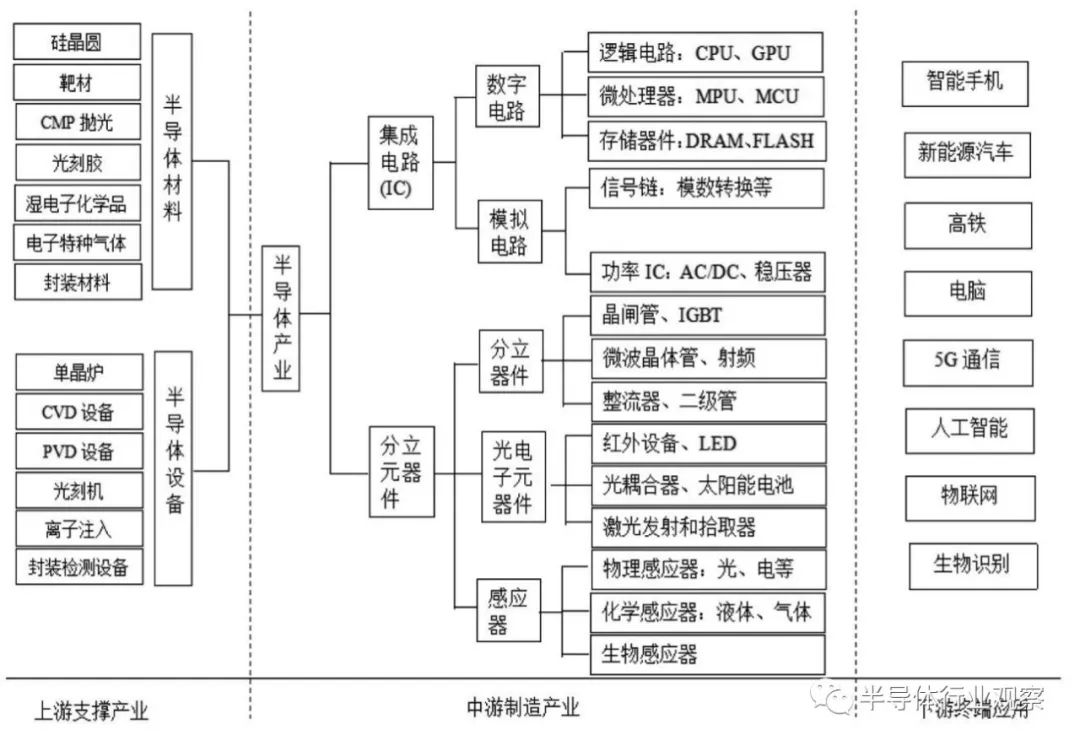

2. Understanding Semiconductors from the Product Dimension

Semiconductors are applied in integrated circuits, consumer electronics, communication systems, photovoltaic power generation, lighting, and high-power power conversion. For instance, diodes are devices made using semiconductors. From both technological and economic development perspectives, the importance of semiconductors is immense. Most electronic products, such as computers, mobile phones, or digital recorders, have core components closely related to semiconductors. Common semiconductor materials include silicon, germanium, and gallium arsenide, with silicon being the most influential in various semiconductor material applications. From a product dimension perspective, semiconductors are the core hardware foundation of the electronic information industry, encompassing four main categories: integrated circuits, optoelectronic devices, discrete devices, and sensors.

Figure 1: Product Dimension Interpretation of the Semiconductor Industry

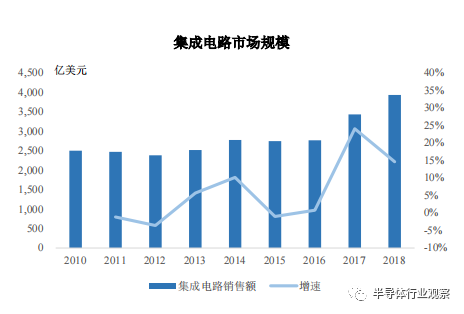

The market size of integrated circuits, which accounts for over 80%, can be subdivided into analog chips, processor chips, logic chips, and memory chips. Thus, when people discuss “integrated circuits,” they are largely representing the concept of “semiconductors.”

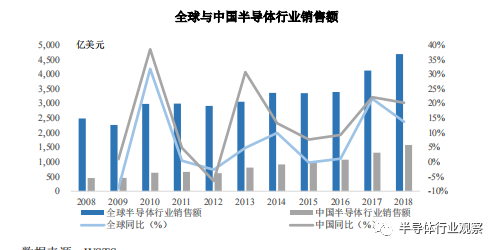

In 2021, the global semiconductor industry sales reached $468.778 billion, an increase of 8.72% year-on-year; the sales of the Chinese semiconductor industry reached $258.1 billion, an increase of 15.22% year-on-year. From 2008 to 2018, the Chinese semiconductor industry rapidly expanded under the drive of national industrial policies and the development of downstream terminal application markets, increasing its share of the global semiconductor industry from 18.16% to 33.73%, highlighting its growing significance in the global semiconductor industry.

Figure 2: Global and Chinese Semiconductor Industry Sales

Note: Image sourced from the Shanghai Silicon Industry Prospectus

(1) Integrated Circuits

Integrated circuits (ICs) are miniature electronic devices or components. Using specific processes, they interconnect the necessary transistors, resistors, capacitors, and inductors in a circuit on a small piece or several pieces of semiconductor wafers or substrate, then encapsulate them in a shell to form a microstructure with the required circuit functions. All components are structurally integrated, marking a significant step towards miniaturization, low power consumption, intelligence, and high reliability of electronic components.

According to the WSTS classification standards, semiconductor chips can be mainly categorized into integrated circuits, discrete devices, sensors, and optoelectronic devices. Among these, integrated circuits can be further subdivided into memory, analog chips, logic chips, and microprocessors. Analog chips can be further subdivided into power devices, amplifiers, filters, feedback circuits, reference source circuits, and switched capacitor circuits. RF front-end chips are a type of analog chip that integrates various types of analog chips into one module. Most applications in today’s semiconductor industry are based on silicon integrated circuits. Integrated circuits play a vital role in various industries and are the cornerstone of modern information society. The meaning of integrated circuits has far exceeded its original definition, yet its core aspect remains unchanged: “integration.” The various disciplines derived from this revolve around the questions of “what to integrate,” “how to integrate,” and “how to deal with the pros and cons of integration.” Silicon integrated circuits are mainstream, where all components needed to achieve a certain function are placed on a single silicon chip, forming an entity known as an integrated circuit.

Figure 3: Scale and Growth Rate of China’s Integrated Circuits

Note: Image sourced from the Shanghai Silicon Industry Prospectus

(2) Optoelectronic Devices

Optoelectronic devices are devices made based on the photoelectric effect, also known as photosensitive devices. There are many types of optoelectronic devices, but their working principles are all based on the physical foundation of the photoelectric effect. The main types of optoelectronic devices include: phototubes, photomultiplier tubes, photoresistors, photodiodes, phototransistors, photovoltaic cells, and optocouplers. The conductivity of semiconductor materials is determined by the concentration of charge carriers. The charge carriers in semiconductor materials include free electrons and the vacancies they leave behind—holes. Under normal circumstances, the formation and recombination of free electrons and holes are in dynamic equilibrium. Electrons must absorb energy to overcome atomic binding to become free electrons, and light can provide energy to enhance their ability to break free from atomic binding. This disrupts the original dynamic equilibrium, leading to a formation rate of free electrons and holes that exceeds the recombination rate, thus creating free electron-hole pairs within the semiconductor. Therefore, light can change the concentration of charge carriers, thereby altering the conductivity of the semiconductor. The components of optoelectronic devices include six parts: First, photoresistors, which are the most commonly used in photodetectors. They have a high resistance in the absence of light, and their resistance drops significantly under illumination, greatly enhancing conductivity. The main parameters of photoresistors include dark resistance, dark current, and their corresponding values under light conditions, known as bright resistance and bright current. The greater the difference between bright and dark resistance, the better. When selecting photoresistors, one must also consider their light sensitivity and spectral characteristics; Second, photodiodes, which operate in a cutoff state under no light, similar to regular diodes, exhibiting unidirectional conduction. When illuminated, the carrier concentration in the PN region greatly increases, creating a photocurrent; Third, phototransistors, which differ from ordinary transistors in that their emitter size is relatively small. When illuminated, the photocurrent is roughly equal to the base current of an ordinary transistor, making phototransistors more sensitive than photodiodes; Fourth, photovoltaic cells, the most commonly used being silicon photovoltaic cells, which can directly convert light energy into electrical energy. One key characteristic of photovoltaic cells is that the short-circuit current is linearly proportional to the light illumination. In practice, a very small load resistance is generally chosen, as smaller load resistance leads to better linearity; Fifth, phototubes, generally divided into vacuum phototubes and gas phototubes. Gas phototubes are typically filled with argon or a mixture of argon and neon, both of which are inert gases with relatively low atomic weights. The downside of gas phototubes is that their sensitivity declines quickly; Sixth, photomultiplier tubes, which consist mainly of a cathode chamber and a secondary emission amplification system. The photoelectric characteristics of photomultiplier tubes exhibit a linear relationship under low light flux. The presence of dark current in photomultiplier tubes limits their minimum measurable range.

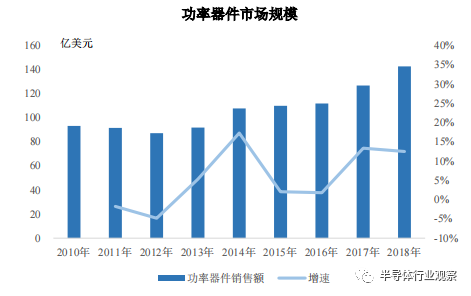

(3) Discrete Devices

Discrete devices are widely used in consumer electronics, computers and peripherals, network communications, automotive electronics, LED displays, and other fields. They include semiconductor diodes: germanium diodes, silicon diodes, compound diodes, etc.; semiconductor transistors: germanium transistors, silicon transistors, compound transistors, etc. Semiconductor discrete devices are fundamental components in electronic circuits, essential components in various electronic product circuits. Discrete devices can be widely applied in various electronic products, with downstream application markets roughly divided as follows: household appliances, power supplies and chargers, green lighting, networks and communications, automotive electronics, smart meters, and instruments. Key devices among discrete components include IGBT, MOS, etc. IGBT (Insulated Gate Bipolar Transistor) is a composite voltage-driven power semiconductor device composed of BJT (Bipolar Junction Transistor) and MOS (Metal-Oxide-Semiconductor Field-Effect Transistor), combining the high input impedance of MOSFET and the low conduction voltage drop of GTR. IGBT modules are characterized by energy-saving, ease of installation and maintenance, and stable heat dissipation. Currently, most products sold in the market are modular products; generally, when people mention IGBT, they refer to IGBT modules. With the promotion of energy-saving and environmental protection concepts, such products will become increasingly common in the market. IGBT is the core device for energy conversion and transmission, often referred to as the “CPU” of power electronics; Metal-Oxide-Semiconductor Field-Effect Transistor, abbreviated as MOSFET, is a field-effect transistor that can be widely used in analog and digital circuits. MOSFETs can be classified into two types based on the polarity of their “channel” (working carriers): “N-type” and “P-type,” commonly referred to as NMOSFET and PMOSFET, respectively, with other abbreviations including NMOS and PMOS.

Figure 4: Market Scale and Growth Rate of Power Devices

Note: Image sourced from the Shanghai Silicon Industry Prospectus

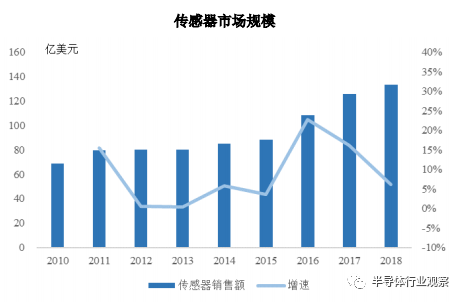

(4) Sensors

Sensors (English name: transducer/sensor) are detection devices that can sense the information being measured and can transform the sensed information into electrical signals or other required forms of output according to specific rules, meeting the requirements for information transmission, processing, storage, display, recording, and control. Sensors mainly include single material sensors, composite material CMOS sensors, and MEMS sensors. With the popularity of multi-camera smartphones, the growth of CMOS image sensors has been rapid; the new fingerprint recognition feature in smartphones has also increased the demand for sensors; the rapid development of autonomous driving technology has increased the demand for various types of sensors, including image sensors, lidar, and ultrasonic sensors.

The characteristics of sensors include: miniaturization, digitization, intelligence, multifunctionality, systematization, and networking. They are the primary link in achieving automated detection and control. The existence and development of sensors enable objects to possess tactile, taste, and olfactory senses, gradually bringing them to life. Sensors are generally categorized based on their basic sensing functions into ten categories: thermal sensitive elements, light sensitive elements, gas sensitive elements, force sensitive elements, magnetic sensitive elements, humidity sensitive elements, acoustic sensitive elements, radiation sensitive elements, color sensitive elements, and taste sensitive elements.

Figure 5: Market Scale and Growth Rate of Sensors

Note: Image sourced from the Shanghai Silicon Industry Prospectus

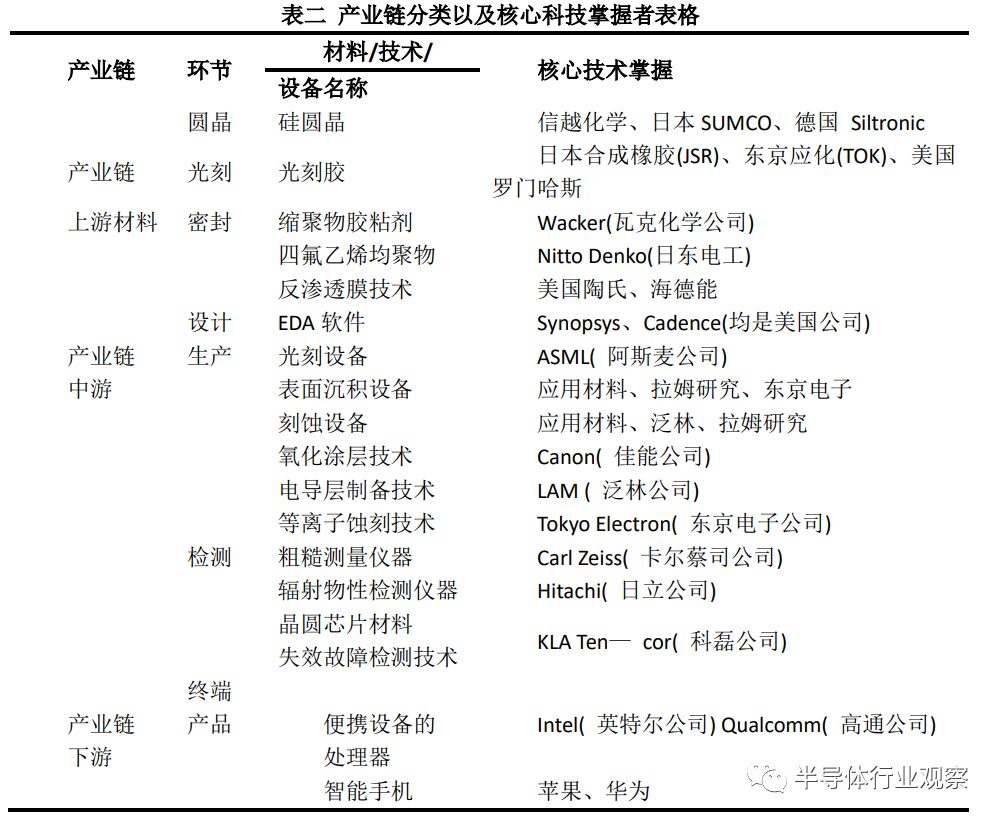

3. Understanding Semiconductors from the Industry Chain Perspective

From the perspective of the industry chain, the electronic information industry chain includes the upstream semiconductor industry represented by integrated circuits, the midstream electronic components and modules industry, and the downstream assembly and terminal application industry.

Upstream represented by Integrated Circuits: The main industrial chain of integrated circuits consists of IC design, IC manufacturing, and IC packaging (the main bottleneck breakthroughs rely on talent in research and investment).

Midstream electronic components industry: Further deepening of industrial division of labor is occurring, with module manufacturers producing whole modules by integrating numerous small components, then supplying them to downstream assembly factories (the main bottleneck breakthroughs rely on refined division of labor, company management models, and optimization of upstream partner enterprises).

Downstream assembly and terminal: The application industry ultimately produces electronic products for the market, with primary application fields including smartphones, personal computers, industrial medical equipment, and automotive electronics (the main bottleneck breakthroughs rely on market capture and optimization of mid and upstream partner enterprises).

From the perspective of the entire semiconductor industry chain, the highest technical barriers are in the upstream IP supply and IC design stages, followed by semiconductor equipment and wafer manufacturing stages, while the packaging and testing industry has the lowest barriers in the industry chain. The industry chain is a value distribution chain, and this article will further analyze the semiconductor industry based on the materials at hand, distinguishing between upstream, midstream, and downstream.

Figure 6: Classification of the Semiconductor Industry Chain

Note: Source from CNKI

(1) Upstream of the Industry Chain: Material Production and Equipment

Semiconductor materials can be divided into two major categories: wafer manufacturing materials and packaging materials. Among them, silicon wafers, gases, photomasks, and photoresists account for over 67% of the overall market size, with silicon and silicon-based materials representing about 32% of the semiconductor manufacturing materials market. Japan occupies more than half of the global semiconductor silicon materials market share, while the US holds a monopoly position in certain fields. Dow Chemical in the US accounts for over 90% of the market for polishing materials used in manufacturing, and Cree in the US has a high monopoly in the field of third-generation semiconductor materials such as silicon carbide and gallium nitride. Domestic semiconductor companies largely rely on imports for materials, with very few local material manufacturers, especially for 12-inch large-size integrated circuit-grade silicon wafers, which remain heavily reliant on imports, mainly including Shanghai Xinsheng, Suzhou Ruihong, and Beijing Kehua. Shanghai Xinsheng Semiconductor has made breakthroughs in 12-inch wafer technology, but its monthly output is only 70,000 to 100,000 wafers, with a small market share.

The semiconductor equipment market is highly monopolized, with core equipment in wafer manufacturing including lithography machines, etching machines, and thin film deposition equipment, accounting for approximately 30%, 25%, and 25% of the wafer manufacturing stage, respectively. In packaging equipment, the main types include thinning machines, dicing machines, and packaging machines. Domestic semiconductor equipment companies are showing a trend of rapid growth, but there is still a gap compared to countries like the US and Japan. American equipment companies account for as much as 56% of the global market share, while China only accounts for 3%. Among the top five global semiconductor equipment companies, American companies Applied Materials, Lam Research, and KLA dominate. Currently, China’s domestic semiconductor equipment industry exhibits characteristics such as low self-sufficiency and a significant demand gap, having achieved domestic substitution in low-end processes, but high-end processes require breakthroughs, with major manufacturers including North Huachuang, Zhongwei Semiconductor, and China Electronics Technology Equipment.

Leading IP suppliers like ARM and fabless IC design leaders like Qualcomm allocate 30% and 20% of their annual revenue to R&D, respectively; leading semiconductor equipment firms like ASML and foundry leaders like TSMC allocate 11% and 8% of their annual revenue to R&D, respectively, while leading packaging and testing companies like ASE allocate only about 4% of their annual revenue to R&D. Compared to other segments of the semiconductor industry chain, the packaging and testing segment has relatively high capital barriers, second only to the wafer manufacturing stage, also requiring significant capital investment to build factories and purchase equipment, with ASE’s average capital expenditure over the past three years accounting for 22.1% of the company’s revenue.

(2) Midstream of the Industry Chain: Device Production and Manufacturing

Semiconductor products mainly include two categories: integrated circuits (ICs, commonly referred to as chips) and semiconductor discrete devices (D-O-S). Integrated circuits/chips can be divided into digital circuits and analog circuits. Digital circuits can be subdivided into microprocessors, logic circuits, and memory. Integrated circuits/chips refer to complex electronic systems that perform specific functions by “integrating” active devices like transistors and diodes with passive components like resistors and capacitors on a single semiconductor substrate, encapsulated within a protective shell. Representative devices include bipolar integrated circuits like TTL, ECL, HTL, LST-TL, STTL, and unipolar integrated circuits like CMOS, NMOS, PMOS.

Semiconductor discrete devices can be classified into discrete devices (diodes, transistors, etc.), optoelectronic devices, and sensitive devices. Discrete devices refer to ordinary electronic components such as resistors, capacitors, and transistors, which are the smallest components without any integration. Representative devices include semiconductor diodes and transistors. Optoelectronic devices refer to various functional devices made using semiconductor photoelectric (or electro-optical) conversion effects. Representative devices include light-emitting diodes (LEDs) and laser diodes (LD), photodetectors or photo receivers, and solar cells. Sensitive devices are key components of sensors that can sensitively perceive certain physical, chemical, or biological information and convert it into electrical information. Representative devices include thermistors, pressure-sensitive resistors, light-sensitive resistors, force-sensitive resistors, magnetic-sensitive resistors, gas-sensitive devices, and humidity-sensitive resistors.

Integrated circuits/chips account for about 80% of semiconductor products, while semiconductor discrete devices account for about 20%. Since most semiconductor products are integrated circuits/chips, the terms semiconductor and integrated circuits/chips are often used interchangeably. The upstream of the integrated circuits/chips industry chain mainly involves the raw materials and production equipment required for integrated circuit/chip manufacturing. The production processes of integrated circuits/chips primarily involve chip design, wafer processing, packaging, and testing. Integrated circuits/chips are mainly applied in downstream industries such as communication devices (including mobile phones), PCs/tablets, consumer electronics, and automotive electronics.

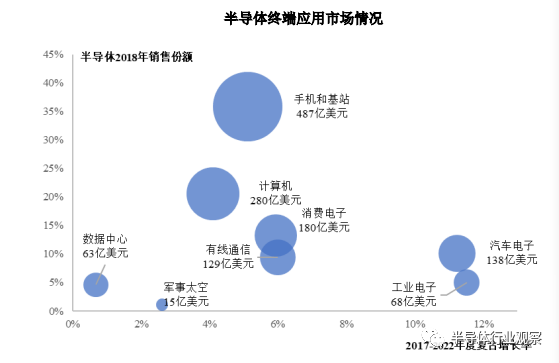

(3) Downstream of the Industry Chain: Product Application and Sales

According to Gartner’s report, the two largest fields in the finished product market are mobile and computing, indicating the growth directions of the past year. The former is primarily driven by the smartphone and storage market, which saw a year-on-year sales growth of 9.6%, while the latter was affected by a decline in PC and tablet sales, leading to an 83% year-on-year sales drop. Research firm Gartner stated that with improvements in the inventory situation of memory, IoT, and other markets with application-specific standard products (ASSP), as well as rising average selling prices (ASP), the global semiconductor market scale is expected to grow by 9.2% to reach $864.1 billion in 2022, a significant increase compared to the 1.5% growth rate in 2021, sweeping away the previous market stagnation and showing various signs of development in the global semiconductor market.

Figure 7: Semiconductor Terminal Application Market Situation

Note: Image sourced from the Shanghai Silicon Industry Prospectus

Gartner predicts that the fastest-growing semiconductor terminal application fields from 2017 to 2022 will be industrial electronics and automotive electronics, which will become the most important driving forces for growth in the global semiconductor industry in the coming years. Among them, the compound annual growth rate in industrial electronics is expected to reach 12%. As industries transition from large-scale to automated and intelligent operations, the deep integration of industry and information technology, and the transformation and upgrading of intelligent manufacturing will drive the growth in industrial electronics demand. The compound annual growth rate for automotive electronics from 2017 to 2022 is expected to be 11%. The growth in automotive electronics mainly stems from the expansion of traditional vehicle electronic functions, the continuous maturation of autonomous driving technology, and the rapid growth of the electric vehicle industry. Various semiconductor products are needed for components such as ABS (Anti-lock Braking System), onboard radar, onboard imaging systems, electronic stability programs, electronic suspension, electric handbrakes, pressure sensors, accelerometers, gyroscopes, and flow sensors, significantly boosting the growth of automotive electronic products. With the popularization of electric vehicles and the continuous improvement of vehicle voltage and battery capacity standards, the demand for power management and discrete power devices will also rise.

Note: Some data in this article has been processed based on official company data to a certain extent, and all images are sourced accordingly! Additionally, the companies mentioned in the article are introduced in a specific order, which does not represent the author’s or any institution’s viewpoint, but merely a matter of presentation. Furthermore, due to the author’s limited information, any misrepresentation is sincerely apologized for!

*Disclaimer: This article is original by the author. The content reflects the author’s personal views, and Semiconductor Industry Observation reprints it merely to convey a different perspective, not indicating agreement or support for the viewpoint. If there are any objections, please feel free to contact Semiconductor Industry Observation.