▍Source: Zhongcheng Medical Equipment

Overall Situation

According to MDCLOUD (Medical Device Data Cloud), a total of 3,863 tender data for ultrasound imaging diagnostic equipment was collected in the third quarter of 2023, involving 1,773 purchasing units and 104 brands.

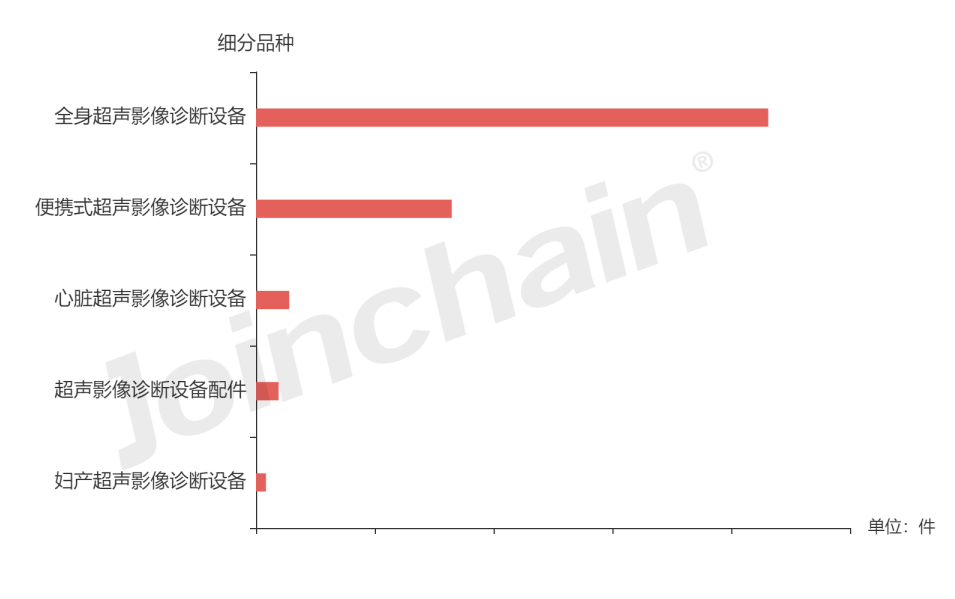

Subcategory Analysis

The tender results show that the highest number of tenders was for full-body ultrasound imaging diagnostic equipment, followed by portable ultrasound imaging diagnostic equipment and cardiac ultrasound imaging diagnostic equipment.Chart 1: Distribution of Tender Quantity for Ultrasound Imaging Diagnostic Equipment by Subcategory in Q3 2023 (Units: Pieces) Data Source: MDCLOUD (Medical Device Data Cloud)

Data Source: MDCLOUD (Medical Device Data Cloud)

Tender Trend

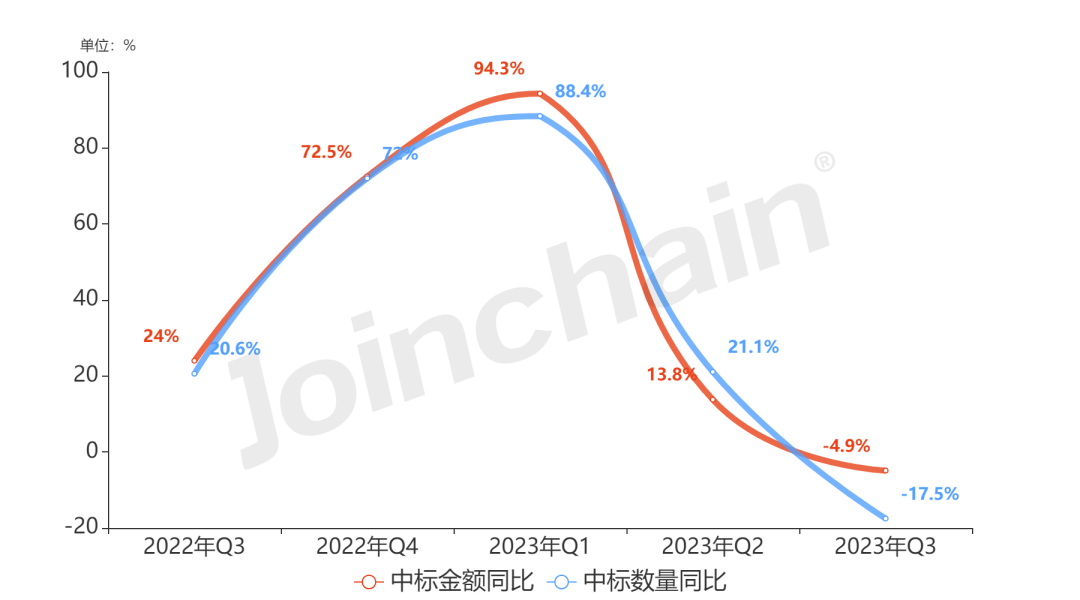

The market size changes for ultrasound imaging diagnostic equipment tenders from Q3 2022 to Q3 2023 are shown below, where the number of tenders for ultrasound imaging diagnostic equipment in Q3 2023 decreased by 17.5% year-on-year, and the tender amount decreased by 4.9% year-on-year.Chart 2: Tender Situation for Ultrasound Imaging Diagnostic Equipment from Q3 2022 to Q3 2023 Data Source: MDCLOUD (Medical Device Data Cloud)

Data Source: MDCLOUD (Medical Device Data Cloud)

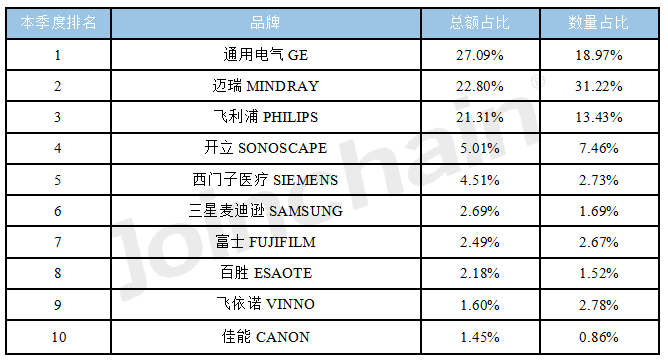

Brand and Model Analysis

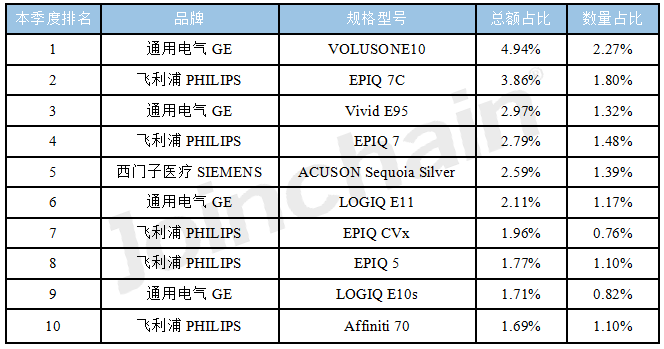

According to the disclosed brand and amount data results from MDCLOUD (Medical Device Data Cloud), in Q3 2023, General Electric ranked first, accounting for 27.09% of the total tender amount. Mindray ranked second, accounting for 22.8% of the total tender amount. Philips ranked third, accounting for 21.31% of the total tender amount.Chart 3: Tender Situation of Ultrasound Imaging Diagnostic Equipment Brands in Q3 2023 (Top 10) Data Source: MDCLOUD (Medical Device Data Cloud)From the model perspective, in Q3 2023, the ultrasound imaging diagnostic equipment model VOLUSONE10 from General Electric ranked first, accounting for 4.94% of the total tender amount, followed by Philips’ EPIQ 7C, accounting for 3.86%, and again General Electric’s Vivid E95, accounting for 2.97%.Chart 4: Tender Situation of Ultrasound Imaging Diagnostic Equipment Models in Q3 2023 (Top 10)

Data Source: MDCLOUD (Medical Device Data Cloud)From the model perspective, in Q3 2023, the ultrasound imaging diagnostic equipment model VOLUSONE10 from General Electric ranked first, accounting for 4.94% of the total tender amount, followed by Philips’ EPIQ 7C, accounting for 3.86%, and again General Electric’s Vivid E95, accounting for 2.97%.Chart 4: Tender Situation of Ultrasound Imaging Diagnostic Equipment Models in Q3 2023 (Top 10) Data Source: MDCLOUD (Medical Device Data Cloud)

Data Source: MDCLOUD (Medical Device Data Cloud)

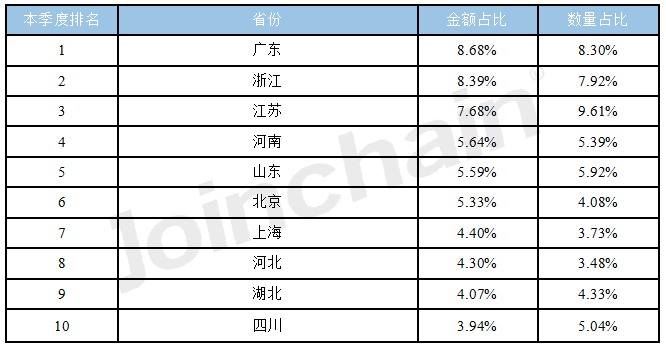

Regional Market

According to the tender results, the regions with the most active tenders for ultrasound imaging diagnostic equipment in Q3 2023 were mainly Guangdong Province, accounting for 8.68% of the purchasing amount; Zhejiang Province ranked second, accounting for 8.39%; and Jiangsu Province ranked third, accounting for 7.68%.Chart 6: Tender Situation of Ultrasound Imaging Diagnostic Equipment by Province (Units: Ten Thousand Yuan) Data Source: MDCLOUD (Medical Device Data Cloud)

Data Source: MDCLOUD (Medical Device Data Cloud)

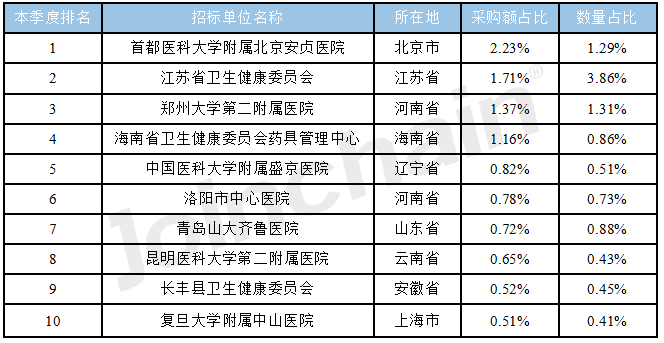

Ranking of Tender Units

According to the tender results, the highest purchasing amount for ultrasound imaging diagnostic equipment in Q3 2023 was from Beijing Anzhen Hospital affiliated with Capital Medical University, accounting for 2.23%; Jiangsu Provincial Health Commission ranked second, accounting for 1.71%; and Zhengzhou University Second Affiliated Hospital ranked third, accounting for 1.37%.Chart 7: Purchasing Situation of Ultrasound Imaging Diagnostic Equipment by Tender Units in Q3 2023 (Top 10) Data Source: MDCLOUD (Medical Device Data Cloud)

Data Source: MDCLOUD (Medical Device Data Cloud)

Ranking of Winning Units

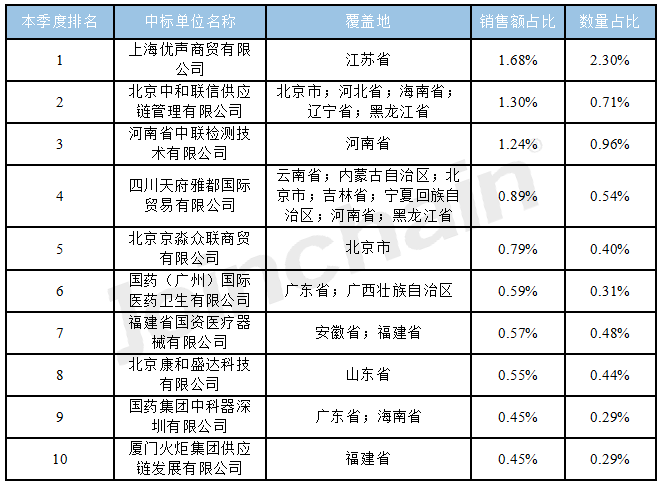

According to the tender results, the winning unit with the highest total sales in Q3 2023 was Shanghai Yousheng Trading Co., Ltd., accounting for 1.68% of sales; Beijing Zhonghe Lianxin Supply Chain Management Co., Ltd. ranked second, accounting for 1.3%; and the third was Henan Zhonglian Testing Technology Co., Ltd., accounting for 1.24% of sales.Chart 8: Sales Ranking of Winning Units for Ultrasound Imaging Diagnostic Equipment in Q3 2023 (Top 10) Data Source: MDCLOUD (Medical Device Data Cloud)– END –

Data Source: MDCLOUD (Medical Device Data Cloud)– END –