This Issue Hot Topics

The development of cellular IoT is actually influenced by the evolution of mobile communication networks.

In the coming years, cellular IoT will transition from primarily 2G connections to NB-IoT and 4G connections. However, this transition will not happen overnight; it requires a smooth migration through product iterations that complement NB-IoT and LTE Cat.1.

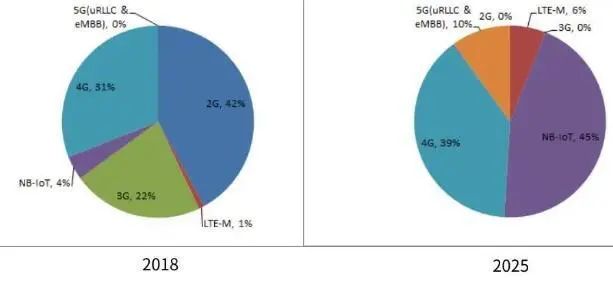

According to Counterpoint data: before 2020, the majority of cellular IoT connections, both existing and new, came from 2G IoT. By 2025, the number of 2G/3G IoT connections will be negligible.

In other words: the migration from 2G IoT to NB-IoT, 4G, and 5G is expected to be completed within five years.

1.

Clear Future Path: Collaborative Development of NB-IoT, 4G, and 5G

On May 7, 2020, the Ministry of Industry and Information Technology issued a notice on “Deepening the Comprehensive Development of Mobile IoT”.

The notice pointed out the need to promote the migration of 2G/3G IoT services to new networks, establishing a comprehensive ecosystem for mobile IoT that includes NB-IoT (Narrowband IoT), 4G (including LTE-Cat1, which is 4G network with rate category 1), and 5G.

Based on enhancing 4G network coverage and accelerating 5G network construction, NB-IoT will meet most low-rate scenario needs, LTE-Cat1 (referred to as Cat1) will meet medium-rate IoT needs and voice requirements, while 5G technology will cater to higher rate, low-latency connectivity needs.

Image / From China Mobile

By the end of 2020, NB-IoT networks are expected to achieve widespread coverage in urban areas above the county level, with deep coverage in key areas; the number of mobile IoT connections will reach 1.2 billion; the price of NB-IoT modules will converge with that of 2G modules, guiding new IoT terminals to migrate towards NB-IoT and Cat1; and a number of benchmark projects and large-scale application scenarios for NB-IoT will be established.

In other words, the current domestic development plan for cellular IoT is very clear: NB-IoT targets low-rate applications, Cat.1 targets medium-low rate + voice, and 5G targets high-rate + low latency + high reliability.

In the market distribution of cellular connections, high-speed connections account for 10%, medium-speed connections account for 30%, and low-speed narrowband connections account for 60%.

Previously, the International Telecommunication Union (ITU) announced that the 3GPP 5G technology (including NB-IoT) has been officially accepted as the ITU IMT-2020 5G technology standard.

At the same time, in the recently frozen R16 version, 3GPP has integrated NB-IoT into the overall evolution of the 5G technology standard, allowing NB-IoT to coexist with NR spectrum and enabling NB-IoT R16 terminals to connect to the 5G core network.

In other words, NB-IoT will occupy the largest share in the IoT ecosystem in the future.

As of April this year, 71 countries worldwide have invested in building 129 mobile IoT networks, with 93 of them being NB-IoT networks.

Huawei predicts that by 2025, the shipment scale of NB-IoT chips will reach 350 million, accounting for nearly 50% of the total cellular IoT chip shipments.

2.

Challenges Ahead for NB-IoT

Although NB-IoT will play a significant role in the future IoT ecosystem, and the number of NB-IoT connections in China surpassed 100 million in February this year, marking a historical turning point for the NB-IoT industry and entering a phase of explosive growth.

However, at the “China Mobile Cat.1 Online Seminar” held yesterday, Xian Miao, Vice President of Unisoc’s Industrial IoT, pointed out: “The peak of 2G IoT shipments will pass, and terminal users need a smooth transition. Although shipments of 2G GSM modules are entering a downward trend, the existing stock and annual shipment volume remain substantial.”

Image / From China Telecom

Therefore, there are still many challenges ahead for NB-IoT:

First, currently, most NB-IoT connections in China are concentrated in a few cities, and there is still a lack of widespread coverage across the country, with many base stations in light or idle states.

Second, compared to advanced technologies like NB-IoT, 4G, and 5G, the utilization efficiency of 2G and 3G technologies is relatively low. However, 2G and 3G connections still account for a significant share of existing IoT connections, with nearly 20% in new IoT connections, necessitating a faster formation of a development pattern where NB-IoT, 4G, and 5G technologies sequentially support various IoT connections.

Third, the coverage of NB-IoT networks still needs further improvement, as some areas do not fully meet the requirements for carrying the migration of 2G connections, although local coverage depth needs to be strengthened.

3.

Three Major Operators Focus on NB-IoT While Strengthening Cat.1

Currently, China Telecom holds over 50% of the NB-IoT market share, ranking first in the industry, with nearly 60 million NB-IoT connections and about 30 million NB-IoT terminal devices connected to China Telecom’s IoT open platform.In the future, it will also focus on deploying the NB-IoT R14 version to enhance the application experience for large data packets and high-speed mobility.

It is understood that China Telecom has already conducted NB-IoT R14 version business tests in 5 provinces and 18 cities, and will promote it on a larger scale in the future.

Since October 2018, China Mobile has officially started developing NB-IoT services, and by the end of February this year, the number of users exceeded 43 million.

Moreover, China Mobile has reached a mature business development point, achieving primary coverage in 346 cities nationwide, with the capability of one-click card activation and availability across the entire network, along with hundreds of thousands of sites. It has completed FDD transformation in the 900M frequency band, enabling software activation, which will support rapid response capabilities for network construction as needed this year and in the future, providing a solid infrastructure for the subsequent development of NB-IoT.

In contrast to the actual situations of Telecom and Mobile, China Unicom has only 6MHz of bandwidth in the 900MHz spectrum resource, so 80% of NB-IoT base stations are deployed in the 1800MHz band.

However, the coverage range of the 1800MHz band is much smaller than that of Telecom’s 800MHz and Mobile’s 900MHz, making development more challenging. In 2019, China Unicom’s financial report showed that it had activated a total of 200,000 NB-IoT base stations.

At the same time, all three major operators have begun to strengthen Cat.1.

Among them, China Telecom is the most proactive, having laid out the LTE Cat.1 ecosystem as early as 2016, launching the LTE Cat.1 DTU, and leveraging its self-developed unified cloud platform to achieve an end-to-end overall solution of “terminal + channel + platform,” which has been successfully implemented in various scenarios nationwide.

China Mobile has launched its own brand Cat.1 module OneMO ML302, integrating the OneNET platform, OneOS operating system, and IoT security, among other core products and services, to create an integrated operation and maintenance service system based on Cat.1 technology.

China Unicom is also conducting public procurement for Cat.1 digital intercom PCBA, with the domestic module manufacturer Meig Smart winning the bid for the PCBA solution based on Unisoc’s 9810DM Cat.1 chip, with a total procurement volume of 500,000 pieces.

The peak of 2G IoT shipments will pass, and terminal users need a smooth transition.

Why did the first batch of 5G IoT terminals choose it?

2G/3G frequency reduction and network retirement: The IoT will welcome an upgrade wave.