| Win-Win is the Way

| Win-Win is the Way

Yesterday, foreign media cited sources saying that ARM’s new CEO Rene Haas stated in a memo to employees that ARM will lay off 12% to 15% of its workforce in the UK and the US. Since the beginning of this year, news surrounding ARM has been continuous. NVIDIA’s abandonment of ARM, ARM’s IPO launch, and ARM’s change of CEO are three major news items that have seamlessly connected, yet were also expected. Last year, Chip Research conducted a survey analyzing the impact of NVIDIA’s acquisition of ARM on the industry, ultimately predicting the failure of the acquisition. As expected, this merger, which greatly harmed ARM’s industry chain customers, ultimately ended in failure.

Now, with ARM initiating an IPO, it must address its relationship with its Chinese joint venture, Anmou Technology. Over the past few years, the trajectory of the relationship between ARM and Anmou Technology has become a topic of great concern in the industry. Currently, some recent reports from foreign media imply that ARM has absolute control over Anmou Technology, which is clearly not the case. In the context of a complex international situation and the rapid development of the domestic industry, while we pay attention to ARM’s dynamics, we must also focus on the future of the local company, Anmou Technology. Before we clear the fog to see the truth, let’s first analyze the relationship between the two.

Clarifying ARM and Anmou Technology

The focus of public discussion is on the relationship between the UK ARM company and the Chinese Anmou Technology. According to the information we have, the joint venture agreement and the ARM licensing agreement (IPLA) clearly state: Anmou Technology is a joint venture established by UK ARM and Chinese capital, with ARM holding 49% and Chinese capital holding 51%. Anmou Technology has the exclusive and permanent right to sell ARM intellectual property products in China; it has complete independent R&D rights to develop CPUs compatible with the ARM architecture and other independently designed processors, and can grant reverse licenses to ARM. It is precisely because ARM’s authorization to Anmou Technology is unique globally that this innovative model confuses many people about the relationship between the two.

In fact, there are indeed two layers of relationships between the two. First, ARM is one of the shareholders of Anmou Technology, holding 49% of the shares but does not have controlling interest. Second, at the corporate level, Anmou Technology is authorized to sell or develop products containing ARM IP, and shares revenue with ARM based on the proportion of ARM intellectual property contained. From this perspective, Anmou Technology is an important customer of ARM, and can even be said to be ARM’s largest customer globally.

Perhaps in the eyes of some foreign media, Anmou Technology is not much different from the former ARM China, but from the perspective of shareholding structure and cooperation agreements, there are three indisputable facts:In terms of ownership, Anmou Technology is controlled by Chinese capital holding 51%, and ARM’s 49% stake is insufficient for control; in terms of corporate legal representation, the legal representative is Anmou Technology’s current chairman and general manager, Wu Xiongang; in terms of operations, Anmou Technology operates independently, and ARM, as a shareholder, has no right to intervene. The 2020 incident where ARM, in collaboration with Hillhouse Capital, attempted to remove Anmou Technology’s chairman and general manager Wu Xiongang ended in failure, further validating the independence of Anmou Technology. The phantom of ARM China in the minds of overseas media is actually a collection of ARM’s China business headquarters established in Shanghai in 2002, along with the second and third branches established in Beijing and Shenzhen in 2004 and 2008, respectively. They only had sales and marketing functions and no independent R&D rights. However, with the formal establishment of Anmou Technology in April 2018, the original wholly-owned subsidiary of ARM China transformed into a joint venture controlled by Chinese capital and operating independently.

In fact, as early as 2014, ARM began to conceive the China 2.0 strategy internally, gradually forming the idea of separating its China business and establishing a joint venture controlled by Chinese capital. After ARM was acquired by SoftBank and privatized in 2016, SoftBank’s founder Masayoshi Son greatly affirmed this idea and actively promoted it, choosing to establish the joint venture headquarters in Shenzhen in 2017. In 2018, ARM valued its China business at 10 billion RMB and sold 51% of the shares to Chinese capital, establishing Anmou Technology and handing over control of the joint venture to Chinese investors. The joint venture is an important link for ARM to strengthen its connection with the Chinese semiconductor market, and ARM showed great sincerity at the time of establishing the joint venture—according to the agreement, the joint venture obtained permanent and exclusive product sales rights in the Chinese market, as well as independent R&D rights based on ARM CPU architecture.

There are four reasons why SoftBank supports the establishment of a joint venture controlled by Chinese capital: First, to avoid antitrust risks, establishing a joint venture controlled by Chinese capital serves as insurance for ARM’s future development in China; second, to some extent, to counter the impact of RISC-V in the Chinese market; third, to better serve the Chinese market, in the context of global technological bifurcation, Anmou Technology can independently develop based on the ARM architecture, which can better meet the needs of the Chinese semiconductor market; fourth, there are already successful cases of joint ventures controlled by Chinese capital, and the results have been very good.

The joint venture model of Anmou Technology is flourishing in the automotive industry. The largest joint venture company in China is in the automotive sector, namely Shanghai General Motors, established in 1997 by Shanghai Automotive Group and General Motors. It is controlled by Shanghai Automotive Group with 51% but operates independently. As of 2019, after 23 years of establishment, Shanghai General Motors had accumulated sales exceeding 20 million vehicles, achieving near-zero inventory on production lines, writing a legendary chapter in the history of car manufacturing in China. SoftBank and ARM also followed suit, planting the seed of Anmou Technology in Chinese soil, allowing it to bear both ARM’s “fruits” and its own “fruits.”

The Value of Anmou Technology

The GL8 series of cars launched by SAIC General Motors in 2000, jointly funded by Shanghai Automotive Group and General Motors, is a self-developed model based on the foreign-funded company. According to relevant statistics, in 2021, the GL8 accounted for as much as 53% of the joint venture brand MPV models. The success of automotive joint ventures also provides a model for the success of semiconductor joint ventures.

Anmou Technology’s “A+X” dual-wheel drive new strategy announced last year is based on the traditional ARM IP agency business, launching the “Core Power” self-developed brand, strengthening the joint venture’s intention to serve the local market. In the process of continuously improving its business and deepening the construction of the local semiconductor industry chain, Anmou Technology represents the inheritance of ARM’s spirit of serving the industry chain.

In terms of supporting the scale of the Chinese semiconductor industry chain, since 2018, Anmou Technology has empowered the domestic chip design industry with an annual output value exceeding 100 billion RMB, driving the downstream intelligent technology industry ecosystem with an annual output value exceeding 1 trillion RMB. In terms of traditional business, Anmou Technology has inherited ARM’s CPU business in China, helping ARM’s CPU cumulative shipments exceed 25 billion units. In terms of the joint venture’s self-developed business, it has also provided nearly 100 million USD in revenue for Anmou Technology. As of last year, all five self-developed product lines of Anmou Technology have achieved customer mass production, with shipments exceeding 100 million units, and over 100 customers nationwide, more than 30 of which have achieved tape-out and mass production. In terms of team size, Anmou Technology has rapidly grown since its establishment four years ago, with the number of local innovation team members doubling to 800, of which over 600 are R&D personnel. Currently, Anmou has over 200 open positions, in stark contrast to ARM’s nearly 1,000 job cuts.

Rooted in the development of the domestic semiconductor industry chain, Anmou Technology has rapidly grown. It is reported that from 2018 to 2021, Anmou Technology’s revenue grew by 2.5 times, with growth rates of 37% and 13% in 2019 and 2020, respectively; during the same period, ARM’s revenue growth rates were only 1.2% and 9.5%. This also means that in those two years, ARM experienced negative growth in markets outside of China, while Anmou Technology was the only source of growth for ARM globally.

In 2021, Huawei’s high-end chips were affected by changes in the trade market environment, which also impacted Anmou Technology’s revenue. However, despite this, Anmou Technology still achieved nearly 5% revenue growth in 2021, which is quite remarkable.

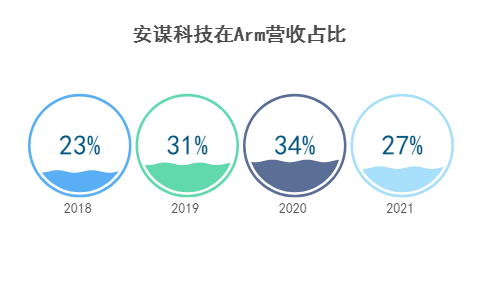

Anmou Technology’s expansion in the Chinese market has become a highlight of ARM’s revenue. As ARM’s joint venture company, Anmou Technology needs to share revenue with its shareholder ARM according to the previous agreement between the two. According to Chip Research’s calculations, between 2018 and 2021, the revenue contributed by Anmou Technology to ARM accounted for 23%, 31%, 34%, and 27% of ARM’s total revenue, making Anmou Technology ARM’s largest customer. We have reason to believe that if it were not for the severe fluctuations in the trade environment, Anmou Technology’s revenue share in ARM would continue to increase.

Serving the local industry chain has brought success to Anmou Technology, and its success perfectly embodies a truth that many people, including many executives at ARM, have “forgotten”: the success of the ARM architecture stems from the success of the industry and the success of its customers. In contrast, after being acquired by SoftBank, ARM began to chase financial “fame and fortune,” neglecting the core of serving the semiconductor industry chain, while Anmou Technology, which has maintained its original intention, has achieved revenue growth rates significantly exceeding those of ARM. The example of the joint venture company rising above its predecessors has also appeared in the past internet market; once a global internet giant, Yahoo’s joint venture in Japan, established in 1996, has developed to become the leading search engine and portal site in Japan, while Yahoo itself has long exited the historical stage. Interestingly, the model of Yahoo Japan is quite similar to that of Anmou Technology: Yahoo holds 40%, while Japanese investors hold 60%. And this Japanese investor is Masayoshi Son of SoftBank, who bought ARM.

Looking ahead, the value of Anmou Technology lies not only in its own profits and the substantial profits it brings to its shareholder ARM. For the Chinese semiconductor industry chain, in the context of changes in the global semiconductor supply chain, such a joint venture with industry attributes bears the responsibility of supporting the development of the Chinese semiconductor industry chain, especially as the ARM architecture is increasingly adopted by more companies in the Chinese market, the presence of a Chinese-controlled company can greatly ensure the development of the local semiconductor industry chain.

For example, as we enter the digital age, data centers have become a key focus for countries in planning for the future. In this technological competition, Chinese semiconductor manufacturers, benefiting from the openness of the ARM architecture, have also begun to enter the server market and have achieved outstanding results.

The Chinese market needs domestically produced products that can be accepted by the global semiconductor market. Therefore, the self-developed products launched by Anmou Technology at this time play an important role: first, the intellectual property of self-developed products belongs to Chinese companies; second, self-developed products are built on the ARM ecosystem, which does not disconnect from the development of the international market. From today’s perspective, the existence of Anmou Technology not only ensures the security of the Chinese semiconductor industry chain but also enhances the confidence of local customers, and ensures that Chinese chip design companies are not excluded from the global semiconductor supply chain, safeguarding the competitiveness of local semiconductor companies in the international arena.

Conclusion

The domestic semiconductor industry has had good examples of Sino-foreign joint ventures for over twenty years. Established in October 1997, Nantong Fujitsu was a joint venture between Nantong Huada and the foreign-funded enterprise Fujitsu (China), specializing in packaging and testing. Ten years later, it successfully listed on the Shenzhen Stock Exchange’s SME board and became a successful cooperation model that Fujitsu promoted to its Chinese business partners. At that time, Fujitsu (China) held 38.46% of the shares, while the company’s chairman Shiming Da and his son held a total of 43% of the shares, thus controlling the company.

In the year of its listing, a statement from the then general manager of Fujitsu (China), Haruhito Takeda, is worth pondering: “Fujitsu is known as ‘Japan’s IBM’ in its home country, but has not achieved corresponding success in China after more than thirty years, which has always troubled me.” The Nantong Fujitsu model is undoubtedly a success in exploring the Chinese market, and what Takeda said, “The successful listing of Nantong Fujitsu is just the beginning,” has proven to be prophetic, as Nantong Fujitsu (later renamed Tongfu Microelectronics) has seen optimistic development after 2007.

Similar to this case, the joint venture Anmou Technology is also on an unstoppable trend in exploring the Chinese market, as stated above. Anmou Technology and ARM have different stages of understanding of the Chinese market and customers, and Anmou Technology has a localized intimacy with Chinese customers. Therefore, whether it is ARM or Anmou Technology, maintaining relationships with Chinese customers and serving them well is a necessary strategy for expanding the Chinese market.

Anmou Technology is a third-party entity, and the rise and fall of the industry is closely tied to its fate, so Anmou thrives in the ecosystem. In the domestic context, supply chain security is the foundation of the ecosystem, and maintaining the independence of Anmou Technology is beneficial to ecosystem construction to a certain extent.

Of course, Anmou Technology’s self-developed IP is a positive result of serving the Chinese market, a response to customer needs, and strengthening self-development aligns with domestic market demands, so Anmou Technology still needs to continue to enhance its self-developed products. Meanwhile, in the current context of severe talent shortages and losses domestically, Anmou Technology must continue to maintain team cohesion, especially among the core management team, to increase the industry’s confidence in Anmou Technology.

Additionally, communication between the management team represented by ARM’s new CEO and Anmou Technology is also extremely important. In an interview with foreign media, new CEO Rene stated that the performance in the Chinese market is very good. The healthy development of the Chinese market positively promotes ARM’s global development, and the joint venture model is an important means to penetrate the Chinese market. ARM’s success is inseparable from the success of its customers, and the industry does not wish for ARM to become a victim of trade wars. Only by Anmou Technology serving the important Chinese market better can ARM and Anmou Technology achieve a win-win situation.

Whether it is SAIC General Motors or Yahoo Japan, the foreign shareholders have never attempted to control the joint venture. At the same time, under the leadership of local controlling shareholders and management, both joint ventures have achieved excellent performance in the local market, even surpassing their foreign shareholders. Clearly, in terms of both performance and ecosystem construction, Anmou Technology is the best strategy for ARM to adapt to the Chinese market, while ensuring that Anmou Technology remains a Chinese-controlled, independently operated joint venture is essential to properly resolve related disputes and ensure that Anmou Technology can continue to safeguard the security of the Chinese industry chain supply, which is also the only way for ARM to maximize its interests in the Chinese market. After all, ARM cannot do without the Chinese market.

About Chip Research: Chip Research (ICwise, official website: www.icwise.com.cn) is committed to becoming a world-class authoritative research institution rooted in China’s semiconductor and electronics industry. In April 2021, it was awarded the “Special Contribution Award” by the Shanghai Integrated Circuit Industry Association for its 20th anniversary. Currently, Chip Research has five major departments.Data Research Department: This department establishes a primary industry market database based on the research team’s in-depth understanding of the industry, extensive connections with the industry, and comprehensive research, and publishes authoritative market data, dynamic tracking, and provides standard report products.Enterprise Service Department: This department provides global and domestic semiconductor industry research services, mainly offering customized research services and consulting services tailored to clients’ personalized and specialized needs. Government Service Department: This department serves central and local governments and related departments, assisting governments and enterprises in establishing extensive communication and cooperation.Industry Investment Banking Department: This department serves both sides of investment and financing in the semiconductor industry, building a full-cycle investment and financing service capability from zero to IPO, providing complete solutions for equity financing, mergers, and acquisitions. Research Commentary Department: Adhering to the principle of “seeking stability rather than speed, seeking precision rather than novelty, seeking depth rather than flattery, seeking quality rather than quantity,” it insists on original and in-depth content, from news to viewpoints, from phenomena to essence, from problems to solutions. From 2015 to 2021, Chip Research has held seven sessions of the Chip Research Integrated Circuit Industry Leaders Summit, which has become one of the most influential industry summits in China. In 2021, Chip Research launched the offline salon brand “Chip Talk/I Say IC!”, aiming to become the most influential IC salon brand.

About Chip Research: Chip Research (ICwise, official website: www.icwise.com.cn) is committed to becoming a world-class authoritative research institution rooted in China’s semiconductor and electronics industry. In April 2021, it was awarded the “Special Contribution Award” by the Shanghai Integrated Circuit Industry Association for its 20th anniversary. Currently, Chip Research has five major departments.Data Research Department: This department establishes a primary industry market database based on the research team’s in-depth understanding of the industry, extensive connections with the industry, and comprehensive research, and publishes authoritative market data, dynamic tracking, and provides standard report products.Enterprise Service Department: This department provides global and domestic semiconductor industry research services, mainly offering customized research services and consulting services tailored to clients’ personalized and specialized needs. Government Service Department: This department serves central and local governments and related departments, assisting governments and enterprises in establishing extensive communication and cooperation.Industry Investment Banking Department: This department serves both sides of investment and financing in the semiconductor industry, building a full-cycle investment and financing service capability from zero to IPO, providing complete solutions for equity financing, mergers, and acquisitions. Research Commentary Department: Adhering to the principle of “seeking stability rather than speed, seeking precision rather than novelty, seeking depth rather than flattery, seeking quality rather than quantity,” it insists on original and in-depth content, from news to viewpoints, from phenomena to essence, from problems to solutions. From 2015 to 2021, Chip Research has held seven sessions of the Chip Research Integrated Circuit Industry Leaders Summit, which has become one of the most influential industry summits in China. In 2021, Chip Research launched the offline salon brand “Chip Talk/I Say IC!”, aiming to become the most influential IC salon brand.