[Event Description]

The company released its Q1 2025 report.The net profit attributable to shareholders in Q1 was 91.552 million yuan, a year-on-year increase of 86.51%; the net profit excluding non-recurring items was 56.178 million yuan, a year-on-year increase of 223.62%.

[Event Commentary]

Active expansion in multiple downstream sectors leads to significant profit growth.The company’s main business is actively expanding new demands in various fields such as automotive electronics, robotic vacuum cleaners, and smart projectors. In Q1, related downstream revenue increased by approximately 50% year-on-year, with a recovery in downstream demand and significant improvements in profitability due to economies of scale.

AI terminals broaden downstream demand, with continuous breakthroughs in industrial, automotive, and consumer sectors.The company’s products are widely used in various markets including smart hardware, intelligent robots, and smart home appliances, with a diversified customer base. In the robotics sector, the company launched the MR series dedicated chips for robots, enhancing multi-dimensional sensor perception capabilities and improving the layout of robot chips. In the industrial sector, the T series dedicated chips were introduced to support upgrades in industrial scene perception, cognition, and control. In the automotive electronics sector, the company’s chips have achieved large-scale production in modules such as AR-HUD and smart headlights.

[Investment Recommendation]

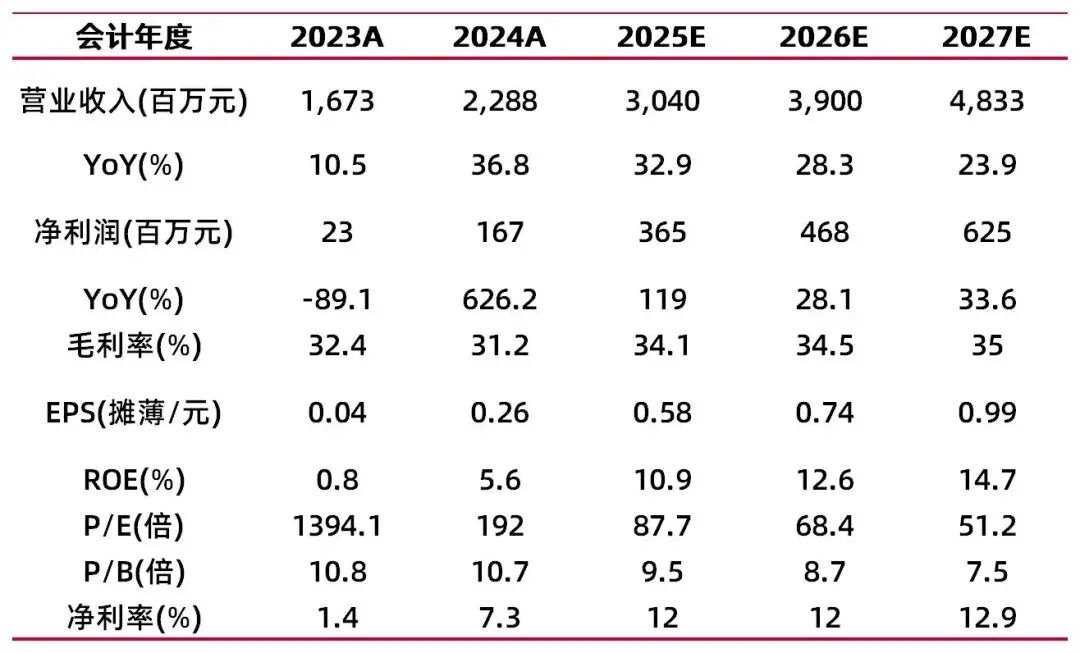

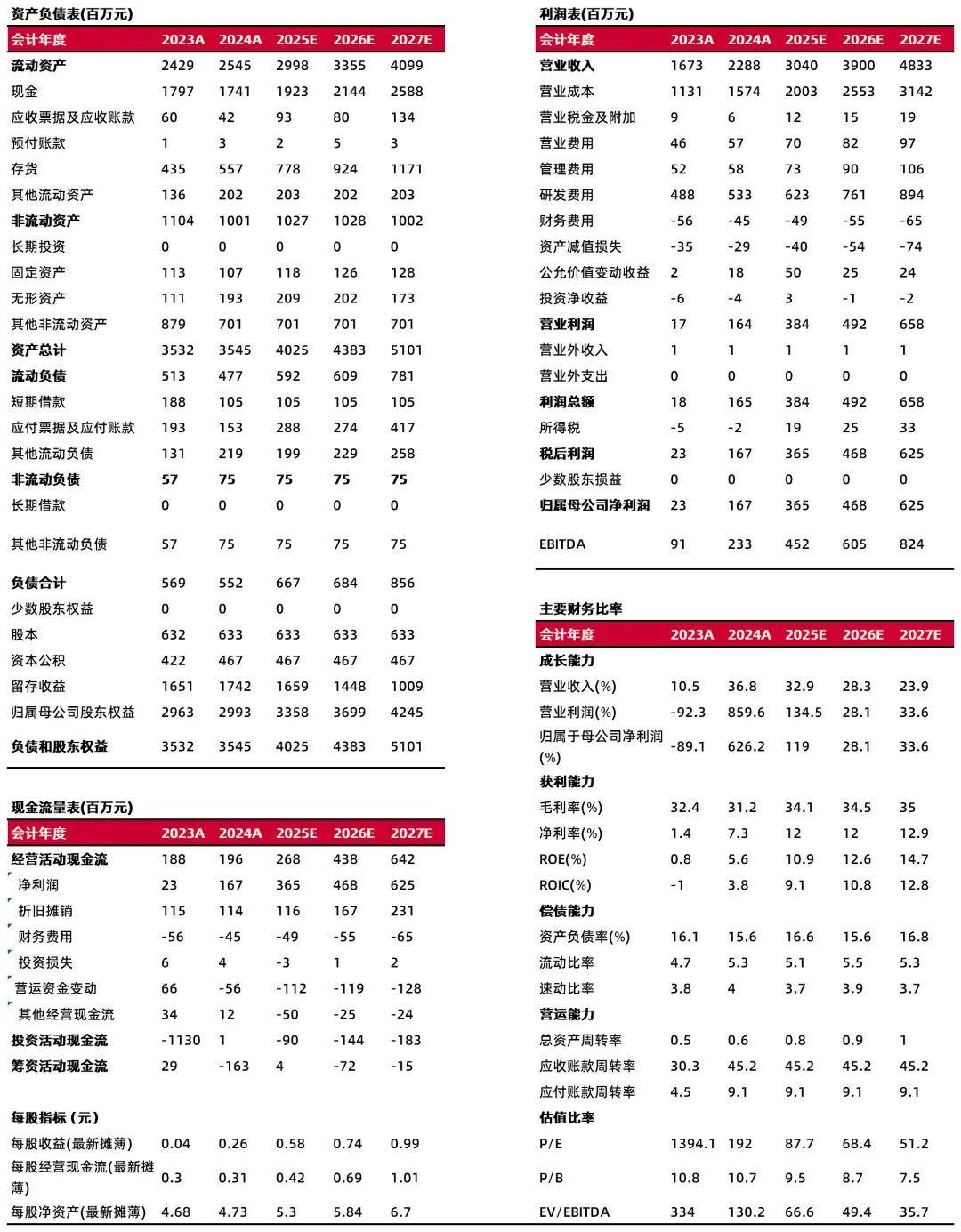

It is expected that the company’s net profit attributable to shareholders will reach 365 million, 468 million, and 625 million yuan from 2025 to 2027, representing year-on-year growth of 119.0%, 28.1%, and 33.6%, respectively, with PE ratios of 87.7, 68.4, and 51.2 times. Considering the company’s active layout in the AI edge SoC field and the establishment of a comprehensive AI product matrix, we initiate coverage with a “Buy-A” rating.

[Risk Warning]

Risks include global macroeconomic fluctuations, intensified international trade frictions, research and development progress falling short of expectations, and increased industry competition.

Financial Data and Valuation

Source: Zuowen, Shanxi Securities Research Institute

Summary of Financial Statement Forecasts and Valuation Data

Source: Zuowen, Shanxi Securities Research Institute

Analyst: Gao Yuyang

Registration Code: S0760523050002

Research Assistant: Tian Faxiang

Email: [email protected]

Report Release Date: April 24, 2025

[Analyst Commitment]

I have registered as a securities analyst with the China Securities Association and commit to providing this report with a diligent professional attitude, independently and objectively. I am responsible for the content and views of this securities research report, ensuring that the sources of information are legal and compliant, the research methods are professional and prudent, and the analytical conclusions are reasonably based. This report accurately reflects my research views. I have not, do not, and will not receive any form of compensation directly or indirectly for the specific recommendations or views in this report. I commit not to use my identity, position, or information obtained during my practice to seek personal gain for myself or others.

[Disclaimer]

This subscription account (WeChat ID: Shanxi Securities Research Institute) is the official subscription account operated by the Shanxi Securities Co., Ltd. Research Institute.

This subscription account is not a platform for publishing securities research reports from the Shanxi Securities Research Institute. The content contained herein is derived from securities research reports that have been officially published by the Shanxi Securities Research Institute. Subscribers using the materials contained in this subscription account may misunderstand key assumptions, ratings, target prices, etc., due to a lack of understanding of the complete report. Subscribers are advised to refer to the complete securities research reports published by the Shanxi Securities Research Institute, carefully read the accompanying statements, information disclosure matters, and risk warnings, and pay attention to the key assumptions under which the relevant analyses and forecasts can be established, as well as the time frame for investment ratings and target price predictions, and accurately understand the meaning of investment ratings.

Shanxi Securities Co., Ltd. (hereinafter referred to as “the Company”) is qualified for securities investment consulting business. The Company does not consider any institution or individual who pays attention to, receives, or subscribes to the content pushed by this subscription account as its natural client. The Company’s securities research reports are based on publicly available information that the Company believes to be reliable, but the Company does not guarantee the accuracy or completeness of such information. Investing in the market involves risks, and investment should be cautious. Under no circumstances does the information or opinions expressed in this subscription account constitute investment advice to anyone. Under no circumstances shall the Company be liable for any losses incurred by anyone due to the use of any content in this subscription account. The materials, opinions, and speculations contained in this subscription account reflect only the judgments of the Company’s research institute on the day the report is published. At different times, the Company may issue reports that are inconsistent with the materials, opinions, and speculations contained in this subscription account. The Company or its affiliates may hold or trade securities or investment targets mentioned in this subscription account, and may also provide or seek to provide investment banking or financial advisory services to these companies, which may create potential conflicts of interest that could affect the objectivity of this report. The Company fulfills its disclosure obligations to the best of its knowledge. The copyright of this subscription account belongs to the Company. The Company reserves all rights to this subscription account. No part of this subscription account may be copied, reproduced, or redistributed in any form or manner without the prior written authorization of the Company, or used in any other way that infringes the Company’s copyright. Otherwise, the Company reserves the right to pursue legal responsibility at any time.

In accordance with the provisions of the “Regulations on the Practice of Issuing Securities Research Reports”, it is hereby declared that employees of our company are prohibited from privately providing our securities research reports to any public media or other institutions without authorization; any public media or other institutions are prohibited from publishing or forwarding our securities research reports without authorization. Authorization for publishing or forwarding our securities research reports must be agreed upon through a signed agreement, and the authorized institution must bear the relevant responsibilities for publication or forwarding.

In accordance with the provisions of the “Regulations on the Practice of Issuing Securities Research Reports”, we remind our securities research business clients not to forward our securities research reports to others, and we remind our securities research business clients and public investors to use caution when using securities research reports published in public media.

In accordance with the provisions of the “Regulations on Integrity in Securities and Futures Business” and the “Implementation Rules for Integrity in Securities Business”, we hereby inform our securities research business clients to comply with the integrity regulations.