1

[PCB Information Network] Just after the festive New Year, news broke of a strike by workers at the Escondida copper mine in Chile, the largest copper mine in the world, and the disruption of exports from the Grasberg mine, the second largest copper mine located in Indonesia. It is estimated that the 20-day shutdown at Escondida and a one-month delay in Grasberg’s exports will lead to a reduction of approximately 100,000 tons in copper supply.

The direct impact of this event is a surge in copper prices. On February 10, LME copper prices skyrocketed over 4% to $6087.5 per ton, reaching a new high since June 2015; COMEX copper also rose over 4.6%, similarly hitting a new high since June 2015.

Some PCB manufacturers expressed their concerns, wondering if the material prices would rise significantly again.

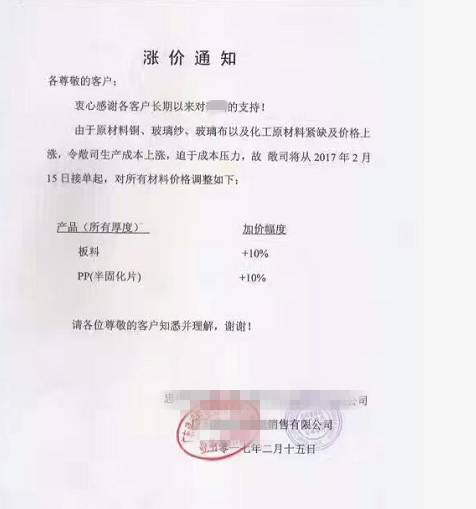

A price increase notice soon confirmed this speculation:

Prices for materials and PP have increased by 10% again.

After a year of consecutive price hikes, an additional 10% increase is a heavy burden for PCB manufacturers who are already struggling. This price hike undoubtedly adds another heavy stone to their already burdened shoulders.

Some lamented, “At this rate, who can survive?”

Even those who were ready to roll up their sleeves and work hard this year felt as if they were doused with a bucket of cold water, chilled to the bone:

“Just as we were gearing up, the material prices pulled us back! The profit margins in PCB manufacturing are razor-thin, and we hope customers can understand the factory’s difficulties.”

2

More distressing news followed.

Since yesterday (15th), the leading fiberglass manufacturer Nanya has cold-repaired one of its electronic-grade fiberglass yarn kilns, which has an annual production capacity of 30,000 tons, and is expected to resume production in three months.

Some analysts in the fiberglass industry predict that the construction of a cold-repair for a 50,000-ton yarn kiln at Kingboard Laminates will also take place in June, and four kilns located in Kunshan, Jiangsu Province, are planned to be gradually moved to Bengbu, Anhui Province, with Fulong Glass Fiber also undergoing cold repairs.

Some manufacturers indicated that last year’s fourth quarter saw mainland manufacturers significantly raise prices for electronic-grade fiberglass cloth citing shortages, and now with the cold repairs of electronic-grade fiberglass yarn kilns, this may further fuel a chain reaction of price increases.

3

In fact, despite the difficulties, most manufacturers are still accepting reasonable price increases.

Currently, price hikes are rampant, and the increase in PCB material prices is just a ripple in the larger wave of rising prices. It is fierce, but it is not the most terrifying wave.

Regarding the reasons for the increase in PCB material prices, there are sufficient justifications:

Strikes or supply disruptions at foreign copper mines; shutdowns at some chemical material factories; cold repairs of electronic-grade fiberglass yarn kilns, etc., have led to rising raw material costs. Additionally, increased environmental pressures and rising factory costs have made price increases more necessary.

What everyone is more worried about is that during this difficult period, some unscrupulous companies may take advantage of the situation to raise prices excessively and make huge profits.

What pains and frustrates them even more is that, with their limited power, they cannot resist or change this situation.

A manufacturer once privately shared his views with me, stating that if there were a financially strong and capable organization that could promptly relay accurate supply and demand information in the industry to them, they would feel more secure knowing they had a clear grasp of market information, and at least they wouldn’t panic and hoard materials, giving unscrupulous players an opportunity.

Moreover, this organization could fairly and justly regulate market prices, maintaining them at a balanced level, preventing the previous long-term losses in the copper foil market, and avoiding the current situation of continuous price increases, where cheers and wails coexist. Development in a fair competitive environment would better promote the prosperity and long-term development of the industry.

This is a great idea.

But who will lead this organization? How will it be done?

We hope that there are truly capable and well-intentioned individuals who can make this happen.

4

At the end of the article, I would like to convey a message to everyone.

According to a report from Huizhong Network yesterday (15th), due to a calming situation regarding the strike at the Escondida copper mine in Chile, international copper prices have shown a significant decline after reaching a nearly 20-month high of $6204 per ton this week. As of the last report, LME three-month copper was trading at $6050 per ton, with a slight increase of 0.04% during the day.

Source: PCB Information Network. Please indicate the source when reprinting.