Author Information

Guo Dong, PhD in Economics, Deputy Researcher at the People’s Bank of China, Senior Economist at the Funding Department of the China Development Bank.

Abstract

Keywords:Renminbi Internationalization; Trade Renminbi; Foreign Exchange Reserves

Classification Number:F831 Document Identification Code:A

1

From the perspective of currency functions, the Renminbi performs its international monetary role in two forms: “trade Renminbi” and “investment Renminbi.” “Trade Renminbi” refers to the cross-border use of Renminbi as a currency for pricing and settlement in international trade; “investment Renminbi” reflects the development form of cross-border holding of financial assets denominated in Renminbi by non-residents.

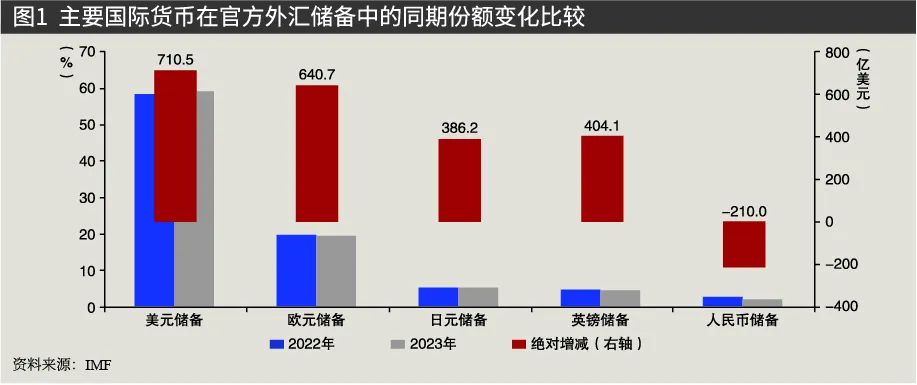

Currently, the trends in the currency functions of Renminbi internationalization show the following changes: first, the status of “trade Renminbi” has strengthened. According to transaction data compiled by the global financial information service provider (Swift), as of November 2023, the Renminbi accounted for 4.6% of global payment transactions, surpassing the Japanese yen at 3.4%, becoming the fourth largest currency in international payments. During the same period, the US dollar accounted for 47%, maintaining its leading position; the euro and the pound were at 23% and 7.5%, respectively. In terms of cross-border settlement, the amount of cross-border Renminbi payments and receipts increased from 12 trillion yuan in 2015 to 42 trillion yuan in 2022; by the first half of 2023, the total amount of cross-border Renminbi payments and receipts reached 24.5 trillion yuan, a year-on-year increase of 20%, accounting for 57% of the total cross-border payment amount during the same period. Second, the share of “investment Renminbi” has decreased. According to data on official foreign exchange reserves released by the International Monetary Fund (IMF), as of the third quarter of 2023, the Renminbi accounted for 2.19% of global official foreign exchange reserves; in the ranking of major international currencies, it lagged behind the US dollar, euro, yen, pound, and Canadian dollar, ranking sixth. In the same period of 2022, its share was 2.63%, ranking fifth, with a widening gap compared to the yen. The Renminbi has shown a dual reduction in both absolute and relative indicators in official foreign exchange reserves: the absolute value has decreased by more than $21 billion year-on-year, and the share has decreased by 0.26%.

Based on IMF data on official foreign exchange reserves, there is a weakening of the dollar’s features in the comparison of international currency shares in foreign exchange reserves. The absolute value of the dollar in official foreign exchange reserves has increased, but its share has significantly declined (see Figure 1), showing an “de-dollarization” trend and an exclusion effect.

The total absolute value of global official foreign exchange reserves increased by more than $287 billion during the same period (from the third quarter of 2022 to the third quarter of 2023), with foreign exchange reserves of major developed economies showing varying degrees of growth. Among them, the dollar and euro are in the first tier of growth, increasing by over $64 billion; the yen and pound are in the second tier, around $40 billion. Although the absolute value of dollar foreign exchange reserves has increased significantly, its share has greatly decreased (surpassing the Renminbi), from 60.10% to 59.17%. Besides the dollar and Renminbi, the relative changes in shares of other major international currencies have shown slight increases, with the yen and pound leading in share growth.

The emergence of the dual characteristics of imbalance in the currency functions of the Renminbi and weakening of the dollar’s features in foreign exchange reserve currency shares presents both “crisis” and “new opportunities”: on the one hand, the imbalance in currency functions poses potential dangers of triggering a currency crisis; on the other hand, the “de-dollarization” of official foreign exchange reserves may provide an opportunity window for remedying the deficiencies of “investment Renminbi.” Historically, “petrodollars” have been a key component in establishing the dollar’s status as the world’s currency. In the context of financial globalization, the commodities market has shown a trend towards energy, with commodities represented by oil choosing the dollar as the currency for pricing and settlement, helping the dollar gain absolute advantages in international trade and monetary discourse (trade dollars). After the collapse of the Bretton Woods system, oil-producing countries such as the Gulf Cooperation Council (GCC) countries accumulated large amounts of dollars due to oil trade, and official foreign exchange reserves urgently needed to find a “safe haven” for dollars, purchasing dollar-denominated assets represented by government bonds formed the main channel for currency return (investment in dollars).

Learning from the experiences and lessons of the evolution of international currencies, the ultimate solution to the imbalance in the currency functions of the Renminbi requires consideration of reshaping the international monetary system, breaking the dollar’s hegemony, and enriching and diversifying the “currency anchor” in regional economies is a necessary path. From the perspective of replacing “petrodollars,” enhancing the currency function of “investment Renminbi” requires increasing the share of Renminbi in foreign exchange reserves within the GCC region to achieve a replacement of the function of “investment dollars.”

2

Based on data from the International Financial Association (IFF), the current foreign exchange asset scale and structure of the GCC “petrodollars” show new characteristics: first, the current account surplus has led to a comprehensive increase in foreign asset scale; second, the structure of foreign asset stocks has shown signs of “weak dollarization,” with new investments showing “de-dollarization”; third, there is an enhanced risk appetite with subjective and objective driving factors for “Renminbiization.”

First, the comprehensive foreign asset scale has increased significantly. IFF predicts that in 2024, supported by a sustained current account surplus, the combined foreign assets of the six GCC countries will increase by $146 billion, reaching approximately $4.4 trillion, with combined liabilities of about $1 trillion and a net foreign asset value of $3.4 trillion. In terms of asset categories, two-thirds of the GCC’s combined foreign assets are managed by sovereign wealth funds (SWFs), which have a diversified investment portfolio of public stocks and fixed-income securities; one-third is invested in liquid assets as official reserves and foreign assets of commercial banks. In terms of investment regions, North America and Europe are the long-term focus areas for GCC investments (accounting for 65%), while the Asia-Pacific region accounts for 2%, with 10% invested in other Middle Eastern and North African countries, and 5% in sub-Saharan Africa and Latin America.

Second, the diversification of investments shows characteristics of “de-dollarization.” The structure of foreign assets in GCC investments has become diversified, with IFF estimating that the current stock of asset categories includes: 35% equity investments, 22% bank deposits, 17% foreign direct investments, 7% US Treasury bonds, 10% other currency bonds, and the remaining 9% comprising a series of less liquid investments, including non-US bonds, mergers, and hedge funds. Although the US remains an important investment area for GCC countries, the proportion of US Treasury bonds held has no longer held a significant advantage and has even reached a historically low level.

As shown in Figure 2, prior to the outbreak of the global COVID-19 pandemic, GCC holdings of US Treasury bonds reached a record peak, which saw a significant decline in the months following the pandemic outbreak, and after dropping to a low level, there has been no significant growth for a long time (the stock shows “weak dollarization”). Saudi Arabia is the largest holder of US Treasury bonds within the GCC region, but the scale of its holdings has shown a steady decline, dropping by nearly 40% from February 2020 to September 2023. The trend of Saudi holdings determines the direction of changes in the regional holding scale, but there is heterogeneity in the holdings of other countries, with Kuwait’s holdings remaining stable and the UAE showing a slight increase.

(2) Country Observation: Currency Cycle Characteristics of Saudi Investments

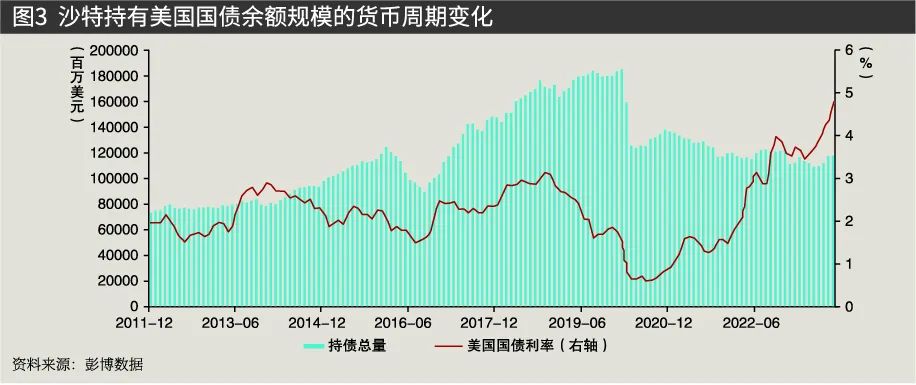

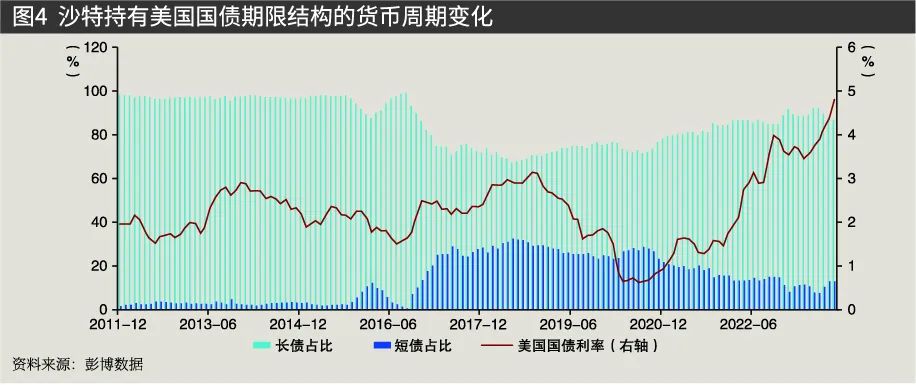

Selecting data on Saudi Arabia’s holdings of US Treasury bonds from December 2011 to October 2023 for observation (see Figures 3 and 4), it is found that the scale and structure of Saudi holdings of US Treasury bonds exhibit certain cyclical characteristics related to monetary policy.

First, the periodic characteristics of point observations. As of the end of October 2023, Saudi Arabia’s holdings of US Treasury bonds reached $117.5 billion, accounting for 1.5% of the total foreign official holdings of US Treasury bonds; in terms of structure, long-term US Treasury bonds dominate, with a total scale exceeding $102.2 billion (accounting for over 87%). During the historical peak of holdings before the COVID-19 pandemic (August 2019), Saudi Arabia’s holdings of US Treasury bonds exceeded $183.7 billion, with long-term US Treasury bonds accounting for 75% and short-term US Treasury bonds for 25%. The corresponding monetary cycle: currently at the tail end of the Federal Reserve’s interest rate hike cycle, the average interest rate of US Treasury bonds is 4.7981%; during the historical peak period, it was at a low point during quantitative easing, with a monthly average interest rate of 1.6264%; the interest rate spread exceeded 317 basis points. High interest rates correspond to a decrease in the prices of existing bonds; based on cross-cycle asset allocation considerations, the reduction of short-term bonds (devaluation and active reduction) will be greater than that of long-term bonds.

Second, the periodic characteristics of scale observations (see Figure 3). Before the COVID-19 pandemic, except for a phase of scale reduction around 2016, Saudi Arabia’s holdings of US Treasury bonds showed a continuous growth trend. During periods of declining US Treasury bond interest rates (expansionary monetary cycles), the scale of holdings showed significant increases; after the normalization of the Federal Reserve’s monetary policy around 2017, Saudi Arabia’s holdings of US Treasury bonds continued to increase. Therefore, prior to the COVID-19 pandemic, the direction of Saudi holdings showed resilience in monetary cycles, maintaining a consistent increase. After the outbreak of COVID-19 in 2020, Saudi holdings saw a sharp decline, contrasting sharply with the excessive expansion of US Treasury bond holdings and Saudi Arabia’s low willingness to increase holdings. After the Federal Reserve’s continuous interest rate hikes, the scale of Saudi holdings has decreased, showing a changing heterogeneity compared to the monetary cycle characteristics before the COVID-19 pandemic.

Third, the periodic characteristics of term structure. Before October 2015, the proportion of Saudi long-term Treasury bonds in its holdings was above 95%, with a very low proportion of short-term Treasury bonds, and only long-term bonds exhibited some sensitivity to monetary cycles. From 2016 to the end of 2019, the proportion of short-term Treasury bonds showed a rapid increase in a stair-step manner, peaking in mid-2018 at over 32% (see Figure 4). The significant increase in short-term Treasury bonds reflects a shift in Saudi investment strategy from passive holding to a more proactive trading approach; based on the trends in US Treasury bond interest rates, short-term bonds exhibited a following characteristic. In the early stages after the COVID-19 pandemic, there was a slight increase in the proportion of short-term bonds, followed by a strategy change towards a steady increase in long-term bonds and a reduction in short-term bonds as the Federal Reserve normalized its monetary policy.

Although the characteristics of Saudi holdings are somewhat related to the Federal Reserve’s monetary policy cycle, after the COVID-19 pandemic, there has been an asymmetrical and irregular temporal variability in the feedback of interest rate fluctuations on holdings. This indicates that Saudi sovereign investment institutions are conducting proactive hedging operations in response to changes in the dollar’s monetary cycle, including sharp reductions in holdings and adjustments in strategies regarding different term structures.

3

To enhance Renminbi internationalization, it is necessary to selectively learn from the evolution experiences of international currencies: the US dollar and euro are successful cases, with the euro having a supranational characteristic as a regional currency; the Japanese yen has lessons in its evolution from trade yen to investment yen. Strengthening the currency function of “investment Renminbi” requires foreign official institutions to increase their holdings of Renminbi safe assets, improve the currency return mechanism, and form a global cycle of the Renminbi. From the perspective of opening up the government bond market, this article proposes relevant policy recommendations.

(1) Enhance the Trade Discourse Power of Renminbi and Expand Its Multi-Scenario Applications

The investment “Renminbiization” in GCC countries has driving factors from “trade Renminbi”: first, the guarantee of absolute trade volume. Despite the US still being the most important geopolitical and military partner in the region, it has long lagged behind China and the EU in trade. China is now the largest trading partner in the region. Second, the change in non-dollar currency pricing. GCC countries have begun to slowly diversify away from the dollar, such as signing bilateral trade agreements allowing for trade settlement in other currencies.

(2) Smooth Channels for Foreign Official Direct Investment in Government Bonds, Cultivate the Habit of Long-Term Investment in Renminbi Government Bonds

China’s financial market still belongs to the emerging market category, and the general trading strategy of international financial institutions is to define Renminbi assets as risk assets to obtain corresponding returns, or to use Renminbi safe assets (such as government bonds) as hedging tools against risks of reserve assets like US Treasury bonds. Therefore, in light of the risk preference adjustments of GCC countries, Renminbi assets will become a potential asset for increasing allocation in the future.

(3) Green Transformation and Digital Renminbi Are Technological Drivers to Expand Holding Willingness

In addition to the financial “de-dollarization,” GCC countries are also showing a gradual trend of decoupling from the US in industrial fields, namely the change of “de-energyization.” On the one hand, China should promote its green transformation through manufacturing advantages, such as the construction of Saudi green cities, etc. On the other hand, China should share its industrial experience and scientific technology in the new energy field. It is particularly important to pay attention to the exploration, development, and smelting of new energy metal resources, as GCC countries have begun cooperation with developed economies like Japan, and China should follow up, taking the initiative and playing a leading role. In the global carbon reduction response to climate change, China is the largest demand market for new energy and has huge potential to become a major supplier of new energy technology and resources.

About Us

International Finance has developed into an economic and financial management magazine that integrates research on domestic and international financial hot topics and issues faced by commercial banks, with its influence in China’s academic and practical circles continuously expanding, now serving as an important reference for decision-making and research in relevant central ministries, domestic financial institutions, and universities.

In 2014, International Finance was included in the first batch of academic journals recognized by the former State Administration of Press, Publication, Radio, Film and Television (now the National Press and Publication Administration); in 2023, it was included in the core journal of the Chinese Academy of Social Sciences’ “Comprehensive Evaluation Report of Chinese Humanities and Social Sciences Journals (2022).”

This journal features columns on current commentary, special topics, international finance, international perspectives, macroeconomics, financial markets, financial technology, banker forums, and banking management.

Scan the QR code to follow us

WeChat public account|International Finance Magazine