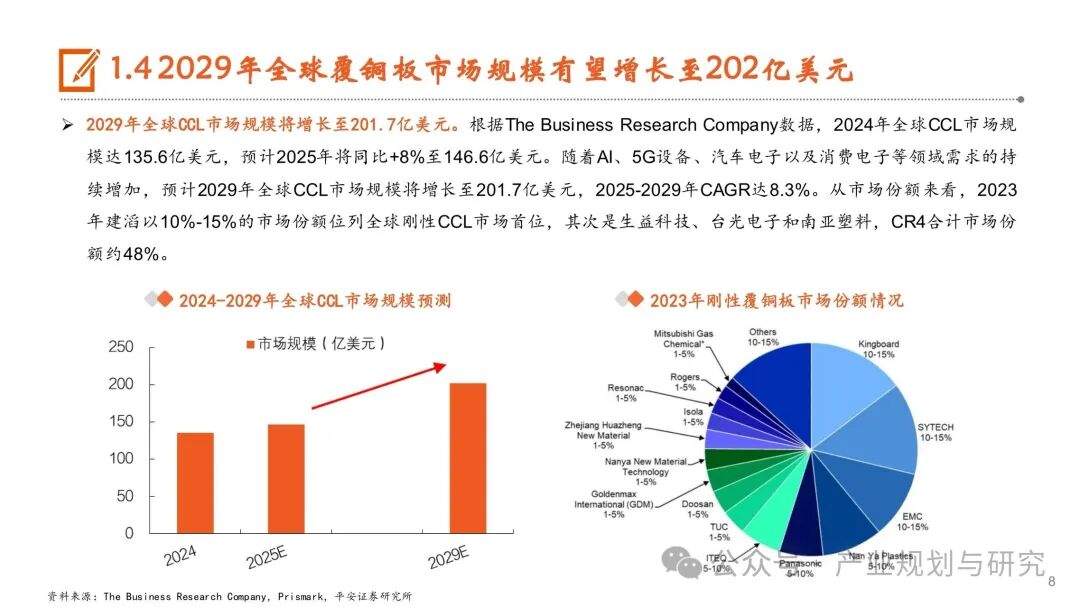

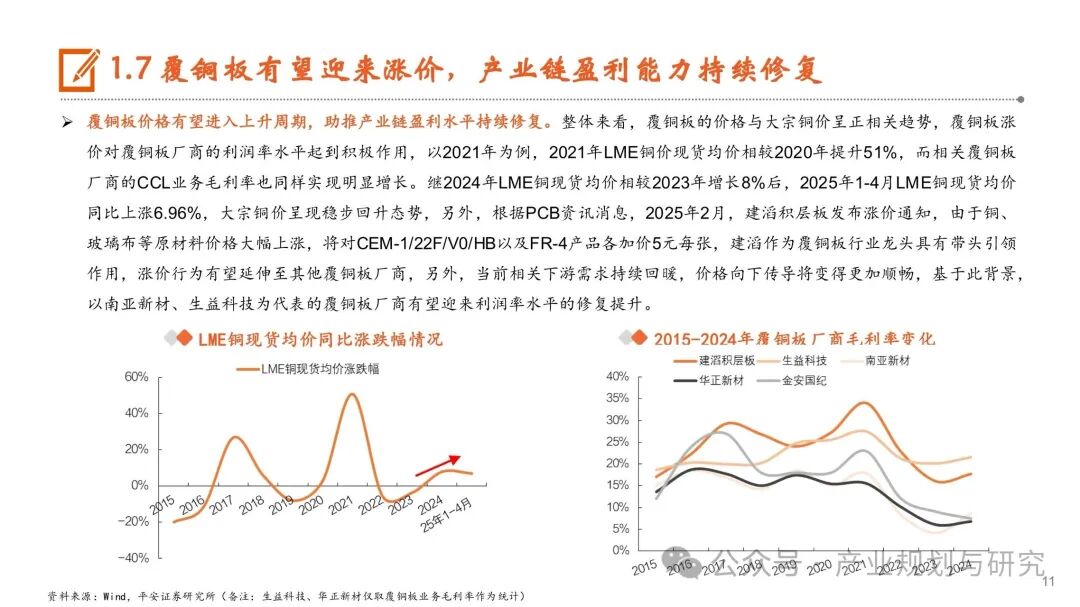

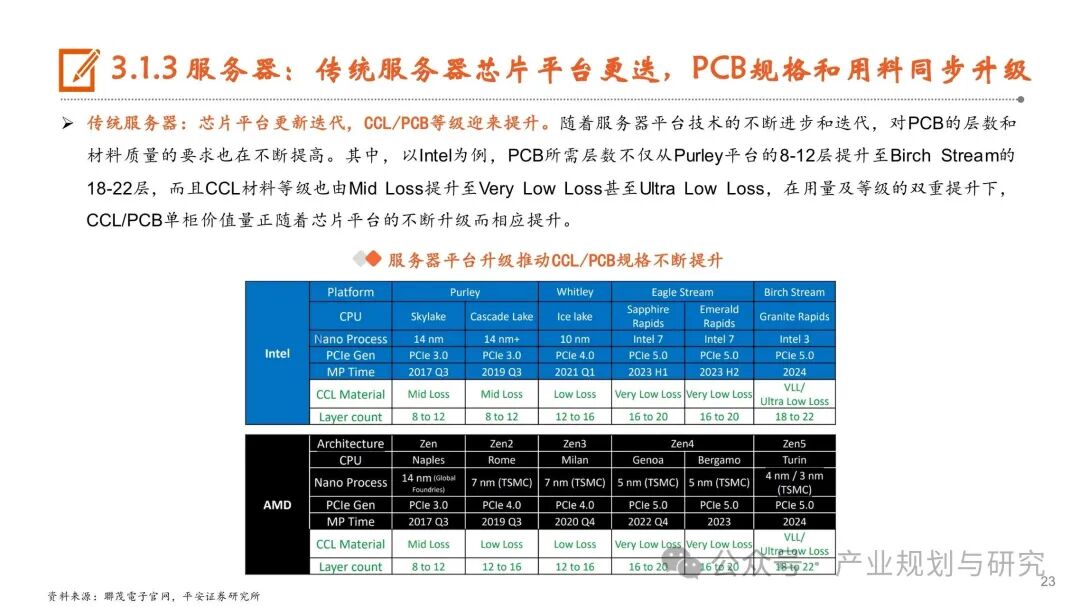

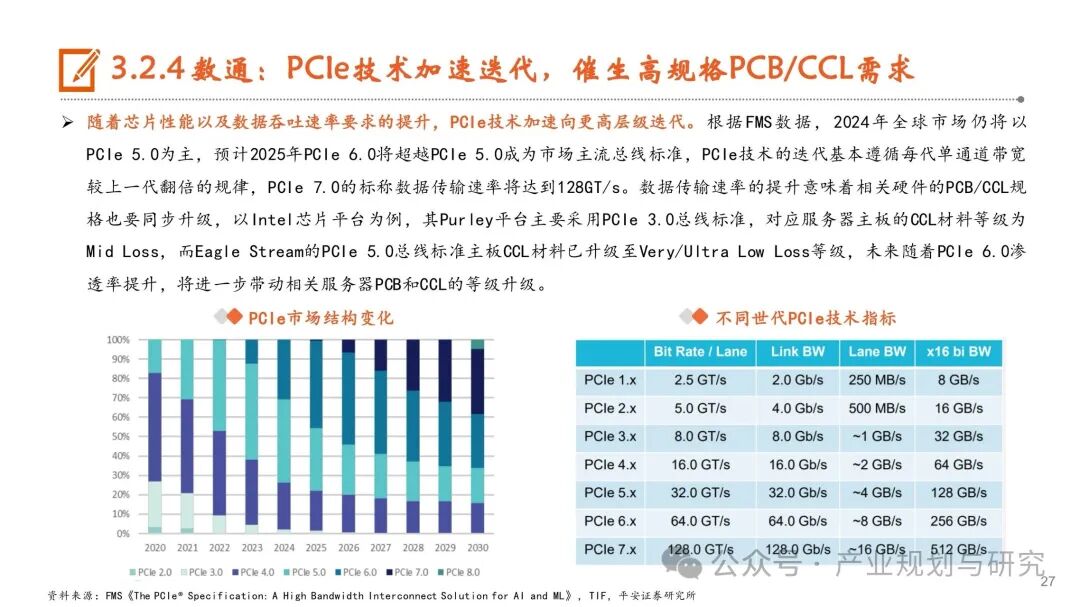

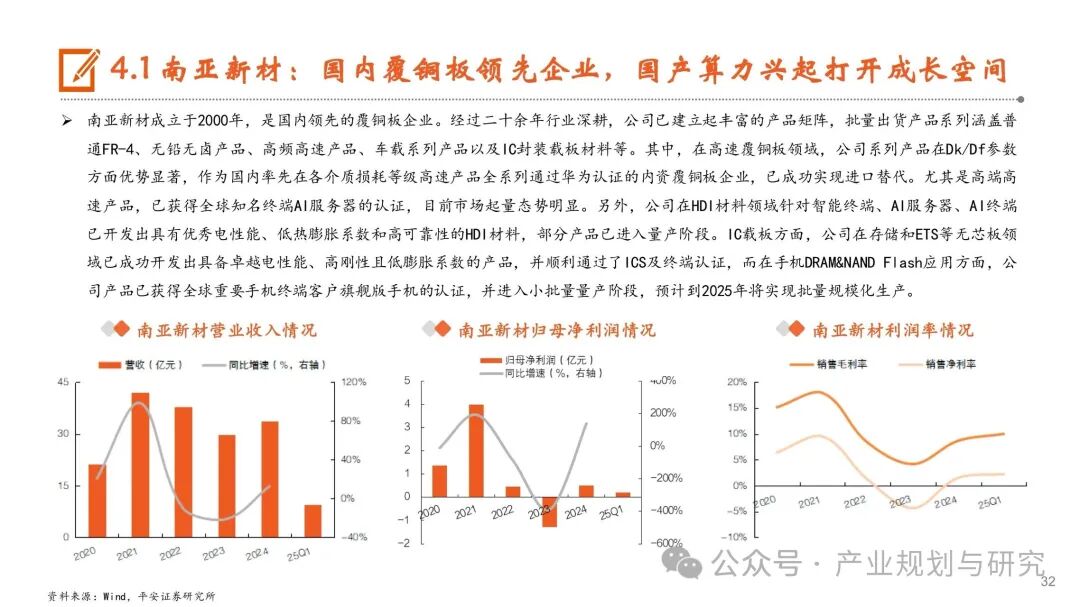

Copper-clad laminates: Market prices continue to rise, with a clear trend towards high-speed and high-frequency applications. From a cyclical perspective, the price of copper-clad laminates shows a positive correlation with the price of bulk copper. After an 8% increase in the average spot price of LME copper in 2024 compared to 2023, the average spot price of LME copper from January to April 2025 increased by 7% year-on-year. The price of bulk copper is showing a steady recovery, and manufacturers of copper-clad laminates, represented by Kingboard Laminates, have successively issued price increase notices. Companies in the copper-clad laminate supply chain are expected to see a recovery in profitability. Additionally, from the perspective of innovation fields such as AI, the demand for high-end copper-clad laminates, such as high-frequency and high-speed types, has significantly increased. In recent years, domestic manufacturers have actively positioned themselves in the high-end market. Considering the current consumption of high-end copper-clad laminate capacity by AI and the rise of the domestic computing power supply chain, domestic manufacturers are expected to seize the opportunity to increase their market share in the high-end sector.

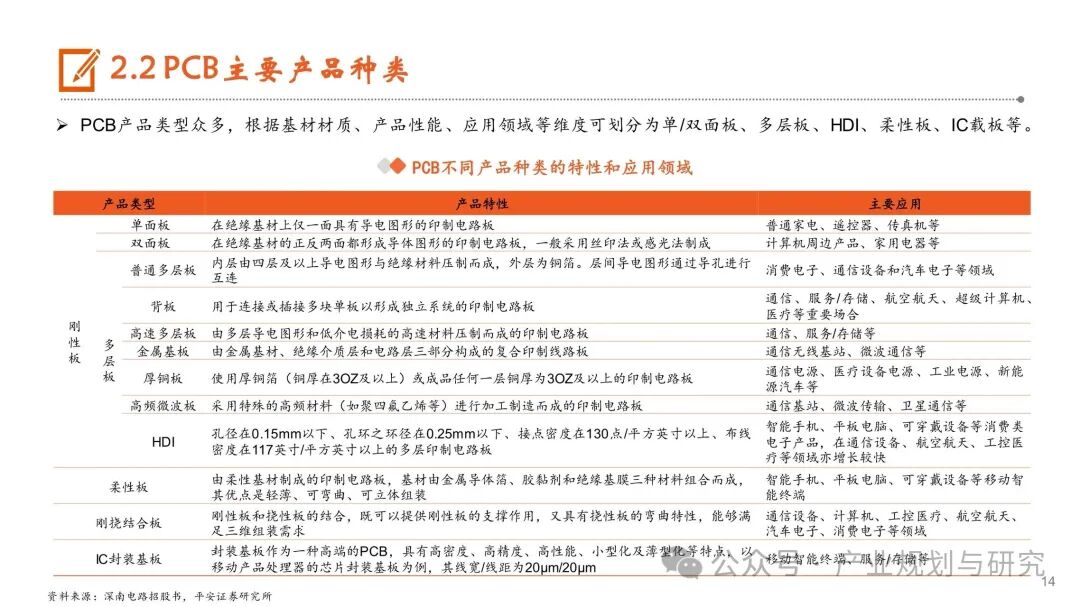

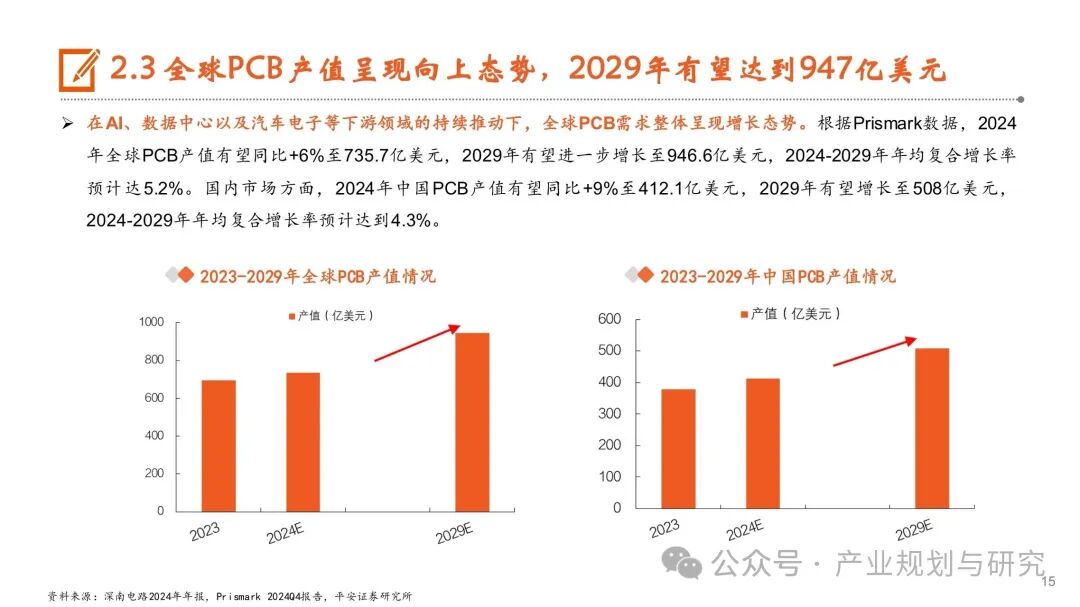

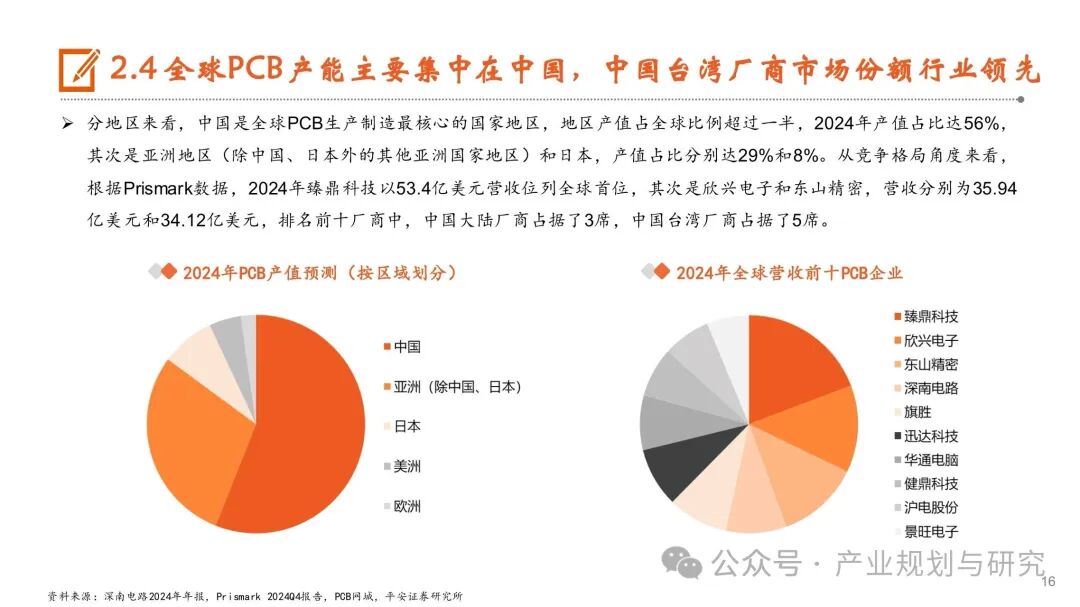

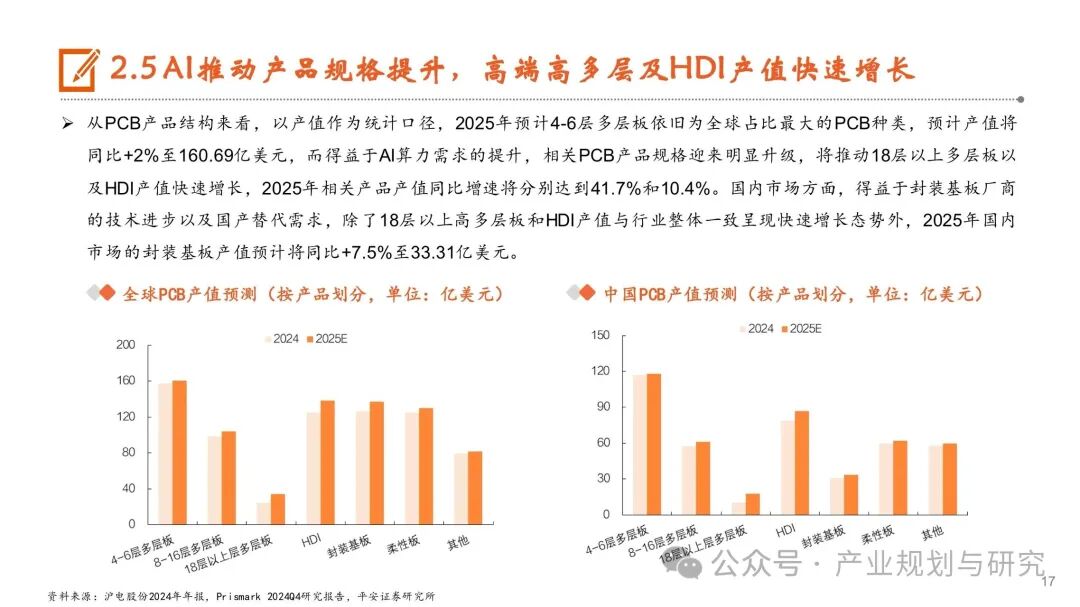

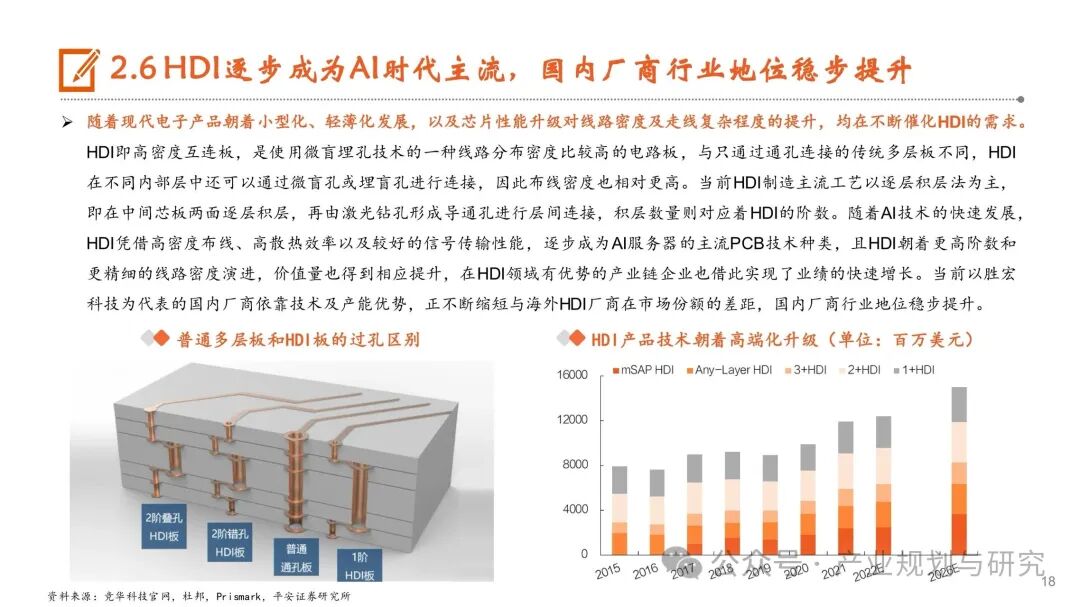

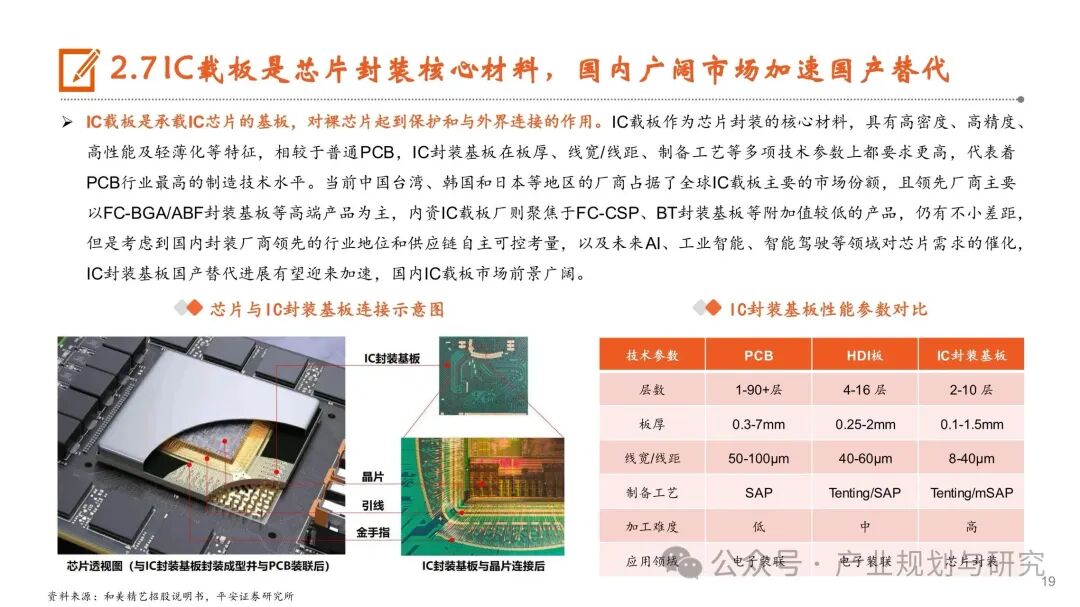

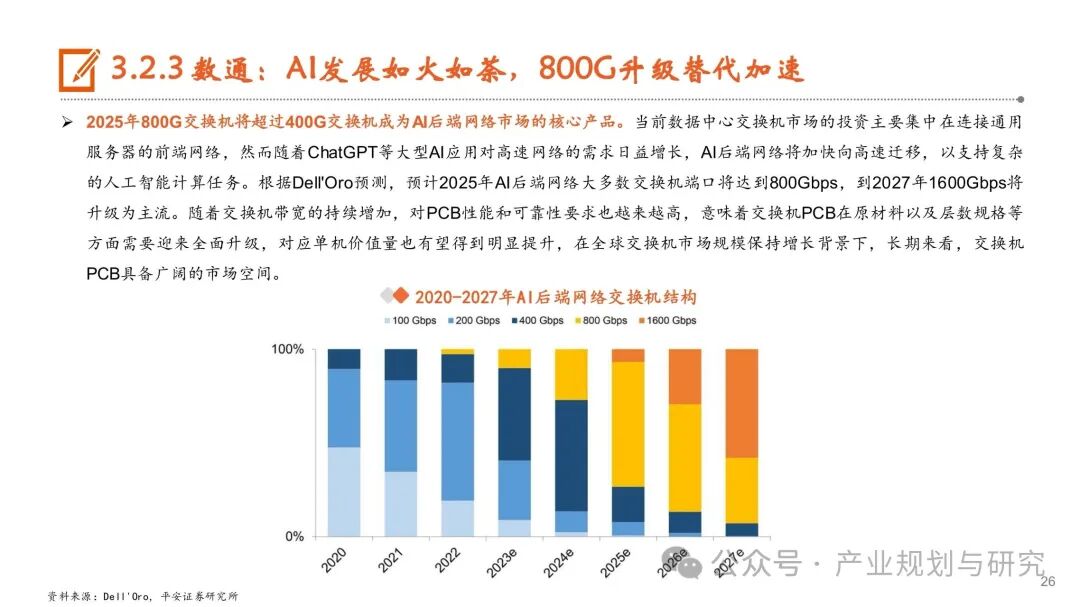

PCB: Growing demand in emerging markets, with AI driving both volume and price increases in PCBs. Currently, the overall demand from the electronics downstream is showing signs of recovery, combined with the continuous upward trend in innovation fields represented by AI and high-speed communication, which jointly supports the overall growth in PCB demand. Furthermore, against the backdrop of strong demand from AI, the structural demand for high-end PCBs has become prominent, especially for high-end multilayer and HDI boards. The global output value growth rates for these two categories are expected to reach 41.7% and 10.4% respectively by 2025. As the performance of AI hardware iterates, PCBs will further upgrade in terms of product technology and materials to higher specifications, and the value of related products will also see a simultaneous increase. Domestic PCB manufacturers, leveraging their prior technological accumulation and enhanced product competitiveness, are gradually improving their industry position in the high-end market.

来源:平安证劵

来源:平安证劵