A few days ago, a friend mentioned some issues regarding the MCU microcontroller market. Currently, the main application fields for MCUs are divided into four major areas: automotive applications, industrial applications, consumer electronics, and the Internet of Things, with automotive applications being the most concentrated.

This article extracts some data and briefly discusses the changes in MCUs in the automotive electronics direction.

1

The overall market size of MCUs and four segmented markets

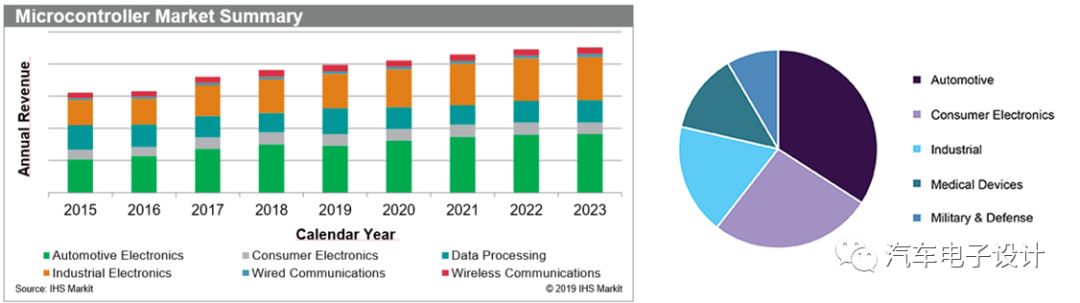

According to IHS Markit, the MCU market was flat in 2019, approaching $20 billion, as shown in the figure below:

Growth of the MCU market

The market share situation of several major segmented markets in the global and Chinese markets is as follows:

1) Automotive electronics

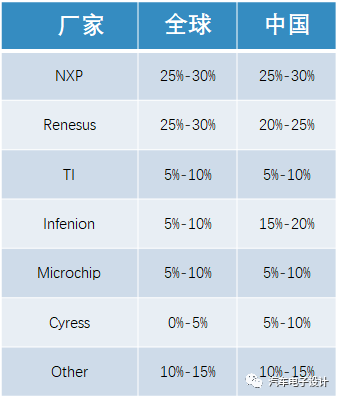

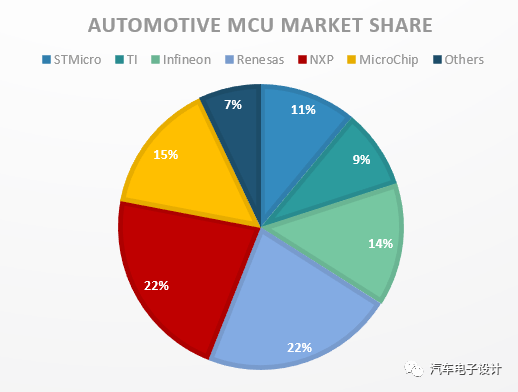

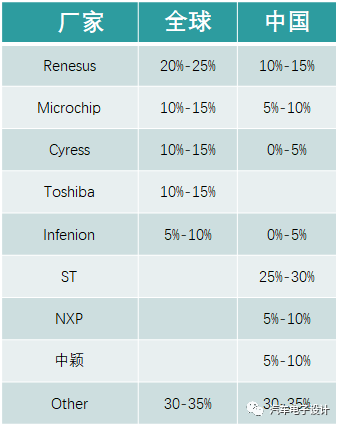

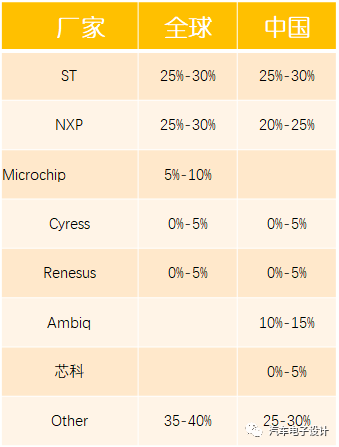

The market for automotive MCUs is $6 billion, and the market shares of the leading MCU companies are relatively stable. The data in the table below is from Strategy Analysis.

In fact, due to the research conducted in this area, there are more accurate market share figures (from IHS).

2) Industrial applications

The industrial application sector shares characteristics with automotive applications, but has higher demands for support and usability, with Japanese companies not having a strong presence in the domestic market.

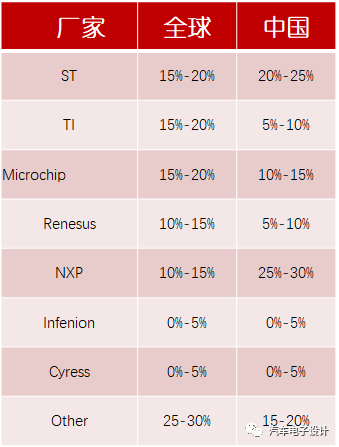

3) Consumer applications

The market for consumer applications is shown in the figure below, where cost and continuity are very important metrics. ST and NXP are the big winners in China.

4) Internet of Things

This market is in its early stages and the landscape is still undecided.

From the above, we can see that automotive and industrial products have longer product lifecycle iterations, involving more issues, along with a series of software product challenges. To do well across the entire lifecycle is quite long; whereas in consumer applications and the Internet of Things, there will be significant changes in the next 3-5 years.

2

The Impact of ECU Integration on MCUs

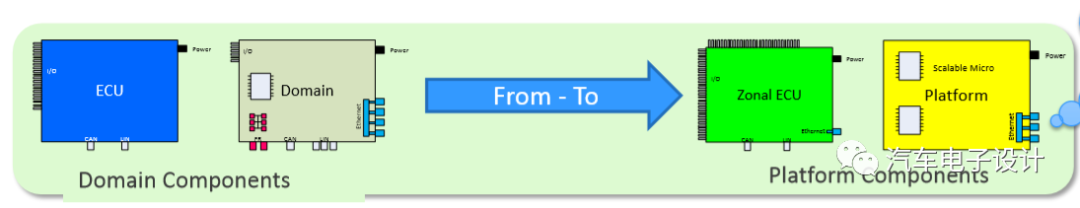

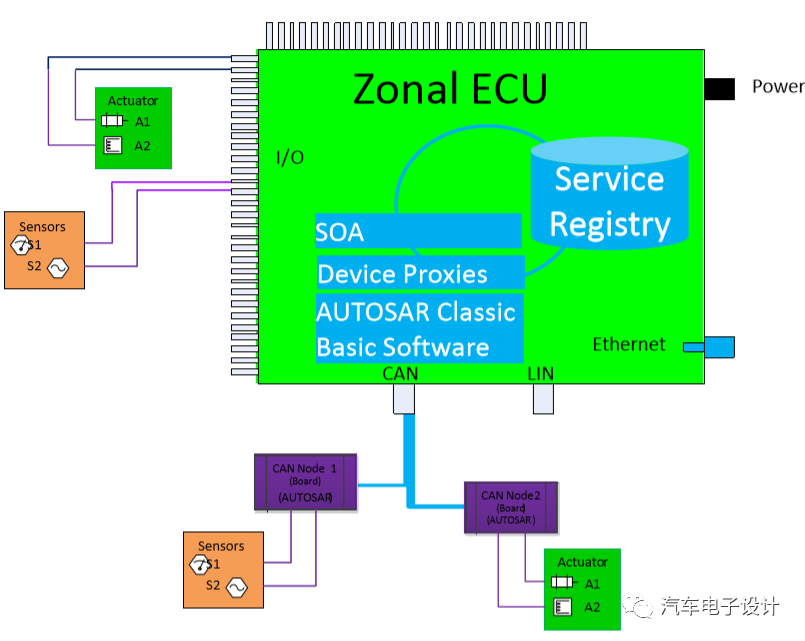

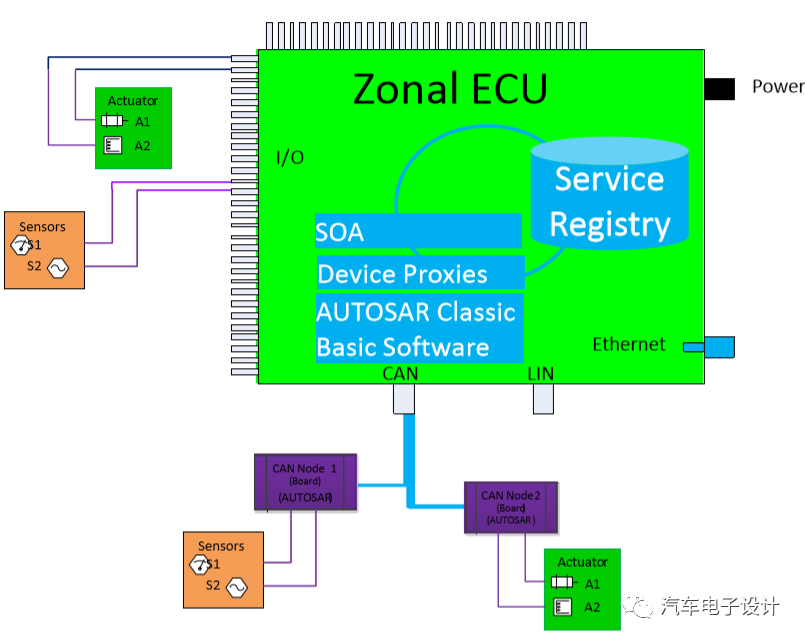

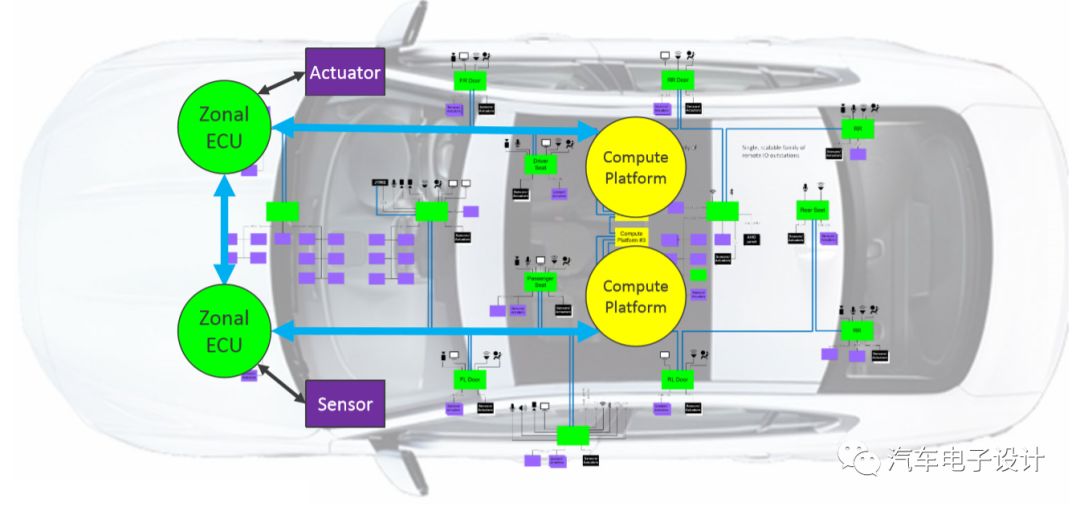

We previously discussed the Zone architecture. Under the Zone architecture, the functions of ECUs are largely dispersed and absorbed. In the article “Automotive Plug and Play from Theory to Implementation,” the characteristics of Zone ECUs are discussed.

Zone ECUs will absorb all input and output interfaces in the physical layout area of the vehicle, regardless of the type of function, using a safe and reliable high-speed network connection to ensure data validity.

Any I/O interface can be accessed through ‘virtualization’, where the physical location is abstracted into services.

Type 1 Zone ECU

A more generalized Zone ECU, using standardized software modules, is compatible with existing ECU networks and acts as a forwarding device for these ECUs, abstracting these functions at the service level.

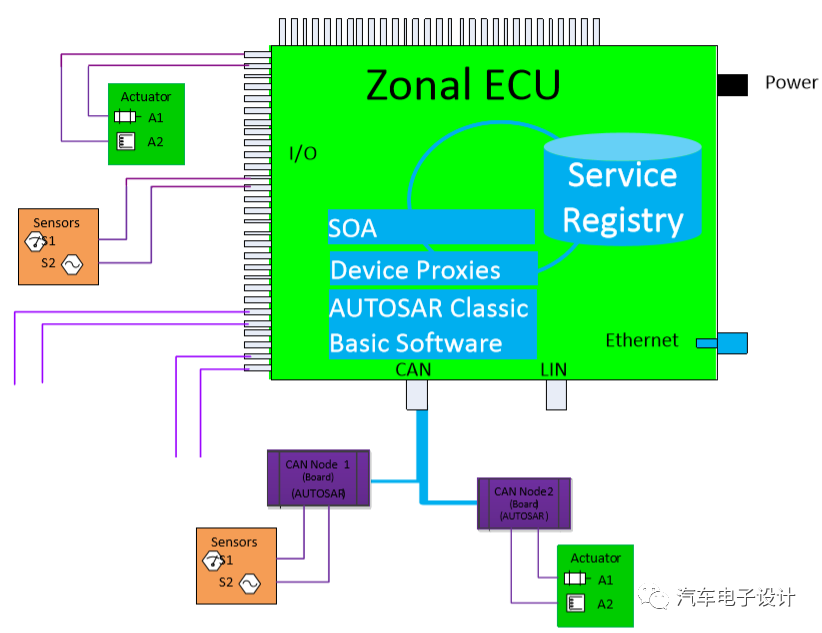

Type 2 Zone ECU

The Zonal Module integrates functions of other ECUs, primarily aimed at enhancing the capabilities of Zone ECUs and reducing the number of ECUs. From a structural perspective, this makes the hardware architecture more complex, and adding new functions becomes more challenging.

In the long term, the design on the computing platform will integrate ultra-high-performance servers, and Zone ECUs will resemble the integrated controllers like the Model 3 we discussed on Monday, consolidating nearby functions and abstracting relevant functionalities to be controlled by the central system, massively virtualizing control I/O. Eventually, the overall number of MCUs will transform into ASICs with computing cores embedded into Smart Sensor cores and Smart Actuators, simplifying the situation.

Summary: In the process of software development, a large amount of Autosar software originally based on different ECUs will be retained and centralized into Zone ECUs, requiring higher-performance MCUs. The computing units will no longer be the original MCUs; they will turn into a safety unit. Overall, this will likely reshape the entire automotive MCU market.