My stock trading is solely for profit, not for the sake of being right or wrong. 1. Trading Review On Monday, I exited Wanji Technology after a price surge and also exited Wuzhou Xinchun at a high position, while I started following Keli Sensor. The logic was based on Friday’s arbitrage with laser radar, hence I chose Wanji Technology, a well-recognized elastic stock, but it didn’t perform as expected that day; instead, it was this Monday that it surged, leading me to exit. Such arbitrage trades shouldn’t be overly complicated; it’s common to exit with small profits or losses, and only when the trade works out well does it become a focus. When I followed Wuzhou Xinchun last Friday, I explained that this kind of turnover might have a chance to catch stocks that are accelerating in the same position, and ultimately, the thought was validated. The four brothers of resonance almost all hit the limit down yesterday, with only Wuzhou Xinchun opening flat and surging to the limit, and later repeatedly breaking the limit, so I simply exited. At that moment, the intraday didn’t look bad, and the support was still decent, so if I had relied solely on intraday analysis, I might have missed out on some gains when it dropped in the afternoon. The reason I didn’t get too caught up in intraday support and exited was that from the perspective of the sector, the strongest stock in the single wave of consecutive limits was Tailor Shares, while the industrial construction below had stronger intraday performance (though it later broke the limit, that was the situation at the time). Therefore, Wuzhou Xinchun had neither an advantageous position nor strength, so I decided to cash out.

As the market continued to diverge, Keli Sensor, being the core of the strong trend in robotics, naturally provided opportunities for switching. Firstly, it has the logic of Huawei’s robotics, catalyzed by Huawei’s weekend investment news in robotics, and it has a strong K-line trend while starting to turn into consecutive limits. The end of a trend is consecutive limits, and the end of consecutive limits is acceleration~ Ultimately, this thought was also validated. On Tuesday, I continued to pay attention to Keli Sensor (exiting Zhongjian Technology and Fanhe Daye Shares). I focused on Yongtai Energy and Kunlun Wanwei. The logic here is carefully sorted from the sector perspective: consumption and finance are emphasized directions in the meeting; basically, there was no expectation difference that day, which was beneficial for holders. At this point, trying to jump in for a quick profit would be difficult, so it’s better to just wish them well from the sidelines. The main core of the topic is still robotics, and Keli Sensor has already established itself as the core of the strong trend, while another trending stock, Zhongjian Technology, which began rolling last week, can be exited at a high position (not that I don’t have confidence, but I prefer not to share supermarket stocks; it’s meaningless to say several stocks are up while one is down). In addition, Fanhe Daye Shares is expected to follow the trend of Shandong Mining Machinery, and the logic of Daye Shares is more authentic, but unfortunately, it was volatile during the day. The logic of Yongtai Technology is low price + shareholding in insurance; in a bull market, low-priced stocks can also be turned into low-cost trades because historically, most low-priced stocks will eventually soar in bull markets. Although history won’t repeat itself simply, there are always traces to follow, and Yongtai Energy’s shareholding in insurance, which is a relatively active direction in the recent financial sector, can also be seen as a new approach. Such stocks have an advantage in low-cost purchases at the opening, and even if they ultimately open high and fall, the losses won’t be too significant (which was indeed the case after the market closed). Kunlun Wanwei is positioned for AI; I have already made enough layouts for robotics, and if the “little robot” AI strengthens in the morning, it won’t be left behind. After a low-cost purchase, it indeed surged, but unfortunately, the index continued to rise while the individual stocks fell back. On Wednesday, I exited all stocks but retained some focus on Keli Sensor (reducing attention at high points). The trading intention for Tuesday’s layout was based on opening high and moving up; that day, a younger brother gathered some data: in recent years, I have had favorable openings several times, and ultimately, many of those high openings fell back… but each time I hope it will be different, only to end up disappointed. Just consider it a romantic investment. However, before the robotics sector is done, Keli Sensor, as the core of trend capacity, still needs to be tracked, so after the surge, I merely reduced my attention rather than completely liquidating. On Thursday, I re-focused on Keli Sensor and newly followed Vision China. The logic became clear after Wednesday’s close: three major sectors (consumption, AI, robotics) + potential finance. The only flaw in consumption yesterday was that while consumption strengthened on Wednesday, Yonghui Supermarket didn’t hit the limit up, so for the next day, I planned not to let consumption drag down sentiment and just stabilize it. After reviewing Wednesday evening, I realized that during the day, Yonghui Supermarket had a focus point; when consumption strengthened on Wednesday, Yonghui Supermarket was still oscillating around the zero axis or slightly above, which had good value. Therefore, I regretted not laying out Yonghui Supermarket today, while the capacity in the AI direction mainly focused on Shengguang Group and Vision China. Are you familiar with the graphics of Vision China? Recently, the popular large bearish line breaking and rebounding have had successes like Liou Shares, Rishang Group, or Wenfeng Shares. The graphic of Shengguang Group is also good, with horizontal consolidation and breakthrough. So, I observed both in parallel, and ultimately, when the divergence occurred, I followed Vision China, which returned to the limit more actively.

Keli Sensor has confirmed its trend capacity in robotics and is rolling repeatedly.

Currently, several major sectors are rotating, so if we use the capacity spread method, it should be Yonghui Supermarket in consumption, Vision China in AI, and Keli Sensor in robotics (the giant wheel can also be considered). I recommend everyone to seriously think and summarize this capacity trend technique. 2. Market Analysis 2.1 Index Today, the index continued to rise, which is a good signal because if it continues to fall, it means that funds do not recognize this breakthrough and need to find support below, which will take more time and easily suppress sentiment, making everyone more uncomfortable. Therefore, an accelerated upward attack is a positive signal! Of course, in the short term, it is still fragmented, with hundreds of stocks hitting the limit up every day, but the limit down of eliminated stocks also makes holders very painful (especially when watching others hit the limit up). Additionally, it should be noted that the K-line patterns mentioned above are also due to the recent dominance of quantitative funds, while traditional funds can only be cautious in this market, joining in to high sell and low buy when they can’t compete.

2.2 Sector and Stock Weight In terms of topics, consumption and finance are the main focuses; finance surged during the lunch break, guiding the index, while consumption, after a downturn in the morning, took over the momentum of finance and continued to rise, ultimately leading to a breakthrough new high for the consumption sector index. AI and robotics each had their own differentiation; robotics had stronger differentiation but still had some active stocks, while AI’s Doubao concept fermented but ultimately left the funds that rushed to the opening with a full belly of Doubao, although there were still some stocks steadily hitting the limit up. Therefore, these two sectors have not yet completed their moves, and I will continue to watch them tomorrow. Robotics: A sector that emerged from the resonance index, overall still not smooth, with the sector index still above the 5-day line; Keli Sensor: Sensor + Huawei Robotics, a low-position core transitioning to consecutive limits. Construction Industry: Accelerating rebound; after topping for a day today, the sector weakened, leading to funds rushing to exit at the end of the day. Wuzhou Xinchun: More proactive during the day, switching to Wuzhou today after the strong performance of Jilun Intelligent yesterday; Jilun Intelligent: Actively adjusted after the opening and repaired, but the active participation was not as good as Wuzhou Xinchun. AI: The Doubao concept has fermented, but the opening was somewhat below expectations, with the front row still acceptable; Tianyu Shuke: AI + Robotics, once a core, was smashed after trying to rebound today; Jincai Hulian: Also aimed at a rebound but likely because of the added financial factor and a thorough adjustment yesterday. Sanwei Communication: The strongest in Doubao, three consecutive limits; Yue Media: Doubao, turnover three consecutive limits; Vision China and Shengguang Group: Capacity trend stocks, with Shengguang’s volume being a bit excessive. Consumption: The meeting’s expectations have landed, and today’s sustained strengthening in the afternoon was somewhat beyond expectations, benefiting the overall trend; Yiming Food: Limit down, looking ahead to whether it will be an A kill or oscillation; Zhongbai Group: Four consecutive limits, accelerating, currently the space in consumption. Huifa Food: Food branch space, accelerating. Yonghui Supermarket: Capacity recognition, the main battlefield for large funds, its belated limit up still stabilizes the market. 2.3 Future Market Currently, consumption and finance have already made their statements, stabilizing overall sentiment, so I remain optimistic about the future market. Consumption is likely to have a strong upward trend tomorrow, and the difficulty of entering at the opening will be high; it will depend on personal judgment. AI and robotics still have rotation expectations, but moving forward, it will be more about how to respond to holdings. For example, if a sector ultimately breaks below the 5-day line or the core stock breaks below the 5-day line, it will need to wait and observe. If it continues to strengthen, we can keep an eye on it. Another reserved program for Friday is that if there are new topics fermenting, we need to pay more attention, as who knows what might happen over the weekend? 3. Unscheduled Insights I still believe that technical matters should be set aside for now because everyone needs to repeatedly reinforce the system of “overall trend → sector → individual stocks” as the foundation (okay, I’ll work on other details of support levels over the weekend, don’t call me lazy). Today, a sister mentioned that if we directly analyze individual stocks, it can easily become ambiguous. The same patterns or models may yield different results. Firstly, we must be clear that no model is 100% reliable, so different outcomes are inevitable. However, considering the complete system will increase the success rate of the same pattern. This is not simply about “good market increases success rate”; it is more because individual stock price movements are influenced by many factors, such as the overall trend, the sector it belongs to, and the operating funds, etc. Sometimes a large sell order is not necessarily driven by the main force; it could just be a large holder participating in the market feeling unhappy or wanting to hedge against losses in other stocks. In short, intraday fluctuations have a lot of randomness and are unavoidable.

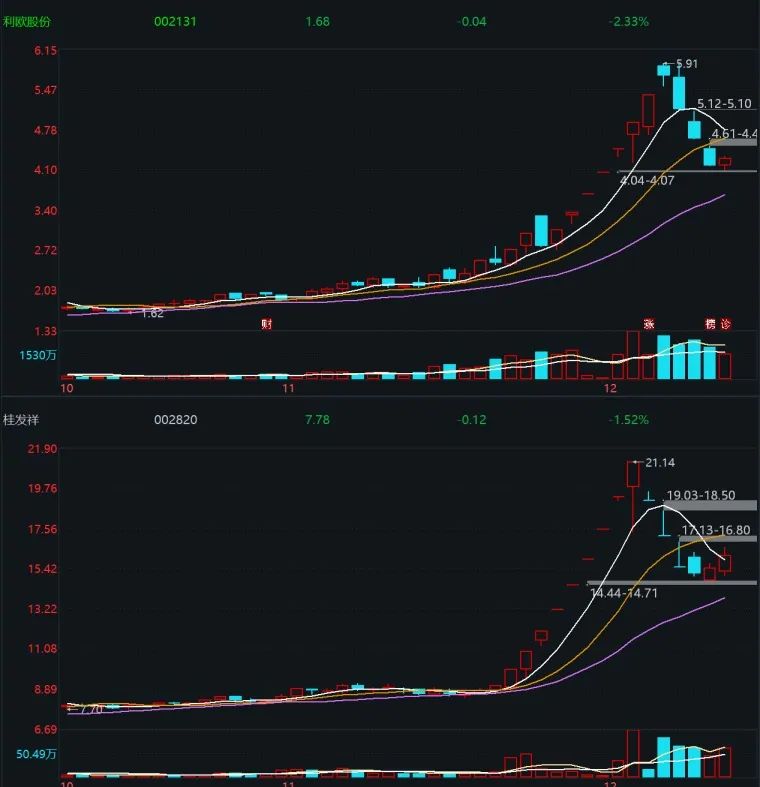

Similarly, regarding the rebound, after a high-point adjustment of 30 points for high-recognition stocks, the strength of today’s rebound varies significantly. Under the premise of the index easing today, Liou Shares only rebounded by three or four points, while Guifaxiang rebounded as much as seven points at one time. Guifaxiang actually has weaker recognition than Liou Shares, but it managed to achieve a stronger increase mainly because Liou Shares’ AI did not rise significantly today, while Guifaxiang’s consumption sector was very proactive in the afternoon.

Therefore, the major trend of sectors is like the “east wind” in the Battle of Chibi; especially for short-term small funds, it is all about borrowing strength and following trends. Analyzing individual stocks in isolation can easily lead to losing one’s way.