|

|

|

|

|

|

|

|

|

|

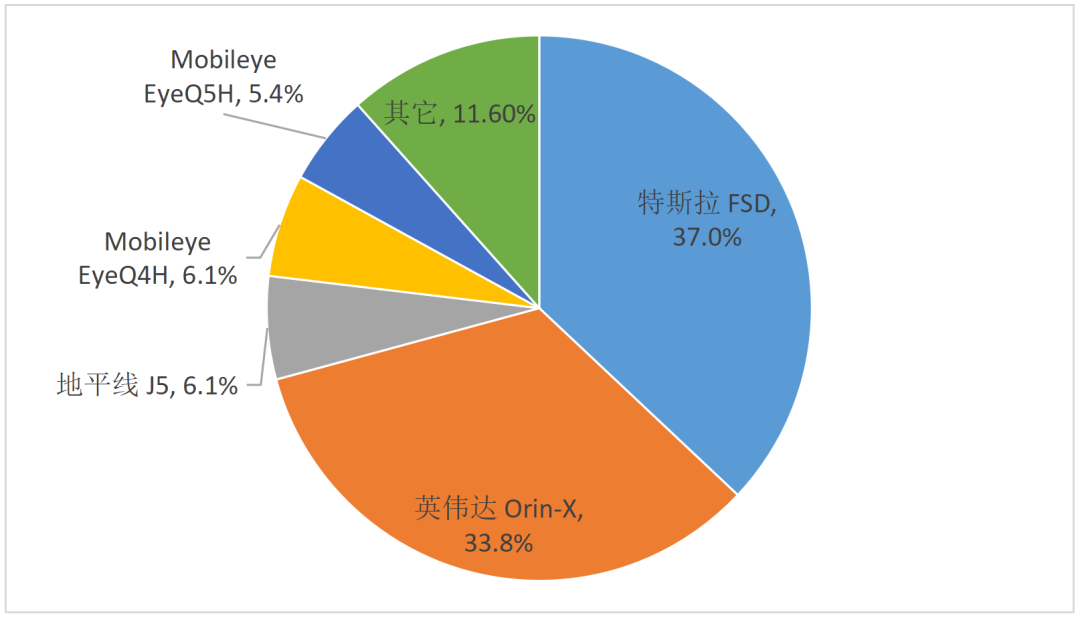

Equipped models include NIO ET5/ET7, Li Auto L7/L8/L9 Max version, Xiaopeng G6/G9/X9/P7i, Zhi Ji LS7, Xiaomi SU7 Pilot Max version, etc.

|

|

|

|

|

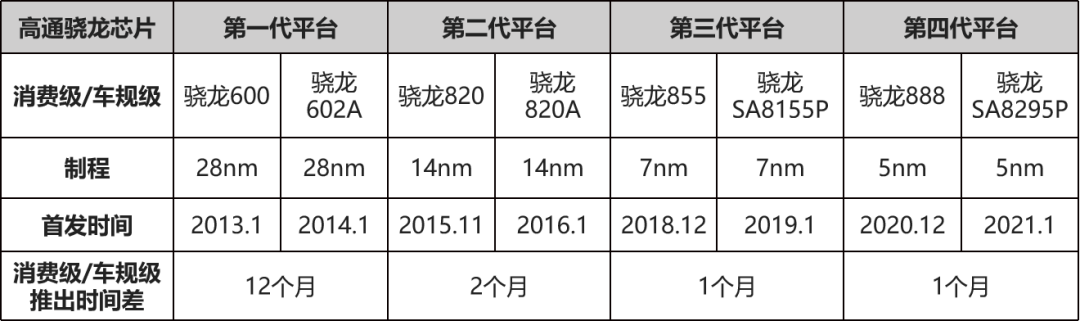

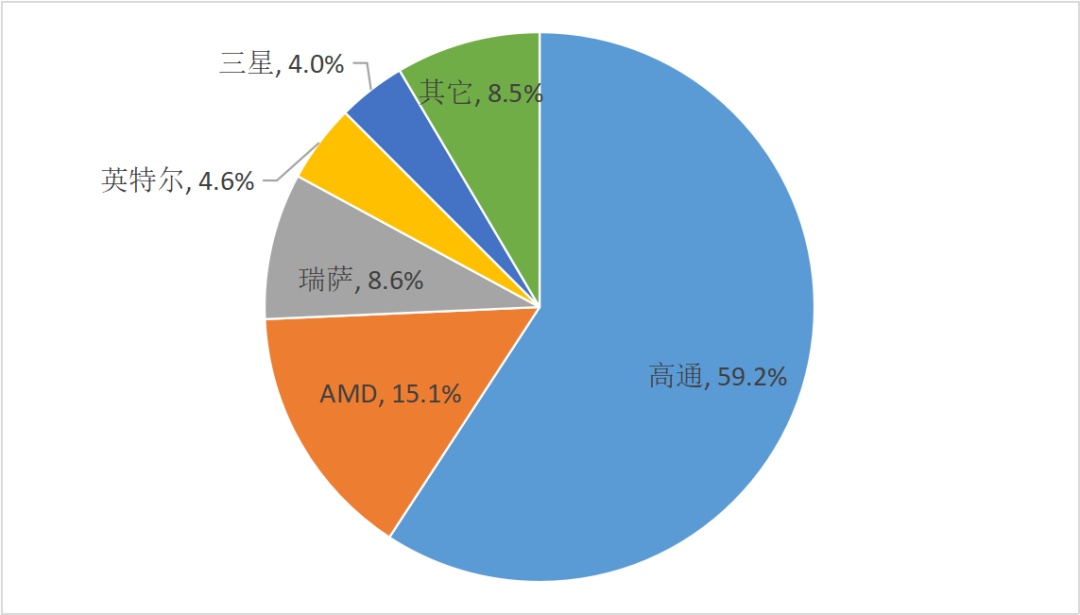

Mainly focuses on cockpit integration, announced plans for equipped vehicle manufacturers including Zeekr, Xiaopeng, Li Auto, BYD, and GAC Aion, etc.

|

|

|

|

|

|

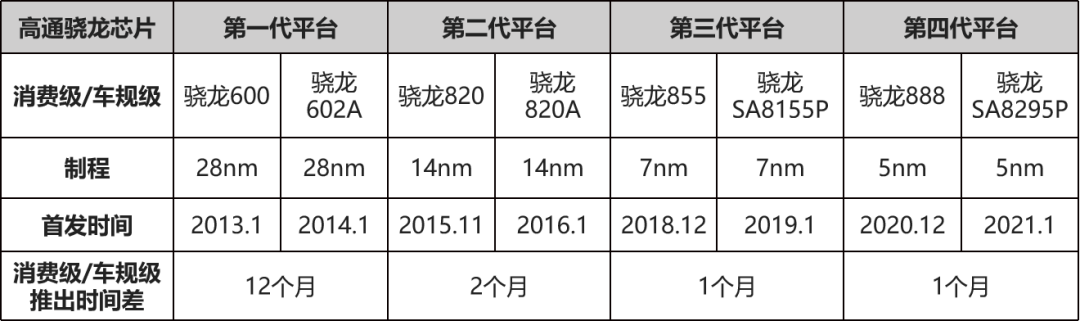

Second-generation chip of Qualcomm Ride platform, currently, Bosch, Continental, Veoneer, Valeo, Desay SV, and Junlian Zhixing are all designing and developing based on this chip; mass production is expected to be achieved in 2024.

|

|

|

|

|

First product of Qualcomm Ride Flex platform, focuses on cockpit integration, expected to achieve mass production delivery by the end of 2024.

|

|

|

|

|

Expected mass production delivery in 2025.

|

|

|

|

|

|

Launched in 2023, mainly targeting L3, L4 level passenger car autonomous driving and L4 level autonomous driving trucks.

|

|

|

|

|

Launched in January 2024, mainly targeting urban NOA scenarios.

|

|

|

|

|

Launched in January 2024, mainly targeting high-speed NOA scenarios.

|

|

|

|

|

Huawei’s MDC610 platform based on a single Ascend 610 chip and MDC810 platform based on two Ascend 610 chips, equipped models include Aito M5/M7/M9, Avita 11/12, Nezha S 715 laser radar version, GAC Aion LX Plus, Arcfox Alpha S Hi version, Zhi Jie S7, etc.

|

|

|

|

|

Already equipped on Li Auto L9/L8/L7 Air and Pro versions, BYD Han EV Honor version, and has obtained mass production cooperation with dozens of models from nine vehicle manufacturers.

|

|

|

|

|

First batch of mass production models expected to be delivered in the fourth quarter of 2024.

|

|

|

|

|

Currently in collaboration with customers for development.

|