(Source: Yole)

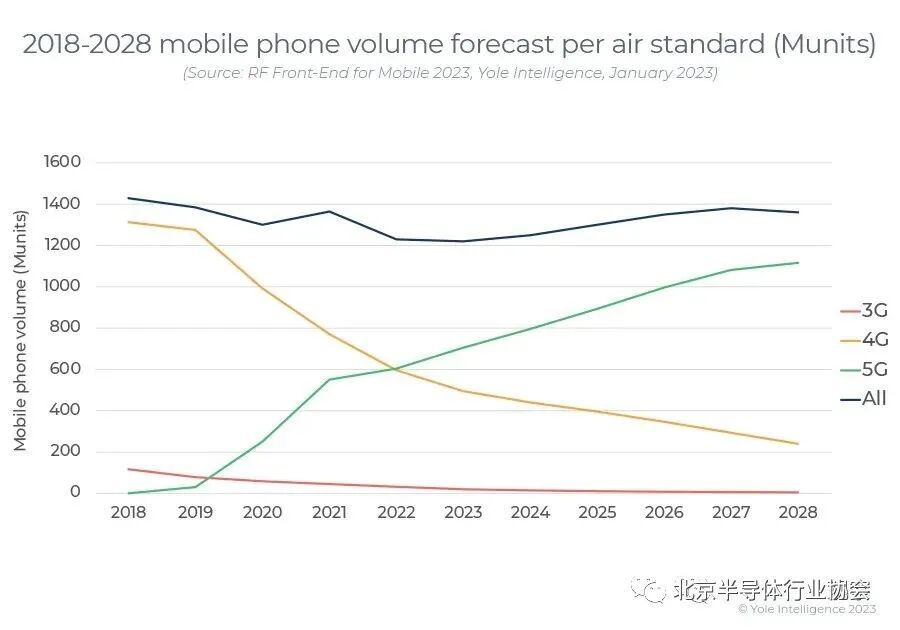

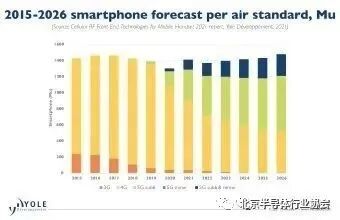

The mobile phone market rebounded in 2021 following the decline caused by the Covid-19 pandemic in 2020. However, due to chip supply shortages, it has not yet reached pre-Covid-19 levels. In 2022, the global macroeconomic downturn and geopolitical tensions such as the Russia-Ukraine war led to a sluggish market and high inflation, severely impacting the smartphone industry. This downturn caused consumers to hesitate in purchasing new phones, prompting original equipment manufacturers (OEMs) to enter a phase of inventory adjustment. Additionally, China’s zero-Covid policy further destabilized the smartphone manufacturing industry.

Despite these challenging conditions, the production of 5G phones in 2022 reached levels comparable to that of 4G phones, although the growth rate was significantly lower than industry expectations. The hype surrounding 5G has dissipated; however, as OEMs and mobile network operators (MNOs) further promote the deployment of this technology, we expect the smartphone market to penetrate further.

The RF Front-End Industry Faces Difficult Times

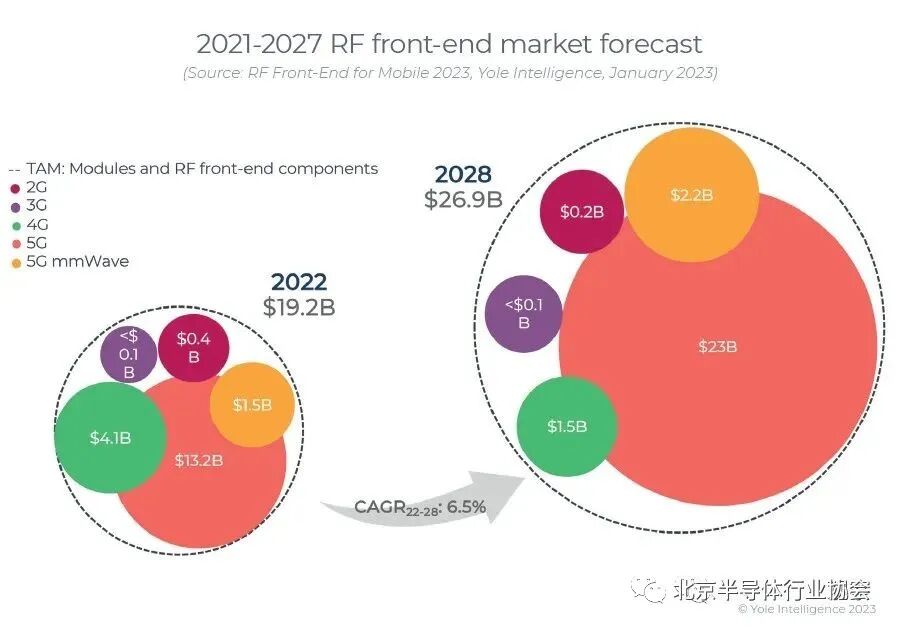

Due to the post-Covid-19 recovery and the proliferation of 5G, the RF front-end market surged to over $19 billion in 2021. However, due to the lower-than-expected adoption rate of 5G, the smartphone market declined, resulting in a flat close for the fiscal year 2022. Consequently, the growth engine for the bill of materials has been operating at a low speed. It is projected that by 2028, the moderate growth of smartphones and the limited potential for 5G adoption will result in a compound annual growth rate (CAGR) for the RF front-end market in the low single digits, reaching $26.9 billion by 2028. At the same time, there are significant market opportunities, as new features of 5G technology will continuously drive innovation in RF front-end technology. Progress is being made in the medium to long term, and investments are being made to prepare for the next wave of growth.

The Competition in the RF Front-End Ecosystem is Intensifying

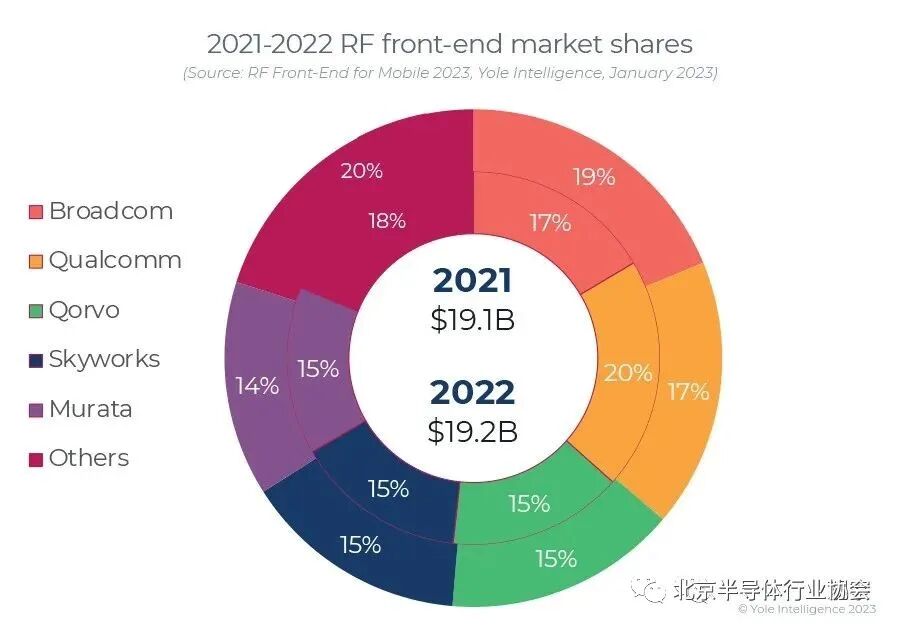

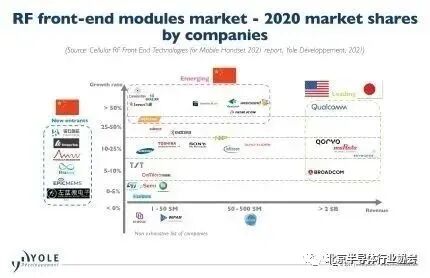

In 2021, Qualcomm led the market with its end-to-end approach, followed by Broadcom’s custom PA module products. Skyworks and Qorvo have similar company profiles, with a wide range of RF product portfolios serving all market segments, although Skyworks is more susceptible to the intensifying competition from China. Murata’s revenue is low due to increasing competition for its filters, and it is restructuring its module product portfolio. In 2022, traditional companies were impacted by the deteriorating macroeconomic environment. Revenue for companies in the RFFE-related fields, except for Broadcom, declined.

Meanwhile, the Chinese RF front-end ecosystem is rapidly growing, with fabless emerging companies capturing a significant share of the domestic market. Maxscend, Vanchip, and Smarter Micro are the most relevant examples, although Maxscend has recently invested in upgrading to a fablite business model. Additionally, there is a long list of ambitious companies that have gained financial capital through public offerings on the Science and Technology Innovation Board. However, not all initiatives will succeed, and we expect consolidation to occur in the medium term.

In summary, Chinese RF front-end manufacturers have a limited market share, as OEMs still rely on high-quality products from leading manufacturers, but the largest companies in China are catching up to the leaders.

Yole: Rapid Rise of Chinese RF Manufacturers

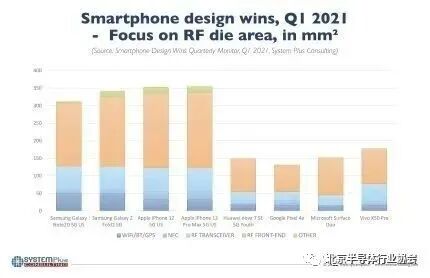

According to data from Yole, as we enter the 5G era, the demand for RF is rapidly surging, and Chinese companies are rising quickly in this process. Yole Développement (Yole) points out that 5G is driving an unprecedented increase in the content of RF devices, as we must support previous radio standards. Therefore, we need to install hundreds of RF components in handheld devices. This demand is not only seen in flagship phones but has also exploded in mid-range and entry-level phones.

Furthermore, the advancement of millimeter waves will bring new growth momentum. Yole continues to point out that at the RF front-end level, 5G phones are relatively more complex than 4G phones. To this end, Yole’s RF team estimates that the RF content in 5G phones is $5 to $8 higher than in 4G versions, while millimeter wave versions add an additional $10. Therefore, the RF front-end market is thriving. Yole stated in its report that by the end of 2021, the entire RF front-end market should reach $17 billion, up from $14 billion in the 2020 calendar year. However, since then, the growth of the RF front-end market is expected to slow down. As 5G becomes mainstream and competition intensifies, the erosion of average selling prices (ASP) will become more pronounced.

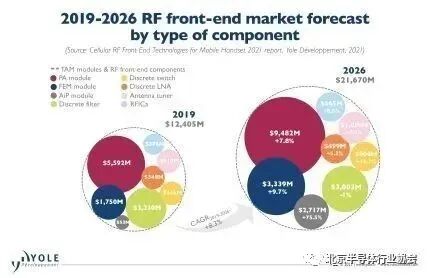

Analysts expect that between 2019 (the year 5G was launched) and 2026, the RF industry will have a CAGR of 8.3%, driving the RF front-end market size to reach $21 billion by 2026.

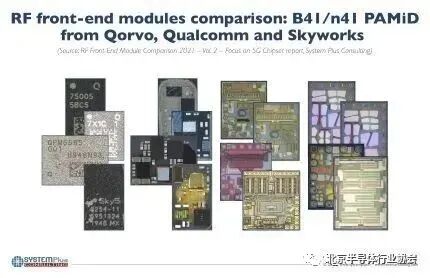

The report emphasizes that the introduction of 5G has increased the complexity of both mobile phones and RF content. Building 5G phones using discrete components while maintaining acceptable form factors is a challenge that requires more integration.

“Leaders in the RF front-end market have flexible module products that adapt to various market demands. In addition, some have customized modules for flagship products,” Yole stated. They further pointed out that several manufacturers, including Skyworks, Murata, Qualcomm, Qorvo, and Broadcom, account for 85% of the RF front-end market share, with Qualcomm experiencing the strongest growth.

It is reported that at the end of 2019, Qualcomm’s market share was lower than that of other suppliers. This change occurred in 2020 among OEM manufacturers such as Samsung. This caused Qualcomm’s share to nearly double at the beginning of the year. However, with the release of the iPhone, the situation changed at the end of 2019, as the iPhone series did not integrate many of Qualcomm’s components in its design. Apple’s goal is also to completely avoid using Qualcomm in the future.

The report shows that various companies from China are emerging and achieving double-digit growth in the RF front-end field. Most of these companies initially engaged in discrete businesses with independent LNAs or switches, allowing them to accumulate expertise and build trust with OEMs. The next step for these Chinese fabless companies is to bring integrated modules to market. This has gained more investment support in China over the past two years. Yole states that not all Chinese RF companies will succeed, but we can expect more collaborations and consolidations in the coming years.

According to Yole, a major difficulty in achieving success will be obtaining wafer capacity. RF components themselves are not in short supply; rather, it is a scarcity within the industry. This drives long-term supply agreements that only large companies can afford.

Wi-Fi and Bluetooth Gain Momentum, Bright Future for RF Front-End

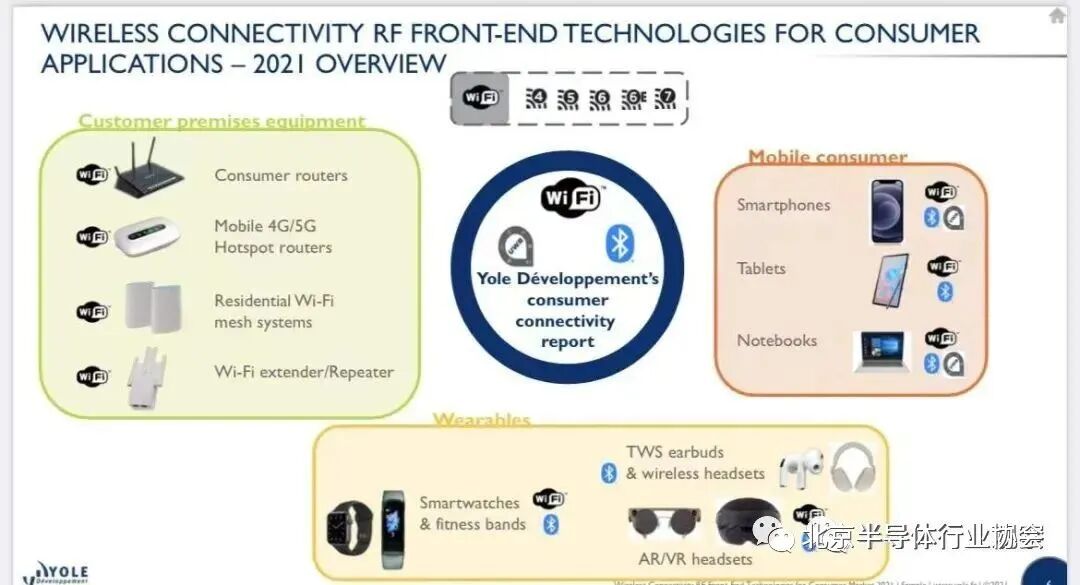

“While everyone’s attention is focused on 5G, other connectivity standards such as Wi-Fi, Bluetooth, and ultra-wideband are also continuously evolving,” asserted Dr. Mohammed Tmimi, a technology and market analyst in Yole’s RF Devices and Technologies department.

He added, “One thing we learned during the repeated COVID-19 lockdowns is that broadband internet is essential for survival, as observed data traffic peaked due to streaming and video calls.”

This is due to the increased data consumption per device and the growing number of devices connected per user. Wireless standards that provide mobile freedom (such as Wi-Fi, Bluetooth, and ultra-wideband technology) significantly enhance this growth. Although the evolution of Wi-Fi is not as prominent as that of cellular standards, Wi-Fi is as important as 5G in the acceleration of digital transformation.

In addition, they also pointed out that consumer devices such as routers and mesh systems will benefit from the latest innovations. According to Malaquin, a senior technology market analyst in Yole’s Power and Wireless division, “Consumer mesh systems are expected to penetrate the market faster, growing from 15 million units shipped in 2021 to 56 million units by 2026. At the same time, the number of consumer routers will remain stable year-on-year, but the RF BoM will further increase with the higher penetration of 4×4 MIMO, Wi-Fi 6E, and future Wi-Fi 7 6GHz bands.” However, Wi-Fi is not the only standard seeing significant developments.

The Bluetooth standard is also being optimized for specific use cases; for example, low-energy Bluetooth audio (BLE Audio) is becoming crucial for serving the truly wireless stereo headphone market. The new BLE audio provides a new high-quality codec (LC3 codec) that offers a good trade-off between power consumption and audio quality; this is achieved through multi-stream functionality that can simultaneously transmit to multiple audio receiver devices. This new feature emerges at a critical time in the hearable device market, with sales of TWS earbuds and wireless headphones expected to more than double, from 387 million units shipped in 2021 to over 900 million units annually by 2026, with Apple leading this market.

With its highly accurate positioning and location capabilities, ultra-wideband technology has also benefited from the COVID-19 situation. As it gains traction in the consumer market for contract tracing, non-contact access control use cases (such as touchless door opening) are expanding. This technology, initiated by Apple and subsequently expanded by companies like Samsung and Xiaomi, is also being introduced into the automotive industry by companies like BMW and Volkswagen. It could ultimately replace keys.

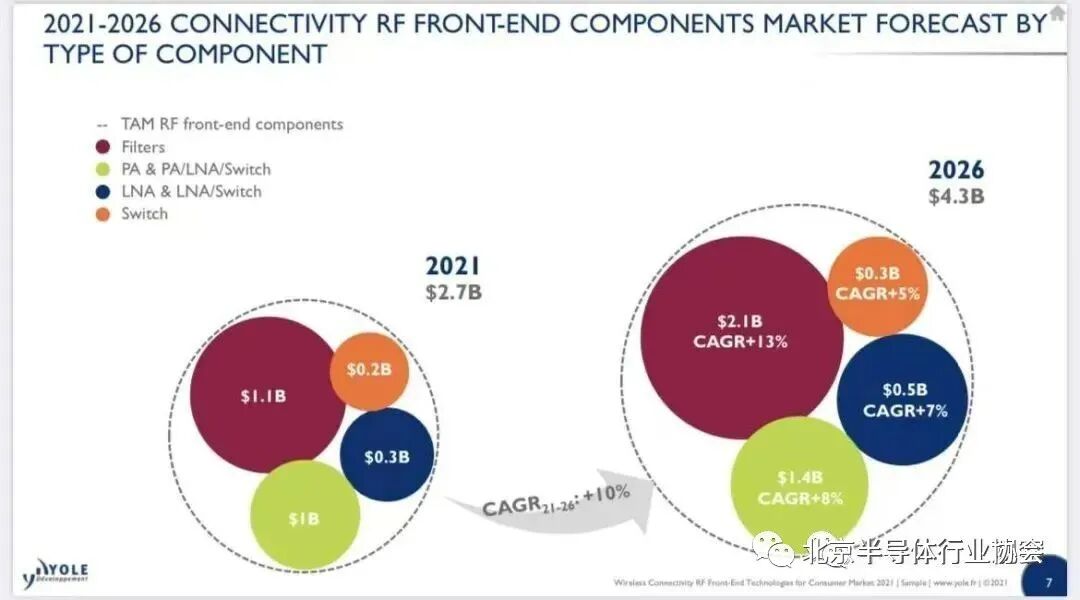

To this end, Yole states that by 2026, the global RFFE market size will reach $4.3 billion, with a CAGR of 10% from 2021 to 2026.

Portable Consumer: RFFE devices for smartphone, tablet, and laptop connectivity are expected to exceed $2 billion in market valuation in 2021.

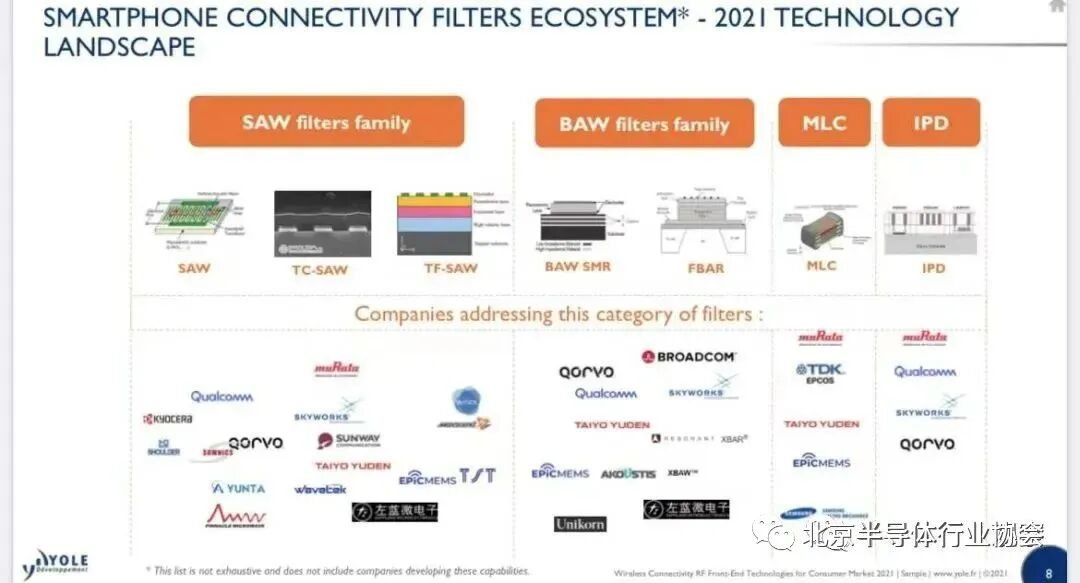

According to Yole, two factors will lead to significant growth in the analyzed connectivity RFFE device market. The first is the increase in the number of specific devices, such as wearable devices embedded with 2.4GHz SAW filters, and the second is the addition of new RF chains for 2×2 and 4×4 MIMO devices, as well as RF chains for the 6GHz band. The number of 6GHz chains will vary by device, while four 6GHz RF chains are becoming increasingly popular in the backhaul of mesh Wi-Fi devices.

Yole’s analysts estimate that the RFFE market for their analyzed products will grow from $2.7 billion in 2021 to $4.3 billion in 2026, with a CAGR of 10% from 2021 to 2026, excluding the market value of chipsets. Among these, smartphones, tablets, and laptops account for the majority share.

Yole’s RF team estimates that Wi-Fi/BT/UWB will account for a $2 billion RFFE market in 2021, and by 2026, this connectivity RFFE market will grow to $3 billion, with a CAGR of 8.4% from 2021 to 2026, driven by the rapid implementation of UWB, Wi-Fi 6E, and 2×2 MIMO in smartphones, which will translate into a higher connectivity RF BoM.

From a technical perspective, Yole states that to enhance the performance of 2×2 MIMO uplink and tri-band operation (2.4, 5, 6 GHz), PAs will drive more capacity and value in the connectivity market. The market for switches and LNA components will also be driven by 2×2 MIMO operation and dual-band operation. The emergence of single-chip PA/LNA/switch platforms will make this architecture more attractive to the smartphone and tablet markets.