AuthorGuilin Zhong (WeChat ID: great_basketball) Editor of “Smart Product Circle”

Undoubtedly, driven by the Internet of Things (IoT) and the interconnection of all things, the embedded WiFi chip market has become the “explosion point,” with total shipments expected to reach 100 million units in 2016 (For more information on embedded WiFi chips, please read “The Chip Companies and Core Technologies Behind Millions of WiFi Modules”). Faced with such a huge “temptation,” both domestic and foreign WiFi chip companies are naturally full of energy, ready to make a big push. What they didn’t expect is that before WiFi chip companies could harvest, the brutal price competition had already arrived.

The IoT WiFi market is just starting to grow, and the price war has already begun

In fact, during the global economic downturn, many companies are trying to transform and break through the existing pattern, and the explosion of the emerging IoT market has shown everyone a new path, naturally attracting a large number of companies to follow suit. Therefore, under the agitation of Qualcomm, TI, Espressif, MTK, and other domestic and foreign companies, the pattern of the IoT WiFi market can be described as turbulent.

2014 was a key turning point for the IoT WiFi market, where traditional WiFi external MCU solutions dominated the market, mostly applied in the industrial sector, while high-cost performance WiFi SOC solutions were gradually accepted by everyone. “The price of traditional WiFi solutions exceeds 40 yuan, which is not suitable for the cost-sensitive consumer market. At the beginning of 2014, Qualcomm launched the WiFi SOC chip Atheros4004, and TI launched the 3200, both priced around $3, instantly pulling the price of WiFi solutions to around 30 yuan.” said Zhao Tongyang, General Manager of Anxinke.

Meanwhile, domestic chip companies naturally would not miss this great opportunity, successfully entering the market and causing ripples in the previously calm “lake surface.” “In mid-2014, MTK launched a more cost-effective chip MT7681, priced at only $1.8, leading to a further drop in solution prices to around 20 yuan. Subsequently, Espressif joined the fray, launching the lower-priced EST8266, with a chip price of $1.2, bringing the solution price down to around 10 yuan.” Zhao Tongyang continued to tell reporters from “Smart Product Circle.”

In early 2016, the chaos further escalated, with Southern Silicon Valley, New Axis, Realtek, and Lian Shengde successively launching WiFi SOC chips, all of which had competitive performance and pricing. It is foreseeable that in the second half of the year, the price of WiFi SOC chips may drop to $0.6, while the price of modules will also fall to around 6 yuan. For system application companies, this is undoubtedly the best news.

The 6 yuan WiFi module has integrated processors, and MCU companies are caught in the crossfire

While WiFi chip companies are busy fighting, MCU companies have already fallen victim to the chaos. This is because in the process of upgrading traditional hardware, WiFi is a good choice, and embedded WiFi chips also integrate MCU processors, so for cost reasons, the independent MCU in the original solution will gradually be replaced. On the other hand, the IoT market’s demand for traditional product networking will only increase, while the value of processors will gradually decline. Therefore, looking back now, Qualcomm’s acquisition of CSR, Avago’s acquisition of Broadcom, and Microchip’s acquisition of Microsemi are not difficult to understand.

“Smart appliances almost all use wireless WiFi networking. However, replacing the MCU in the original appliance solutions is not as simple as imagined. First, solution providers must develop the embedded WiFi system very comprehensively, with stable and reliable performance, so that subsequent development manufacturers can use embedded WiFi chips as MCUs; secondly, solution providers need to offer more comprehensive services, as developing applications based on the WiFi system increases the probability of issues arising, and it is relatively difficult to resolve them. Therefore, in many simple smart products, such as smart toys and smart speakers, this trend can already be seen, while more complex smart hardware will require a long time to adjust.” said Lu Haidong, R&D Director of Shenzhen Topband Co., Ltd.

Li Shuyang, Marketing Manager of Zhongying Electronics, also told reporters from “Smart Product Circle”: “In the smart appliance market, the proportion of appliances with WiFi networking functions is not high, commonly seen in smart ovens, smart air conditioners, smart rice cookers, and other products. Due to safety considerations, the appliance industry has not yet seen replacements. However, in the next three years, MCUs on control panels are likely to be replaced, while MCUs in systems like air conditioning compressor control and rice cooker heating control will not see replacements in the short to medium term.“

In fact, this situation is somewhat similar to the metaphor of “boiling a frog in warm water.” The market trend is like this pot of slowly heated “warm water,” while most MCU companies are the “frogs” sitting in the warm water. If they do not wake up in time and actively jump out of the warm water, they may be abandoned by the trend.

Integration or proactive attack, MCU companies face a transformation crisis

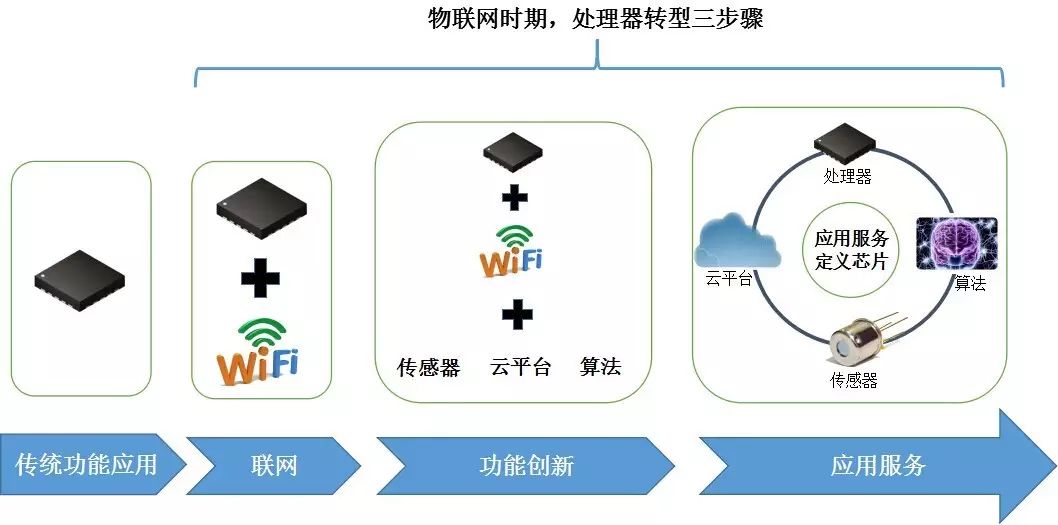

In such a passive situation, how should MCU companies layout? Li Wenjuan, Senior Analyst at Sira Media, believes: “Processor manufacturers being integrated by wireless technology manufacturers, or proactively integrating wireless technology is a common layout strategy. However, in the evolution of IoT intelligence in three steps, networking is just the first step and also the simplest requirement. After achieving networking, IoT development enters the stage of functional innovation, where traditional industry applications will join forces with the electronics industry for cross-border innovation. At this time, communications, semiconductors, and the Internet will also join the ranks of integration with traditional industries. For example, companies engaged in children’s education start crossing into robotics, and companies providing O2O services lay out smart hardware products.

Therefore, after completing the networking function, the next step for MCU is to focus on “functional innovation,” based on the application solutions and technical advantages accumulated by MCU companies over the years, cross-border integrating upstream and downstream resources in specific application ecosystems, such as software algorithms, sensors, cloud platforms, etc., forming a complete ecological turnkey solution to quickly adapt to the demands of emerging IoT niche markets, for example: ST binds MCUs with various motor algorithms to provide targeted services for different types of products and companies; Atmel collaborates with Bosch to package MCUs, sensors, and algorithms into complete solutions.

In the future, the third step of IoT intelligence will be to connect services based on mature functional application foundations. At this time, the role of ICs will become a customized carrier for services, that is, software hardening, especially the performance specifications of MCUs are closely linked to service requirements, and even the architecture of MCUs will be redefined by applications and services.

For more original articles, please click “Read the original” to enter the Smart Product Circle website!