According to Wind data, the market value of semiconductor stocks heavily held by funds in Q2 2022 accounted for about 7.1% of the total market value of the semiconductor industry, a significant decrease compared to Q4 2021, with holdings dropping to the level of Q2 2020. The third quarter is expected to welcome the traditional peak season for semiconductors.

Early-stage investment research reminds: the semiconductor market shows more of a structural trend throughout the year, rather than a comprehensive valuation uplift.

As a member of the chip design industry, let’s comprehensively sort out the core concept stocks in the semiconductor industry chain together.

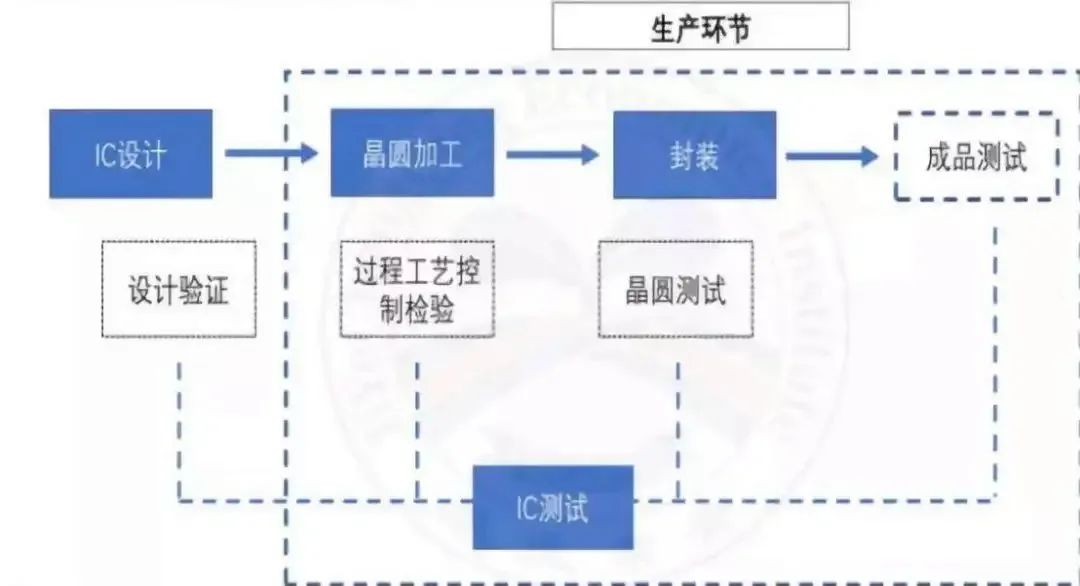

1. Introduction to the Semiconductor Integrated Circuit Industry Chain

To make it easier for everyone to understand, let’s briefly introduce the semiconductor integrated circuit industry chain.

Note: In addition to the midstream and downstream production manufacturing stages, equipment, materials, and EDA tools also belong to the upstream.

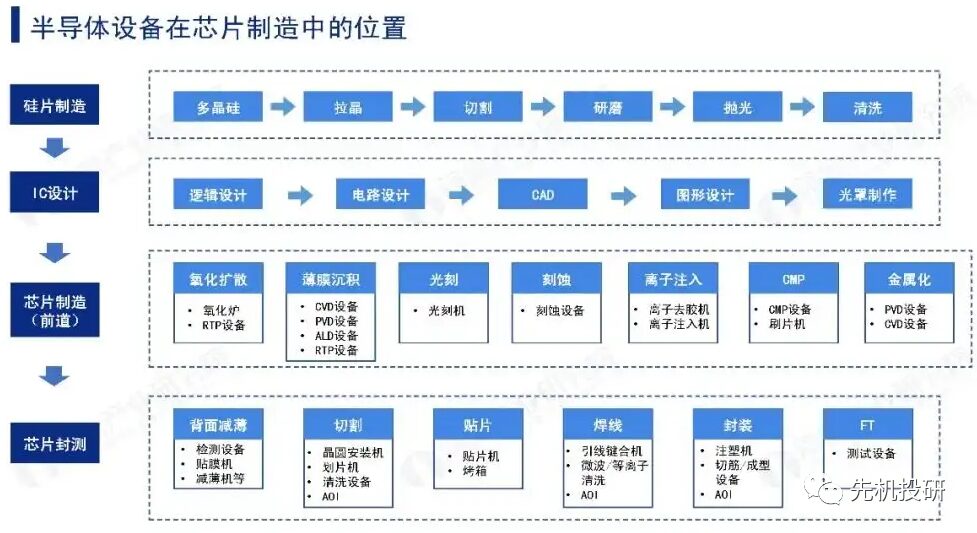

1. Crystal Equipment

Jingsheng Electromechanical 300316: Semiconductor + photovoltaic equipment, a leading domestic company in crystal growth equipment.

Main products include fully automatic single crystal growth furnaces, polysilicon casting furnaces, sapphire crystal furnaces, zone melting silicon single crystal furnaces, single crystal silicon rod cutting and grinding integrated machines, polysilicon block grinding integrated machines, silicon rod single wire cutting machines, silicon block single wire cutting machines, sapphire ingots, sapphire wafers, LED device testing and sorting equipment, automated production lines for LED lamps, etc. The company’s products are mainly used in emerging industries with good market prospects such as solar photovoltaic, integrated circuits, and LEDs.

2. Wafer Processing Equipment

North Huachuang 002371: The semiconductor equipment company with the most complete product line, providing semiconductor equipment and components including etchers, PVD, CVD, oxidation furnaces, diffusion furnaces, cleaning machines, and MFCs, covering most key process equipment in the semiconductor pre-processing.

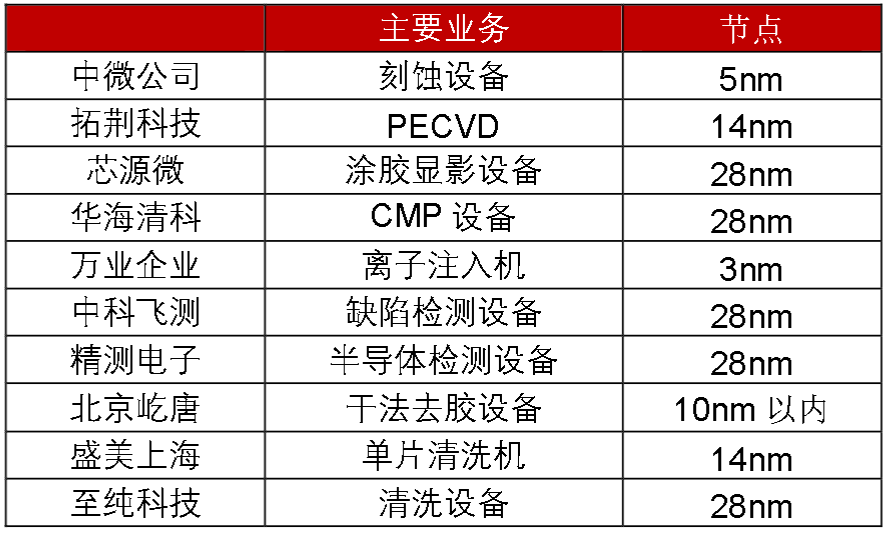

Zhongwei Company 688012: A leading domestic etching machine manufacturer, mainly involved in the fields of dielectric etching, MOCVD (Metal Organic Chemical Vapor Deposition), etc.; plasma etching equipment has been applied in international first-tier customers from 65nm to 14nm, 7nm, and 5nm and other advanced integrated circuit processing manufacturing lines and advanced packaging production lines.

Tuo Jing Technology 688072: The company’s main products include plasma-enhanced chemical vapor deposition (PECVD) equipment, atomic layer deposition (ALD) equipment, and sub-atmospheric chemical vapor deposition (SACVD) equipment, widely applied in domestic wafer fabs for 14nm and above integrated circuit manufacturing lines, and has started 10nm and below process product verification testing.

Shengmei Shanghai 688082: The company’s main products include semiconductor cleaning equipment, semiconductor plating equipment, and advanced packaging wet equipment. The company adheres to a differentiated competition and innovation development strategy, through self-developed single-wafer megasonic cleaning technology, single-wafer tank-type combination cleaning technology, plating technology, stress-free polishing technology, and vertical furnace tube technology, providing customized equipment and process solutions to global wafer manufacturing, advanced packaging, and other customers, effectively improving customers’ production efficiency, enhancing product yield, and reducing production costs.

Chip Origin Micro 688037: Products include photolithography process coating and developing equipment (coater/developer, spray coater) and single-wafer wet equipment (cleaning machines, stripping machines, wet etchers), which can be used for 6-inch and below single wafer processing (such as LED chip manufacturing) and 8/12-inch single wafer processing (such as integrated circuit manufacturing front-end wafer processing and back-end advanced packaging stages).

The company has successfully mastered various core technologies of semiconductor equipment products, including photolithography process film uniform coating technology, irregular wafer surface spraying technology, refined developing technology, internal microenvironment precise control technology, wafer front and back particle cleaning technology, precise supply and recovery technology of chemical agents, etc., and owns multiple independent intellectual property rights.

Zhichun Technology 603690: A domestic leader in high-purity technology, focusing on high-purity process systems and semiconductor wet (cleaning) equipment, layout in the broad semiconductor equipment field.

In 2021, the company’s high-purity process system integration revenue was 1.078 billion yuan, a year-on-year increase of 24.86%, accounting for about 50% of the main business revenue; the company’s semiconductor cleaning equipment entered a rapid growth phase, with 2021 operating revenue of 701 million yuan, a year-on-year increase of 222.06%, accounting for 33.64% of the main business revenue; in 2022, the company’s new wet equipment order target is to exceed 2 billion yuan, with an estimated 60% of the new orders being single wafer equipment.

Huahai Qingke 688120: The company is a high-end semiconductor equipment manufacturer with core independent intellectual property rights, mainly producing chemical mechanical polishing (CMP) equipment. CMP is a key process necessary for advanced integrated circuit manufacturing front-end processes, advanced packaging, etc. The CMP equipment produced by the company can be widely applied in 12-inch and 8-inch integrated circuit mass production lines, and the overall technical performance of the products has reached a leading level in the country. The company launched the first domestically produced 12-inch CMP equipment with core independent intellectual property rights and achieved mass production sales, currently the only high-end semiconductor equipment manufacturer in the country providing 12-inch CMP commercial models for integrated circuit manufacturers.

Wanye Enterprise 600641: Its subsidiary Kaishitong is a scarce domestic target for ion implanters, covering applications down to 3nm. In December 2021, the company cooperated with Ningbo Xinen to establish Zhongjiaxin Semiconductor, mainly covering etching, thin film deposition, rapid thermal processing, annealing, cleaning equipment, and other core front-end equipment for integrated circuits.

The company announced that in the first half of 2022, semiconductor equipment revenue increased by about 150% compared to the same period last year, with the company and its subsidiaries cumulatively adding semiconductor equipment orders exceeding 750 million yuan. The company’s semiconductor revenue is growing rapidly, with a full order book, and with the promotion of domestic substitution for semiconductor equipment, the company’s revenue and orders are expected to see sustained high growth.

3. Testing Equipment

Huaxing Yuanchuang 688001: A supplier of flat panel display and integrated circuit testing equipment, launching a super-large-scale mixed-signal chip testing machine platform, a leading domestic semiconductor testing equipment manufacturer.

The company targets the high proportion of SoC and RF testers, and the self-developed T7600 series testers have achieved mass production in fingerprint, image sensing, MCU, TOF, and other chip testing, with DSP, NorFlash, and other chip testing applications also verified and entering mass production preparation. In the future, the company will further explore domestic first and second-tier large packaging testing factory and independent third-party testing factory customers, promote the installation of standard testing equipment, and fully benefit from the trend of domestic substitution of semiconductor back-end testing equipment.

Huafeng Measurement and Control 688200: The company is one of the earliest enterprises to enter the integrated circuit testing equipment industry in China, mainly focusing on analog and mixed-signal testing equipment, being the domestic leader in this field.

Changchuan Technology 300604: The testing equipment has moved from the packaging and testing stage to the wafer manufacturing stage; the main products are testers and sorters. In 2019, the company successfully acquired Singapore integrated circuit packaging testing equipment manufacturer STI, whose 2D/3D high-precision optical inspection technology (AOI) is globally competitive.

Jingce Electronics 300567: Entering the semiconductor testing field from panel testing, covering applications down to 28nm. In 2021, the company’s semiconductor testing business achieved revenue of 136 million yuan, a year-on-year increase of 110.54%. Currently, the company has become a leader in domestic semiconductor testing equipment and is committed to continuous R&D investment in this field, and will fully benefit from the domestic substitution process in the future.

The company’s subsidiary Wuhan Jinghong focuses on the automatic testing equipment (ATE) field (the main products are storage chip testing equipment), with CP and FT products currently receiving corresponding orders, and aging products achieving batch repeat orders. The company’s subsidiary Shanghai Jingce focuses on the leading testing equipment field, and in 2021, the company’s film thickness products and electron beam measurement equipment obtained bulk orders from domestic first-tier customers, and breakthrough orders for optical defect detection equipment, while OCD equipment has passed domestic first-tier customer validation, and products such as semiconductor wafer stress testing equipment are in the development, certification, and expansion process.

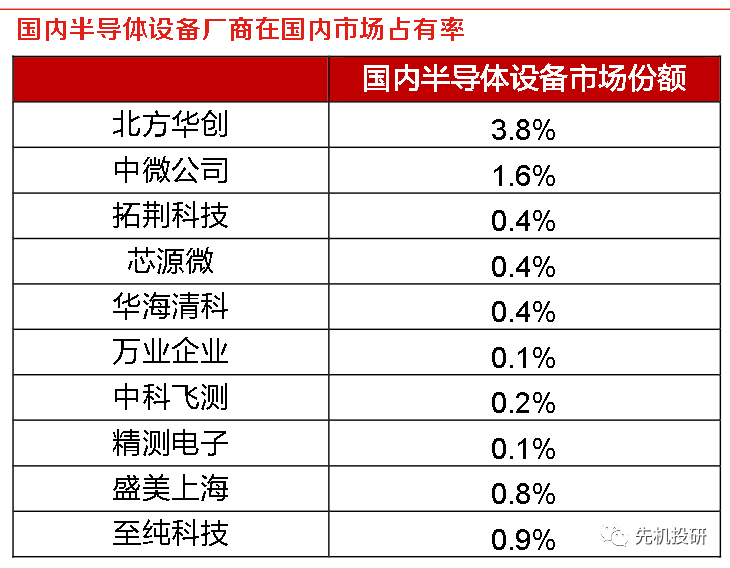

1. Revenue Scale: From the perspective of semiconductor equipment-related revenue in 2021, North Huachuang had the largest scale, achieving revenue of 7.1 billion yuan, followed by Zhongwei Company with revenue of 3.1 billion yuan.

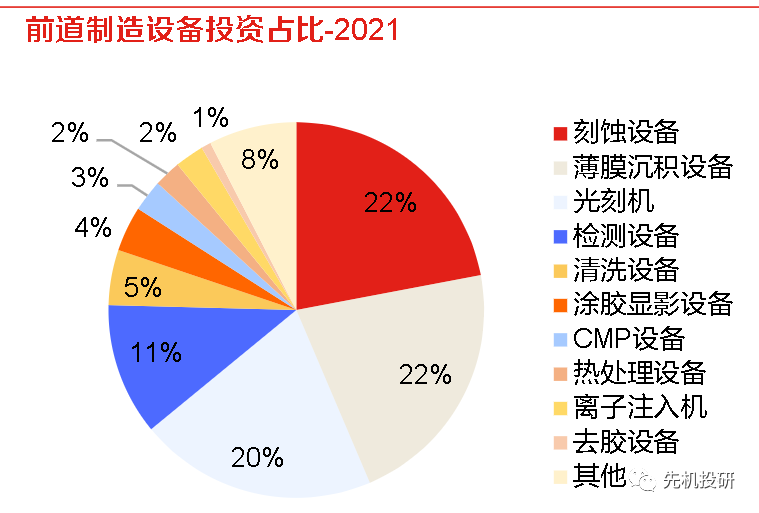

2. Chip Manufacturing (Front-End) Equipment Investment Proportion

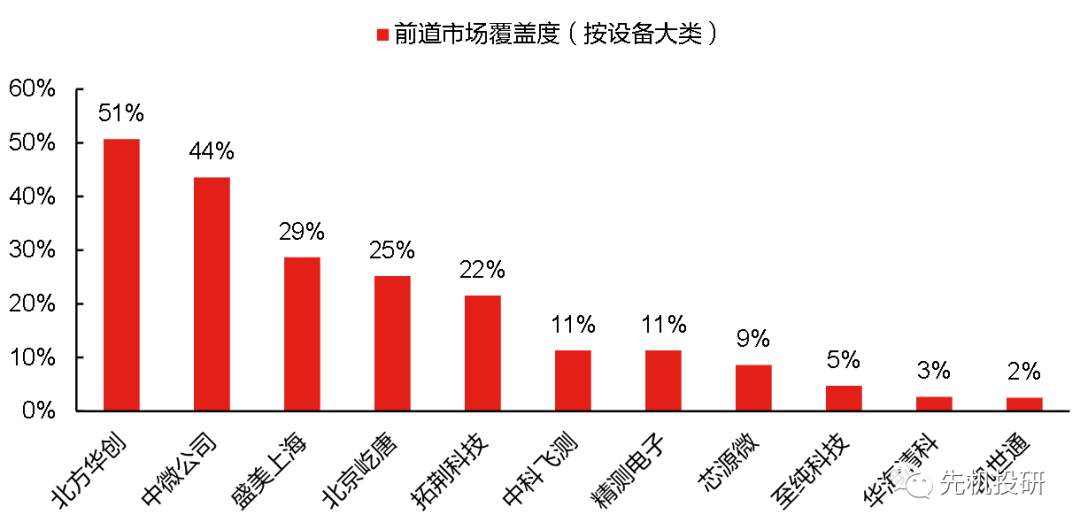

3. Product Coverage: From the current perspective, North Huachuang has the widest product coverage in the integrated circuit front-end field, with its equipment covering etching, thin film deposition, thermal processing, and cleaning fields. Shengmei Shanghai also has various product coverage, including cleaning, thermal processing, and thin film deposition. Most other companies currently focus on one or two fields, deeply cultivating niche markets and continuously increasing their market share in their respective segments.

According to Gartner’s 2021 data on the market share of various semiconductor front-end equipment, the three domestic semiconductor equipment manufacturers with the highest product coverage are North Huachuang, Zhongwei Company, and Shengmei Shanghai, with product coverage reaching 51%, 44%, and 29%, respectively. Tuo Jing Technology, due to its positioning in core equipment segments, also has a product market coverage of 22% by major categories.

4. Market Share of Semiconductor Equipment Manufacturers in the Domestic Market:

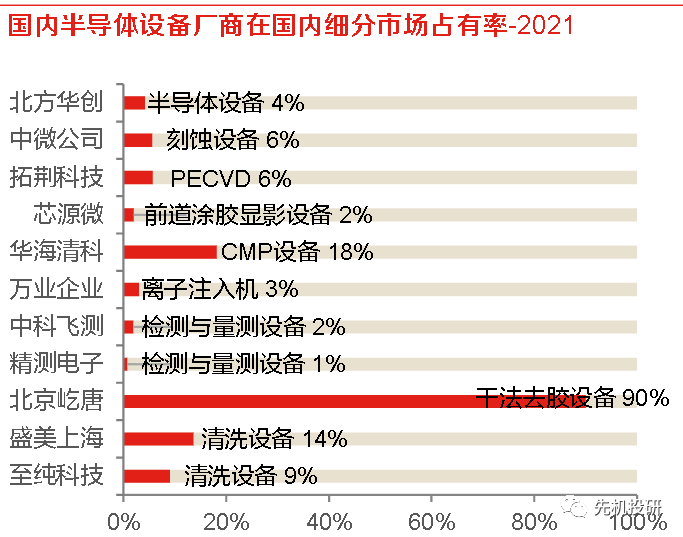

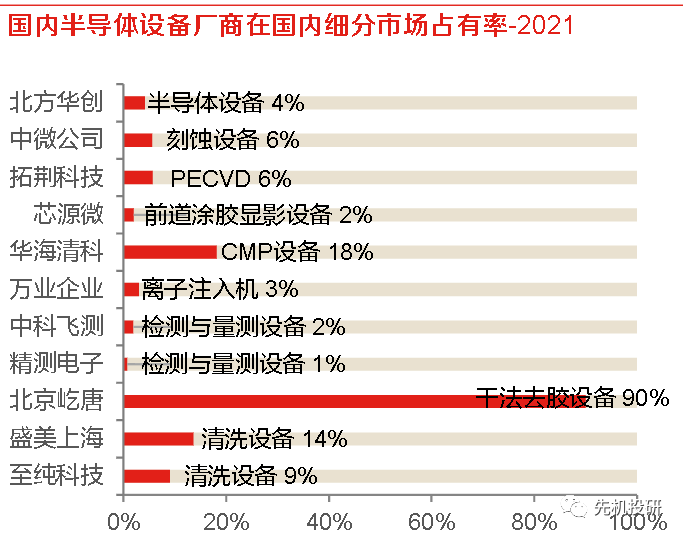

Currently, from the perspective of the domestic manufacturer share, it is roughly divided into three tiers: the first tier is the field that has achieved most localization, mainly for stripping equipment; the second tier is the field that has achieved partial localization, mainly including cleaning equipment, CMP equipment, etching equipment, with a localization rate of about 10-20%; the third tier is the field that is in the initial stage of localization, mainly including thin film deposition equipment, ion implantation equipment, coating and developing equipment, testing and measurement equipment, with a localization rate mostly at a low single-digit level.

1) The semiconductor equipment market is currently mainly dominated by foreign manufacturers, with the industry showing a highly monopolized competitive pattern, and the overall localization rate of semiconductor equipment is only about 10%, providing broad long-term growth space for domestic companies.

2) With China’s high emphasis on the semiconductor industry, some domestic semiconductor equipment manufacturers have achieved breakthroughs in certain technical fields after over ten years of technological research and accumulation.

3) Domestic manufacturers have significant room for improvement in profitability. Mature semiconductor equipment manufacturers generally have a gross profit margin in the range of 40-50%, and a net profit margin in the range of 20-25%. Currently, the gross profit margin level of domestic manufacturers is relatively close to that of overseas manufacturers, but the net profit margin is mostly below 10%, showing a significant gap with overseas manufacturers, mainly due to the early development stage of the companies, high R&D investment, and the lack of obvious management and sales economies of scale.

4) The scale effect of semiconductor equipment is significant, and profitability is expected to improve rapidly. As the scale of enterprise operations expands, the scale effect becomes apparent, and profitability is expected to further improve.

5) Some domestic semiconductor equipment manufacturers are actively expanding their business scope and developing towards platformization. A broader product line coverage can enable integrated circuit equipment manufacturing companies to provide more comprehensive and integrated products and services to customers, achieving bundled sales of equipment; on the other hand, it is conducive to expanding scale and improving bargaining power with upstream and downstream.

5. Risk Analysis

1) Localization progress not meeting expectations: The progress of semiconductor equipment localization is a core determinant of the current stage of semiconductor equipment manufacturers’ performance; if the localization progress does not meet expectations, the revenue of companies in the industry will be negatively affected.

2) Industry equipment market conditions not meeting expectations: The semiconductor industry is highly prosperous, with significant increases in capital expenditures in the chip manufacturing sector; if prosperity declines, overall equipment spending levels will decrease, negatively affecting the revenue levels of companies in the industry.

3) Customer validation progress not meeting expectations: Semiconductor equipment needs to pass customer validation to achieve mass sales; if validation progress does not meet expectations, it will lead to lower than expected revenue for companies in the industry.

4) Risk of supply chain disruptions for components: Although domestic semiconductor equipment manufacturers are actively working on upstream component localization, some components still rely on overseas suppliers, posing a risk of supply chain disruptions.

————-