Daily Case Study: Learning IPO Cases to Become an IPO Expert

Continuing with daily cases, we will launch related learning cases on “Provision for Impairment of Fixed Assets”. Stay tuned!

This case is for the Ampelon DeepStock Exchange IPO Project

1. Expected Revenue, Gross Margin, and Capacity Utilization of Temperature Sensors in 2022

The company will gradually exit the supply of temperature sensors for Midea Group’s household air conditioners in 2022. During the reporting period, the revenue generated from temperature sensors for the main customer, Midea Group, will decline significantly, while revenues from other important temperature sensor customers such as Company A and its designated OEMs, Gree Electric, etc., will increase significantly, leading to a slight decline in the company’s revenue from temperature sensors in 2022. The gross margin of the temperature sensors supplied to Midea Group is very low, while the incremental revenue from temperature sensors corresponds to a higher gross margin. Therefore, the company expects a decline in revenue from temperature sensors in 2022, but an increase in gross profit.

From January to June 2022, the sales revenue of temperature sensors was 155.234 million yuan, a year-on-year decrease of 14.82%, mainly due to the company’s exit from the supply of some low-margin temperature sensors used by Midea Group. Excluding Midea Group, the sales revenue of temperature sensors from January to June 2022 was 141.792 million yuan, a year-on-year increase of 14.65%. From January to June 2022, the gross margin of the company’s temperature sensors reached 35.34%, significantly higher than the gross margin of 29.58% in 2021, with gross profit increasing year-on-year and improved profitability. Due to the significantly lower sales gross margin for Midea Group in 2021 compared to the average gross margin, the overall revenue scale was relatively low despite a decrease in revenue from Midea Group, but the overall gross margin improved significantly. The company expects that the gross margin situation for temperature sensors in the first half of 2022 will be similar to that of the entire year of 2022. Therefore, the customer structure for temperature sensors has been significantly optimized in 2022, and the contribution of temperature sensor sales revenue to operating performance is relatively high.

As of June 30, 2022, the total amount of orders for the company’s temperature sensors was 61.9169 million yuan. Aside from the reduction in orders from Midea Group, other customers such as Xinmarde Group, Hebei Group, Gree Electric, TCL, Haier Smart Home, BYD, and Fotile have sufficient order volumes, resulting in a healthy overall order volume for temperature sensors.

From January to August 2022, the capacity utilization rates for the company’s temperature sensors and NTC thermistors were 84.83% and 70.25%, respectively, which did not show significant adverse changes compared to the capacity utilization rates of 90.90% and 80.08% in 2021.

2. Situation and Amount of Fixed Assets Related to Temperature Sensors

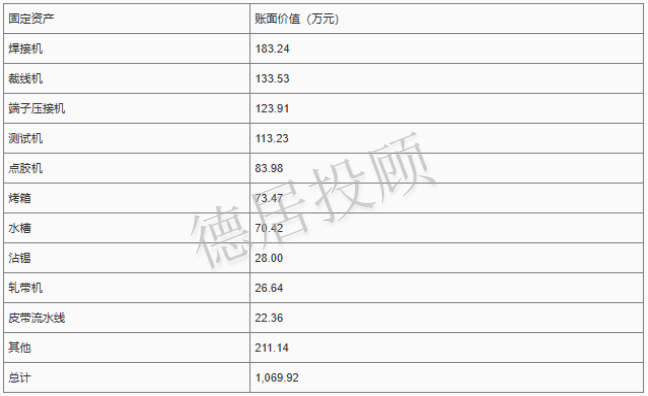

Temperature sensors are mainly composed of NTC thermistors and other materials further encapsulated, with the core process being encapsulation, primarily manual operations. The fixed assets related to the encapsulation of the company’s temperature sensors include machinery, instruments, and office equipment, mainly machinery, with a book value of 10.6992 million yuan as of June 30, 2022.

The fixed assets involved in producing temperature sensors for Midea Group can also be used to produce temperature sensors for other customers. As of June 30, 2022, the status of various fixed assets related to temperature sensors is as follows:

The soldering machine, wire cutting machine, terminal crimping machine, testing machine, dispensing machine, oven, sink, tin dipping machine, rolling machine, and conveyor line are all machinery used in the general production process of temperature sensors and are not limited to producing temperature sensors for Midea Group. Other fixed assets in the table include various fixed assets such as environmental protection equipment, marking machines, and air conditioning, all of which are general fixed assets for temperature sensors.

As of June 30, 2022, the core material of temperature sensors is the NTC thermistor, with a total book value of fixed assets related to NTC thermistors amounting to 12.7371 million yuan. All fixed assets related to NTC thermistors are general fixed assets and are not limited to machinery used for producing temperature sensors for Midea Group.

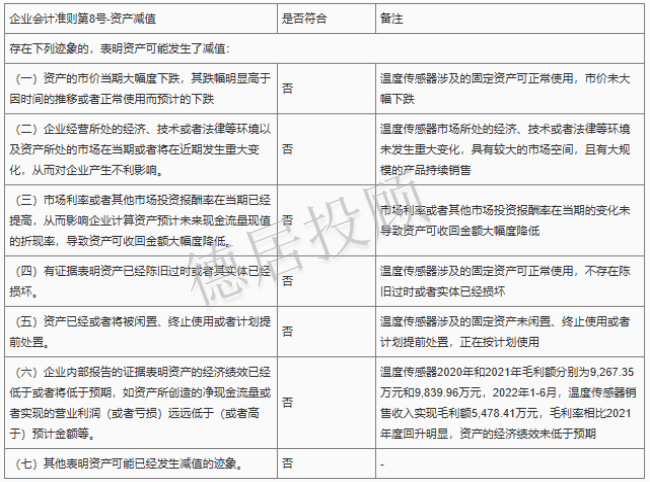

3. No Impairment Signs for Fixed Assets Related to Temperature Sensors, No Need for Impairment Provisions

According to the “Accounting Standards for Enterprises No. 8 – Asset Impairment (2006)”, the existence of certain impairment signs indicates that assets may be impaired. The fixed assets related to the company’s temperature sensors do not show any signs of impairment, and there is no need to make impairment provisions. Specific analysis is as follows:

The article is complete. If you like it, please click “Like” and share it.

Previous Pushes

Deju Cooperation Cases

Are you still watching?