Core Insights

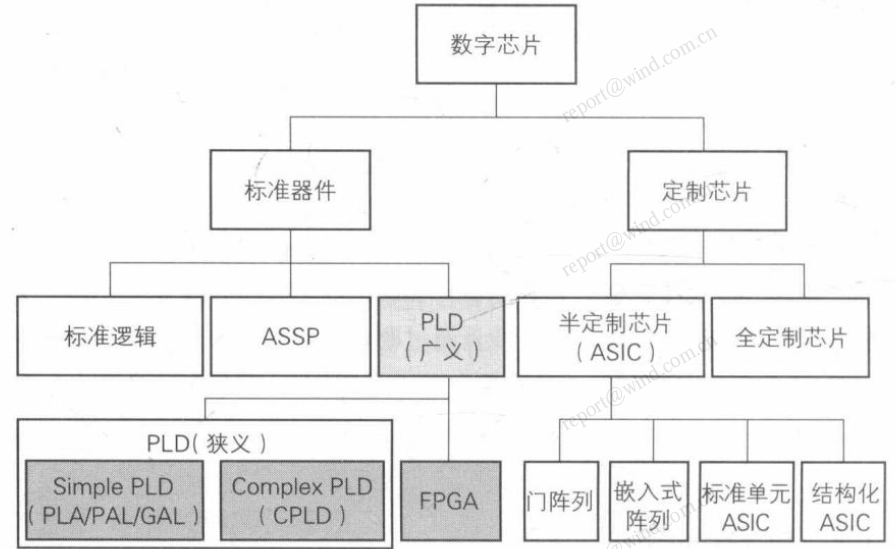

FPGA is a branch of digital chips, unlike fixed-function chips such as CPUs and GPUs, FPGAs can be given specific functions according to user needs after manufacturing.

FPGA chips are involved in multiple fields such as communication, industry, military/aerospace, automotive, and data centers, and the annual compound growth rate of the Chinese FPGA market is expected to exceed 17%, significantly higher than the global rate.

FPGA—A High-Performance Chip Customizable by Users

FPGA (Field Programmable Gate Array) is a subcategory of digital chips, with on-site programmability being the biggest feature of FPGAs. Chips like CPUs and GPUs have fixed functions once manufactured, while FPGAs can be configured with specific circuits according to user needs through EDA software after manufacturing, thus granting them specific functions. The programmable technology of FPGAs is based on flash memory, anti-fuse, and static RAM.

Image: Position of FPGA in Digital Chips

Source: “Principles and Structures of FPGA”, CITIC Construction Investment

FPGA consists of three parts: programmable logic units (Logic Cells), input-output units (Input Output Block) for external signal interaction, and a switch box array connecting the first two elements. From a product development perspective, advanced processes (technology) and advanced packaging can enhance FPGA capacity, while optimizing the design of basic units LC and other system designs under the same process can improve FPGA performance. Additionally, continuous software optimization and a rich soft-core IP library also reflect the competitiveness of different manufacturers.

Rapid Growth in the FPGA Industry,Significant Domestic and International Gaps

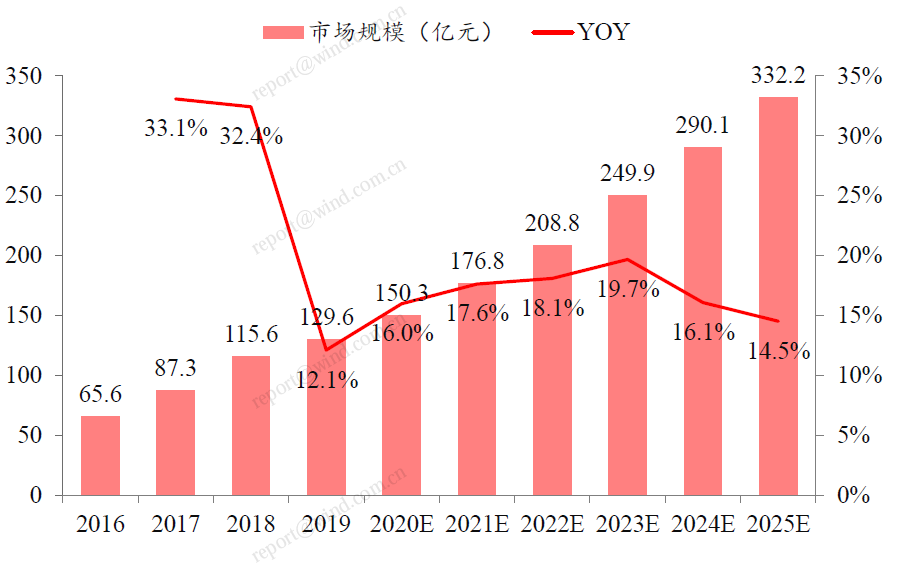

The accelerated development of emerging markets such as data center construction, artificial intelligence, and autonomous driving has driven continuous growth in FPGA demand. According to Gartner, the global FPGA market size is expected to grow from $5.585 billion in 2020 to $9.69 billion in 2026, with an annual compound growth rate of 9.6%. Additionally, according to Frost & Sullivan, the Chinese FPGA market size is expected to grow from 17.68 billion yuan to 33.22 billion yuan from 2021 to 2025, with an annual compound growth rate of 17.1%, indicating that the growth rate of the Chinese FPGA market is higher than the global rate.

Image: Forecast of China’s FPGA Market Size

Source: Frost & Sullivan, CITIC Construction Investment

From the perspective of downstream markets, FPGA chips are involved in communication, industry, military/aerospace, automotive, and data centers, with the communication market holding the highest share and expected to continue to increase, while the automotive sector is expected to grow the fastest among these fields.

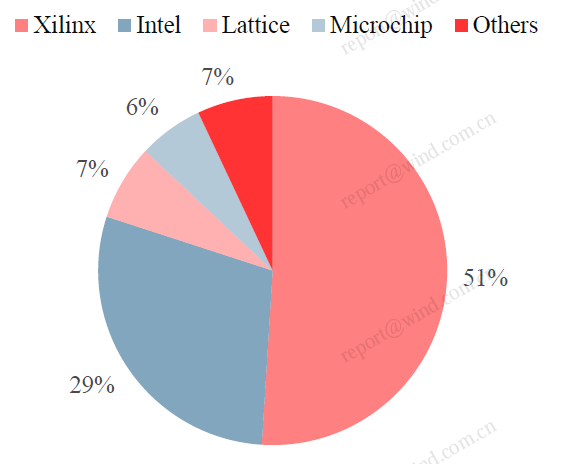

Currently, the FPGA industry has a high concentration. According to Gartner data, four American companies—Xilinx, Intel, Lattice, and Microchip—account for 93% of the global market share, while domestic FPGA manufacturers held 16% of the domestic market share in 2021, indicating significant room for domestic substitution.

Image: 2021 Global FPGA Market Share (by revenue)

Source: Gartner, Morgan Stanley, CITIC Construction Investment

Significant Room for Domestic Substitution, Focus on Left-Side Layout Opportunities in the Chip Industry Next Year

Currently, domestic FPGA manufacturers have significant gaps in product richness and technical strength compared to top international manufacturers. For instance, there is almost a vacuum in advanced process products below 14 nm domestically, and the product matrix richness of domestic companies in the 28 nm process is also not as rich as that of overseas giants. Coupled with performance gaps in logic capacity and other aspects, there is substantial room for improvement. At the same time, the domestic market capacity is vast, with Xilinx generating over 30% of its revenue in China, and Lattice over 50%, making China their largest revenue region. Recently, international giants have been raising prices, providing ample market space for domestic manufacturers to substitute.

In summary, whether in the civilian market with continuously evolving demands or in specialized markets with significant self-controllable needs due to national security considerations, FPGAs have good prospects for domestic substitution, and domestic FPGA manufacturers have vast growth potential.

From the overall perspective of the chip industry, the industry’s prosperity has weakened this year. As the semiconductor industry gradually enters the latter half of its downward cycle next year, some downstream segments of the chip industry have begun to show signs of demand recovery. Attention should be paid to left-side layout opportunities in the chip industry, and the Guozheng Semiconductor Chip Index should be monitored.

Reviewed by: Zhang Jingwei, Wang Jing, Heng Gege