Risk management professionals need to reduce model development time and develop and deploy transparent, stable, and easily upgradable applications.

Learn how to use MATLAB® to develop risk control models, scale models based on application size, test according to regulatory requirements, and perform stress testing under various scenarios:

√

The existing code examples show you how to quickly develop risk control applications for credit risk, market risk, counterparty risk, and more.

√

Provide examples of application development, including instructional videos and professional technical articles.

√

Selected excellent models developed in the MATLAB user community for user reference.

Get all the code model examples mentioned below

Click “Read the Original”

Market Risk

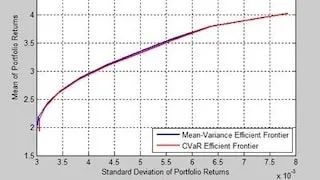

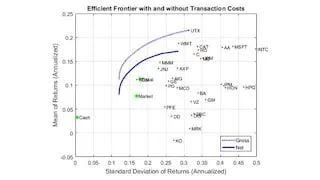

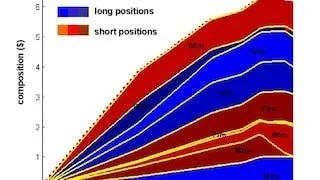

CVaR portfolio optimization workflow.

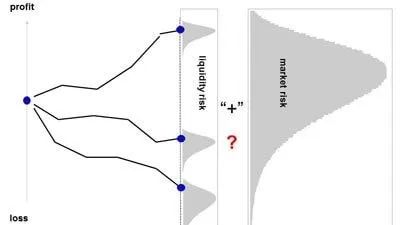

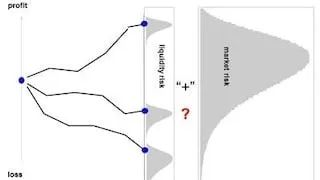

Integrating liquidity risk and market risk risk control models.

Using MATLAB to quantify and monitor market risk.

<<< Swipe left to see more >>>

Required MATLAB Products

MATLAB®

Optimization ToolboxTM

Financial ToolboxTM

Statistics and Machine Learning ToolboxTM

Operational Risk

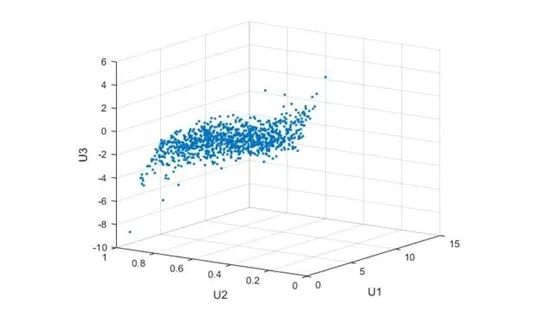

Using copulas to simulate correlated random variables.

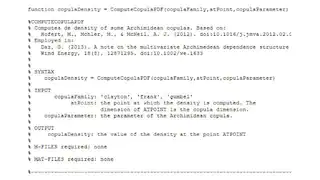

Density of multidimensional Archimedean copulas.

Modeling operational risk.

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

Credit Risk

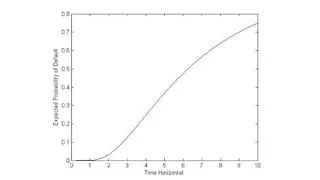

Predicting the probability of company default.

KMV credit risk model – calculation of default probability.

Instructional video: Using MATLAB to predict company default probability.

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

Optimization Toolbox

Financial Toolbox

Liquidity Risk

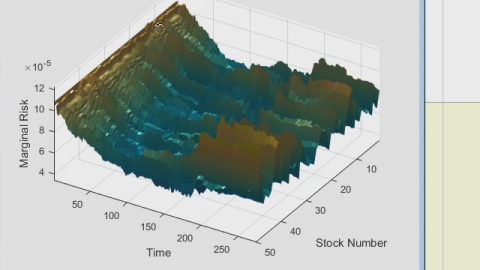

Portfolio optimization.

Integrating liquidity risk and market risk risk control models.

Using MATLAB to effectively integrate portfolio management with trading.

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

Optimization Toolbox

Financial Toolbox

Systemic Risk

Using graph theory and Markov chains to study risk contagion (demo example).

Using the IRIS toolbox for macroeconomic modeling and forecasting.

Using graph theory and Markov chains to study risk contagion (technical article).

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

Parallel Computing Toolbox

Counterparty Risk

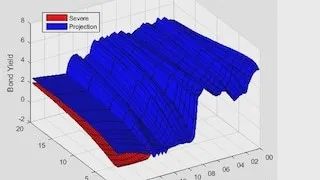

Counterparty credit risk and CVA.

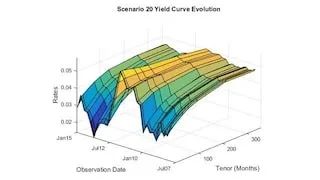

Monte Carlo simulation and pricing of financial derivatives.

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

Optimization Toolbox

Financial Toolbox

Financial Instruments ToolboxTM

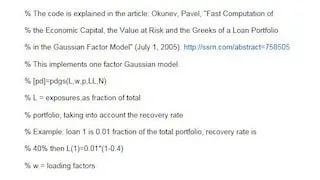

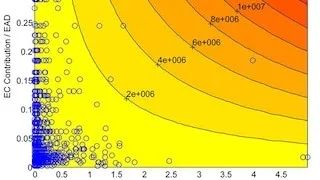

Economic Capital

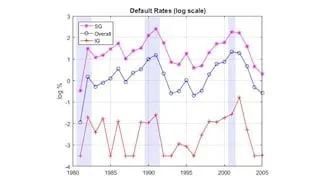

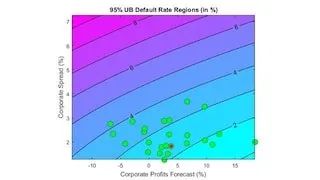

Predicting corporate loan default rates: stress testing.

Cumulative distribution function of CDO asset loss in Gaussian factor model.

Basel Accord compliance requirements and risk management analysis: calculation of economic capital.

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

Optimization Toolbox

Financial Toolbox

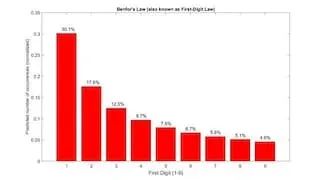

Fraud Prevention, Compliance, and Legal Compliance

Benford’s Law toolbox.

Monitoring systemic fraud through automated data analysis in MATLAB.

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

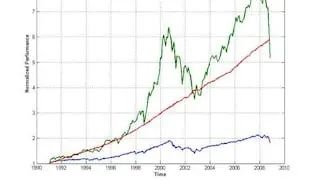

Stress Testing

Using the Black-Litterman model and related techniques for stress testing.

Using MATLAB for macro stress testing.

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

Optimization Toolbox

Econometrics ToolboxTM

Datafeed ToolboxTM

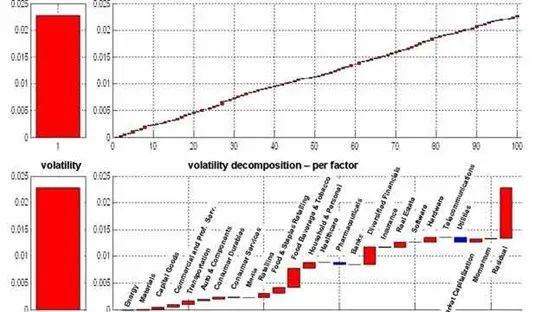

Risk Assessment/Smart Beta

Multi-factor model (code sharing).

Using MATLAB to build portfolios: Smart Beta.

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

Optimization Toolbox

Financial Toolbox

Datafeed Toolbox

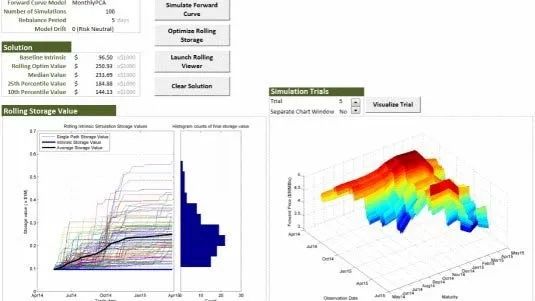

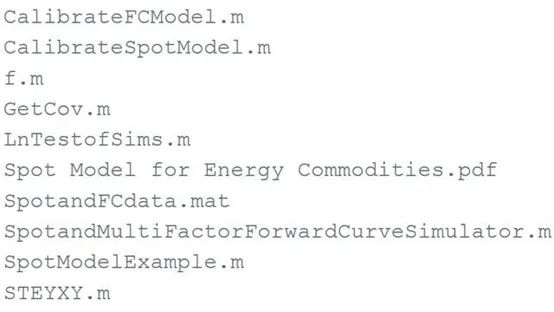

Commodity Risk

Valuation of natural gas contracts.

Code sharing: Using Monte Carlo methods to simulate the curves of spot and forward contracts for commodities.

Using MATLAB for the valuation of natural gas contracts.

<<< Swipe left to see more >>>

Required Products

MATLAB

Statistics and Machine Learning Toolbox

Optimization Toolbox

Financial Toolbox

Financial Instruments Toolbox

Get the code model examples mentioned in the text

Click “Read the Original”