Note: Friends who reward at the end of the article will directly support the author Winnie Shao, Ph.D. :)

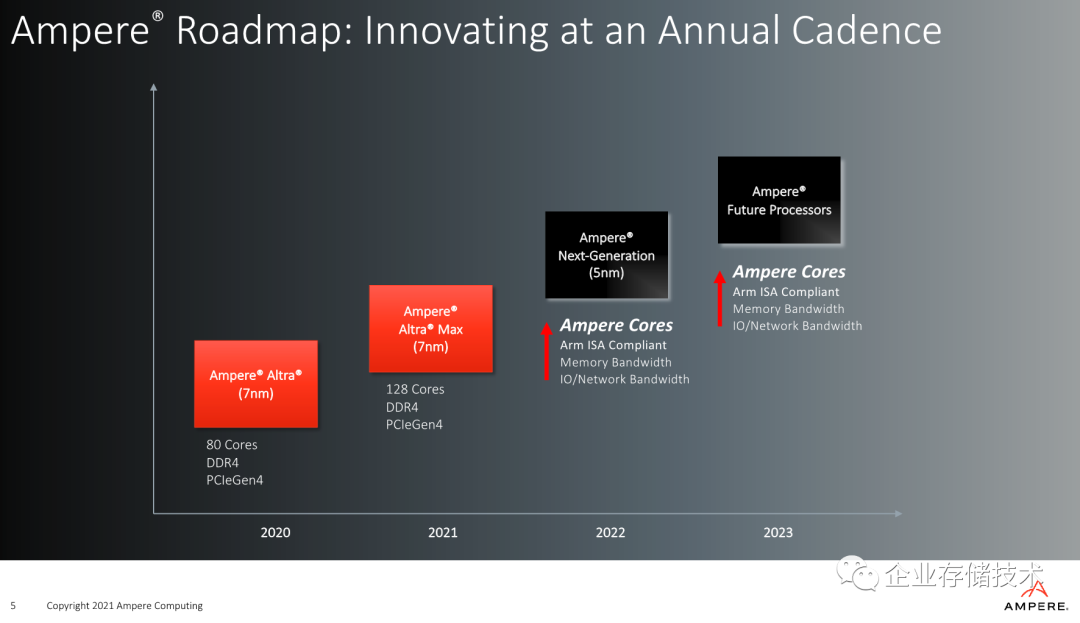

On May 18, U.S. time, Ampere, focusing on arm server processors, released a roadmap update, while announcing that the next generation 5nm Siryn will adopt self-developed cores, instead of following the arm Neoverse standard core route.

Although Ampere is a startup, it released the 80-core Altra in 2020, and this year it is the 128-core Altra Max. Although both are 7nm chips, the architecture has not changed much. But think about the cost of a single wafer for 7nm and 5nm, and the rhythm of one generation per year, this is very much the style of mainstream server CPU manufacturers.

Click the image to enlarge (same below)

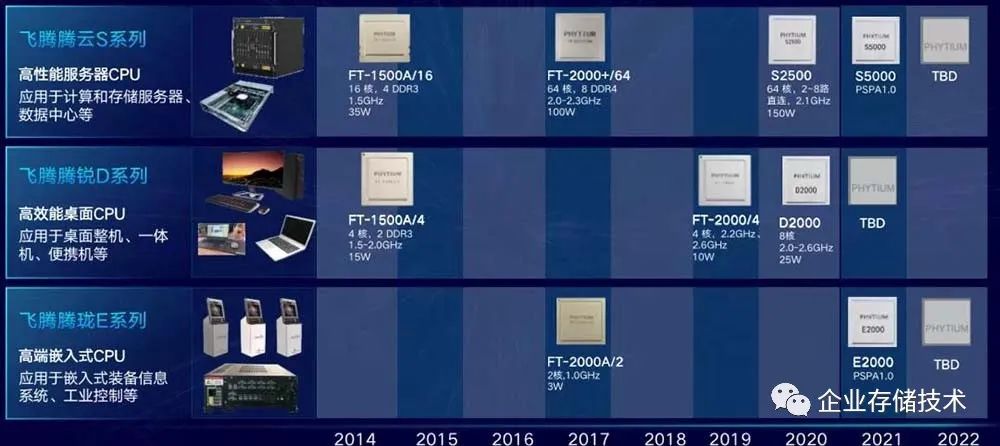

Let’s take a look at the domestic Feiteng, which, starting in 2019, has accelerated from two generations every two years to two chips a year, and in 2021, there are three chips on the roadmap, while working hard in the server, desktop, and embedded markets. This is the industrial pace brought by the new leader of Feiteng. (Here’s a moment of sympathy for HiSilicon, which should have had the Kunpeng 930 launch this year.)

Independent chip companies are working so hard, what about the internet giant AWS? After releasing Graviton 2 in 2019, there were no server processor chip releases in 2020, but they did release the Trainium chip for machine learning training. It feels like Graviton3 must be released in 2021. Graviton 2 is a 7nm 64-core chip; what will Graviton3 look like? Will it mainly increase the number of cores? Or increase storage throughput? Or do two-way and four-way system interconnections? My guess is based on N2 or V1, and then it’s all yes, yes, 2. (If I’m wrong, then after December, I’ll secretly delete the article.)

For this, I also reviewed what AWS CEO Andy Jassy said about chip innovation in 2019. He mentioned that acquiring AnnapurnaLabs was a major turning point in AWS history. If AWS wants to push cost-effectiveness to the extreme, it must get into chip development itself. So how did Graviton2 perform? Liftr Insight data shows that AWS Graviton instances account for 4% among the top four cloud service providers, and 14% of AWS’s own instances, up from less than 1% 18 months ago.

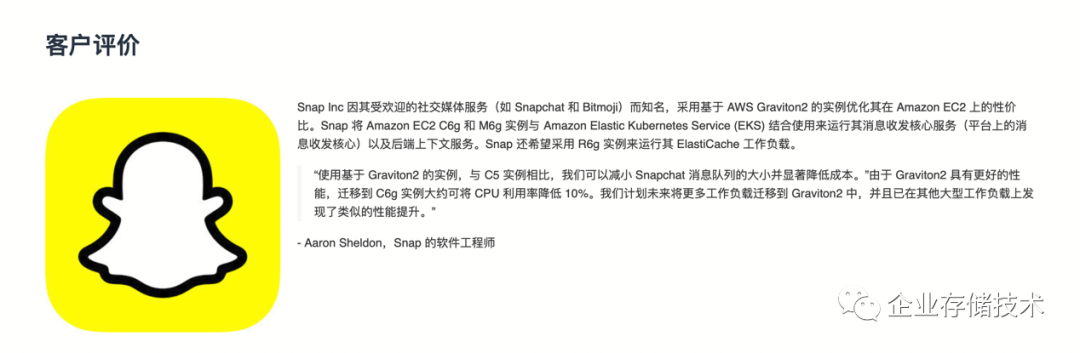

When I opened the Graviton2 homepage, I originally wanted to check the ecosystem issue but was pleasantly surprised to find a heavyweight new customer, Snap. So I went to supplement what AWS posted online at re:Invent 2020, where a small section discussed why Snap chose the combination of Graviton + Amazon Elastic Kubernetes Services (Amazon EKS). The motivation is very simple: 65% cost savings.

Interestingly, two shares were mentioned. The first was an experience from an AWS engineer, who said that using self-developed arm server processors allowed him to get very close to customers, understanding their applications and usage methods. This opportunity to work shoulder to shoulder with major clients can be considered a byproduct of self-developed hardware.

The second was that both AWS and Snap’s presenters mentioned the support capabilities of multi-CPU architecture. For cloud service providers and software application companies, once a basic capability of end-to-end multi-CPU architecture support is built, switching between different CPU architectures will be very smooth, which opens the door for AMD64 and arm64. The software community is preparing for the upcoming battle among Intel, AMD, and arm.

Looking back at Ampere’s launch event, it was surprising to see strong ecosystem endorsements from Microsoft and Oracle, and this endorsement is not just for Ampere as a customer, but for the entire arm server camp. If Microsoft, Oracle, and AWS all target the migration of commercial relational databases to arm servers, that would cover 3/4 of the market, just thinking about it is exciting. My confidence in this speculation comes from AWS’s Large Memory (X2gd) instance released in March this year, which is aimed at database and cache database applications. (There is also EMC, which continues to quietly support arm64; will they also support it publicly in the future?)

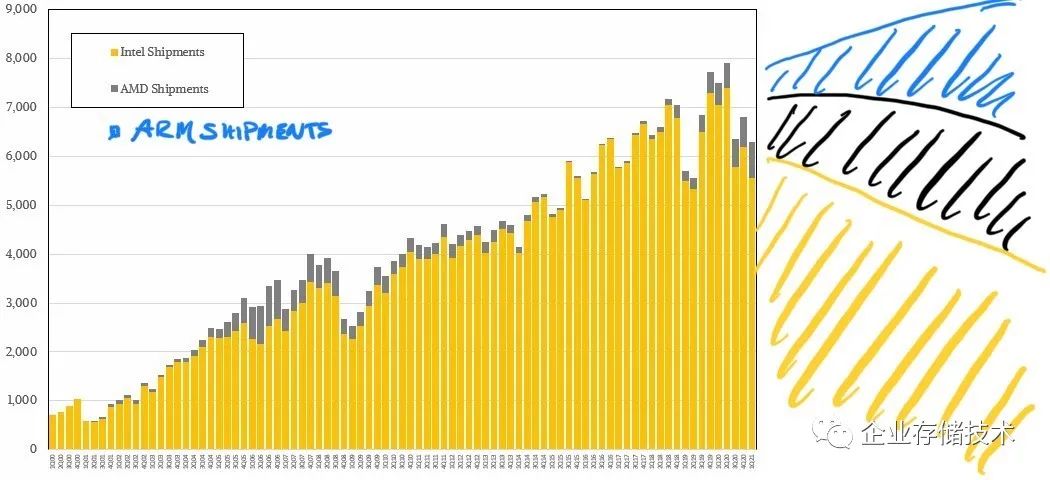

Finally, I borrow a soul drawing from the editor of nextplatform, predicting the market for Intel, AMD, and arm in servers. In my ideal market structure, it is a stage point of 60:20:20. Such a large market, facing such a turning opportunity, can be a bit more lively here in China.

Also recommend the author’s good articles

《【Revealing the Semiconductor Industry, Helping China Chip】Dr. Winnie Shao is starting a course!》

《Cerebras: The Company That Produced the World’s Largest Chip》

《Chronicles of Arm Server Chips》

《Multi-Die Packaging: Chiplet Research Report》

《SmartNIC: The “Small” arm Server in the “Large” x86 Server》

《The Road to AMD’s Second Rise》

Note: This article only represents the author’s personal views and is not related to any organization. If there are errors or shortcomings, please feel free to criticize and correct in the comments. Further communication technology,. If you want to share your technical dry goods on this public account, please feel free to contact me:)

Respect knowledge, please retain the full text when reprinting. Thank you for your reading and support! “Enterprise Storage Technology” WeChat public account:HL_Storage

Long press the QR code to directly recognize and follow

History article summary:http://chuansong.me/account/huangliang_storage

http://www.toutiao.com/c/user/5821930387/

↓↓↓