Source / Knowledge Automation (ID: zhishipai)

Author / Lin Xueping

Whether it’s the high-speed trains or the transformers weighing four to five hundred tons, the heavy equipment of major powers is often admired. First of all, it gives a stunning impression due to its size. Moreover, the unit price is often not low, with a 1 million kilowatt boiler worth several hundred million.

In contrast, the sensor industry is quite a troublesome one. As a marginalized component industry, it is the accessory of accessories in the equipment of major powers. Although it is difficult for heavy equipment to operate without it, it is inherently a supporting role, always remaining in the shadows. When it comes to the characteristics of orders, manufacturing masters often show helplessness, there are over fifty thousand types of sensors globally, and a factory may need to produce hundreds of models, while many orders are often counted in thousands, or just hundreds, dozens, or even a few, typical small-batch, multi-variety. The technical difficulty is high, orders are complex, the value is minimal, and the fields are intricate, undoubtedly making sensors a tough industry.

However, Chinese manufacturing always faces challenges head-on, sensor companies need to choose their breakthrough paths.

1/ The Art of the Seesaw

Taking the bearing industry as an example, the role of the bearing lubrication system is very important. A bearing lubrication system will have many lubrication pipelines. At those crossroads, the oil valve distributor plays the role of a traffic police officer, responsible for directing the lubricating oil to its respective journeys. However, the oil valve distributor is merely a following mechanism, not an executing mechanism. The baton in its hand is an executing mechanism that drives the distributor to open and close. To maintain the smoothness of the oil pressure pipeline, it is necessary to detect whether the distributor executes properly, and then notify the executing mechanism whether to continue acting. This “detection” task is assigned to the sensor. In this sense, the sensor is almost the starting point of all automation, not to mention intelligence. Situational awareness is the most important step for humanity to move towards intelligence.

In the wind power sector, facing the essential components of large wind turbines, bearings are indispensable, and the lubrication system in the wind power industry is also very important. An international bearing company currently mainly uses German brand sensors, which utilize a Hall effect switching technology. However, this type of sensor has a fatal flaw in the wind power sector, which is the unresolved electromagnetic compatibility issue. Due to the large torque of wind power motors, large current phenomena often occur, generating strong electromagnetic interference. The Hall effect is a magnetic switch that detects changes in external electromagnetic fields, even the smallest magnetic field changes can be sensed. However, due to the peculiarities of wind power, this type of Hall effect switch often experiences occasional false triggers, leading to misjudgments. This poses challenges for the wind power industry, which requires high stability.

Inductive switches are another choice. Hall effect switches do not generate a magnetic field but rely on detecting external magnetic fields. When an external superimposed magnetic field occurs, it can easily lead to misjudgments; whereas inductive sensors generate their own magnetic field and detect the degree of disruption to their magnetic field to determine position. Thus, they are less affected by external electromagnetic interference, making them a good choice.

However, relative to application scenarios, the advantages of any technology are relative: opening one window means closing another. The window that closes is the pressure issue. Excessive oil pressure in the wind turbine lubrication system can deform the most commonly used metal packaging of inductive containers, rendering them inadequate. Therefore, the wind turbine lubrication system does not choose the inductive principle for comprehensive reasons.

More pressure-resistant ceramic packaged inductive containers can now be introduced. However, the difficulty of ceramic manufacturing and debugging is greater, and its hardness is higher than that of metal. The team at Yike Company began to challenge this process.

In fact, the sensor industry is such an intriguing field, with principles made public, not kept secret from anyone, but process optimization is the internal skill. The choice of technology in sensor R&D is always a seesaw principle, adding half a kilogram on one side and eight taels on the other.

Yike has rebalanced this seesaw by optimizing the internal circuitry, putting significant effort into filtering and signal processing to meet electromagnetic compatibility interference standards. They redesigned the new process, adopting a high-strength ceramic sensing surface to enhance oil pressure resistance, and using specially processed demagnetizing metal for the shell. This combination has finally achieved ceramic packaging while being more pressure-resistant.

Such innovative processes are indeed one of the essential skills for sensor manufacturers, otherwise, they will always lag behind foreign brands. Japanese Keyence and Japanese Yokogawa sensors are not particularly advanced in circuit boards; they are products from the 1980s, but their excellent craftsmanship has kept them in continuous demand. If they ever feel that their craftsmanship might be surpassed, they will quickly launch reserves of second and third generation processes, continuing to suppress the market share of close competitors. This is precisely why Chinese sensors have struggled to penetrate the core applications of core users. The stark technological gap acts like a firepower blockade, suppressing the advancement of domestic sensors.

This mixed technological breakthrough has made Yike’s ceramic inductive sensors favored by this bearing company. This is also an innovation in the lubrication system application in the wind power industry.

This is the characteristic of the sensor industry. From a competitive perspective, foreign manufacturers have already occupied most of the main roads, leaving only a small niche for Chinese manufacturers to nibble on.

In the testing phase, even the lubrication pump was damaged during extreme acceleration tests, yet this inductive sensor remained unaffected. This finally allowed it to break through the monopoly of German sensor manufacturers and step into the spotlight.

Of course, the sensor industry is such a meticulous field, even if the processes and circuits are breakthrough, the chips remain difficult to overcome, and the core magnetic materials still rely on Japanese TDK and American TOMITA’s manganese-zinc ferrite. In the world of sensors, every detail must be deeply explored and studied.

2/ Optoelectronic Soft, The Four Great Detectives

The variety of sensors is so vast that various measurement principles are utilized. The optoelectronic laser ranging is also a common sensor principle. This type of laser generally uses visible lasers, allowing the light spot to be seen. Due to the high energy of lasers and the small light spot, they can be seen from afar and are suitable for high precision, long-distance measurement.

Optoelectronic laser ranging often uses triangulation and time-of-flight (TOF, also known as “femtosecond”) two principles. The former is suitable for short-distance high-precision needs, such as thickness detection of 3C components, detecting the forward and reverse directions of machined parts to prevent misprocessing, etc.; while the latter is mainly suitable for medium to long distances with relatively lower precision requirements.

The design accuracy of the femtosecond principle is generally measured in meters. It is often used in anti-collision scenarios, on factory automation sites, many AGVs (automated guided vehicles) running around often require this; also in special scenarios such as port machinery, where large cranes operate at long distances (30 meters, even 100 meters); and in steel mills where the temperature is very high, sensors cannot be too close, hence this type of femtosecond principle optoelectronic sensor is also used. Its ranging principle employs the time-of-flight (TOF) method. The phase method is one of the TOF methods, where one wavelength cycle counts as a complete phase, and the time difference is calculated based on the phase difference between emission and reception, then multiplied by the speed of light to determine the distance. It sounds cool, but the verification and testing of optoelectronic laser ranging switch products are quite complex, with a significant gap between domestic and international standards.

If one were to simplify matters, they could purchase a complete set of modules and then do the integration. However, such integration often sacrifices much effectiveness since the matching relationship between sub-components is unpredictable. Yike chose a difficult path, which is to divide the sensor into the smallest units as much as possible, and then purchase component-level rather than module-level products, starting from mastering the technology platform, thus breaking free from dependence on integrated modules. Items like CMOS optical imaging devices and light sources are necessary purchases. However, achieving precise measurement algorithms and optical path design for laser optics is much more complex than component issues. To elevate their capabilities, companies must redesign integration platforms, do their own brackets and software, and even mold their own lenses, providing optical parameters for lens manufacturers to customize production. With suitable brackets, good optical structures can be made, and good circuit designs must follow.

However, optoelectronic sensors are a place where the “Four Great Detectives” converge: Light, Electricity, Mechanics, and Software, none can be missing. The key to laser ranging is structural stability, and the other is the optical loop, which is closely related to software algorithms such as compensation and response frequency.

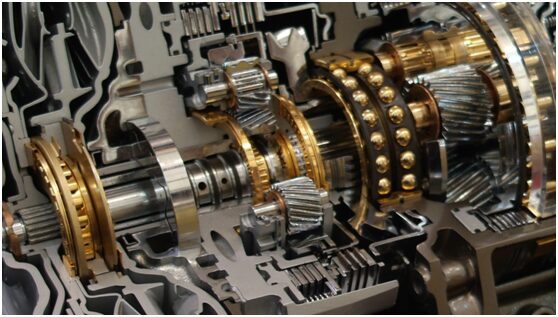

Figure 2 / Sensors Hidden Within

The principles of sensors are not complex, but to achieve product consistency, it is necessary to solve the problems of various usage environments. How to ensure that CMOS processes signals can output more stably without jitter requires continuous adjustment of algorithms. Just like soldiers practicing shooting at a target, it requires a lot of time to accumulate.

So where does the data for the algorithms come from? This data can only come from the test bench. Therefore, sensor factories need to have a test bench that can collect data from multiple points, in different environments, and with different measured objects for product validation. To achieve stable parameter optimization, often over a hundred different materials, colors, and reflectivity scenarios need to be tuned. For example, dark rubber has a high light absorption rate; a frosted mobile phone case has a large light scattering effect and inconsistent colors. Only when these different scenarios are applicable can stable sensor performance be formed.

This is precisely what is lacking domestically. The samples from domestic and international sensors may have consistent parameters, but once in specific environments, significant drift phenomena are observed. Ultimately, this is due to insufficient accumulation of engineering databases. The engineering database created through repeated experiments on test benches is the most needed nourishment for software algorithms. Otherwise, software optimization simply does not exist. With the combination of optics, mechanics, and electricity, along with software optimization, optoelectronic sensors can take a leap forward.

In the laser ranging field, the two giants are Japan’s Keyence and Germany’s Sick. The development of Chinese sensors has been immersed in the shadows of these two giants. Following closely is American Banner. Some domestic manufacturers are forming benchmarks against Banner, which is an important reference. Standing firm here makes it possible to challenge the giants.

3/ No Reverse Engineering

Encoders are the most commonly used feedback sensors on control components, converting physical quantities into electrical signals. They are used in motion control, servo motors, spindle motors, etc., to control motion characteristics. The application market is very broad: such as machine tools, logistics, textiles, printing and packaging, robotics, etc. Due to their extensive use in machinery, they have almost become an independent product category.

Taking the most common industrial mother machine as an example, the core brain of the machine tool is the CNC system, which has three basic units: the controller, the servo system, and the detection unit. The detection unit relies on devices like encoders to determine measurement accuracy; it acts like a sentinel’s eye, directing where the executing motor will go. Encoders need to have good parameter matching requirements with the servo system and controller.

Encoders primarily have two technical routes, one German and one Japanese. Encoders were first used in German machine tools, with Heidenhain being a representative brand. Japan also has its technical solutions, represented by Tamagawa. One is high-end, and the other is mid-range, both firmly controlling the market. Other manufacturers from Europe and the US, as well as Chinese manufacturers, adopt a technology route and system architecture that lies between the two. Heidenhain and Tamagawa are two mountains in the Chinese encoder market.

Yike has had close cooperation with Guangzhou CNC, the largest CNC system manufacturer in China, for over a decade, enabling continuous optimization of product processes. As Guangzhou CNC continues to upgrade, encoders are also evolving from incremental types to absolute types. Incremental encoders are prone to cumulative errors and have upper limit precision constraints. Absolute multi-turn encoders can achieve precise positioning. This requires analyzing customer needs and finding differentiated solutions for validation.

The manufacturing of encoders is characterized by the complexity of the manufacturing process. For example, the chips for signal generation and processing, and the code discs need to be imported; manufacturers need to design their circuits, translate the chip application plans into products, and then complete manufacturing through appropriate processes. The components of an encoder mainly include light-emitting tubes, code discs, and receivers. The distance between these three has a close coupling relationship. The control of the distance between them does not have a clear standard. It relies entirely on repeated testing and data analysis to find the optimal distance.

This is a tightly-knit integration of mechanics and optics; the mechanical parts must maintain precision and material selection under high-speed, high-temperature conditions, while optical design must undergo testing, which must be done positively. Imported optical code discs from abroad are encrypted, like a password, making it impossible to reverse engineer. The electrical part, especially for bus-type encoders, requires various bus protocol interfaces. Ultimately, these three parts need to be assembled together while ensuring precision.

This is a chain-like breakthrough; high-end machine tools will drive the demand for high-end CNC systems, which in turn will upgrade encoders and further promote the development of etching machine equipment. To truly see a demonstration of domestic projects, one must descend from domestic equipment to domestic CNC, and then to domestic encoders, at least three layers deep, to touch the pulse of domestic production. This is a lengthy process.

4/ Breaking Through Everywhere

Sensors are ubiquitous; every field and industry requires manufacturers to engage in fierce competition and hard-core breakthroughs, making comprehensive breakthroughs very challenging. This requires each sensor manufacturer to find their unique strengths.

Sensors that can resist instantaneous large currents and corrosion on sanitation vehicles are also pain points. Due to the small market, foreign sensors sometimes are unwilling to customize, leaving a tiny opportunity for domestic brands. Every opportunity requires full effort.

Many operating environments for sensors are extremely harsh. For example, sensors used for fire-spark splatter protection in robots are both consumables and located in harsh environments. During the electric welding process, electric sparks belong to strong electric and magnetic fields, generating alternating magnetic fields that can exceed 12,000 amperes during spot welding, requiring strong anti-interference capabilities from sensors. A German manufacturer of clamping cylinders used in automotive welding is switching from a German sensor brand to a domestic brand. This is a good start.

Machine tool processing generates a lot of heat, which poses significant interference to ordinary inductive sensors. These limit switch sensors generally adopt welding and component packaging methods; the different expansion coefficients of the front plug and metal shell often lead to performance failures of the sensors. It is worth mentioning that the lubricating oil used in machine tools has a strong permeability, often seeping into circuit boards, causing sensor failures. Nowadays, sensors have undergone integrated design, solving the issues of high sealing and expansion coefficients without using welding. It can be seen that these are not technical difficulties, but rather craftsmanship insights. The most important factors are circuit optimization and manufacturing processes to ensure consistency. Sensors may be small, but they are a benchmark for manufacturing capabilities.

5/ A Note: From Integrated Innovation to Component Innovation

China’s large equipment has made remarkable progress, such as Zhenhua Port Machinery and Erzhong Group’s 1000MW nuclear pressure equipment. However, without attention to components, many integrators can easily become mere workers for core component manufacturers. This phenomenon is also occurring in Europe and Germany. The market share of many system integrators is declining, while that of component manufacturers is increasing.

China needs to transition from integrated innovation to component innovation. The domestic climate encouraging domestic products is also improving. The automotive industry is the most evident; previously, the electronic control systems of joint venture factories were designed abroad and almost impossible to change. Now, China’s decision-making autonomy has increased, allowing for greater flexibility in domestic products. Whether it’s improvements on the production line or component selection, new opportunities have emerged.

This is a moment of national fortune; China’s manufacturing is climbing up the value chain, allowing for a comprehensive review of all products in the value chain from top to bottom, from large to small. As the “accessory king” of equipment, sensors are severely undervalued. This moment is a critical juncture for sensors to shine.

.END .

Contact Us: xtydqi001 (Duty WeChat)

Advertising and Business Cooperation: Phone 15053167995 WeChat qqmm-777

Submissions and Interview Talks: Email [email protected]

Copyright Statement: In addition to publishing original articles, Manufacturing Circle is also committed to the exchange and sharing of excellent articles. Reprinting must indicate the source and author; to apply for reprinting authorization, please leave a message at the end or in the background. All rights reserved, infringement will be pursued.