Click Automotive Technology Review to follow us

The 12th “Year of Origin” for Connected Vehicles

In 2009, Toyota’s G-Book and General Motors’ OnStar officially launched connected vehicle services in China. The same year, a number of local Chinese companies began actively participating in the connected vehicle industry chain. Therefore, 2009 is regarded as the first “Year of Origin” for the connected vehicle industry in China.

From the security and rescue of the 2G era to the infotainment of the 3G/4G era, and now to the new era of automotive “four transformations”, connected vehicles are expected to provide data connectivity after full vehicle digitization, enabling connections between people and the outside world as well as between vehicles and the outside world. This is seen as an essential part of autonomous driving, and many believe that connected vehicles could become the next mobile internet.

While the vision is grand, the reality is often stark. Over the past decade, mobile communication networks have evolved from 3G to the current 5G, and smartphones have transitioned from Java feature phones to iPhone 11. However, connected vehicles are still struggling to “emerge from their Year of Origin”, and only the participants truly understand the challenges involved. Can the “Year of Origin curse” of connected vehicles be broken, and if so, how? This article attempts to find answers through the logical deconstruction of connected vehicles.

Logical Deconstruction of Connected Vehicle Commercialization

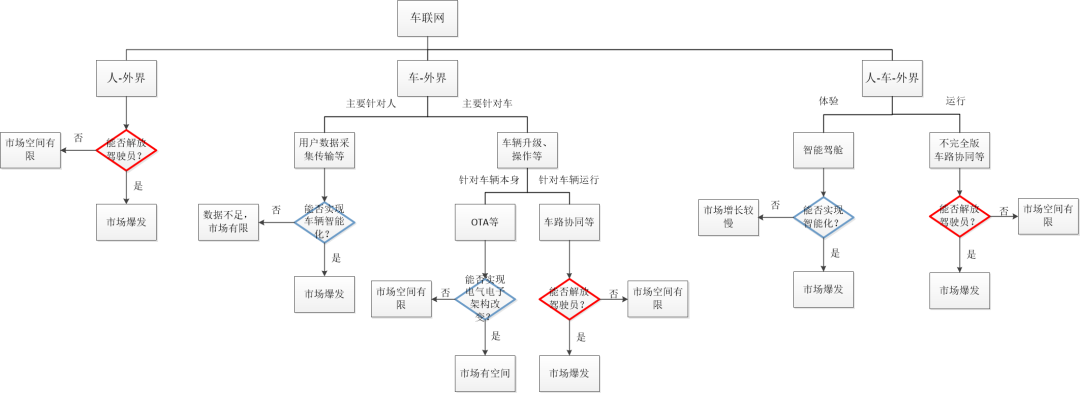

Connected vehicles can be divided into three aspects based on the participants involved in the connection: people-external world, vehicle-external world, and people-vehicle-external world.

1. People-External World

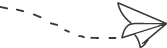

The connection between people and the external world currently requires a human driver to operate the vehicle, necessitating full attention to driving. Therefore, the space for generating value from connected vehicles is currently limited. If humans can be liberated from driving in the future, the market space for connected vehicles will be released. Thus, whether autonomous driving can be achieved and whether drivers can be liberated are key factors in unlocking the explosion of the connected vehicle market through the people-external world connection.

Figure 1: People-External World Logical Diagram

2. Vehicle-External World

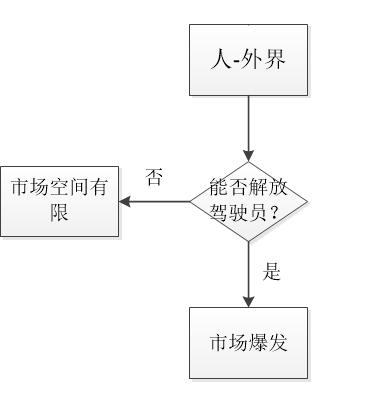

The connection between vehicles and the external world does not require human intervention but exists solely between vehicles and the external world. From the perspective of data application, it can be divided into data interactions mainly targeting people and data interactions primarily targeting vehicles. Data interaction targeting people mainly involves the collection, processing, and output of data related to user driving, preferences, maintenance, etc., focusing more on providing assessments and services for users, primarily used in the automotive aftermarket. The key points here are data collection, processing, and transmission, which rely on vehicle intelligence.

Data interaction targeting vehicles includes data required for vehicle upgrades, operations, and runtime, which can be further divided into interactions for the vehicle itself (such as OTA) and interactions during vehicle operation and runtime (such as vehicle-road collaboration). OTA not only upgrades applications like infotainment systems but can also delve into updates at the vehicle’s ECU level. The key lies in whether it can achieve changes in the vehicle’s electronic and electrical architecture, transitioning to a centralized architecture centered around domain controllers rather than the traditional distributed architecture. For vehicle-road collaboration, the focus is on whether autonomous driving can be achieved.

Figure 2: Vehicle-External World Logical Diagram

3. People-Vehicle-External World

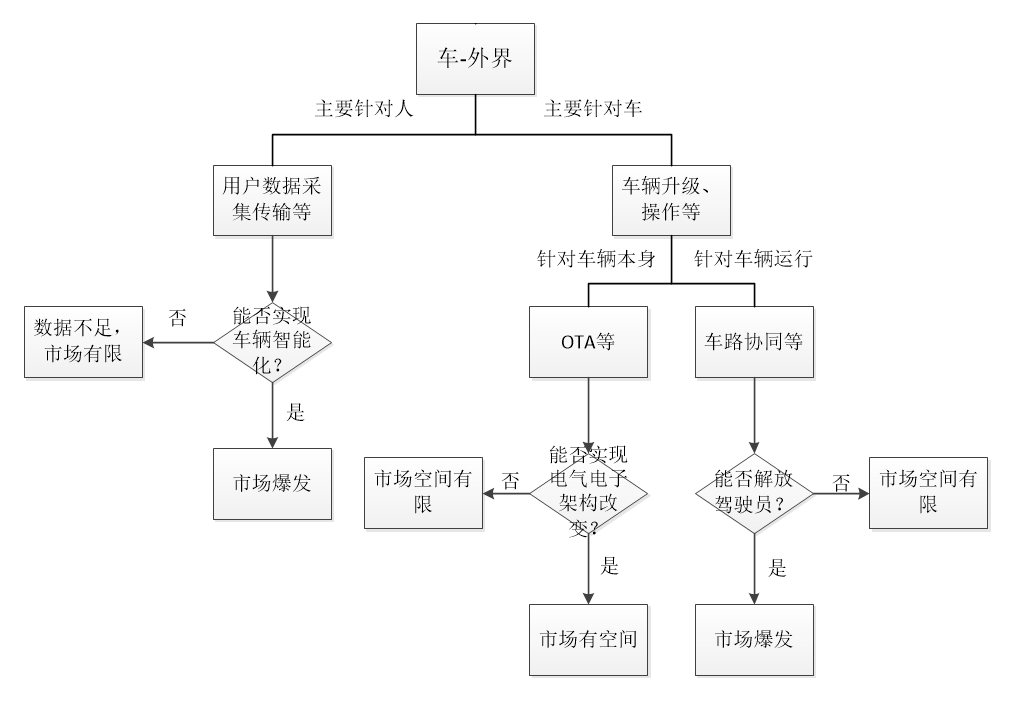

The connection between people, vehicles, and the external world can be divided into driving experience and vehicle operation. The driving experience mainly includes human-machine interaction and intelligent cockpits, representing a more diversified interaction between people and the external world. Vehicles become carriers for understanding humans and gateways to the internet, and the speed of commercialization depends on the progress of intelligence implementation.

In terms of vehicle operation, this primarily includes driver assistance, providing decision-support information to drivers in the phase before full autonomous driving is achieved. The external world conveys information through the vehicle to the driver, who then makes judgments. The key point is how much this can assist the driver. Before fully achieving autonomous driving, drivers need to participate in driving, so vehicle-road collaboration information can only serve as prompts or warnings, rarely taking control. Current vehicle sensors already enable many warning and driver-assistance functions, but how much additional functionality can connected vehicles provide? What is the actual value to drivers? How willing are people to pay for this? Beyond merely following trends to equip vehicles with gimmicky features, automakers need to deeply contemplate the underlying logic.

Figure 3: People-Vehicle-External World Logical Diagram

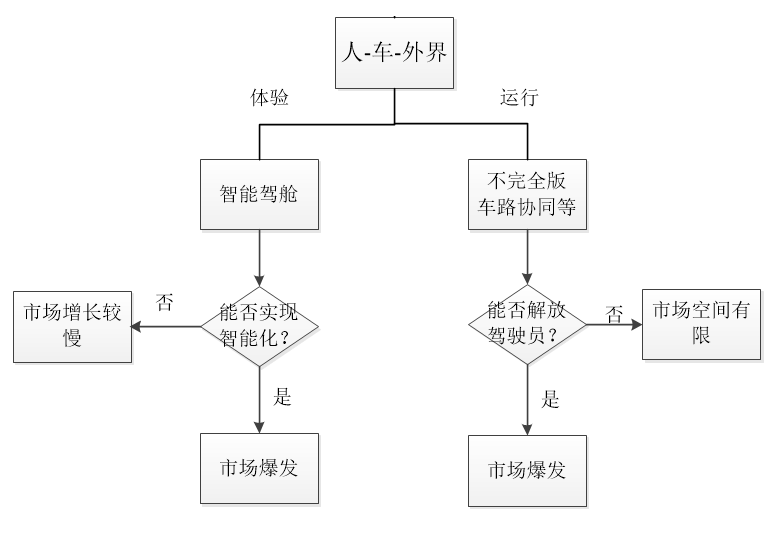

By this point, have you noticed something interesting? — All the key nodes for the successful large-scale commercialization of connected vehicles ultimately hinge on two points: Can intelligence be achieved? Can autonomous driving be realized? (as indicated by the red and blue boxes in the figure below)

Figure 4: The Logical Dilemma and Key Nodes of Connected Vehicles

This is the logical dilemma that has prevented connected vehicles from escaping their Year of Origin — “Starting in Fifth Gear”. As a technology that can only realize its maximum value at the highest stage of intelligent networking, connected vehicles have fallen into a quagmire of delayed profitability due to their premature birth and exploration.

Of course, we do not deny the valuable nature of any exploration. Today, at a turning point where “new infrastructure” strongly supports the development of connected vehicles, it is precisely the time to consider redefining the commercialization of connected vehicles.

Outlook on Connected Vehicle Commercialization

The logical dilemma faced by connected vehicle commercialization arises because connected vehicles are still at a stage where infrastructure is not yet complete. The infrastructure required for connected vehicles is extensive, not just limited to the widely discussed OBU, RSU, base stations, data centers, etc. As mentioned earlier, connected vehicles are built on the foundation of vehicle intelligence. The beginning and end of connected vehicles, from data acquisition to a series of processed data applications, all require intelligence as a foundation. Since intelligence is still in a developmental phase, connected vehicles cannot advance independently.

Currently, connected vehicles are still in the infrastructure construction stage, which may last for 5-10 years. During this stage, vehicles themselves are evolving towards intelligence, changes are occurring in electronic and electrical architectures, and new sensors and edge computing units are being applied. In terms of driving experience, directions represented by intelligent cockpits are beginning to develop; in the automotive aftermarket, data collection and processing are gradually starting to monetize data into related services. Vehicle-road collaboration is gradually being established but remains in a small-scale demonstration phase, requiring the gradual establishment of related standards and facilities.

After the infrastructure is initially improved, connected vehicles will enter the next stage. This stage will begin large-scale construction of roadside infrastructure and further deepen vehicle intelligence. On this basis, it will gradually start to promote features such as partial autonomous driving vehicle-road collaboration and vehicle scheduling, moving towards intelligent scheduling and autonomous driving.

Investment Suggestions for Connected Vehicles

Currently, connected vehicles are proposed as an important sector of “new infrastructure”. In the coming period, the focus of attention will be on the hardware needed for OBU, RSU, base stations, data centers, etc., from chips to modules to complete machines, especially chips and modules with core competitiveness and technological content. Within 5-10 years, OBU will gradually become standard equipment for vehicles, while RSUs will be demonstrated in small batches. For startups, the complete machine market is currently dominated by Tier 1 suppliers, so opportunities are limited; the opportunities lie in the underlying chips, modules, and other hardware.

In terms of software, aside from the software required for OBU, RSU, base stations, data centers, etc., the focus should be on improving user experience and content. Improving user experience mainly includes experiences during driving and maintenance, with the development direction for enhancing driving experience being intelligent cockpits; the direction for improving usage experience primarily lies in the automotive aftermarket, utilizing big data for more targeted and convenient maintenance. In terms of content, until drivers are fully liberated, the vehicle’s focus will remain on companion-style interactions, differing from the interactions of the current mobile internet era and resembling more traditional car FM radio.

In summary, in the long term, as a high-level application of intelligent networking, connected vehicles will undoubtedly achieve a splendid transformation into commercialization, and their commercial value should not be underestimated, but this depends on the progress of intelligence and autonomous driving. In the coming period, investments driven by “new infrastructure” in connected vehicle hardware should remain a key focus for investors.

■ Author Profile: Bachelor of Engineering from Zhejiang University, Master of Engineering from the University of Michigan, Ann Arbor. Over 5 years of technical work experience in automotive companies such as Volkswagen, Continental, and General Motors. After returning to China, joined FAW Equity Investment Company, focusing on investments in the automotive industry chain.

END

Automotive Technology Review

Scan to follow us