Skip to content

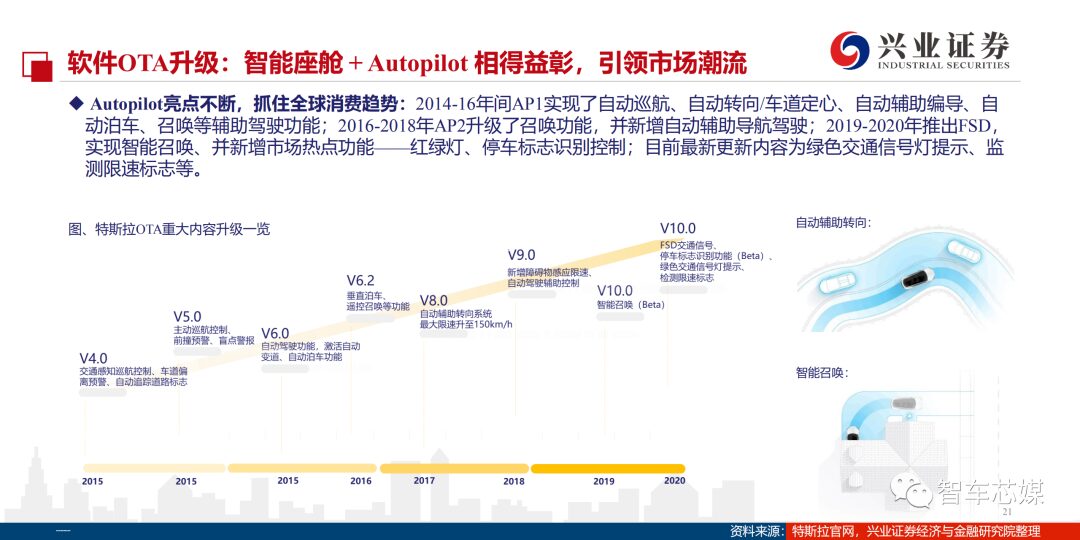

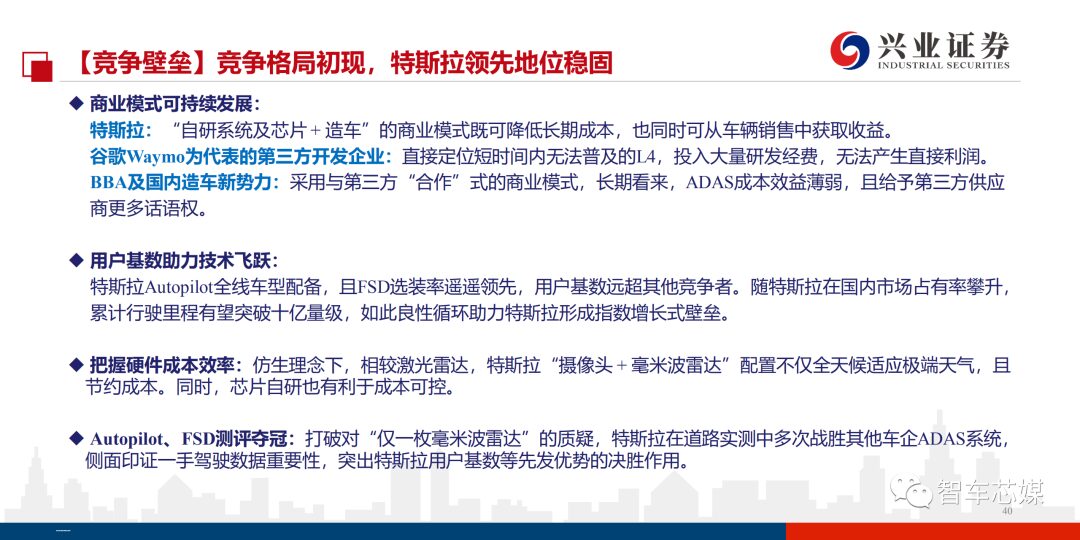

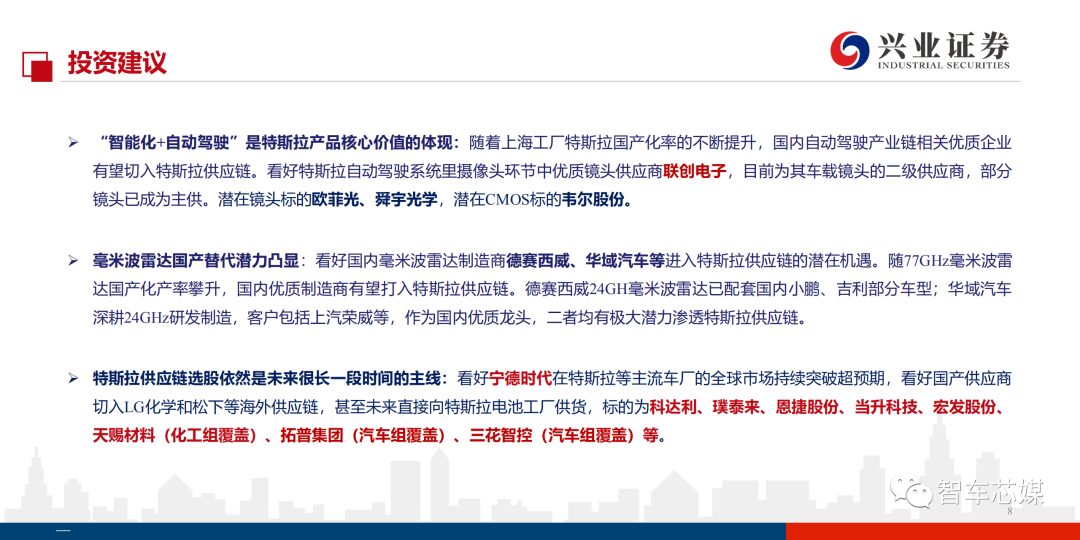

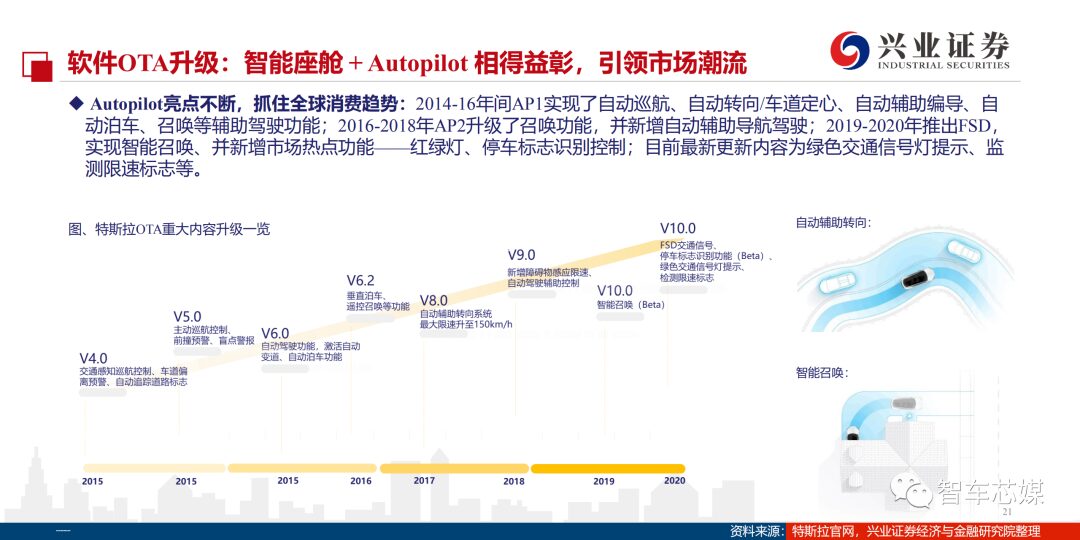

This report focuses on Tesla’s autonomous driving technology.Tesla, with its Autopilot and FSD (Full Self-Driving) assistance features, not only crushes its competitors in the market but also propels Tesla from a mere car manufacturer to a platform and technology company, leading the industry’s trends.

-

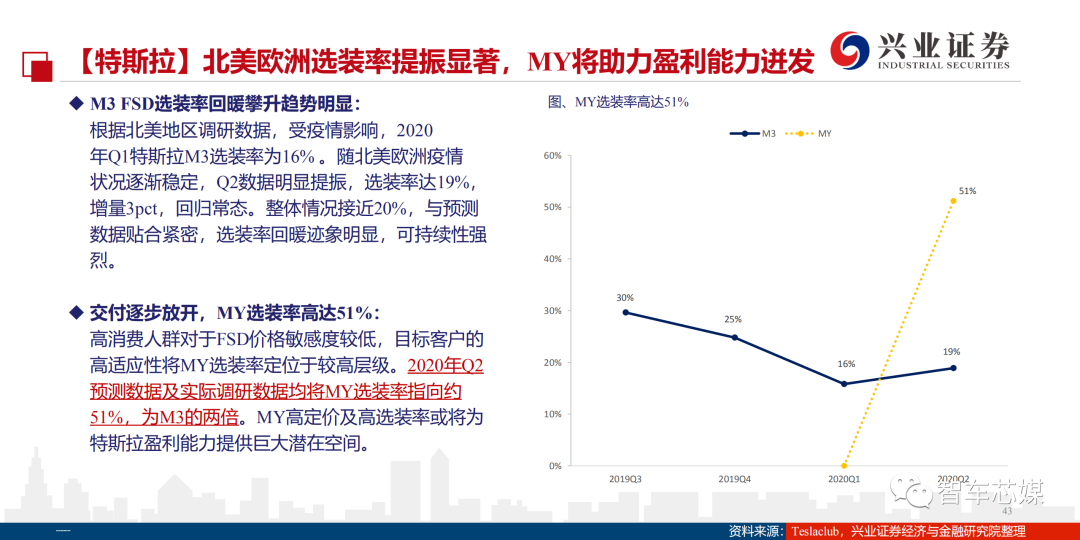

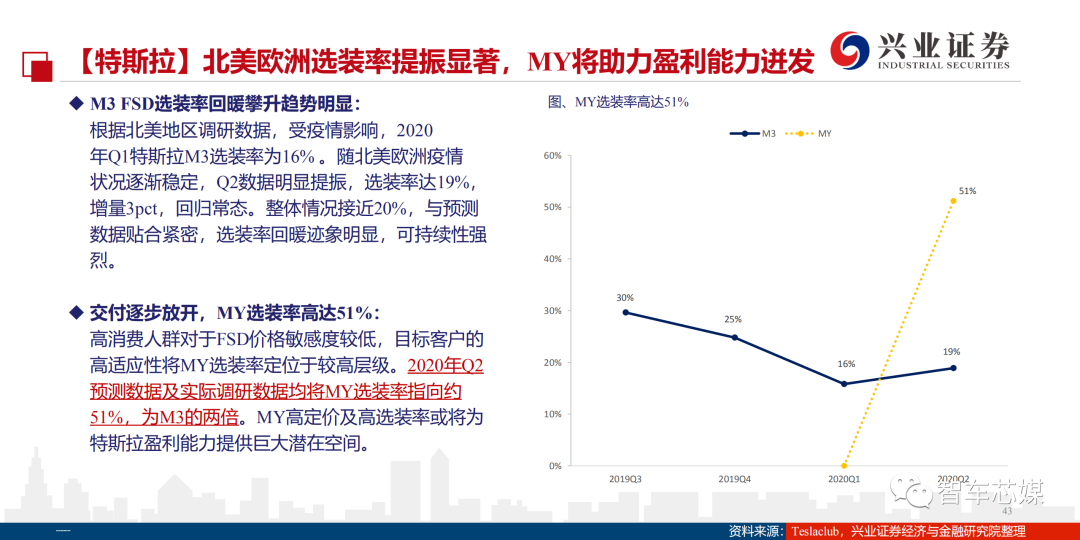

With its self-developed chips and ADAS (Advanced Driver Assistance Systems) platform, significant hardware cost efficiency, globally leading autonomous driving features, and smart cockpit, Tesla has precisely identified the preferences of consumers in China and the U.S. for “intelligence + autonomous driving.” In the future, the FSD option rate will have considerable room for growth. According to actual survey data, the current FSD option rate for the Model Y in the U.S. has exceeded 50%, while the corresponding rate for the Model 3 has steadily increased to around 25%.

-

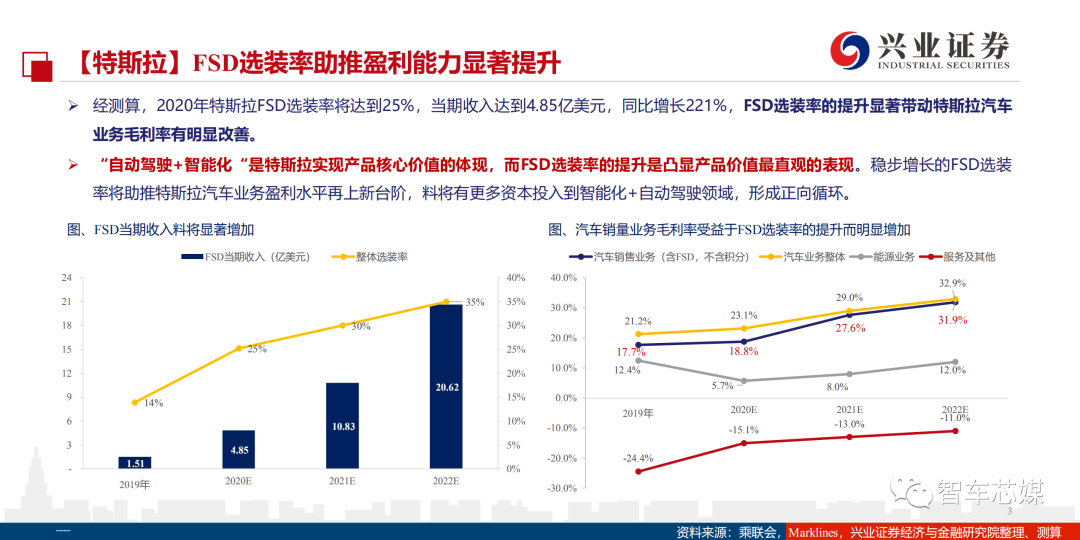

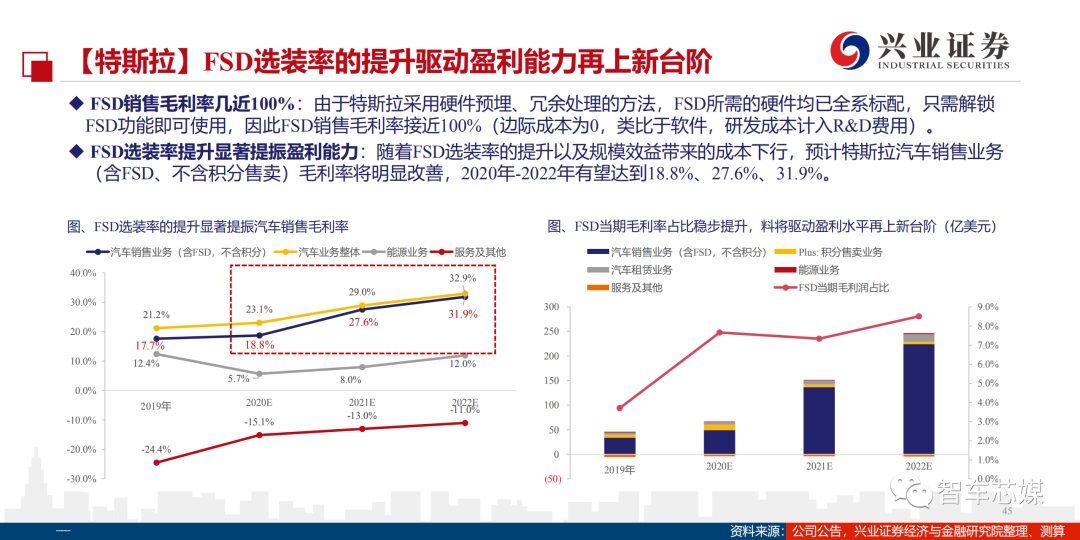

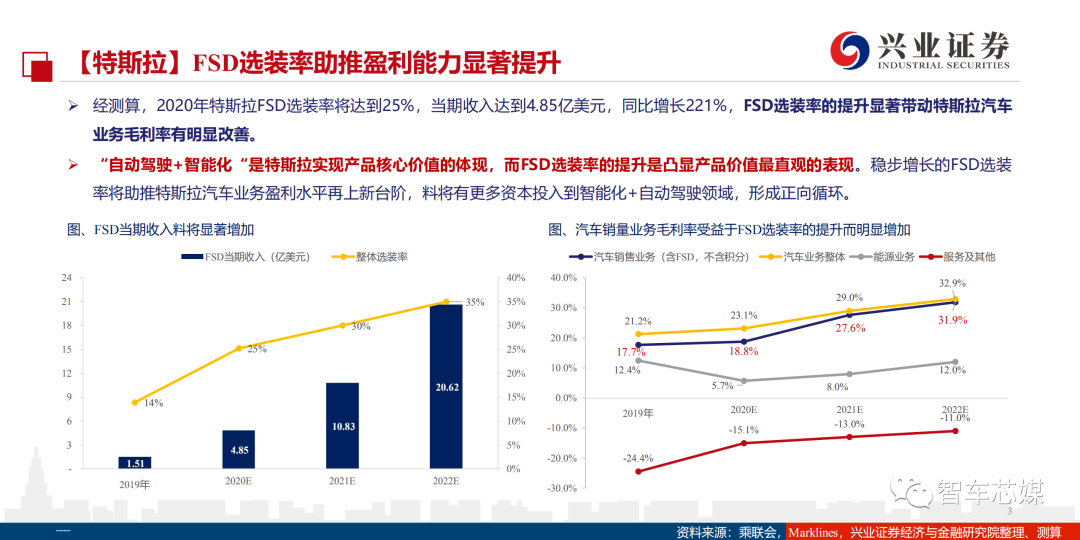

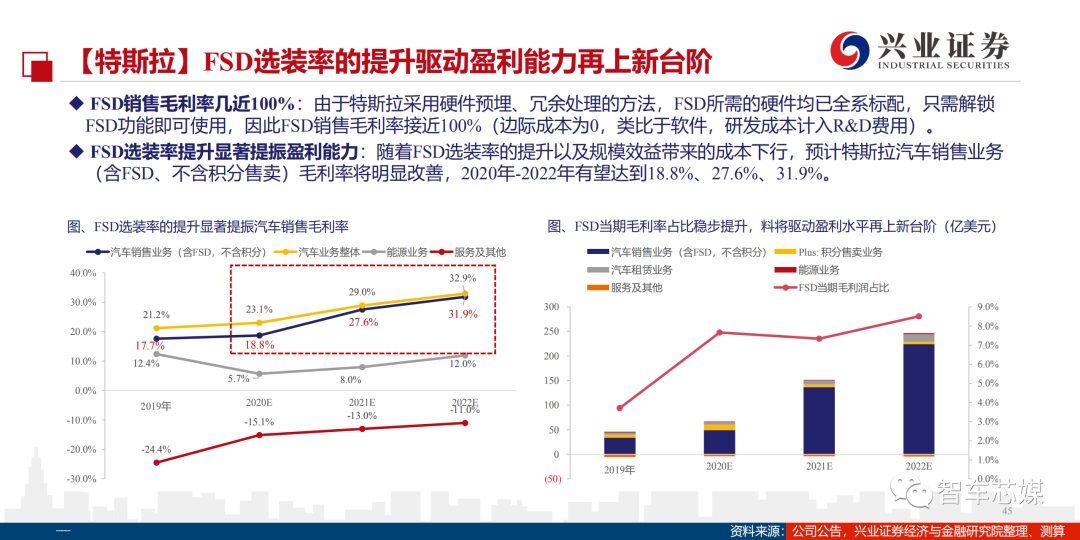

Benefiting from the “chip + platform + car manufacturing” business model, Tesla’s FSD revenue for 2020-2022 reached $490 million, $1.08 billion, and $2.06 billion (software, all profits), driving the gross profit margin of sales to new heights, predicted to reach 18.8%, 27.6%, and 31.9% respectively for 2020-2022. At the same time, autonomous driving + intelligence reflects the core product value of Tesla, which will further drive Tesla’s sales volume; the increase in vehicle ownership will lead to the accumulation of driving data related to autonomous driving, facilitating the refinement and upgrade of FSD features; this virtuous cycle will help Tesla establish a leading competitive position.

-

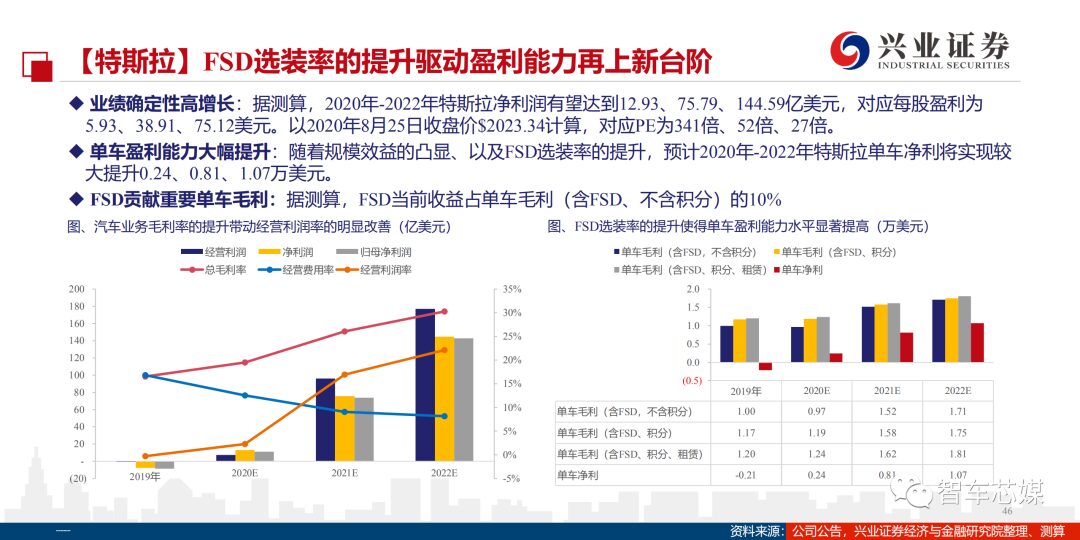

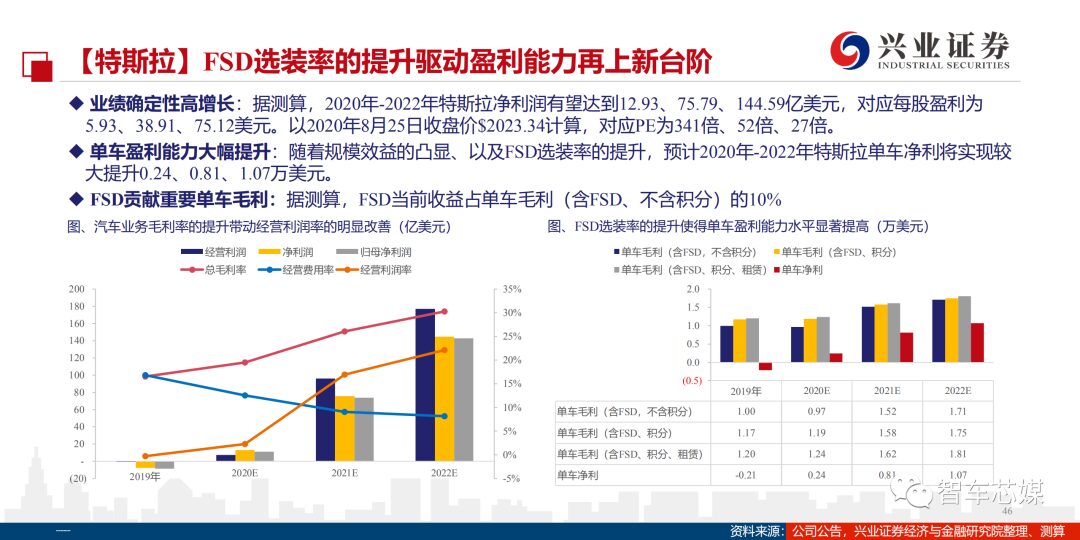

With the rapid release of overall vehicle production capacity, increased consumer acceptance of autonomous driving, and continuous breakthroughs in innovative value concepts, Tesla’s production and sales are expected to enter an explosive growth phase. It is predicted that Tesla’s net profit for 2020-2022 will reach $1.293 billion, $7.579 billion, and $14.459 billion, corresponding to earnings per share of $1.19, $7.93, and $15.32. Based on the closing price of $475.05 on August 31, 2020, the corresponding PE ratios are 399x, 60x, and 32x.

FSD Option Rate Significantly Boosts Profitability

-

According to estimates, Tesla’s FSD option rate will reach 25% in 2020, with revenue reaching $485 million, a year-on-year increase of 221%. The increase in FSD option rate significantly boosts the gross profit margin of Tesla’s automotive business.

-

“Autonomous driving + intelligence” embodies Tesla’s realization of core product value, and the increase in FSD option rate is the most intuitive representation of product value. The steadily growing FSD option rate will propel Tesla’s automotive business profitability to new heights, and more capital is expected to flow into the fields of intelligence + autonomous driving, forming a positive cycle.

Pioneers of Intelligence + Electrification

-

Million Deliveries Expected: It is predicted that Tesla’s global deliveries will reach 510,000, 900,000, and 1.3 million units for 2020-2022, mainly due to the continued increase in production and sales of the Model 3 and Model Y, as well as the ramp-up of other models like Cybertruck and Semi, further expanding market space.

-

Sales Growth + FSD Boost Dual Drivers: The continuous high growth in overall vehicle sales combined with the steady increase in FSD option rate is expected to result in Tesla’s automotive business revenue reaching $28.6 billion, $51.9 billion, and $74.2 billion for 2020-2022, with a three-year compound growth rate of 53%. The revenue from FSD during this period will account for 7.7%, 7.3%, and 8.5% of total automotive business revenue.

-

FSD Option Boosts Gross Profit Per Vehicle (Including FSD, Excluding Credits): From 2019 to 2022, the gross profit per vehicle is projected to be $10,000, $9,700, $15,200, and $17,100, with the contribution of FSD revenue to gross profit accounting for 4%/10%/8%/9%.

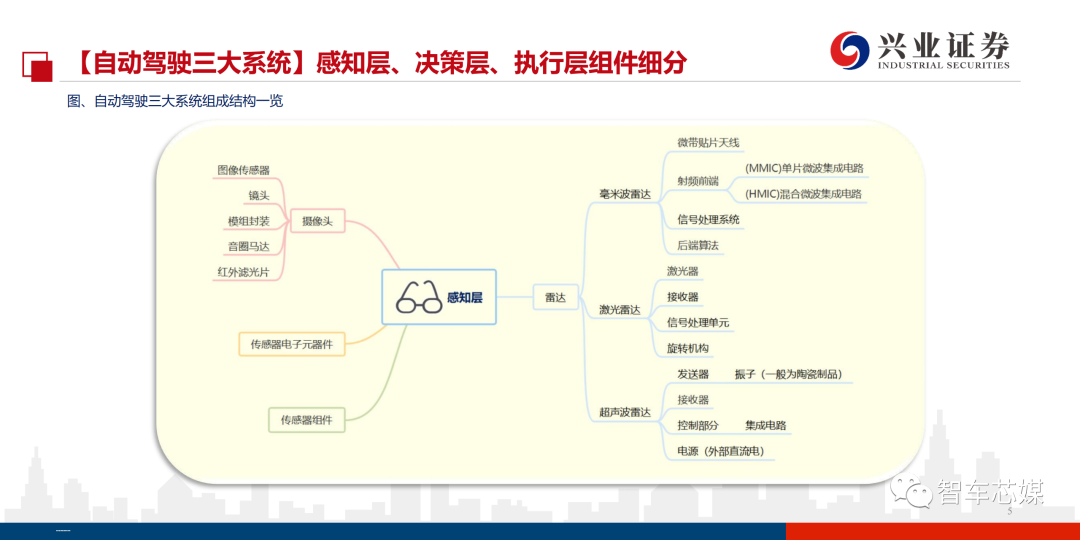

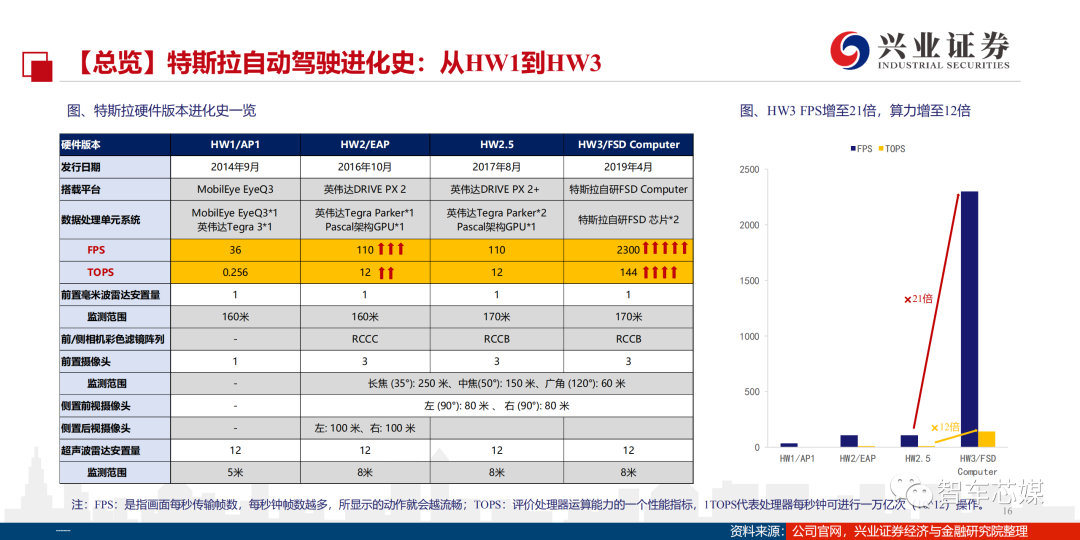

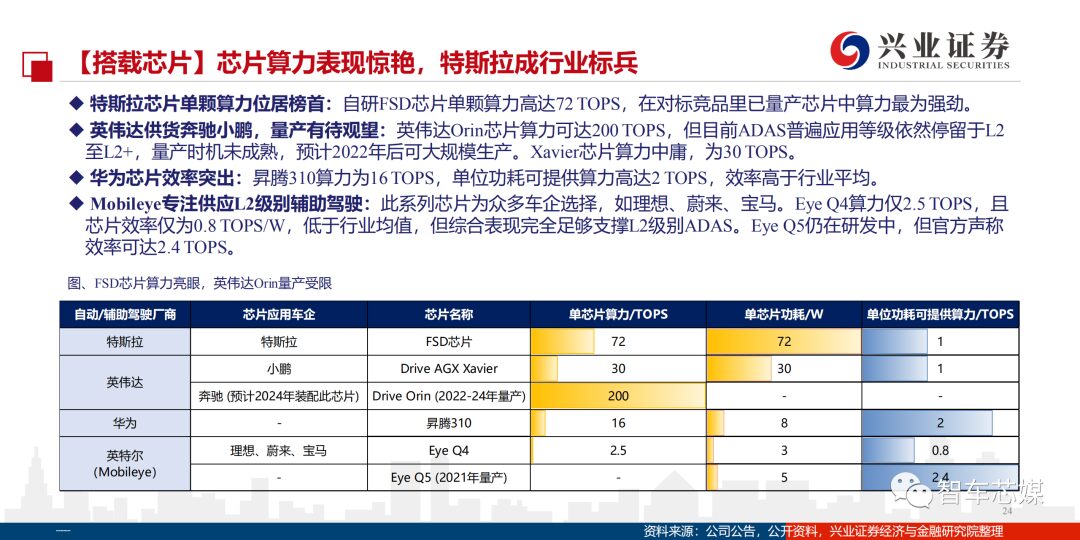

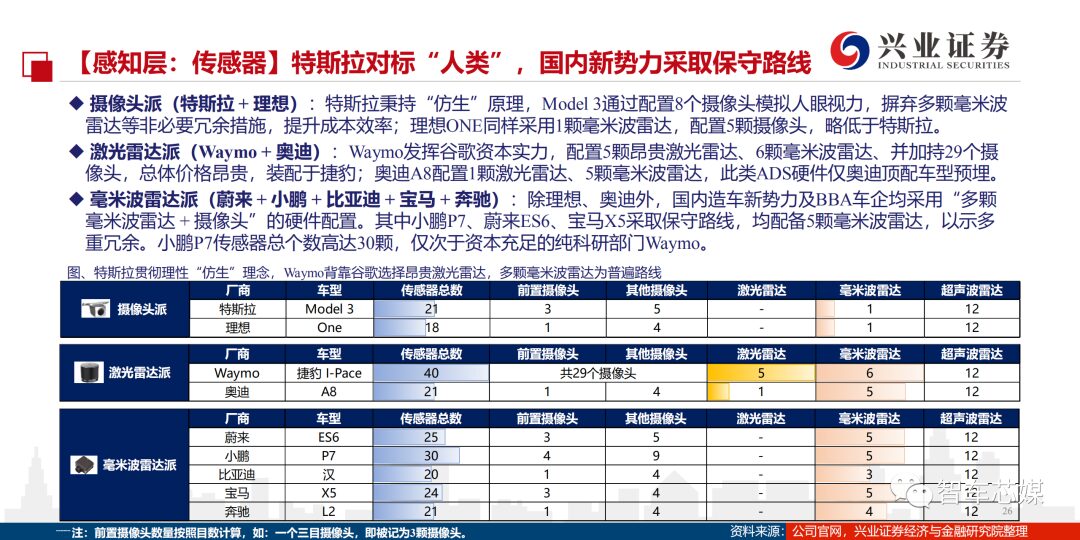

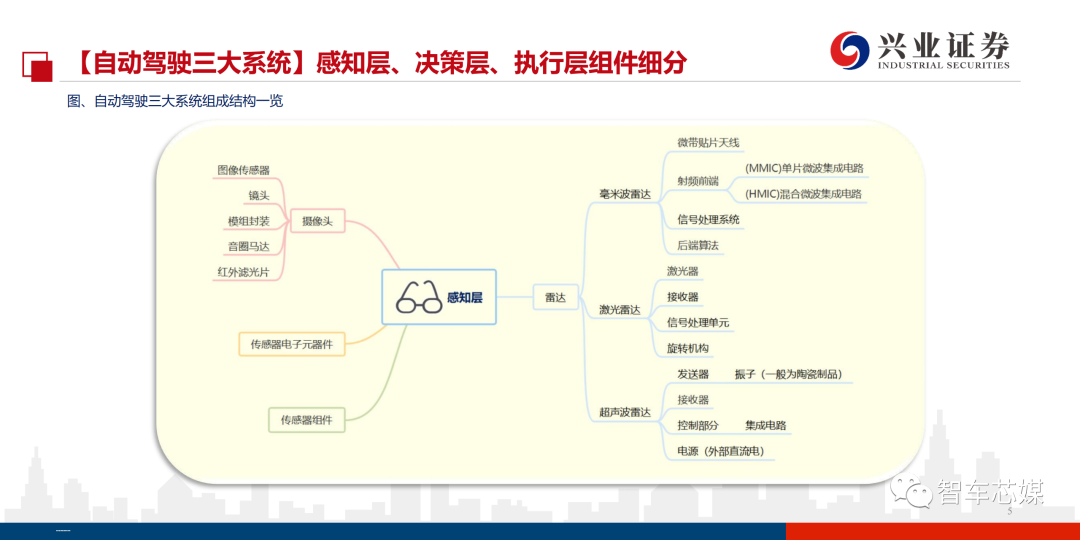

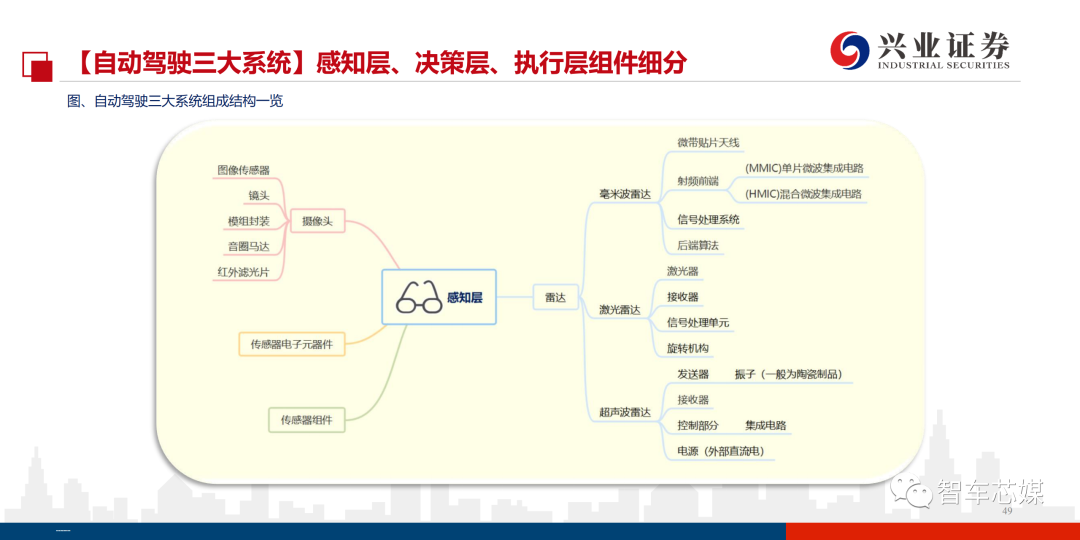

Self-Designed Software Chips and Vertical Procurement of Sensor Components

-

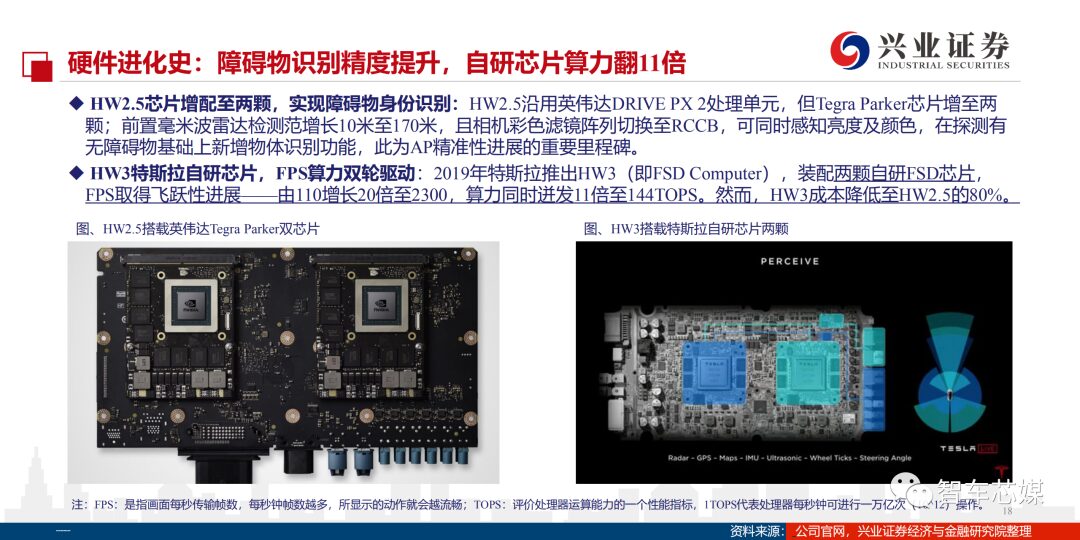

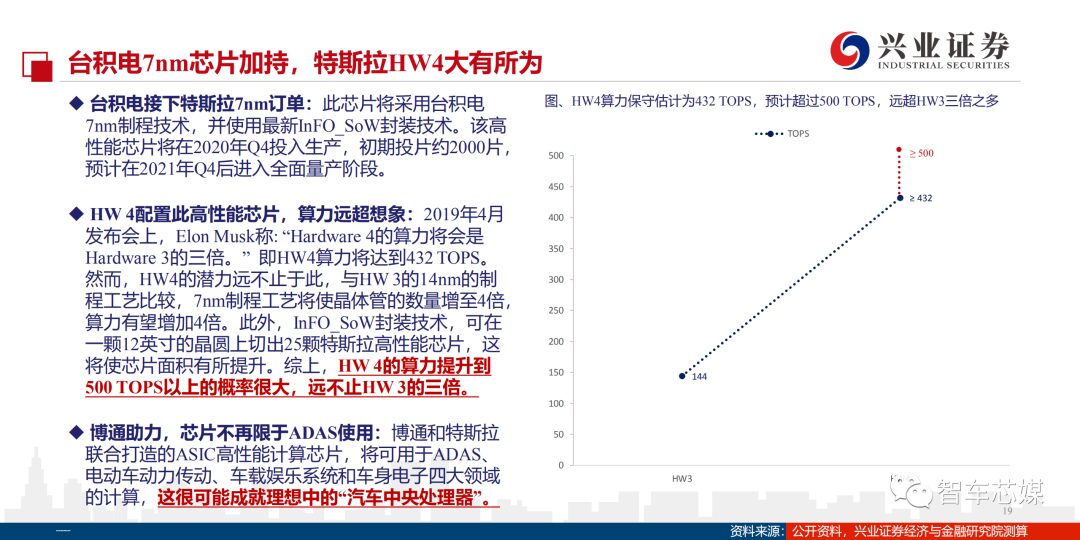

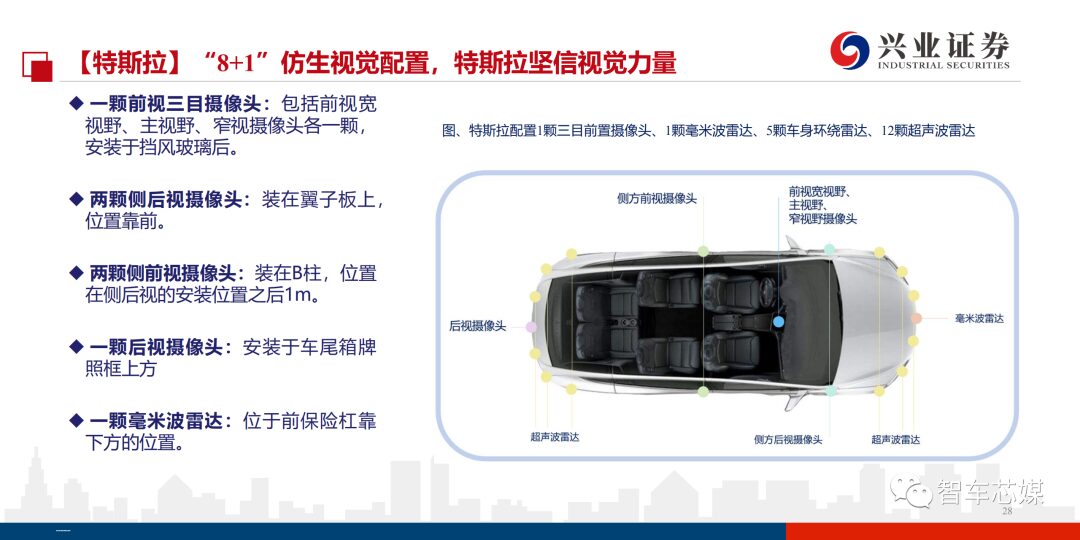

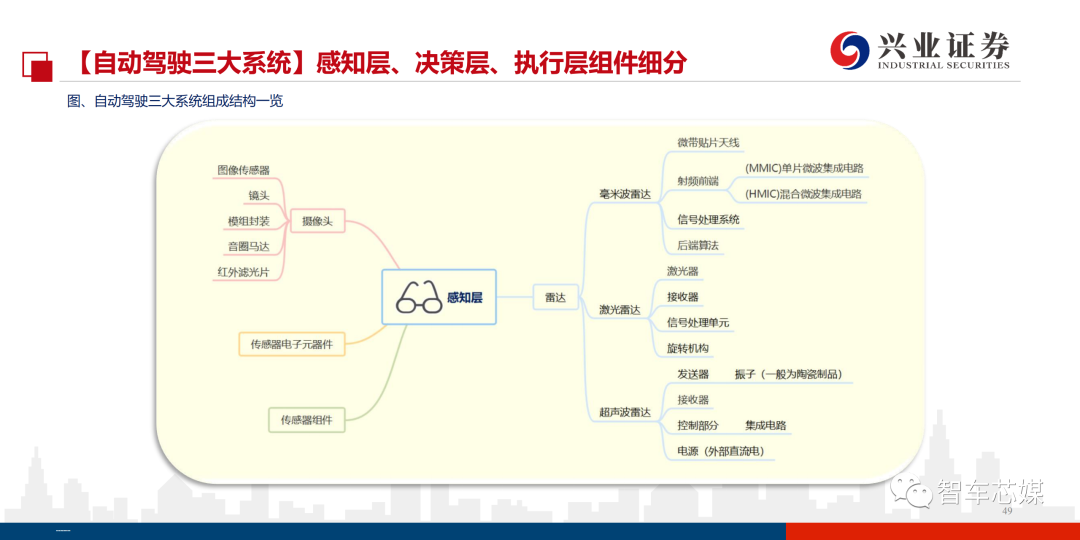

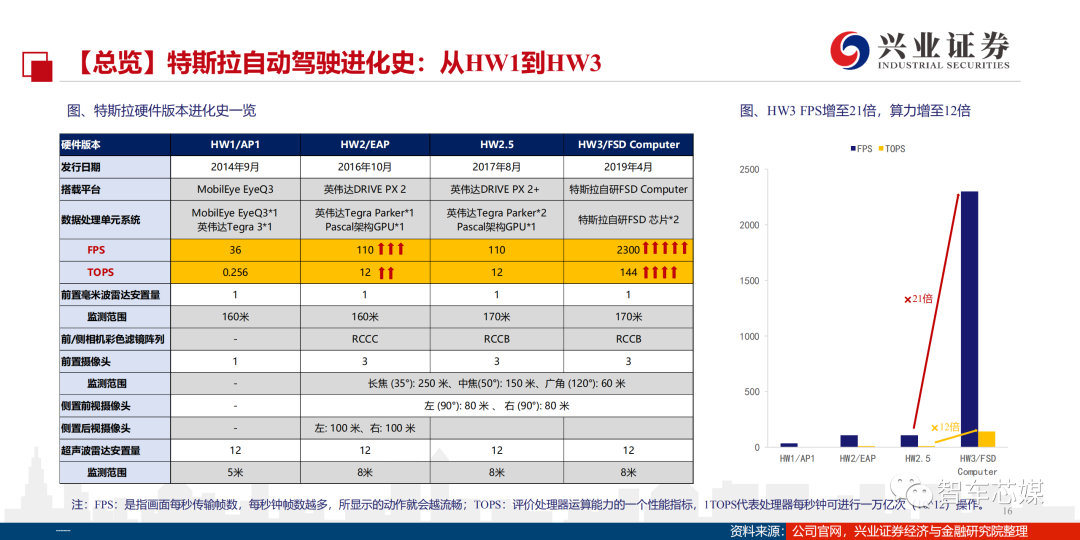

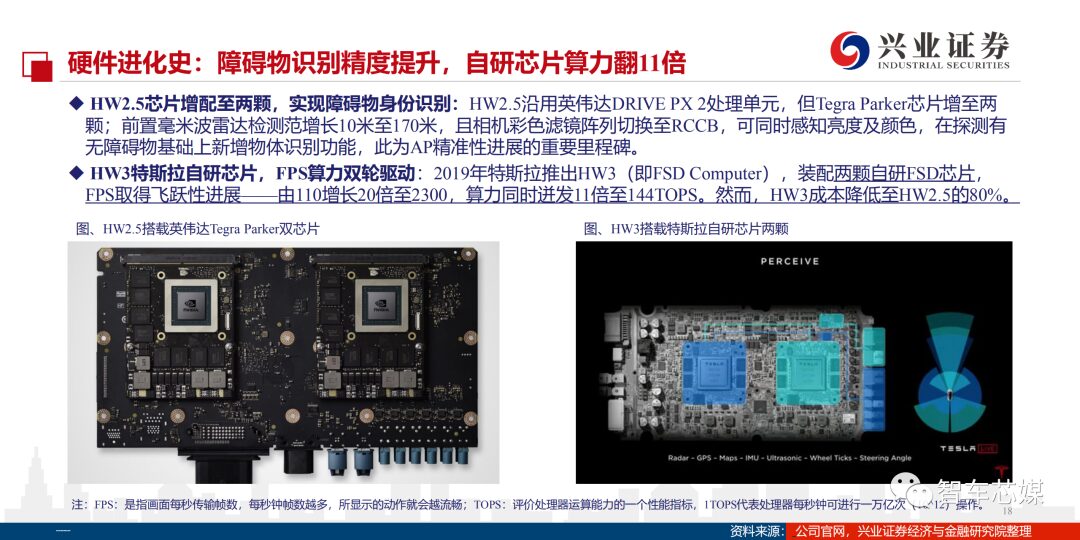

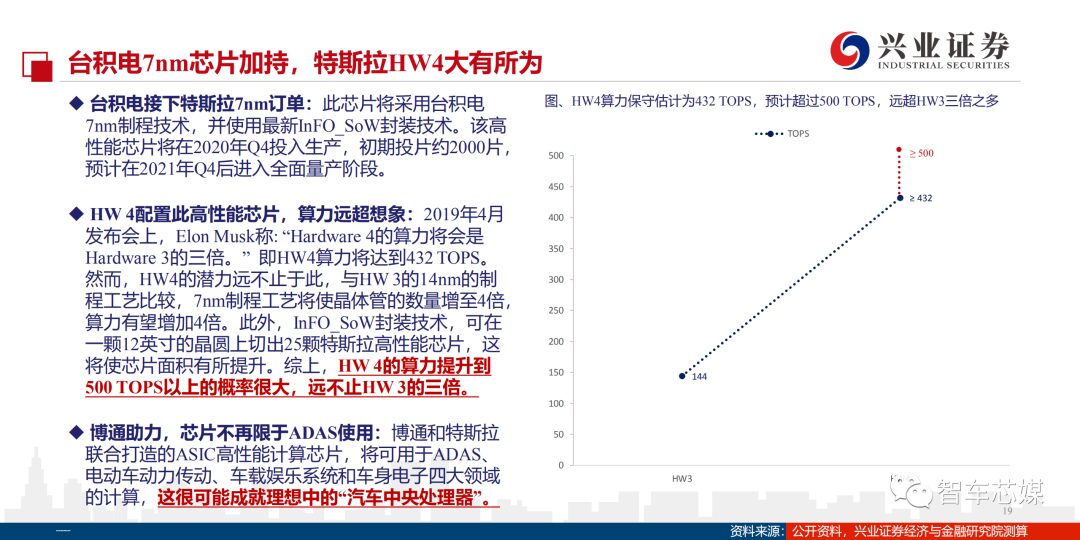

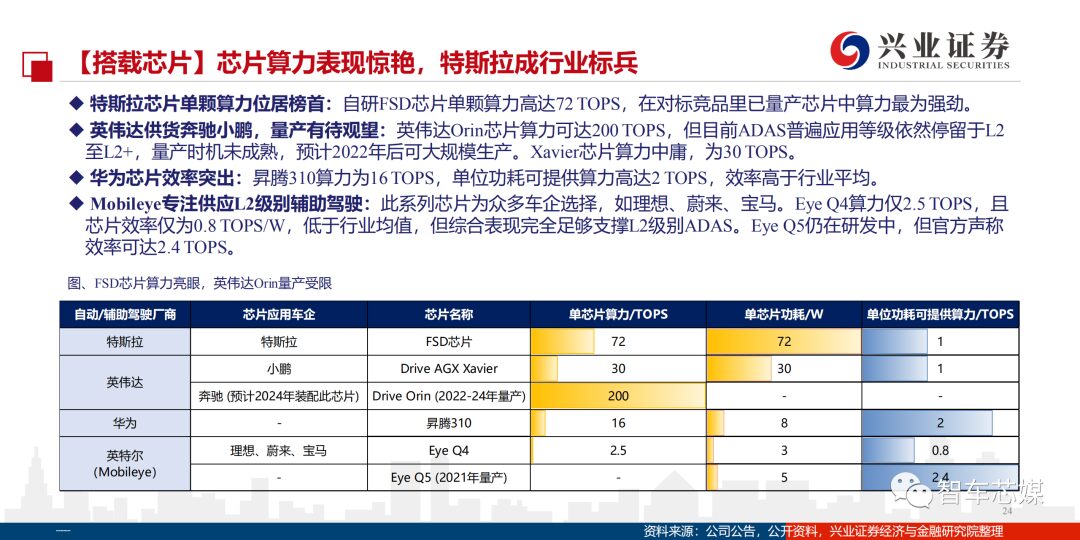

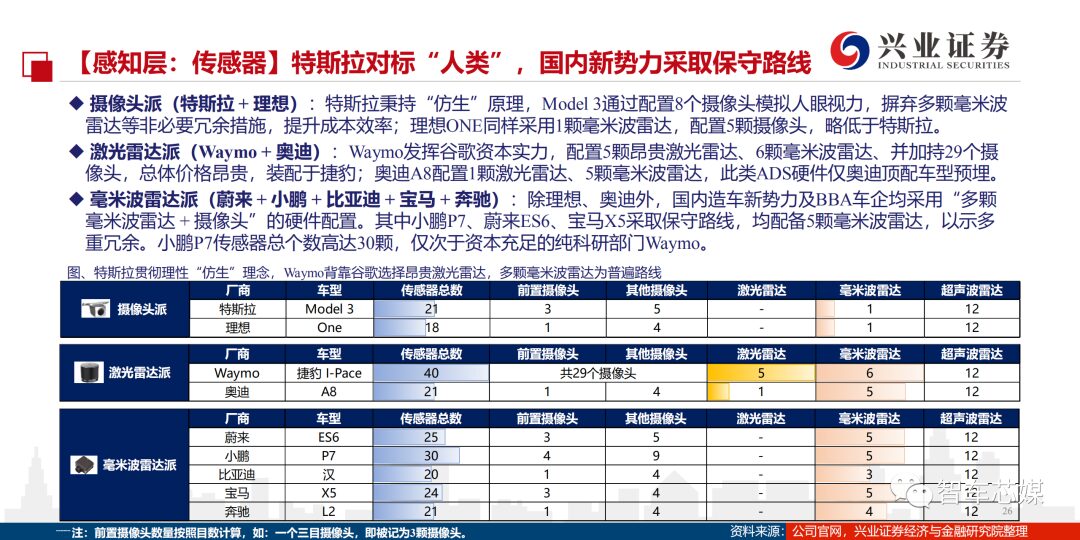

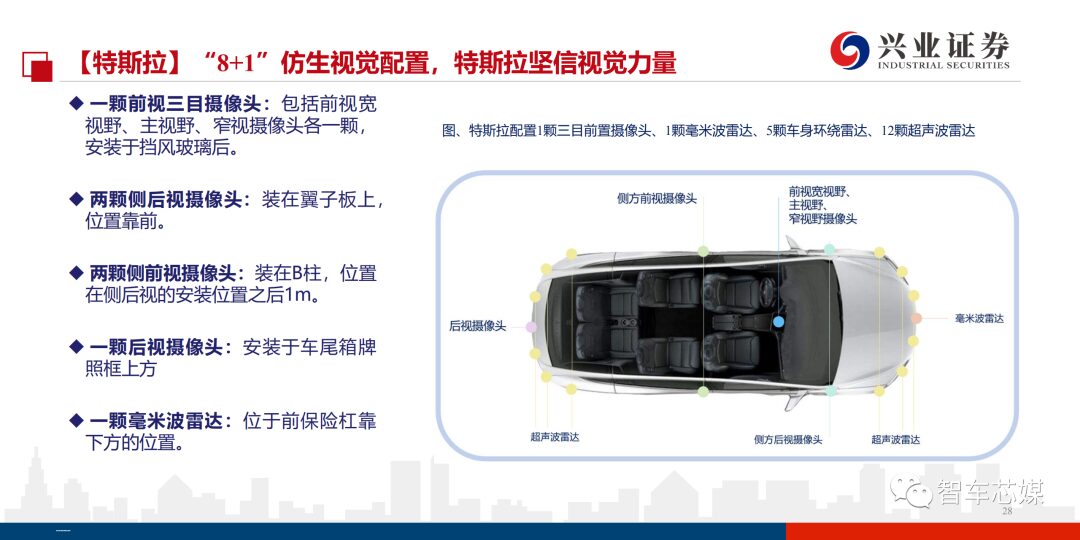

Tesla grasps core technology: In April 2019, Tesla officially launched its fully self-developed chip, paired with its own software system, which can essentially achieve full autonomous driving. The chip + software system is the crown jewel of ADAS (Advanced Driver Assistance Systems), allowing Tesla to break free from the constraints of traditional chip leaders, adhering to the principle of first principles, and self-developing and designing to master core technology.

-

Large Space for Domestic Replacement of Sensor Components: Tesla’s original suppliers for the three-eye camera and millimeter-wave radar were Mobileye and Valeo. Lianchuang Electronics has now entered Tesla’s supply chain as a secondary supplier of vehicle-mounted cameras, with some lenses being the main supply. Sunny Optical, OFILM, and others have a deep research accumulation in the field of vehicle-mounted cameras; Huayu Automotive and Desay SV’s millimeter-wave radar have been equipped with various models from SAIC, Xiaopeng, Geely, etc., and are expected to accelerate penetration into Tesla’s supply chain.

Welcome to all angel round enterprises in the automotive industry chain (including the electrification industry chain)(Friendly connections with 500 automotive investment institutions, including top-tier organizations; some high-quality projects will be selected for themed roadshows to existing institutions);There is a communication group for leaders of science and technology innovation companies, and numerous groups related to the automotive industry, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, vehicle networking, etc. To join, please scan the administrator’s WeChat (Please indicate your company name)