In the field of AIOT and the Internet of Things, there are many niche display technologies that are popular in the market, with the three main types being: PMOLED, silicon-based OLED, and e-paper. These niche display technologies are widely used in various downstream fields such as healthcare, home applications, retail, consumer electronics, automotive control, wearable products, and security products.

The PMOLED display panel is a type of OLED panel that has self-illuminating properties. Compared to traditional small and medium-sized LCD panels, it has a thinner panel thickness, which can be as thin as 0.2mm, and offers higher picture quality with characteristics such as high brightness and high contrast, similar to STN-LCD products in the LCD display field.

The e-paper display module is a reflective display solution that does not emit light by itself and does not require a backlight. It achieves display through the reflection of ambient light, providing a display effect similar to traditional paper. The e-paper display module can continue to display images even after the power source is removed; it only consumes power when changing the image, making it extremely low in power consumption, suitable for downstream fields that are highly sensitive to power consumption.

The silicon-based OLED display is an advanced OLED device made with single-crystal silicon as the integrated drive backplane. Compared to traditional display technologies, silicon-based OLED technology features high resolution, small size, high contrast, low power consumption, and stable performance. It is mainly used in near-eye displays and projection display systems and is expected to become a primary solution for next-generation smart wearable displays like VR and AR in the 5G communication era.

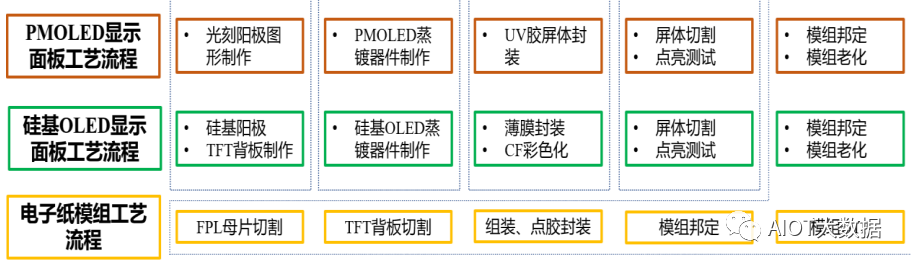

1. PMOLED Display Panel Process Flow

The specific process flow for PMOLED display panels can be divided into five parts: backplane process (photolithography), deposition process, packaging process, panel process, and module process:

(1) Photolithography: The drive backplane is made using photolithography, which mainly includes preparing the ITO layer (indium tin oxide film, producing ITO conductive glass), molybdenum-aluminum-molybdenum layer, PI layer, and RIB layer on the substrate.

(2) Deposition process: This mainly includes substrate cleaning, organic material deposition, and cathode aluminum layer deposition.

(3) Packaging process: Starting from the feeding of the packaging sheet, it goes through cleaning, drying sheet attachment, dispensing, and UV glue (Ultraviolet Rays, invisible glue) bonding with the deposited materials. After baking and inspection, large panel sheets are obtained.

(4) Panel process: This mainly includes cutting and cleaning the large panel sheets, as well as electrical testing and appearance inspection. After passing inspection, they are stored.

(5) Module process: After processes such as IC bonding, FPC bonding, gluing, and surface mounting, it undergoes light-shielding attachment, appearance inspection, and finished product quality inspection before being packaged and stored.

2. Silicon-Based OLED Display Process Flow

The specific process flow for silicon-based OLED displays can also be divided into five parts: backplane process (drive backplane production), deposition process, packaging process, panel process, and module process:

(1) Drive backplane production: The CMOS backplane required for silicon-based OLED is made using semiconductor processes, followed by the production of the anode reflection layer and anode confinement layer using physical vapor deposition, chemical vapor deposition, photolithography, and etching processes.

(2) Deposition process: This mainly includes substrate cleaning, organic material deposition, and cathode material deposition.

(3) Packaging process: First, the silicon-based OLED thin film packaging is made using PECVD and ALD equipment; then organic color filter materials are spin-coated using photolithography to produce the three primary colors (R, G, B) needed for silicon-based OLED, completing the colorization process.

(4) Panel process: This mainly includes cutting and cleaning the large panel sheets, as well as electrical testing and appearance inspection. After passing inspection, they are stored.

(5) Module process: Through cleaning, dispensing bonding, cutting, appearance inspection, bonding, gluing, appearance inspection, and testing, they are packaged and stored after passing inspection.

3. E-Paper Display Module Process Flow

The production process for e-paper display modules involves the module process link, mainly going through cutting, assembly, gluing, bonding, OTP programming, and other production processes to complete the production of e-paper display modules:

(1) Cutting: Cutting the e-paper film and TFT backplane.

(2) Assembly: Assembling the PS water-resistant film, e-paper film, TFT drive backplane, and other e-paper display materials.

(3) Gluing: Using a dispensing machine to evenly glue the assembled products and curing them.

(4) Bonding: Bonding the drive chip with the e-paper display panel to form a module.

(5) OTP programming: Programming the waveform for the drive IC, followed by final inspection and storage.

Current Market Trends for New Flat Panel Display Technologies

Currently, the main technological routes for new flat panel display devices include OLED, LCD, e-paper, and LED.

1. Characteristics of OLED Display Technology

OLED is a carrier injection type of luminescence. Its principle of luminescence involves organic semiconductor materials and luminescent materials being driven by an electric field, where electrons and holes are injected from the cathode and anode, respectively, forming excitons in the organic luminescent material, which then emit visible light through radiative relaxation. The entire physical process of OLED luminescence involves carrier injection, transport, and exciton diffusion, which can be roughly divided into five stages: carrier injection, carrier migration, exciton generation, photon generation through exciton recombination, and photon escape from the luminescent layer.

As a new generation of flat panel display technology, OLED has many excellent characteristics. OLED display technology offers high picture quality, high brightness, high contrast, and a wide color gamut. Additionally, due to its self-illuminating nature, it does not require a backlight, allowing for a viewing angle of over 160 degrees, and the overall thickness of the module is small with fast response times. The organic material layer naturally has flexibility, making it easy to achieve flexibility with flexible substrates. Based on the all-solid-state module structure and the absence of liquid materials, it has a wide temperature range, especially good low-temperature characteristics, and does not have the issue of liquid materials solidifying in low-temperature states as seen in TFT-LCD.

Overall, OLED features high picture quality (high contrast, high brightness, wide color gamut), no viewing angle limitations, ultra-thin design, fast response times, and a wide working temperature range.

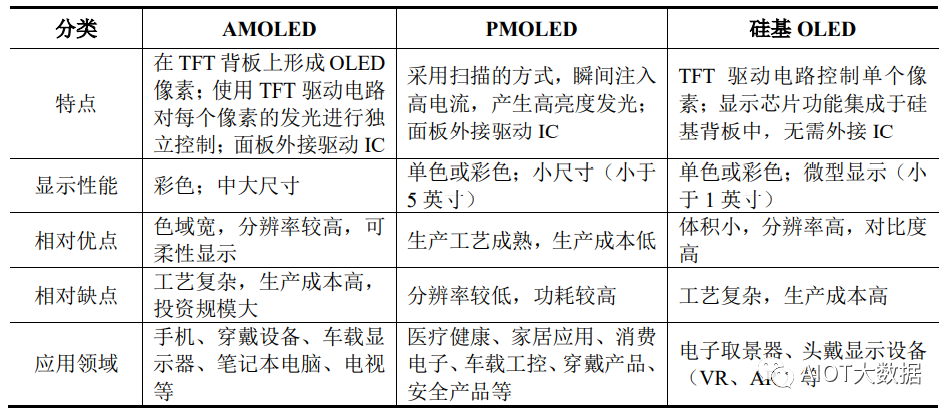

Generally, according to the different backplane drive methods, OLED technology can be divided into active matrix drive backplanes (AMOLED), passive matrix drive backplanes (PMOLED), and integrated drive backplanes (silicon-based OLED). Among them, AMOLED has better display quality and faster response times, mainly targeting large and medium-sized displays with high production volumes, including smartphone screens, tablet displays, and televisions. PMOLED features high brightness and lower production costs, thus it is primarily used in diverse customized products, focusing on small and medium-sized displays for markets such as healthcare, home applications, consumer electronics, automotive control, and security products. Silicon-based OLED is an advanced display technology with high resolution and small size, suitable for micro-display panels and near-eye display scenarios, such as electronic viewfinders and head-mounted displays. The specific comparisons of the three technologies are as follows:

AMOLED technology uses independent thin-film transistor circuits to control each pixel, achieving continuous and independent luminescence of pixels through bonded external drive ICs. AMOLED employs active driving methods, avoiding duty cycle issues, and is not limited by the number of scanning electrodes, making it easy to achieve high resolution, wide color gamut, and flexible displays. The deposition and packaging processes in AMOLED technology are complex, leading to higher overall production costs that require significant investment. The main downstream application areas for AMOLED include smartphones, wearable devices, automotive displays, laptops, and televisions.

PMOLED technology consists of a cathode and anode forming a matrix structure, where a horizontal group of display pixels shares the same type of electrode, and a vertical group shares another electrode of the same type. It lights up the pixels in the array in a scanning manner, with each pixel momentarily glowing at high brightness in a short pulse mode. The production process of PMOLED is mature, effectively lowering manufacturing costs, with current product sizes mostly under 5 inches, primarily focusing on 3 inches and below. The main application areas for PMOLED include healthcare, home applications, consumer electronics, automotive control, wearable products, and security products.

The silicon-based OLED display integrates the OLED device into a single-crystal silicon integrated circuit chip that has integrated video signal processing and pixel driving arrays, eliminating the need for external display drive chips like PMOLED and AMOLED. This integration saves significant space. In addition to possessing the excellent characteristics of OLED devices, silicon-based OLEDs also feature small size, lightweight, high resolution, and high contrast. Due to the complexity of the process and high production costs, silicon-based OLEDs are currently mainly used in near-eye display systems such as electronic viewfinders and head-mounted displays.

2. Characteristics of LCD Display Technology

LCDs do not have self-illuminating properties and are non-self-luminous displays that require a backlight module to provide light sources. The development of the LCD industry has gone through a history of upgrading from monochrome twisted nematic (TN-LCD) to super twisted nematic (STN-LCD), from super twisted nematic with color filters to active thin-film transistor (TFT-LCD) displays.

TFT-LCDs place the liquid crystal box between two parallel glass substrates, with TFTs set on the lower glass substrate and color filters on the upper substrate. The rotation direction of the liquid crystal molecules is controlled by the signals and voltage changes from the TFT, affecting the polarization light emitted from each pixel, ultimately achieving the display effect. TFT-LCD display technology has the advantages of being lightweight, low cost, and mature stable technology, with broad downstream applications.

3. Characteristics of E-Paper Display Technology

E-paper uses electrophoretic electronic ink technology. Its basic composition involves coating electronic ink onto a layer of plastic film, which is then bonded to TFT circuits, controlled by drive ICs to form pixel patterns. It consists of two transparent plates with opposite polarities, containing millions of microcapsules or microcups, each filled with charged electrophoretic particles suspended in a transparent liquid. When powered, an electric field controls the movement of the charged electrophoretic particles to produce images. Since the electrophoretic particles remain stable when the image is static, power is only needed when the displayed content changes, leading to extremely low energy consumption. E-paper does not emit light by itself; it reflects natural light to form images, offering a reading experience similar to paper. E-paper is widely used in e-readers due to these characteristics, and its application in electronic price tags in retail has seen significant growth, with potential expansion into areas like digital currency and smart transportation in the future.

4. Characteristics of LED Display Technology

Traditional LED displays include indoor and outdoor LED screens, small pitch LED displays, mainly focusing on large display fields such as outdoor media, advertising, sports venues, public transportation, large theaters, exhibitions, and concerts. New high-resolution LED display technologies mainly include MiniLED and MicroLED, which differ primarily in LED size. MiniLED refers to LED devices measuring around 100 micrometers, representing a transitional product from small pitch LED to MicroLED. Currently, MiniLED technology has entered the early mass production stage, primarily applied in MiniLED displays and MiniLED backlighting, with applications mainly in large display screens like commercial advertising displays and large outdoor displays, with future prospects for entering the 4K/8K large-size LED TV market. MicroLED further reduces particle size to around 10 micrometers. MicroLED does not require a backlight module, offering high luminous efficiency and low power consumption, while also possessing high resolution, high brightness, and high contrast characteristics. The market demand and product technology for MicroLED are gradually starting, but there are still technical challenges to overcome, including mass transfer, and it remains in the technology reserve stage without achieving large-scale production.

The PMOLED industry has matured, with the market size expected to steadily increase in the long term.

(1) As the origin of OLED technology, PMOLED technology has become increasingly mature.

From a technological process comparison, PMOLED, which belongs to the OLED industry, has a simple structure and easy processing, thus the development and mass production of OLED technology and products have mainly started with PMOLED. The first commercialization of OLED was achieved in 1997 when Pioneer Electronics used a PMOLED display panel with a resolution of 256*64 for car audio panels. After more than twenty years of industrial development, major PMOLED display panel manufacturers can maintain high yield rates in continuous production, and PMOLED production technology has become mature and stable.

The development of OLED technology in China also began with PMOLED technology. Tsinghua University and other universities and research institutions started researching OLED technology in the 1990s. Among them, in 2001, Beijing Visionox Technology Co., Ltd. collaborated with Tsinghua University to establish the first OLED pilot line in mainland China, and in 2003 began small-scale production of monochrome OLED products for the instrumentation market, becoming the first company in mainland China capable of producing and selling OLED products. In October 2008, the first PMOLED production line, also the first OLED production line in mainland China, achieved mass production in Kunshan by Visionox, marking the gradual maturity of PMOLED technology in China.

PMOLED products are mostly small-sized panels, and PMOLED technology has gradually matured, with stable market development and no demand for continuous upgrading of production lines as seen in the AMOLED industry. As a latecomer in the OLED industry, China still lags behind foreign companies in the upstream manufacturing equipment and organic materials, and is even monopolized by foreign companies. However, after over ten years of development, the panel manufacturing segment of China’s OLED, especially PMOLED, has gradually matured, with domestic PMOLED manufacturers leading the industry in terms of product stability, brightness, and other technical indicators.

(2) Chinese PMOLED panel companies are gradually occupying the global market.

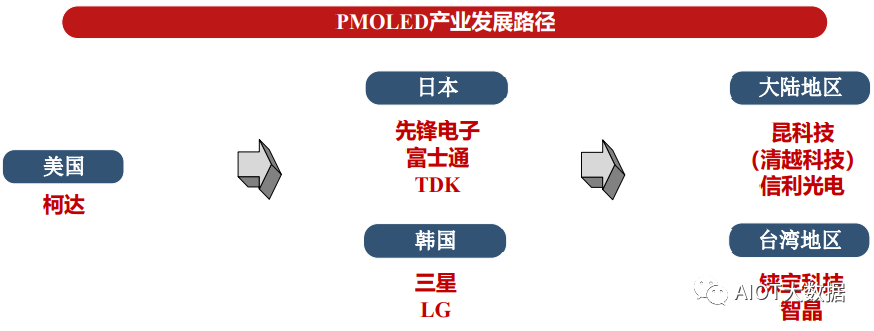

The global PMOLED panel industry has experienced a process of “originating in the US, developing in Japan and South Korea, and gaining momentum in Taiwan and mainland China.” The early development of the OLED industry coincided with the development of the PMOLED industry, which was first successfully developed in the US, and then industrialized by Japanese and Korean manufacturers.

In 1997, Pioneer Electronics achieved PMOLED industrialization and successfully developed full-color PMOLED display panels in 1999; in 2000, Motorola’s mobile phones adopted Pioneer Electronics’ 1.8-inch multi-color PMOLED display panels and achieved commercialization; in 2001, Samsung launched mobile phones equipped with full-color PMOLED display panels; in 2002, Fujitsu configured a 1.0-inch full-color PMOLED display panel produced by Pioneer Electronics on the sub-screen of the F505i mobile phone, leading to a surge in the application of PMOLED in mobile phone sub-screens. Subsequently, Korean manufacturers such as Samsung and LG gradually shifted their investments from the PMOLED industry to the AMOLED industry, while companies represented by Taiwan and mainland China began to gradually occupy market share in the PMOLED industry.

(3) Market demand from various downstream industries will drive further development of PMOLED.

If OLED is likened to LCD, PMOLED is comparable to STN-LCD, while AMOLED is akin to TFT-LCD. PMOLED does not require TFT as a substrate, has low production costs, low mold costs, and mature production processes. It controls gray levels, resolution, and picture quality through current, with products mainly being monochrome and multi-color, primarily focusing on the low-resolution small-size market, suitable for customized product development. AMOLED features a wide color gamut and high resolution, suitable for a wide range of sizes, with the maximum demand for television panels. However, it has complex production processes, high production costs, and high mold costs, mainly used for mass production of standardized products.

Given the aforementioned characteristics of PMOLED, its downstream fields exhibit flexible application scenarios and low industry concentration, forming a stark contrast to the market distribution of AMOLED, which is primarily concentrated in mobile phone panels and television panels.

PMOLED has matured to become a conventional display method, flexibly applicable across various industries, with demand from different industries continuously evolving with the times. Its development coincided with the widespread use of MP3 players, resulting in strong demand for PMOLED products in the downstream market. The explosion of smart wearable products, mainly wristbands, from 2014 to 2018 also promoted industry growth. The COVID-19 pandemic that spread globally in 2020 saw PMOLED’s main growth point reflected in the healthcare sector.

In the future, with the development of 5G/AIoT, the expansion of markets such as home appliances, smart homes, healthcare, and industrial control instruments is expected to drive the small screen market represented by PMOLED to develop again.

1. Analysis of the Home Appliance Market Development

The home appliance market is vast and will continue to develop towards intelligence, refinement, and redesign in the future. Traditional white goods products such as air conditioners and refrigerators, as well as small household appliances like ovens, induction cookers, dishwashers, and air purifiers, all require small-sized display panels during their smart upgrades. Moreover, new smart home devices, including smart lamps, smart locks, and smart speakers, are gradually emerging, also requiring displays to provide interactive information platforms.

PMOLED is mainly used in the display panel market under 3 inches. Compared to STN-LCD technology, it has advantages such as high contrast, high brightness, and wide applicability in working environments (temperature, humidity). Compared to AMOLED, it has cost advantages and mass production advantages in small sizes. Therefore, PMOLED has strong advantages in the application of display panels in home appliances.

For downstream brand manufacturers, applying PMOLED displays only requires a small additional cost but can significantly enhance the external appearance of the product, thereby increasing its added value.

Currently, some home appliance manufacturers have gradually started using PMOLED display panels, including well-known brands such as Samsung, Haier, and Xiaomi. The application fields include air conditioners, refrigerators, ovens, smart speakers, induction cookers, dishwashers, and air purifiers, indicating that the intelligentization and upgrading demands of the home appliance industry will further drive the development of the PMOLED industry.

A. The white goods market shows stable performance, with positive future prospects.

In the air conditioning market, the COVID-19 pandemic has also advanced the upgrade of domestic consumption concepts. Consumers have become significantly more concerned about indoor air health, leading to increased popularity of health air conditioners with functions such as fresh air, purification, dust prevention, and high-temperature sterilization. Beyond health factors, consumer focus on product comfort and smart features is also increasing, with air conditioning products rapidly developing towards healthier and smarter directions. Overall, under the stable recovery of the domestic economy and real estate market, new demand in the air conditioning industry will continue to be maintained.

According to statistics and forecasts from Aowei Cloud Network, the sales volume of air conditioners in China in 2020 and 2021 was 51.34 million units and 59.05 million units, respectively, with sales revenue reaching 154.5 billion yuan and 195.3 billion yuan. In terms of the refrigerator market, as a core appliance for food storage and management, the demand for refrigerators is even more rigid. In a complex external environment, the stability of the refrigerator industry is relatively strong. According to Aowei Cloud Network statistics, the retail revenue of refrigerators in China reached 90 billion yuan in 2020, with sales volume reaching 32.56 million units, and retail revenue is expected to grow by 2.3% and retail volume by 2.0% in 2021. Furthermore, the global refrigerator production capacity has become significantly reliant on the Chinese market, with customs data showing that refrigerator exports grew by 35.6% year-on-year in 2020. It is expected that the Chinese refrigerator market will continue to maintain a high ownership status. Despite the potential for low-price competition and short-term price declines, this will help quickly release market demand, and in the long term, the refrigerator industry will continue to develop steadily.

B. Online sales of small appliances increase, with cross-border e-commerce driving exports.

Due to the impact of the COVID-19 pandemic, home quarantine has led to a high demand for cooking and cleaning small appliances, with online sales showing a strong performance, while offline channels have been significantly impacted due to reduced foot traffic. Overall, small appliances show varied performance across different channels, presenting a differentiated trend. According to Aowei Cloud Network’s total channel push data, the total retail revenue of 11 categories of kitchen small appliances in 2020 was 56.63 billion yuan, a year-on-year decline of 11.3%, with online retail revenue of 36.60 billion yuan, a year-on-year increase of 9.4%.

Moreover, cross-border e-commerce has gradually become an important means of foreign trade, with broad future market space. In 2020, driven by the pandemic, China’s cross-border exports experienced accelerated development, with domestic small appliance brands also ramping up their layouts. Currently, the R&D innovation capabilities of domestic home appliance brands have improved, and in the future, they are expected to enjoy the dividends of rapid growth in overseas online channels due to their increasingly competitive products.

C. The global smart home market is experiencing strong growth.

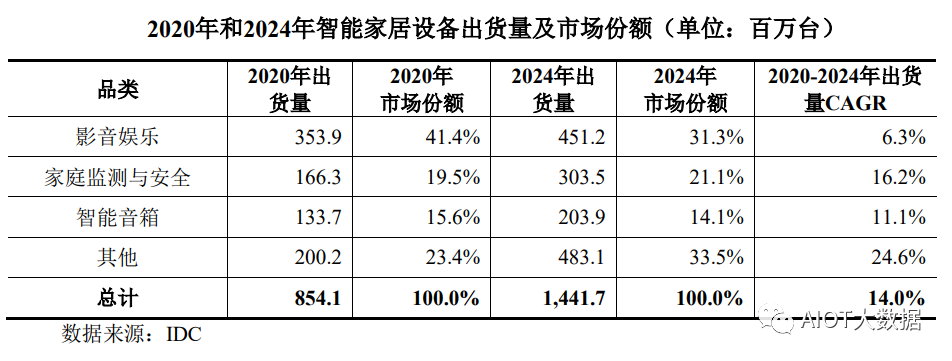

According to IDC forecasts, despite the severe impact of the pandemic on the global economy in 2020, the smart home market still maintained considerable growth momentum, and in the future, as consumption focuses shift from vacations, dining out, and other areas, the smart home market will further develop. It is expected that the global shipment volume of smart home devices will reach 854 million units in 2020, a year-on-year increase of 4.1%, and will reach 1.441 billion units by 2024, with a compound annual growth rate of 14% from 2020 to 2024. Among them, smart home devices for audio and video entertainment, including smart TVs and interactive network TVs, are expected to see shipment volumes of 354 million units and 451 million units in 2020 and 2024, respectively; smart home devices for monitoring and security, including smart cameras, smart doorbells, and locks, are expected to see shipment volumes of 166 million units and 304 million units in 2020 and 2024, respectively; smart speakers, as widely recognized smart home products, are expected to see shipment volumes of 134 million units and 204 million units in 2020 and 2024, respectively, with a compound annual growth rate of 11.1% from 2020 to 2024.

2. Analysis of the Healthcare Market Development

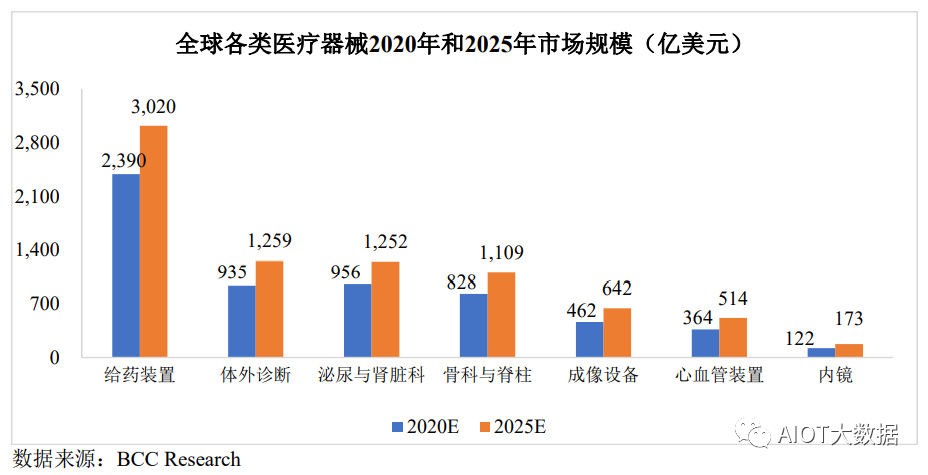

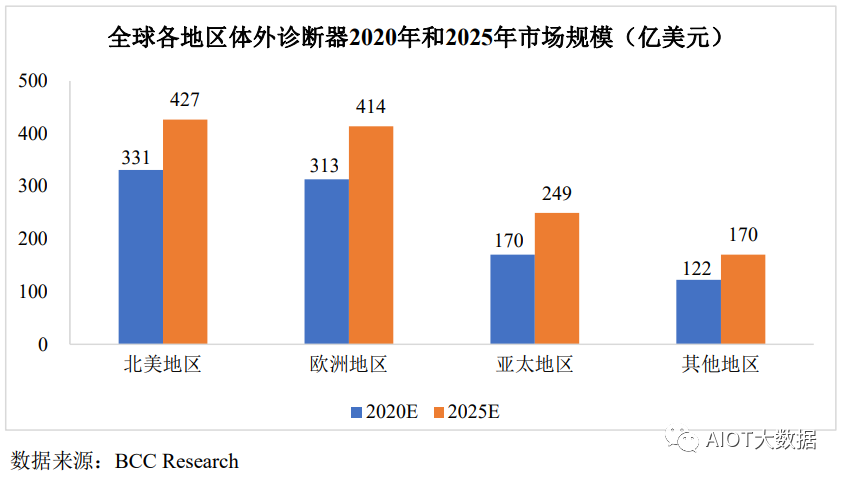

With the continuous growth of the population, the gradual increase in the aging population globally, and the economic growth in developing countries, the global medical device market is expected to continue to grow in the long term. Medical device products are diverse and can be categorized based on end customers and usage scenarios, including drug delivery devices, in vitro diagnostics, imaging instruments, orthopedic medical devices, and more. According to a research report by BCC Research, the global medical device market is expected to reach $796.911 billion by 2025.

Common household medical devices belong to the point-of-care testing (POCT) devices within in vitro diagnostics, including electronic pulse oximeters, electronic blood pressure monitors, oxygen concentrators, and various physiotherapy and rehabilitation equipment. The display function of household medical devices focuses on quickly presenting data, and currently, PMOLED displays have been widely used in household medical devices due to their simple panel structure, easy processing, fast response times, and low costs. Therefore, the development of the medical device industry with information display needs will drive the continuous demand for PMOLED display products.

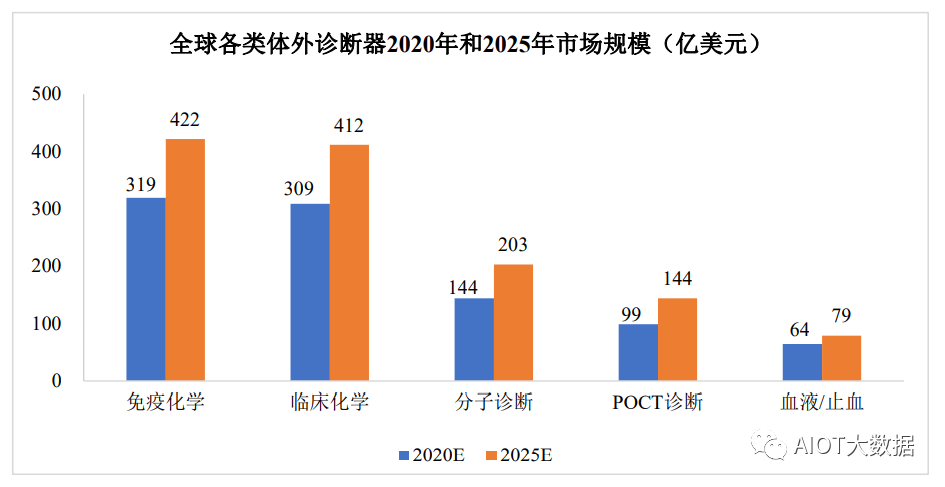

According to a research report by BCC Research, the global in vitro diagnostics market has entered a stage of steady development, with a projected growth rate of around 6%. The growth rate for POCT devices is slightly higher than the overall in vitro diagnostics market, around 7.8%. It is expected that the global in vitro diagnostics market will reach $125.921 billion by 2025, with the POCT device market size expected to be approximately $14.373 billion.

Currently, the Asia-Pacific region has become the fastest-growing medical device market globally, with the medical device market expected to benefit from the increase in per capita healthcare spending in China due to consumption upgrades and the aging population. Strong policies such as the Healthy China initiative for 2030 will also continue to drive the development of the medical device industry. According to BCC Research statistics and forecasts, the Asia-Pacific medical device market is expected to reach $24.916 billion by 2025.

3. Analysis of the Industrial Control Instrument Market Development

Industrial control instruments are diverse, with fewer individual products, and operate in complex environments where functional displays do not need to present vivid colors. PMOLED has advantages such as customization, low production costs, and wide applicability in working environments (temperature, humidity), making it highly suitable for the data display needs of industrial control instruments. In contrast, AMOLED technology has high customization mold costs, is colorful but expensive; LCD technology, based on the principle of backlighting rather than self-illumination, makes it difficult to recognize display content in bright environments and at side angles, failing to meet the needs of industrial control displays well. Therefore, PMOLED products have strong advantages in terms of environmental suitability, reading convenience, cost control, and mass production, and are expected to occupy a more important position in the industrial control display field in the future.

With the rapid development of “Industry 4.0” and “Industrial Internet,” the demand for display products in industrial instruments and equipment manufacturing continues to expand, leading to rapid development in industrial control display products. Instruments and meters can be divided into general-purpose instruments and specialized instruments, with industrial automatic control system devices belonging to general-purpose instruments. According to statistics and forecasts by the Forward Industry Research Institute, the market size of the industrial automatic control system device industry in China is expected to reach 188.6 billion yuan in 2020, and with the steady advancement of China Manufacturing 2025, it is expected to reach 234.7 billion yuan by 2025.

The e-paper display technology is expanding into new application fields.

The biggest difference between e-paper and other major display technologies is that e-paper is a bistable, reflective display technology. Bistable means that even when the power source is removed, the image on the e-paper display remains visible and does not disappear. It only consumes power when changing the image. Reflective display means that it does not emit light by itself and does not require a backlight; it uses ambient light to illuminate the e-paper display screen, refracting light to the viewer’s eyes, similar to the visibility principle of traditional paper or objects in daily life. Therefore, the brighter the ambient light, the clearer the e-paper becomes.

Currently, the downstream application fields of e-paper include e-readers, retail signage, bulletin boards, electronic name badges, and electronic door signs, with application scenarios spanning consumer markets, new retail, smart cities, smart logistics, and smart healthcare.

(1) E-Readers

The e-reader market remains the primary application field for e-paper technology. The display effect of e-paper closely resembles real paper, with no backlight or active lighting design, providing certain eye protection attributes. Furthermore, e-book readers, due to their portability, long standby times, focused reading experience, and advantages not found in other terminals, fulfill the deep reading needs of many users and are widely accepted by consumers.

Currently, mainstream e-book readers are mostly under 10 inches, and it is expected that future e-book readers will continue to move towards larger screen sizes. At the same time, with the maturity of color e-paper technology, e-paper readers with richer colors will gradually be introduced to the market.

The education market is an important development direction for future e-readers. With the rise of online education, the visual levels of young people are continuously deteriorating, and e-paper, which emphasizes eye protection, is an excellent solution for educational digitization. In particular, the improvement of color e-paper technology allows e-paper to present both text and images, enhancing reading enjoyment. E-paper has advantages in protecting vision in the education market, and its ability to store vast amounts of information compared to paper books can significantly reduce the use of paper books, helping to lighten students’ backpacks and reduce paper waste.

(2) Electronic Price Tags

Based on the energy-saving and eye-protecting display characteristics of e-paper, this technology has gradually expanded from a single e-reading field to diversified fields such as new retail, transportation, education, logistics, and healthcare, especially with the fastest development in retail. With the rise of new retail and smart retail, e-paper display technology can replace paper materials, becoming a solution for electronic shelf labels and promotional advertisements at retail endpoints. Its ultra-low power consumption allows batteries to last for years, and it offers a wide viewing angle of 180 degrees, black and white, multi-color, or full-color options, with excellent readability under various lighting conditions, similar to paper. Moreover, electronic shelf labels enable retailers to quickly and efficiently update label content on shelves in real-time, achieving real-time price changes, product reconfiguration, and quick arrangement of promotional items, reducing routine costs and providing retailers with the ability to update prices in real-time, effectively reducing the occurrence of pricing errors.

In countries like Germany, France, and the UK, many chain retailers have already implemented electronic paper as electronic shelf label solutions. According to Global Market Insight data, the market size of electronic price tags exceeded $1 billion in 2019 and is expected to grow at a compound annual growth rate of 10% between 2020 and 2026. It is expected that the global industry shipment volume will reach 600 million units by 2026, with a market capacity exceeding $2 billion. While this technology has been first applied in Europe, many retailers in China are also conducting pilot projects, such as Wumart Supermarket, Yonghui Supermarket, Supermarket Fa, Hema Fresh, Convenience Bee, and other supermarkets and new convenience stores gradually applying electronic price tags in large quantities. With the promotion of smart retail, e-paper technology is expected to see further development in the IoT era, showing good growth potential.

(3) Other Application Markets

In addition to applications in e-readers and electronic price tags, e-paper technology has also given rise to numerous application scenarios in other downstream industries. In the digital finance application field, as early as 2013, China UnionPay launched a visible UnionPay card. It adopted e-paper display technology, loading a display screen and digital keyboard on the surface of the financial IC card, capable of displaying non-sensitive information such as the electronic balance, transaction records, or user points in the bank card. Combined with dynamic token functions, it can also display transaction authentication information. However, due to cost and practicality issues, its promotion has not been ideal. In recent years, with strong state support, digital currency has been gradually promoted, with card-type digital wallets being one important carrier format. Its appearance resembles the early visible UnionPay card, and e-paper, as a low-power display method, is expected to become the display method for card-type digital wallets. In the future, if the product path proves successful and gains widespread market acceptance, it will present broad market prospects.

Moreover, in the field of smart transportation, e-paper smart bus stop signs and information display boards have emerged, while in the healthcare information and caregiving application fields, e-paper is used in ward door signs and bedside cards. In the public domain, applications of e-paper display products have appeared in outdoor advertising boards and gas station price displays. The diversification of downstream application fields will bring new development prospects for e-paper display modules.

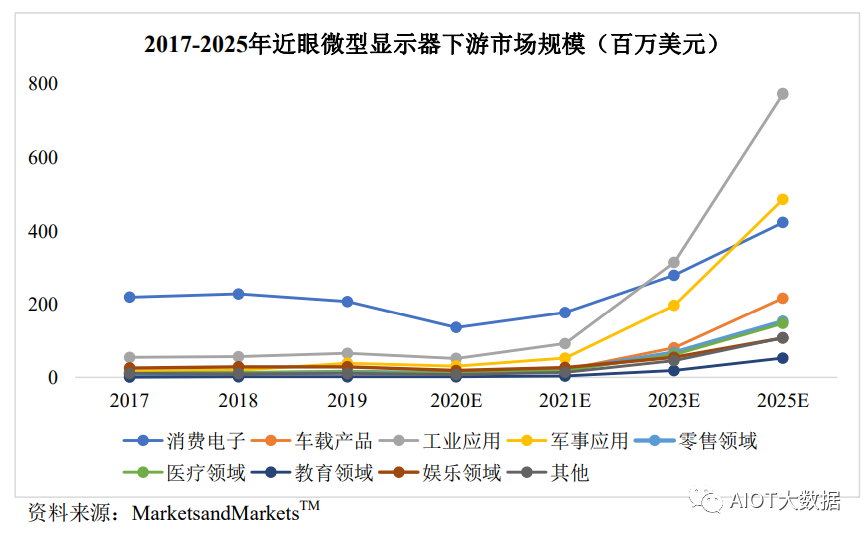

The micro-display industry is rapidly developing, and silicon-based OLED is expected to become a widely used technology type.

Micro-displays refer to displays smaller than 1 inch, an important branch of display devices. Unlike traditional PMOLED and AMOLED display technologies, the OLED technology applied in micro-display fields is known as silicon-based OLED, which is made with single-crystal silicon as the driving backplane, integrating the traditionally external bonded display chip into the silicon-based backplane, with pixel sizes being 1/10 of traditional display devices, offering much higher precision than traditional devices. Silicon-based OLED technology features small size, lightweight, low power consumption, and high resolution, mainly applied in near-eye displays and projection display systems, including HMDs, HUDs, and EVFs.

(1) OLED is expected to become the main application technology for micro-displays, with the Asia-Pacific region holding the highest share.

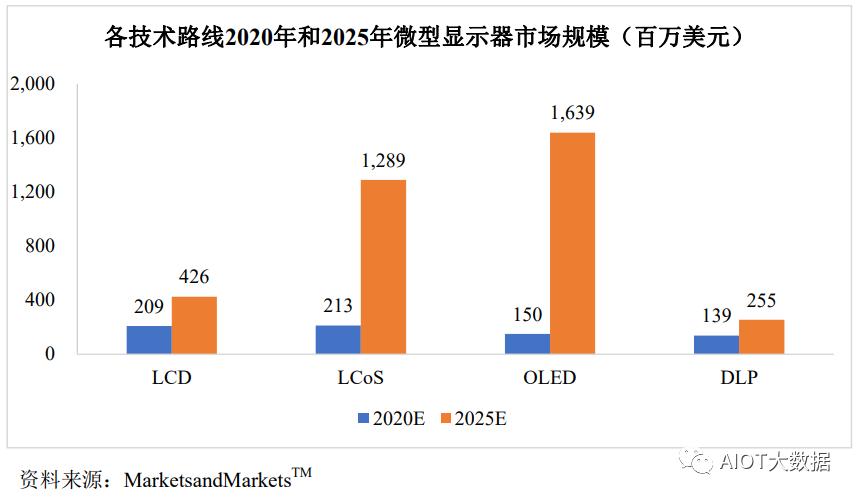

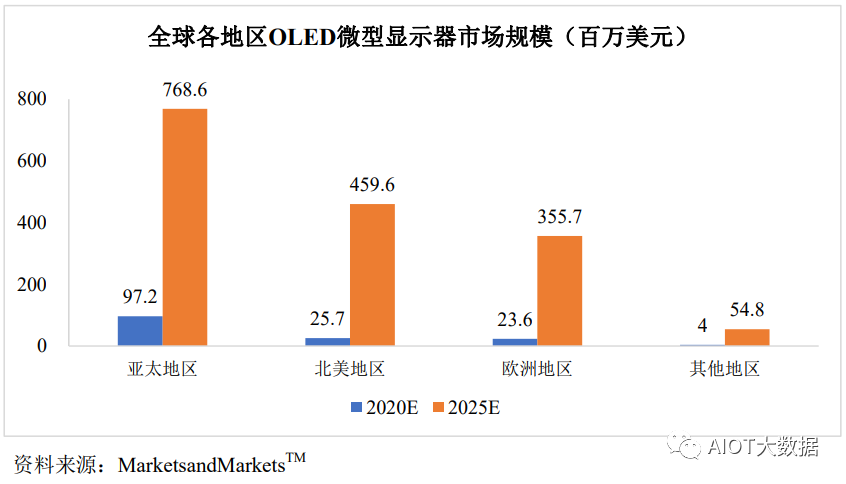

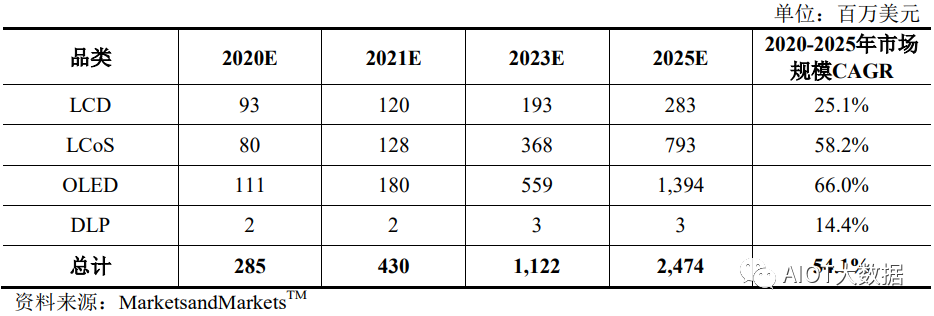

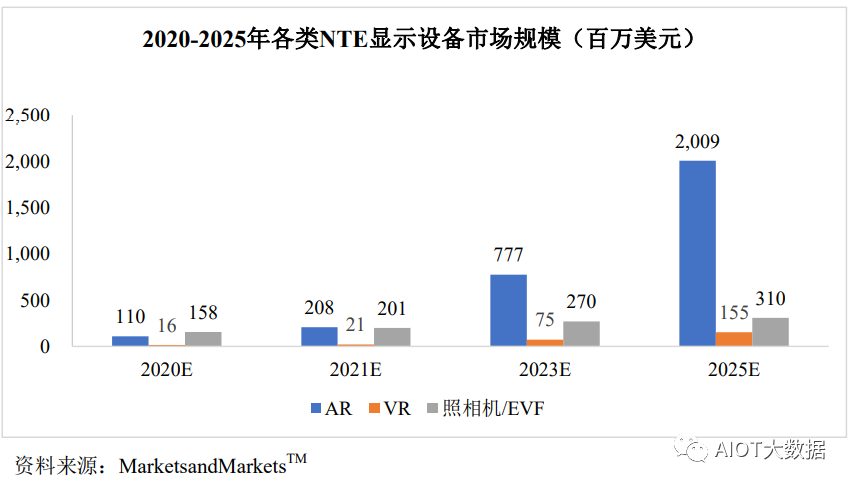

According to research reports by MarketsandMarketsTM, from 2020 to 2025, the market size for OLED micro-displays is expected to grow rapidly, with a compound annual growth rate of 61.2%, reaching $1.639 billion by 2025, surpassing LCD and LCoS to become the most widely used technology type in micro-displays.

In the Asia-Pacific region, substantial government investments have accelerated large-scale urbanization and industrialization, driving technological innovation in the OLED micro-display industry through research and development activities by industries and institutions. Economic development and population size also stimulate consumer demand, allowing the Asia-Pacific region to continue leading the development direction of OLED micro-displays.

(2) The application of near-eye display devices is driving the development of OLED micro-displays.

Near-eye display devices (NTE) include electronic viewfinders and head-mounted displays. These devices are compact, lightweight, and portable. The integration of OLED micro-displays with such electronic devices best reflects their small size, lightweight, low power consumption, and high resolution characteristics. According to MarketsandMarketsTM data, the market size for OLED micro-displays used in near-eye display devices is expected to reach $1.394 billion by 2025.

Currently, the demand for micro-displays in camera and EVF applications is greater than in HMDs, with HMDs being one of the main drivers of future market growth for micro-displays, and also one of the fastest-growing fields. EVF is a type of camera viewfinder, mainly used in digital cameras and camcorders. Compared to traditional EVFs that use LCD micro-display technology, EVFs using silicon-based OLED display technology offer high contrast, wide color gamut, and fast response times, significantly enhancing the viewing and shooting experience of digital cameras. Currently, SONY has applied OLED micro-displays in the electronic viewfinders of its high-end digital cameras.

HMDs are devices worn on the head, such as helmets or headsets, allowing users to obtain images, data, and other information in their field of view. HMDs can magnify images on micro-displays through optical systems, presenting large-screen images to viewers, achieving various effects such as VR and AR. OLED micro-displays’ small size and low power consumption help reduce the size of HMDs, enabling the development of compact and lightweight devices while ensuring longer usage times.

VR and AR technologies are widely applied in near-eye display devices, both of which are technologies that directly materialize the virtual world into human perception. VR technology uses computer simulation to create a three-dimensional virtual world, providing immersive experiences through near-eye displays, mainly applied in entertainment fields, including gaming, live sports broadcasts, and more. Particularly in the entertainment gaming industry, VR penetration is rapidly increasing. In 2016, SONY launched the consumer-grade VR gaming console PlayStationVR, promoting the development of VR technology in terminal applications. AR technology overlays virtual objects in real-time onto the real world, allowing the simultaneous existence of virtual and real objects in the same image or space. Currently, AR near-eye displays are applied in military fields for weapon sights and other equipment. With advancements in computing technology, AR devices will also be widely applied in healthcare, industry, education, consumer electronics, and entertainment fields. Overall, the future of near-eye display devices is gradually maturing, with a wide range of downstream applications, which will strongly drive the demand for OLED micro-display products.

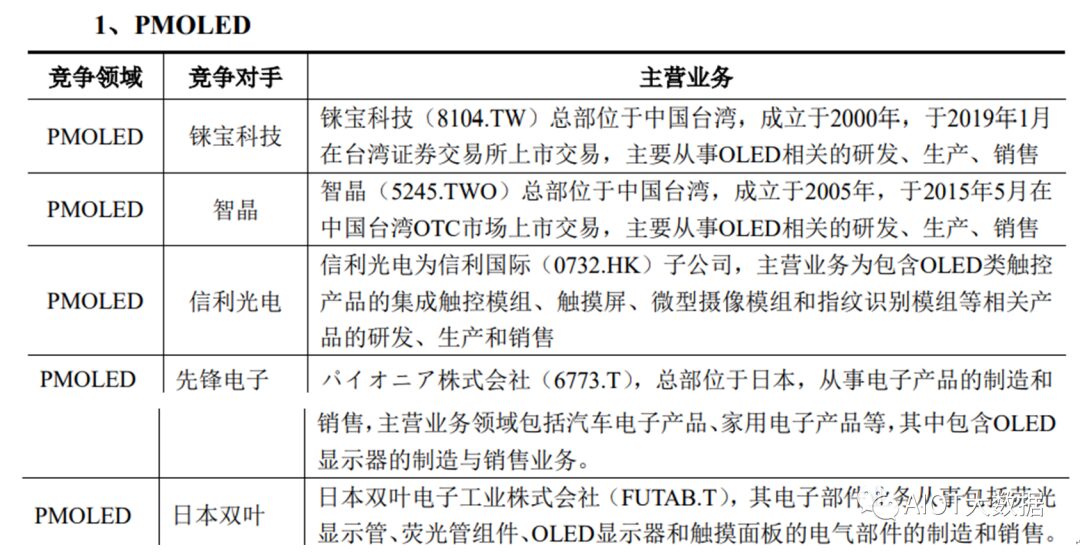

Key Enterprises in the Industry

The development of the global PMOLED panel industry has gone through a process of “originating in the US, developing in Japan and South Korea, and gaining momentum in Taiwan and mainland China.” The early development of the OLED industry coincided with the development of the PMOLED industry, which was first successfully developed in the US, and then industrialized by Japanese and Korean manufacturers. Subsequently, Korean manufacturers such as Samsung and LG gradually shifted their investments from the PMOLED industry to the AMOLED industry, while companies represented by Taiwan and mainland China began to gradually occupy market share in the PMOLED industry. Currently, the number of PMOLED display manufacturers is relatively small, with high market concentration, including Taiwanese companies like RITEK and JDI, as well as mainland Chinese companies such as Visionox and QD Laser, and Japanese companies like Pioneer, FUJITSU, and SEIKO. Among them, mainland Chinese and Taiwanese manufacturers dominate the PMOLED display panel market, while Japanese companies have a strong technical foundation due to years of deep cultivation in the field.

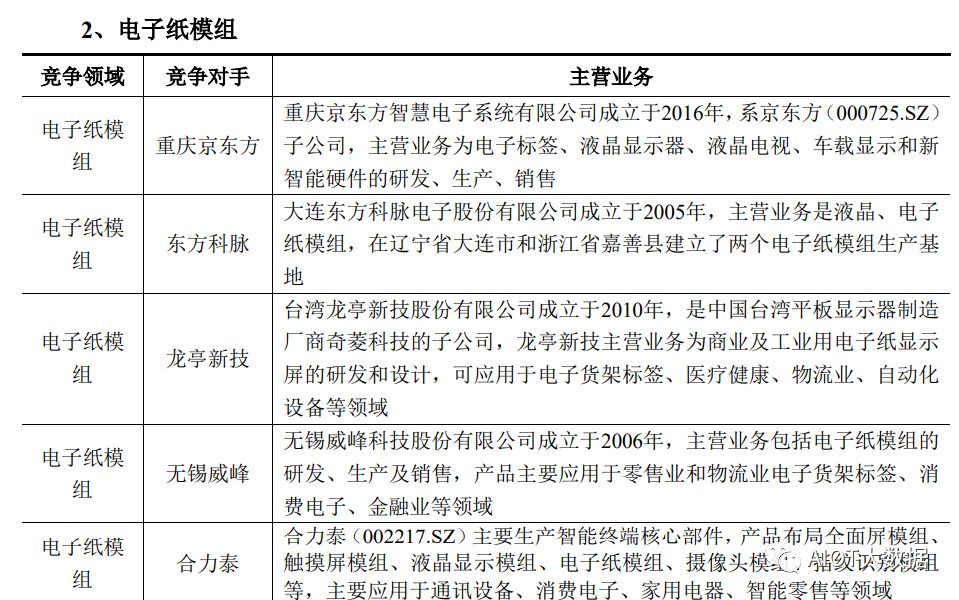

The core raw material for electronic ink films is produced by only two major companies globally, namely E Ink Holdings (8069.TW) and Guangzhou Aoy Electronic Technology Co., Ltd., with E Ink Holdings holding a significant position in the global electronic paper industry as the largest supplier of electronic ink films.

The industry mainly includes electronic paper display module manufacturers such as QD Laser, HeLiTai, Dongfang Kema, Longting Xinji, Wuxi Weifeng, and Chongqing BOE.

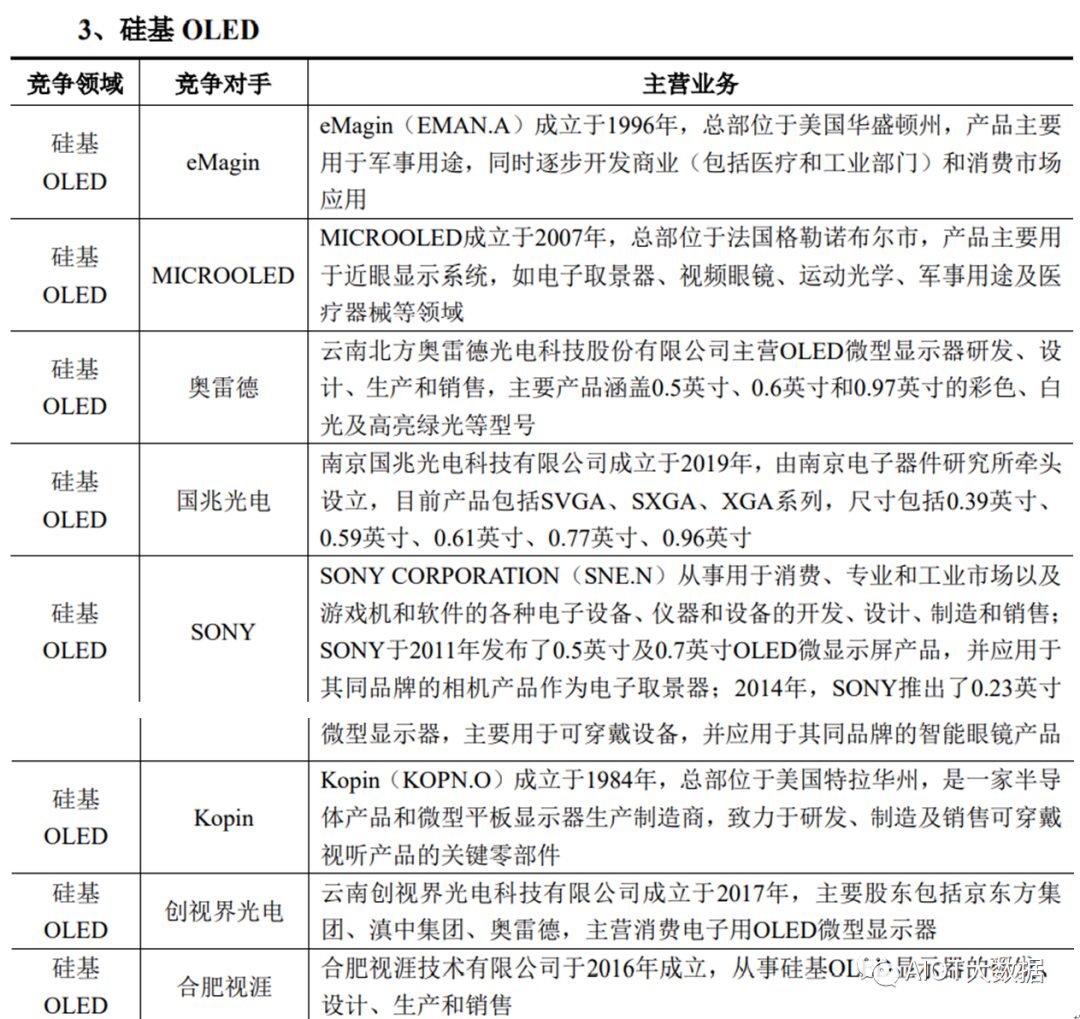

Currently, OLED micro-display technology is mainly applied in military and consumer electronics fields, with early applications in the military field involving key industry participants like eMagin, MICROOLED, Oledcomm, and Guozhao Optoelectronics. The main application scenarios for silicon-based OLED in the consumer market include HMDs, HUDs, and EVFs. Only SONY has launched EVFs and HMDs using OLED micro-displays in its brand, while other major participants focusing on consumer electronics are still in the stage of continuously improving process levels and yield rates. Overall, the silicon-based OLED display industry is in its early development stage, with all major manufacturers accelerating production line layouts and rapidly improving technical levels to meet the fast-growing market demand.

Source: Display Hub