4.2.2.3 Cardiac Pacemakers

4.2.2.3.1 Device Overview

(1)Clinical Applications

A cardiac pacemaker is an electronic therapeutic device implanted in the human body. It emits electrical pulses powered by a battery through a pulse generator, stimulating the myocardium in contact with the electrodes via lead wires, causing the heart to contract and beat. This treatment aims to address cardiac dysfunction caused by certain arrhythmias. Particularly for patients with heart disease who do not respond well to medication or for whom treatment is ineffective, cardiac pacemakers have been clinically successful. If the heart’s original pacemaker loses its function, leading to disrupted impulse formation, or if the heart’s intrinsic conduction system fails to operate normally (such as in cases of sinus arrest, sinoatrial block, sinus bradycardia, or ectopic rhythms in the atria or ventricles, as well as tachycardia), a pacemaker can replace or supplement the physiological electronic system that normally stimulates and controls heart contractions.

Implantable cardiac pacemakers are accepted by both doctors and patients due to their simple installation, minimal trauma, reduced pain, and significant efficacy during clinical procedures.

There are various types of pacemakers tailored to different patients:

Single-chamber and dual-chamber pacemakers: primarily used for bradycardia, these are the most commonly used types. The former implants one pacing lead into the heart, mainly for patients with chronic atrial fibrillation; the latter implants one pacing lead in the atrium and another in the ventricle, simulating normal heartbeats.

Triple-chamber pacemakers: also known as cardiac resynchronization therapy (CRT), have been in use for nearly 20 years. They are used for patients with enlarged hearts and heart failure, accompanied by asynchronous heart contractions, improving cardiac function, restoring heart size, and extending patient lifespan.

Implantable cardioverter-defibrillators (ICDs): devices that can automatically detect ventricular tachycardia, bradycardia, and ventricular fibrillation, delivering controlled shocks to restore normal heart rhythm. Compared to standard pacemakers, those with defibrillation capabilities are significantly more complex.

When an ICD detects arrhythmia in the patient’s ventricles, it releases electrical pulses to restore normal heartbeats. If this does not restore normal rhythm, or if the ventricles begin to fibrillate (instead of contracting normally), the ICD will deliver high-energy electrical pulses (shocks) for defibrillation.

(2)Device Composition

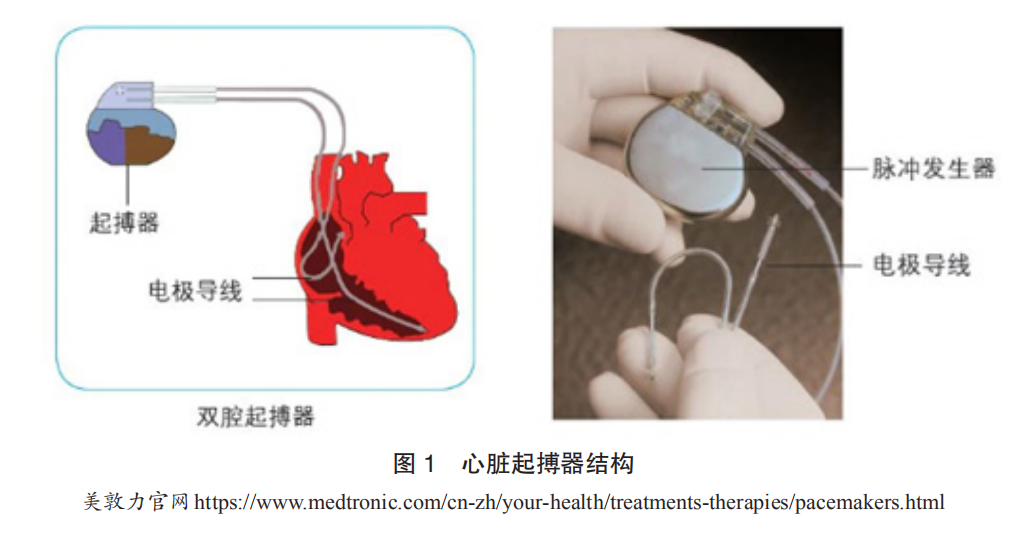

The main components of a cardiac pacemaker include: a pulse generator (composed mainly of a power source and electronic circuitry, capable of generating and outputting electrical pulses) and electrode leads (conductive metal wires wrapped in an insulating layer, which transmit the pacemaker’s electrical pulses to the heart and relay the heart’s intracardiac electrocardiogram back to the pacemaker). The pulse generator is oval-shaped, very small, approximately 40mm × 50mm × 6mm, and weighs about 30 grams. It is essentially a microcomputer powered by a high-performance battery. Pacemakers are typically implanted subcutaneously in the upper chest, with leads reaching the heart through veins, and the electrode at the end of the lead is fixed to the inner surface of the heart muscle. When the pacemaker operates, the electrical pulses emitted by the pulse generator are transmitted through the lead and electrode to the myocardium, causing it to contract. Simultaneously, the pacemaker’s electrodes collect the heart’s electrical activity and store it in the chip within the pulse generator for analysis (Figure 1).

Implantable cardioverter-defibrillators (ICDs) consist of sensing electrodes, defibrillation electrodes, and a pulse generator, which includes a metal casing, battery, high-voltage capacitor, and control circuitry. The pulse generator contains two series-connected lithium-silver oxide batteries as the power source, energy-storing electrolytic capacitors, and various electronic circuits.

The casing of the pulse generator is made of titanium, and its connectors are made of epoxy polymer resin, with 3 to 4 sockets connecting to the sensing and defibrillation electrode leads. The other end of the electrode lead connects to the heart, monitoring the electrocardiogram signals to identify whether ventricular tachycardia or fibrillation occurs and releasing energy for defibrillation.

(3)Technological Development History

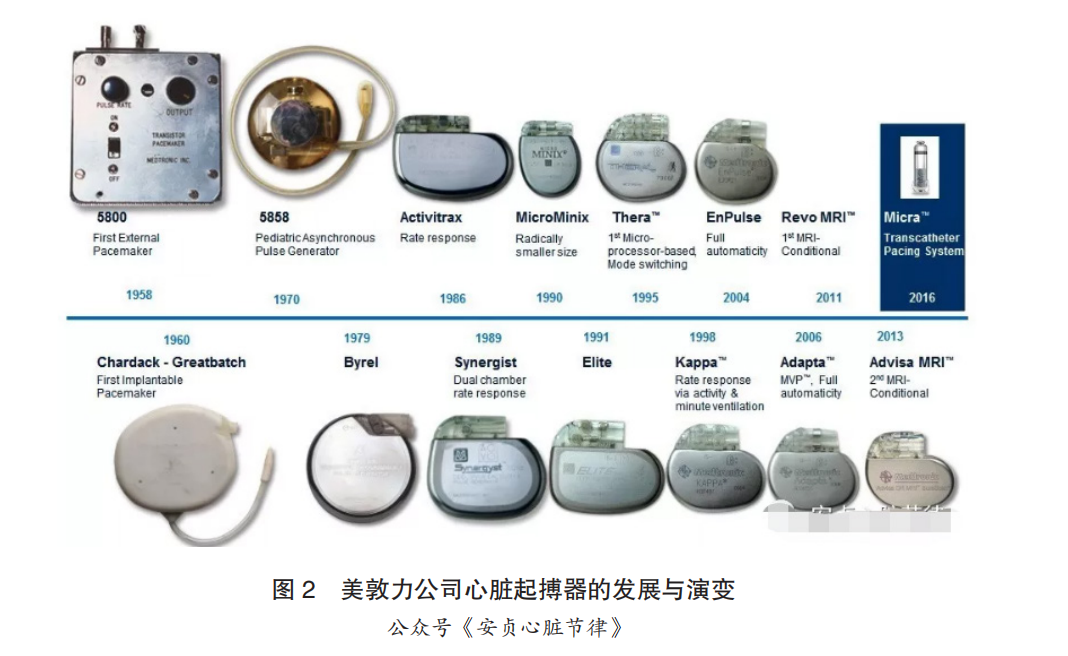

The development of implantable cardiac pacemaker technology can be divided into three stages:

The first stage (before 1990) was the technological nascent period. The implantable cardiac pacemaker originated around the 1960s, with the world’s first implantable pacemaker designed and manufactured by Swedish engineer Elmgvist in 1958; dual-chamber pacemakers were clinically applied in 1977; and implantable cardioverter-defibrillators (ICDs) were clinically applied in 1980.

The second stage (1990-1997) was the rapid growth period. Starting in the 1990s, implantable cardiac pacemakers gradually entered a phase of rapid growth. In 1998, the triple-chamber pacemaker CRT was introduced. Medtronic and Biotronik dominated the market during this period, with Sorin and St. Jude also gradually entering the field.

The third stage (1997 to present) is the stable maturity period. Since 1997, implantable cardiac pacemakers have entered a phase of steady maturity. During this stage, the technology of implantable cardiac pacemakers has become increasingly refined, with Medtronic and Biotronik still in a leading position, while many companies and researchers have entered this area. As of now, Boston Scientific, Sorin, and St. Jude are among the top newcomers. Additionally, the technology of implantable cardioverter-defibrillators has matured after a period of rapid growth, with clinical efficacy and application now well established. In 2002, the CRT-D, combining CRT and ICD functions, was introduced.

Today’s pacemaker technology has reached a highly advanced stage, with the functions and performance of various types of pacemakers greatly meeting patient needs. However, technological advancement is endless, and many companies and research institutions are now studying new types of pacemakers. Research on new pacemakers can be divided into two categories: one focuses on improving traditional pacemakers, such as researching new power sources and materials to extend pacemaker lifespan, and studying leadless and miniaturized pacemakers. The second category involves researching biological pacing. Biological pacing is a novel pacing method that constructs safe and effective pacing cells through cellular and genetic technologies, restoring sinus rhythm and normal conduction system function in the heart.

(4)Technological Extension Exploration

To date, the development of cardiac pacemakers has expanded to include many indications, such as orthostatic hypotension, malignant neurocardiogenic syncope (vasovagal), congenital long QT syndrome, and simple PR interval prolongation, which will be one of the future application directions for pacemakers.

With advancements in computer technology, telemetry, and electronics, fully automated pacemakers may emerge in the future. This pulse generator will be able to operate automatically based on the patient’s cardiac electrophysiological status, utilizing various physiological parameters and sensor data to determine the most suitable pacing method. Future pacemakers will not only support heart rhythms but also combat tachycardia, defibrillate, synchronize, and provide multi-site pacing. Pacemakers will evolve from automation and modernization to intelligence.

Currently, electrode lead pacemakers can achieve multi-site pacing, and future electrode lead pacemakers will be able to pace from the epicardium. Due to the complications caused by leads, future electrode lead pacemakers will develop towards a leadless stage. After decades of development, the core components and software of defibrillators have become increasingly refined, with little change in the core components in recent years. Future developments will continue to optimize core components and software while updating other components (Figure 2).

4.2.2.3.2 Market Status and Trends

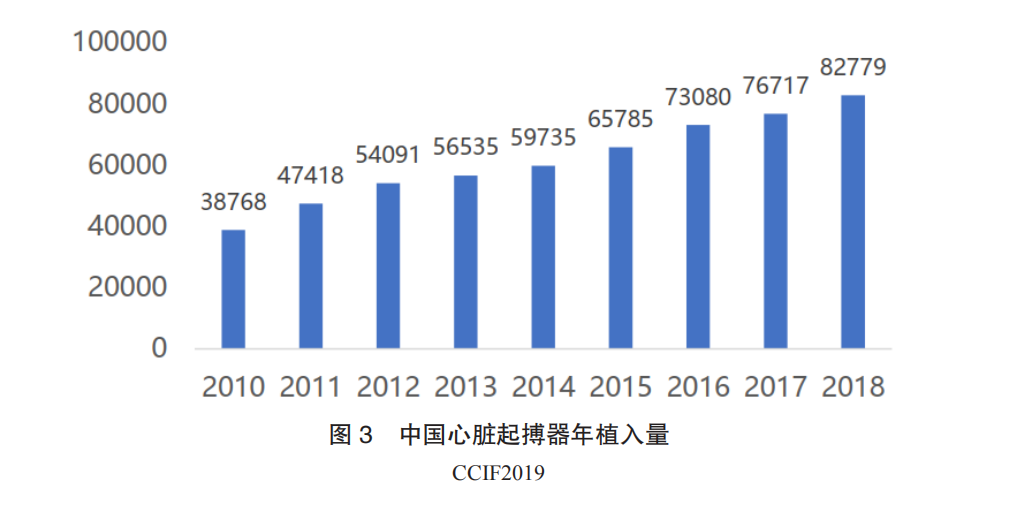

Currently available cardiac pacemakers include single-chamber pacemakers, dual-chamber pacemakers, triple-chamber pacemakers, and defibrillators. Among these, single-chamber pacemakers can only meet basic cardiac pacing needs, with single-chamber pacemakers accounting for only 30% of clinical applications in China. The most important application, dual-chamber pacemakers, occupies about 65% of the market. The demand for pacemakers in China is large and continues to grow, but the overall penetration rate is low, with industry growth at only around 10%. Currently, there are about 1 million bradycardia patients in China, with an average of 300,000 to 400,000 new patients added each year. For bradycardia patients, implanting a cardiac pacemaker is the only effective treatment method. However, the number of pacemaker implants in China is limited. According to CCIF 2019 data, 82,800 pacemakers were implanted nationwide in 2018, a year-on-year increase of 7.90%, with dual-chamber pacemakers accounting for 74.81% (Figure 3). In 2015, the number of implantable cardioverter-defibrillators (ICDs) implanted in China was 2,800, with a year-on-year increase of 18%. From 2005 to 2015, the compound annual growth rate was 30%. The top five regions for pacemaker implant surgeries are Jiangsu, Shanghai, Beijing, Zhejiang, and Sichuan, while regions like Guangxi, Inner Mongolia, Qinghai, Hainan, and Ningxia have relatively low implant volumes. The reasons for the low penetration rate include: ① high surgical risks, primarily concentrated in three hospitals in developed regions; ② inadequate patient education, leading to resistance to preventive implantation; ③ most importantly, the current pacemaker market is monopolized by foreign companies, with the most commonly used dual-chamber pacemakers priced at over 50,000 yuan, placing a heavy financial burden on patients and making widespread adoption difficult. The process of domestic companies replacing imports has just begun, with significant unmet treatment needs.

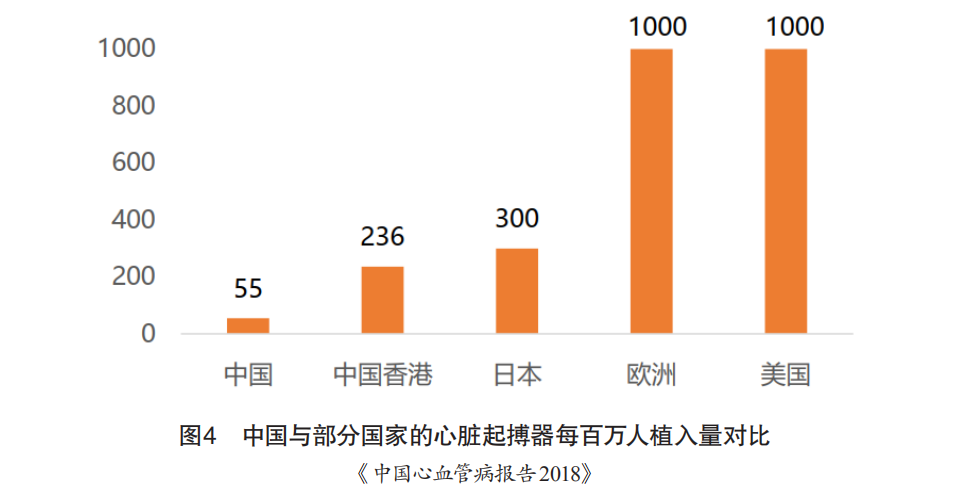

Moreover, the number of pacemaker implants in China is significantly lower than in economically developed countries. In 2014, New Zealand had 11 times the number of implants compared to China, Japan had 10 times, and the United States had nearly 1,000 per million population, which is 23 times that of China (Figure 4). With the gradual increase in the reimbursement ratio for medical insurance, the reimbursement rate for implanted pacemakers has risen from 50% to over 70%, indicating that implantable pacemaker products have significant market capacity and growth potential.

The earliest use of cardiac pacemakers in China dates back to the early 1980s when the cardiac pacemaker produced by St. Jude Medical (now acquired by Abbott) entered China, followed by the entry of Biotronik from Germany and Medtronic from the United States in the late 1980s and early 1990s, respectively. In the early 21st century, Boston Scientific from the United States also entered the Chinese market, gradually forming a four-way competitive landscape.

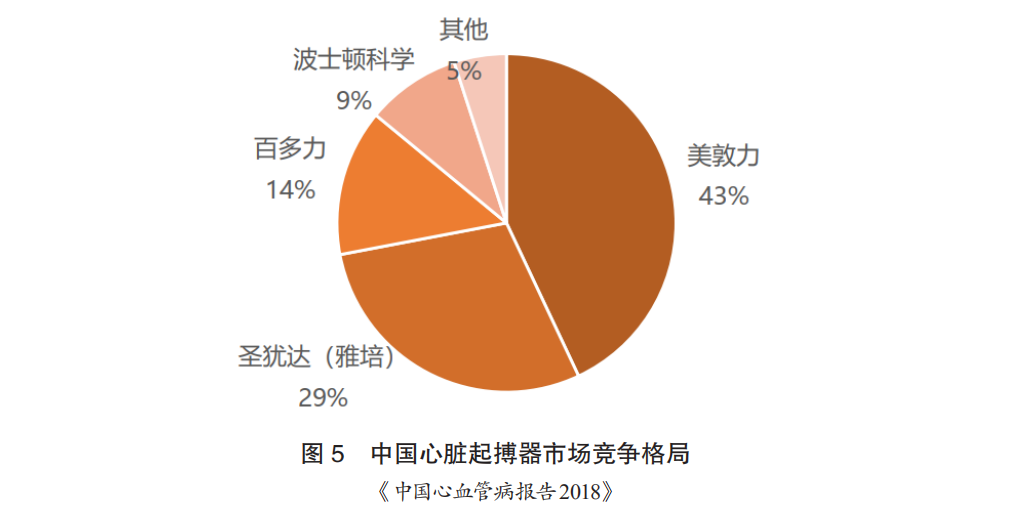

The pacemaker market has long been dominated by foreign companies, with Medtronic holding over 50% market share, St. Jude over 20%, and Biotronik over 10%, with Boston Scientific and Sorin occupying a portion of the market (Figure 5). Domestically, only Qinming is producing pacemakers, which are in the mid-to-low-end category. The prices of pacemakers are very high. Among them, Medtronic’s mid-to-high-end products are priced at around 50,000 to 100,000 yuan, while Biotronik’s dual-chamber pacemakers are priced at around 60,000 yuan.

Although the number of implantable cardioverter-defibrillators (ICDs) in China has grown rapidly, it still lags significantly behind economically developed countries, with New Zealand having 81 times the number of implants compared to China, Japan 27 times, and the United States exceeding 450 per million population, far above China’s figures. Therefore, implantable defibrillator products have significant market capacity and growth potential.

As domestic medical device giants (Lepu, MicroPort, and Ason) gradually enter the pacemaker industry, along with the improvement of domestic residents’ consumption levels and medical standards, it is expected that the next five years will witness a turning point in the import substitution of pacemakers in China, with the overall market scale rapidly exceeding 5 billion yuan.

4.2.2.4 Ablation Devices

Ablation refers to the minimally invasive intervention of placing an ablation catheter at the target site within the patient, using external energy to destroy the target area to achieve the desired intervention effect without damaging or only slightly damaging surrounding tissues. The equipment consists of an ablation energy generator and an ablation catheter. Depending on the form of external energy, ablation devices can be classified into pulsed electric field ablation devices, cryoballoon ablation devices, ultrasound ablation devices, and laser ablation devices.

4.2.2.4.1 Pulsed Electric Field Ablation Devices

(1)Device Overview

(1)Clinical Applications

Pulsed electric field ablation (PFA), also known as irreversible electroporation, involves applying high-voltage electrical pulses to the phospholipid bilayer of cell membranes in a short time, leading to the formation of transmembrane potentials and generating unstable electric fields. This results in irreversible permeabilization damage to the cell membrane, creating nanoscale pores, altering the permeability of the cell membrane, disrupting the homeostasis of the intracellular environment, and ultimately leading to cell apoptosis, achieving non-thermal ablation. Previously, electroporation ablation was used as an effective means to destroy malignant tumor tissues, and its application in atrial fibrillation ablation has gradually become a research hotspot in recent years.

PFA has the following characteristics: ① The pulsed electric field maintains the integrity of the tissue matrix within its ablation area. ② The ablation threshold is tissue-specific, allowing for the selective ablation of certain specific tissues (such as myocardial tissue). The ablation threshold for myocardial tissue is lower than that of most other tissues, allowing for the ablation of myocardial cells while avoiding damage to adjacent tissues (such as the esophagus or phrenic nerve). ③ PFA is extremely fast, often measured in milliseconds or even shorter. ④ Compared to traditional radiofrequency ablation methods, PFA does not rely on catheter contact force to cause extensive myocardial damage. Therefore, the application of pulsed electric field ablation in atrial fibrillation treatment is safer and more effective, significantly reducing surgical time.

(2)Device Composition

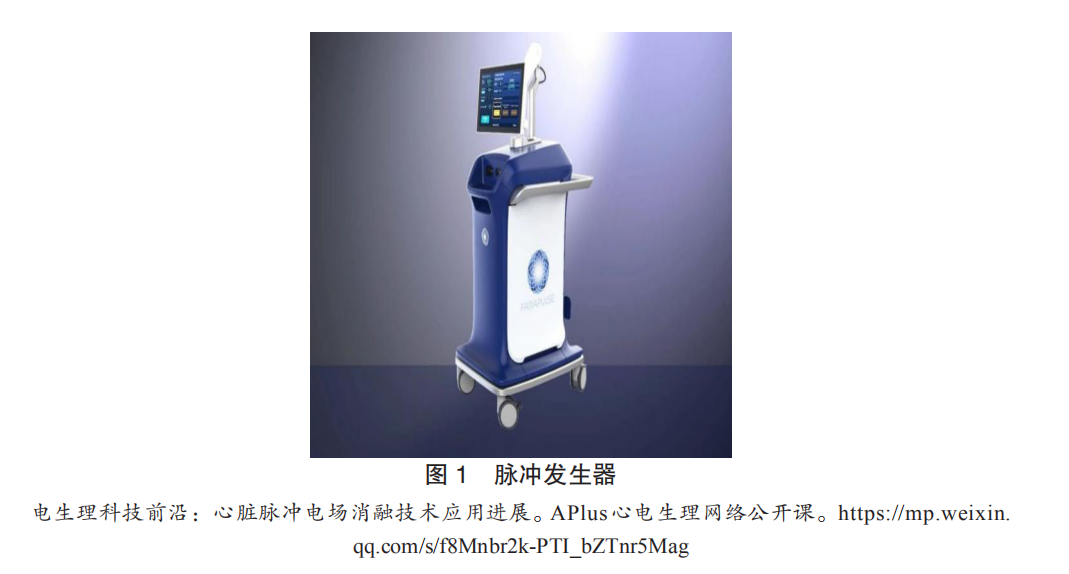

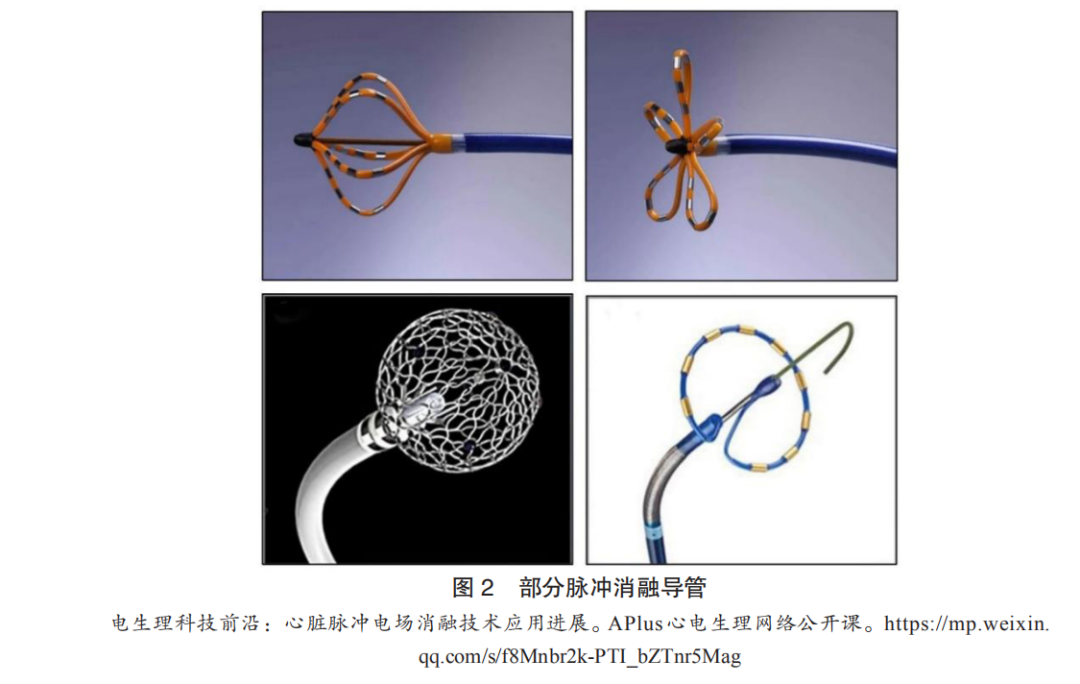

Currently, the PFA systems used in clinical research mainly consist of a generator that provides high-voltage pulses (Figure 1) and an ablation catheter (Figure 2). The core component, the ablation catheter, has several different design types, including: ① Boston Scientific’s Farapulse ablation catheter, which has 20 electrodes evenly distributed across 5 independent semi-circular structures. When not fully expanded, the electrodes are arranged longitudinally in a basket shape, and when fully expanded, they are arranged laterally in a petal shape, allowing for controlled expansion to accommodate different diameters of pulmonary veins. ② Affera’s lattice-tip ablation catheter features a shape-memory mesh spherical ablation electrode with 9 evenly distributed microelectrodes (including thermocouples for temperature-controlled radiofrequency ablation). The spherical ablation electrode has perfusion micropores and a central reference electrode. Its advantage lies in the ability to use the ablation electrode as a three-dimensional mapping electrode for precise positioning, allowing for a switch between radiofrequency ablation and biphasic pulsed ablation modes during atrial fibrillation ablation. ③ Medtronic’s PulseSelect ablation catheter has a ring-shaped design with 9 evenly distributed electrodes, with a 20° tilt angle. Odd-numbered electrodes (1, 3, 5, 7, 9) serve as positive electrodes, while even-numbered electrodes (2, 4, 6, 8) serve as negative electrodes, discharging synchronously for pulsed ablation, and can also be used as mapping electrodes.

(3)Technological Development History

The technological development of PFA in the cardiovascular field can be divided into three stages. The first stage (2007-2018) was the basic research phase. In 2007, Lavee et al. utilized electroporation for ablation of pig atrial epicardium, demonstrating that PFA could rapidly and precisely ablate through the wall without local heating effects. In 2011, Wittkampf et al. first demonstrated the preclinical feasibility of electroporation technology for isolating pulmonary veins, providing preliminary evidence for PFA as a method for atrial fibrillation ablation. The second stage (2018-2020) was the clinical validation phase. In 2018, Reddy et al. first applied PFA in clinical atrial fibrillation ablation, finding that an average of 3.26 ablations per pulmonary vein could achieve complete isolation (100% success rate), with total ablation time not exceeding 1 minute and average fluoroscopy time of 12 minutes, with no complications. Subsequent small-scale clinical studies using different ablation catheters confirmed that PFA could preferentially damage myocardial tissue, achieve ultra-fast isolation of pulmonary veins, and demonstrate excellent durability and long-term safety. The third stage (after 2020) is the industrial development phase. In early 2021, the Farapulse PFA system received CE approval for market entry, and numerous related companies have emerged domestically, leading to an intense development of PFA technology, which is evolving towards faster, more precise, and integrated solutions.

(4)Technological Extension Exploration

The tissue selectivity, non-thermal ablation, rapid energy release, effective damage, and the ability to operate without complete contact make pulsed electric field ablation a strong candidate for the next generation of ablation energy, with potential applications extending to the ablation of hypertrophic cardiomyopathy.

(2)Market Status and Trends

Currently, there are over 10 million patients with atrial fibrillation in China, and globally, the number is 33.5 million, expected to double by 2060. The characteristics of PFA and early research results have largely confirmed its advantages in atrial fibrillation ablation. However, only Boston Scientific’s product has received CE approval and has not yet entered large-scale clinical use. In the future, factors such as the level of domestic electrophysiologists, accumulation of clinical evidence, launch of domestic products, establishment of atrial fibrillation centers, and relevant national policies will drive significant market space for PFA.

(3)Industry Overview

The PFA industry for atrial fibrillation is still in its early stages, with major medical companies like Boston Scientific, Medtronic, and Johnson & Johnson having made early investments. As of July 2021, only the Farapulse ablation system acquired by Boston Scientific has received CE approval, making it the first PFA product on the market. Medtronic’s PulseSelect ablation system has been approved to enter the domestic “Special Review Procedure for Innovative Medical Devices”; Johnson & Johnson’s VARIPULSE system is currently recruiting patients for clinical trials. Affera’s integrated system combining PFA and traditional radiofrequency ablation has been used to treat over 130 patients, and based on clinical trial results and the integrated mapping and ablation system, it is expected to occupy a place in future atrial fibrillation ablation platforms. There is a growing enthusiasm for PFA in China, with efforts to catch up with imported companies. In 2020, multiple patents were granted in this field, and companies like Nomu Medical, PulseFlow Technology, and Ruidi Technology are actively developing PFA systems. By the end of 2020, Hangzhou Nomu Medical completed the first clinical application of PFA in Asia. It is expected that multiple PFA systems will be launched in the future, intensifying competition in the atrial fibrillation ablation field.

4.2.2.4.2 Cryoballoon Ablation Devices

(1)Device Overview

(1)Clinical Applications

Cryoballoon ablation involves releasing liquid nitrogen within the balloon to freeze surrounding tissues, causing cell death and irreversible damage. The damage caused by freezing to cells and tissues occurs through immediate and delayed effects. Immediate effects include low-temperature stress and direct cellular damage; delayed effects result from tissue damage during rewarming, including intracellular recrystallization and rupture, and vascular-mediated damage. Cryoballoon ablation is primarily used in the cardiovascular field for atrial fibrillation ablation to prevent the transmission of abnormal electrical signals. It is recommended for pulmonary vein isolation in paroxysmal atrial fibrillation and can also be used to treat persistent atrial fibrillation, although the optimal ablation strategy for persistent atrial fibrillation remains unclear. Compared to radiofrequency ablation, cryoballoon ablation offers advantages such as better catheter stability, continuous and uniform scar boundaries, minimal damage to the endocardial surface, good integrity of adjacent tissues, and less discomfort for patients.

(2)Device Composition

The cryoballoon ablation system consists of a cryoablation device, a balloon-type cryoablation catheter, a disposable intracardiac mapping electrode catheter, and adjustable sheaths, connecting wires, and exhaust pipes (Figure 3).

The cryoablation device consists of electronic and mechanical components, as well as patented software, which transports the stored liquid refrigerant through coaxial cables to the ablation catheter while controlling the cryoballoon for cryoablation treatment. The balloon-type cryoablation catheter, as the core component, works with the cryoablation device to control the temperature of the ablation target, meeting various cryoablation strategies. The disposable intracardiac mapping electrode catheter is used to check the electrical signals around the pulmonary veins during cryoablation. The adjustable sheath is used to guide the cryoballoon ablation catheter to the target site and provide support for the catheter.

(3)Technological Development History

Cryoballoon technology has been clinically applied since 1999 and has undergone four generations of development. The first-generation cryoballoon had four refrigerant injection heads built into the proximal end, forming a circular freezing area at the equator, with minimal freezing effect at the distal end. The second-generation balloon, produced in 2005, had the same shape as the first-generation balloon but underwent four improvements. First, the number of refrigerant injection heads increased from 4 to 8, distributed to the distal end, allowing effective and uniform freezing from the top to the distal end of the balloon, increasing the surface temperature uniformity from 47% to 83%; simultaneously, the tissue penetration capability significantly improved, shortening the freezing time required. Second, the freezing area of the balloon surface changed from circular to hemispherical, with an elliptical design at the tip better suited to the shape of the pulmonary vein orifice, increasing the contact area between the cryoballoon and the pulmonary vein. Third, the curvature of the delivery sheath was increased to 135 degrees, enhancing flexibility. Fourth, the inner core of the balloon was reduced to 2mm, increasing deformability and adaptability. The third-generation cryoballoon was introduced in 2015, with the distal spiral electrode further shortened in distance to the balloon, allowing better recording of pulmonary vein potentials during the ablation process. The fourth-generation cryoballoon further shortened the length from the distal end to the tip to 8mm, and compared to previous generations, the coaxial connector could rotate 35°; the freezing coil inside the balloon was moved forward, allowing for more effective cooling at the front end, with technology evolving towards greater efficiency, precision, and uniformity. However, the second-generation cryoballoon products are still the most widely used in clinical practice.

Currently, a significant limitation of cryoballoon ablation is its narrow indications, as the cryoballoon catheter is specifically designed for the anatomical structure of the pulmonary veins. If patients with paroxysmal atrial fibrillation have typical atrial flutter or ectopic foci originating from non-pulmonary veins, radiofrequency ablation is required to treat the patient’s foci. Due to the difficulty of performing linear and fragmented potential ablation with cryoballoons, their efficacy for persistent atrial fibrillation and some paroxysmal atrial fibrillation cases is limited. Future developments may expand their use beyond pulmonary vein isolation to include improvements in the left atrial roof and left atrial appendage.

(2)Market Status and Trends

In recent years, over 700,000 cases of cryoballoon ablation for atrial fibrillation have been performed globally, with over 100 large hospitals in China purchasing cryoablation systems, and the number of applications exceeding 30,000 cases. Currently, the market is monopolized by Medtronic, which is the first and only company to have FDA approval for a catheter used to treat persistent atrial fibrillation. Considering that only a small number of patients among the approximately 10 million atrial fibrillation patients in China have received ablation treatment, the future market for cryoballoon ablation holds significant potential.

(3)Industry Overview

The domestic cryoablation industry is still in its early stages, with no products approved for market entry. Several domestic cryoballoon ablation catheters are under development. As of July 2021, only two companies, MicroPort and Kangfeng Bio, have had their cryoablation systems pass the special review procedure for innovative medical devices. Kangfeng Bio has completed all clinical trial enrollments and has received hundreds of millions of RMB in Series B financing, and is expected to be approved for market entry soon, intensifying competition in this field.

4.2.2.4.3 Excimer Laser Ablation Devices

(1)Device Overview

(1)Clinical Applications

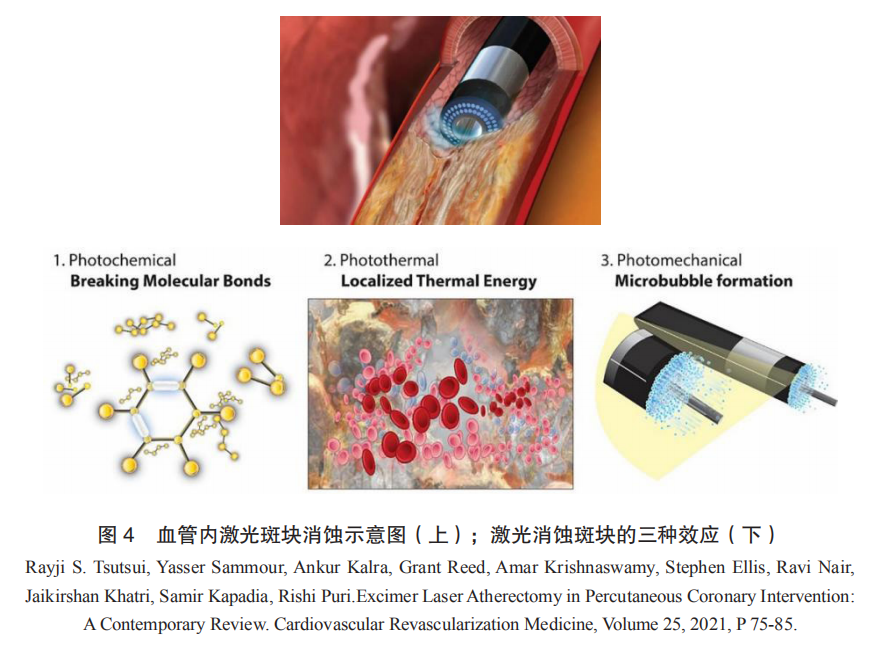

Excimer laser coronary angioplasty (ELCA) is based on intravascular laser plaque ablation technology, using a fiber optic catheter to deliver high-energy laser into the vascular lumen, directly acting on the narrowed or occluded lesions, utilizing photochemical, photothermal, and photomechanical effects to pulverize plaques into micron-sized particles, thereby reducing volume and expanding the lumen (Figure 4). The devices used for plaque ablation typically employ 308nm excimer lasers as the energy source, hence referred to as excimer laser ablation devices. The 308nm excimer laser offers optimal safety and efficacy, with a shallow interaction depth with biological tissues (<50μm), pulse widths in the nanosecond range, and energy injected instantaneously and released in a micro-explosion form, resulting in minimal overall thermal effects and precise, controllable ablation effects.

ELCA is currently mainly used for plaque modification and vascular preparation in complex coronary interventions. Clinical indications include lesions that are not passable by balloons and chronic total occlusions (CTOs), in-stent restenosis (ISR), poor stent expansion, calcification, and venous graft lesions. Over the past 25 years, the overall success rate of ELCA in coronary interventions has exceeded 80%, with an average complication rate of 9%.

For CTO lesions, ELCA can be delivered directly along the original guidewire without the need for exchanging specialized guidewires, achieving success rates of 85% to 100% in CTO opening procedures. For poor stent expansion and in-stent restenosis lesions, the laser can reduce the plaque inside and outside the stent without damaging the metal stent structure, providing unique advantages. For primary calcified lesions, especially severe calcification, although mechanical rotational or shockwave balloons remain the first choice clinically, using ELCA to open a channel and then exchanging guidewires for rotational ablation, known as the RASER technique, can further enhance the success rate of interventional treatment for severe calcified lesions.

(2)Device Composition

Excimer laser ablation devices mainly consist of an excimer laser system host and a laser catheter. The CVX-300 excimer laser system host from Philips subsidiary Spectranetics and the corresponding laser catheter are shown in Figure 5.

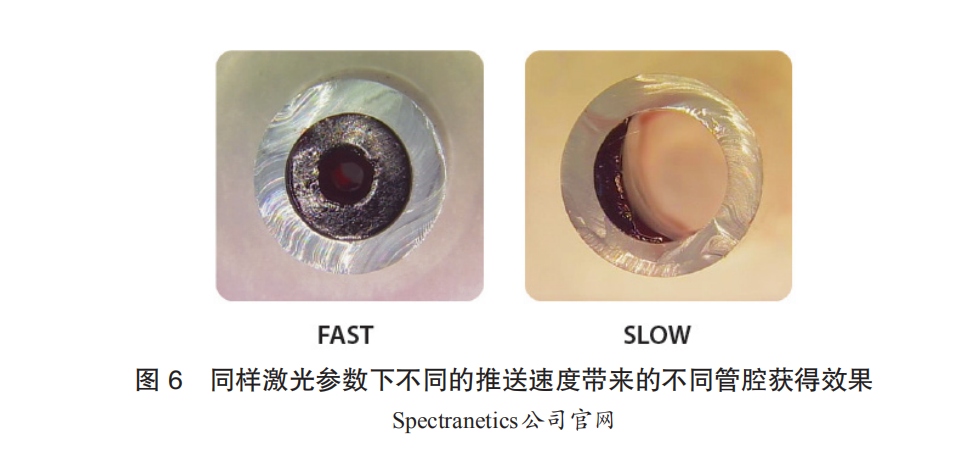

The host contains a xenon chloride (XeCl) excimer laser light source, capable of emitting specific energy, pulse width, and repetition frequency of 308nm ultraviolet pulsed laser. Energy density and push speed will affect the ablation effect; at slower push speeds (<1mm/s), the actual ablation diameter can exceed 1.5 times the physical diameter of the catheter (Figure 6). Specific parameters are selected based on the type, severity, and surgical plan of the target lesion. The catheter comes in three series: ECLA laser catheters for coronary ablation, Turbo-Elite laser catheters for peripheral vascular ablation, and GlideLight laser sheaths for lead extraction, with different sizes available in each series. The four parameters: catheter model size, energy density, repetition frequency, and push speed, provide clinical flexibility in controlling the ablation effect.

(3)Technological Development History

Since the 1980s, the exploration of using various lasers for intravascular treatment has never ceased. In 1992, the 308nm excimer laser was registered with the FDA and remains the only approved laser in the coronary field.

Regarding intravascular laser plaque ablation technology, the main safety concern is the risk of vascular perforation. Although this risk has remained within acceptable limits and has been continuously reduced with accumulated experience, some users have criticized these devices for lacking real-time monitoring and warning mechanisms. The development of integrated feedback functions in the laser catheter tip to achieve automatic identification of ablated tissues has always been a significant call for clinical development of this technology. In 2020, the original Eximo research team published preliminary research results indicating that real-time analysis of acoustic signals during ablation could determine the type of ablated tissue. In the same year, a national major scientific research instrument and equipment development project titled “Development of an Intravenous Laser Ablation System with Integrated Real-Time Feedback and Low-Damage Conduction Performance” was officially established by the Air Force Medical University, Huazhong University of Science and Technology, and Shenzhen Zhongke Weiguang Medical Device Technology Co., Ltd., aiming to develop an integrated system for laser ablation and intravascular optical imaging to address the real-time determination of tissue properties in the laser working area, ensuring ablation safety and reducing the learning curve for the procedure.

Additionally, recent advancements in solid-state lasers, ultrafast lasers, and other technologies have sparked a new wave of development in vascular laser plaque ablation devices, with several new devices for peripheral vascular applications entering the market.

(2)Market Status and Trends

After nearly 30 years of clinical practice, intravascular laser plaque ablation technology has secured a place in complex coronary intervention surgeries, but its functions and characteristics dictate that it will not be widely used as a routine surgical technique. According to statistics, from 2010 to 2019, the consumption of Spectranetics’ ECLA coronary laser catheters was approximately 50,000 units; other reports indicate that in the entire vascular intervention field, the global market for intravascular plaque ablation (four technologies: Directional, Rotational, Orbital, and Laser Atherectomy) reached $525 million in 2020 and is expected to exceed $1 billion by 2027, with laser technology currently accounting for over a quarter of the market. The main driving factors for future growth in this field include:

The continuous development of interventional treatment for complex coronary lesions globally, where laser ablation offers immediate volume reduction effects for ISR, CTO, and other indications, is continuously strengthening and consolidating its clinical position, with ELCA gradually becoming an indispensable tool in clinical practice.

The continuous development of interventional treatment for peripheral vascular lesions globally, where laser ablation technology is increasingly accepted in clinical practice, is rapidly developing techniques for intravascular volume reduction of long thrombotic lesions and the combination of laser with DCB, presenting growth opportunities comparable to coronary interventions.

Thanks to breakthroughs in upstream optoelectronic technologies such as new laser types and special optical fiber devices, the iterative innovation of intravascular laser ablation devices has gained momentum, especially with the potential for simultaneous optimization of product performance and pricing. It is reported that besides Spectranetics/Philips, Ra Medical, Eximo/AngioDynamics, and CSI/Aerolase, domestic companies are also investing in the development of next-generation laser plaque ablation systems, and the first domestic product in this field is expected to be launched soon.

(3)Industry Overview

Philips: For a long time, Spectranetics has been committed to promoting the development of ELCA technology and accumulating clinical evidence. After completing the acquisition, Philips has restructured its product line, incorporating excimer lasers into the “Image Guided Therapy” segment along with other products like Volcano IVUS, and has further clarified its focus on new growth points such as lead extraction. Notably, in July 2021, the latest member of the excimer laser product family, a laser sheath for removing inferior vena cava filters, received FDA “breakthrough device” designation, indicating that laser technology still holds significant potential in the field of vascular intervention. In the mainland Chinese market, excimer lasers are expected to play an important role in the diabetic foot treatment centers that Philips is actively establishing.

Ra Medical: The DABRA excimer laser system from Ra Medical received FDA approval in 2017 for opening lower limb artery CTO lesions. Ra Medical has experience in developing excimer lasers for dermatological applications, and compared to the CVX-300, the DABRA host is smaller, and the catheter employs a large-lumen liquid-filled optical structure, completely different from Spectranetics’ circularly arranged optical fiber array structure. Currently, the DABRA catheter is only available in one size (5F), and Ra Medical is working on clinical trials to expand the indications and simultaneously develop a new generation of catheters to address current issues with guidewire-free lumens and shelf life.

CSI: Cardiovascular System Inc. (CSI) signed a cooperation agreement with AeroLase, a medical laser manufacturer, in 2018 to jointly develop intravascular laser ablation systems, with progress still unclear.

AngioDynamics: The B-Laser system from Eximo, an Israeli company, received FDA approval in 2018 for peripheral artery interventions. In 2019, AngioDynamics acquired Eximo for $65 million, and the laser products were renamed Auryon. The main innovations of the Auryon system include: ① The host uses a 355nm tripled ND:YAG solid laser light source with a shorter pulse width (<25ns) and higher instantaneous power; the overall size and weight are only one-third of the CVX-300, making it relatively inexpensive. ② The catheter tip features a cutting edge structure and real-time negative pressure suction function, enhancing volume reduction effects while further controlling the risk of distal embolization. Although the 355nm laser differs from the 308nm excimer laser in terms of organic molecular bond cleavage, reports indicate that the Auryon system is also safe and effective for peripheral artery ablation. A large-scale real-world registry study involving over 100 cases is currently underway. Additionally, unlike the 308nm laser, the 355nm wavelength laser does not exhibit significant reactions in contrast agent environments, allowing for real-time imaging throughout the ablation process, which may become an important advantage of this wavelength laser.

4.2.2.4.4 New Applications of Ablation Technology – Renal Denervation

(1)Device Overview

(1)Clinical Applications

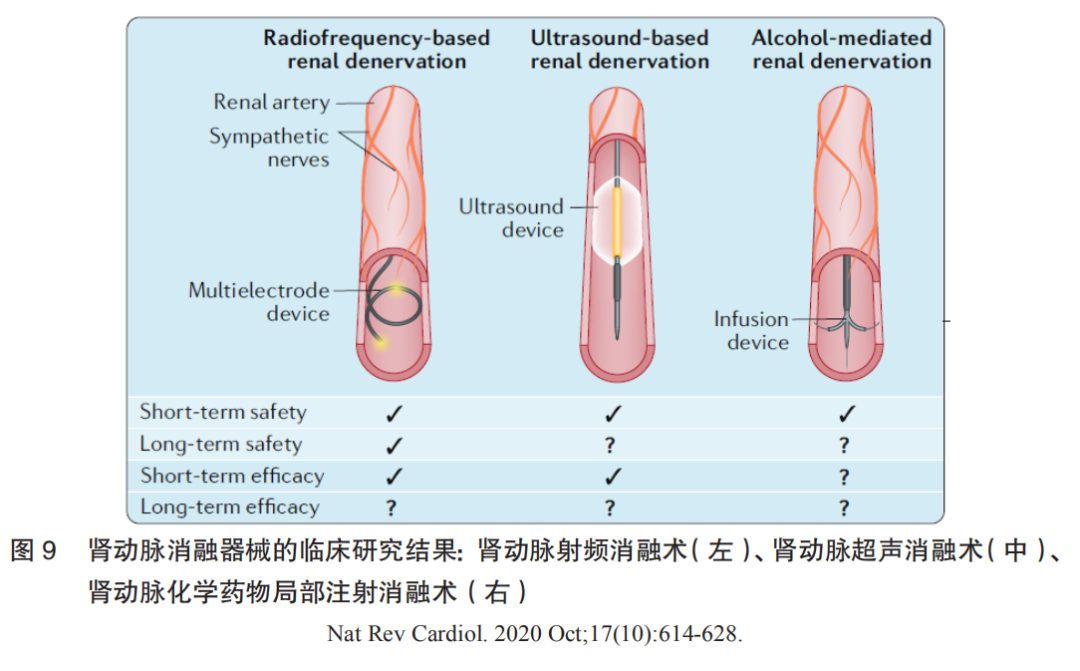

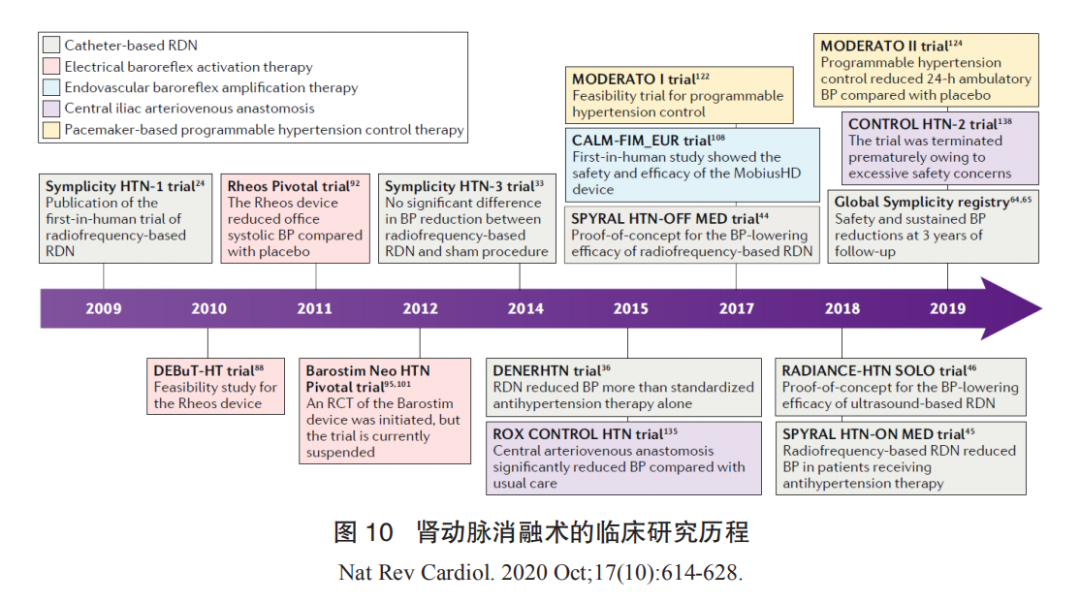

Renal denervation (RDN) has become a research hotspot in the field of hypertension treatment in recent years, employing radiofrequency energy, ultrasound energy, cryoenergy, or chemical destruction to damage sympathetic nerve fibers located on the outer membrane of the renal artery, leading to a decrease in overall sympathetic nervous system activity and subsequently lowering arterial blood pressure. Currently, RDN mainly includes three categories: renal artery radiofrequency ablation, renal artery ultrasound ablation, and renal artery chemical drug local injection ablation. Clinical research results indicate that renal artery radiofrequency ablation demonstrates both short-term and long-term safety; it shows good antihypertensive effects with or without the combination of antihypertensive medications. In terms of long-term antihypertensive effects, although the three-year follow-up results of global registered studies show stable antihypertensive effects of RDN, further RCT-level clinical research evidence is needed to confirm its long-term efficacy.

Clinical research results for the three types of renal artery ablation devices are shown in Figure 9.

(2)Device Composition

Based on the type of ablation energy used, renal artery ablation devices can be divided into renal artery radiofrequency ablation devices, renal artery ultrasound ablation devices, and renal artery chemical injection ablation devices. The ablation catheter generally consists of device connection components, operational control components, and blood-contacting components. Among these, the blood-contacting components are the technical core. In addition to needing to ensure stable contact with the renal artery wall, the catheter should also possess a certain degree of adaptability and controllability to accommodate different degrees of vascular wall distortion. Furthermore, recent developments have introduced resistance or temperature feedback systems to enhance the operator’s control over the ablation process, particularly changes in resistance after ablation, which will become the technical core of competition among various products in the future.

(3)Technological Development History

Hypertension is the primary risk factor for many cardiovascular and cerebrovascular diseases, with a large patient base. Approximately 1.39 billion people worldwide suffer from hypertension, with about 260 million in China. However, the global average control rate for hypertension is less than 50%, and in China, the control rate is currently below 20%. In addition to low awareness of hypertension, there are issues with medication use and patient compliance. Therefore, to better supplement the shortcomings of antihypertensive medications and improve the rate of achieving target blood pressure, researchers have been exploring therapies beyond antihypertensive medications.

Basic exploration phase: ① As early as the late 1940s, when effective antihypertensive medications had not yet emerged, some surgeons in Europe and the United States observed that hypertensive patients commonly exhibited symptoms of sympathetic nervous system hyperactivity, such as facial flushing and irritability. They chose surgical methods (splanchnicectomy) to remove sympathetic nerve plexuses or ganglia in the abdominal cavity to treat hypertension, achieving some efficacy. However, due to excessive complications from surgical procedures and the emergence of antihypertensive medications, this surgical approach gradually ceased. ② Starting in the 1970s, researchers began performing sympathectomy on the renal artery, achieving success in various hypertensive models, including rats, pigs, rabbits, and dogs, further confirming that renal artery denervation could significantly lower blood pressure. ③ With the development of neurophysiological examination techniques, two reliable methods for assessing sympathetic nervous system activity have emerged for clinical application. One relies on microneurography to measure sympathetic nerve electrical activity in the gastrocnemius muscle to assess overall sympathetic nervous system activity, known as muscle sympathetic nervous activity (MSNA); the other uses radiotracer dilution methods to detect the release of norepinephrine in plasma to evaluate overall sympathetic nervous system activity. The development of these detection techniques has further clarified that patients with resistant hypertension indeed exhibit overactive sympathetic nervous activity. In this field, Professor Murray Esler from the Baker IDI Heart and Diabetes Institute in Melbourne, Australia, has conducted extensive research.

Technological validation phase: In 2007, the first successful percutaneous renal artery denervation was performed, introducing minimally invasive treatment for hypertension. Subsequently, two early clinical trials, Symplicity HTN-1 and HTN-2, were completed in Europe and Australia. The trial results confirmed that patients with resistant hypertension undergoing this minimally invasive procedure experienced average reductions in systolic and diastolic blood pressure of approximately 30 mm Hg and 12 mm Hg, respectively, with no significant adverse reactions or complications. Importantly, these patients showed no signs of significant blood pressure rebound during follow-up of approximately three years. This was the first proven minimally invasive surgical technique to clearly lower blood pressure, quickly gaining popularity in developed countries like Europe and Australia. In 2013, Boston Scientific predicted the global market value of renal artery denervation surgery to be $2.5 billion. However, just as nearly everyone believed this revolutionary technology would rapidly spread globally, a clinical study conducted in the United States, Simplicity HTN-3, reported disappointing results. The study showed that renal artery denervation surgery did not demonstrate significant blood pressure-lowering effects in patients with resistant hypertension. The publication of these results raised questions about this emerging technology, leading companies like Boston Scientific/Covidien/St. Jude to halt their research on this technology, and some clinical studies were also suspended. The conflicting results between this study and the previous two clinical trials (Simplicity HTN-1 and HTN-2) prompted many experts to propose various explanations for the discrepancies, including insufficient operator experience, changes in antihypertensive medications, and inadequate ablation sites being too close to the renal artery openings. Additionally, global experts further clarified the design standards for future clinical studies related to RDN treatment, such as recommending the establishment of sham surgery control groups, excluding patients with isolated systolic hypertension, and using 24-hour dynamic blood pressure as the endpoint for efficacy assessment. The clinical research history of renal artery denervation is shown in Figure 10.

Industry development phase: After 2014, this period is generally referred to as the post-HTN3 era. The American company Medtronic has released the DenerHTN study, Spyral HTN Off-Med, and Spyral HTN OnMed studies; the American company Recor has completed the Radiance HTN SOLO study using the Paradise ultrasound catheter. The positive results of these studies have reaffirmed the effectiveness and safety of renal artery denervation as a valid supplement to antihypertensive medications, regardless of whether antihypertensive medications are used. The Global Symplicity Register study has confirmed the long-term efficacy and clinical safety of RDN treatment from a real-world registry perspective (n=2700+). After setbacks, the technology has regained favor, and in December 2020, the FDA approved three renal artery denervation devices as breakthrough devices. This indicates a renewed welcome and optimistic attitude from the international market and academic community towards RDN technology.

Renal artery denervation technology has been proven to be an effective supplement to antihypertensive medications, demonstrating certain efficacy and long-term safety. However, two major clinical challenges remain to be addressed. ① The patient population for surgery is uncertain, with approximately 30% of patients not experiencing blood pressure reduction or even experiencing increases. Currently, the exclusion criteria for RDN include isolated systolic hypertension, which lacks clear clinical evidence and severely impacts the application of this technology among hypertensive patients, as elderly individuals over 65 often present with normal diastolic pressure. ② Determining the surgical endpoint is also a significant challenge for the clinical application of this technology. Currently, multiple ongoing studies are exploring how to establish surgical endpoints for RDN, such as the SMART clinical study conducted domestically, but there is still a lack of clear answers regarding the reliability of the technology, requiring further in-depth exploration.

(4)Technological Extension Exploration

In addition, renal artery denervation is being studied for clinical applications in treating insulin resistance, paroxysmal atrial fibrillation, ventricular arrhythmias, heart failure, and nocturnal paroxysmal sleep apnea. Thus, renal artery denervation is poised to become a promising and mature technology in the future cardiovascular and metabolic treatment fields due to its reliable safety and relatively simple clinical surgical operation.

(2)Market Status and Trends

Currently, renal artery denervation has not yet entered clinical practice, and no products have been approved for market entry domestically or internationally. The future market in China still faces many uncertainties. From a fundamental perspective, considering that Boston Scientific previously estimated the global market value of renal artery denervation surgery to be $2.5 billion in 2013, if we simply calculate based on China’s share of the global hypertensive population (1/5), the RDN market in China is projected to be around $500 million. Additionally, the aging society will lead to a continued increase in hypertension incidence, coupled with the current low treatment rate, indicating significant growth potential for the RDN market in the future.

(3)Industry Overview

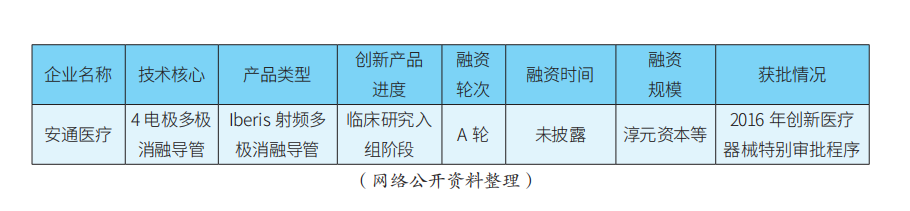

Renal artery denervation technology is still in its early stages in the international market, with Medtronic being the leading player, followed closely by Recor. In China, RDN is still in its early stages, with all clinical studies currently in the enrollment phase.

In terms of technological entry points, second-generation radiofrequency ablation devices often adopt multi-electrode layouts, and products can be divided into three categories: ① Multi-electrode radiofrequency ablation catheters: Medtronic’s Symplicity Spyral, MicroPort’s FlashPoint multi-polar catheter, etc.; ② Companies using mesh electrode radiofrequency ablation catheters: St. Jude’s previous EnligHTN, and Meili Weiye’s basket electrode, etc.; ③ Companies using balloon electrode radiofrequency ablation catheters: Boston Scientific’s previous Vessix V2 and Covidien’s previous Oneshot, etc. Domestically, Xinmai’s mappable positioning ablation catheter has methodological innovations and holds a certain degree of international leadership, but the feasibility and stability of its SMART mapping system still require clinical and market validation. Ultrasound ablation devices are represented by ReCor’s Paradise ultrasound catheter, and there are also SoniVie’s TIVUS ultrasound products. Chemical injection ablation devices are represented by Ablative’s Peregrine series products. Additionally, it is worth mentioning that Kangfeng Bio’s renal artery cryoballoon ablation product, which uses deep cryogenic control technology with liquid nitrogen to achieve renal artery ablation, has certain originality.

In terms of product progress, there are reports that Medtronic’s Symplicity Spyral product is expected to receive FDA approval soon. On April 16, 2021, Academician Ge Junbo led the completion of the first domestic renal artery denervation surgery using the Symplicity Spyral catheter at the Boao Super Hospital in Hainan. In the future, through innovative channels, Medtronic may consider using clinical data from foreign FDA studies combined with surgical data from super hospitals to apply for NMPA registration in China ahead of schedule. On the other hand, Recor’s Paradise ultrasound renal artery ablation product has recently received strategic investment from Otsuka Pharmaceutical, making it an important player in the Asian market. Most domestic RDN products are still in the clinical trial enrollment phase, generally constrained by the current RDN clinical trial enrollment criteria requiring diastolic pressure >90 mm Hg and other factors. In contrast, Xinmai’s mappable positioning renal artery radiofrequency ablation products, Kangfeng’s renal artery cryoballoon products, MicroPort’s saline multi-polar catheter ablation products, and Meili Weiye’s basket multi-polar ablation products are all in leading positions in the race.

In terms of financing, apart from MicroPort, there are currently no listed domestic companies, with most still in early financing stages.

The main innovative products and financing progress of key RDN companies are shown in Table 1.

(Cai Xingxing, Li Jianan, Zhang Yi, Yang Yanqin)

Copyright Statement

Article 1: All content of white papers published in this public account is owned by CCI;

Article 2: Any organization or individual is prohibited from using the content of the white paper for commercial purposes;

Article 3: Without authorization, no organization or individual may reproduce, copy, publish, or modify the white paper in any form;

Article 4: When reproducing or quoting the content of the white paper, it must be noted that “Source: CCI Cardiovascular Physician Innovation Club”;

Article 5: CCI reserves the right to pursue legal responsibility for violations of the above provisions.

To obtain reproduction authorization, please send “White Paper Reproduction” along with the public account name and the title of the content you wish to reproduce, or leave a message with the same content to apply for reproduction.

CCI Cardiovascular Physician Innovation Club

Long press the QR code to follow us

Planning for this issue: Shen Li

Article Authors: Bao Chen, Su Hongdong, et al.

Post-production: Ling Wujuan