Skip to content

Since the AspenCore analyst team released the “Research Report on 30 Domestic Wireless Connection (Bluetooth/Wi-Fi/NB-IoT/LoRa) Chip Manufacturers” last year, there have been significant changes in wireless connection technology and market, such as the rapid penetration of WiFi 6, the application of Bluetooth LE Audio, and the emergence of ultra-wideband (UWB) technology and applications. In addition, the landscape of domestic wireless connection chip manufacturers has also changed significantly, with the number of companies we compiled increasing from 30 to 55.

Scan to register for the EE live lecture: Fabless Technology and Application Series – New Bluetooth Standards and AIoT Application Trends

This report is not just an update of last year’s report; there have also been significant changes in the content and presentation. The main content of the report includes:

1. Wireless connection market trends

2. Domestic wireless connection chip manufacturers: listed companies

3. Case study of domestic wireless connection chip manufacturers: Espressif Technology

4. Top 55 domestic wireless connection chip manufacturers survey statistical analysis

5. Emerging wireless connection technologies, standards, and applications

On November 10-11, 2022, AspenCore will hold the “IIC Shenzhen – 2022 International Integrated Circuit Exhibition and Seminar” at the Shenzhen Great China International Exchange Square (Sheraton Hotel). Scan the QR code below to register.

👇 Scan to register 👇

Wireless Connection Market Trends

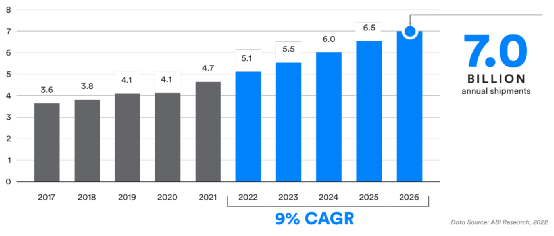

Bluetooth technology has expanded from its initial audio transmission to areas such as low-power data transmission, indoor positioning services, and reliable large-scale device networks. According to market statistics and forecasts from ABI Research, the annual shipment of global Bluetooth devices is expected to grow 1.5 times from 2021 to 2026, with a compound annual growth rate (CAGR) of 9%, and by 2026, the annual shipment of Bluetooth devices will exceed 7 billion for the first time.

According to authoritative market research predictions, the global Wi-Fi 6 market size is expected to reach $11.5 billion this year and grow to $26.2 billion by 2027, with a CAGR of 17.9%. Additionally, according to the Wi-Fi 6 market report released by IDC in 2021, the shipment of WiFi 6 devices is expected to exceed 3.5 billion units this year, with 20% supporting the 6 GHz band; by 2025, the shipment of WiFi 6 devices is expected to reach 5.2 billion units, with 41% being WiFi 6E devices.

By the end of 2022, it is expected that the number of NB-IoT base stations in China will exceed 700,000, covering most important scenarios. Currently, China Mobile has achieved major coverage of NB-IoT in 346 cities nationwide (covering main roads above townships), China Telecom’s overall coverage rate of NB-IoT has reached 97.84%, and China Unicom has established NB-IoT networks in 8 core city nodes. As of 2022, the number of IoT connections among the three major domestic operators is approximately 1.15 billion. If we roughly calculate based on a 42% share, the number of connections carried by the 2G network is estimated to be nearly 500 million, indicating a huge potential market for NB-IoT. With the retirement of 2G and 3G networks, by 2025, cellular IoT devices will mainly be carried by 5G, 4G, LTE-M, and NB-IoT, with NB-IoT accounting for 45%, indicating significant growth potential.

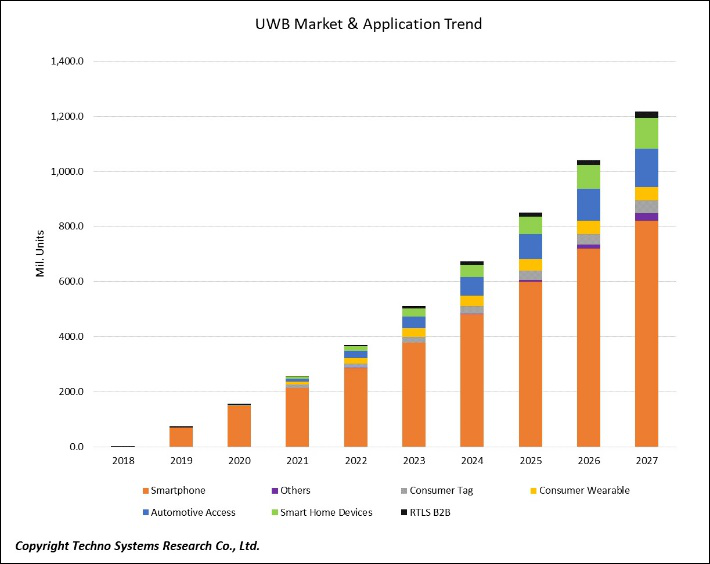

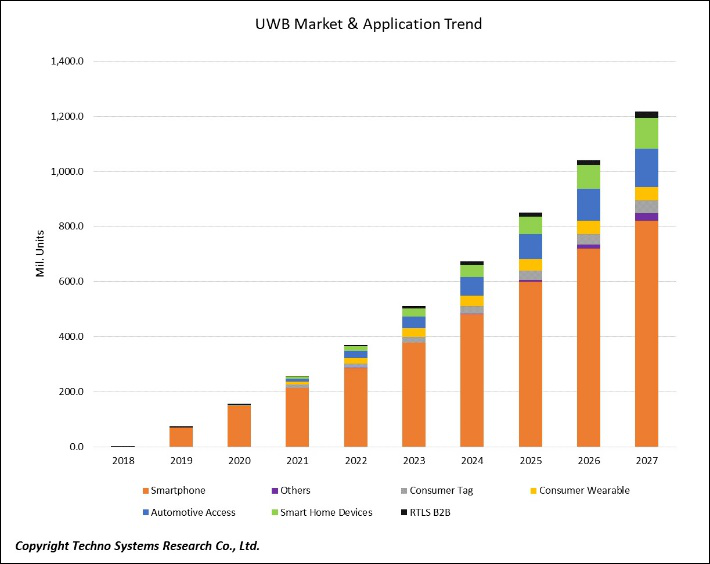

According to market research by Techno Systems, UWB has the potential to develop a market size comparable to Bluetooth and WiFi, with global UWB chip shipments expected to exceed 1.2 billion units by 2027, with the highest proportion coming from smartphone and automotive applications.

Operational Analysis of Domestic Wireless Connection Chip Listed Companies in the First Half of 2022

We selected these 7 listed companies from numerous wireless connection chip manufacturers and conducted a comprehensive comparison of their financial reports and operations in the first half of 2022. Among them, Hengxuan Technology, Espressif Technology, Broadcom, ZKLANXUN, and Jochip Technology derive most of their business and revenue from wireless connection chip products and related businesses, while Aojie Technology and Goodix Technology have a smaller proportion of revenue from wireless connection chip products. Additionally, GigaDevice and National Technology also have wireless MCUs and Bluetooth chip products, but due to their low revenue share and lack of clear distinction in their financial reports, we did not include them in our analysis.

There are also several wireless connection chip companies preparing for IPOs, including Tailing Microelectronics, Ankai Microelectronics, and Qinheng Microelectronics. However, due to the inability to obtain their financial data for the first half of this year, they are also not included.

1. Wireless revenue refers to the sales revenue of the company’s WiFi/Bluetooth/NB-IoT/LoRa and other wireless connection chip products, measured in millions;

2. Wireless gross profit is derived from the gross profit margin of wireless revenue, measured in millions;

3. Year-on-year growth: growth in the first half of 2022 compared to the first half of 2021;

4. R&D proportion: the proportion of R&D investment to total revenue.

Now, we will analyze and compare these 7 representative domestic wireless connection chip manufacturers based on several financial and operational indicators.

1. Wireless business revenue: the highest is Hengxuan Technology, with 687 million yuan; the lowest is Aojie Technology, which, despite having total revenue of 1.08 billion yuan in the first half of 2022, only has 6.08% of its revenue from non-cellular IoT chips (WiFi/LoRa/BLE/satellite navigation), amounting to only 61.99 million yuan.

2. Year-on-year growth (decline) ratio: compared to the first half of 2021, revenue generally declined, which is directly related to the decline in market demand this year. The most significant decline was Broadcom (29%), mainly due to the impact of the Shanghai epidemic control in the first half of the year and weak global market demand; the smallest decline was Espressif Technology (3%), which can be attributed to its global customer and revenue channel diversification. Additionally, Goodix Technology, which is diversifying its product line and transforming, has seen rapid revenue growth in wireless connection and audio chip products, accounting for 23.3% of total revenue.

3. Gross profit and gross profit margin: The gross profit margin of wireless chip manufacturers is generally around 40%, while ZKLANXUN and Broadcom are below 30%, significantly lower than their peers.

4. R&D proportion: Domestic wireless chip manufacturers generally have an R&D proportion of over 25%, with Aojie Technology reaching as high as 44%, which is related to its significant investment in cellular mobile communication chips and cutting-edge wireless technologies; ZKLANXUN has the lowest (5%), and its gross profit margin is also the lowest (22%), as its main products are Bluetooth chips aimed at the mid-to-low-end TWS earphone market.

Case Study of Domestic Wireless Connection Chip Manufacturer: Espressif Technology

Espressif Technology is a developer of AIoT chips and wireless connection solutions listed on the Sci-Tech Innovation Board. Its unique business model, positioning, and core competitiveness are particularly noteworthy among domestic and foreign wireless connection chip manufacturers. The AspenCore analyst team specifically selected this company as a representative for a case study of domestic wireless connection chip manufacturers.

The business model of Espressif Technology can be summarized as: a unique business model B2D2B (Business-to-Developer-to-Business) developed from the developer ecosystem. Its advantages are as follows:

1. Create an ecosystem to attract a large number of developers to join;

2. Most developers are technical developers from commercial companies (regardless of company size and industry), and they bring business opportunities from their companies;

3. When selecting chips and evaluating software solutions, companies in the same industry will refer to each other;

4. The company seizes the initiative to consult and convert it into sales revenue.

-

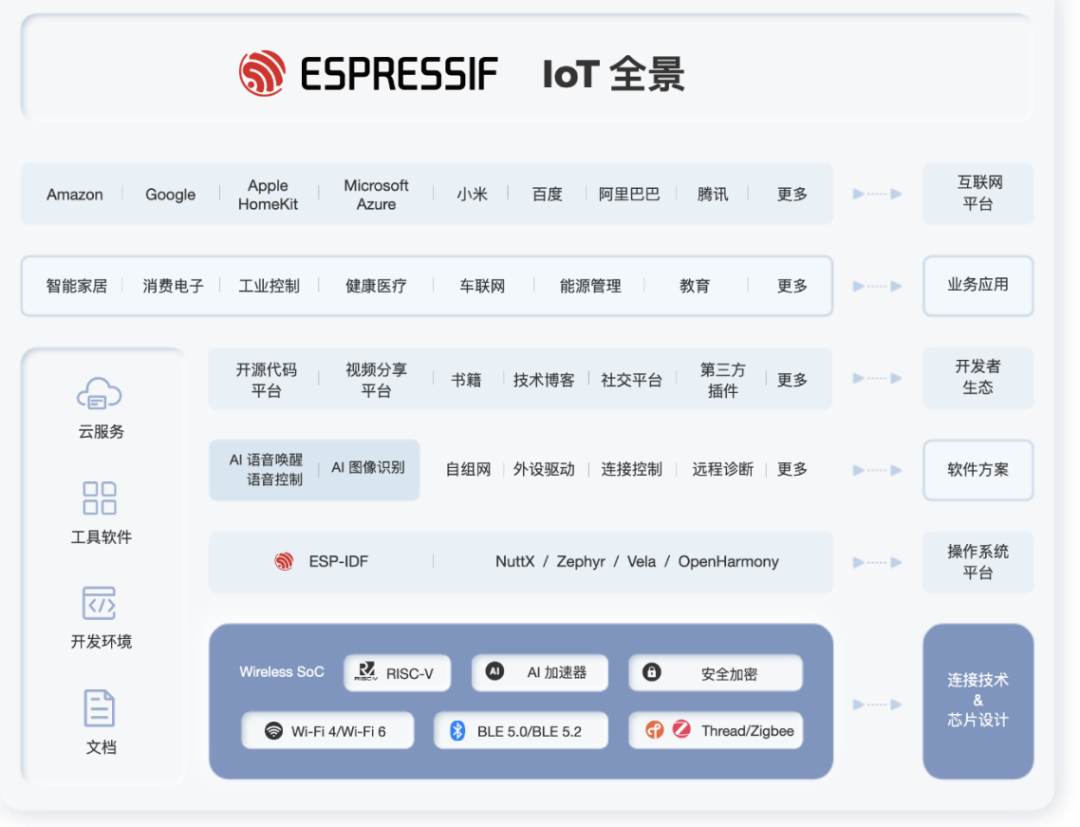

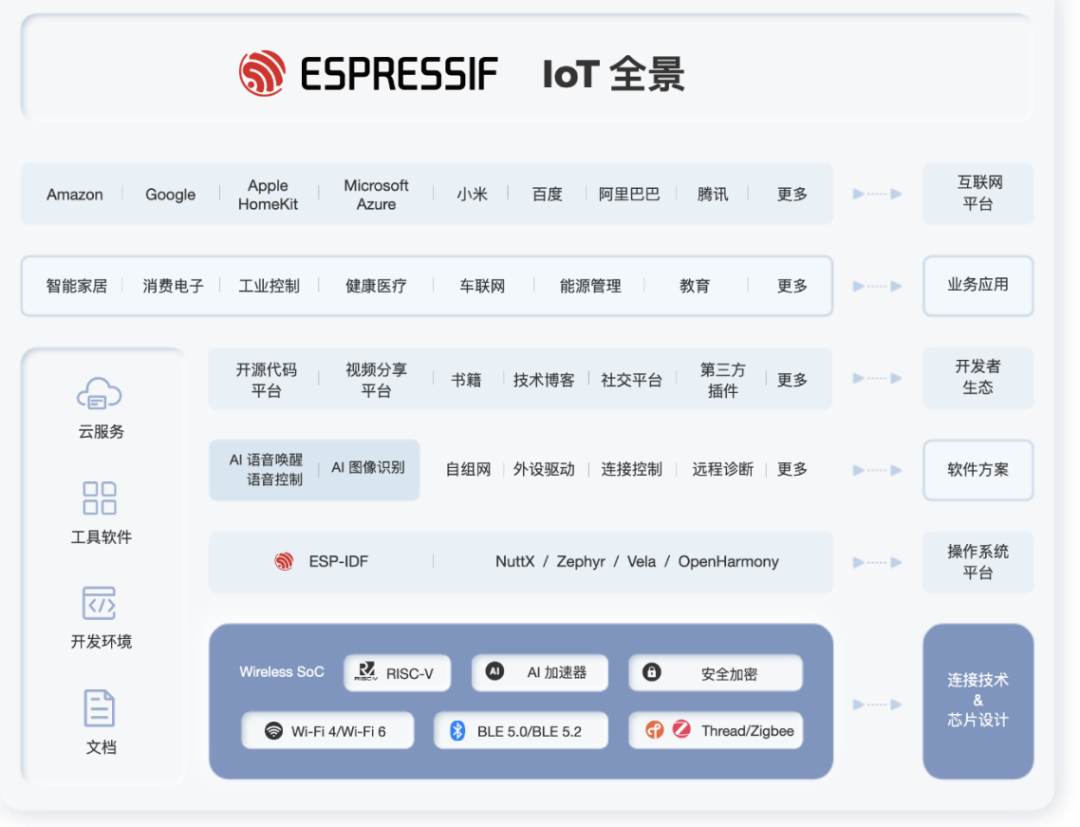

Company positioning: Espressif’s strategic goal is to develop into an IoT platform company, combining chip hardware, software solutions, and cloud computing technology, to provide one-stop AIoT products and services to all enterprises and developers globally.

-

Product positioning: For AIoT applications, the company’s products focus on “processing + connectivity”. “Processing” centers on MCUs, including AI computation; “connectivity” focuses on wireless communication, currently covering Wi-Fi, Bluetooth, and Thread, Zigbee technologies, with product boundaries expanding to the Wireless SoC field.

-

Core technologies: WiFi 6, RISC-V processor core, RF and baseband technology, BLE, AI voice recognition and image processing, AIoT cloud platform.

Espressif began developing and designing IoT Wi-Fi MCU communication chips at its inception, and its products have now expanded to the Wireless SoC field. The company has accumulated a series of core technologies with independent intellectual property rights in the IoT chip field, such as RISC-V instruction set-based MCU architecture, heterogeneous methods and architectures for Wi-Fi IoT, high-power Wi-Fi RF technology, highly integrated chip design technology, collective control systems for multiple Wi-Fi IoT devices, and AI hardware acceleration.

2. System Competitiveness

The advantage of mastering system-level software capabilities lies in its ability to leverage core software development capabilities at the lower level when collaborating with third-party platforms. Espressif’s hardware products not only support the native operating system development framework ESP-IDF but also support third-party operating systems such as NuttX, Zephyr, Xiaomi Vela, and open-source Harmony. When the new smart home standard Matter was established overseas, the company’s products were able to provide technical support immediately, and they have already supported multiple customers in achieving standard adaptation.

3. Software Competitiveness

Software solutions: Beyond system-level software development capabilities, the next layer closer to users is software application development capability. Above the operating system are numerous software application solutions, including AI artificial intelligence (offline/online intelligent voice recognition and control, image recognition), Wi-Fi Mesh networking, BLE-Mesh networking, touch functions, and various peripheral drivers, covering the main development needs of downstream customers, significantly lowering the threshold and cost for customer application development. Additionally, the company also provides a large number of application examples to help developers greatly improve product development efficiency.

4. Ecosystem Competitiveness

Espressif’s goal is to build an IoT ecosystem that integrates chip hardware, software, customer business applications, and developer communities. This is reflected in:

1. Diversified business application scenarios: In addition to smart home and consumer electronics, its products are entering more and more new fields and customers, including industrial control, vehicle networking, healthcare, smart offices, energy management, etc. The downstream business scenarios present diverse forms, and its open ecosystem model is developed to fit these long-tail, diverse, and fragmented business forms. This can serve not only influential brand customers in the industry but also a large number of small and medium-sized customers and startups.

2. Developer ecosystem: The company’s open-source community ecosystem has high visibility in the global IoT developer community. Many engineers, makers, and tech enthusiasts actively develop new software applications based on the company’s hardware products and basic software development toolkits, freely exchanging and sharing experiences in using the company’s products and technologies.

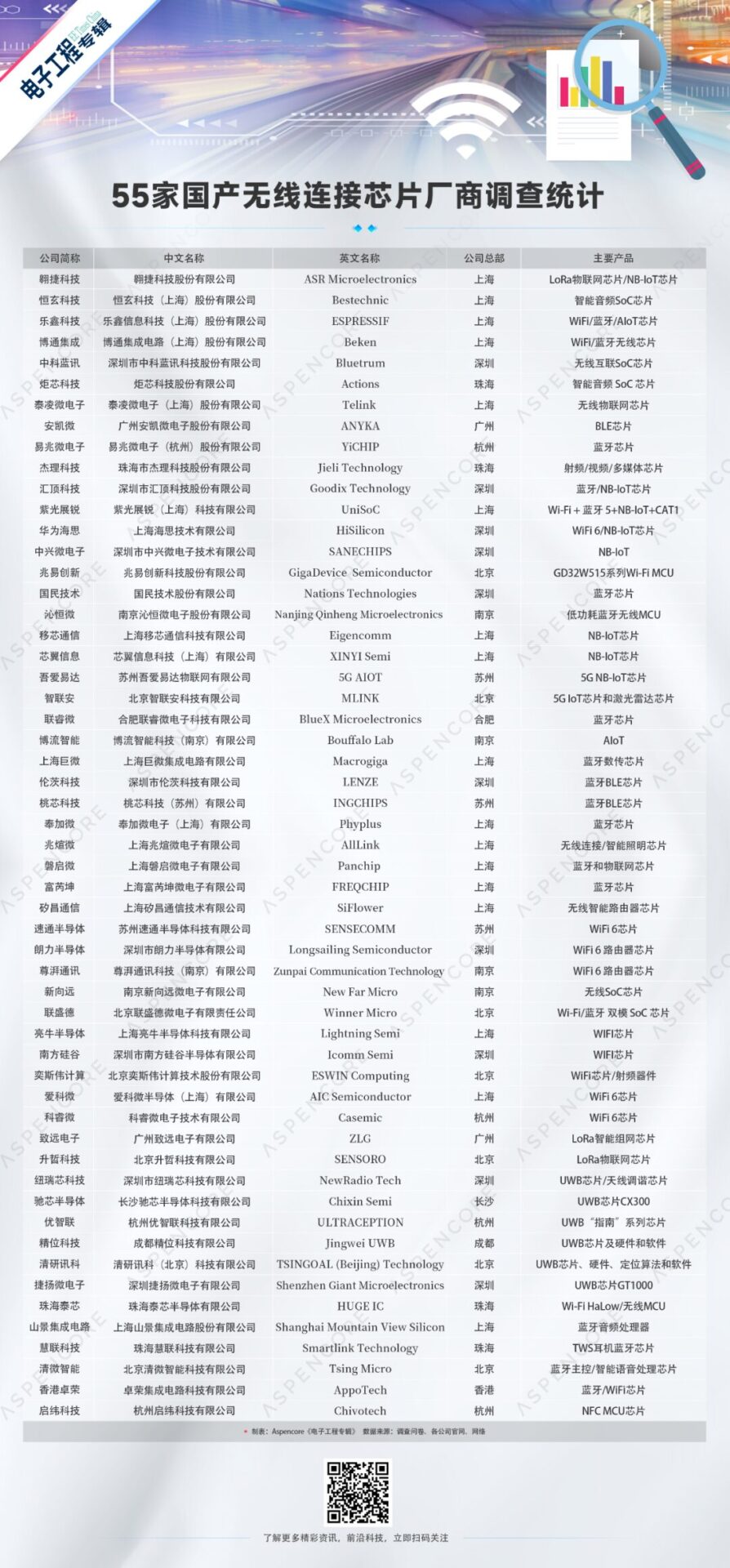

Survey Statistics of 55 Domestic Wireless Connection Chip Manufacturers

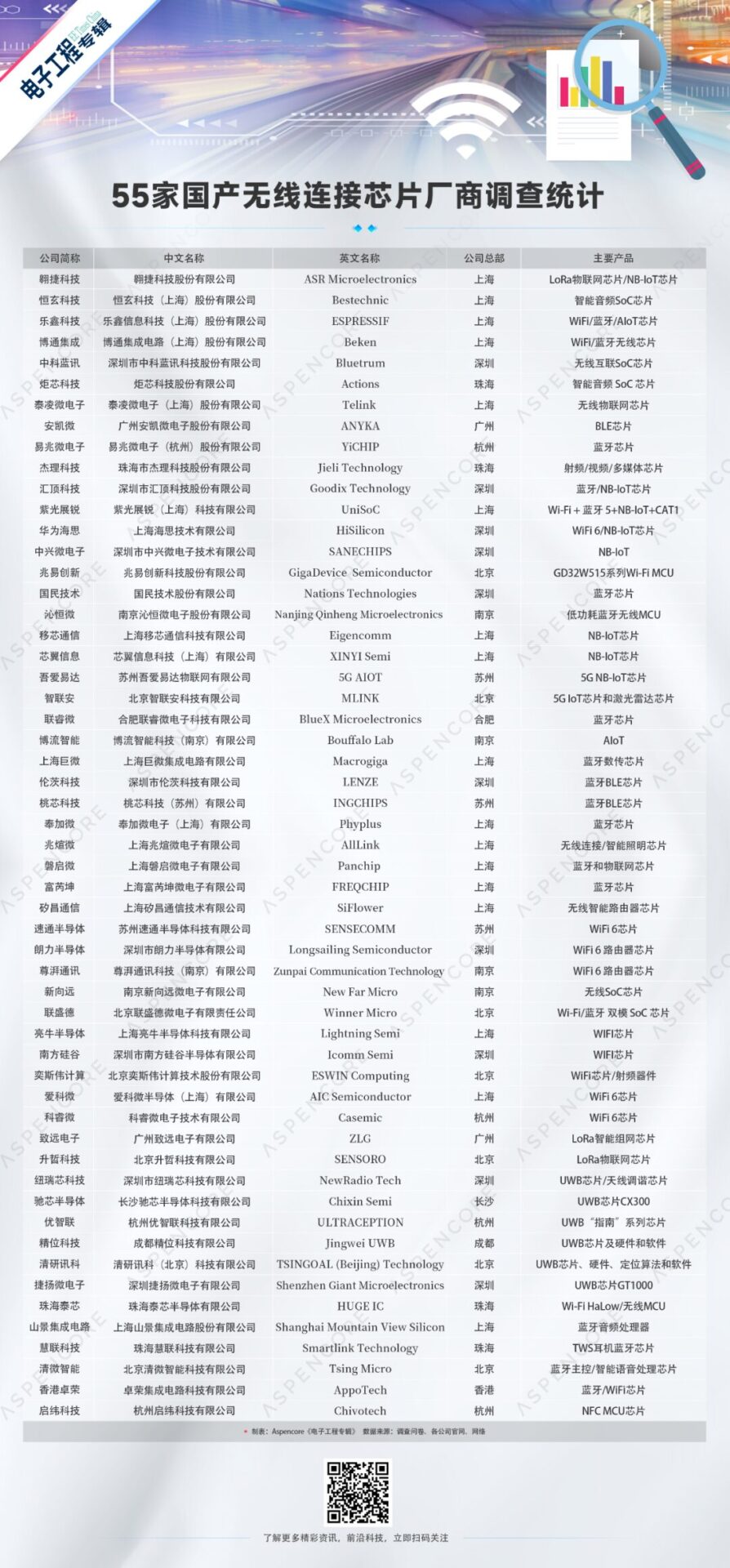

The AspenCore analyst team has compiled 55 domestic wireless connection chip manufacturers, whose main technologies and products cover the wireless fields of WiFi/WiFi 6, Bluetooth/BLE, Bluetooth audio SoC, Bluetooth wireless MCU, NB-IoT, CAT1, LoRa, and UWB.

Now, the statistical analysis of these 55 manufacturers is as follows:

1. There are 11 companies that are already listed or in the process of applying for listing, including GigaDevice, which recently launched WiFi wireless MCU, and National Technology, which provides Bluetooth wireless chip products, although wireless business accounts for a small proportion for them.

2. There are 11 manufacturers capable of providing multi-mode wireless chips such as WiFi, Bluetooth, and NB-IoT, including Aojie Technology, Espressif Technology, Broadcom, Tailing Microelectronics, Goodix Technology, Unisoc, Huawei HiSilicon, ZTE Microelectronics, Boliu Intelligent, Lianshengde, and Hong Kong Zhuorong.

3. There are 9 manufacturers providing Bluetooth audio and/or TWS earphone SoC chips, including Hengxuan Technology, ZKLANXUN, Jochip Technology, Tailing Microelectronics, Goodix Technology, Jieli Technology, Furukawa, Shanjing Integrated Circuit, and Huilian Technology.

4. There are 8 manufacturers providing WiFi 6 chips, including Huawei HiSilicon, Xichang Communication, Sutong Semiconductor, Longli Semiconductor, Zunpai Communication, Boliu Intelligent, Aike Micro, and Kerui Micro.

5. There are 8 manufacturers providing NB-IoT chips, including Aojie Technology, Goodix Technology, Unisoc, Huawei HiSilicon, ZTE Microelectronics, Yicheng Communication, Xinyi Information, and Wuaie Da.

6. There are 6 manufacturers providing UWB chips, including Nuwai Technology, Chixin Semiconductor, Youzhilian, Jingwei Technology, Qingyan Xunke, and Jieyang Microelectronics.

7. There are 3 manufacturers providing LoRa IoT chips, including Aojie Technology, Zhiyuan Electronics, and Shengzhe Technology.

8. By headquarters region, there are 17 in Shanghai, 10 in Shenzhen, 7 in Beijing, 4 each in Hangzhou/Nanjing/Zhuhai, 3 in Suzhou, 2 in Guangzhou, and 1 each in Chengdu/Hefei/Changsha/Hong Kong.

Emerging Wireless Connection Technologies, Standards, and Applications

Matter: Unified Wireless Connection and Smart Home Standard

In 2019, the smart home open standard Matter was first proposed by Amazon, Apple, Google, Samsung SmartThings, and the ZigBee Alliance, initially referred to as the IP Connected Home Project (CHIP). The project aims to develop and promote a new connection protocol that eliminates patent fees, integrating different protocol components like Zigbee, Thread, Bluetooth, and Wi-Fi into an overall standard to simplify the development costs for smart home device manufacturers and improve compatibility between products.

In 2021, Matter replaced the original CHIP as the official name of the standard, and the ZigBee Alliance was renamed the Connectivity Standards Alliance (CSA). As a new connection standard for smart homes, Matter provides a unified connection protocol based on IP, allowing smart locks, smart speakers, smart kettles, air conditioners, TVs, curtains, lights, and other devices from different brands to interact more smoothly on the Matter platform, thus providing better practicality and user experience for home products.

In October this year, the CSA announced the official release of the Matter 1.0 technical specification, and the certification program was opened simultaneously. Smart home brands can conduct relevant testing and certification for their products, and once certified, they can start selling devices with the Matter logo.

The Matter 1.0 version operates over Wi-Fi, Thread, and Ethernet, using low-power Bluetooth for device debugging, supporting a range of smart home devices, including lighting and electrical, HVAC control, curtains, security sensors, door locks, and media devices.

This is a milestone event in the history of smart home development, indicating that alliance members from various segments of the IoT ecosystem, from chips to retail, can now have a complete solution, providing a new generation of products that offer interconnectivity across brands and ecosystems, allowing consumers to experience better privacy protection, security, and convenience.

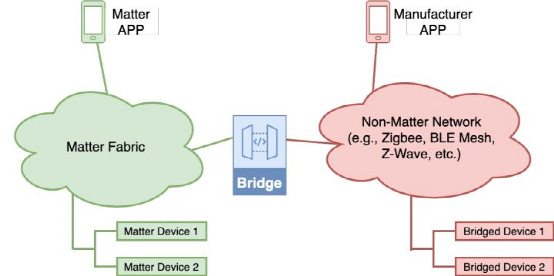

Existing devices commonly use Zigbee, Z-Wave, and other IoT wireless protocols. Although they cannot connect directly to Matter, the foundation for connection is there – bridging is the key for Matter to connect to these existing devices. By integrating such bridging gateways in new devices, existing sensor networks can interoperate with the Matter network.

Bridging devices in the Matter ecosystem allow users to control their Matter and non-Matter devices without distinction.

In the Matter ecosystem, non-Matter devices can serve as “bridged device” nodes, completing the mapping between other protocols (such as Zigbee) and the Matter protocol through the bridging device, thus enabling communication with Matter devices in the system.

WiFi 6 and WiFi 7: High Bandwidth, Multi-User, and Low Latency to Meet Extremely High Throughput (EHT) Application Needs

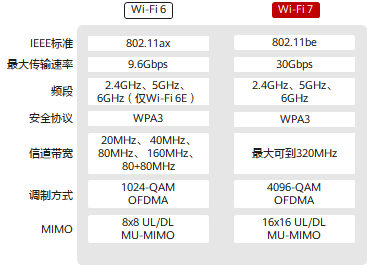

WiFi 6 (802.11ax) is the latest generation of Wi-Fi standards following Wi-Fi 5 (802.11ac), introducing new technologies such as OFDMA, uplink/downlink MU-MIMO, BSS Coloring, and TWT. WiFi 6 has significantly improved performance, with bandwidth and concurrent user numbers increased by 4 times compared to Wi-Fi 5, along with lower latency and energy consumption.

Wi-Fi 6 is designed to address high-density wireless access and high-capacity wireless services, such as outdoor large public places, high-density venues, indoor high-density wireless offices, electronic classrooms, and other scenarios. In these application scenarios, the number of client devices accessing the Wi-Fi network has seen tremendous growth, and the increasing voice and video traffic also puts pressure on Wi-Fi networks. For instance, 4K video streams (bandwidth requirement of 50Mbps/person), voice streams (latency less than 30ms), and VR streams (bandwidth requirement of 75Mbps/person, latency less than 15ms) are highly sensitive to bandwidth and latency. If network congestion or retransmission leads to transmission delays, it will significantly impact user experience. The high bandwidth and user capacity of WiFi 6 can meet these demands, and market forecasts suggest that WiFi 6 is expected to replace WiFi 5 and become mainstream within three years.

As WLAN technology evolves, homes, enterprises, and commercial locations are increasingly relying on Wi-Fi as their primary means of access. New applications that have emerged in recent years have higher requirements for throughput and latency, such as 4K and 8K video (transmission rates may reach 20Gbps), VR/AR, gaming (latency requirements below 5ms), remote work, online video conferencing, and cloud computing. Although the Wi-Fi 6 standard has particularly focused on user experience in high-density scenarios, it still cannot fully meet the higher demands for throughput and latency.

Therefore, IEEE 802.11 has released a new revision standard, IEEE 802.11be, which is the next-generation standard WiFi 7 with Extremely High Throughput (EHT). Wi-Fi 7 builds on Wi-Fi 6 and introduces technologies such as 320MHz bandwidth, 4096-QAM, Multi-RU, multi-link operation, enhanced MU-MIMO, and multi-AP collaboration, thereby providing higher data transfer rates and lower latency. Wi-Fi 7 is expected to support throughput of up to 30Gbps, approximately three times that of Wi-Fi 6.

Wi-Fi 7 supports the following new features:

1. Supports a maximum bandwidth of 320MHz: To achieve a maximum throughput of no less than 30Gbps, Wi-Fi 7 will continue to introduce the 6GHz band and add new bandwidth modes, including contiguous 240MHz, non-contiguous 160+80MHz, contiguous 320 MHz, and non-contiguous 160+160MHz.

2. Supports Multi-RU mechanism: In Wi-Fi 6, each user can only send or receive frames on the specific RU assigned, greatly limiting the flexibility of spectrum resource scheduling. To further enhance spectrum efficiency, Wi-Fi 7 defines a mechanism that allows multiple RUs to be assigned to a single user.

3. Introduces higher-order 4096-QAM modulation technology: The highest modulation method in Wi-Fi 6 is 1024-QAM, where modulation symbols carry 10 bits. To further enhance the rate, Wi-Fi 7 will introduce 4096-QAM, allowing modulation symbols to carry 12 bits. Under the same coding, Wi-Fi 7’s 4096-QAM can achieve a 20% rate increase compared to Wi-Fi 6’s 1024-QAM.

4. Introduces Multi-Link mechanism: To efficiently utilize all available spectrum resources, it is imperative to establish new spectrum management, coordination, and transmission mechanisms across 2.4 GHz, 5 GHz, and 6 GHz. The working group has defined technologies related to multi-link aggregation, mainly including enhanced multi-link aggregation MAC architecture, multi-link channel access, and multi-link transmission.

5. Supports more data streams, enhanced MIMO functionality: In Wi-Fi 7, the number of spatial streams increases from 8 in Wi-Fi 6 to 16, theoretically doubling the physical transmission rate. Supporting more data streams also brings a powerful feature – distributed MIMO, meaning that 16 data streams can be provided not just by one access point, but by multiple access points working together, requiring collaboration among multiple APs.

6. Supports coordinated scheduling among multiple APs: The coordinated scheduling among multiple APs in Wi-Fi 7 includes time-domain and frequency-domain coordination planning between cells, interference coordination between cells, and distributed MIMO, which can effectively reduce interference between APs and greatly improve the utilization of air interface resources.

The application scenarios for Wi-Fi 7 include: video streaming, video/voice conferencing, wireless gaming, real-time collaboration, cloud/edge computing, industrial IoT, immersive AR/VR, and interactive remote healthcare.

BLE Auracast: Low Latency, Low Power, and Better Audio Experience

Recently, the Bluetooth Alliance announced the completion of the long-awaited LE Audio series specifications, which not only greatly enhance Bluetooth audio performance but also support hearing assistance functions, and released a new broadcast audio technology called Auracast. This new broadcast audio technology will allow audio source devices (such as smartphones) to broadcast one or more audio streams simultaneously to countless audio receiving devices (such as TWS earphones, speakers, hearing aids, etc.). Auracast will change the way we interact and communicate with others and the outside world, providing users with a better listening experience.

Auracast broadcast audio will enable all types of public places – from large venues like airports and conference centers to smaller venues like stadiums, cinemas, and places of worship – to provide high-quality audio experiences, enhancing customer satisfaction and accessibility. Typical application scenarios include:

1. Silent screens: Public places with silent TV screens, such as airports, stadiums, and waiting rooms, will provide a more satisfying viewing experience, allowing viewers to use their own Bluetooth earplugs or hearing devices to listen to the audio of the TV broadcasts.

2. Tour systems: Public places providing tours, such as museums, conference centers, and tourist attractions, can allow visitors to use their own Bluetooth earplugs or hearing devices while participating in the tour, creating a more engaging tour experience.

3. Multilingual support: Public places supporting simultaneous interpretation services (such as conference centers) can provide enhanced audio experiences, allowing attendees to use their own Bluetooth earplugs or hearing devices to listen to audio in their desired language.

4. Hearing enhancement/assistance: Venues deploying public broadcasting systems (such as airports, cinemas, auditoriums, conference centers, religious venues, etc.) can allow visitors to receive broadcast audio directly in their own Bluetooth earplugs or hearing devices, providing a higher quality audio experience. When used in this way, Auracast broadcast audio can serve as a high-quality, low-cost next-generation assistive listening system (ALS), improving the audio experience for visitors with hearing impairments.

Ultra-Wideband (UWB): High-Precision Ranging and Indoor Positioning Technology

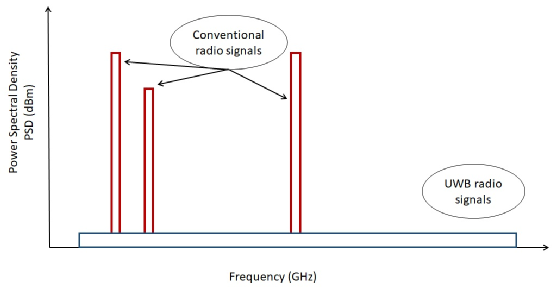

Like WiFi and Bluetooth, ultra-wideband (UWB) is a short-range wireless communication protocol. Since Apple introduced the UWB chip U1 and AirTag functionality in its iPhone 11 in 2019, UWB has entered the public eye and become a popular application for short-range wireless communication and precise positioning. UWB was originally limited to military use, and in 2002, the FCC released UWB commercialization regulations, allowing UWB to use unlicensed frequency bands, with a frequency range from 3.1 to 10.5 GHz. The FCC and ITU define UWB as antenna transmissions with a signal bandwidth exceeding 500 MHz. This pulse-based communication system’s each transmission pulse can occupy at least 500 MHz of UWB bandwidth.

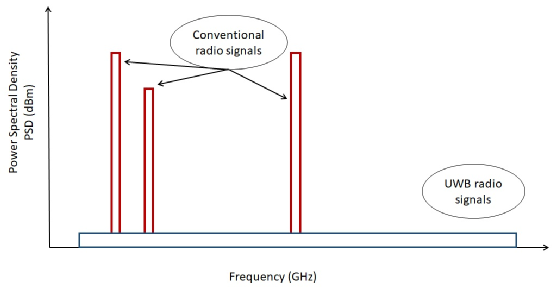

UWB does not use a carrier but utilizes nanosecond (ns) to picosecond (ps) level non-sinusoidal narrow pulses to transmit data. The time modulation technology used greatly enhances its transmission speed while consuming relatively low power and having precise positioning capabilities. Unlike the continuous carrier methods commonly used in wireless communication, UWB uses extremely short pulse signals to transmit data, with bandwidth occupancy reaching several GHz, allowing maximum data transmission rates of hundreds of Mbps. Due to the use of extremely short pulses, UWB devices emit very low power, only a fraction of current continuous carrier systems.

Compared with other short-range communication protocols, the spectral density of UWB is as shown. UWB can operate efficiently in signal-dense environments with almost no interference. It operates within a frequency range of 3.1-10.6 GHz, with required transmission power ranging from 0.5mW to 41.3 dBm/MHz. UWB’s transmission distance is around 10 meters, with transmission rates up to 480Mbps, which is dozens of times higher than Bluetooth, making it ideal for large-scale multimedia information transmission.

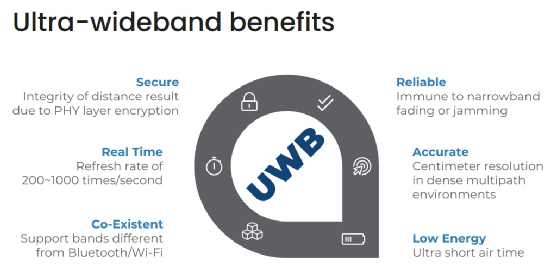

The main applications of UWB include communication and sensing, positioning and tracking, and radar detection. Compared to WiFi and Bluetooth positioning technologies, UWB’s high-precision ranging and indoor positioning capabilities have the following advantages:

1) High positioning accuracy: Bandwidth determines the signal distance resolution capability (proportional relationship). UWB excels in distance resolution capability, with accuracy potentially reaching hundreds of times that of traditional systems under specific conditions. The bandwidth of ultra-wideband pulse signals is at the nanosecond level, with positioning accuracy typically less than a few centimeters.

2) High security: UWB’s low transmission power allows its signals to be well concealed among other types of signals and environmental noise, making it difficult for traditional receivers to identify and receive. They must use the same spread spectrum code pulse sequence as the transmitter for demodulation, thus ensuring strong system security.

3) Strong anti-interference capability: From a radio frequency mechanism perspective, UWB’s emitted pulse waves have stronger anti-interference capabilities than continuous electromagnetic waves, and the frequency bands UWB operates in (3GHz-10GHz) have significantly fewer external interference signals compared to 2.4G wireless positioning technologies.

4) High transmission rate: Channel capacity is proportional to bandwidth, and UWB has a wide bandwidth, thus offering a high transmission rate.

5) Low power consumption: In short-range communication applications, UWB transmitters generally operate at power levels below 1mW; lower transmission power can extend system operating time and also results in minimal electromagnetic wave radiation to the human body.

Main Application Scenarios of UWB

Consumer applications — mobile phones and tag accessories, smart homes, drones/robots, mobile payments, wearable devices, VR/AR

Automotive applications — keyless entry systems, underground garage and parking navigation, remote parking, V2X and ADAS, internal vehicle detection, proximity sensing

Industrial applications — factory workshops, hospitals/nursing homes, smart buildings, new retail, smart agriculture, smart cities

International suppliers of UWB chips and application solutions include:

Compared with other short-range communication protocols, the spectral density of UWB is as shown. UWB can operate efficiently in signal-dense environments with almost no interference. It operates within a frequency range of 3.1-10.6 GHz, with required transmission power ranging from 0.5mW to 41.3 dBm/MHz. UWB’s transmission distance is around 10 meters, with transmission rates up to 480Mbps, which is dozens of times higher than Bluetooth, making it ideal for large-scale multimedia information transmission.

The main applications of UWB include communication and sensing, positioning and tracking, and radar detection. Compared to WiFi and Bluetooth positioning technologies, UWB’s high-precision ranging and indoor positioning capabilities have the following advantages:

1) High positioning accuracy: Bandwidth determines the signal distance resolution capability (proportional relationship). UWB excels in distance resolution capability, with accuracy potentially reaching hundreds of times that of traditional systems under specific conditions. The bandwidth of ultra-wideband pulse signals is at the nanosecond level, with positioning accuracy typically less than a few centimeters.

2) High security: UWB’s low transmission power allows its signals to be well concealed among other types of signals and environmental noise, making it difficult for traditional receivers to identify and receive. They must use the same spread spectrum code pulse sequence as the transmitter for demodulation, thus ensuring strong system security.

3) Strong anti-interference capability: From a radio frequency mechanism perspective, UWB’s emitted pulse waves have stronger anti-interference capabilities than continuous electromagnetic waves, and the frequency bands UWB operates in (3GHz-10GHz) have significantly fewer external interference signals compared to 2.4G wireless positioning technologies.

4) High transmission rate: Channel capacity is proportional to bandwidth, and UWB has a wide bandwidth, thus offering a high transmission rate.

5) Low power consumption: In short-range communication applications, UWB transmitters generally operate at power levels below 1mW; lower transmission power can extend system operating time and also results in minimal electromagnetic wave radiation to the human body.

Main Application Scenarios of UWB

Consumer applications — mobile phones and tag accessories, smart homes, drones/robots, mobile payments, wearable devices, VR/AR

Automotive applications — keyless entry systems, underground garage and parking navigation, remote parking, V2X and ADAS, internal vehicle detection, proximity sensing

Industrial applications — factory workshops, hospitals/nursing homes, smart buildings, new retail, smart agriculture, smart cities

International suppliers of UWB chips and application solutions include:

-

Decawave: Acquired by Qorvo for $400 million in 2020;

-

NXP: Released UWB+SE chips, targeting the automotive keyless entry application market;

-

3db Access: Renesas will obtain technology licensing from 3db UWB, and both parties will work together to provide secure access solutions for smart homes, IoT, Industry 4.0, as well as mobile computing and vehicle networking applications;

-

Apple U1: Since the iPhone 11, all iPhones and iPads have adopted UWB technology;

-

Microchip: Released UWB chip products in 2021

-

CEVA: UWB technology solutions and IP

Domestic UWB chip manufacturers include: Nuwai Technology, Chixin Semiconductor, Jingwei Technology, Qingyan Xunke, Hanwei Microelectronics, Youzhilian, Jieyang Micro.

Click the lower left corner “Read Original” to download the complete PDF version

International Integrated Circuit Exhibition Shenzhen Station

[November 10-11] Shenzhen Great China International Exchange Square, see you there!

# Global Distribution and Supply Chain Leaders Summit

24th Efficient Power Management and Power Device Forum

Industry 4.0 Technology and Application Forum

“Chip” Product Release and Series Project Matching Meeting, etc.

Exhibition area: Gathering 100+ domestic and foreign exhibitors, setting up themed pavilions for Industry 4.0, power and power semiconductors, wireless connections, distribution and supply chains, etc., helping you seize new opportunities in the industry.

👇 Scan the QR code to register 👇