Author / Zhang Wuhua, General Manager of Information Technology Department, Huaxia Bank Guangzhou Branch

Zhang Weiqing, Huang Li, Yu Haiyang, Information Technology Department, Huaxia Bank Guangzhou Branch

Industrial digital finance is an innovative financial model targeted at the industrial sector, which has received strong policy support in recent years and is in a stage of rapid development and continuous improvement. Industrial digital finance is based on enterprise data as the core foundation, relying on the industrial internet as the underlying support, and leveraging powerful digital technologies to comprehensively promote the deep integration and development of industry and finance. The integration of industrial finance and digitalization effectively uses technologies such as the Internet of Things, big data, and artificial intelligence to solve many issues, including the association between online electronic warehouse receipts and offline physical assets, avoiding false warehouse receipts and repeated pledges. However, this also requires that the banking industry’s digital finance platform has the capability to analyze and process the massive perception and business data generated by the applications of IoT, big data, and artificial intelligence, ensuring precise parsing, deep mining, and real-time response to these complex information flows. In recent years, with the continuous development of edge computing technology, the data processing and computing capabilities have shifted from the traditional “end-to-cloud” centralized computing model to a three-layer processing model of “end-edge-cloud,” which offers higher processing and computing performance, lower latency, and better security. This article analyzes the research and application of edge computing technology in the field of industrial digital finance and proposes recommendations for banks to use edge computing technology in this area to promote further integration and development of industrial financial digitization.

Edge Computing Has Wide Application Scenarios in Industrial Digital Finance

In today’s wave of digital transformation, edge computing is a cutting-edge technology strategy that focuses on building a distributed open model located at the network edge, close to physical entities or data generation sources. Compared to traditional cloud computing paradigms, edge computing pushes computing power directly to the source of data generation with its unique advantages. This transformation not only significantly reduces data processing latency but fundamentally enhances the real-time response capability of data processing, ensuring the immediacy and accuracy of information flow. The key capabilities of networking, computing, storage, and applications are deeply integrated into edge computing, aiming to provide efficient edge intelligent services at close range. Through these services, edge computing can precisely respond to the urgent needs for agile connectivity, real-time business processing, data optimization analysis, application intelligent upgrades, and enhanced security and privacy protection in the digital transformation of industries, thereby promoting more efficient, flexible, and secure digital operations across various sectors. In the “Financial Technology Development Plan (2022-2025)” released by the People’s Bank of China in 2022, it strategically pointed out high-frequency business scenarios in the financial industry, actively deploying and developing intelligent edge computing nodes. This plan aims to construct a cutting-edge technology-led, precisely adaptable edge computing capability system to empower the digital transformation of the financial industry and promote a more efficient and intelligent financial service ecosystem.

In the field of industrial digital finance, banks combine edge computing with technologies such as the Internet of Things, artificial intelligence, blockchain, 5G, and digital twins to fully utilize local computing resources as key edge nodes. As an IoT edge node, it receives data from the IoT sensing layer of movable asset financing enterprises, achieving real-time data collection and processing; as an artificial intelligence edge node, it can achieve real-time data analysis and decision-making by deploying algorithms and models on edge services; the combination of digital twins and edge computing can fully leverage the advantages of both. Edge computing can provide real-time, rapid data processing capabilities for digital twins, ensuring the real-time and accuracy of digital twins; meanwhile, digital twins can help edge computing achieve a deeper understanding and optimization of the physical world. Additionally, edge computing can effectively reduce data transmission costs and risks, improve data security and privacy protection capabilities, providing strong support and guarantees for the development of industrial digital finance, thereby promoting the digital transformation and innovation of industrial finance.

Exploring Digital Innovation Models in Industrial Finance Using Edge Computing

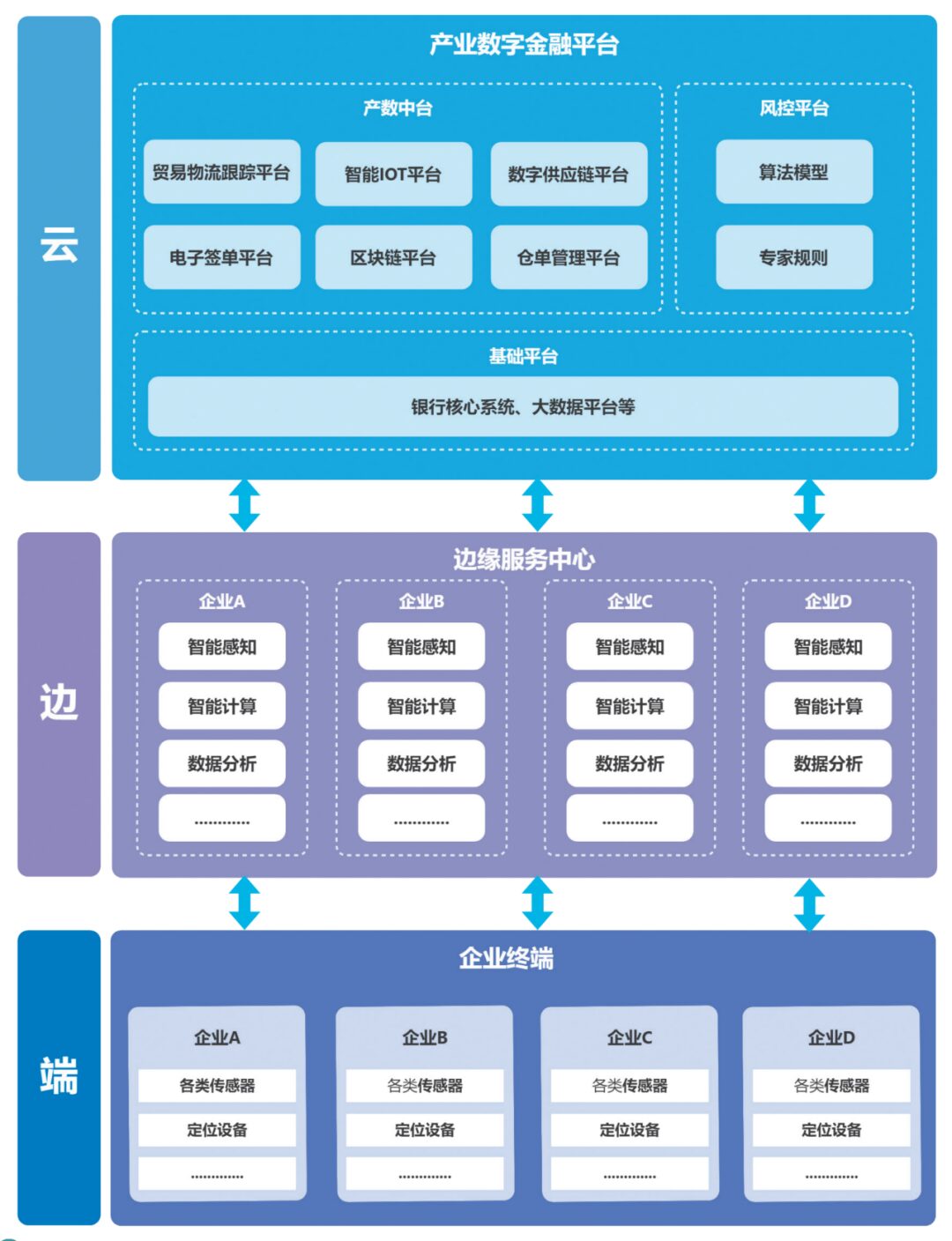

Through advanced technologies such as the Internet of Things, blockchain, artificial intelligence, and big data, industrial digital finance has achieved comprehensive transparency of information data along the industrial chain, deep tracking of asset conditions, and real-time access to the latest data, allowing for timely monitoring and early warning of potential risks (as shown in Figure 1). At the same time, with comprehensive data analysis of enterprise production operations and capital flows, it can precisely construct a digital credit system and flexibly implement digital guarantee mechanisms. The traditional model of industrial digital finance services is a “cloud-end” model, while the introduction of edge computing technology can transform this traditional centralized “cloud-end” model into a “cloud-edge-end” model. It offloads all or part of the computational tasks that originally ran on the cloud to edge services, fully utilizing the computing capabilities and storage resources of local devices, improving the efficiency and performance of data analysis and algorithm model execution. Reducing the computational pressure on the “cloud” can also solve many issues such as slow data transmission speeds and insufficient data processing capabilities, while some enterprise digital movable asset monitoring rules and risk warning rules can be preloaded to the edge service side, allowing for timely detection and alerts of abnormal digital movable assets and business operations. This timely alerting resolves the problem of information asymmetry in the banking risk control field, ensuring that risks are controllable.

Figure 1: Technical Architecture of Industrial Digital Finance “Cloud-Edge-End”

1. Enterprise Side (End). The enterprise side introduces technologies such as the Internet of Things, electronic warehouse receipts, and digital twins to ensure the authenticity and traceability of enterprise digital assets by acquiring ecological data (industrial chain, logistics, etc.) of the enterprise industry, ensuring the authenticity of goods management, real-time monitoring of goods, and solving issues such as false warehouse receipts and multiple receipts for one item, no longer relying solely on traditional movable asset financing management. It also collects enterprise production operation data to provide important data support for banks to establish enterprise digital credit, implement digital guarantees, and facilitate movable asset financing.

2. Bank Side (Cloud). The industrial digital finance platform is based on the bank’s core system and big data foundational platform, applying digital innovation technologies such as the Internet of Things, artificial intelligence, blockchain, digital ecological maps, and digital twins to build an integrated intelligent open platform covering digital credit, risk control, and monitoring, capable of external data and ecological data connections, meeting the needs of providing digital movable asset financing services for various industry chains. The industrial digital finance platform can orchestrate various models and rules (such as enterprise risk models) based on key information such as enterprise type and credit, offloading model algorithms to edge service nodes deployed within enterprises.

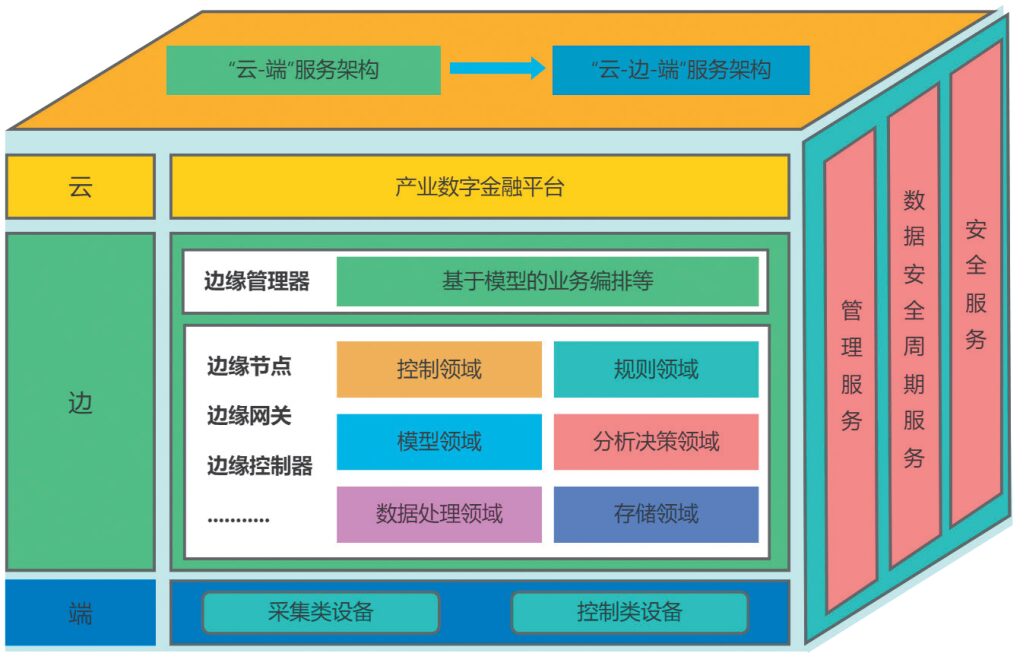

3. Edge Side (Edge). In the three-layer structure of “cloud-edge-end,” the edge part plays a key role (as shown in Figure 2). Besides receiving, analyzing, and transmitting information flows between the cloud and the end, it also provides functions such as data processing, analysis, intelligent sensing, intelligent computation, and security privacy computing. This layer includes various computing storage devices such as edge gateways, edge controllers, decision engines, as well as network facilities like switches and routers, integrating the computing, storage, and network resources of the edge area. Additionally, there exists software known as the edge manager, whose primary responsibility is to execute relevant tasks by operating on edge nodes to achieve this goal.

Figure 2: “Edge Side” Technical Architecture

By integrating with IoT and digital twin technologies, movable asset financing enterprises, manufacturing equipment pledged enterprises, and transportation vehicle mortgaged enterprises connect IoT devices (including sensors, cameras, sensor nodes, and various sensing devices) to edge computing nodes, conducting data collection and processing at the source of data generation. By locally analyzing and processing the collected IoT perception data through edge services, the pressure on network transmission and data processing for cloud services can be significantly reduced. The cloud can also orchestrate and distribute the IoT rules for different enterprises based on “thousand enterprises, thousand faces” to the edge services of enterprises, allowing edge computing services to conduct real-time and efficient rule processing based on the collected enterprise IoT data without needing to compute in the cloud. Through edge computing for analyzing and processing enterprise IoT data, it can provide more real-time and rapid data processing capabilities for enterprise digital twins, ensuring the real-time and accuracy of digital twins.

In integration with artificial intelligence, the cloud’s model inference and computing capabilities are migrated to edge computing services, enabling real-time analysis and decision-making on data. By decentralizing data processing and analysis capabilities to the point of data generation, edge computing can ensure that data receives a faster response. Edge computing services analyze the collected enterprise data based on dispatched models, such as risk control models, and then upload the analysis results to the cloud for subsequent processing, alleviating the processing pressure on cloud model algorithms while obtaining real-time and accurate risk control information.

In integration with blockchain, blockchain technology can enhance the security and data traceability of edge computing. Blockchain technology ensures the integrity and immutability of data, which is crucial for the protection and compliance of sensitive information. Simultaneously, edge services can act as nodes in a blockchain network, providing faster and more efficient support for the execution of smart contracts, thereby promoting the development of smart contracts and blockchain technology in the field of industrial digital finance.

Value of Edge Computing in Industrial Digital Finance

1. Higher Data Quality. IoT technology provides data support for the digital finance business of commercial banks within the industry, greatly promoting the construction and optimization of intelligent risk control models. The enterprise data generated by IoT technology is also substantial; edge computing can process data at the source, reducing errors and distortions, thus improving data quality.

2. More Efficient Real-Time Data Processing and Decision-Making. Analyzing and processing IoT data in the cloud, along with various model computations and decisions, places immense computational pressure on the cloud. Edge computing technology applies data processing and analysis capabilities to the point of data generation, enabling real-time analysis and decision-making based on dispatched models from the cloud, constructing a new model of “cloud training, edge inference.”

3. Better Security System. Edge computing also holds significant importance for data security and privacy protection in industrial digital finance. Traditional data processing methods often involve transmitting large amounts of data to central servers for processing, which not only increases the risks of network transmission but may also expose data to leakage risks. Edge computing allows data to be encrypted and processed locally, reducing the likelihood of data being attacked or stolen during transmission, thus better protecting the privacy and data security of enterprise users.

Conclusion and Outlook

With the continuous development and maturation of edge computing technology, its integration and application in the field of industrial digital finance is leading to a profound transformation. Edge computing provides unprecedented real-time data processing capabilities for industrial digital finance with faster response speeds, lower latency, higher efficiency, and flexibility, as well as better privacy and security, enabling immediate data insights and intelligent decision-making in financial transactions, risk management, and customer service.

On the road of digital transformation in industrial finance, edge computing is not only a catalyst for technological innovation but also a key force driving the transformation of financial service models. It breaks through the time and location constraints of data processing and decision-making in traditional financial services, allowing banks to respond more effectively to market dynamics and quickly meet customer needs. By deploying computing resources at edge nodes such as IoT devices and smart terminals, banks can collect and analyze massive data from various aspects such as supply chains, production lines, and transaction terminals in real time, thereby constructing more precise and comprehensive risk assessment models and investment decision support systems. Additionally, edge computing promotes the deep integration of finance with other industries, providing strong financial support for industrial upgrades and transformations.

Looking to the future, with the continuous integration and development of technologies such as 5G, the Internet of Things, and artificial intelligence, “edge computing +” will play an increasingly important role in the field of industrial digital finance. On the one hand, edge computing will further enhance the intelligent level of financial services, promoting continuous innovation in financial technology; on the other hand, it will also facilitate the deep integration of finance with the real economy, providing more precise and efficient financial support for industrial upgrades and transformations. In this process, banks need to continuously strengthen their technological innovation and risk management capabilities to better adapt to the changes and challenges brought by edge computing. At the same time, regulatory agencies need to closely monitor the application of edge computing in the financial sector, formulating corresponding regulatory policies and standards to ensure the stability and security of the financial market.

(This article was published in the August 2024 issue of “Financial Electronics”)