NB-IoT technology is a low-power wide-area network (LPWA) solution defined by the 3GPP standard, characterized by extremely low power consumption, wide coverage, and a large number of connections. Its device coverage can be enhanced by 20dB, and the battery life can exceed 10 years.

Given the advantages of NB-IoT and the Ministry of Industry and Information Technology’s release of the “Technical Requirements for Low Power Short Range Radio Transmitting Equipment (Draft for Comments)”, NB-IoT has become a key technology promoted by the three major operators and equipment suppliers represented by Huawei in China.

2018·Twists and Turns

In 2017, many NB-IoT industry applications began deployment and incubation. In 2018, operators held large-scale bidding activities, and China Mobile’s plan to bid for 5 million NB-IoT modules attracted participation from most companies in the industry, with the price of NB-IoT modules dropping below 20 yuan.

2018 was expected to be a process of scaling up. However, the market provided a cold response. Huawei had predicted that the total number of NB-IoT connections would reach 50 million in 2018, but currently, even reaching 30 million seems challenging.

Analyzing the reasons, the limitation of application scenarios is a significant issue. The five major million-level application scenarios for NB-IoT are: water management, gas, electric bicycles, smoke detection, and home appliances. Additionally, there are some more fragmented niche areas that are difficult to scale.

Although the Ministry of Industry and Information Technology released the “Technical Requirements for Low Power Short Range Radio Transmitting Equipment (Draft for Comments)”, which may be a heavy blow to LoRa, LoRa has not disappeared. Companies like Alibaba, Tencent, and Google have invested in LoRa, and many enterprises such as China Unicom and the Broadcasting Network Group have joined the LoRa camp, continuously expanding the industrial ecosystem. The competition between NB-IoT and these two major camps has never ceased.

It is worth noting that, despite holding NB-IoT, China Unicom has started to redevelop LoRa since 2018 to avoid direct competition with Mobile and Telecom. There is widespread speculation that due to Unicom’s high-frequency band of 1800MHz and limited low-frequency band of 900 MHz spectrum resources, compared to Mobile and Telecom, Unicom’s signal coverage indeed has inherent difficulties, and the cost of deployment is higher than the other two operators. As the market is still in the fermentation stage and far from the profitability point, if Unicom can enter the LoRa technology and closely cooperate with Alibaba, China Tower, and the Broadcasting Network, this could increase its possibilities in competing with Mobile, Telecom, and Huawei.

Thus, the promotion of NB-IoT in 2018 also experienced twists and turns.

2019·Development Trends

Application Aspects

According to IDC, by 2025, the number of global IoT devices will exceed 50 billion, with industrial IoT devices dominating. The China Industrial Internet Industry Alliance estimates that from 2017 to 2019, the industry scale will grow at an average annual growth rate of 18%, reaching a scale of 1 trillion yuan by 2020.

Moreover, industrial Internet and vehicle networking are strategic high-value industries driving new economic development, with expected development dividends. By deconstructing the industrial chain, the terminal layer and platform PaaS will explode first in the future. NB-IoT technology has already confirmed its connection position in this explosion.

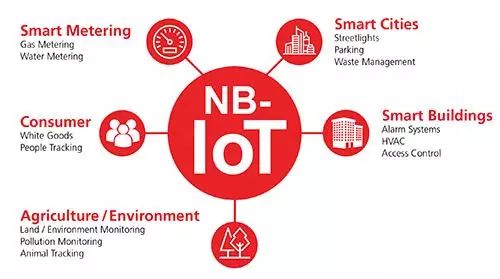

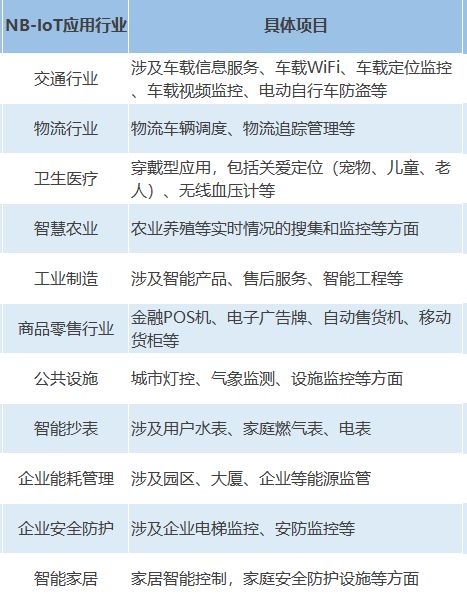

Currently, the vertical application industries of NB-IoT mainly focus on transportation, logistics, healthcare, retail, smart metering, public facilities, smart home, smart agriculture, industrial manufacturing, corporate energy management, and corporate security protection. These demands have all become markets for NB-IoT growth.

The specific applications are shown in the figure below:

(Source: Qianzhan Economics, Chart: Global IoT Observation)

Infrastructure Aspects

As of September 2018, the number of NB-IoT base stations opened by China Telecom has expanded to 400,000. China Mobile has achieved continuous coverage and full commercial use of NB-IoT in about 348 cities. In May 2018, China Unicom achieved commercial use of 300,000 NB-IoT base stations. The three operators have completed over a million NB-IoT base stations for commercial use, making China home to the world’s largest NB-IoT network, with network optimization and deep coverage being the next focus.

It is expected that by 2020, more than 1.5 million NB-IoT base stations will be built in the country, leading the world in scale. This network can basically achieve nationwide coverage and deep coverage of indoor, transportation networks, underground pipelines, etc.; by 2025, it is expected that the number of NB-IoT base stations will reach 3 million. The large-scale construction of NB-IoT base stations will lay a solid foundation for the development of China’s IoT application industry.

Price Aspects

As for lower prices, many debates argue that module manufacturers are engaging in “loss-leader” sales. In fact, the bidding for NB-IoT modules is viewed as a platform for manufacturers to publicly set prices, and it is unlikely that operators will procure according to the bidding quantity. This creates room for negotiation for manufacturers, allowing them to set tiered pricing based on procurement quantities, thus ensuring their profit margins. In 2019, the price of NB-IoT modules will gradually decrease.

Policy Aspects

As mentioned above, NB-IoT is backed by policies, which will clear many obstacles in market promotion. Overall, the global trend of IoT taking over mobile internet and becoming a new blue ocean for growth has already emerged. Driven by policies, standards, and regulations, China’s IoT technology path will mainly focus on NB-IoT. From 2018 to 2020, the IoT will be in a period of connection explosion, where cellular IoT shows greater growth elasticity, dominated by the three major operators, but unified in the choice of connection methods, primarily promoting connections with NB-IoT and 4G.

Overcoming Challenges

Currently, the urgent need for China’s NB-IoT is to overcome technical issues, particularly in chip design. Xiong Haifeng, president of Shanghai Yixin Communication Technology Co., Ltd., pointed out in an interview: “NB-IoT chips must develop towards modularization and SOC (System on Chip). If the performance of our receiving end is good enough, peripheral circuits like DC/DC, FEM, and SAW can be simplified, reducing module costs; on the other hand, optimizing and innovating chip architecture can solidify core chip functions and communication functions in hardware.”

Xiong Haifeng believes that the design of NB-IoT chips faces two main challenges. First, the rapid development of NB-IoT standards and industry requires chips to quickly follow standards, evolve, iterate, and stabilize in a short time. This places high demands on the frequency performance indicators, protocol consistency, compatibility, and stability with various base stations.

Secondly, to truly achieve a 10-year battery life with low power consumption, comprehensive optimization design is required from chip architecture to implementation and actual application. These challenges are also trends in the development of NB-IoT chips, requiring joint efforts from industry chain players to promote technological maturity.

We look forward to seeing how NB-IoT performs in 2019!

Long press the QR code to follow Linzhi IoT, let technology protect your home