In September 2017, the China Asset Appraisal Association revised and issued new appraisal standards in accordance with the spirit and requirements of appraisal methods. Among them, Article 32 of the “Asset Appraisal Practice Standards – Enterprise Value” explicitly states that “where feasible, the differences in control and liquidity between the appraisal object and transaction cases, and their impact on the value of the appraisal object, should be considered.” Since then, the differences in liquidity have been formally mentioned at the operational level in market-based assessments, specifically limited to the application of comparative methods for publicly listed companies. How can we quantify the lack of liquidity? Here we briefly analyze several put option models that provide reference ideas for calculating liquidity discounts.

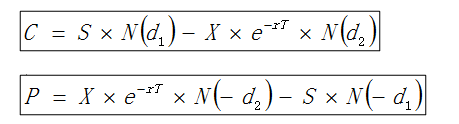

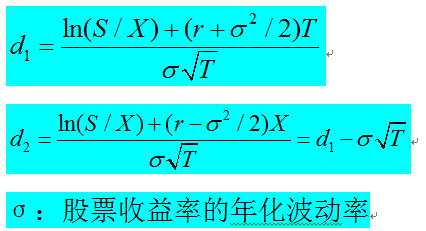

1. Black-Scholes Option Pricing Model (BS Model)

The Black-Scholes option pricing model is the most classic option, representing standard options rather than exotic options, and it is a European option, meaning it cannot be exercised before the option’s expiration date.

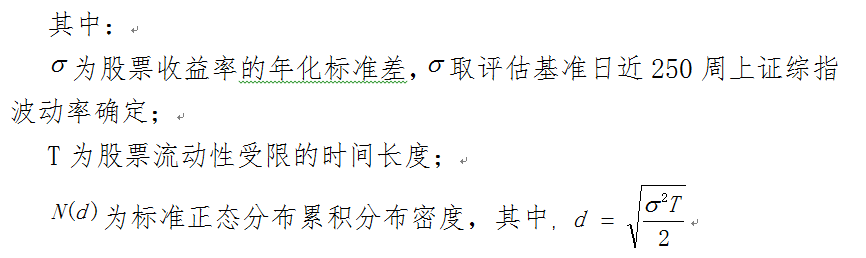

Where:

C represents the value of the call option

P represents the value of the put option

S represents the current value of the underlying asset

X represents the strike price of the option

T represents the time to expiration of the option contract (in years)

r represents the risk-free interest rate

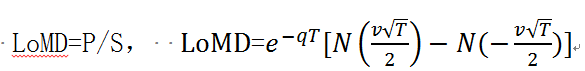

2. Asian Average Option Model (AAP Model)

Asian average options are defined as options where the payoff is determined by the average price of the underlying asset over a certain period before the option’s expiration date combined with the strike price, also known as average price options. This model determines the option’s payoff at expiration not by the market price of the underlying asset but by the average price of the underlying asset over a specific period during the option contract. This period is referred to as the averaging period.

In early September 2017, the China Fund Industry Association introduced the calculation of liquidity discounts using Asian options in the “Guidelines for Valuation of Illiquid Stocks (Trial)” published in September 2017.

FV=S×(1-LoMD)

Where:

FV: the value of the illiquid stock on the valuation date

S: the fair value of the same stock traded on the stock exchange on the valuation date

LoMD: the liquidity discount corresponding to the remaining lock-up period of the illiquid stock.

P: option value

S: the fair value of the same stock traded on the stock exchange on the valuation date

T: the remaining lock-up period, expressed in years

σ: the expected annualized volatility of the stock price during the remaining lock-up period

q: the expected annualized dividend yield of the stock

N: the cumulative distribution function of the standard normal distribution

Compared to the standard AAP model, this model is a simplified version of the Asian average option, as it does not use the risk-free return rate. Considering the relatively low dividend distribution rate of stocks in our country, this model is more appropriate. When averaging prices, either arithmetic or geometric averages can be used, corresponding to two types of Asian options: arithmetic average Asian options and geometric average Asian options, with arithmetic average Asian options being the most common.

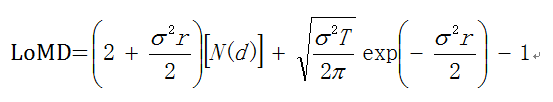

3. Lookback Option Model (LBP Model)

The function of lookback options is to allow the holder to exercise the option at the most favorable price that the underlying asset has reached during the option’s effective period at expiration.

Compared to the Asian average option (AAP), this model uses the highest price that occurred during the holding period of the option to determine the exercise price.

4. Considerations When Using Option Models

1. When using option models to calculate liquidity discounts, choose an appropriate model based on the characteristics and assumptions of the appraisal object.

When calculating liquidity discounts, the liquidity discounts calculated by the above three models with the same rates of return and volatility are: BS model<AAP model<LBP model.

The implications of the models are different, and the assumptions of each model are also different. The estimation results from the BSP model and AAP model are closer to the seller’s expectations of liquidity, viewed from the asset holder’s perspective, while the LBP model is more of a judgment and expectation made by potential buyers based on the market. Therefore, the standpoint of the assessment is crucial; in practical operations, special attention should be paid.

2. Select appropriate parameters based on the chosen model

The relationship between models and parameters is akin to that between hardware and software; models are the hardware, and parameters are the software. Different models require different parameters, and different parameters within the same model can yield different results. Therefore, the choice of parameters in the model is crucial. Considering derivatives aimed at hedging, derivatives issued by enterprises with embedded derivative clauses, and financial investment-type derivatives, the parameters mainly include: rates of return, discount rates, and volatility.

3. Be aware of the limitations of model applications

Models are based on a series of assumptions and may deviate from actual situations. Regardless of which model is used, the results obtained should accurately reflect the asset’s value and comply with market rules, rather than being rigidly applied. (Author’s Unit: China United Asset Appraisal Group Co., Ltd. This article is reprinted from “China Asset Appraisal” 2018, Issue 4)

Call for Contributions

If you are an appraiser or engaged in the appraisal profession and want to share something with everyone, hurry up and submit your work! There are no restrictions on the subject matter! However, it must be original and must not contain any content that violates laws and regulations, such as pornography and violence; please send your submissions to: [email protected].